Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Problem 7-5

Caricato da

Irfan ghani0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

66 visualizzazioni2 pagineThe document provides financial statements for Niagara Company for the year ended December 31, Year 9 including a statement of cash flows using the direct method, an income statement, and a comparative balance sheet. The statement of cash flows shows the company had a net cash increase of $10 from $65 in operating activities, -$50 in investing activities, and -$5 in financing activities. The income statement shows the company had net income of $60. The comparative balance sheet shows total assets increased $50 to $1900 from $1800 and retained earnings increased $30 to $130 from $100.

Descrizione originale:

akl2 beams

Titolo originale

PROBLEM 7-5

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document provides financial statements for Niagara Company for the year ended December 31, Year 9 including a statement of cash flows using the direct method, an income statement, and a comparative balance sheet. The statement of cash flows shows the company had a net cash increase of $10 from $65 in operating activities, -$50 in investing activities, and -$5 in financing activities. The income statement shows the company had net income of $60. The comparative balance sheet shows total assets increased $50 to $1900 from $1800 and retained earnings increased $30 to $130 from $100.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

66 visualizzazioni2 pagineProblem 7-5

Caricato da

Irfan ghaniThe document provides financial statements for Niagara Company for the year ended December 31, Year 9 including a statement of cash flows using the direct method, an income statement, and a comparative balance sheet. The statement of cash flows shows the company had a net cash increase of $10 from $65 in operating activities, -$50 in investing activities, and -$5 in financing activities. The income statement shows the company had net income of $60. The comparative balance sheet shows total assets increased $50 to $1900 from $1800 and retained earnings increased $30 to $130 from $100.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

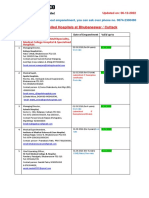

PROBLEM 7-5

Prepare statement of cash flow using direct method

NIAGARA COMPANY

Statement of Cash Flows

For Year Ended December 31, Year 9

Cash Flows From Operating Activities

Cash Receipt From Customer 980

Cash Paid For Inventories -645

Cash Paid For Operating Expense -270

Net Cash From Operating Activites 65

Cash Flows From Investing Activities

Purchase Fixed Asset -50

Cash Flows From Financing Activities

Long Term Debt 50

Notes Payable to Bank -25

Divend cash From RE -30

Net Cash From Financing Activities -5

Net Increase in Cash 10

Beginning Cash Balance 50

Ending Cash Balance 60

NIAGARA COMPANY

Income Statement

For Year Ended December 31, Year 9

Sales 1000

Cost of goods sold -650

Depreciation expense -100

Sales and general expense -100

Interest expense -50

Income tax expense -40

Net income 60

Year 8 Year 9 Selisih

Assets

Cash 50 60 10

Accounts receivable, net 500 520 20

Inventory 750 770 20

Current assets 1300 1350 50

Fixed assets, net 500 550 50

Total assets 1800 1900

Liabilities and Equity

Notes payable to banks 100 75 -25

Accounts payable 590 615 25

Interest payable 10 20 10

Current liabilities 700 710 10

Long-term debt 300 350 50

Deferred income tax 300 310 10

Capital stock 400 400 0

Retained earnings 100 130 30

Total liabilities and equity 1800 1900

Potrebbero piacerti anche

- 1 Prof Chauvins Instructions For Bingham CH 4Documento35 pagine1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Homework Assignment DoneDocumento6 pagineHomework Assignment DoneKezia N. ApriliaNessuna valutazione finora

- Bharat Chemical CaseDocumento5 pagineBharat Chemical CaseambitiousfirkinNessuna valutazione finora

- Book Speos 2023 R2 Users GuideDocumento843 pagineBook Speos 2023 R2 Users GuideCarlos RodriguesNessuna valutazione finora

- Non-Current Assets Total Equity Current Assets: Cash Flow ExerciseDocumento2 pagineNon-Current Assets Total Equity Current Assets: Cash Flow ExerciseJuan Diego del Prado SánchezNessuna valutazione finora

- Cash FlowsDocumento12 pagineCash FlowsEjaz AhmadNessuna valutazione finora

- SESSION 3 Practice TemplateDocumento7 pagineSESSION 3 Practice Templateyimin liuNessuna valutazione finora

- Income Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Documento3 pagineIncome Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Sathyanarayana GNessuna valutazione finora

- Fin Q2Documento6 pagineFin Q2Pulkit SethiaNessuna valutazione finora

- Cash FlowDocumento12 pagineCash FlowalguienNessuna valutazione finora

- BT B Sung Chapter 45Documento2 pagineBT B Sung Chapter 45Yến Nhi VũNessuna valutazione finora

- ExamDocumento4 pagineExammohammad maabrehNessuna valutazione finora

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocumento4 paginePractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNessuna valutazione finora

- BFN202 Seminar Questions SET1Documento3 pagineBFN202 Seminar Questions SET1baba cacaNessuna valutazione finora

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocumento4 paginePractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNessuna valutazione finora

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Documento9 pagineAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNessuna valutazione finora

- Paper Financial ManagementDocumento8 paginePaper Financial ManagementAbul Ala Daniyal QaziNessuna valutazione finora

- Practice Exercise - Ship Shape Retail - SolutionDocumento4 paginePractice Exercise - Ship Shape Retail - Solution155- Salsabila GadingNessuna valutazione finora

- Homework Assignment DoneDocumento6 pagineHomework Assignment DoneLong Le KimNessuna valutazione finora

- Managerial Accounting PPDocumento42 pagineManagerial Accounting PPSaurav KumarNessuna valutazione finora

- Cash Flow QuestionsDocumento6 pagineCash Flow QuestionsBhakti GhodkeNessuna valutazione finora

- Cash FlowwDocumento6 pagineCash FlowwSyeda IsmailNessuna valutazione finora

- Owners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Documento3 pagineOwners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Nithin Duke2499Nessuna valutazione finora

- Tugas AKD Week 9Documento2 pagineTugas AKD Week 9Muhammad zikri FajarNessuna valutazione finora

- Chapter 17 Cash FlowDocumento13 pagineChapter 17 Cash FlowToni MarquezNessuna valutazione finora

- Cash Flow Analysis Lyst5937Documento5 pagineCash Flow Analysis Lyst5937Vibhav SinghNessuna valutazione finora

- Solved ProblemDocumento4 pagineSolved ProblemSophiya NeupaneNessuna valutazione finora

- Reflective - 3k Words + Solving CalculationsDocumento3 pagineReflective - 3k Words + Solving CalculationsOsama JavedNessuna valutazione finora

- DauderisAnnand-IntroFinAcct-Chapter11 AmendedDocumento15 pagineDauderisAnnand-IntroFinAcct-Chapter11 AmendedHome Made Cookin'Nessuna valutazione finora

- MarchDocumento14 pagineMarchMobeen AhmadNessuna valutazione finora

- Afm Paper DalmiaDocumento5 pagineAfm Paper DalmiaasheetakapadiaNessuna valutazione finora

- 02 Profits, Cash Flows and Taxes - StudentsDocumento25 pagine02 Profits, Cash Flows and Taxes - StudentslmsmNessuna valutazione finora

- Illustration Ratio AnalysisDocumento6 pagineIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020Nessuna valutazione finora

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocumento1 paginaInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNessuna valutazione finora

- Balance Sheet Rules SummaryDocumento4 pagineBalance Sheet Rules SummaryCristina Bejan100% (1)

- AssetsDocumento2 pagineAssetsShesha Nimna GamageNessuna valutazione finora

- First 1302020Documento9 pagineFirst 1302020fNessuna valutazione finora

- Solved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchDocumento65 pagineSolved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchChaitanyaNessuna valutazione finora

- Cashflow ActivityDocumento2 pagineCashflow ActivityHannie CaratNessuna valutazione finora

- Orkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesDocumento7 pagineOrkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesOmar SrourNessuna valutazione finora

- Lecture 2 Answer1 1564205815261Documento18 pagineLecture 2 Answer1 1564205815261Trinesh BhargavaNessuna valutazione finora

- Sloved Questions Financial AnalysisDocumento12 pagineSloved Questions Financial AnalysisMurad KhanNessuna valutazione finora

- Ratio AnlysDocumento5 pagineRatio AnlysVi PhuongNessuna valutazione finora

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocumento18 pagine2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNessuna valutazione finora

- FAWCM - Cash Flow 2Documento29 pagineFAWCM - Cash Flow 2Jake RoosenbloomNessuna valutazione finora

- SCF With DODocumento3 pagineSCF With DOMuhammad Asif KhanNessuna valutazione finora

- 02 24 Free Cash FlowDocumento17 pagine02 24 Free Cash FlowAnil RatnaniNessuna valutazione finora

- SABV Topic 5 QuestionsDocumento5 pagineSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNessuna valutazione finora

- Saplan - Danilyn - Final OutputDocumento16 pagineSaplan - Danilyn - Final OutputMarilyn Cercado FernandezNessuna valutazione finora

- Wa0035.Documento5 pagineWa0035.Barack MikeNessuna valutazione finora

- Math Solution - Session 11Documento8 pagineMath Solution - Session 11Saoda Feel IslamNessuna valutazione finora

- Fin Mid Fall 2020Documento2 pagineFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630Nessuna valutazione finora

- Exercise ProfitabilityDocumento2 pagineExercise ProfitabilityPhong Nghiêm TấnNessuna valutazione finora

- Highland Malt Accounting Project PDFDocumento12 pagineHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Pembahasan Chapter 14Documento8 paginePembahasan Chapter 14Ai TanahashiNessuna valutazione finora

- Accounting Project - UDocumento1 paginaAccounting Project - UDamilare ElijahNessuna valutazione finora

- 02 24 Free Cash FlowDocumento6 pagine02 24 Free Cash FlowcherifsambNessuna valutazione finora

- Solutions Ch09Documento24 pagineSolutions Ch09KyleNessuna valutazione finora

- Model Policies and Procedures for Not-for-Profit OrganizationsDa EverandModel Policies and Procedures for Not-for-Profit OrganizationsNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDa EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Cosmic Handbook PreviewDocumento9 pagineCosmic Handbook PreviewnkjkjkjNessuna valutazione finora

- India Biotech Handbook 2023Documento52 pagineIndia Biotech Handbook 2023yaduraj TambeNessuna valutazione finora

- Qualitrol 900 910Documento6 pagineQualitrol 900 910chennupati999Nessuna valutazione finora

- Trading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankDocumento49 pagineTrading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankChristyann LojaNessuna valutazione finora

- Datos Adjuntos Sin Título 00013Documento3 pagineDatos Adjuntos Sin Título 00013coyana9652Nessuna valutazione finora

- Dept & Sem: Subject Name: Course Code: Unit: Prepared byDocumento75 pagineDept & Sem: Subject Name: Course Code: Unit: Prepared by474 likithkumarreddy1Nessuna valutazione finora

- Empanelled Hospitals List Updated - 06-12-2022 - 1670482933145Documento19 pagineEmpanelled Hospitals List Updated - 06-12-2022 - 1670482933145mechmaster4uNessuna valutazione finora

- List of Olympic MascotsDocumento10 pagineList of Olympic MascotsmukmukkumNessuna valutazione finora

- Application of Contemporary Fibers in Apparel - LyocellDocumento5 pagineApplication of Contemporary Fibers in Apparel - LyocellVasant Kothari100% (1)

- IPS PressVest Premium PDFDocumento62 pagineIPS PressVest Premium PDFLucian Catalin CalinNessuna valutazione finora

- Atlascopco XAHS 175 DD ASL Parts ListDocumento141 pagineAtlascopco XAHS 175 DD ASL Parts ListMoataz SamiNessuna valutazione finora

- Jurnal Vol. IV No.1 JANUARI 2013 - SupanjiDocumento11 pagineJurnal Vol. IV No.1 JANUARI 2013 - SupanjiIchsan SetiadiNessuna valutazione finora

- Switching Lab-05b Configuring InterVLAN RoutingDocumento2 pagineSwitching Lab-05b Configuring InterVLAN RoutingHernan E. SalvatoriNessuna valutazione finora

- Advantages Renewable Energy Resources Environmental Sciences EssayDocumento3 pagineAdvantages Renewable Energy Resources Environmental Sciences EssayCemerlang StudiNessuna valutazione finora

- English For General SciencesDocumento47 pagineEnglish For General Sciencesfauzan ramadhanNessuna valutazione finora

- What Is Product Management?Documento37 pagineWhat Is Product Management?Jeffrey De VeraNessuna valutazione finora

- Contemp Person Act.1Documento1 paginaContemp Person Act.1Luisa Jane De LunaNessuna valutazione finora

- Cocaine in Blood of Coca ChewersDocumento10 pagineCocaine in Blood of Coca ChewersKarl-GeorgNessuna valutazione finora

- Contigency Plan On Class SuspensionDocumento4 pagineContigency Plan On Class SuspensionAnjaneth Balingit-PerezNessuna valutazione finora

- 13507Documento5 pagine13507Abinash Kumar0% (1)

- Four Hour Body Experiment Tracker TemplateDocumento4 pagineFour Hour Body Experiment Tracker Templatechanellekristyweaver100% (1)

- Hydraulics and PneumaticsDocumento6 pagineHydraulics and PneumaticsRyo TevezNessuna valutazione finora

- Taxation Law 1Documento7 pagineTaxation Law 1jalefaye abapoNessuna valutazione finora

- 2432 - Test Solutions - Tsol - 2432 - 21702Documento5 pagine2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalNessuna valutazione finora

- Islamiyat ProjectDocumento21 pagineIslamiyat ProjectSubhan Khan NiaziNessuna valutazione finora

- Controlled DemolitionDocumento3 pagineControlled DemolitionJim FrancoNessuna valutazione finora

- Lifting PermanentmagnetDocumento6 pagineLifting PermanentmagnetShekh Muhsen Uddin Ahmed100% (1)

- CH 15Documento58 pagineCH 15Chala1989Nessuna valutazione finora