Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Preface: An Analysis of The Business Policy of ML Philbusiness Solutions Co. in Relation To The Improvement of Revenue

Caricato da

Shanaya Mae ValezaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Preface: An Analysis of The Business Policy of ML Philbusiness Solutions Co. in Relation To The Improvement of Revenue

Caricato da

Shanaya Mae ValezaCopyright:

Formati disponibili

An Analysis of the Business Policy of ML PhilBusiness Solutions Co.

In Relation to the Improvement of Revenue

1

CHAPTER 1

INTRODUCTION

Preface

Business Policy defines the scope or spheres within which decisions can be taken by

the subordinates in an organization. It permits the lower management to deal with

the problems and issues without consulting top level management every time for

decisions. Business policies are the guidelines developed by an organization to

govern its actions. They define the limits within which decisions must be made.

Proper practice of the business policy will reflect to the company’s performance. In

order to test company’s performance an analysis of the financial statements will be

done.

Financial statement analysis is the process of analysing a company’s financial

statements for decision making purposes and to understand the overall health of an

organization. Financial statements record financial data, which must be evaluated

through financial statement analysis to become more useful to investors,

shareholders, managers, and other interested parties. Through the method of

reviewing and analyzing a company’s accounting reports in order to gauge its past, present

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

2

or projected future performance. This process of reviewing the financial statements allows

for better economic decision making.

Globally, publicly listed companies are required by law to file their financial

statements with the relevant authorities. Firms are also obligated to provide their

financial statements in the annual report that they share with their stakeholders. As

financial statements are prepared in order to meet requirements, the second step in

the process is to analyze them effectively so that future profitability and cash flows

can be forecasted.

Therefore, the main purpose of financial statement analysis is to utilize information

about the past performance of the company in order to predict how it will fare in the

future. Another important purpose of the analysis of financial statements is to

identify potential problem areas and troubleshoot those.

The researchers choose ML PhilBusiness Solutions Co. that is one of the companies in

the country under the accounting industry that offers business consultancy services.

This study is focused on the analysis of financial statements of ML PhilBusiness

Solutions Co. for the year 2015 to 2017.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

3

Company Profile

ML PhilBusiness Solutions Co. is a partnership formed last July 13, 2011, issued by

the Securities and Exchange Commission. The principal office of the partnership is

located at 42B Ipo St. Cor. N.S. Amoranto St., Quezon City. The partners of the said

partnership are Marvin Lozada, Marlon Lozada and Ernesto Pacis who contributed

cash as their investment in the company. The purpose for which the partnership is

formed is to provide business consultancy services.

The partnership having Mr. Marvin Lozada as the managing partner, has hired

accounting staffs in charge of different duties that needed to accomplish the

services. The duties are segregated as follows:

•Overall Monitoring

•Billing and Collections

•Liaison Officer

•Computation of VAT

•Withholding Tax on Compensation

•Sales and Purchases

•Disbursement Books

•Receipt Books

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

4

Basis of Accounting

The financial statements have been prepared in accordance with Philippine

Financial Reporting Standards (PFRSs). The Accounting Standards Council (ASC)

approved the issuance of new and revised Philippine Accounting Standards (PAS)

and new PFRS based on International Accounting Standards (IAS) and

International Financial Reporting Standards (IFRS). The financial statements have

been prepared on the historical cost basis. The principal accounting policies adopted

are set out below.

Revenue recognition

Revenue is measured at the fair value of the consideration receive and

represents amount received for goods provided in the normal course of

business, net of discounts, VAT and other sales related taxes.

Cash

Cash includes cash on hand and in banks.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

5

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and

any impairment in value. The initial cost of property and equipment comprises

its purchase price and other cost directly attributable in bringing the assets to its

working condition and location for its intended use. Expenditures incurred after

the fixed assets have been put into operations such as, repairs and maintenance

costs are normally charged to income in the period in which the costs are

incurred. In situations where it can be clearly demonstrated that the

expenditures collection have resulted in an increase in the future economic

benefits expected to be obtained from the use of an item of property and

equipment beyond its originally assessed standard of performance, the

expenditures are capitalized as an additional cost of property and equipment.

When asset are retired or otherwise, disposed of, the cost and related

accumulated depreciation and amortization are removed from the accounts and

any resulting gain or loss is credited or charged to current operations.

Depreciation is calculated on a straight-line basis over the estimated useful lives

of the assets. The useful life and depreciation methods are reviewed periodically

to ensure that the period and method of depreciation are consistent with the

expected pattern of economic benefits from items of property.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

6

Mission and Vision

This company aims to provide business consultancy services that will help businesses

to be knowledgeable about their position and stability in the industry. Furthermore,

the company provides information necessary for the business in their decision

making process and strategic planning for their long term operations.

The partners see the company to be profitable in the long run, having a legacy of

integrity, effective and efficient management operations as well as to the employees

of the company.

Research Issues

The researchers have observed the following issues during their interview:

1. Budgeting for Contingent Expenses

The company did not have sufficient budget allocated for emergency

expenses which lead to insufficient cash fund. The researchers aim to help

the company to make a detailed breakdown of the expenses that the

company could encounter to provide contingency plan for the next

accounting years.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

7

2. Internal Control for Revenue Policy

The company does not have any control policy regarding the collection of

payments and other methods of payment to settle down the obligation of the

clients, because of this, the company’s receivables are more likely to be

written off. The researchers aim to study regarding on the possible internal

control for revenue policy that can be helpful for the company's operation.

3. Business Policy in Relation to Revenue Recognition

Based on the Financial Statements given by the ML PhilBusiness Solutions

Co., the researchers discovered that in the year 2016 the company has

encountered a loss which resulted from giving a huge amount of discount to

some of their clients that affected its operations. The researchers aim to

study the past performance of the company in order to make improvements

to its revenue recognition policy.

Focal Issue

The study will focus on the analysis of the Business Policy of ML PhilBusiness

Solutions Co., in Relation to the improvement revenue recognition. In accordance to

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

8

the 2016 loss, it is discovered that the omission of the company’s receivable from

client is a big factor because the company does not always realize the full amount of

the consideration fee agreed by both parties making the revenue understated. There

are instances that the company offers low-priced rate for specific clients, which is

also a big factor because the rate given is much reduced from its normal rate. This

study involves only those charged with governance and the employees related with

the accounting department concerning the financial statements analysis and other

significant issues affecting the company's financial statements and its revenue

recognition that may arise during the study. In the study of financial statements

analysis, it requires certain methods and process that would determine ML

PhilBusiness Solutions Co.'s position and stability in the industry.

The improvement of the revenue recognition helps the company to record and to

account revenue properly. The study has also considered future trends that would

be useful for the company's decision making process and strategic planning. The

researchers decided to use the ratio analysis method for the satisfaction of

completion and understanding the financial statements of ML PhilBusiness Co.

Concerning the study, the researchers also will apply certain guidelines to test if the

suggested improvement of revenue policy will be effective to the company. The ratio

analysis method to be used in the study will illustrate specific changes that

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

9

significantly affect the financial statements of the company on the specific year.

Ratio analysis method provides the needed formula to comprehend the financial

statements provided by the company.

Scope and Limitation

The scope of this study is on the analysis of the business policy of ML PhilBusiness in

relation to the improvement of the revenue recognition that includes precautionary

measures needed to prevent the recurrence of the prior loss. This study is also

focused on the major problems and issues that affect the company's financial

statements and the necessary alternative plans to be implemented to prevent

further loss and risks that may occur in future events.

This study is conducted only for ML PhilBusiness Solutions Co., its management and

employees within the accounting department who are significantly involve in the

study. Any unrelated firms, departments and topics are beyond the scope of this

study. It has also been limited that the information disclosed by the researchers

about the company's profile are only the information answered during the interview

that any other information are deemed confidential for the company's protection.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

10

Definition of Terms

The following are the terms used by the researchers in conducting the study:

Billing and Collection Staff

Locate and notify customers of delinquent accounts by mail, telephone, or personal

visit to solicit payment.

Cash Flows

The increase or decrease in the amount of money a business, institution, or

individual has. In finance, the term is used to describe the amount of cash (currency)

that is generated or consumed in a given time period.

Confidentiality

Set of rules or a promise that limits access or places restrictions on certain types of

information.

Contingent Expenses

Expenses which will be incurred only if something happens.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

11

Disbursement Books

Record kept by internal accountants of all financial expenditures made by a company

before they are posted to the general ledger.

Financial Statements

Written records that convey the business activities and the financial performance of

a company. Financial statements include the balance sheet, income statement, and

cash flow statement.

Liaison Officer

Person who liaises between two organizations to communicate and coordinate their

activities. Generally, liaison officers are used to achieve the best utilization of

resources or employment of services of one organization by another.

Net Income

The total revenue in an accounting period minus all expenses incurred during the

same period.

Net Loss

It is a decrease in net income that is outside the normal operations of the business.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

12

Profitability

The ability of a company to use its resources to generate revenues in excess of its

expenses. In other words, this is a company’s capability of generating profits from its

operations.

Receipt Books

A financial journal that contains all cash receipts and payments, including bank

deposits and withdrawals. Entries in the cash book are then posted into the general

ledger.

Revenue Recognition

Revenue recognition is a generally accepted accounting principle (GAAP) that

determines the specific conditions in which revenue is recognized or accounted for.

Written off

A term used to represent that a company's receivables from customers or clients are

most likely to be uncollected.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

13

CHAPTER 2

REVIEW OF RELATED LITERATURE

This chapter presents the related literatures and studies derived from various

reading materials found in both foreign and local books, theses, and Internet which

are relevant to this study. These related studies enlightened the researchers by

providing guidelines and enough information to come up with a better

understanding of the study.

Related Literature

Foreign

According to Ponthieu and Insley (1996), "Small businesses constitute 97% of all

businesses in the United States and employ more than 58% of the laor force" (p. 35).

The small business sector is growing at a very impressive rate, with small businesses

making up more than 50% of the sales and products in the private sector (U.S. SBA,

1994). The importance of small businesses to the economy is quite evident.

According to Ray H. Garisson (1998), the Importance of Comparison of Financial

Statements are not only historical documents but they are also essentially static

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

14

documents. They speak only of the events of a single period of time. However,

statement users are concerned about more than just a present; they are also

concerned about the trend of events over time. For this reason, financial statement

analysis directed toward a single period is of limited usefulness. The results of

financial statement analysis for a particular period are of value only when viewed in

comparison with the results of other periods and in some cases, with the results of

other firms. It is only through comparison that one can gain insight into trends and

make intelligent judgements as to their significance.

Also, the Need to Look Beyond Ratios, according to Ray H. Garisson (1998), is that

there is a tendency for the inexperienced analyst to assume that ratios are sufficient

in themselves as a basis for judgments about the future. Nothing could be further

from the truth. The experienced analyst realizes that the best-prepared ratio analysis

must be regarded as tentative in nature and never as conclusive itself. Ratios should

not be viewed as an end, but rather they should be viewed as a starting point, as

indicators of what to pursue in greater depth. They raise many questions, but they

rarely answer any questions by themselves. In addition to looking at ratios, the

analyst must look at other sources of data in order to make judgements about the

future of an organization.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

15

The term ‘financial analysis’, also known analysis and interpretation of financial

statements’, refers to the process of determining financial strengths and weakness

of the firm by establishing strategic relationship between the items of the balance

sheet, profit and loss account and opposite data. “Analysing financial statements,”

according to Metcalf and Titard, “ is a process of evaluating the relationship between

component parts of a financial statements to obtain a better understanding of a

firm’s position and performance”. The purpose of financial analysis is to diagnose the

information contained in financial statements so as to judge the profitability and

financial soundness of the firm. Just like a doctor examines his patient by recording

his body temperature, blood pressure, etc. before making his conclusion regarding

the illness and before giving his treatment, a financial analyst analysis the financial

statements with various tools of analysis before commenting upon the financial

health or weaknesses of a company. Financial statement analysis is an attempt to

determine the significance and meaning of the financial statement data so that

forecast may be made of the future earnings, ability to pay interest and debt

maturities and profitability of a sound dividend policy. (Batch 2009-2011). Financial

Statement Analysis. Retrieved from URL. Projectformba.blogspot.com.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

16

Local

According to Ma. Elenita Cabrera (2015), the quality analysis depends on an effective

business analysis. The broader business context in which a company operates must

be assessed as its financial statements are read and interpreted. A review of financial

statements which reflect business activities is contextual and can only be effectively

undertaken within the framework of a thorough understanding of the broader forces

that impact company performance.

M. Cabrera and G. Cabrera (2017), Financial Statement Analysis involves careful

selection of data from financial statement for the primary purpose of forecasting the

financial health of the company. This is accomplished by examining trends in key

financial data, comparing financial data across companies, and analysing key

financial ratios. Another important aspect of financial analysis is the comparison of

actual financial conditions with expected financial conditions. Expected conditions

may be represented by predetermined standards, past performance or competitor’s

performance or industry average. Managers, investors, and lenders analyse financial

statements to identify an organization’s financial strengths and weaknesses.

Although financial statements are essentially historical documents and they tell what

has happened during a particular period of time, most users are concerned about

what will happen in the future.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

17

Related Studies

Foreign

A study by Beckman and Marks (1996) found that business experience was a factor

in the success of small firms. Another study by Costa, 1994, indicated that strategic

planning contributes to long-running success for businesses. Other factors for

success include quality, customer focus, innovative marketing practices, flexibility

and employee empowerment (Zetlin, 1994). Filley and Pricer (1991) defined several

tools for small business success. These included good management techniques, such

as appropriate operating strategies, leadership and time management. Other tools

were good financial management and pricing strategies, motivational strategies for

employees and ensuring only those employees with ability are hired.

Rachchh Minaxi A (2011), in his research article on financial performance he has

pointed and suggested that the financial statement analysis involves analysing the

financial statements to extract information that can facilitate decision making. It is

the process of evaluating the relationship between component parts of the financial

statements to obtain a better understanding of an entity’s

position and performance.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

18

Priyaaks (Mar 2012), in his research article on financial performance he has pointed

that Financial statement analysis is the process of examining relationships among

financial statement elements and making comparisons with relevant information. It

is a tool in decision-making processes related to stocks, bonds, and other financial

instruments.

Verdi Ali (2010), in his study he identifies whether this company has a strong

financial fundamentals and whether investment in the company will be of a long

term nature. Its financial statements had been analysed during 5 years period (2004-

2008). Financial analysis has been measured by various ratios. The study concludes

that current ratio has declined in the last 4 years. However, it is still well above the

industry level, and it maintains a good level of liquidity.

Local

Florenz C. Tugas (2012), in his study he analysed the comparative financial statement

of listed firms belonging to the education subsector in the Philippines, there are only

three listed firms in the education subsector and they are Centro Escolar University

(CEU), Far Eastern University (FEU) & ipeople. This research paper aims to analyse

the financial statements of these three firms for three periods (2009 – 2011) using

various ratios. The data for the above study were obtained from the Philippine stock

exchange (PSE) website. To provide a basis for analysis, for each financial ratio, the

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

19

firm adjudged as the best one (using rule of thumb and ratio trends) was given three

points, the next one, two points, and the last one, one point. The total points for

each ratio category were then computed to arrive at an overall basis for 63 analyses.

The research paper is both exploratory and quantitative in context and in design.

After conducting a comprehensive financial ratio analysis, FEU (44 points) ranked

first as the most financially healthy, followed by Malayan (40 points), then CEU (36

points).

R. Del Rosario (2012) according to his study, financial statement analysis involves

comparison of the firm's performance from other firms of the same industry and

evaluating trends in the firm’s financial position over time. He used the financial

ratio analysis to determine the ratio of current assets available over current liabilities

to indicate the ability of the firm to pay its debts when they fall due. It was stated

that the current ratio aims to show which of the selected universities' current assets

are more liquid to pay the liabilities more immediate. The study concluded that not

all of the current assets of one of the selected universities are immediately realizable

when immediate settlements for current liabilities are needed.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

20

Synthesis

The above literatures and studies were conducted to tell that the purpose of

financial analysis is to diagnose the information contained in financial statements

with a view to judge the profitability and financial soundness of the firm. The

purpose of the analysis depends upon the person interested in such analysis and his

object. Financial statements are prepared primarily for decision making. Financial

statement analysis refers to the process of determining financial strength and

weakness of the firm by properly establishing strategic relationship between the

items of the balance sheet and profit and loss account. There are various methods

and techniques used in analysing financial statements which used by the researchers

in the above studies.

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

21

CHAPTER 3

Research Methodology

In this chapter, it covers the research design and methodology, including interviews

and establishing accuracy during and after data collection and data analysis. Data

were collected in different ways and forms. These involve interactive interviews with

the company’s manager and related personnel that will be helpful in the study.

The interviewee’s interest, protections, well-being, their emotional safety and

identity were considered important. Confidentiality is strictly observed in this study.

The disclosure of how the integrity and consistency of the data analysis and

interpretation will be concluded in the study.

Research Design

The study that will be conducted using descriptive method describes and interprets

what the researchers want to study about the company. It is concerned with the

depth analysis of the business policy of the company in relation to the improvement

of their revenue and the forecasted financial statement using the proposed

SPCBA RESEARCH CENTER

An Analysis of the Business Policy of ML PhilBusiness Solutions Co. In Relation to the Improvement of Revenue

22

improvement in their revenue recognition in order to test whether it will give a

significant change to the company’s performance

Data Collection

The researchers use both methods of data collection which are the primary and

secondary data for their convenience. Primary data are data which has been

obtained by the researchers directly from the company itself. The researchers give

more emphasis on the given annual reports and records of ML PhilBusiness Solutions

Co. for the reliability of data, suitability of data and adequacy of data in the context

of the issue, which the researchers wants to study. The researchers also conducted

an interview. It is personal and unstructured interview to gather relevant

information regarding the subject matter. The secondary data are the data which is

already in existence and someone has obtained for specific purpose but reutilize by

the researchers.

SPCBA RESEARCH CENTER

Potrebbero piacerti anche

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Da EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Valutazione: 4.5 su 5 stelle4.5/5 (3)

- Balanced Scorecard for Performance MeasurementDa EverandBalanced Scorecard for Performance MeasurementValutazione: 3 su 5 stelle3/5 (2)

- The Balanced Scorecard: Turn your data into a roadmap to successDa EverandThe Balanced Scorecard: Turn your data into a roadmap to successValutazione: 3.5 su 5 stelle3.5/5 (4)

- Project Report AnshulDocumento25 pagineProject Report AnshulAnshul GoelNessuna valutazione finora

- Performance ManagementDocumento17 paginePerformance ManagementSæra HashmiNessuna valutazione finora

- PCM Term PaperDocumento22 paginePCM Term Paper8130089011Nessuna valutazione finora

- BUS 1.3 - Financial Awareness - Level 4 AssignmentDocumento9 pagineBUS 1.3 - Financial Awareness - Level 4 AssignmentDave PulpulaanNessuna valutazione finora

- Faca ShristiDocumento11 pagineFaca Shristishristi BaglaNessuna valutazione finora

- Evaluating Firm Performance - ReportDocumento5 pagineEvaluating Firm Performance - ReportJeane Mae BooNessuna valutazione finora

- Consultant Strategies for New Professionals in the FieldDa EverandConsultant Strategies for New Professionals in the FieldNessuna valutazione finora

- From Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Da EverandFrom Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Nessuna valutazione finora

- Acc AnalysisDocumento3 pagineAcc AnalysisMd Sifat KhanNessuna valutazione finora

- Tata Steel Ratio AnalysisDocumento41 pagineTata Steel Ratio AnalysisGourav VallakattiNessuna valutazione finora

- 05 Finance For Strategic Managers V2Documento27 pagine05 Finance For Strategic Managers V2Renju George100% (1)

- Part 2Documento54 paginePart 2Mirza AamirNessuna valutazione finora

- Financial Performance 1Documento54 pagineFinancial Performance 1bagyaNessuna valutazione finora

- AP NurTasnimDocumento25 pagineAP NurTasnimAtta UllahNessuna valutazione finora

- Balanced ScorecardDocumento4 pagineBalanced Scorecardhaftamu GebreHiwotNessuna valutazione finora

- Assigment Individual2Documento5 pagineAssigment Individual2haftamu GebreHiwotNessuna valutazione finora

- DevaDocumento15 pagineDevagokulraj0707cmNessuna valutazione finora

- Scope of Management AccountingDocumento3 pagineScope of Management AccountingMuhammad Akmal HossainNessuna valutazione finora

- Applied Nusiness Finance AssignmentDocumento13 pagineApplied Nusiness Finance AssignmentHajra HaroonNessuna valutazione finora

- Hervas - Uloa Let's AnalyzeDocumento2 pagineHervas - Uloa Let's AnalyzeClarizzaNessuna valutazione finora

- The 4 Perspectives of The Balanced ScorecardDocumento6 pagineThe 4 Perspectives of The Balanced Scorecardnivedita patilNessuna valutazione finora

- Internal Factors: Other Depertmen T PolociesDocumento2 pagineInternal Factors: Other Depertmen T PolociesWenceslao, Jr. MoralesNessuna valutazione finora

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookDa EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNessuna valutazione finora

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldDa EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNessuna valutazione finora

- HR Score CardDocumento12 pagineHR Score CardKAVIVARMA R KNessuna valutazione finora

- What Is Accounting PrinciplesDocumento17 pagineWhat Is Accounting PrinciplesvicenteferrerNessuna valutazione finora

- Chapter - I 1.1 Introduction To The StudyDocumento91 pagineChapter - I 1.1 Introduction To The StudyNaresh KumarNessuna valutazione finora

- Financial Statements and Analysis: Why This Chapter Matters To You Learning GoalsDocumento55 pagineFinancial Statements and Analysis: Why This Chapter Matters To You Learning GoalsSana MohdNessuna valutazione finora

- Buy-Side Business Attribution - TABB VersionDocumento11 pagineBuy-Side Business Attribution - TABB VersiontabbforumNessuna valutazione finora

- ASSIGNMENT I Management Acc. Unit - 1Documento5 pagineASSIGNMENT I Management Acc. Unit - 1nikita bajpaiNessuna valutazione finora

- Managing Finance: Your guide to getting it rightDa EverandManaging Finance: Your guide to getting it rightNessuna valutazione finora

- Financial Management Practices and Their Impact On Organizational PerformanceDocumento10 pagineFinancial Management Practices and Their Impact On Organizational PerformanceIzey OdiaseNessuna valutazione finora

- Challnenegeof What Is A Balanced Scorecard (BSC) ?: Key TakeawaysDocumento18 pagineChallnenegeof What Is A Balanced Scorecard (BSC) ?: Key TakeawaysMalede WoledeNessuna valutazione finora

- Financial StatementDocumento36 pagineFinancial StatementKopal GargNessuna valutazione finora

- Balanced Scorecard - Wells Fargo (BUSI0027D) PDFDocumento12 pagineBalanced Scorecard - Wells Fargo (BUSI0027D) PDFRafaelKwong50% (4)

- Financial Statement AnalysisDocumento87 pagineFinancial Statement AnalysisShreyaSinglaNessuna valutazione finora

- How to Improve Performance through the Balanced ScorecardDa EverandHow to Improve Performance through the Balanced ScorecardValutazione: 3 su 5 stelle3/5 (3)

- Accounting - Saad Imran..Documento26 pagineAccounting - Saad Imran..Saad ImranNessuna valutazione finora

- Sai Naik ProjectDocumento78 pagineSai Naik ProjectSAIsanker DAivAMNessuna valutazione finora

- The CFO PerspectiveDocumento16 pagineThe CFO Perspectivectgshabbir3604Nessuna valutazione finora

- Chapter 4 Identification of Key Performance MeasuresDocumento8 pagineChapter 4 Identification of Key Performance MeasuresKenneth John TomasNessuna valutazione finora

- A Study On Balance Scorecard and Its Implementation On Herbal StrategiDocumento10 pagineA Study On Balance Scorecard and Its Implementation On Herbal StrategiGrety Nischala MNessuna valutazione finora

- Theoretical Framework of The Study: Ratio AnalysisDocumento39 pagineTheoretical Framework of The Study: Ratio AnalysisKurt CaneroNessuna valutazione finora

- Gopal B S Kle Work EDITS WORKSDocumento52 pagineGopal B S Kle Work EDITS WORKSSarva ShivaNessuna valutazione finora

- QuestionsDocumento2 pagineQuestionsJoe DicksonNessuna valutazione finora

- Mastering Operational Performance : The Ultimate KPI HandbookDa EverandMastering Operational Performance : The Ultimate KPI HandbookNessuna valutazione finora

- BSC - Chadwick Case StudyDocumento7 pagineBSC - Chadwick Case Studyrgaeastindian100% (4)

- Lecture 18 19 Introduction of Financial Statement AnalysisDocumento22 pagineLecture 18 19 Introduction of Financial Statement AnalysissumitsgagreelNessuna valutazione finora

- Functional Department of The OrganizationDocumento9 pagineFunctional Department of The OrganizationHai HelloNessuna valutazione finora

- Narrative - Assumptions and ISFDocumento10 pagineNarrative - Assumptions and ISFKatrizia FauniNessuna valutazione finora

- Midterm Fin Oo4Documento82 pagineMidterm Fin Oo4patricia gunio100% (1)

- Lecture-1&2 - Introduction of Financial Statement AnalysisDocumento23 pagineLecture-1&2 - Introduction of Financial Statement AnalysisPrabjot SinghNessuna valutazione finora

- How Being in A Broken Family Affect The Academic PerformanceDocumento2 pagineHow Being in A Broken Family Affect The Academic Performancekit yabutNessuna valutazione finora

- Sample Middle School Mla Research PaperDocumento8 pagineSample Middle School Mla Research Papercajxtbj8100% (1)

- Care Bangladesh Research Proposal FinalDocumento24 pagineCare Bangladesh Research Proposal FinalMuhibur Rahman AbirNessuna valutazione finora

- 02 Producing Data, SamplingDocumento9 pagine02 Producing Data, SamplingadmirodebritoNessuna valutazione finora

- Creativity & Innovation Brainstorming TechniquesDocumento50 pagineCreativity & Innovation Brainstorming TechniquesFirdhaus SakaffNessuna valutazione finora

- Corporate Social Responsibility Our Modern Apparel Industry, Human Rights Impacts and The Purchasing Power of The ConsumerDocumento235 pagineCorporate Social Responsibility Our Modern Apparel Industry, Human Rights Impacts and The Purchasing Power of The ConsumerCecilia CeciCeciNessuna valutazione finora

- By: Prof. Radhika Sahni Binomial DistributionDocumento23 pagineBy: Prof. Radhika Sahni Binomial DistributionYyyyyNessuna valutazione finora

- Population Studies AssignmentDocumento8 paginePopulation Studies AssignmentSubi SabuNessuna valutazione finora

- Academic Performance of Working StudentDocumento4 pagineAcademic Performance of Working StudentLee MinNessuna valutazione finora

- Com Dev KsapDocumento21 pagineCom Dev KsapAfu Anish shakya100% (1)

- Understanding The Main Organisational Antecedents of Employee Participation in Continuous ImprovementDocumento18 pagineUnderstanding The Main Organisational Antecedents of Employee Participation in Continuous ImprovementMridula RajakNessuna valutazione finora

- NOTE FOR BEGINNERS: Target CSE 2014 and Beyond... : WWW - Upsc.gov - inDocumento2 pagineNOTE FOR BEGINNERS: Target CSE 2014 and Beyond... : WWW - Upsc.gov - ingargatworkNessuna valutazione finora

- WARR, Mark. Fear of Crime in The United States. Avenues For Research and Policy PDFDocumento39 pagineWARR, Mark. Fear of Crime in The United States. Avenues For Research and Policy PDFCarol ColombaroliNessuna valutazione finora

- Thesis On Motivation and Employee Performance PDFDocumento7 pagineThesis On Motivation and Employee Performance PDFtracywilliamssalem100% (2)

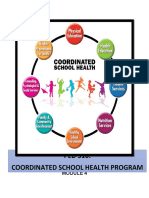

- PED 316: Coordinated School Health ProgramDocumento11 paginePED 316: Coordinated School Health ProgramMark Johnson Dela PeñaNessuna valutazione finora

- COURSE 9: Engaging Teachers Through Action Research Towards Meeting The 21st Century ChallengesDocumento58 pagineCOURSE 9: Engaging Teachers Through Action Research Towards Meeting The 21st Century ChallengesRuss EstilloteNessuna valutazione finora

- Measure of PositionDocumento13 pagineMeasure of PositionTrisha Park100% (2)

- Sample Size DeterminationDocumento19 pagineSample Size DeterminationGourav PatelNessuna valutazione finora

- Customer Satisfaction Towards Coca Cola Shivam Patel RbmiDocumento94 pagineCustomer Satisfaction Towards Coca Cola Shivam Patel RbmiIAS Dinesh Kumar100% (3)

- National Children Science CongressDocumento37 pagineNational Children Science Congressvinit_khaiwal5045Nessuna valutazione finora

- Survey of Family in Kathmandu FinalDocumento90 pagineSurvey of Family in Kathmandu FinalIrada Parajuli GautamNessuna valutazione finora

- FINAL (SG) - PR2 11 - 12 - UNIT 2 - LESSON 3 - Writing The Research BackgroundDocumento13 pagineFINAL (SG) - PR2 11 - 12 - UNIT 2 - LESSON 3 - Writing The Research BackgroundJashley Munar HernandezNessuna valutazione finora

- Technical Document Claims enDocumento15 pagineTechnical Document Claims enDany DidiNessuna valutazione finora

- Participatory Monitoring and Evaluation Handbook For Trained Field Workers 1988Documento59 pagineParticipatory Monitoring and Evaluation Handbook For Trained Field Workers 1988ZerotheoryNessuna valutazione finora

- Qualitative Approaches To Social RealityDocumento24 pagineQualitative Approaches To Social RealityVania SofiaNessuna valutazione finora

- Effective ReadingDocumento12 pagineEffective ReadingAryan AhmedNessuna valutazione finora

- III Sem. BA Economics - Core Course - Quantitative Methods For Economic Analysis - 1Documento29 pagineIII Sem. BA Economics - Core Course - Quantitative Methods For Economic Analysis - 1Agam Reddy M50% (2)

- Lesson 2 Importance of Research Across Fields VariablesDocumento6 pagineLesson 2 Importance of Research Across Fields VariablesRonald Serrano100% (1)

- SixSigmaChart PDFDocumento1 paginaSixSigmaChart PDFghafoorian_khoshgovar1488Nessuna valutazione finora

- Higher Engineering Mathematics (Part 1 of 11)Documento125 pagineHigher Engineering Mathematics (Part 1 of 11)Anonymous UoHUag100% (1)