Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Prime Fiji Beachfront Land Near Surfing Hotspot

Caricato da

manoranjan838241Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Prime Fiji Beachfront Land Near Surfing Hotspot

Caricato da

manoranjan838241Copyright:

Formati disponibili

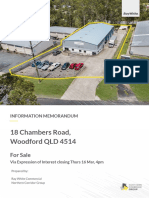

INFORMATION MEMORANDUM

Momi Freehold Land, Fiji

For Sale by Private Treaty

July 2017

Information Memorandum – Momi Freehold Land, Fiji 1

CONTENTS

Introduction and Contact Details 4

Executive Summary 5

The Opportunity 6

Services & Utilities 7

Location 8

Fiji Overview 9

Market Overview 10

Economics and Tourism 11

Key Investment Attributes 14

Target Market 15

Method of Sale 16

Disclaimer 17

Annexures 18

Information Memorandum – Momi Freehold Land, Fiji 2

Information Memorandum – Momi Freehold Land, Fiji 3

INTRODUCTION & CONTACT DETAILS

Knight Frank New Zealand has been appointed by our clients to market the sale of Momi

Freehold Land which will be available for sale by Private Treaty.

This Information Memorandum provides preliminary information to assist interested parties

with their assessment of the property.

This Information Memorandum is produced as a general guide only and does not constitute

valuation advice nor an offer for sale or purchase. All parties should undertake and rely on

their own independent due diligence investigations and not rely on the information contained Rick Kermode Licensed Salesperson

in this document to make their purchasing decision. Commercial Sales & Leasing Broker | Fiji Specialist Broker

M +64 21 882 452

Sales Process E rick.kermode@nz.knightfrank.com

Knight Frank is proud to offer Momi Freehold Land for sale by private treaty and expressions

of interest.

Sale & Purchase Agreement

Particulars and Conditions of Sale of Real Estate by negotiation is provided upon request to

Rick Kermode or Allen Beagley.

Allen Beagley Licensed Salesperson

National Director, Hotels

M +64 27 220 2033

E allen.beagley@nz.knightfrank.com

Information Memorandum – Momi Freehold Land, Fiji 43

EXECUTIVE SUMMARY

Legal Owner Clint Miller and Robert Flood

The property offers a freehold title described within Certificate of Title Volume 44 Folio 4344 as all that parcel of land containing 4 acres and

23 perches.

Legal

See appendices for copy of Certificate of Title.

Zoning While there is no formal zoning, any approvals will be granted under the Nadi Rural Local Authority.

Address Savusavu Road, Momi Bay, Fiji.

Position 18° South 177° East

Land Type Level site positioned back from the beach with road access to the northern boundary. Current site is vacant allowing for native vegetation.

Land Area 4 acres 23 perches

Land Tenure Freehold

The property at this time offers a fresh canvas for total development. We understand that while there are no services to the site, the ongoing

Current Offering

development of the nearby hotel site – So Sofitel – will allow for sealed road and water supply to be connected to the boundary.

Information Memorandum – Momi Freehold Land, Fiji 5

THE OPPORTUNITY

The Momi Bay site is approximately 30 kilometres from Nadi township (40 minutes).

Momi Bay is to the south-west of Nadi, with nearby developments including:

• Marriott – Momi Bay opened April 2017.

• Ongoing development of SO Sofitel (former Seashell Cove Resort).

Access is by road though equally with a resort development, this could be

accessed by helicopter (10 minutes from Nadi International Airport).

The site itself is ideally located between the 5-star international Marriott Resort with

the soon to be completed SO Sofitel (2018).

In effect, the property offers an idyllic tropical presentation with a blank canvas to

build your own resort, underpinned and supported by the ongoing developments as

above.

It offers a proximal location with respect to Nadi International Airport (45 minutes)

with the Momi Bay locality becoming an emerging resort area.

A feature of the property is the direct access to the world class left-hand

‘Cloudbreak’, offering stunning surfing opportunities. Given its feature position in the

international surfing arena, we understand that over 10 million people a day watch

online when surfing competitions are held. The proximity of the Momi site allows the

potential to develop a dedicated surf resort to harness the surfing tourism potential.

It is in close proximity to Tavarua Island, a mile north of “Cloudbreak”, and Namotu

Island, three miles north, both offering accommodation, reinforcing the potential to

add further accommodation to Momi.

At this stage, there is no formal proposal for a resort. However, given its near beach

front positioning, road access and emerging resort area then the property is well-

positioned to facilitate a resort.

The asking price is US$1,700,000 plus VAT.

Information Memorandum – Momi Freehold Land, Fiji 6

SERVICES & UTILITIES

We understand that with the development of the SO Sofitel Resort, that fresh

water will be available to the area albeit a power supply is already available,

though no sewage.

Transportation is available by road.

We understand that while part of the property has power lines and poles across

it, they will be removed.

Information Memorandum – Momi Freehold Land, Fiji 7

LOCATION

South Pacific Fiji Islands Momi Freehold Land

FIJI

NEW

CALEDONIA

MOMI

MOMI

• The Fiji Islands are located between 12° south and • Momi is approximately 30 kilometres from Nadi township or 40 kilometres from Nadi International Airport.

21° south with a longitude of between 17° east and • It offers in effect a seaside location with emerging developments (Marriott/So Sofitel) positioning the

178° west. property in a resort area.

• They offer a total land area of 18,376 square • The property is unoccupied and ready for development.

kilometres. Fiji has a total of 844 islands and islets

with only 106 inhabited.

Information Memorandum – Momi Freehold Land, Fiji 8

FIJI OVERVIEW

Climate approximately three years in 1987 to the most recent coup 2006 being less than

one year.

Summer temperatures (November – March), range between 23 degrees Celsius

and 34 degrees Celsius and in winter (April – October) they range between 20 There was a period of political uncertainty and pressure was exerted on the

degrees Celsius and 26 degrees Celsius. A cooling trade wind blows from the Fijian Government by other countries (New Zealand, Australia) to hold

southeast for most of the year. democratic elections. These were held in September 2014.

Rainfall is higher to the eastern area of Vitu Levu though the subject area located Notwithstanding the fact that there was a global financial crisis, (GFC – 2007-

in the Mamanucas (west) would achieve a lesser rainfall than afforded to the 2013) the political environment in Fiji has created other issues, in particular from

Suva area. an export perspective. The fact remains that investor confidence was severely

eroded with the ongoing political uncertainty and a challenging economic

Our advice is that Nadi International Airport receives around 1,867 mm of annual environment. This has now improved with foreign reserves increasing since

rainfall. This area of Fiji is known as the dry side (western area). 2011 and a stabilising balance of payments.

Government Legal

Fiji has endured coups during 1987, 2000 and 2006. While there has been an The legal system is based upon the British system with the judiciary operating

initial hiatus post-coup with visitor arrivals decreasing, this recovered. It is through the Supreme Court, Court of Appeal, High Court and Magistrates Court.

interesting to note that the economic recovery period has decreased from With the most recent coup, the Government scrapped the constitution and

dismissed the judiciary. This was reinstated in September 2013.

Information Memorandum – Momi Freehold Land, Fiji 9

MARKET OVERVIEW

In the past year, there has been a surge of investment activity within Fiji. Fiji has an elected government which has opened many doors and re-

established relationships with its neighbours New Zealand and Australia.

This has not only been factored to recent acquisitions but also developments

including: The economy in the region has improved and visitor numbers to Fiji are

increasing.

• Marriott Resort, Momi (1km north of subject) which is a 45-minute drive from

Nadi International Airport. Fiji is becoming sought after by investors, developers and tourists.

This resort featured on opening in April 2017, 136 contemporary deluxe

rooms and 114 luxurious bure villas including 22 unique over-water bure Its national airline has new aircraft and opened new routes and destinations

villas with direct lagoon access. bringing a greater market to Fiji. Confidence is high and we are at a poignant

• Completed in 2016 was the investment of FJD $80M in the Pearl Resort moment in the Fijian island market.

Hotel with a marina development in Pacific Harbour.

• Development of residential sections to the periphery of the Natadola Golf Knight Frank’s Island Review 2015 assessed current property market conditions

Course in association with the Intercontinental Natadola Resort. across the world’s top island destinations which resulted in these key findings:

• There is also local investment taking place in Fiji with the Hilton Denarau

being bought by local Indian businessman. • Online viewings of island properties for sale increased by 21% in 2014 in

• They also contracted Sonaisali Island Resort and Tadrai and additional land comparison with a year earlier.

for circa FJD $22M. • Tight planning restrictions are protecting prices on some islands.

• Further is the ongoing development of South Denarau with a proposed • In the last decade, there has been a 69% increase in private flights to island

marina, hotels, commercial and residential developments with a canal focus. destinations.

• The Sonaisali was upgraded and rebranded “The Double Tree Hilton”. • In Asia, the concept of a second home or “lifestyle” purchase is slowly

• Opening in 2016 was the Pullman Nadi Bay Resort & Spa with 234 keys. becoming more established and we expect this trend will increase

• These developments are a very good sign that local businesses are significantly in the next five years with major repercussions for global

prepared to invest in Fiji’s tourism sector and it reflects the ongoing growth markets. Together, Bali, Phuket and Fiji represent the most mature markets

and strength of this market. but they remain tourist destinations rather than established hotspots in the

western model.

Information Memorandum – Momi Freehold Land, Fiji 10

ECONOMICS AND TOURISM

The Reserve Bank of Fiji economic review for the month ended May 2017 From a monetary aspect, while the Fiji dollar depreciated against the Euro,

indicated that the Fijian economy is forecast to record an unprecedented eighth Japanese Yen and the US Dollar, it appreciated against both the Australian and

year of consecutive growth post-independence. The economy is projected to New Zealand dollars.

grow by 3.8% this year (2017) slightly higher than that previous anticipated at

3.6%. Further, inflation fell to 4.1% in April 2017 from 5.6% in March.

While sectoral performances have been mixed, the cumulative to April visitor Inflation remains high compared with the trend in the last few years with this

arrivals rose by over the year by 7.2% backed by high arrivals from the US, New being largely attributed to higher prices for yaqona due to supply shortages and

Zealand, the Pacific Islands and Australia. an increase in fuel prices.

Foreign reserves rose in April to $2.0B which is sufficient to cover 5.1 months of

retained imports of goods and non-factor services.

Information Memorandum – Momi Freehold Land, Fiji 11

ECONOMICS AND TOURISM CONT

Tourism: We also note that there has been a strong increase in arrivals with a 5% increase

for the year ended 2016 as compared with the previous year (2015).

By way of purpose of visit for the year ended December 2016, holidays

represented 75.84% at 600,887, the largest sector of all arrivals followed by VFR Annual IVA - Fiji

at 8.62% or 68,262 arrivals. 800000

750000

Percentage Share of Visitor Type - 2016 700000

650000

Other, 8.67% Business, 4.16%

IVA 600000

Education / 550000

Conference, 1.77%

Training,… 500000

450000

VFR, 8.62% 400000

2008 2009 2010 2011 2012 2013 2014 2015 2016

Holiday, 75.84%

Years

IVA

Business Conference Holiday VFR Education / Training Other

On reflection, we note the strength of arrivals is still from the Australian market at

45.48% followed by New Zealand at 20.68%, however we have seen increasing

The main markets can be summarised by the following: levels from both the United States and The Peoples Republic of China.

Australia

New

Zealand USA

United

Kingdom Europe Japan

China-

PRC

Pacific

Islands Other Total

In effect, over 65% of arrivals are from New Zealand or Australia being their near

2011 344829 103181 55089 24054 32354 9616 24389 38823 42715 675050

neighbours within a flying time of three to four hours respectively.

2012 337291 106122 56478 17076 29327 7069 26395 38886 41946 660590

2013 340151 108239 55385 17209 28905 7314 23423 39450 37630 657706 This demonstrates that the strength of the market is predominated by both

2014 349217 123978 61924 16782 30585 5888 28333 39298 35625 691630

Australia and New Zealand.

2015 367273 138357 67831 16716 31195 6092 40174 48570 38447 754655

2016 360370 163836 69628 16712 31916 6274 49083 49741 44760 792320

Information Memorandum – Momi Freehold Land, Fiji 12

ECONOMICS AND TOURISM CONT

Turning to gross tourism earnings, we note that earnings since 2011 have This is formatted by way of a graph as follows:

compounded more than 5%.

Tourism Earnings $M

This being reflected as follows:

$2,000

Tourism Earnings $M

Year Earnings $M $1,500

2011 $1,286.50

2012 $1,300.00 $1,000

2013 $1,318.20

2014 $1,404.60 $500

2015 $1,560.20

2016 est $1,638.21 $0

2011 2012 2013 2014 2015 2016 est

This confirming total tourism earnings for 2016 which are estimated at $1.638B

or more than 25% of GDP.

Information Memorandum – Momi Freehold Land, Fiji 13

KEY INVESTMENT ATTRIBUTES

• Offering a freehold tenure, this is premium and sought after real estate within Fiji.

• Almost beach front locality.

• Other resorts established (Marriott) and the completion of the SO Sofitel in 2018 all underpin the immediate area from a tourism aspect.

• A “greenfields” site, unique and effectively a blank canvas for further development.

• Possibility to develop a resort property.

• Potential to develop a private residence.

• Proximal location with respect to Nadi International Airport (45 minutes).

• Road access.

• A resort development on the site would exude the traditional Fijian hospitality, warmth, friendliness and relaxation uniquely blended with contextual Fijian

landscape setting and its relation to the sea. With its tropical landscaped area, expansive Momi Bay views coupled with the unique landfall, this spectacular

setting allows for the Fijian character to be exhibited and delivered.

• Proximal to the beach front.

• In effect, the current presentation of the site allows for the ability to explore all possible development options.

• Elevated development on the site would give views to “Cloudbreak” and Tavarua Island.

Information Memorandum – Momi Freehold Land, Fiji 14

TARGET MARKET

The Fiji hospitality market has demonstrated increasing confidence, with the This strengthens the confidence in Fiji. New Zealand and Australia have shown

upgrade of the Pearl Resort, the Starwoods acquisition, rebranding of the strong increases in tourist arrivals and this has flow on effects for improved

Amunuca on Tokoriki Island to a Sheraton, and the upgrade of the Yalulele investor confidence.

Resort, Natadola.

The successful purchaser of Momi could come from anywhere within our global

In addition was the opening of the Marriott, Momi Bay in April 2017. This reach. We believe the most likely eventual buyer will be an experienced and well-

features 136 keys and 114 bure villas, some of which are over water. funded developer, resort owner or individual.

Increasing arrivals from generating markets, particularly from New Zealand and Purchasers which could have an interest in the property for investment or,

Australia all underpin the tourism economy within Fiji. operate as an owner occupier could include:

A new proposal to South Denarau (Denarau Waters) with a marina, hotels, canal • Hotel and leisure.

front residential and commercial all reinforces the confidence in this Fiji market. • Investors in tourism.

In fact, 100 residential lots were sold over a 10-month period in Denarau Waters. • Private individual.

Other Hotel Development Sites:

• Port Denarau proposed hotel Denarau Yacht Club area.

• Port Denarau hotel site adjacent to the carpark in the commercial area.

• FNPF developed the Marriott in the Momi Bay Development which opened

in April 2017.

• Due diligence on a hotel in Denarau Waters.

• Pullman Wailoaloa (234 keys).

• Proposed Holiday Inn, Denarau Island (152 keys).

• SO Sofitel, Momi Bay, 5 star by CP Group.

• Due diligence on a hotel on Naisoso Island.

Information Memorandum – Momi Freehold Land, Fiji 15

METHOD OF SALE

The method of sale as a vacant site is to be sold by way of a private treaty process.

Initial investigations will allow for due diligence subject to the signing of a confidentiality agreement and inspection of the property. All interested parties will be consulted

and urged to conduct their own due diligence.

The conclusion of the sale period will be September 30, 2017.

Information Memorandum – Momi Freehold Land, Fiji 16

DISCLAIMER

The information contained in the Information Memorandum is published by Knight Frank for

the vendor solely for potential purchasers to assist them in deciding whether or not they

wish to make further enquiries with respect to the property. Any depictions of property

boundaries are approximate. In common with all owners of land in Fiji the vendor does not

have any ownership or exclusive rights of the adjoining sea, beaches, foreshore, rivers or

streams.

None of the information contained in this report can constitute any representation or offer by

the vendor or the Agent. Prospective purchasers and their advisors should make their own

enquiries to satisfy themselves as to the correctness of the information.

The Agent will not assume liability for negligence or otherwise for the material contained in

this report. Any liability on the part of the Agent, its employees or agents for loss or damage

in any claim arising out of or in connection with this memorandum (other than liability which

is totally excluded by this clause), shall not (whether or not the liability results from or

involves negligence) exceed $1,000.

Value Added Tax Disclaimer

The purchase price and the value of the property may be affected by Value Added Tax

(VAT). Knight Frank is not qualified to provide advice on any VAT issue relating to the

property including how the purchase should be structured to comply with VAT legislation in

Fiji.

You should satisfy yourself by your own enquiries as to the impact of VAT upon the

purchase price. Neither the Vendor nor Knight Frank makes any representation, express or

implied, as to whether or not VAT has any effect on the property or the purchase price.

KFNZ Ltd, LA (REAA 2008), MREINZ

Information Memorandum – Momi Freehold Land, Fiji 17

ANNEXURES

Annexure 1: Certificate of Title 19

Annexure 2: Photographs 24

Information Memorandum – Momi Freehold Land, Fiji 18

ANNEXURE 1: CERTIFICATE OF TITLE

Information Memorandum – Momi Freehold Land, Fiji 19

ANNEXURE 2: PHOTOGRAPHS

Information Memorandum – Momi Freehold Land, Fiji 24

Information Memorandum – Momi Freehold Land, Fiji 25

Information Memorandum – Momi Freehold Land, Fiji 22

Information Memorandum – Momi Freehold Land, Fiji 27

Information Memorandum – Momi Freehold Land, Fiji 24

Information Memorandum – Momi Freehold Land, Fiji 25

Information Memorandum – Momi Freehold Land, Fiji 30

Information Memorandum – Momi Freehold Land, Fiji 31

Information Memorandum – Momi Freehold Land, Fiji 32

Potrebbero piacerti anche

- Investing in Fiji’s Real Estate: Current Issues and OpportunitiesDa EverandInvesting in Fiji’s Real Estate: Current Issues and OpportunitiesNessuna valutazione finora

- Commodities for Every Portfolio: How You Can Profit from the Long-Term Commodity BoomDa EverandCommodities for Every Portfolio: How You Can Profit from the Long-Term Commodity BoomNessuna valutazione finora

- The Jet Volume 9 Number 3Documento24 pagineThe Jet Volume 9 Number 3THE JETNessuna valutazione finora

- Residential - Aspx 1Documento5 pagineResidential - Aspx 1SonishNessuna valutazione finora

- 5096 Article 1Documento100 pagine5096 Article 1texujingyingguanli126.comNessuna valutazione finora

- WWW - Harcourts.co - NZ: Nasoso Lot 25 Koki StreetDocumento20 pagineWWW - Harcourts.co - NZ: Nasoso Lot 25 Koki StreetSonishNessuna valutazione finora

- Sold Beachfront Development Site in North FremantleDocumento4 pagineSold Beachfront Development Site in North FremantleYC TeoNessuna valutazione finora

- Six Fountains Commercial DevelopmentDocumento19 pagineSix Fountains Commercial DevelopmentHerman CoetzeeNessuna valutazione finora

- MTN Nigeria 2020 Audited Financials ReportDocumento110 pagineMTN Nigeria 2020 Audited Financials ReportKayode ToheebNessuna valutazione finora

- InfoDocumento3 pagineInfoJaya ThawaniNessuna valutazione finora

- Tax Law Review Income TaxesDocumento41 pagineTax Law Review Income TaxesNissi JonnaNessuna valutazione finora

- The Investor's Guide to Business in the PhilippinesDocumento62 pagineThe Investor's Guide to Business in the PhilippinesMartin MartelNessuna valutazione finora

- National Institutional Analysis Report On Fiji IslandsDocumento5 pagineNational Institutional Analysis Report On Fiji IslandsTatianna GroveNessuna valutazione finora

- Shop 8, 2-8 Burwood Highway, Burwood East Burwood Heights Shopping CentreDocumento13 pagineShop 8, 2-8 Burwood Highway, Burwood East Burwood Heights Shopping CentreSarawat's GuitarNessuna valutazione finora

- Al Furjan - Dubai Home StyleDocumento3 pagineAl Furjan - Dubai Home StyleVicente Beyrouthy ArribasNessuna valutazione finora

- Doing Business in The Philippines 2009 (Apr2010)Documento37 pagineDoing Business in The Philippines 2009 (Apr2010)PCGJeddahNessuna valutazione finora

- Valuation Report - MREIT INC. Festive Walk 1B Towers 1 2 FINAL SIGNEDDocumento42 pagineValuation Report - MREIT INC. Festive Walk 1B Towers 1 2 FINAL SIGNEDVinessah BalaoroNessuna valutazione finora

- AUB's history and operations as a commercial bankDocumento5 pagineAUB's history and operations as a commercial bankKate CabintoyNessuna valutazione finora

- Business Plan - Bahari HouseDocumento25 pagineBusiness Plan - Bahari HouseGeorgeNessuna valutazione finora

- 2009 SEC Audited Financial StatementsDocumento15 pagine2009 SEC Audited Financial StatementsProshareNessuna valutazione finora

- THUNDERBIRD RESORTS Investment E Brochure PDFDocumento28 pagineTHUNDERBIRD RESORTS Investment E Brochure PDFESPCHINANessuna valutazione finora

- Investment News: Marei BenefitsDocumento28 pagineInvestment News: Marei BenefitsKim at MAREINessuna valutazione finora

- Signing Away Sovereignty: How Investment Agreements Threaten Regulation of The Mining Industry in The PhilippinesDocumento30 pagineSigning Away Sovereignty: How Investment Agreements Threaten Regulation of The Mining Industry in The PhilippinesIPCM SecretariatNessuna valutazione finora

- 415 Mangapapa Road IM 151022Documento18 pagine415 Mangapapa Road IM 151022BenNessuna valutazione finora

- Slides Global Movements and Trade Dubai As A Worldwide Logistics Conduit 72220Documento121 pagineSlides Global Movements and Trade Dubai As A Worldwide Logistics Conduit 72220shriyaNessuna valutazione finora

- 18 Chambers Road, Woodford QLD 4514: For SaleDocumento8 pagine18 Chambers Road, Woodford QLD 4514: For SaleSarawat's GuitarNessuna valutazione finora

- Philequity Fund: Fund Fact Sheet As of Jan 31, 2020Documento1 paginaPhilequity Fund: Fund Fact Sheet As of Jan 31, 2020JeanneNessuna valutazione finora

- Looting in Kenya-Kroll Report (Hapa Kenya Version)Documento101 pagineLooting in Kenya-Kroll Report (Hapa Kenya Version)hapakenya100% (7)

- Findit Gold Inc Fgi Was Created in 2005 and IsDocumento1 paginaFindit Gold Inc Fgi Was Created in 2005 and IsFreelance WorkerNessuna valutazione finora

- Notice and AgendaDocumento1 paginaNotice and AgendaIrene SalvadorNessuna valutazione finora

- FijiTimes - Jan 18 2013 PrintDocumento48 pagineFijiTimes - Jan 18 2013 PrintfijitimescanadaNessuna valutazione finora

- Property Profile Report - 230302180309212Documento10 pagineProperty Profile Report - 230302180309212SriChallaNessuna valutazione finora

- ATH To Buy All Fintel Shares: February 10, 2012Documento48 pagineATH To Buy All Fintel Shares: February 10, 2012fijitimescanadaNessuna valutazione finora

- Sector Profiles: Invest in FijiDocumento30 pagineSector Profiles: Invest in FijiicalNessuna valutazione finora

- Case 1Documento4 pagineCase 1Bridgette OsumNessuna valutazione finora

- Real Estate in Different ProspectiveDocumento15 pagineReal Estate in Different ProspectiveJanardan farms & ResortsNessuna valutazione finora

- ProfilePresentation-Audit FirmsDocumento45 pagineProfilePresentation-Audit FirmsMudassar PatelNessuna valutazione finora

- IPCS_ForeignPropertyOwnership_May18_Web-(1)Documento40 pagineIPCS_ForeignPropertyOwnership_May18_Web-(1)EMMANUEL JASON CASASNessuna valutazione finora

- L1 - JN - Equity 2024 V1Documento39 pagineL1 - JN - Equity 2024 V1Rohan ShekarNessuna valutazione finora

- MLC Practice Profile Mauritius May 2016Documento30 pagineMLC Practice Profile Mauritius May 2016Manish AroraNessuna valutazione finora

- Kuku B Power PointDocumento16 pagineKuku B Power PointJOMO KELVINNessuna valutazione finora

- Fund Fact Sheet as of May 29, 2020Documento1 paginaFund Fact Sheet as of May 29, 2020Marlon DNessuna valutazione finora

- ISSUES JollibeeDocumento4 pagineISSUES JollibeeMelanie Joy Gopela Flores33% (6)

- May 15, 2023 ELG1 Monthly BOT Meeting ReportDocumento59 pagineMay 15, 2023 ELG1 Monthly BOT Meeting ReportAngelica L. JintalanNessuna valutazione finora

- The Mining Law ReviewDocumento292 pagineThe Mining Law ReviewMartin GriffinNessuna valutazione finora

- Annual Report & Financial StatementsDocumento76 pagineAnnual Report & Financial StatementsCorneliusNessuna valutazione finora

- Deneb Pre Listing 201411Documento144 pagineDeneb Pre Listing 201411Makoya_malumeNessuna valutazione finora

- Fiji Pays Off 1st Global BondDocumento48 pagineFiji Pays Off 1st Global BondfijitimescanadaNessuna valutazione finora

- Prime Land For SaleDocumento12 paginePrime Land For Saledigital nusantaraNessuna valutazione finora

- Investment Guide: Board of Investment of Sri LankaDocumento28 pagineInvestment Guide: Board of Investment of Sri LankaHeshan RanganaNessuna valutazione finora

- IFC SI+Tourism Investor+Guide ONLINEDocumento66 pagineIFC SI+Tourism Investor+Guide ONLINEPsycho GotuNessuna valutazione finora

- Fincare Small Finance Bank Company ProfileDocumento17 pagineFincare Small Finance Bank Company Profileavnish singhNessuna valutazione finora

- Property Profile Report 13 Phillip StreetDocumento13 pagineProperty Profile Report 13 Phillip StreetRohanNessuna valutazione finora

- Kobi Real Estate Fund 1 PPM 1Documento182 pagineKobi Real Estate Fund 1 PPM 1veldanezNessuna valutazione finora

- A Resolution Allowing Adfil IncDocumento1 paginaA Resolution Allowing Adfil Incpaul esparagozaNessuna valutazione finora

- Dot Property Magazine Issue 032 Fall 2020Documento76 pagineDot Property Magazine Issue 032 Fall 2020Joseba UmbelinaNessuna valutazione finora

- David Einhorn Short - St. JoeDocumento139 pagineDavid Einhorn Short - St. JoeCaleb Peter HobartNessuna valutazione finora

- Tips & Traps When Buying A Condo, Co-op, or TownhouseDa EverandTips & Traps When Buying A Condo, Co-op, or TownhouseValutazione: 3.5 su 5 stelle3.5/5 (4)

- Ron's Road to Wealth: Insights for the Curious InvestorDa EverandRon's Road to Wealth: Insights for the Curious InvestorNessuna valutazione finora

- 1.1 4 - Discounting Risky Cash FlowsDocumento40 pagine1.1 4 - Discounting Risky Cash Flowsmanoranjan838241Nessuna valutazione finora

- Lecture 04Documento82 pagineLecture 04irshan amirNessuna valutazione finora

- Break-even analysis of paper industry: A real life case studyDocumento12 pagineBreak-even analysis of paper industry: A real life case studymanoranjan838241Nessuna valutazione finora

- Article 202Documento14 pagineArticle 202manoranjan838241Nessuna valutazione finora

- Memorandum of Artcles For AGM To Be Held On 23rd Novemver 2005Documento45 pagineMemorandum of Artcles For AGM To Be Held On 23rd Novemver 2005manoranjan838241Nessuna valutazione finora

- DP 200906Documento18 pagineDP 200906manoranjan838241Nessuna valutazione finora

- A Break Even Analysis Is A MethodDocumento2 pagineA Break Even Analysis Is A Methodmanoranjan838241Nessuna valutazione finora

- MemorandumDocumento11 pagineMemorandummanoranjan838241Nessuna valutazione finora

- 3 BepDocumento1 pagina3 Bepmanoranjan838241Nessuna valutazione finora

- Formation of CompaniesDocumento7 pagineFormation of Companiesmanoranjan838241Nessuna valutazione finora

- Basel Norms IIDocumento3 pagineBasel Norms IImanoranjan838241Nessuna valutazione finora

- Indiancompaniesact 1956Documento18 pagineIndiancompaniesact 1956manoranjan838241Nessuna valutazione finora

- v28n3 3Documento6 paginev28n3 3manoranjan838241Nessuna valutazione finora

- Cost - Benefit Training Handouts 9-02Documento8 pagineCost - Benefit Training Handouts 9-02manoranjan838241Nessuna valutazione finora

- BackyardTrends CBAIRRDocumento2 pagineBackyardTrends CBAIRRmanoranjan838241Nessuna valutazione finora

- Cost and Benefit AnalysisDocumento1 paginaCost and Benefit Analysismanoranjan838241Nessuna valutazione finora

- Bonds IIIDocumento2 pagineBonds IIImanoranjan838241Nessuna valutazione finora

- Feasibility AnalysisDocumento4 pagineFeasibility Analysismanoranjan838241Nessuna valutazione finora

- Bond ValuationDocumento4 pagineBond Valuationmanoranjan838241Nessuna valutazione finora

- Calculation of Stock BetaDocumento2 pagineCalculation of Stock Betamanoranjan838241Nessuna valutazione finora

- पूरानी यादेंDocumento24 pagineपूरानी यादेंmanoranjan838241Nessuna valutazione finora

- Beta N GrowthDocumento18 pagineBeta N Growthmanoranjan838241Nessuna valutazione finora

- Annual Note 2022 Shooting For The MoonDocumento27 pagineAnnual Note 2022 Shooting For The Moonmanoranjan838241100% (1)

- Business Valuation ModelDocumento1 paginaBusiness Valuation Modelmanoranjan838241Nessuna valutazione finora

- Annual Note 2022 Shooting For The MoonDocumento27 pagineAnnual Note 2022 Shooting For The Moonmanoranjan838241100% (1)

- Ludhiana DelhiDocumento2 pagineLudhiana Delhiarun.trikhaNessuna valutazione finora

- Order No.-1981-1982Documento6 pagineOrder No.-1981-1982manoranjan838241Nessuna valutazione finora

- Annual Note 2022 Shooting For The MoonDocumento27 pagineAnnual Note 2022 Shooting For The Moonmanoranjan838241100% (1)

- Vdoc - Pub Parrys Valuation and Investment TablesDocumento551 pagineVdoc - Pub Parrys Valuation and Investment TablesWan Rosman100% (1)

- Safe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesDocumento48 pagineSafe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesCuesta AndresNessuna valutazione finora

- Checklist For HR Audit Policy and ProceduresDocumento3 pagineChecklist For HR Audit Policy and ProcedureskrovvidiprasadaraoNessuna valutazione finora

- Periodic - Properties - Part 2 - by - AKansha - Karnwal - 1702453072953Documento68 paginePeriodic - Properties - Part 2 - by - AKansha - Karnwal - 1702453072953Saktipratik MishraNessuna valutazione finora

- Limiting and Excess Reactants Lesson PlanDocumento3 pagineLimiting and Excess Reactants Lesson Planapi-316338270100% (3)

- Plusnet Cancellation FormDocumento2 paginePlusnet Cancellation FormJoJo GunnellNessuna valutazione finora

- Eun 9e International Financial Management PPT CH01 AccessibleDocumento29 pagineEun 9e International Financial Management PPT CH01 AccessibleDao Dang Khoa FUG CTNessuna valutazione finora

- Jamaica's Unemployment Aims, Causes and SolutionsDocumento23 pagineJamaica's Unemployment Aims, Causes and Solutionsnetzii300067% (3)

- 1 PPT - Pavement of Bricks and TilesDocumento11 pagine1 PPT - Pavement of Bricks and TilesBHANUSAIJAYASRINessuna valutazione finora

- Impact of Agile On IT and BusinessDocumento6 pagineImpact of Agile On IT and BusinessPurva RaneNessuna valutazione finora

- Earth & Life Science Q1 Module 2 - DESIREE VICTORINODocumento22 pagineEarth & Life Science Q1 Module 2 - DESIREE VICTORINOJoshua A. Arabejo50% (4)

- No-Vacation NationDocumento24 pagineNo-Vacation NationCenter for Economic and Policy Research91% (54)

- The Power of Compounding: Why It's the 8th Wonder of the WorldDocumento5 pagineThe Power of Compounding: Why It's the 8th Wonder of the WorldWaleed TariqNessuna valutazione finora

- IAS 8 Tutorial Question (SS)Documento2 pagineIAS 8 Tutorial Question (SS)Given RefilweNessuna valutazione finora

- Revised Answer Keys for Scientist/Engineer Recruitment ExamDocumento5 pagineRevised Answer Keys for Scientist/Engineer Recruitment ExamDigantNessuna valutazione finora

- 5.3.2 Generation of Dislocations: Dislocations in The First Place!Documento2 pagine5.3.2 Generation of Dislocations: Dislocations in The First Place!Shakira ParveenNessuna valutazione finora

- D2 Pre-Board Prof. Ed. - Do Not Teach Too Many Subjects.Documento11 pagineD2 Pre-Board Prof. Ed. - Do Not Teach Too Many Subjects.Jorge Mrose26Nessuna valutazione finora

- Chrome Blue OTRFDocumento4 pagineChrome Blue OTRFHarsh KushwahaNessuna valutazione finora

- Leaflet STP2025 LightDocumento2 pagineLeaflet STP2025 LightNoel AjocNessuna valutazione finora

- Importance of Time Management To Senior High School Honor StudentsDocumento7 pagineImportance of Time Management To Senior High School Honor StudentsBien LausaNessuna valutazione finora

- Lauritzen 1964Documento10 pagineLauritzen 1964Priyanka GandhiNessuna valutazione finora

- CL Commands IVDocumento626 pagineCL Commands IVapi-3800226100% (2)

- PSE Inc. V CA G.R. No. 125469, Oct 27, 1997Documento7 paginePSE Inc. V CA G.R. No. 125469, Oct 27, 1997mae ann rodolfoNessuna valutazione finora

- Standard Chartered BackgroundDocumento6 pagineStandard Chartered BackgroundAwesum Allen MukiNessuna valutazione finora

- Restructuring ScenariosDocumento57 pagineRestructuring ScenariosEmir KarabegovićNessuna valutazione finora

- Mech Course HandbookDocumento20 pagineMech Course Handbookbrody lubkeyNessuna valutazione finora

- PDF To Sas DatasetsDocumento6 paginePDF To Sas DatasetsSiri KothaNessuna valutazione finora

- Lecture Notes - Sedimentation TankDocumento45 pagineLecture Notes - Sedimentation TankJomer Levi PortuguezNessuna valutazione finora

- Dance Manual W. Learning Outcomes PDFDocumento8 pagineDance Manual W. Learning Outcomes PDFJoshua Quijano LamzonNessuna valutazione finora

- Jharkhand VAT Rules 2006Documento53 pagineJharkhand VAT Rules 2006Krushna MishraNessuna valutazione finora