Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Step-By-Step Procedure For Sole Business Propietorship

Caricato da

Abigaile PaulinoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Step-By-Step Procedure For Sole Business Propietorship

Caricato da

Abigaile PaulinoCopyright:

Formati disponibili

STARTING A SOLE PROPRIETORSHIP BUSINESS IN THE PHILIPPINES

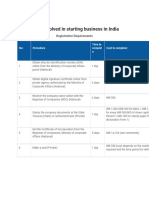

Time to Associated Costs

Department Procedure

complete (Estimated as of 2006)

Business Name

Registration Certificate from any DTI

Office or log on

to www.bnrs.dti.gov.ph.

Validity: 5 years Registration Fee

Requirements: Scope:

1. DTI National=P2000

Accomplished Business 1-2 days

(Department of Regional=P1000

Name Registration Form

Trade Industry) City/Municipality=P500

[Single Proprietorship]

Barangay=P200*Total fees to include

Tax Identification Number

Php 15 documentary stamp tax (DST)

(TIN)

List of five business names

ranked according to

preference

2. Barangay Obtain Barangay clearance 2 days PHP 800

The fees vary depending on the local government unit

(city/municipality) issuing the mayor’s permit.

Estimates:

PHP 900, sanitary permit fee + 0.2% of capital for license fee

Obtain Mayor’s Permit to operate at 1-2 weeks

3. Mayor’s PHP 2000, permit fee for businesses engaged in retailPHP 2,500 garbage

the Licensing depending on

Office collection feePHP 360, occupational taxPHP 905, occupational police

Section of the City or Municipality city

clearance/ health clearance

PHP 1,500, plumbing inspection fee

PHP 850, electrical inspection fee

PHP 500 building permit fee

PHP 400 sign board permit fee)

PHP 500 (registration fee) + PHP 100 (certification fee) and PHP 15

A. Register TIN with the BIR 2 days

(documentary stamp tax, in loose form to be attached to Form 2303)

B. Obtain Certificate of Authority to

1 day No Charge

Print (ATP) Form

4. BIR C. Buy special books at any

1 day PHP130- PHP150 ( 4 pcs )

(Bureau of Bookstore OR BIR’s Office

Internal Revenue)

D. Print receipts and invoices at the

14 days PHP180/ Booklet

print shops accredited by the BIR

E. Have books of accounts and

Printer’s Certificate of Delivery of

1day No charge

Receipts and Invoices (PCD) stamped

by the BIR

5. SSS Register with the Social Security

(Social Security

1 week No charge

System (SSS)

System)

6. PHIC Register with the Philippines Health

(Philippine Health Insurance 1 day No charge

Insurance Company (Phil Health)

Corporation)

Steps On How To Register A Sole Proprietor Business

1. Register your business name at the Department of Trade and Industry (DTI)

Make sure to search the DTI website to see if there are any businesses in existence that have

a name similar to yours. If the business name that you want is available, fill out a business

name application form, and submit it to DTI’s office. You must wait for your DTI certificate of

registration before you move onto the next step of opening your own sole proprietor business.

2. Register with Barangay

Once you have received your certificate of registration from the DTI, it’s time to go to the

Barangay where your business is located to fill out an application. In addition to your

application, you will need to submit your DTI Certificate of Business Registration, two valid

IDs, and a proof of residence. Wait and claim your Barangay Certificate of Business

Registration.

3. Register your sole proprietor business with the Mayor’s Office (LGU)

The next step, after receiving your Barangay certificate of business registration, is registering

your business at the municipal office in the city where your business is located. You will need

to fill out an application, as well as submit your Certificate of Business Registration from the

DTI, your Barangay Clearance Certificate, two valid forms of ID, and proof of residency.

4. Register with The Bureau of Internal Revenue (BIR)

After you receive your certificates and permits from DTI and LGU, it’s time to register your

sole proprietor business with the BIR. To do this, you will need to visit your regional district

office in the city where your business is located. You will be required to fill out a BIR form

1901, which is an application to register your sole proprietorship. In addition to your

completed BIR form 1901, you will need to submit your Certificate of Registration from DTI,

your Barangay Clearance Certificate, your Mayor’s Business Permit, proof of residency, and

valid ID. You will also have to pay for registration, (BIR Form 0605), and register your book of

accounts and provide any receipts or invoices you have for the business. After all of this has

been completed, you will be able to claim your certificate of registration, (BIR form 2303).

Make sure you have covered all additional clearances, permits, or licenses you need to obtain

before opening your business to the public. There are certain categories of business that

require additional documentation. After you have completed the four steps listed above, you

can focus on a strategy to succeed in your new business venture.

Potrebbero piacerti anche

- International Taxation In Nepal Tips To Foreign InvestorsDa EverandInternational Taxation In Nepal Tips To Foreign InvestorsNessuna valutazione finora

- Starting A Busi-WPS OfficeDocumento2 pagineStarting A Busi-WPS OfficeNicajane BarrettoNessuna valutazione finora

- LGU Requirements - PhilippinesDocumento11 pagineLGU Requirements - Philippinesni_kai2001100% (2)

- Business RegistrationDocumento7 pagineBusiness RegistrationEric SanchezNessuna valutazione finora

- Accreditation CycleDocumento21 pagineAccreditation CycleNathalie PadillaNessuna valutazione finora

- Assignment No.1 AmgetubigDocumento10 pagineAssignment No.1 AmgetubigAllison GetubigNessuna valutazione finora

- Untitled 1Documento8 pagineUntitled 1santoshguptNessuna valutazione finora

- Introduction of The CompanyDocumento25 pagineIntroduction of The CompanynareshNessuna valutazione finora

- Explains The Procedures in Making The Business LegalDocumento6 pagineExplains The Procedures in Making The Business LegalBerlin AlcaydeNessuna valutazione finora

- Handouts Basic Requirements For Registering Sole ProprietorDocumento7 pagineHandouts Basic Requirements For Registering Sole ProprietorAinne Tan100% (1)

- Philippines Business Registration: Time To CompleteDocumento13 paginePhilippines Business Registration: Time To CompleteMymyluridoNessuna valutazione finora

- 2023 KYBP Profile and Services (Latest Promo)Documento14 pagine2023 KYBP Profile and Services (Latest Promo)Kenny Diego ChenNessuna valutazione finora

- Primer - Quick and Easy Primer On Paying Your Taxes (BIR Issuance)Documento11 paginePrimer - Quick and Easy Primer On Paying Your Taxes (BIR Issuance)Diane JulianNessuna valutazione finora

- 5.0 Financial Aspect: No. Procedure Time To Complete Associated CostsDocumento24 pagine5.0 Financial Aspect: No. Procedure Time To Complete Associated CostsTesslene Claire SantosNessuna valutazione finora

- Steps Involved in Starting BusinessDocumento2 pagineSteps Involved in Starting BusinessAkshat AgarwalNessuna valutazione finora

- Trademark Registration ProcessDocumento2 pagineTrademark Registration ProcessEngineering DepartmentNessuna valutazione finora

- Kandee 3Documento13 pagineKandee 3Kandee Marie ApiNessuna valutazione finora

- Gontiñas 3 PDFDocumento13 pagineGontiñas 3 PDFKandee Marie ApiNessuna valutazione finora

- Gontiñas 3 PDFDocumento13 pagineGontiñas 3 PDFKandee Marie ApiNessuna valutazione finora

- Steps in Registering Your Business in The PhilippinesDocumento5 pagineSteps in Registering Your Business in The PhilippinesSherie Joy MercadoNessuna valutazione finora

- Tax Guide For Professionals: A Quick and Easy Primer On Paying Your TaxesDocumento8 pagineTax Guide For Professionals: A Quick and Easy Primer On Paying Your TaxesDanica FranciaNessuna valutazione finora

- CIM Tax File 00001 - Guide To Business Registration (Sole Proprietorship)Documento3 pagineCIM Tax File 00001 - Guide To Business Registration (Sole Proprietorship)CharlzNessuna valutazione finora

- Legal Formalities For Starting A Company in IndiaDocumento10 pagineLegal Formalities For Starting A Company in Indiavaibs14Nessuna valutazione finora

- Legal Aspect Legal Requirements: Fruity FloralDocumento14 pagineLegal Aspect Legal Requirements: Fruity FloralJesse CorpuzNessuna valutazione finora

- Flyer For All Types of Registration PDFDocumento2 pagineFlyer For All Types of Registration PDFPaulNessuna valutazione finora

- Hazel 3 PDFDocumento13 pagineHazel 3 PDFKandee Marie ApiNessuna valutazione finora

- Steps Involved in Starting BusinessDocumento2 pagineSteps Involved in Starting Businessnalin7angrishNessuna valutazione finora

- Cost-Of-Doing-Business Angeles CityDocumento5 pagineCost-Of-Doing-Business Angeles CityAlberto R. MercadoNessuna valutazione finora

- Professional Company Business Introduction PresentationDocumento7 pagineProfessional Company Business Introduction PresentationEugene Carlo OntolanNessuna valutazione finora

- 第三方服务信息收集 AaronDocumento21 pagine第三方服务信息收集 Aaronmollywong10014Nessuna valutazione finora

- Revised Organizational MGMTDocumento13 pagineRevised Organizational MGMTGirlie-Mae Espinueva EstiocoNessuna valutazione finora

- Sample Business Proposal/ PlanDocumento13 pagineSample Business Proposal/ PlanUmma Mie ZY100% (1)

- Flowchart Valencia-CityDocumento1 paginaFlowchart Valencia-CityPrincess Mae SamborioNessuna valutazione finora

- Cost of Doing Business in Zamboanga CityDocumento2 pagineCost of Doing Business in Zamboanga CityJianna SepeNessuna valutazione finora

- Barangay Micro Business Enterprise LawDocumento2 pagineBarangay Micro Business Enterprise LawIan De DiosNessuna valutazione finora

- Basic Requirements and Procedure in Registering A Sole Proprietor BusinessDocumento4 pagineBasic Requirements and Procedure in Registering A Sole Proprietor BusinessAyumi Xuie MontefalcoNessuna valutazione finora

- Department of Trade & Industry (DTI) Registration: 3 DaysDocumento2 pagineDepartment of Trade & Industry (DTI) Registration: 3 DaysBplo CaloocanNessuna valutazione finora

- Organizational and Management AspectDocumento9 pagineOrganizational and Management AspectAshy LeeNessuna valutazione finora

- Investment Requirements For A Food Truck BusinessDocumento10 pagineInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- Activity 02Documento4 pagineActivity 02HaruNessuna valutazione finora

- Steps Involved in Starting Business in IndiaDocumento1 paginaSteps Involved in Starting Business in IndiaPhanindra B RNessuna valutazione finora

- Steps in Registering Your Business in The PhilippinesDocumento7 pagineSteps in Registering Your Business in The PhilippinesJonas Celiz DatorNessuna valutazione finora

- Bir RegistrationDocumento11 pagineBir RegistrationArielle CabritoNessuna valutazione finora

- SEC Incorporation Lending CompanyDocumento8 pagineSEC Incorporation Lending Companyfalcones.legis.societas04Nessuna valutazione finora

- Fernandez Mary Lei M. Bsais 2a Technopreneurship Assignment 1Documento5 pagineFernandez Mary Lei M. Bsais 2a Technopreneurship Assignment 1francis dungcaNessuna valutazione finora

- 2307 BirDocumento3 pagine2307 BirPFMPC SecretaryNessuna valutazione finora

- For Printing BPLO MISC Cit CharterDocumento11 pagineFor Printing BPLO MISC Cit CharterMC Ivana PerezNessuna valutazione finora

- Legal AspectsDocumento11 pagineLegal AspectsIsaiah CruzNessuna valutazione finora

- 2001 MCno 04Documento6 pagine2001 MCno 04Mary Camille Anne RamirezNessuna valutazione finora

- Registration Procedure CTT Oct 2020Documento2 pagineRegistration Procedure CTT Oct 2020ACYATAN & CO., CPAs 2020Nessuna valutazione finora

- Pasig BPLO Charter. Udate 12-6-2018Documento7 paginePasig BPLO Charter. Udate 12-6-2018Roy LataquinNessuna valutazione finora

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocumento3 pagineCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasRonaldo CatindigNessuna valutazione finora

- Requirement For CY 2024Documento2 pagineRequirement For CY 2024abmbookkeepingofficeNessuna valutazione finora

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocumento2 pagineCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNessuna valutazione finora

- DV Consulting Inc Summary of ServicesDocumento5 pagineDV Consulting Inc Summary of ServicesDv AccountingNessuna valutazione finora

- Entrep Lab MidtermsDocumento2 pagineEntrep Lab MidtermsAdriane LustreNessuna valutazione finora

- Starting A Business in Davao PDFDocumento6 pagineStarting A Business in Davao PDFLRMNessuna valutazione finora

- BIOTECHDocumento18 pagineBIOTECHYeshaswi NagNessuna valutazione finora

- Tgs 1Documento1 paginaTgs 1Musdalifah RhazakNessuna valutazione finora

- EMERHUB Quotation - Foreign Owned Company Establishment For LF ConsultingDocumento8 pagineEMERHUB Quotation - Foreign Owned Company Establishment For LF ConsultingadmlfconsultNessuna valutazione finora

- MSJ FinalizedDocumento96 pagineMSJ Finalizedjohnnyg776Nessuna valutazione finora

- Form2a 1 Application Residential Other Minor - Catacutan Bldg.Documento1 paginaForm2a 1 Application Residential Other Minor - Catacutan Bldg.Karen MunozNessuna valutazione finora

- Case Study 7Documento2 pagineCase Study 7QinSiangAngNessuna valutazione finora

- Strategic Management ReportDocumento33 pagineStrategic Management ReportLuxme PokhrelNessuna valutazione finora

- Enhanced Commercial Cooking NC3 COC2 - POLODocumento20 pagineEnhanced Commercial Cooking NC3 COC2 - POLOKen OsumoNessuna valutazione finora

- Pfin5 5th Edition Billingsley Solutions ManualDocumento25 paginePfin5 5th Edition Billingsley Solutions ManualSarahSweeneyjpox100% (52)

- OD223976402654163000Documento4 pagineOD223976402654163000Aditya JaiswalNessuna valutazione finora

- Engineering Economics FormularsDocumento9 pagineEngineering Economics FormularsFe Ca Jr.Nessuna valutazione finora

- Chinese CurencyDocumento36 pagineChinese CurencyAtish JainNessuna valutazione finora

- Legprof CasesDocumento104 pagineLegprof CasesJemaica SebolinoNessuna valutazione finora

- Paypal Resolution PackageDocumento46 paginePaypal Resolution PackageTavon LewisNessuna valutazione finora

- 10 AxiomsDocumento6 pagine10 AxiomsJann KerkyNessuna valutazione finora

- Quality Metal Service CenterDocumento5 pagineQuality Metal Service CenterDatuk JujuNessuna valutazione finora

- UnpublishedDocumento8 pagineUnpublishedScribd Government DocsNessuna valutazione finora

- Chapter 5 - Process Flow and LayoutDocumento35 pagineChapter 5 - Process Flow and LayoutKamlendran BaradidathanNessuna valutazione finora

- Menu EngineeringDocumento9 pagineMenu Engineeringfirstman31Nessuna valutazione finora

- BLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.Documento1 paginaBLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.BaurzhanNessuna valutazione finora

- Philippines As An Emerging Market: Mentor - Dr. Shalini TiwariDocumento10 paginePhilippines As An Emerging Market: Mentor - Dr. Shalini TiwariRahul ChauhanNessuna valutazione finora

- CAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsDocumento78 pagineCAPITAL ASSET PRICING MODEL - A Study On Indian Stock Marketsnikhincc100% (1)

- Project Management Professional (PMP) Training &NEWDocumento792 pagineProject Management Professional (PMP) Training &NEWAmer Rahmah100% (7)

- Compendium of GOs For Epc in AP PDFDocumento444 pagineCompendium of GOs For Epc in AP PDFPavan CCDMC100% (1)

- Stake Holder Analysis - ExxonmobilDocumento8 pagineStake Holder Analysis - Exxonmobilshalabhs4uNessuna valutazione finora

- New Business Models For Creating Shared ValueDocumento21 pagineNew Business Models For Creating Shared ValueDhiya UlhaqNessuna valutazione finora

- Ebenezer Sathe: ProfileDocumento2 pagineEbenezer Sathe: ProfileRaj ShNessuna valutazione finora

- AG - The Contract Management Benchmark Report, Sales Contracts - 200604Documento26 pagineAG - The Contract Management Benchmark Report, Sales Contracts - 200604Mounir100% (1)

- 300 Business Card Details Updated FileDocumento42 pagine300 Business Card Details Updated FileDebobrota K. Sarker0% (1)

- Halmore - PL 25923 - BOP 1 (Non COA 12)Documento10 pagineHalmore - PL 25923 - BOP 1 (Non COA 12)Humayun NawazNessuna valutazione finora

- G.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationDocumento12 pagineG.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationKristine VillanuevaNessuna valutazione finora

- Options Trading Strategies: Understanding Position DeltaDocumento4 pagineOptions Trading Strategies: Understanding Position Deltasubash1983Nessuna valutazione finora

- AWS High Performance ComputingDocumento47 pagineAWS High Performance ComputingNineToNine Goregaon East MumbaiNessuna valutazione finora