Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kelompok 5 Soal Terjemahan

Caricato da

ElgaNurhikmahCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kelompok 5 Soal Terjemahan

Caricato da

ElgaNurhikmahCopyright:

Formati disponibili

Your first major assignment after your recent promotion at Ice Nine involves overseeing the

management of account receivable and inventory. The fisrt item that you must attend to involves a

proposed change credit policy that involved relaxing credit term from the existing terms 0f 1/50, net

70 to 2/60 net 90 in hopes of securing new sales. The management of Ice Nine does not expect bad

debt losses on its current customers to change under the new credit policy. The following information

should aid you in the analysis of this problem : (source : Financial Management, Principles and

Aplications, Titman,Keown,Martin,2014, Page 641)

New Sales level (all credit) $ 8,000,000

Original sales level (all credit) $ 7,000,000

Contribution margin 25%

Percents bad debt losses on new sales 8%

New average collection period 75 days

Original average collection period 60 days

Additional investment in inventory $ 50,000

Pre tax required rate of return 15%

New percent cash discount 2%

Percent of customers taking the new cash discount 50%

Original percent cash discount 1%

Percent of cusomers taking the old cash discount 50%

To help in your decision on relaxing credit terms, you have been asked to respond to the following

questions :

a. What determines the size of investment Ice Nine makes in Account Receivables ?

b. If a firms currently buys from Ice Nine on trade of credit with present terms of 1/50 net to and

decides to forgo the trade credit discount and pay on the next day, what is the annualized cost to

that firm of forgoing the discount ?

c. If Ice Nine changes its trade credit terms to 2/60 net 90, what is the annualized cost to firm that

buys on credit from Ice Nine and decided to forgo the trade credit discount and pay on the next

day ?

d. What is the estimated change in profit resulting from the increased sales less any additional bad

debts associated with the proposed change in credit policy ?

e. Estimate the cost of additional investment in account receivable and inventory associated with this

change in credit policy ?

f. Estimate the change in the cost of cash discount if the proposed change in credit policy is enacted

!

g. Compute the incremental revenues with the incremental costs. Should the proposed change be

enacted ?

1 SOAL INI BERSIFAT RAHASIA “HARUS DIKEMBALIKAN” | MILIK UNIVERSITAS MERCU BUANA

Potrebbero piacerti anche

- Chapter 7 BVDocumento2 pagineChapter 7 BVprasoonNessuna valutazione finora

- Wrigley Case AnswerDocumento4 pagineWrigley Case AnswerYehan MatuilanaNessuna valutazione finora

- Worldwide Paper CompanyDocumento1 paginaWorldwide Paper CompanyendiaoNessuna valutazione finora

- CASE6Documento7 pagineCASE6Yến NhiNessuna valutazione finora

- Jun18l1-Ep04 QDocumento18 pagineJun18l1-Ep04 QjuanNessuna valutazione finora

- MENG 6502 Financial ratios analysisDocumento6 pagineMENG 6502 Financial ratios analysisruss jhingoorieNessuna valutazione finora

- Super Project Case SolutionDocumento3 pagineSuper Project Case SolutionasaqNessuna valutazione finora

- Orange County Case ReportDocumento8 pagineOrange County Case ReportOguz AslayNessuna valutazione finora

- ACCT233 Midterm Exam Multichoice QuestionsDocumento7 pagineACCT233 Midterm Exam Multichoice QuestionsDominic Robinson0% (1)

- Understanding Capital Structure and LeverageDocumento14 pagineUnderstanding Capital Structure and LeverageJishan Mahmud-1220Nessuna valutazione finora

- If The Coat FitsDocumento4 pagineIf The Coat FitsAngelica OlescoNessuna valutazione finora

- Jacobs Division PDFDocumento5 pagineJacobs Division PDFAbdul wahabNessuna valutazione finora

- ProblemDocumento3 pagineProblemNicole LabbaoNessuna valutazione finora

- Analysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142Documento7 pagineAnalysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142ice1025Nessuna valutazione finora

- VAT Questions and AnswersDocumento2 pagineVAT Questions and AnswersChristian Mark AbarquezNessuna valutazione finora

- Taxation policies' effect on employee investment practicesDocumento64 pagineTaxation policies' effect on employee investment practicesprashanthNessuna valutazione finora

- Balance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessDa EverandBalance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessNessuna valutazione finora

- Statement of Cash Flows Indirect MethodDocumento3 pagineStatement of Cash Flows Indirect MethodheykmmyNessuna valutazione finora

- IPO AssignmentDocumento3 pagineIPO AssignmentBadr IftikharNessuna valutazione finora

- Asset Quality Management in BankDocumento13 pagineAsset Quality Management in Bankswendadsilva100% (4)

- The Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalDocumento10 pagineThe Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalSalil Kuwelkar100% (1)

- Mckenzie CorporationDocumento2 pagineMckenzie CorporationVipin KumarNessuna valutazione finora

- CPPIB's Private Equity Strategy vs Fund of FundsDocumento3 pagineCPPIB's Private Equity Strategy vs Fund of FundsJitesh Thakur100% (1)

- Q&E Micro Week 1Documento1 paginaQ&E Micro Week 1Aisha IslamadinaNessuna valutazione finora

- Case PDFDocumento5 pagineCase PDFAmyNessuna valutazione finora

- Chapter 4 Financial Statement AnalysisDocumento7 pagineChapter 4 Financial Statement AnalysisAnnaNessuna valutazione finora

- Zong BDocumento3 pagineZong BAbdul Rehman AmiwalaNessuna valutazione finora

- Problem Set #1 Solution: Part 1 (Cost of Capital)Documento4 pagineProblem Set #1 Solution: Part 1 (Cost of Capital)Shirley YeungNessuna valutazione finora

- PGPM FLEX MIDTERM Danforth - Donnalley Laundry Products CompanyDocumento3 paginePGPM FLEX MIDTERM Danforth - Donnalley Laundry Products Companyhayagreevan vNessuna valutazione finora

- Quiz 2 - QUESTIONSDocumento18 pagineQuiz 2 - QUESTIONSNaseer Ahmad AziziNessuna valutazione finora

- Flirting with Risk: Managing Investment PortfoliosDocumento13 pagineFlirting with Risk: Managing Investment PortfoliosKristin Joy Villa PeralesNessuna valutazione finora

- Should You Lease or Buy an Expensive Nuclear ScannerDocumento1 paginaShould You Lease or Buy an Expensive Nuclear ScannerrajbhandarishishirNessuna valutazione finora

- Making Star Products Investing DecisionDocumento3 pagineMaking Star Products Investing DecisionLove Digno-Del Rosario0% (3)

- Chapter 6 Review in ClassDocumento32 pagineChapter 6 Review in Classjimmy_chou1314Nessuna valutazione finora

- HW8 AnswersDocumento6 pagineHW8 AnswersPushkar Singh100% (1)

- Assignment 2 Kelompok 3 1. Fitriyanto 2. Garin Ario Tetuko 3. Retno Ajeng Zulia OctaviaDocumento4 pagineAssignment 2 Kelompok 3 1. Fitriyanto 2. Garin Ario Tetuko 3. Retno Ajeng Zulia OctaviaiyanNessuna valutazione finora

- NPV Breakeven AnalysisDocumento20 pagineNPV Breakeven AnalysisGizella Almeda0% (1)

- Wrigley Gum 21Documento18 pagineWrigley Gum 21Fidelity RoadNessuna valutazione finora

- CH 14 FMDocumento2 pagineCH 14 FMAsep KurniaNessuna valutazione finora

- Koehl's Doll Shop Cash Budget and Loan RequirementsDocumento3 pagineKoehl's Doll Shop Cash Budget and Loan Requirementsmobinil1Nessuna valutazione finora

- HBL Products: Domestic Banking: Service LineDocumento13 pagineHBL Products: Domestic Banking: Service LineSalman RahmanNessuna valutazione finora

- Data: Fazio Pump Corporation - CurrentDocumento8 pagineData: Fazio Pump Corporation - CurrentTubagus Donny SyafardanNessuna valutazione finora

- 07 Cafmst14 - CH - 05Documento52 pagine07 Cafmst14 - CH - 05Mahabub AlamNessuna valutazione finora

- CR Par Value PC $ 1,000 $ 40: 25 SharesDocumento4 pagineCR Par Value PC $ 1,000 $ 40: 25 SharesBought By UsNessuna valutazione finora

- KCHRDocumento3 pagineKCHRAftab AhmeedNessuna valutazione finora

- FSA 8e Ch04 SMDocumento63 pagineFSA 8e Ch04 SMmonhelNessuna valutazione finora

- CEC Case Study - Capital Structure and Financial Leverage OptionsDocumento9 pagineCEC Case Study - Capital Structure and Financial Leverage OptionsChirag Maheshwari100% (1)

- Case 75 The Western Co DirectedDocumento10 pagineCase 75 The Western Co DirectedHaidar IsmailNessuna valutazione finora

- Handout 2Documento3 pagineHandout 2Anu AmruthNessuna valutazione finora

- Levered Vs Unlevered Cost of Capital.Documento7 pagineLevered Vs Unlevered Cost of Capital.Zeeshan ShafiqueNessuna valutazione finora

- Chap 7aaDocumento86 pagineChap 7aaHoNestLiArNessuna valutazione finora

- Bond ValuationDocumento52 pagineBond ValuationDevi MuthiahNessuna valutazione finora

- Partnership Liquidation: Answers To Questions 1Documento28 paginePartnership Liquidation: Answers To Questions 1El Carl Sontellinosa0% (1)

- Mid Term Exam MCQs For 5530Documento6 pagineMid Term Exam MCQs For 5530Amy WangNessuna valutazione finora

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDocumento10 pagineChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosNessuna valutazione finora

- WrigleyDocumento4 pagineWrigleyswetaagarwal2706Nessuna valutazione finora

- Chapter 5 Financial Decisions Capital Structure-1Documento33 pagineChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedNessuna valutazione finora

- Suburban Electronics Company ValuationDocumento7 pagineSuburban Electronics Company ValuationHilmi DaffaNessuna valutazione finora

- Case 32 - Analysis GuidanceDocumento1 paginaCase 32 - Analysis GuidanceVoramon PolkertNessuna valutazione finora

- GUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONDocumento6 pagineGUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONDorianne BorgNessuna valutazione finora

- Wacc Mini CaseDocumento12 pagineWacc Mini CaseKishore NaiduNessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- TSP 70Documento15 pagineTSP 70onetimer64100% (1)

- Income Taxation Part 1 Tax On Corporations (Handouts)Documento2 pagineIncome Taxation Part 1 Tax On Corporations (Handouts)Hershey ReyesNessuna valutazione finora

- Northern Traders: Billed To: Shipped ToDocumento1 paginaNorthern Traders: Billed To: Shipped ToGourav baruNessuna valutazione finora

- Cost Calculation Pome PAODocumento2 pagineCost Calculation Pome PAOAULIA ANNANessuna valutazione finora

- Direct Tax Code: Taxation LawDocumento4 pagineDirect Tax Code: Taxation LawNitin GoyalNessuna valutazione finora

- State Budget Analysis 2023-24 RajasthanDocumento7 pagineState Budget Analysis 2023-24 RajasthanArunNessuna valutazione finora

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Documento45 pagineSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNessuna valutazione finora

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocumento2 pagine2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNessuna valutazione finora

- Casualties, Disasters, Thefts (p547)Documento24 pagineCasualties, Disasters, Thefts (p547)Dann KopkoNessuna valutazione finora

- Acca Tx-Mys 2019 SeptemberDocumento13 pagineAcca Tx-Mys 2019 SeptemberChoo LeeNessuna valutazione finora

- Cma Final GST Handwritten Notes - 1608648948Documento2 pagineCma Final GST Handwritten Notes - 1608648948Padmini SatapathyNessuna valutazione finora

- Magliochetti Moving Corp Has Been in Operation Since January 1 PDFDocumento1 paginaMagliochetti Moving Corp Has Been in Operation Since January 1 PDFTaimour HassanNessuna valutazione finora

- Class - 1 Clubbing of IncomeDocumento41 pagineClass - 1 Clubbing of IncomeTomy MathewNessuna valutazione finora

- CR DESIGN Service Invoice for Residential House PlansDocumento1 paginaCR DESIGN Service Invoice for Residential House PlansSachin SuccaramNessuna valutazione finora

- TAXATION 2: ESTATE TAX RULESDocumento13 pagineTAXATION 2: ESTATE TAX RULESJoseph Mangahas50% (2)

- Payslip EPay 20231026Documento1 paginaPayslip EPay 20231026jacksparrow2023mayNessuna valutazione finora

- Indirect Taxes Are Levied On The Production or Consumption of Goods andDocumento10 pagineIndirect Taxes Are Levied On The Production or Consumption of Goods andPARTH NAIKNessuna valutazione finora

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Documento1 paginaPayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNessuna valutazione finora

- BIR Ruling on Estate Tax Extension for Villaluz HeirsDocumento1 paginaBIR Ruling on Estate Tax Extension for Villaluz HeirsVikki AmorioNessuna valutazione finora

- PercentageDocumento18 paginePercentage?????Nessuna valutazione finora

- Cost accounting projects breakeven analysis profitDocumento3 pagineCost accounting projects breakeven analysis profitbiniamNessuna valutazione finora

- Taxation Question BankDocumento3 pagineTaxation Question BankRishikesh BhujbalNessuna valutazione finora

- 2019 1099-Consol Morgan Stanley 5948 KentDocumento10 pagine2019 1099-Consol Morgan Stanley 5948 Kentesteysi775Nessuna valutazione finora

- CPA Review Center Income Tax TheoriesDocumento4 pagineCPA Review Center Income Tax TheoriesJennifer Arcadio100% (1)

- ACC708 Lecture 2Documento26 pagineACC708 Lecture 2Emjes Giano100% (1)

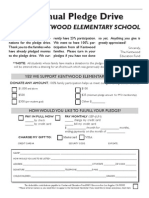

- PLEDGELTR11711Documento1 paginaPLEDGELTR11711MarkYamaNessuna valutazione finora

- Tax LawDocumento32 pagineTax Lawgilbert213Nessuna valutazione finora

- Bustax - Estate and Donor's TaxDocumento4 pagineBustax - Estate and Donor's TaxPhoebe LunaNessuna valutazione finora