Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Monthly Closing Check List

Caricato da

Imienaz Chus0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

153 visualizzazioni2 paginemcc

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentomcc

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

153 visualizzazioni2 pagineMonthly Closing Check List

Caricato da

Imienaz Chusmcc

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

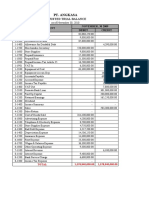

Monthly Closing

Standard Operating Procedure

Last Updated 01/15/2017

This SOP refers to Administration Departments process for closing out the period each month.

This procedure should be reviewed every month and the check list completed indicating that

each step has been completed.

Company Wide Month End

1. Complete all receiving of merchandize………………………………………………..Warehouse

2. Invoice all supply orders that have been delivered ………………………..Customer Care

3. Complete all equipment billing for Sales……………………………………………..Admin Dept

4. Close all completed service calls and invoice………………………..…….……Service Admin

5. Invoice all base contract amounts……………………………………………….….Contract Billing

6. Invoice all usage that has not billed but can be estimated………….…..Contract Billing

7. Enter all accounts Payable invoices received……………………………….Accounts Payable

8. Made sure all physical inventories have been posted………………….Inventory Control

9. Complete all Bank Deposits/ACH postings…………………………….…Accounts Receivable

10. Enter all Misc AP transactions that would go to expense ………….…Accounts Payable

Accounting Department: (make sure the last day of month is used as posting

date)

1. Run all reoccurring GL entries

a. Reserve for bad Debt

b. Usage billed for closing month but billed in current month is posted to

correct revenue period. (Contract Billing Revenue)

2. Run AR aging report and reconcile with balance sheet. Ensure that amounts in the

un-deposited GL match those transactions that have not yet it the bank account in

“New Deposit” window.

3. Run AP aging report and reconcile with balance sheet.

4. Run Inventory valuation report and reconcile with balance sheet.

5. Run Purchase Order Receipt Trial Balance Report and reconcile with GL#2002

6. Reconcile all Cashbook accounts with statements from financial institutions.

7. Ensure Contract Accruals have run (e-agent task) – Check queue that all accruals

have posted.

a. Check that accrual amounts have posted to appropriate month.

b. Run “Contract Deferred Revenue Reconciliation” report.

8. Run Fixed Asset Depreciation Task – Run “Fixed Asset” report and reconcile with

balance sheet.

*save all reports and trial balances to “End of Month” file on I:Drive.

Once everything matches, close period.

Period MUST be closed before Sales tax reports are run and amounts paid.

Potrebbero piacerti anche

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesDa EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNessuna valutazione finora

- InterviewDocumento2 pagineInterviewMajda MohamadNessuna valutazione finora

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyDa EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNessuna valutazione finora

- Month End Closing ProceduresDocumento8 pagineMonth End Closing ProceduresAniruddha ChakrabortyNessuna valutazione finora

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Documento14 pagineACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNessuna valutazione finora

- Comprehensive Problem Assignment - PDFDocumento20 pagineComprehensive Problem Assignment - PDFJunior RobinsonNessuna valutazione finora

- Accounting Q&ADocumento50 pagineAccounting Q&AKumaar Guhan50% (2)

- The Conceptual Framework of AccountingDocumento34 pagineThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Payables Month End ChecklistDocumento2 paginePayables Month End ChecklistblowbabaNessuna valutazione finora

- RJDAMA CHRISTIAN ACADEMY INC. 2nd SUMMATIVE TESTDocumento3 pagineRJDAMA CHRISTIAN ACADEMY INC. 2nd SUMMATIVE TESTjelay agresorNessuna valutazione finora

- EBS Period ClosingDocumento18 pagineEBS Period ClosingdbaahsumonbdNessuna valutazione finora

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocumento10 pagineModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNessuna valutazione finora

- Computerized AccountingDocumento55 pagineComputerized AccountingBWAMBALE SALVERI MUZANANessuna valutazione finora

- Acc201 Su2Documento5 pagineAcc201 Su2Gwyneth LimNessuna valutazione finora

- Acc 103 Quiz ReviewerDocumento7 pagineAcc 103 Quiz Reviewerfernandezmaekyla1330Nessuna valutazione finora

- #01 Accounting ProcessDocumento3 pagine#01 Accounting ProcessZaaavnn VannnnnNessuna valutazione finora

- Period Close Processing Checklist - R12 General LedgerDocumento5 paginePeriod Close Processing Checklist - R12 General LedgerSureshNessuna valutazione finora

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Documento14 pagineACTBAS1 - Lecture 11 (Completion of Acctg Cycle)ivang95Nessuna valutazione finora

- Accountancy - Chapter 4 & 5Documento5 pagineAccountancy - Chapter 4 & 5maricarNessuna valutazione finora

- ACTG123 (Reviewer)Documento3 pagineACTG123 (Reviewer)Jenna BanganNessuna valutazione finora

- Accounting PhaseDocumento3 pagineAccounting PhaseFaithful FighterNessuna valutazione finora

- Period Closing ActivitiesDocumento16 paginePeriod Closing ActivitiesAshu GroverNessuna valutazione finora

- Practice Exam II Accounting 101Documento12 paginePractice Exam II Accounting 101Abdelkebir LabyadNessuna valutazione finora

- CHAP05Documento48 pagineCHAP05Trúc NenokonNessuna valutazione finora

- Architect's accounting entriesDocumento3 pagineArchitect's accounting entriesHelen SabuquelNessuna valutazione finora

- Accounting Process CycleDocumento12 pagineAccounting Process Cyclechandra sekhar Tippreddy100% (1)

- New Microsoft Word DocumentDocumento2 pagineNew Microsoft Word Documentracc wooyoNessuna valutazione finora

- Steps in The Accounting CycleDocumento8 pagineSteps in The Accounting CycleMarianne GonzalesNessuna valutazione finora

- Fin Actg BasicsDocumento2 pagineFin Actg BasicsKenny KeeNessuna valutazione finora

- R12 Month End and Year End Close User GuideDocumento16 pagineR12 Month End and Year End Close User GuideHaslina Hasan100% (2)

- The Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDocumento41 pagineThe Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDodgeSanchezNessuna valutazione finora

- Accounting ProcessDocumento5 pagineAccounting ProcessValNessuna valutazione finora

- ACTG121LEC (Reviewer)Documento3 pagineACTG121LEC (Reviewer)Jenna BanganNessuna valutazione finora

- Record to Report - General Ledger Accounting_240401_004120Documento11 pagineRecord to Report - General Ledger Accounting_240401_004120Bharat ChekuriNessuna valutazione finora

- Introduction: The Accounting Process Is A Series of Activities That BeginsDocumento20 pagineIntroduction: The Accounting Process Is A Series of Activities That BeginsMiton AlamNessuna valutazione finora

- Month End Closing Procedures 0Documento9 pagineMonth End Closing Procedures 0narasi64Nessuna valutazione finora

- Understanding the Four Main Accounting Transaction CyclesDocumento25 pagineUnderstanding the Four Main Accounting Transaction CyclesMaricar PinedaNessuna valutazione finora

- Review of Financial Statement PreparationDocumento21 pagineReview of Financial Statement PreparationKim RoblesNessuna valutazione finora

- WEEK-15-18Documento33 pagineWEEK-15-18Johncarlo GenestonNessuna valutazione finora

- The Accounting Cyc: 1. Identify TransactionsDocumento8 pagineThe Accounting Cyc: 1. Identify TransactionsEnatnesh DegagaNessuna valutazione finora

- Supplementary Material Module 5Documento10 pagineSupplementary Material Module 5Darwin Dionisio ClementeNessuna valutazione finora

- Welcome To The Period End Closing TopicDocumento25 pagineWelcome To The Period End Closing TopicFernandoNessuna valutazione finora

- Completing The Accounting CycleDocumento9 pagineCompleting The Accounting CycleTikaNessuna valutazione finora

- Q3-Module-1Documento15 pagineQ3-Module-1shamrockjusayNessuna valutazione finora

- Introduction To Computerized Accounting: Unit 1Documento88 pagineIntroduction To Computerized Accounting: Unit 1Turyamureeba JuliusNessuna valutazione finora

- The Accounting Cycle: 1. TransactionsDocumento2 pagineThe Accounting Cycle: 1. TransactionsJonalyn MontecalvoNessuna valutazione finora

- Chapter 6 LectureDocumento21 pagineChapter 6 LectureDana cheNessuna valutazione finora

- Audit Summary Cash Receipt and Sales Receipt FlowchartDocumento8 pagineAudit Summary Cash Receipt and Sales Receipt Flowchartandi TenriNessuna valutazione finora

- Accounting CycleDocumento3 pagineAccounting CyclefranciscalinjeNessuna valutazione finora

- Fiscal and Interim Accounting PeriodsDocumento20 pagineFiscal and Interim Accounting Periodskareem abozeedNessuna valutazione finora

- R12 Month End Close ChecklistDocumento15 pagineR12 Month End Close ChecklistHaslina Hasan100% (2)

- CH 4Documento59 pagineCH 4ad_jebbNessuna valutazione finora

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocumento16 pagineFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNessuna valutazione finora

- FAR Summary NotesDocumento53 pagineFAR Summary NotesVeronica BañaresNessuna valutazione finora

- CHAPTER 2 - Accounting CycleDocumento11 pagineCHAPTER 2 - Accounting CycleFranz Josef MereteNessuna valutazione finora

- Finalizing The Accounting ProcessDocumento2 pagineFinalizing The Accounting ProcessMilagro Del ValleNessuna valutazione finora

- Period Close Dependencies FusionDocumento6 paginePeriod Close Dependencies FusionKv kNessuna valutazione finora

- Review of Accounting Process 1Documento2 pagineReview of Accounting Process 1Stacy SmithNessuna valutazione finora

- Cash & Accrual Basis Multiple ChoiceDocumento17 pagineCash & Accrual Basis Multiple Choiceedison martin100% (2)

- Reconcile AP Trial Balance to GL Creditors AccountDocumento1 paginaReconcile AP Trial Balance to GL Creditors Accountmanukleo100% (1)

- Fotl SizeDocumento10 pagineFotl SizeImienaz ChusNessuna valutazione finora

- Bahasa Inggeris Ii - Penulisan Mei Tahun 4 1 Jam 15 MinitDocumento8 pagineBahasa Inggeris Ii - Penulisan Mei Tahun 4 1 Jam 15 MinitImienaz ChusNessuna valutazione finora

- Accounting Excel Template July ST V3Documento50 pagineAccounting Excel Template July ST V3Imienaz ChusNessuna valutazione finora

- Checkbook RegisterDocumento3 pagineCheckbook RegisterImienaz ChusNessuna valutazione finora

- Accounts Receivable LedgerDocumento8 pagineAccounts Receivable LedgerImienaz ChusNessuna valutazione finora

- Expenses Description Jan Feb Mar Apr May Jun Jul Aug Sep: Page 1 of 2Documento2 pagineExpenses Description Jan Feb Mar Apr May Jun Jul Aug Sep: Page 1 of 2sajibimtiazNessuna valutazione finora

- Accounts Payable Report Generator1Documento2 pagineAccounts Payable Report Generator1Imienaz ChusNessuna valutazione finora

- Expense Report TemplateDocumento2 pagineExpense Report TemplateImienaz ChusNessuna valutazione finora

- Personal Budget TemplateDocumento12 paginePersonal Budget TemplateImienaz ChusNessuna valutazione finora

- Excel purchase return book with tax detailsDocumento4 pagineExcel purchase return book with tax detailsImienaz ChusNessuna valutazione finora

- Inventory Control SheetDocumento1 paginaInventory Control SheetImienaz ChusNessuna valutazione finora

- Inventory Control SheetDocumento10 pagineInventory Control SheetImienaz ChusNessuna valutazione finora

- Cash Book Template VATDocumento2 pagineCash Book Template VATImienaz ChusNessuna valutazione finora

- ICT - 0418 - Y07 - SW - T03 (Storage Devices and Media (43Kb) )Documento2 pagineICT - 0418 - Y07 - SW - T03 (Storage Devices and Media (43Kb) )Yenny TigaNessuna valutazione finora

- ExpreesionDocumento62 pagineExpreesionImienaz ChusNessuna valutazione finora

- Derive Cost Center in Oracle Payables SLADocumento9 pagineDerive Cost Center in Oracle Payables SLAMuthumariappan21100% (1)

- Nonprofit Financial StatementsDocumento46 pagineNonprofit Financial Statementsrengkujeffry5323Nessuna valutazione finora

- Chap 004Documento84 pagineChap 004MubasherAkramNessuna valutazione finora

- Handout No. 3 Accrev San BedaDocumento10 pagineHandout No. 3 Accrev San BedaJustine CruzNessuna valutazione finora

- Međunarodno Računovodstvo - Strani PojmoviDocumento9 pagineMeđunarodno Računovodstvo - Strani PojmoviJoško KinjerovacNessuna valutazione finora

- Receiving Receipts FAQ'sDocumento13 pagineReceiving Receipts FAQ'spratyusha_3Nessuna valutazione finora

- 01 BIWS Accounting Quick Reference PDFDocumento2 pagine01 BIWS Accounting Quick Reference PDFcarminatNessuna valutazione finora

- Kaplan Ac113 - Acc 113 Module 4 Exam (All Are Correct)Documento2 pagineKaplan Ac113 - Acc 113 Module 4 Exam (All Are Correct)teacher.theacestudNessuna valutazione finora

- Kerja Kelompok PT Angkasa BDocumento28 pagineKerja Kelompok PT Angkasa BElisa EndrianiiNessuna valutazione finora

- Adjustments To Financial Statements - Students - ACCA Global - ACCA GlobalDocumento4 pagineAdjustments To Financial Statements - Students - ACCA Global - ACCA Globalacca_kaplan100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento50 pagineIdentify The Choice That Best Completes The Statement or Answers The QuestionasffghjkNessuna valutazione finora

- Roku Inc (ROKU US) - AdjustedDocumento9 pagineRoku Inc (ROKU US) - Adjustedjustinbui85Nessuna valutazione finora

- Full Download Ebook PDF Financial Accounting Information For Decisions 8th PDFDocumento41 pagineFull Download Ebook PDF Financial Accounting Information For Decisions 8th PDFbrad.harper906100% (35)

- Ashton Tate Limited ANSWERDocumento4 pagineAshton Tate Limited ANSWERJoseph HallNessuna valutazione finora

- Ellis CAMPBELL, JR., Director of Internal Revenue For The Second Collection District of Texas, v. William A. SAILER and Wife, Patricia O'Leary SailerDocumento4 pagineEllis CAMPBELL, JR., Director of Internal Revenue For The Second Collection District of Texas, v. William A. SAILER and Wife, Patricia O'Leary SailerScribd Government DocsNessuna valutazione finora

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocumento14 pagineAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- Case Studies Fev AnswersDocumento5 pagineCase Studies Fev AnswersAisha KhanNessuna valutazione finora

- Commissioner of Internal Revenue v. Solidbank Corporation (416 SCRA 436)Documento17 pagineCommissioner of Internal Revenue v. Solidbank Corporation (416 SCRA 436)Art BurceNessuna valutazione finora

- Applied Auditing: 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645Documento7 pagineApplied Auditing: 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645Bryan PiañarNessuna valutazione finora

- Oracle EBSR12 Inventory Version 01Documento256 pagineOracle EBSR12 Inventory Version 01MosunmolaNessuna valutazione finora

- Monthly Digest Dec 2013Documento134 pagineMonthly Digest Dec 2013innvolNessuna valutazione finora

- Audit Accrued Expenses ProgramDocumento10 pagineAudit Accrued Expenses ProgramPutu Adi NugrahaNessuna valutazione finora

- Cash Flow AnalysisDocumento75 pagineCash Flow AnalysisBalasingam PrahalathanNessuna valutazione finora

- Appendix 4Documento4 pagineAppendix 4Rajesh ShirwatkarNessuna valutazione finora

- 06 Financial Estimates and ProjectionsDocumento19 pagine06 Financial Estimates and ProjectionsSri RanjaniNessuna valutazione finora

- Financial Terms GlossaryDocumento1.135 pagineFinancial Terms GlossaryLenin FernándezNessuna valutazione finora

- Accounting Reviewer 1.1Documento35 pagineAccounting Reviewer 1.1Ma. Concepcion DesepedaNessuna valutazione finora

- Chapter 4Documento50 pagineChapter 4Nguyen Hai AnhNessuna valutazione finora

- PT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23Documento16 paginePT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23adisetNessuna valutazione finora

- Oracle R12 P2P Interview Preparation - by Dinesh Kumar SDocumento94 pagineOracle R12 P2P Interview Preparation - by Dinesh Kumar Sdineshcse86gmailcomNessuna valutazione finora

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Basic Accounting: Service Business Study GuideDa EverandBasic Accounting: Service Business Study GuideValutazione: 5 su 5 stelle5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDa EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungValutazione: 4 su 5 stelle4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyDa EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyValutazione: 4 su 5 stelle4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora