Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LSPA

Caricato da

Rebecca HarringtonCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LSPA

Caricato da

Rebecca HarringtonCopyright:

Formati disponibili

SIL19543 S.L.C.

S. ll

116TH CONGRESS

1ST SESSION

To protect consumers from usury.

IN THE SENATE OF THE UNITED STATES

llllllllll

Mr. SANDERS (for himself and Mr. WHITEHOUSE) introduced the following

bill; which was read twice and referred to the Committee on

llllllllll

A BILL

To protect consumers from usury.

1 Be it enacted by the Senate and House of Representa-

2 tives of the United States of America in Congress assembled,

3 SECTION 1. SHORT TITLE.

4 This Act may be cited as the ‘‘Loan Shark Prevention

5 Act’’.

6 SEC. 2. INTEREST RATE REDUCTION.

7 (a) NATIONAL CONSUMER CREDIT USURY RATE.—

8 Section 107 of the Truth in Lending Act (15 U.S.C. 1606)

9 is amended by adding at the end the following new sub-

10 section:

11 ‘‘(f) NATIONAL CONSUMER CREDIT USURY RATE.—

SIL19543 S.L.C.

2

1 ‘‘(1) LIMITATION ESTABLISHED.—

2 ‘‘(A) IN GENERAL.—Notwithstanding sub-

3 section (a) or any other provision of law, but

4 except as provided in paragraph (2), the annual

5 percentage rate applicable to any extension of

6 credit may not exceed the lesser of—

7 ‘‘(i) 15 percent on unpaid balances,

8 inclusive of all finance charges; or

9 ‘‘(ii) the maximum rate permitted by

10 the laws of the State in which the con-

11 sumer resides.

12 ‘‘(B) OTHER FEES.—Any fees that are not

13 considered finance charges under section 106(a)

14 may not be used to evade the limitations of this

15 paragraph, and the total sum of such fees may

16 not exceed the total amount of finance charges

17 assessed.

18 ‘‘(2) EXCEPTIONS.—

19 ‘‘(A) BOARD AUTHORITY.—The Board may

20 establish, after consultation with the appro-

21 priate committees of Congress, the Secretary of

22 the Treasury, and any other interested Federal

23 financial institution regulatory agency, an an-

24 nual percentage rate of interest ceiling exceed-

25 ing the 15 percent annual rate under paragraph

SIL19543 S.L.C.

3

1 (1) for periods of not to exceed 18 months,

2 upon a determination that—

3 ‘‘(i) money market interest rates have

4 risen over the preceding 6-month period;

5 and

6 ‘‘(ii) prevailing interest rate levels

7 threaten the safety and soundness of indi-

8 vidual lenders, as evidenced by adverse

9 trends in liquidity, capital, earnings, and

10 growth.

11 ‘‘(B) TREATMENT OF CREDIT UNIONS.—

12 The limitation in paragraph (1) does not apply

13 with respect to any extension of credit by an in-

14 sured credit union, as that term is defined in

15 section 101 of the Federal Credit Union Act

16 (12 U.S.C. 1752).

17 ‘‘(3) PENALTIES FOR CHARGING HIGHER

18 RATES.—

19 ‘‘(A) VIOLATION.—The taking, receiving,

20 reserving, or charging of an annual percentage

21 rate or fee greater than that permitted by para-

22 graph (1), when knowingly done, shall be

23 deemed a violation of this title, and a forfeiture

24 of the entire interest which the note, bill, or

SIL19543 S.L.C.

4

1 other evidence of the obligation carries with it,

2 or which has been agreed to be paid thereon.

3 ‘‘(B) REFUND OF INTEREST AMOUNTS.—If

4 an annual percentage rate or fee greater than

5 that permitted under paragraph (1) has been

6 paid, the person by whom it has been paid, or

7 the legal representative thereof, may, by bring-

8 ing an action not later than 2 years after the

9 date on which the usurious collection was last

10 made, recover back from the lender in an action

11 in the nature of an action of debt, the entire

12 amount of interest, finance charges, or fees

13 paid.

14 ‘‘(4) CIVIL LIABILITY.—Any creditor who vio-

15 lates this subsection shall be subject to the provi-

16 sions of section 130.

17 ‘‘(g) RELATION TO STATE LAW.—Nothing in this

18 section may be construed to preempt any provision of

19 State law that provides greater protection to consumers

20 than is provided in this section.’’.

21 (b) CIVIL LIABILITY CONFORMING AMENDMENT.—

22 Section 130(a) of the Truth in Lending Act (15 U.S.C.

23 1640(a)) is amended by inserting ‘‘section 107(f),’’ before

24 ‘‘this chapter’’.

Potrebbero piacerti anche

- DOJ/Pence Reply To GohmertDocumento14 pagineDOJ/Pence Reply To GohmertRebecca Harrington100% (1)

- Gohmert Court FilingDocumento43 pagineGohmert Court FilingHenry Rodgers50% (2)

- Prepared Testimony of Dr. Rick BrightDocumento5 paginePrepared Testimony of Dr. Rick BrightRebecca HarringtonNessuna valutazione finora

- Brett Kavanaugh Monica Lewinsky Memo 8.15.98Documento2 pagineBrett Kavanaugh Monica Lewinsky Memo 8.15.98Rebecca HarringtonNessuna valutazione finora

- Carter Page FISA ApplicationDocumento412 pagineCarter Page FISA ApplicationRebecca Harrington100% (1)

- Searchable Mueller ReportDocumento448 pagineSearchable Mueller ReportRebecca Harrington100% (2)

- Mattis Resignation LetterDocumento2 pagineMattis Resignation LetterRebecca Harrington100% (1)

- 2018-08-20.EEC Lynch To Kelly-WH Re Bolton SF86 Information RequestDocumento4 pagine2018-08-20.EEC Lynch To Kelly-WH Re Bolton SF86 Information RequestRebecca HarringtonNessuna valutazione finora

- The Government'S Sentencing MemorandumDocumento40 pagineThe Government'S Sentencing MemorandumAnonymous dHcjlTwONessuna valutazione finora

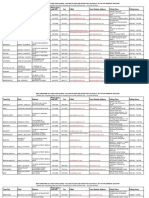

- New Hampshire Polling Place Locations Open-Close TimesDocumento25 pagineNew Hampshire Polling Place Locations Open-Close TimesRebecca HarringtonNessuna valutazione finora

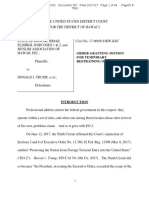

- Trump v. HawaiiDocumento92 pagineTrump v. HawaiiAnonymous FBZLGrNessuna valutazione finora

- Interim Redacted Report and ResponsesDocumento1.356 pagineInterim Redacted Report and ResponsesPennLiveNessuna valutazione finora

- Manafort IndictmentDocumento31 pagineManafort IndictmentKatie Pavlich100% (5)

- Trump JR Emails Senate Judiciary CommitteeDocumento63 pagineTrump JR Emails Senate Judiciary CommitteeRebecca HarringtonNessuna valutazione finora

- United States Senate Committee On The Judiciary: Testimony of Natalia VeselnitskayaDocumento52 pagineUnited States Senate Committee On The Judiciary: Testimony of Natalia VeselnitskayaStephen LoiaconiNessuna valutazione finora

- James B. Comey StatementDocumento7 pagineJames B. Comey StatementYahoo News100% (6)

- Cllib-T-: Norton Rose FulbrightDocumento12 pagineCllib-T-: Norton Rose FulbrightStephen LoiaconiNessuna valutazione finora

- Paul Manafort June 9 Notes and SchedulesDocumento1 paginaPaul Manafort June 9 Notes and SchedulesStephen LoiaconiNessuna valutazione finora

- SCOTUS Travel BanDocumento16 pagineSCOTUS Travel BanAnonymous 2lblWUW6rS100% (2)

- Trump Travel Ban 3 OpinionDocumento40 pagineTrump Travel Ban 3 OpinionRebecca HarringtonNessuna valutazione finora

- Trump Jr. TranscriptDocumento224 pagineTrump Jr. TranscriptM Mali67% (3)

- ACLU Transgender Military Trump Ban ComplaintDocumento39 pagineACLU Transgender Military Trump Ban ComplaintRebecca HarringtonNessuna valutazione finora

- CEJA Analysis of California Cap-And-Trade Bill AB-398Documento2 pagineCEJA Analysis of California Cap-And-Trade Bill AB-398Rebecca HarringtonNessuna valutazione finora

- Ahmad Khan Rahami ComplaintDocumento14 pagineAhmad Khan Rahami ComplaintRebecca HarringtonNessuna valutazione finora

- Congressional Letter To AF, NASA, FAA On Assured Access To SpaceDocumento4 pagineCongressional Letter To AF, NASA, FAA On Assured Access To SpaceRebecca HarringtonNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- April 10, 2015 Strathmore TimesDocumento28 pagineApril 10, 2015 Strathmore TimesStrathmore TimesNessuna valutazione finora

- American Civil War, WikipediaDocumento32 pagineAmerican Civil War, WikipediaMariko100% (1)

- Marie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th GradeDocumento50 pagineMarie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th Gradeluiz carvalhoNessuna valutazione finora

- Vda. de Consuegra v. Government Service Insurance System (1971)Documento1 paginaVda. de Consuegra v. Government Service Insurance System (1971)Andre Philippe RamosNessuna valutazione finora

- Household Services: Department of Education - Republic of The PhilippinesDocumento21 pagineHousehold Services: Department of Education - Republic of The PhilippinesRina Vianney De Leon40% (5)

- Ipocc User Interface enDocumento364 pagineIpocc User Interface enMarthaGutnaraNessuna valutazione finora

- A New High Drive Class-AB FVF Based Second Generation Voltage ConveyorDocumento5 pagineA New High Drive Class-AB FVF Based Second Generation Voltage ConveyorShwetaGautamNessuna valutazione finora

- PROFILITE 60 EC Suspended 09 130 3001-01-830 Product Datasheet enDocumento4 paginePROFILITE 60 EC Suspended 09 130 3001-01-830 Product Datasheet enGabor ZeleyNessuna valutazione finora

- Chapter 8 OkDocumento37 pagineChapter 8 OkMa. Alexandra Teddy Buen0% (1)

- Daily Timecard Entry in HoursDocumento20 pagineDaily Timecard Entry in HoursadnanykhanNessuna valutazione finora

- SafeCargo PDFDocumento76 pagineSafeCargo PDFSyukry MaulidyNessuna valutazione finora

- ERACS JournalDocumento8 pagineERACS Journalmahasiswaprofesi2019Nessuna valutazione finora

- Industrial Tour Report (JEWEL - MANAGEMENT-CU)Documento37 pagineIndustrial Tour Report (JEWEL - MANAGEMENT-CU)Mohammad Jewel100% (2)

- Project ProposalDocumento6 pagineProject Proposalapi-386094460Nessuna valutazione finora

- Components in Action Script 2.0 UNIT 3Documento4 pagineComponents in Action Script 2.0 UNIT 3k.nagendraNessuna valutazione finora

- History of Titan Watch IndustryDocumento46 pagineHistory of Titan Watch IndustryWasim Khan25% (4)

- EE5 Writing Revision Unit1-5Documento8 pagineEE5 Writing Revision Unit1-5Chuc VuNessuna valutazione finora

- Practical Approach To Practice 5SDocumento4 paginePractical Approach To Practice 5SNikola DjorovicNessuna valutazione finora

- 803 Web Application Class XI 1Documento254 pagine803 Web Application Class XI 1Naina KanojiaNessuna valutazione finora

- Innovative Uses of Housing Lifting Techniques-JIARMDocumento16 pagineInnovative Uses of Housing Lifting Techniques-JIARMPOOJA VNessuna valutazione finora

- Breadtalk AR 2011Documento158 pagineBreadtalk AR 2011Wong ZieNessuna valutazione finora

- Design and Construction of Water Supply SchemeDocumento126 pagineDesign and Construction of Water Supply SchemeShreyansh SharmaNessuna valutazione finora

- Practice Ch3Documento108 paginePractice Ch3Agang Nicole BakwenaNessuna valutazione finora

- 4563Documento58 pagine4563nikosNessuna valutazione finora

- Comprehensive Case 1 BKAR3033 A221Documento3 pagineComprehensive Case 1 BKAR3033 A221naufal hazimNessuna valutazione finora

- Cryogenics 50 (2010) Editorial on 2009 Space Cryogenics WorkshopDocumento1 paginaCryogenics 50 (2010) Editorial on 2009 Space Cryogenics WorkshopsureshjeevaNessuna valutazione finora

- ECS 1601 Learning Unit 7 Quiz: Key Concepts of the Circular Flow, Autonomous vs Induced Spending, Fiscal PolicyDocumento4 pagineECS 1601 Learning Unit 7 Quiz: Key Concepts of the Circular Flow, Autonomous vs Induced Spending, Fiscal PolicyVinny HungweNessuna valutazione finora

- CAT Álogo de Peças de Reposi ÇÃO: Trator 6125JDocumento636 pagineCAT Álogo de Peças de Reposi ÇÃO: Trator 6125Jmussi oficinaNessuna valutazione finora

- Long-Range FM Transmitter With Variable Power OutputDocumento2 pagineLong-Range FM Transmitter With Variable Power OutputHaspreet SinghNessuna valutazione finora

- TeramisoDocumento1 paginaTeramisoNasriyah SolaimanNessuna valutazione finora