Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ONETT For Sale of Real Property Classified As Ordinary Asset

Caricato da

d-fbuser-494170720 valutazioniIl 0% ha trovato utile questo documento (0 voti)

181 visualizzazioni1 paginaONETT

Titolo originale

ONETT for Sale of Real Property Classified as Ordinary Asset

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoONETT

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

181 visualizzazioni1 paginaONETT For Sale of Real Property Classified As Ordinary Asset

Caricato da

d-fbuser-49417072ONETT

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

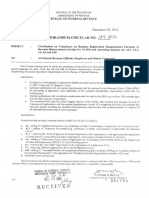

"Annex B-4"

ONETT COMPUTATION SHEET

EXPANDED WITHHOLDING TAX (EWT) and DOCUMENTARY STAMP TAX (DST)

SALE OF REAL PROPERTY CONSIDERED AS ORDINARY ASSET

Revenue Region No. ______ , Revenue District Office No. ______ - _______________________________

NAME OF SELLER/S: ADDRESS: TIN:

NAME OF BUYER/S: ADDRESS: TIN:

DATE OF TRANSACTION: DUE DATE (EWT): DUE DATE (DST):

Tax Fair Market Tax Base

OCT/TCT ZV/ Zonal Value Selling Price

Declaration LOCATION CLASS. AREA Value (FMV) (ZV/FMV/SP whichever is

CCT No. No. (TD) sq. m. (ZV) (SP)

per TD higher)

TOTAL

COMPUTATION DETAILS: PER AUDIT PER REVIEW

EXPANDED WITHHOLDING TAX

TAX DUE

Legal basis: RR No. 2-98/RR No. 6-2001 (CTRP) NIRC

P x P P

(Tax Base) (applicable rate)

Habitually engaged (registered with HLURB/HUDCC/6 or more transactions)

Below P500,000.00 = 1.5%

P500,000.00 to P2M = 3.0%

P2M and above = 5.0%

Not habitually engaged = 6.0%

LESS: Tax Paid per Return, if a return was filed ------------------------------------------------------

EWT STILL DUE / (OVERPAYMENT) ------------------------------------------------------------------------- P P

Add: 25% Surcharge P

Interest ( to )

Compromise Penalty

TOTAL AMOUNT STILL DUE ON EWT -------------------------------------------------------------------------- P P

DOCUMENTARY STAMP TAX

TAX DUE

Legal basis: Section 196 (CTRP) NIRC

P x P15.00 for every P1,000.00 or a fraction thereof P P

(Tax Base)

LESS: Tax Paid per Return, if a return was filed ------------------------------------------------------

DST STILL DUE / (OVERPAYMENT) ------------------------------------------------------------------------- P P

Add: 25% Surcharge P

Interest ( to )

Compromise Penalty

TOTAL AMOUNT STILL DUE ON DST -------------------------------------------------------------------------- P P

Remarks:

To be accomplished by ONETT Team. Payment Verified by: To be accomplished upon review.

Computed by: Reviewed by:

ONETT Officer ONETT Member/ Collection Section Chief, Assessment Div.

(Signature Over Printed Name) OR No. Tax Type Date of Payment (Signature Over Printed Name)

Approved by: Approved by:

Head, ONETT Team Regional Director

(Signature Over Printed Name) (Signature Over Printed Name)

Reference:

The BIR is not precluded from assessing and collecting any deficiency internal revenue tax(es) that maybe found from the taxpayer after examination or review.

CONFORME:

TAXPAYER/AUTHORIZED REPRESENTATIVE Telephone No. Date

(Signature Over Printed Name)

Instruction: Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer.

Please attach additional sheet, if necessary.

Potrebbero piacerti anche

- Rmo15 03anxb PDFDocumento1 paginaRmo15 03anxb PDFAM CruzNessuna valutazione finora

- Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineDocumento1 paginaComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineKobi SaibenNessuna valutazione finora

- Issuance of Certificate of No Pending CaseDocumento4 pagineIssuance of Certificate of No Pending CaseGerry DayananNessuna valutazione finora

- Extra Judicial Settlement of The EstateDocumento3 pagineExtra Judicial Settlement of The EstateEnerita AllegoNessuna valutazione finora

- Affidavit of One and The Same PersonDocumento2 pagineAffidavit of One and The Same Personcha chaNessuna valutazione finora

- The Civil Registrar The Civil Registrar: Application For Marriage LicenseDocumento3 pagineThe Civil Registrar The Civil Registrar: Application For Marriage Licensepot420_aivanNessuna valutazione finora

- Deed of Conditional Sale - SampleDocumento5 pagineDeed of Conditional Sale - SampleNoribeth BajentingNessuna valutazione finora

- ContractDocumento7 pagineContractPanyang Bianca Perlado - MascariñasNessuna valutazione finora

- Notes On Sale of Private Agricultural LandDocumento3 pagineNotes On Sale of Private Agricultural LandRonnil RosilloNessuna valutazione finora

- RDO No. 52 - Paranaque CityDocumento197 pagineRDO No. 52 - Paranaque CityKarla KatigbakNessuna valutazione finora

- Affidavit of Discrepancy and Correction - Joyce M. Galino.3.2017Documento1 paginaAffidavit of Discrepancy and Correction - Joyce M. Galino.3.2017black stalkerNessuna valutazione finora

- Affidavit of Change of VenueDocumento1 paginaAffidavit of Change of Venueailyn rentaNessuna valutazione finora

- RDO-Zarraga, IloiloDocumento823 pagineRDO-Zarraga, IloiloDoni June Almio100% (1)

- Deed of Conditional Sale (Sccribed)Documento2 pagineDeed of Conditional Sale (Sccribed)Bong RoqueNessuna valutazione finora

- Aff Transferro-Ree-1Documento2 pagineAff Transferro-Ree-1Anonymous kJPBOi0HNessuna valutazione finora

- Bir Form 1707 CGT CarDocumento2 pagineBir Form 1707 CGT CarAnne VallaritNessuna valutazione finora

- Petition To Cancel Adverse Claim-AmigableDocumento4 paginePetition To Cancel Adverse Claim-Amigablegelbert palomar100% (1)

- Extrajudicial Settlement of EstateDocumento4 pagineExtrajudicial Settlement of EstateCuki IsbusyNessuna valutazione finora

- BIR Ruling No. OT-026-20 (RMO 9-14)Documento4 pagineBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNessuna valutazione finora

- 221 A Application Form NewDocumento1 pagina221 A Application Form NewAaron ChavezNessuna valutazione finora

- Republic of The Philippines Civic Center B Building, City Hall Compound, Quezon CityDocumento1 paginaRepublic of The Philippines Civic Center B Building, City Hall Compound, Quezon CityACYATAN & CO., CPAs 2020Nessuna valutazione finora

- Attachments Amaia Land Corp.Documento4 pagineAttachments Amaia Land Corp.AbbaNessuna valutazione finora

- Affidavit Vacant LotDocumento1 paginaAffidavit Vacant LotEugene Medina LopezNessuna valutazione finora

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocumento1 paginaFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNessuna valutazione finora

- Dar Clearance Form 1.0Documento1 paginaDar Clearance Form 1.0Colleen Rose GuanteroNessuna valutazione finora

- Petition For Dropping LTFRBDocumento3 paginePetition For Dropping LTFRBMegan Camille SanchezNessuna valutazione finora

- Deed of SaleDocumento4 pagineDeed of SaleBenna Arzaga CabutihanNessuna valutazione finora

- Contract AgreementDocumento2 pagineContract AgreementMa Belle100% (1)

- Annex C 0621-EADocumento2 pagineAnnex C 0621-EAMELLICENT LIANZA100% (1)

- 1701A Annual Income Tax ReturnDocumento2 pagine1701A Annual Income Tax ReturnJaneth Tamayo NavalesNessuna valutazione finora

- Affidavit - Ante (No Loans)Documento1 paginaAffidavit - Ante (No Loans)Danielle Edenor Roque PaduraNessuna valutazione finora

- Affidavit Carl Francis DizonDocumento1 paginaAffidavit Carl Francis DizonGabriel0% (1)

- Dar Administrative Order No 8Documento74 pagineDar Administrative Order No 8don dehaycoNessuna valutazione finora

- E.S.A.P. Application Form (2019)Documento2 pagineE.S.A.P. Application Form (2019)Jigo Dacua100% (1)

- DEED OF HEIRSHIP AND SALE - FonolleraDocumento2 pagineDEED OF HEIRSHIP AND SALE - FonollerarjpogikaayoNessuna valutazione finora

- Deed of Conditional SaleDocumento2 pagineDeed of Conditional SalelalaNessuna valutazione finora

- Delisting of ProjectDocumento5 pagineDelisting of ProjectMark Kevin Samson100% (1)

- SPECIAL POWER OF ATTORNEY - MortgageDocumento2 pagineSPECIAL POWER OF ATTORNEY - MortgagebobbyrickyNessuna valutazione finora

- 2021-11 Annex D REQUEST FORM DISLODGING - Res - 0Documento1 pagina2021-11 Annex D REQUEST FORM DISLODGING - Res - 0NASSER DUGASANNessuna valutazione finora

- GFFS General Form Rev 20061Documento14 pagineGFFS General Form Rev 20061Genesis Manalili100% (1)

- Lumber Supply ContractDocumento2 pagineLumber Supply ContractLyn OlitaNessuna valutazione finora

- Citizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantDocumento4 pagineCitizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantcarmanvernonNessuna valutazione finora

- Earnest Money Receipt Agreement (Final)Documento1 paginaEarnest Money Receipt Agreement (Final)v_sharon100% (1)

- Deed of Extra-Judicial Settlement of ReaDocumento5 pagineDeed of Extra-Judicial Settlement of Reaernesto tabilisma100% (1)

- 2022 Obc GuidelinesDocumento3 pagine2022 Obc GuidelinesDOLE Region 6100% (1)

- DOTR Memorandum Circular 2016 020-2016Documento12 pagineDOTR Memorandum Circular 2016 020-2016Anonymous dtceNuyIFINessuna valutazione finora

- Undertaking AritanaDocumento1 paginaUndertaking AritanaLhess RamosNessuna valutazione finora

- Dar Letter of RequestDocumento1 paginaDar Letter of RequestVictoria BonanzaNessuna valutazione finora

- Business SignatoryDocumento2 pagineBusiness SignatoryYangee PeñaflorNessuna valutazione finora

- Petition To Substitute UnitDocumento2 paginePetition To Substitute UnitKristine JanNessuna valutazione finora

- RDO No. 80 - Mandaue City, CebuDocumento757 pagineRDO No. 80 - Mandaue City, CebuGloria MacionNessuna valutazione finora

- Republic Act No. 274: Approved: June 15, 1948Documento1 paginaRepublic Act No. 274: Approved: June 15, 1948givemeasign24Nessuna valutazione finora

- Lawyers ID FormDocumento1 paginaLawyers ID Formnicakyut100% (1)

- Checklist of Documentary RequirementsDocumento5 pagineChecklist of Documentary RequirementsCara Lucille RosNessuna valutazione finora

- 2019form RevGIS Stock UpdatedDocumento10 pagine2019form RevGIS Stock UpdatedRonaldo Barleta100% (1)

- AffidavitDocumento1 paginaAffidavitWerner SchlagerNessuna valutazione finora

- Retirement of Business Form-FinalDocumento1 paginaRetirement of Business Form-Finalfrancis helbert magallanesNessuna valutazione finora

- Onett Computation SheetDocumento1 paginaOnett Computation SheetBreahziel ParillaNessuna valutazione finora

- Rmo15 03anxb3Documento21 pagineRmo15 03anxb3Maureen PerezNessuna valutazione finora

- CGT Tomanda AntokDocumento1 paginaCGT Tomanda AntokNvision PresentNessuna valutazione finora

- Lopez v. HeesenDocumento11 pagineLopez v. Heesend-fbuser-49417072Nessuna valutazione finora

- Takata v. Bureau of Labor Relations, G.R. No.196276 PDFDocumento9 pagineTakata v. Bureau of Labor Relations, G.R. No.196276 PDFd-fbuser-49417072Nessuna valutazione finora

- Prieto v. ArroyoDocumento4 paginePrieto v. Arroyod-fbuser-49417072Nessuna valutazione finora

- Erezo v. Jepte PDFDocumento6 pagineErezo v. Jepte PDFd-fbuser-49417072Nessuna valutazione finora

- Lita Enterprises v. Court of Appeals PDFDocumento6 pagineLita Enterprises v. Court of Appeals PDFd-fbuser-49417072Nessuna valutazione finora

- Mendoza v. Teh PDFDocumento5 pagineMendoza v. Teh PDFd-fbuser-49417072Nessuna valutazione finora

- Eusebio v. Eusebio PDFDocumento7 pagineEusebio v. Eusebio PDFd-fbuser-49417072Nessuna valutazione finora

- Bayanihan Music Philippines, Inc., Petitioner, vs. BMG Records (Pilipinas) and Jose Mari Chan, Et Al.Documento6 pagineBayanihan Music Philippines, Inc., Petitioner, vs. BMG Records (Pilipinas) and Jose Mari Chan, Et Al.d-fbuser-49417072Nessuna valutazione finora

- Cebu Salvage v. Philippine Home Assurance PDFDocumento4 pagineCebu Salvage v. Philippine Home Assurance PDFd-fbuser-49417072Nessuna valutazione finora

- de Borja v. Tan PDFDocumento3 paginede Borja v. Tan PDFd-fbuser-49417072Nessuna valutazione finora

- Filipino Society of Composers v. TanDocumento6 pagineFilipino Society of Composers v. Tand-fbuser-49417072Nessuna valutazione finora

- Unilever vs. Proctor & GambleDocumento7 pagineUnilever vs. Proctor & Gambled-fbuser-49417072Nessuna valutazione finora

- SM Land, Inc., Et Al. v. City of Manila, Et Al., G.R. No. 197151, October 22,2012Documento13 pagineSM Land, Inc., Et Al. v. City of Manila, Et Al., G.R. No. 197151, October 22,2012d-fbuser-49417072Nessuna valutazione finora

- Spouses Nicasio C. Marquez and Anita J. Marquez, ALINDOG, RespondentsDocumento8 pagineSpouses Nicasio C. Marquez and Anita J. Marquez, ALINDOG, Respondentsd-fbuser-49417072Nessuna valutazione finora

- Revenue Memorandum Circular No. 137-2016Documento1 paginaRevenue Memorandum Circular No. 137-2016d-fbuser-49417072Nessuna valutazione finora

- Revenue Memorandum Circular No. 31-2008Documento16 pagineRevenue Memorandum Circular No. 31-2008d-fbuser-49417072Nessuna valutazione finora

- 172 Fernandez Hermanos, Inc. v. CIR (Uy)Documento4 pagine172 Fernandez Hermanos, Inc. v. CIR (Uy)Avie UyNessuna valutazione finora

- UntitledDocumento8 pagineUntitledgraceNessuna valutazione finora

- CIR v. San Miguel Corporation (180740) (180910) 11-11-2019 CDDocumento2 pagineCIR v. San Miguel Corporation (180740) (180910) 11-11-2019 CDAnime FreakNessuna valutazione finora

- Advanced TaxationDocumento99 pagineAdvanced TaxationLee HailuNessuna valutazione finora

- Intro To RitDocumento3 pagineIntro To RitJennifer ArcadioNessuna valutazione finora

- CLASSIFICATION of TAXESDocumento26 pagineCLASSIFICATION of TAXESPeyti PeytNessuna valutazione finora

- Cir VS BpiDocumento2 pagineCir VS BpiCelinka ChunNessuna valutazione finora

- En Banc: Republic of The Philippines Quezon CityDocumento19 pagineEn Banc: Republic of The Philippines Quezon CityJonas CruzNessuna valutazione finora

- CIR v. AlgueDocumento6 pagineCIR v. AlgueEvelyn TocgongnaNessuna valutazione finora

- Cta 1d Ac 00200 D 2018oct22 Oth PilaaDocumento21 pagineCta 1d Ac 00200 D 2018oct22 Oth PilaaephraimNessuna valutazione finora

- Cases On Taxation For Individualss AnswersDocumento11 pagineCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocumento23 pagineWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaNessuna valutazione finora

- Iiqe Paper 2 Pastpaper 20200518Documento25 pagineIiqe Paper 2 Pastpaper 20200518Tsz Ngong KoNessuna valutazione finora

- Golden Bell Challenge: Acca F6 Taxation - June 2019Documento215 pagineGolden Bell Challenge: Acca F6 Taxation - June 2019Phương NguyễnNessuna valutazione finora

- TPC - List of The Regulations Under The Tax Procedure Code ActDocumento65 pagineTPC - List of The Regulations Under The Tax Procedure Code ActEdward BiryetegaNessuna valutazione finora

- RCBC v. CIR GR No. 170257 Sep. 7, 2011Documento14 pagineRCBC v. CIR GR No. 170257 Sep. 7, 2011AlexandraSoledadNessuna valutazione finora

- Transfer and Business TaxationDocumento131 pagineTransfer and Business TaxationMr.AccntngNessuna valutazione finora

- TAX - Allowable DeductionsDocumento39 pagineTAX - Allowable DeductionsFerl ElardoNessuna valutazione finora

- D) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015Documento67 pagineD) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015JouseffLionelColosoMacolNessuna valutazione finora

- 2010 P T D (Trib.) 1394Documento2 pagine2010 P T D (Trib.) 1394haseeb AhsanNessuna valutazione finora

- Estate Tax Requirements: BIR Form 1801 GuidelinesDocumento15 pagineEstate Tax Requirements: BIR Form 1801 GuidelinesJonahNessuna valutazione finora

- STATCON CASE DIGEST 7 Dec.08,2020Documento43 pagineSTATCON CASE DIGEST 7 Dec.08,2020credit analystNessuna valutazione finora

- 82.2 Francia V IACDocumento1 pagina82.2 Francia V IACluigimanzanaresNessuna valutazione finora

- Taxation Law: Answers To Bar Examination QuestionsDocumento125 pagineTaxation Law: Answers To Bar Examination QuestionsAnonymous bioCvBieYNessuna valutazione finora

- KEY WORDS Income TaxationDocumento15 pagineKEY WORDS Income TaxationAndrew Mercado NavarreteNessuna valutazione finora

- Tax Remedies and Additions To Tax Handouts PDFDocumento13 pagineTax Remedies and Additions To Tax Handouts PDFdang0% (1)

- G.R. No. 183408, July 12, 2017 Commissioner of Internal Revenue, Petitioner Lancaster Philippines, Inc., Respondent Decision Martires, J.Documento9 pagineG.R. No. 183408, July 12, 2017 Commissioner of Internal Revenue, Petitioner Lancaster Philippines, Inc., Respondent Decision Martires, J.Aerith AlejandreNessuna valutazione finora

- United States Court of Appeals Seventh CircuitDocumento6 pagineUnited States Court of Appeals Seventh CircuitScribd Government DocsNessuna valutazione finora

- Revenue Memorandum Order No. 32-07: October 8, 2007 October 8, 2007Documento14 pagineRevenue Memorandum Order No. 32-07: October 8, 2007 October 8, 2007nathalie velasquezNessuna valutazione finora

- Document 3 PDFDocumento50 pagineDocument 3 PDFChristine Jane AbangNessuna valutazione finora