Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Assessment

Caricato da

John Lester Juan PagdilaoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Assessment

Caricato da

John Lester Juan PagdilaoCopyright:

Formati disponibili

Tax Assessment

-refers to the process of determining the correct amount of tax due in accordance with the

prevailing tax laws. Taxpayer reports hos own assessment of his tax liability in his tax return to

the Internal Revenue Officer.

Tax Return- refers to a formal report prepared by the taxpayer or his agent in a prescribed form

showing an enumeration of taxable amounts and description of taxable transaction, allowable

deductions, amount of tax and tax payable to the government.

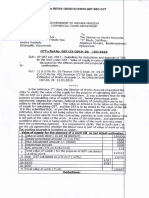

TAX ASSESSMENT

Taxpayer’s Assessment Government’s Assessment

(Thru Tax Returns) (Before and After Payments of Tax)

Assessment Period

-refers to the period in processing, appraising and determining the value of the subject of

taxation, including the computation of tax prescription, surcharges, and interests to arrive at the

specific sum of tax charged on a person or property.

TAX ASSESSMENT PERIOD

When is Within the 3-year prescription period, when the taxpayer filed an

Government accurate tax return.

Tax

Assessment

Made? Within the 10-year prescription period when the BIR discovers that the

tax return filed was fraudulent.

Before the expiration of the 3-year period, the BIR and the taxpayer

may agree on the period of assessment.

Jeopardy Assessment, if the taxpayer

-retires from business

-leaves the country

TAX ASSESSMENT PROCEDURE

BIR Sends written notice of findings Taxpayer

Responds

Issues Assessment Fails to respond

Files protest within 30 days

from receipt of assessment

Submits proofs within 60 days

from filing of protest

No supporting documents.

Assessment becomes final

Denies taxpayer’s

protest or ignores

supporting

documents within Appeals to the CTA within

180 days upon 30 days from receipt of

submission deial or from the lapse of

the 180-day period

No appeal was made. BIR

decision on Tax Assessment

becomes final, executory

and demandable.

Potrebbero piacerti anche

- Bir Process On Tax AssessmentDocumento8 pagineBir Process On Tax AssessmentAnonymous qjsSkwF50% (2)

- Lecture 8 - Tax Remedies and Additions To TAxDocumento7 pagineLecture 8 - Tax Remedies and Additions To TAxVic FabeNessuna valutazione finora

- Pagong BagalDocumento1 paginaPagong Bagaljuliet_emelinotmaestroNessuna valutazione finora

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Documento71 pagineMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- BirDocumento15 pagineBirRudolf Christian Oliveras Ugma100% (1)

- General Principles of TaxationDocumento50 pagineGeneral Principles of TaxationKJ Vecino BontuyanNessuna valutazione finora

- Bir Train Law PresentationDocumento74 pagineBir Train Law PresentationPAULINE KRISTINE FULGENCIO100% (3)

- Tax ReviewerDocumento14 pagineTax ReviewerRey Victor GarinNessuna valutazione finora

- Year-End Tax Requirements and ProceduresDocumento164 pagineYear-End Tax Requirements and ProceduresDarioNessuna valutazione finora

- Taxation Case Digest2Documento242 pagineTaxation Case Digest2Kevin LavinaNessuna valutazione finora

- RR 22-2020 (Notice of Discrepancy) PDFDocumento3 pagineRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNessuna valutazione finora

- Tax Compliance On PayrollDocumento2 pagineTax Compliance On PayrollJoyceNessuna valutazione finora

- Tax CasesDocumento87 pagineTax CasesSachieCasimiroNessuna valutazione finora

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocumento4 pagineBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNessuna valutazione finora

- Notes in Holding CompanyDocumento2 pagineNotes in Holding CompanyFerdz Pascual BadilloNessuna valutazione finora

- TaxationDocumento27 pagineTaxationdorothy92105Nessuna valutazione finora

- Foreign Corporation Registration in TheDocumento2 pagineForeign Corporation Registration in TheDodongNessuna valutazione finora

- BIR RMC No. 62-2005Documento15 pagineBIR RMC No. 62-2005dencave1Nessuna valutazione finora

- BIR Provides "Rich Broth" For CorruptionDocumento4 pagineBIR Provides "Rich Broth" For Corruptionrico mangawiliNessuna valutazione finora

- Formula of Cash Flow Direct MethodDocumento2 pagineFormula of Cash Flow Direct MethodAshiq HossainNessuna valutazione finora

- RR 2-98 - Withholding TaxesDocumento99 pagineRR 2-98 - Withholding TaxesbiklatNessuna valutazione finora

- FIRS Handbook on Reforms in the Tax System 2004-2011Da EverandFIRS Handbook on Reforms in the Tax System 2004-2011Nessuna valutazione finora

- Invalidating Tax Assessment January 2024 2Documento68 pagineInvalidating Tax Assessment January 2024 2arnulfojr hicoNessuna valutazione finora

- De Minimis BenefitsDocumento2 pagineDe Minimis BenefitsClaudine SumalinogNessuna valutazione finora

- Revenue Memorandum Order No. 37-94: March 25, 1994Documento8 pagineRevenue Memorandum Order No. 37-94: March 25, 1994Rufino Gerard Moreno IIINessuna valutazione finora

- 2018 Albano Doctrine On INCOME Taxation For The 2018 Bar ExamDocumento14 pagine2018 Albano Doctrine On INCOME Taxation For The 2018 Bar ExamNissi JonnaNessuna valutazione finora

- Accounting System 2Documento67 pagineAccounting System 2Kristine ArsolonNessuna valutazione finora

- Fallacies of RelevanceDocumento2 pagineFallacies of RelevanceHikmatyar Khan100% (1)

- Lecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateDocumento65 pagineLecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateKristian ArdoñaNessuna valutazione finora

- Summary of Significant SC Decisions (April May June 2011)Documento2 pagineSummary of Significant SC Decisions (April May June 2011)elmersgluethebombNessuna valutazione finora

- Articles of Incorporation GreenDocumento14 pagineArticles of Incorporation GreenMarkus AureliusNessuna valutazione finora

- 2022CC SEC Extension Offices Citizens Charter 2022 1st EditionDocumento1.008 pagine2022CC SEC Extension Offices Citizens Charter 2022 1st EditionGERALD DAANOYNessuna valutazione finora

- Matching Cost Against RevenueDocumento1 paginaMatching Cost Against Revenuejuliet_emelinotmaestroNessuna valutazione finora

- Tax Remedies 2011Documento103 pagineTax Remedies 2011Doni June AlmioNessuna valutazione finora

- Lecture Notes XIII Selected Topics On Philippine TaxationDocumento9 pagineLecture Notes XIII Selected Topics On Philippine TaxationSar CaermareNessuna valutazione finora

- 2010 Tax Matrix - Individual AliensDocumento2 pagine2010 Tax Matrix - Individual Alienscmv mendozaNessuna valutazione finora

- Legal Opinion Tranfer Share of Stock EstateDocumento1 paginaLegal Opinion Tranfer Share of Stock EstateChristian Marko CabahugNessuna valutazione finora

- 7925-2005-Bir Ruling No. 009-05Documento4 pagine7925-2005-Bir Ruling No. 009-05Alexander Julio Valera100% (1)

- Tax Practice Set ReviewerDocumento9 pagineTax Practice Set Reviewerjjay_santosNessuna valutazione finora

- Corporate Recovery and Tax Incentives For EnterprisesDocumento5 pagineCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNessuna valutazione finora

- Excise TaxDocumento15 pagineExcise TaxQedew ErNessuna valutazione finora

- Dole Do - 147 15Documento28 pagineDole Do - 147 15Allen Ponce100% (2)

- NU 3 Phil Deposit Insurance LawDocumento36 pagineNU 3 Phil Deposit Insurance LawBack upNessuna valutazione finora

- Final Decision On Disputed AssessmentDocumento17 pagineFinal Decision On Disputed AssessmentJasper AlonNessuna valutazione finora

- Articles of IncorporationDocumento2 pagineArticles of Incorporationjp002259Nessuna valutazione finora

- The Philippines: Tax Assessment, Appeal and Dispute ResolutionDocumento29 pagineThe Philippines: Tax Assessment, Appeal and Dispute ResolutionJBNessuna valutazione finora

- Tax On Partnerships Estates and TrustsDocumento12 pagineTax On Partnerships Estates and TrustsLouina YnciertoNessuna valutazione finora

- Corporation-Bylaws - More FunctionalDocumento12 pagineCorporation-Bylaws - More Functionalstada0Nessuna valutazione finora

- Sole ProprietorshipDocumento1 paginaSole ProprietorshipJane Constantino100% (1)

- Chapter 1 NegoDocumento27 pagineChapter 1 Negojhaeus enaj100% (1)

- Compromise and Abatement - EbilloDocumento5 pagineCompromise and Abatement - Ebillolegine ramaylaNessuna valutazione finora

- Procedures of Partnership FirmDocumento2 pagineProcedures of Partnership FirmUnimarks Legal Solutions100% (1)

- Chapter 2: Tax AdministrationDocumento3 pagineChapter 2: Tax AdministrationHezroNessuna valutazione finora

- Lecture 9 - Community TaxDocumento1 paginaLecture 9 - Community TaxVic FabeNessuna valutazione finora

- W2 Module 2 Tax Administration Part IDocumento53 pagineW2 Module 2 Tax Administration Part IElmeerajh JudavarNessuna valutazione finora

- Why Do We Need AccountingDocumento4 pagineWhy Do We Need Accountinglaxmi300Nessuna valutazione finora

- Ca (GH), Mgim, Emba F.I.M.S. (Dip. IMS), FIPFM, FCFM: FinanceDocumento6 pagineCa (GH), Mgim, Emba F.I.M.S. (Dip. IMS), FIPFM, FCFM: FinanceAndrews DwomohNessuna valutazione finora

- Tax RemediesDocumento14 pagineTax RemediesMatt Marqueses PanganibanNessuna valutazione finora

- Tax Remedies ReviewerDocumento9 pagineTax Remedies ReviewerhrvyvyyyNessuna valutazione finora

- Tax Remedies and IncrementsDocumento16 pagineTax Remedies and Incrementscobe.johnmark.cecilioNessuna valutazione finora

- Exam - Taxation MSA 206Documento4 pagineExam - Taxation MSA 206Juan FrivaldoNessuna valutazione finora

- Presentation1 Stamp Duty TaxDocumento12 paginePresentation1 Stamp Duty Taxabelu habite neriNessuna valutazione finora

- INCOME TAX AND GST. JURAZ-Module 3Documento11 pagineINCOME TAX AND GST. JURAZ-Module 3hisanashanutty2004100% (1)

- Jaico Invoice 23Documento1 paginaJaico Invoice 23bansal book storeNessuna valutazione finora

- Super ProjectDocumento2 pagineSuper ProjectQiang ChenNessuna valutazione finora

- Direct Taxes 639034001021902385Documento1 paginaDirect Taxes 639034001021902385Raghava KruthiventiNessuna valutazione finora

- Invoice Original 1882427818115Documento1 paginaInvoice Original 1882427818115Anno DominiNessuna valutazione finora

- 1098T17Documento2 pagine1098T17RegrubdiupsNessuna valutazione finora

- 2021-09-30T21-06 Transaction #4321966431251448-8519037Documento1 pagina2021-09-30T21-06 Transaction #4321966431251448-8519037fetacademymediaNessuna valutazione finora

- BASHIR Salary Slip (50129700 May, 2017)Documento1 paginaBASHIR Salary Slip (50129700 May, 2017)Abidullah KhanNessuna valutazione finora

- Prelim TaskDocumento4 paginePrelim TaskJohn Francis RosasNessuna valutazione finora

- TAXATIONDocumento21 pagineTAXATIONRichelle Ann CarinoNessuna valutazione finora

- Eisner Vs Macomber TAxDocumento3 pagineEisner Vs Macomber TAxKayee KatNessuna valutazione finora

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocumento1 paginaIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNessuna valutazione finora

- US Internal Revenue Service: p678wDocumento240 pagineUS Internal Revenue Service: p678wIRSNessuna valutazione finora

- Reports - 8586292782296956996PT1Documento1 paginaReports - 8586292782296956996PT1Eto eto vrNessuna valutazione finora

- Pavitra Conbuild PVT LTDDocumento3 paginePavitra Conbuild PVT LTDShubham DwivediNessuna valutazione finora

- Tax Invoice: Excitel Broadband Pvt. LTDDocumento1 paginaTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyNessuna valutazione finora

- 1274 PDFDocumento1 pagina1274 PDFAbhilashKrishnanNessuna valutazione finora

- COVID Relief Funds ApplicationDocumento10 pagineCOVID Relief Funds ApplicationMichael JohnsonNessuna valutazione finora

- Tax SitusDocumento1 paginaTax SitusReiner VesagasNessuna valutazione finora

- Gross Estate IntroductionDocumento2 pagineGross Estate IntroductionJustz LimNessuna valutazione finora

- Vanishing Deductions X Estate Tax ComputationDocumento2 pagineVanishing Deductions X Estate Tax ComputationShiela Mae OblanNessuna valutazione finora

- HSN Table 12 10 22 Advisory NewDocumento2 pagineHSN Table 12 10 22 Advisory NewAmanNessuna valutazione finora

- GST Pass Order PDFDocumento4 pagineGST Pass Order PDFvenkat dNessuna valutazione finora

- Erratum Cpa Reviewer 2Documento1 paginaErratum Cpa Reviewer 2Monina Ninyah Aguiling Manulat100% (1)

- Nigeria Withholding Tax GAZETTE 2015Documento4 pagineNigeria Withholding Tax GAZETTE 2015ahmad bNessuna valutazione finora

- Simplified Tax InvoiceDocumento1 paginaSimplified Tax InvoiceixaxkhanNessuna valutazione finora

- ME Holding Corp vs. CADocumento2 pagineME Holding Corp vs. CAJeremae Ann CeriacoNessuna valutazione finora