Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Haryana CST Return Format Form - 1

Caricato da

Virender SainiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Haryana CST Return Format Form - 1

Caricato da

Virender SainiCopyright:

Formati disponibili

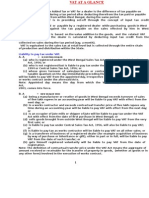

FORM-1

Form of Return under Rule 7-A of the Central Sales Tax (Haryana) Rules, 1957.

Return for the period From : 1-Apr-10 To : 30-Jun

Registration Mark and No. Tin No. 0 6 3 0 1 2 9 2 9 0 2 3

Name of the dealer HARAYANA WARE HOUSING

Status

(Whether individual, Hindu undivided family, association, club, firm, company, guardian or trustee.)

Style of the business

Rs. P.

1. Gross amount received or receivable by the dealer during the period in

17944672.72

respect of sales of goods.

Deduct –

(i) Sales of goods outside the State (as defined in Section 4

0

of the Act)

(ii) Sales of goods in course of export outside India

0

(as defined in Section 5 of the Act)

(iii) Turnover of goods transferred outside the State as

0

defined in section 6A(1)

2. Balance – Turnover on inter-State sales and

17944672.72

sales within the State

Deduct – Turnover on sales within the State 17944672.72

3. Balance – Turnover on inter-State sales 0

Deduct – Cost of freight, delivery or installation when such

cost is separately charged

4. Balance – Total Turnover on Inter-State sales 0

Deduct –

(i) Turnover of inter-State sales of goods unconditionally exempt

from tax under (the East Punjab General Sales Tax Act, 1948) *

(ii) Turnover of sales of goods returned by the purchaser witnin

a period of (three months under rule 11(2)(b) of the Central

Sales Tax (Registration and Turnover) Rules, 1957.) **

(iii) Turnover in respect of subsequent sales falling

under clauses (a) and (b) of section 6(2) of the Act.

4-A. Balance – Taxable turnover in respect on inter-State sales 0

5. Goods-wise break-up of above

A. Declared goods

(i) Sold to registered dealers on prescribed declaration,

- vide Declaration attached

(ii) Sold otherwise

B. Other goods –

(i) Sold to registered dealers on prescribed declaration,

- vide Declaration attached.

(ii) Sold otherwise

Total 0

6. (i) Taxable at Per cent Rs , On which tax amounts to Rs. 0

(ii) Taxable at Per cent Rs , On which tax amounts to Rs. 0

(iii) Taxable at Per cent Rs , On which tax amounts to Rs. 0

(iv) Taxable at Per cent Rs , On which tax amounts to Rs. 0

(v) Taxable at Per cent Rs , On which tax amounts to Rs. 0

(vi) Taxable at Per cent Rs , On which tax amounts to Rs. 0

7. Total tax payable on Rs. 0 amount to Rs. 0

8.Tax paid, if any, by means of Treasury chala n/Cheques/Draft

No. , dated Rs.

1. I enclosed with this return the original copy of each of the declarations received by me in respect of sales made

to registered dealers, together with a signed list of such declarations and

statement under subrule (3) of rule 8.

2. I declare that the statements made and particulars furnished in and with this return are true and complete.

Place Signature

Date Status

* Since repealed, read in its place “The Haryana Value Added Tax Act, 2003” in the light of Sec. 6 of The

Punjab General Clauses Act, 1898.

** Since the sub-rule referred therein omitted, read in its place “six months from the date of delivery of the

goods under Sec. 8A of the Central Sales Tax Act, 1956.”

ACKNOWLEDGEMENT

Received from a dealer possessing Registration

Certificate No a return of sales tax payable by him for the period

from to with enclosures mentioned therein

Place Receiving officer

Date

Potrebbero piacerti anche

- Extended Warranty Detail Invoice ReportDocumento1 paginaExtended Warranty Detail Invoice ReportMayur DoriwalaNessuna valutazione finora

- 53 Summary On Vat CST and WCTDocumento16 pagine53 Summary On Vat CST and WCTYogesh DeokarNessuna valutazione finora

- Maharashtra Value Added Tax Act 2Documento27 pagineMaharashtra Value Added Tax Act 2Minal ShethNessuna valutazione finora

- A Brief Introduction of MVAT - : by Chinmay GangwalDocumento28 pagineA Brief Introduction of MVAT - : by Chinmay GangwalAmolaNessuna valutazione finora

- Navi Loan AgreementDocumento13 pagineNavi Loan Agreementashish singhNessuna valutazione finora

- Mics Rapid Revision Notes CA FinalDocumento38 pagineMics Rapid Revision Notes CA FinalShraddha NepalNessuna valutazione finora

- CUSTOMS Summary Book MAY 21 by CA Yachana Mutha BhuratDocumento52 pagineCUSTOMS Summary Book MAY 21 by CA Yachana Mutha BhuratSandyNessuna valutazione finora

- CP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at SourceDocumento108 pagineCP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at Sourcesaravana pandianNessuna valutazione finora

- Presentation Form - HC - 05.10.2015Documento1 paginaPresentation Form - HC - 05.10.2015Marius Damian100% (1)

- PPT-on-GST Annual-ReturnDocumento33 paginePPT-on-GST Annual-Returnshrutha p jainNessuna valutazione finora

- GST Annual Return and AuditDocumento10 pagineGST Annual Return and AuditRachit ChhedaNessuna valutazione finora

- TIMTADocumento6 pagineTIMTAKarl Anthony Rigoroso MargateNessuna valutazione finora

- Atzpr8899q Q2 2023-24Documento2 pagineAtzpr8899q Q2 2023-24Akansha Jain100% (1)

- MTP 2 (Extra MCQ) - Question PaperDocumento13 pagineMTP 2 (Extra MCQ) - Question PaperDeepsikha maitiNessuna valutazione finora

- Income From Capital Gain by Vishal GoelDocumento57 pagineIncome From Capital Gain by Vishal Goelgoel76vishal100% (1)

- 13 - Distribution of Powers Between Federal and Provincial Governments - NotesDocumento4 pagine13 - Distribution of Powers Between Federal and Provincial Governments - Notesm.tayyab3318Nessuna valutazione finora

- IND As 115 - Bhavik Chokshi - FR ShieldDocumento18 pagineIND As 115 - Bhavik Chokshi - FR ShieldESWAR REDDY Chintam ReddyNessuna valutazione finora

- DIRECT TAX Finalold p7Documento5 pagineDIRECT TAX Finalold p7VIHARI DNessuna valutazione finora

- Form CHG-1-16032017 Signe Cfil CDocumento6 pagineForm CHG-1-16032017 Signe Cfil CsunjuNessuna valutazione finora

- Form A1Documento3 pagineForm A1gaytri mandapNessuna valutazione finora

- Bitcoin Probablistic PaymentsDocumento2 pagineBitcoin Probablistic PaymentsjhonNessuna valutazione finora

- 194Q TDS On Purchase of GoodsDocumento25 pagine194Q TDS On Purchase of GoodsPallavi SharmaNessuna valutazione finora

- Wadhwa Commission Report On Orissa PDSDocumento187 pagineWadhwa Commission Report On Orissa PDSDebabrata MohantyNessuna valutazione finora

- Final Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Documento31 pagineFinal Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Sanket Mhetre100% (1)

- Dec 2004 CS Executive AnswersDocumento74 pagineDec 2004 CS Executive Answersjesurajajoseph0% (1)

- Study MaterialDocumento2 pagineStudy MaterialVasanth MNessuna valutazione finora

- Advanced Taxation and Fiscal PolicyDocumento5 pagineAdvanced Taxation and Fiscal PolicyTimore FrancisNessuna valutazione finora

- Direct Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceDocumento20 pagineDirect Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceManohar LalNessuna valutazione finora

- Lease: Legacy eLERT® Home eLERTDocumento18 pagineLease: Legacy eLERT® Home eLERTRosalee WebbNessuna valutazione finora

- Assess Audit 22022018Documento33 pagineAssess Audit 22022018Suresh Kumar YathirajuNessuna valutazione finora

- Opinion - 80IA - Slump SaleDocumento16 pagineOpinion - 80IA - Slump SaleShashankNessuna valutazione finora

- Eco 02 Ignou BookDocumento24 pagineEco 02 Ignou BookAkshay50% (2)

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocumento12 pagineTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNessuna valutazione finora

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocumento89 pagineDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12Nessuna valutazione finora

- DT Icai MCQ 3Documento5 pagineDT Icai MCQ 3Anshul JainNessuna valutazione finora

- Adobe Scan Mar 5 2022Documento19 pagineAdobe Scan Mar 5 2022PAULA MENDITANessuna valutazione finora

- Stock Statement Format PDF FreeDocumento1 paginaStock Statement Format PDF FreeSahil Pardesisahil77100% (1)

- GEMC-511687761006958 Bid Epbg PDFDocumento3 pagineGEMC-511687761006958 Bid Epbg PDFNarendra JhaNessuna valutazione finora

- Implentation of Direct Tax Code in IndiaDocumento193 pagineImplentation of Direct Tax Code in IndiaSugandha GuptaNessuna valutazione finora

- 7 Final Accounts of CompaniesDocumento15 pagine7 Final Accounts of CompaniesAakshi SharmaNessuna valutazione finora

- Total Computation QB by CA Pranav ChandakDocumento37 pagineTotal Computation QB by CA Pranav ChandakSurajNessuna valutazione finora

- KwaMoja Manual PDFDocumento638 pagineKwaMoja Manual PDFerlanvrNessuna valutazione finora

- Yosef Workelule - The Judicial Protection of Consumer Rights in Ethiopia: The Case of Amhara National Regional StateDocumento103 pagineYosef Workelule - The Judicial Protection of Consumer Rights in Ethiopia: The Case of Amhara National Regional Stateankesha banjaNessuna valutazione finora

- STPIDocumento26 pagineSTPIyagayNessuna valutazione finora

- Bai Tap Hop DongDocumento3 pagineBai Tap Hop DongKhánh Linh Mai TrầnNessuna valutazione finora

- T363 GCIS House Rules - Part I (IaaS DBaaS) v1.0Documento23 pagineT363 GCIS House Rules - Part I (IaaS DBaaS) v1.0Linus Harri0% (1)

- Physical Delivery in MCXDocumento50 paginePhysical Delivery in MCXVinay RajputNessuna valutazione finora

- Pragyapan Patra For Auditor Dai NewDocumento1 paginaPragyapan Patra For Auditor Dai NewPL ConsultantsNessuna valutazione finora

- Section 2 - Amendment of Schedule-1 of Act No. 2 of 1899Documento34 pagineSection 2 - Amendment of Schedule-1 of Act No. 2 of 1899ASHUTOSH MISHRANessuna valutazione finora

- Capital Trainers Full PPT On TDSDocumento78 pagineCapital Trainers Full PPT On TDSYamuna GNessuna valutazione finora

- Commonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiDocumento37 pagineCommonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiCIBIL CHURUNessuna valutazione finora

- Evolution of Indian BankingDocumento5 pagineEvolution of Indian BankingManu SainiNessuna valutazione finora

- Format of Management Representation For GST AuditDocumento5 pagineFormat of Management Representation For GST AuditCA Shashank JainNessuna valutazione finora

- Public Policy - A Limitation To The Application of Foreign Law in Private International Law - Priyanshu Kumar Tripathy & Pancham LalDocumento6 paginePublic Policy - A Limitation To The Application of Foreign Law in Private International Law - Priyanshu Kumar Tripathy & Pancham Lalsivank yoNessuna valutazione finora

- Taxation Treaties of India With Different Countries: Master of Business AdministrationDocumento12 pagineTaxation Treaties of India With Different Countries: Master of Business AdministrationHarjot SandhayNessuna valutazione finora

- Vat at A GlanceDocumento19 pagineVat at A GlanceABHIJIT MONDAL100% (1)

- Stock - Book Debts CalculationDocumento6 pagineStock - Book Debts CalculationAbhishekNessuna valutazione finora

- Form Jvat 409Documento2 pagineForm Jvat 409Suzanne BradyNessuna valutazione finora

- Form Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - CertificateDocumento5 pagineForm Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - Certificatecharan srNessuna valutazione finora

- RTGS - Format Idbi BankDocumento1 paginaRTGS - Format Idbi BankVirender Saini100% (3)

- Up Vat Challan FormatDocumento8 pagineUp Vat Challan FormatVirender SainiNessuna valutazione finora

- Epayment Form - NewDocumento3 pagineEpayment Form - NewVirender SainiNessuna valutazione finora

- The Gujarat Value Added Tax Rules, 2006Documento3 pagineThe Gujarat Value Added Tax Rules, 2006Virender SainiNessuna valutazione finora

- Transportation Systems ManagementDocumento9 pagineTransportation Systems ManagementSuresh100% (4)

- Achieving Rapid Internationalization of Sub Saharan Africa - 2020 - Journal of BDocumento11 pagineAchieving Rapid Internationalization of Sub Saharan Africa - 2020 - Journal of BErnaNessuna valutazione finora

- Louis I Kahn Trophy 2021-22 BriefDocumento7 pagineLouis I Kahn Trophy 2021-22 BriefMadhav D NairNessuna valutazione finora

- Memorandum of Inderstanding Ups and GoldcoastDocumento3 pagineMemorandum of Inderstanding Ups and Goldcoastred_21Nessuna valutazione finora

- Future Trends in Mechanical Engineering-ArticleDocumento2 pagineFuture Trends in Mechanical Engineering-ArticleanmollovelyNessuna valutazione finora

- SPED-Q1-LWD Learning-Package-4-CHILD-GSB-2Documento19 pagineSPED-Q1-LWD Learning-Package-4-CHILD-GSB-2Maria Ligaya SocoNessuna valutazione finora

- Gabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFDocumento2 pagineGabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFatelierimkellerNessuna valutazione finora

- Top Notch 1 Unit 9 AssessmentDocumento6 pagineTop Notch 1 Unit 9 AssessmentMa Camila Ramírez50% (6)

- Text and Meaning in Stanley FishDocumento5 pagineText and Meaning in Stanley FishparthNessuna valutazione finora

- Ethical Dilemma Notes KiitDocumento4 pagineEthical Dilemma Notes KiitAritra MahatoNessuna valutazione finora

- Options TraderDocumento2 pagineOptions TraderSoumava PaulNessuna valutazione finora

- Posh TTTDocumento17 paginePosh TTTKannanNessuna valutazione finora

- Sample of Notarial WillDocumento3 pagineSample of Notarial WillJF Dan100% (1)

- Computer Engineering Project TopicsDocumento5 pagineComputer Engineering Project Topicskelvin carterNessuna valutazione finora

- Satisfaction On Localized Services: A Basis of The Citizen-Driven Priority Action PlanDocumento9 pagineSatisfaction On Localized Services: A Basis of The Citizen-Driven Priority Action PlanMary Rose Bragais OgayonNessuna valutazione finora

- Objectivity in HistoryDocumento32 pagineObjectivity in HistoryNeelab UnkaNessuna valutazione finora

- Weak VerbsDocumento3 pagineWeak VerbsShlomoNessuna valutazione finora

- Granularity of GrowthDocumento4 pagineGranularity of GrowthAlan TangNessuna valutazione finora

- PotwierdzenieDocumento4 paginePotwierdzenieAmina BerghoutNessuna valutazione finora

- Action Plan Templete - Goal 6-2Documento2 pagineAction Plan Templete - Goal 6-2api-254968708Nessuna valutazione finora

- SaveHinduTemples PDFDocumento7 pagineSaveHinduTemples PDFRavi RathoreNessuna valutazione finora

- Our Identity in Christ Part BlessedDocumento11 pagineOur Identity in Christ Part BlessedapcwoNessuna valutazione finora

- Firewall Training, Checkpoint FirewallDocumento7 pagineFirewall Training, Checkpoint Firewallgaurav775588Nessuna valutazione finora

- Retail Strategy: MarketingDocumento14 pagineRetail Strategy: MarketingANVESHI SHARMANessuna valutazione finora

- Expense ReportDocumento8 pagineExpense ReportAshvinkumar H Chaudhari100% (1)

- Engels SEM1 SECONDDocumento2 pagineEngels SEM1 SECONDJolien DeceuninckNessuna valutazione finora

- Theodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Documento4 pagineTheodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Scribd Government DocsNessuna valutazione finora

- Annaphpapp 01Documento3 pagineAnnaphpapp 01anujhanda29Nessuna valutazione finora

- Full Download Health Psychology Theory Research and Practice 4th Edition Marks Test BankDocumento35 pagineFull Download Health Psychology Theory Research and Practice 4th Edition Marks Test Bankquininemagdalen.np8y3100% (39)

- Baseball Stadium Financing SummaryDocumento1 paginaBaseball Stadium Financing SummarypotomacstreetNessuna valutazione finora