Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

252289600057294

Caricato da

Pricila MercyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

252289600057294

Caricato da

Pricila MercyCopyright:

Formati disponibili

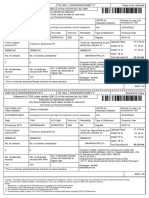

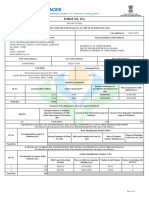

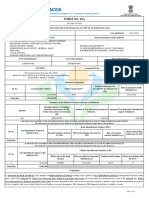

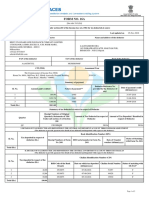

SAM Hash 00000000000000001813 File Hash 00000000000057928186 Copy to be retained

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

252289600057294 PANDYAN GRAMA BANK TUTICORIN NA QTLVQSPE

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

24 April 2019 MRIP00860G CHEWT57744 26Q Q4 Regular 2018-19

Total challan Total tax deposited as per Upload Fees (`) 42.37

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % -

450134.00 450134.00 450134.00 SGST 9 % -

IGST 18 % (`) 7.63

No. of challans No. of challans unmatched TAMILNADU (33)

Total (Rounded off) (`) 50.00

12 0 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 25228

No. of deductee No. of deductee

where tax deducted at Religare Broking Limited

records records with PAN

higher rate 176 B, 1st Floor, Twin Towers Mani Nagar, 2nd Street

Above Hotel anjapper

52 52 2 Tuticorin - 628003

TAMILNADU

*This is a computer generated Receipt and does not require signature

SAM 1.00

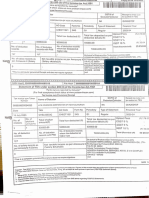

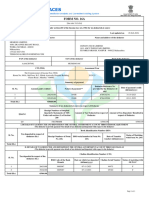

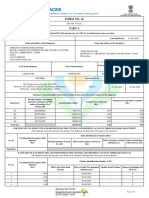

SAM Hash 00000000000000001813 File Hash 00000000000057928186 Deductor's Copy

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

252289600057294 PANDYAN GRAMA BANK TUTICORIN NA QTLVQSPE

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

24 April 2019 MRIP00860G CHEWT57744 26Q Q4 Regular 2018-19

(`) 42.37

Total challan Total tax deposited as per Upload Fees

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % -

SGST 9 % -

450134.00 450134.00 450134.00

IGST 18 % (`) 7.63

No. of challans No. of challans unmatched TAMILNADU (33)

(`) 50.00

Total (Rounded off)

12 0 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 25228

No. of deductee No. of deductee

where tax deducted at Religare Broking Limited

records records with PAN

higher rate 176 B, 1st Floor, Twin Towers Mani Nagar, 2nd Street

Above Hotel anjapper

52 52 2 Tuticorin - 628003

TAMILNADU

*This is a computer generated Receipt and does not require signature

SAM 1.00

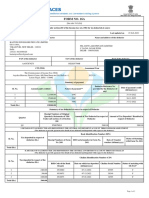

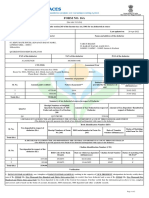

*Caution: The details above are as per the particulars reported by the deductor. Figures in this receipt is/are no confirmation of their correction/verification of data

from Tax Information Network. Details of discrepancies, if any, are available at www.tin-nsdl.com (TDS/TCS Statement Status).

Notes:

i. Receipt No. is valid only if the TDS Statement is accepted at the TIN Central system.

ii. Verify status of the TDS Statement through the TDS/TCS Statement Status facility.

iii. File correction Statement to rectify error including deductee PAN.

iv. Provide latest mobile number in the TDS/TCS Statement to facilitate SMS alerts regarding TDS/TCS Statements.

Potrebbero piacerti anche

- 252289600057294Documento1 pagina252289600057294Pricila MercyNessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961GST JINessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Dy ManagerNessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961aapka.kapil3758Nessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNessuna valutazione finora

- TDS BalamuruganDocumento1 paginaTDS Balamuruganbharani.mudomsNessuna valutazione finora

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Documento1 paginaCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961krishnaNessuna valutazione finora

- TCS Statement Details for DSV JewellersDocumento1 paginaTCS Statement Details for DSV Jewellerssuneet bansalNessuna valutazione finora

- TCS Ack. Q4 FY 1718Documento1 paginaTCS Ack. Q4 FY 1718Ravi kantNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToNanu PatelNessuna valutazione finora

- BBGPV1509K Q2 2019-20 Vandana S PrasadDocumento2 pagineBBGPV1509K Q2 2019-20 Vandana S PrasadKapil PandeyNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToEr Sumit SiwatchNessuna valutazione finora

- Form 16A TDS CertificateDocumento2 pagineForm 16A TDS CertificateSharad VermaNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToPravin AwalkondeNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToNanu PatelNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToShankara NarayananNessuna valutazione finora

- Form 16 TDS CertificateDocumento2 pagineForm 16 TDS Certificatejatin kuashikNessuna valutazione finora

- TDS Certificate SummaryDocumento2 pagineTDS Certificate SummaryAkriti JhaNessuna valutazione finora

- Ayfpv2618c Q1 2021-22Documento2 pagineAyfpv2618c Q1 2021-22sandeep kumarNessuna valutazione finora

- Form 16A TDS CertificateDocumento2 pagineForm 16A TDS CertificatePridex Medical Technologies LLNessuna valutazione finora

- Akdpn3820e Q3 2023-24Documento3 pagineAkdpn3820e Q3 2023-24truth.astrology0751Nessuna valutazione finora

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Documento3 pagineSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNessuna valutazione finora

- Aacca3193k Q3 2024-25Documento3 pagineAacca3193k Q3 2024-25Yogesh KanojiyaNessuna valutazione finora

- Aadcp9992n Q3 2023-24Documento3 pagineAadcp9992n Q3 2023-24Harikrishan BhattNessuna valutazione finora

- Form 16A TDS CertificateDocumento2 pagineForm 16A TDS CertificateRichardNoelFernandesNessuna valutazione finora

- Form 16 SummaryDocumento9 pagineForm 16 SummarySujata ChoudharyNessuna valutazione finora

- Form 16A CertificateDocumento2 pagineForm 16A CertificateKapil PandeyNessuna valutazione finora

- Somya Amritanshu - Arcpa1206b - Q3 - Ay202223Documento2 pagineSomya Amritanshu - Arcpa1206b - Q3 - Ay202223Sourabh PunshiNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToRomendro ThokchomNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToAkriti JhaNessuna valutazione finora

- QwertabacbDocumento3 pagineQwertabacbNDKKMDBNessuna valutazione finora

- Basha Form 16Documento6 pagineBasha Form 16BakiarajNessuna valutazione finora

- 29 Dec 2022Documento1 pagina29 Dec 2022kumar sNessuna valutazione finora

- TDS CertificateDocumento2 pagineTDS CertificateJyoti MeenaNessuna valutazione finora

- Form 16Documento2 pagineForm 16sowjanya0% (1)

- Mukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884Documento1 paginaMukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884lucky dudeNessuna valutazione finora

- Form16 - Vinoth Subramaniyan PDFDocumento6 pagineForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNessuna valutazione finora

- Form16-2021-2022 Part A (1)Documento2 pagineForm16-2021-2022 Part A (1)thaarini doraiswamiNessuna valutazione finora

- FORM 16 TAX DEDUCTION CERTIFICATEDocumento10 pagineFORM 16 TAX DEDUCTION CERTIFICATESnehal RanawareNessuna valutazione finora

- FSMPP1416G Q1 2023-24Documento3 pagineFSMPP1416G Q1 2023-24Parvez AhmadNessuna valutazione finora

- FY2022 23 Form16 PF FormDocumento3 pagineFY2022 23 Form16 PF FormJoydip MukhopadhyayNessuna valutazione finora

- Victor Singh - CWCPS5027H - Q1 - Ay202223 - 16aDocumento2 pagineVictor Singh - CWCPS5027H - Q1 - Ay202223 - 16agitu sorgtNessuna valutazione finora

- Awyps9796h Q4 2018-19 PDFDocumento2 pagineAwyps9796h Q4 2018-19 PDFKuldeep SinghNessuna valutazione finora

- BOHPxxxx5E Q3 2019-20Documento2 pagineBOHPxxxx5E Q3 2019-20Tamziul IslamNessuna valutazione finora

- Hamara Pump Q3 Fy 2021-2022Documento2 pagineHamara Pump Q3 Fy 2021-2022Advocate SkitaxNessuna valutazione finora

- Hamara Pump Q4 Fy 2019-20Documento3 pagineHamara Pump Q4 Fy 2019-20Advocate SkitaxNessuna valutazione finora

- Form 16 TDS certificate summaryDocumento2 pagineForm 16 TDS certificate summaryGnana SekarNessuna valutazione finora

- Hamara Pump Q1 Fy 2020-21Documento3 pagineHamara Pump Q1 Fy 2020-21Advocate SkitaxNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From Todaleep sharmaNessuna valutazione finora

- Ahnpp9921f Q4 2023-24Documento3 pagineAhnpp9921f Q4 2023-24ps245702Nessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From Tomuinbaig11Nessuna valutazione finora

- Traces: Form No. 16Documento5 pagineTraces: Form No. 16blinkfinance7Nessuna valutazione finora

- Testing Instruments Manufacturing Co. Pvt. LTD.: Tim CDocumento4 pagineTesting Instruments Manufacturing Co. Pvt. LTD.: Tim Cabhjt629Nessuna valutazione finora

- FORM 16A CERTIFICATEDocumento2 pagineFORM 16A CERTIFICATERashmi RanaNessuna valutazione finora

- GST PMT-06 Payment Challan Form DetailsDocumento1 paginaGST PMT-06 Payment Challan Form DetailsSanjayThakkarNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToPrakash PandeyNessuna valutazione finora

- Form No. 16A: From ToDocumento2 pagineForm No. 16A: From ToNanu PatelNessuna valutazione finora

- SRS Document - Dhaval PaswalaDocumento8 pagineSRS Document - Dhaval PaswalaQIT HarikaNessuna valutazione finora

- Router Mercusys - MW325 - ManualDocumento60 pagineRouter Mercusys - MW325 - ManualJorge MunguiaNessuna valutazione finora

- Upgrading and Migrating To Oracle Database 12c Release 2 (12.2.0.1)Documento24 pagineUpgrading and Migrating To Oracle Database 12c Release 2 (12.2.0.1)kashifmeoNessuna valutazione finora

- DE10-Lite User Manual September 7, 2016Documento62 pagineDE10-Lite User Manual September 7, 2016Daniel CornelioNessuna valutazione finora

- Yineth Natalia Mañunga Esteban Orbes Rosero Leonardo ZambranoDocumento47 pagineYineth Natalia Mañunga Esteban Orbes Rosero Leonardo Zambranocondorito10100% (3)

- Arihant Term 1Documento171 pagineArihant Term 1Anuj Joshi100% (3)

- Initiating A Zone Transfer - DNS & Bind CookbookDocumento1 paginaInitiating A Zone Transfer - DNS & Bind CookbookJames OmaraNessuna valutazione finora

- Assignment 5Documento4 pagineAssignment 5Vince DieselNessuna valutazione finora

- SILABUS MATERI TRAINING Bizhub Pro 1050eDocumento1 paginaSILABUS MATERI TRAINING Bizhub Pro 1050einfo counterNessuna valutazione finora

- The Story of Carbanak Began When A Bank From Ukraine Asked Us To Help With A Forensic InvestigationDocumento8 pagineThe Story of Carbanak Began When A Bank From Ukraine Asked Us To Help With A Forensic InvestigationJibon JainNessuna valutazione finora

- ESPEC MVI56E MCMR ModbusDocumento3 pagineESPEC MVI56E MCMR ModbusFelixWhiteNessuna valutazione finora

- DA210 DC2700 User Manual CDocumento49 pagineDA210 DC2700 User Manual CSvitaho ImportNessuna valutazione finora

- Infinera MGMT Suite Software BrochureDocumento4 pagineInfinera MGMT Suite Software BrochureYugo Irwan BudiyantoNessuna valutazione finora

- Install & Use Automated Raffle Machine GuideDocumento26 pagineInstall & Use Automated Raffle Machine Guidejuana jane rapadasNessuna valutazione finora

- Performance Description EPLAN Electric P8 v2.5 (EN) PDFDocumento80 paginePerformance Description EPLAN Electric P8 v2.5 (EN) PDFAdhitya ReNessuna valutazione finora

- Chapter II RRLDocumento1 paginaChapter II RRLGabriel BecinanNessuna valutazione finora

- 2G KPI DescriptionDocumento18 pagine2G KPI DescriptionArnab HazraNessuna valutazione finora

- Grade 11 Com Prog 1 History of Computer ProgrammingDocumento16 pagineGrade 11 Com Prog 1 History of Computer ProgrammingLeslie PerezNessuna valutazione finora

- JST-420W Multi-Door Access ControlDocumento4 pagineJST-420W Multi-Door Access ControlDANIEL HERNANDEZ HUASASQUICHENessuna valutazione finora

- Advantages and Disadvantages of HIS-1-1Documento12 pagineAdvantages and Disadvantages of HIS-1-1michael huavasNessuna valutazione finora

- Crypto Currency Tracker PBL ReportDocumento13 pagineCrypto Currency Tracker PBL ReportRao AnuragNessuna valutazione finora

- Next Generation NetworkDocumento3 pagineNext Generation NetworkmusharafNessuna valutazione finora

- DEFCON 25 - Untrustworthy Hardware (And How To Fix It)Documento53 pagineDEFCON 25 - Untrustworthy Hardware (And How To Fix It)Omar AfacereNessuna valutazione finora

- Communication Interface For Gilbarco 2 Wire Protocol: Brief Descrip OnDocumento2 pagineCommunication Interface For Gilbarco 2 Wire Protocol: Brief Descrip OnYasir ShokryNessuna valutazione finora

- Ramcloud: Scalable High-Performance Storage Entirely in DramDocumento16 pagineRamcloud: Scalable High-Performance Storage Entirely in Dramturah agungNessuna valutazione finora

- Why Favor Composition Over Inheritance in Java and Object Oriented ProgrammingDocumento3 pagineWhy Favor Composition Over Inheritance in Java and Object Oriented Programmingpavani21Nessuna valutazione finora

- Hirschmann RS30Documento3 pagineHirschmann RS30fassina01Nessuna valutazione finora

- How To Connect To The Student Wireless PDFDocumento2 pagineHow To Connect To The Student Wireless PDFanish sargathNessuna valutazione finora

- Orbit MCR Release Notes Rev AL - 9.2.2Documento8 pagineOrbit MCR Release Notes Rev AL - 9.2.2David José Barrios ItriagoNessuna valutazione finora

- Video Pro X EN PDFDocumento434 pagineVideo Pro X EN PDFJ Esmil Rodriguez100% (1)