Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Effect of Money Market in The Indian Economic Expansion: Pankaj Tiwari

Caricato da

sonal jainTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Effect of Money Market in The Indian Economic Expansion: Pankaj Tiwari

Caricato da

sonal jainCopyright:

Formati disponibili

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

Effect of Money Market in the Indian

Economic Expansion

Pankaj Tiwari

Research Scholar, Uttarakhand Technical University, Dehradun.

Abstract: Financial consistent quality is percent of the general typical advancement in GDP

noteworthy for oversaw economy advancement between 2003. 04 and 2007-08. The organization

anyway this can't be expert without strong division saw an improvement in GDP between

budgetary structures. Financial organizations and 2002-03 and 2007-08. The organization part saw an

markets are ending up being all the more advancement of 11 for every penny in the year

confounding during the time creating or pulling up 2007-08 as against 9.8 percent in 2006-07. The

or pulling down the economies. Coin business area genuine divisions to have pulled in remote

is a basic part of the economy. The money related hypothesis join financial organizations, data

section in India is seeing a time of advancements. exchanges, power and information advancement,

Since liberalization, there has been an extending cash related organizations, which incorporates

and creating of budgetary markets. The budgetary banks, area, insurance and business organizations

fragment has acquired more paramount quality, saw a climb of 11.1 percent in the midst of 2007-08

profitability and quality by the combined effect of against the 10.9 for every penny improvement in

contention, managerial measures, approach the prior year.

environment and motivation among the business

segment players including banks, the financial 2. India Financial Market:

markets, especially coin market. Coin business part

is a business open door for transient budgetary The cash related business division in India present

assets that are close substitutes of money. This is more best in class than various diverse parts as it

paper examination the honest to goodness effects of got the opportunity to be created as right on time as

money related markets and to give adequate the 19 the century with the securities exchanges

information exclusively on budgetary markets of Mumbai, Ahmadabad and Kolkata. In the mid

the changing conditions both inside the country 1960s, the amount of securities exchanges India got

and elsewhere. In order to adjust up to such the opportunity to be eight-including Mumbai,

change, the structure of the current money related Ahmadabad and Kolkata. Beside these three

associations is sure to accomplish an all-around exchanges, there was the Madras, Kanpur, Delhi,

new edge which is difficult to translate. The Bngalore and pune exchange too. Today there are

purpose behind this paper is to advocate and 23 nearby securities exchanges India. The Indian

invigorate cash related markets in the general securities trades till date have stayed stagnant due

change of the economy. to the rigid financial controls. It was just in 1991,

after the liberalization strategy that the India

Keywords – Financial Sector, Financial securities market saw a hurricane of IPOs serially.

advancement, Monetary Operations and Money The business area saw various new associations

Market. spreading over across over different industry

segments and business began to flourish. The

1. Introduction dispatch of the NSE (National Stock Exchange)

and the OTCEI (Over the counter Exchange of

Budgetary organizations are a part of the financial India) in the mid-1990s helped in controlling a

structure including cash related foundations, cash smooth and direct sort of securities trading. The

related markets, cash related instruments and regulatory body for the Indian capital markets was

organizations that empower the trading of benefits. the SEBI (Securities and Exchange Board of India).

Fiscal associations work in the budgetary markets The capital markets in India experienced

and give cash related organizations. The cash turbulence after which the SEBI came into

related status and the assistant parts have shown discernible quality. The business segment escape

reliable and constant changes in the nearby past. conditions must be traversed by taking remarkable

These movements are more extraordinarily measures.

unmistakable in the midst of this season of retreat.

The organization part of the Indian economy expect

a primary part and has contributed around 68.6

Imperial Journal of Interdisciplinary Research (IJIR) Page 178

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

3. Ability Of The India Financial related game plan. Money market makes open

Market: hypothesis roads for transient period. It helps in

making hold supports and interests in the economy.

India Financial Market helps in propelling the Cash market gives non0inflationary wellsprings of

venture assets of the economy – getting a record to government. It is possible by issuing

convincing channel to transmit distinctive cash treasury charges remembering the finished

related plans. The Indian budgetary zone is objective to raise short credits. In any case this

particularly made, forceful, gainful and facilitated doesn't prompts increases in the expenses. Beside

to face all staggers. In the India cash related those, coin business area is an arrangement which

business division there are diverse sorts of financial suits banks and budgetary associations overseeing

things whose expenses are controlled by the in transitory monetary activities, for instance, the

different buyers and merchants in the business part. enthusiasm for and supply of money.

The other determinant variable of the expenses of

the cash related things is the business segment 5. Helps In Equilibrating Liquidity

forces of premium and supply.The cash market Position Of Banks.

made in light of the fact that social occasions have

surplus resources, while others required cash. One of the main issue that affected banks'

Today it incorporates cash instruments moreover. efficiency was high pre-emption as cash store

extent (CRR) and statutory liquidity extent (SLR),

4. Money Market Role In Economy which had come to at the by and large unusual

Development: condition of 63.5 for every penny in the early1990s

Besides, the controlled structure of advance

An area of the budgetary business part in which charges did not allow banks to change the

money related instruments with high liquidity and financing costs depending upon the credit

short advancements are traded, the cash business estimation of the borrower and, thusly, infringed on

division is used by individuals as a techniques for the a locative capability of advantages. An

procuring and crediting in the short term, from a arranged diminishment in the SLR and the CRR

couple days to just under a year. Coin market was grasped beginning January 1993 and April

securities involve far from being obviously true 1993, exclusively.

confirmations of store (CDs), representative's

affirmations, Treasury charges, business paper, The SLR was progressively brought down from the

metropolitan notes, government sponsors and top rate of 38.5 percent in February 1992 to the

repurchase understandings (repos). then statutory slightest of 25.0 for every penny by

October 1997. There was a sharp abatement in the

The sorted out a portion of Indian cash business Central Government's money related inadequacy in

segment is really made and made. The coin market the basic years of changes. Fittingly, there was to a

in that part of a cash related business division lesser degree a need to use the sparing cash

which deals in the getting and crediting of territory as a prisoner wellspring of advantages.

temporary advances all things considered for a Financing costs on Government securities were in

period of not precisely or equal to 365 days. It is an like manner made basically showcase chose. The

instrument to clear transient cash related trades in CRR of booked business banks (SCBs) which was

an economy. It needs to offer office to changing 15 for every penny of net demand and time

liquidity to the banks, business undertakings, non- liabilities (NDTL) between July 1, 1989 and

dealing with a record budgetary establishments October 8, 1992, was obtained down stages to 9.5

(NBFs) and other cash related associations close by for each penny by November 22, 1997. Between

monetary experts. To keep up money related parity. November 1995 and January 1997, the CRR was

It plans to keep a concordance between the decreased by as much as 5 rate centers. The

enthusiasm for and supply of money for transient incremental CRR of 10 percent was furthermore

cash related trades. To progress budgetary pulled back.

growth.Money business part can do this by making

stores available to various units in the economy, for 6. Spare Requirement Cash

instance, agriculture, little scale business Reserve Ratio (Crr)

endeavors, et cetera. Cash market gives adequate

record to trade and industry. Basically it Every business bank needs to keep certain base

furthermore gives office of discounting bills of cash spares with RBI. Following upon change to

exchange for trade and industry. To help in sub Section 42(1), the Reserve Bank, having

completing Monetary Policy and it gives a admiration to the necessities of securing the

framework for a practical execution of the cash monetary relentlessness in the country, RBI can

suggest Cash Reserve Ratio (CRR) for booked

Imperial Journal of Interdisciplinary Research (IJIR) Page 179

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

manages an account with no floor rate or rooftop The instruments of cash related methodology

rate, (Before the request of this remedies, similarly including the repo rate, cash hold distribute and

as range 42(1) of the RBI Act, the Reserve Bank bank rate are used by the Central Bank of the

could support CRR for arranged banks some place country to give the obliged making a beeline for the

around 5% and 20% of total of their advantage and financial plan. Extension is one of the certified

time liabilities). RNI uses this gadget to addition or monetary issues that all the making economies

decrease the store need depending upon whether it need to stand up to now and again. Designed

needs to affect a decay or an extension in the instabilities do impact the worth level in a

money supply. surprising route, dependent upon the interest and

supply circumstance at the given reason for time.

A development in Cash Reserve Ratio (CRR) will Coin market rates accept a critical part in

make it required regarding the banks to hold an controlling the worth line. Higher rates in the coin

unlimited degree of their stores as stores with the markets diminish the liquidity in the economy and

RBI. This will reduce the degree of their stores and have the effect of decreasing the fiscal activity in

they will credit less. This will accordingly reduce the system. Lessened rates, on the other hand,

the money supply. The present rate is 4.75% (As a extend the liquidity in the business part and chop

Reduction in CRR by 0.25 as on Date – 17 down the cost of capital fundamentally, therefore

September 2012). - 25 premise centers cut in Cash growing the endeavor. This limit moreover helps

Reserve Ratio (CRR) on 17September 2012, it will the RBI to control the general trade supply out the

release Rs.17, 000 crore into the structure/Market. economy. Such operations supplement the attempts

of direct imbuement of as of late printed notes by

7. Arranged Components Of the RBI.

Money Market:

Cash markets are a champion amongst the most

imperative instruments of any making economy. As 8. Possible Destiny Of Open

opposed to just ensuring that the money market in Markets

India coordinates the flood of credit and credit

rates, this framework has created as one of the Cash related openness is be a condition under

basic course of action contraptions with the which the tenants of one country are in a position

organization and the RBI to control the monetary to trade their advantages with occupants of another

procedure gadgets with the lawmaking body and country. A to some degree tender significance of

the RBI to control the budgetary methodology, openness may be implied as budgetary joining of

money supply, credit creation and control, two or more economies. Of late, the system of

development rate and general financial game plan globalization has benefitted market operations and

of the State. Therefore, the first and the chief limit the cash related technique mechanical assemblies

of the money market instrument is managerial in extremely vital. The thinking is not simply to

nature. While choosing the total volume of credit control the economy and its money markets for the

course of action for the six month to month time general budgetary change, furthermore to attract

traverses, the credit approach in like manner goes more outside capital into the country. Remote.

for organizing the surge of credit as indicated by Wander results in extended money related activity,

the requirements adjusted by the organization as compensation and employment time in the

demonstrated by the necessities of the economy. economy, free and unhindered stream of remote

Recognize approach as an instrument is key to capital and creating compromise of the overall

ensure the openness of the credit in attractive markets is the indication of openness of economies.

volumes; it in like manner obliges the credit needs

of various zones of the economy. The RBI helps Indian contribution with open markets has been a

the assembly to execute polices related to the credit mixed one. On the positive side, the improvement

orchestrates through its statutory control over the rate of the country has taken off to new levels and

keeping cash game plan of the country. the outside trade had been creating at around 20

percent in the midst of the past couple of years.

Cash related course of action, on the other hand, Remote exchange holds have succeeded to by and

has longer term perspective and goes for amending large more hoisted sums and the country has

the unbalanced nature in the economy. Credit fulfilled new statures in the general monetary

system and the cash related game plan, both change. The coin market segment has expected a

supplement each other to finish the whole deal vital part in snappy change of the country in the

destinations directed by the council. It not simply midst of the post-changes period.

keeps up complete control over the credit creation

by the banks, also keeps a close-by watch over it.

Imperial Journal of Interdisciplinary Research (IJIR) Page 180

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

On the other side, the post-changes period has seen month declaration. Distinctive instruments,

for the most part lesser advancement of the social including Treasury charges, pay premium exactly

part. Coin market segment has kept the business at improvement. A couple sorts of cash business

divisions perky, yet the social region needs more segment theories pay premium rejected from

connected with thought. With the base of the government wage charge. Temporary avoided bills

economy now braced, the money market issued by metropolitan and state governments fall

instrument ought to similarly focus on ensuring that level into this arrangement.

suitable course is given to the credit streams so that

the poorest zones of the overall population also get. Security: Money market endeavors are more secure

than most due to their liquidity. Their liquidity

9. Characteristics Of Cash Business minimizes long - term vulnerabilities about

Segment Instruments: associations and governments and secures against

financing cost increases. Instruments, for instance,

Money market instruments channel money from Treasury charges build additional prosperity from

examiners to borrowers who need money, for a their administration backing. Government –

dare to quality as a coin market instrument, ensured money market store accounts in like

advance authorities must have the ability to recoup manner have security against bank dissatisfaction if

their trade out a year or less, picking among short their adjustments fall inside assurance rules. As of

terms securities issued by banks, associations or the date of creation, individual records are

governments. Monetary masters make their legislatively secured for up to $ 250,000. Coin

purchases through traders, at closeout or from market normal resources don't pass on government

various foundations. The various sorts of coin assurance, so financial specialists can lose money if

business division instruments offer principal the offer worth dives underneath $ 1.00.

qualities, nonetheless they also have vital

differentiations. Risks and Disadvantages: The distinctive coin

market instruments have a few insults. The most

Grouping, Money market instruments fuse short veritable risk for any theory is default. If the

terms and supports of store (CDs), common business or government issuing the instrument

securities, Treasury bills and other government misses the mark, the money related authority can

securities. More advanced cases fuse business lose part or the lion's share of his money. Locking

paper, repurchase assention and agent's up money for a reasonably long extend, for

affirmations. Particular budgetary masters most instance, one year, moreover grows the risk of

customarily place assets into cash market store rising financing costs. By and large monetary

records and money market regular resources. A authorities must pay a discipline to cash out a CD

coin market store record is a one of a kind of bank early.

or venture account that licenses check creating. A

money market shared resource is not a budgetary Banks moreover charge costs for surpassing the

adjust paying little heed to the likelihood that a allowed number of checks in a coin market store

bank offers it. It is a common resource placing account, Money market normal sponsors

assets into money market instruments. commonly charge an organization charge of 1

percent.

Liquidity: Liquidity of an endeavor implies how

quickly, and adequately monetary experts can get 10. Components Of Money Market

to their money. Coin market instruments are

modestly liquid by definition in light of the way A particularly –developed cash business division is

that the trade is open out a year or less. Modified critical for a present economy. In any case,

terms range from one day to one year. Coin market genuinely, coin market has made as an eventual

store records and money market normal resources outcome of mechanical and business progress, it

have high liquidity, as speculators may get the moreover has basic part to play amid the time spent

opportunity to money with check when they require industrialization and money related headway of a

it. Some cash market instruments in like manner country. Hugeness of a made coin business area

permit resale to discretionary buyers if the and its distinctive limits are discussed underneath:

examiner needs the key before advancement.

1. Financing Trade: Money Market accept

Treasury bills and some remarkable CDs fall into

basic part in financing both internal and moreover

this arrangement.

widespread trade. Business record is made open to

Return: Money market instruments pay energy to the merchants through bills of exchange, which are

the advance authority. Bank coin market accounts, decreased by the bill market. The affirmation house

for occasion, incorporate premium consistently to and refund markets help in financing outside trade.

Imperial Journal of Interdisciplinary Research (IJIR) Page 181

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

2. Financing Industry: Money market adds to suggestion helps the business wanders through its

the improvement of organizations in two ways. association with and sway on long –term capital

business part.

a) Money market helps the organizations in

securing short – term advances to meet their 11. Indian Money Market:

working capital necessities through the course of

action of record bills, business papers, et cetera. The entire money market in India can be isolated

into two segments. They are sorted out cash market

b) Industries all things considered need and the muddled coin market. The clamorous coin

whole deal propels, which are given in the capital business division can in like manner be known as

business area. Nevertheless, capital business area an unapproved money market. Both of these

depends in transit of and the conditions in the coin portions incorporate a couple of constituents. The

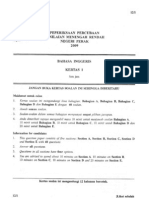

market. The transient financing expenses of the going with outline will help you in perception the

coin market affect the long – term credit charges of progressive structure of the Indian cash market.

the capital business area. Thusly, cash showcase by

Figure – 1: Source : RBI 2016

Figure 2:Source RBI 2016

12. Liquidity Adjustment Facility And the uncollateralized market. Over the span of the

Call Rate latest decade, while the step by step turnover in the

call money promote either stagnated or declined,

In the change of various constituents of the coin that of the collateralized segment, market repo

promote, the most colossal point of view was the notwithstanding CBLO, extended complex.

advancement of the collateralized market inverse

Imperial Journal of Interdisciplinary Research (IJIR) Page 182

Imperial Journal of Interdisciplinary Research (IJIR)

Vol-2, Issue-8, 2016

ISSN: 2454-1362, http://www.onlinejournal.in

The Money Market Supply to Indian GDP is shown The figure 3 shows that with an constant increase

below starting from 2015 to 2016 in Money Supply from Jul 2015 upto Apr 2016

there is a sharp dip due to low interest rate .

Figure 3:Source RBI 2016

13.Conclusion publicize now is much greater as for GDP than 10

years back.

Cash market securities contain begging to be

proven wrong assertions of store (CDs), financial 14.References

specialist's affirmations, Treasury charges, business [1] Acharya, Viral V. and Tanju Yorulmazer (2008).

paper, city notes, government finances and ìCash-in-the-Market Pricing and Optimal Resolution of

repurchase understandings (repos).Financial Bank Failures,îReview of Financial Studies 21(6), 2705-

2742.

soundness is vital for kept up economy

[2] Allen, Franklin, Elena Carletti and Douglas Gale

advancement anyway this can't be proficient (2008). ìInterbank Market Liquidity and Central Bank

without strong money related systems. The cash Intervention,îworking paper.

related business segment in India present is more [3] Allen, Franklin and Douglas Gale (2004). ìFinancial

bleeding edge than various distinctive territories as Fragility, Liquidity, and Asset Prices,îJournal of the

it got the opportunity to be sorted out as in front of European Economic Association 2, 1015-1048.

calendar as the 19 the century with the securities [4] Ashcraft, Adam, James McAndrews and David Skeie

exchanges Mumbai, Ahmadabad and Kolkata. (2008). ìPrecautionary Reserves and the Interbank

Fiscal organizations and markets are ending up Market,îFederal Reserve Bank of New York Sta§

Reports no. 370.

being all the more confounding during the time

[5] Bagehot, Walter (1873). Lombard Street: A

creating or pulling up or pulling down the Description of the Money Market. (Scriber, Armstrong,

economies. Cash business segment is a key part of and Co., New York).

the economy. The cash related territory in India is [6] Bhattacharya, Sudipto and Douglas Gale (1987).

seeing a time of headways. In the headway of ìPreference Shocks, Liquidity and Central Bank Policy,î

various constituents of the coin showcase, the most in W. Barnett and K. Singleton (eds.), New Approaches

gigantic point was the improvement of the to Monetary Economics, Cambridge University Press,

collateralized market versus the uncollateralized 69-88

market. Throughout the latest decade, while the

consistently turnover in the call coin promote either

stagnated or declined, that of the collateralized

segment, market repo notwithstanding CBLO,

extended complex. Issuance of 91 treasury bills has

also extended distinctly. The general money

Imperial Journal of Interdisciplinary Research (IJIR) Page 183

Potrebbero piacerti anche

- Sulit: 1. This Question Paper Consists of Section A and B. 2. Answer All QuestionsDocumento8 pagineSulit: 1. This Question Paper Consists of Section A and B. 2. Answer All Questionsanon_266690265Nessuna valutazione finora

- Bahasa Inggeris P1 Trial PMR Perak 2009Documento12 pagineBahasa Inggeris P1 Trial PMR Perak 2009HaFez Hisham100% (3)

- 2015pt2 Final Q PaperDocumento12 pagine2015pt2 Final Q PaperAida MusaNessuna valutazione finora

- Common Malaysian Errors: 1. Nouns Used Differently in Malaysian and Standard EnglishDocumento7 pagineCommon Malaysian Errors: 1. Nouns Used Differently in Malaysian and Standard EnglishSyazlina OmarNessuna valutazione finora

- Exam Social Studies Yr 4Documento8 pagineExam Social Studies Yr 4Afezz greenNessuna valutazione finora

- Module 5 Star 2016 - CemerlangDocumento59 pagineModule 5 Star 2016 - CemerlangAnna Michael Abdullah75% (8)

- Penulisan - Bi UpsrDocumento113 paginePenulisan - Bi UpsrLily NG AI LeeNessuna valutazione finora

- Rational ClozeDocumento7 pagineRational ClozeFahmi ShamsuddinNessuna valutazione finora

- An Excursion to Penang IslandDocumento8 pagineAn Excursion to Penang IslandDevi PalaniappanNessuna valutazione finora

- Percubaan Upsr English Year 6 2019 (Paper 2)Documento9 paginePercubaan Upsr English Year 6 2019 (Paper 2)Vee Gunushakran0% (1)

- SJK (C) Pu Sze Year 3 English Language Assessment (4) : Paper 1Documento8 pagineSJK (C) Pu Sze Year 3 English Language Assessment (4) : Paper 1Anonymous 7dHDP4jNessuna valutazione finora

- English YR-3-FINALSDocumento5 pagineEnglish YR-3-FINALSdzan enux100% (1)

- English Form 2 March Test 2017Documento8 pagineEnglish Form 2 March Test 2017Rosy Nurul Hidayati YahyaNessuna valutazione finora

- SPM EssaysDocumento13 pagineSPM EssaysJee RazaliNessuna valutazione finora

- Pds II Papers - English Peka Paper IIDocumento3 paginePds II Papers - English Peka Paper IILeena HmkNessuna valutazione finora

- 2015 Pt2 Final-Mark SchemeDocumento10 pagine2015 Pt2 Final-Mark SchemeAida MusaNessuna valutazione finora

- Soalan Trial English BI UPSR Paper 1 SabahDocumento13 pagineSoalan Trial English BI UPSR Paper 1 SabahsasauballNessuna valutazione finora

- Cloze TestDocumento2 pagineCloze TestSimone NgNessuna valutazione finora

- English Workshop MaterialDocumento6 pagineEnglish Workshop MaterialRoslan AhmadNessuna valutazione finora

- English Essay Outline Pt3Documento1 paginaEnglish Essay Outline Pt3nuriqmaNessuna valutazione finora

- Cloze Test 59Documento6 pagineCloze Test 59Nipan Ratchapol SrathongjaiNessuna valutazione finora

- 3) Set 2 Bi PT3 (Question) PDFDocumento11 pagine3) Set 2 Bi PT3 (Question) PDFTing ShiangNessuna valutazione finora

- Modul Latih Tubi PT3Documento81 pagineModul Latih Tubi PT3liniNessuna valutazione finora

- Pcgphs j3 2023 Uec Trial - Paper 1Documento4 paginePcgphs j3 2023 Uec Trial - Paper 1Matanaeiswaran TamilchelvamNessuna valutazione finora

- Form 2 English Mid Year Exam Pt3 FormatDocumento15 pagineForm 2 English Mid Year Exam Pt3 FormatAbigail SabaNessuna valutazione finora

- Sekolah Kebangsaan Merlimau: Final Exam English Year 4 Paper 1 NAMEDocumento11 pagineSekolah Kebangsaan Merlimau: Final Exam English Year 4 Paper 1 NAMEsuhailah_wanNessuna valutazione finora

- Teacher Jusini's English ModulesDocumento40 pagineTeacher Jusini's English ModulesVictor Wilfred89% (9)

- Mock Test 2 Upsr 2017 Bahasa Inggeris PDFDocumento30 pagineMock Test 2 Upsr 2017 Bahasa Inggeris PDFAnonymous I7rLI3qslG100% (1)

- Idioms and Their Meanings with ExamplesDocumento2 pagineIdioms and Their Meanings with ExamplesNadhirah100% (1)

- Rational Cloze ExerciseDocumento44 pagineRational Cloze ExercisePang Fui ShihNessuna valutazione finora

- pt3 EssayDocumento7 paginept3 Essayshahriahjalaluddin100% (3)

- 2017 Pt3 English Muar JohorDocumento13 pagine2017 Pt3 English Muar Johornetiiyah netiiNessuna valutazione finora

- 2021 Selangor Bahasa - Inggeris K1 Set 1Documento17 pagine2021 Selangor Bahasa - Inggeris K1 Set 1Sainah ManigothNessuna valutazione finora

- Peperiksaan Percubaan Penilaian Menengah Rendah I (Egeri Perak 2 0 0 8Documento12 paginePeperiksaan Percubaan Penilaian Menengah Rendah I (Egeri Perak 2 0 0 8api-19619977Nessuna valutazione finora

- SPM Percubaan 2007 SBP English Language Paper 2Documento16 pagineSPM Percubaan 2007 SBP English Language Paper 2ChinWynn.comNessuna valutazione finora

- Bahasa Inggeris: Kertas 1Documento16 pagineBahasa Inggeris: Kertas 1miejyNessuna valutazione finora

- SPM 1119 2010 Bi K2Documento19 pagineSPM 1119 2010 Bi K2pss smk selandar100% (1)

- English Paper 1 Part 1-3Documento8 pagineEnglish Paper 1 Part 1-3Nurul AisyahNessuna valutazione finora

- Ready For Advanced Test 3Documento6 pagineReady For Advanced Test 3Katarina Dragicevic100% (3)

- English exam tips for primary studentsDocumento16 pagineEnglish exam tips for primary studentsMohd HanizaNessuna valutazione finora

- RfA TB Test5 PDFDocumento6 pagineRfA TB Test5 PDFVictor Ivanov80% (5)

- SPM Power Up f4 Set 2 p1 8 Aug 2022Documento10 pagineSPM Power Up f4 Set 2 p1 8 Aug 2022qhNessuna valutazione finora

- Mount Kinabalu climb raises funds for shelter homeDocumento16 pagineMount Kinabalu climb raises funds for shelter homeAfiq NaimNessuna valutazione finora

- 2017 Peperiksaan Sumatif 1 (Repaired)Documento14 pagine2017 Peperiksaan Sumatif 1 (Repaired)heeyeonnahNessuna valutazione finora

- Future of RoboticsDocumento19 pagineFuture of RoboticsPutera SilapagNessuna valutazione finora

- Trial SPM Perak Bahasa Inggeris 2009Documento28 pagineTrial SPM Perak Bahasa Inggeris 2009fizmieNessuna valutazione finora

- 1.4 Bahasa Inggeris Soalan Kertas 2 Set BDocumento15 pagine1.4 Bahasa Inggeris Soalan Kertas 2 Set BWnhannan MohamadNessuna valutazione finora

- 雅思开课前测试Documento8 pagine雅思开课前测试657420488Nessuna valutazione finora

- SPM 1119 2011 Bi K2Documento19 pagineSPM 1119 2011 Bi K2pss smk selandarNessuna valutazione finora

- Avaliação de Entrada Lingua Portuguesa: Secretaria Municipal de Educação-Sme São João Do ManteninhaDocumento12 pagineAvaliação de Entrada Lingua Portuguesa: Secretaria Municipal de Educação-Sme São João Do ManteninhaMaria Da Penha Monteiro De Araújo AraújoNessuna valutazione finora

- ENGLISH TEST FOR 9 TH FORM DapanDocumento8 pagineENGLISH TEST FOR 9 TH FORM DapanHưng ĐặngNessuna valutazione finora

- Form 5 P2 Mid Term2010Documento15 pagineForm 5 P2 Mid Term2010Syimee SharifuddinNessuna valutazione finora

- Ready for Advanced Tree-House HotelsDocumento6 pagineReady for Advanced Tree-House HotelsSvetla YordanovaNessuna valutazione finora

- Form 4 Test Uk1Documento14 pagineForm 4 Test Uk1banuNessuna valutazione finora

- Photocopiable Tests: Unit 1 TestDocumento3 paginePhotocopiable Tests: Unit 1 TestMUSICA ELECTRONICA 2019Nessuna valutazione finora

- Mid Year PPR 2 2016 Form 4Documento21 pagineMid Year PPR 2 2016 Form 4Marinette Baltazar-ShamsudinNessuna valutazione finora

- Mostra 2021 b2 EnglishDocumento16 pagineMostra 2021 b2 EnglishGabriel Comas BosqueNessuna valutazione finora

- General PaperDocumento12 pagineGeneral PaperShashwat ShresthaNessuna valutazione finora

- 492 - 8 - Keynote PR - WB - Unit 5Documento10 pagine492 - 8 - Keynote PR - WB - Unit 5ruslan.bondarenkoNessuna valutazione finora

- Test March f2 2019Documento5 pagineTest March f2 2019farahNessuna valutazione finora

- PMR Diagnostic TestDocumento11 paginePMR Diagnostic TestabdfattahNessuna valutazione finora

- A FIGHTER'S LINES - Poem about aging and passing the torch of freedom to new generationsDocumento2 pagineA FIGHTER'S LINES - Poem about aging and passing the torch of freedom to new generationsabdfattahNessuna valutazione finora

- PT3 Speaking Ideas by 3.6 2016 (SMK Convent Muar)Documento6 paginePT3 Speaking Ideas by 3.6 2016 (SMK Convent Muar)abdfattahNessuna valutazione finora

- Techniques for SPM Section CDocumento20 pagineTechniques for SPM Section CNoris FahriNessuna valutazione finora

- Midterm English Form4Documento18 pagineMidterm English Form4abdfattahNessuna valutazione finora

- As B Loan CalculatorDocumento3 pagineAs B Loan CalculatorabdfattahNessuna valutazione finora

- Frog Vle ArticleDocumento3 pagineFrog Vle ArticleabdfattahNessuna valutazione finora

- Go GreenDocumento11 pagineGo GreenabdfattahNessuna valutazione finora

- DW HazeDocumento2 pagineDW HazeabdfattahNessuna valutazione finora

- Passive VoiceDocumento2 paginePassive VoiceabdfattahNessuna valutazione finora

- Writing Informal Letter - SSVDocumento10 pagineWriting Informal Letter - SSVRachel Chai Chin MingNessuna valutazione finora

- Balance in Language Teaching and Learning - Honoring Tradition AnDocumento72 pagineBalance in Language Teaching and Learning - Honoring Tradition AnabdfattahNessuna valutazione finora

- The CurseDocumento3 pagineThe CurseabdfattahNessuna valutazione finora

- Section D Poem LPU2012Documento2 pagineSection D Poem LPU2012abdfattahNessuna valutazione finora

- Literal and Figurative Meaning and ThemesDocumento2 pagineLiteral and Figurative Meaning and ThemesabdfattahNessuna valutazione finora

- The Meaning of The Poem (In The Midst of Hardship)Documento2 pagineThe Meaning of The Poem (In The Midst of Hardship)abdfattah100% (1)

- Mixed Methods ApproachbDocumento56 pagineMixed Methods Approachbabdfattah100% (2)

- Using The Details From The Novel That You Have StudiedDocumento4 pagineUsing The Details From The Novel That You Have StudiedabdfattahNessuna valutazione finora

- SLA Grammar Acquisition and PedagogyDocumento13 pagineSLA Grammar Acquisition and PedagogyabdfattahNessuna valutazione finora

- Teaching English as a Lingua FrancaDocumento9 pagineTeaching English as a Lingua Francaabdfattah0% (1)

- What Is Malaysian English and How Did It Develop in MalaysiaDocumento3 pagineWhat Is Malaysian English and How Did It Develop in MalaysiaabdfattahNessuna valutazione finora

- Teaching Listening N SpeakingDocumento35 pagineTeaching Listening N SpeakingabdfattahNessuna valutazione finora

- Trial PMR Pahang 2010 Eng (p2)Documento8 pagineTrial PMR Pahang 2010 Eng (p2)abdfattahNessuna valutazione finora

- English SPM ModuleDocumento197 pagineEnglish SPM Moduleabdfattah100% (16)

- Lesson Plan Small LDocumento8 pagineLesson Plan Small Labdfattah100% (2)

- Comparing Effectiveness of Family Planning Methods: How To Make Your Method More EffectiveDocumento1 paginaComparing Effectiveness of Family Planning Methods: How To Make Your Method More EffectiveGabrielle CatalanNessuna valutazione finora

- Yale's Burned Baboons, Harvard's Dead Goat Make Ivy League Lab Abuse ListDocumento5 pagineYale's Burned Baboons, Harvard's Dead Goat Make Ivy League Lab Abuse ListPeter M. HeimlichNessuna valutazione finora

- Down SyndromeDocumento4 pagineDown SyndromeninaersNessuna valutazione finora

- Hospital pharmacy rolesDocumento9 pagineHospital pharmacy rolesSwarna BiswasNessuna valutazione finora

- Vaginal Discharge Causes and TreatmentDocumento47 pagineVaginal Discharge Causes and TreatmentGladstone AsadNessuna valutazione finora

- Evidence-Based Preconception CareDocumento16 pagineEvidence-Based Preconception CareLaila Putri SuptianiNessuna valutazione finora

- Fractional CO2Documento4 pagineFractional CO2Rahul PillaiNessuna valutazione finora

- Confidentiality and Legal Components of TelemedicineDocumento6 pagineConfidentiality and Legal Components of TelemedicinegagansrikankaNessuna valutazione finora

- The Result of Any Laboratory Test Is Only As Good As The Sample Received in The LaboratoryDocumento16 pagineThe Result of Any Laboratory Test Is Only As Good As The Sample Received in The LaboratoryZeeshan YousufNessuna valutazione finora

- (PDF) Distalising Molars - How Do You Do ItDocumento1 pagina(PDF) Distalising Molars - How Do You Do ItDorian GrayNessuna valutazione finora

- Handwashing PDFDocumento2 pagineHandwashing PDFoktoNessuna valutazione finora

- Jadwal Piket Kebidanan Puskesmas Kalibawang Bulan Januari 2021Documento4 pagineJadwal Piket Kebidanan Puskesmas Kalibawang Bulan Januari 2021Untung Edi PurwantoNessuna valutazione finora

- Fourniers Gangrene of The External Genitalia: Plastic Reconstruction by Thin Skin GraftDocumento7 pagineFourniers Gangrene of The External Genitalia: Plastic Reconstruction by Thin Skin GraftIJAR JOURNALNessuna valutazione finora

- Closing PDA with Amplatzer DeviceDocumento13 pagineClosing PDA with Amplatzer DevicerosyadNessuna valutazione finora

- Who HGN CF WG 04.02Documento26 pagineWho HGN CF WG 04.02webmasterofdeathNessuna valutazione finora

- Rogo Se Bachav, Mohan GuptaDocumento122 pagineRogo Se Bachav, Mohan Guptaankurgoel30100% (1)

- Quality Control of Blood Components SOPDocumento4 pagineQuality Control of Blood Components SOPBALAJINessuna valutazione finora

- Project Protocol 2Documento4 pagineProject Protocol 2bhargavNessuna valutazione finora

- SPO-SHG-HA-006 SPO Mengurangi Risiko Cedera Pasien Akibat Jatuh - Dual Linguage - Rev08 - 09092021Documento21 pagineSPO-SHG-HA-006 SPO Mengurangi Risiko Cedera Pasien Akibat Jatuh - Dual Linguage - Rev08 - 09092021Yulita Itha PalangdaNessuna valutazione finora

- Basic Clinical Parasitology PDF 4656784Documento1 paginaBasic Clinical Parasitology PDF 4656784Natalie EnriquezNessuna valutazione finora

- 2018 Expanded National Nutrition Survey-ILOILO CITYDocumento90 pagine2018 Expanded National Nutrition Survey-ILOILO CITYIloiloCityNutritionCenter IcncNessuna valutazione finora

- Biology Investigatory Project Ideas for Class 12 CBSEDocumento35 pagineBiology Investigatory Project Ideas for Class 12 CBSEJubilee sharma0% (1)

- OrthoWard JOURNALDocumento1 paginaOrthoWard JOURNALShewit MisginaNessuna valutazione finora

- M PostpartumDocumento23 pagineM PostpartumDonaJeanNessuna valutazione finora

- The Modern Management of Incisional HerniasDocumento9 pagineThe Modern Management of Incisional HerniasAnonymous oh1SyryiNessuna valutazione finora

- Community Health Nursing Part 1 & 2Documento35 pagineCommunity Health Nursing Part 1 & 2Darren VargasNessuna valutazione finora

- Factors influencing nutritional status of under-five childrenDocumento11 pagineFactors influencing nutritional status of under-five childrenocmain100% (1)

- Gundao Bernard Jr. Solicito Definitely A Low-TDocumento3 pagineGundao Bernard Jr. Solicito Definitely A Low-TBernard, Jr. GundaoNessuna valutazione finora

- Hospital RelationshipDocumento14 pagineHospital RelationshipprofjthiruNessuna valutazione finora

- Module 1 Lab-1Documento27 pagineModule 1 Lab-1k kkkNessuna valutazione finora