Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CIPA Sample Questions

Caricato da

warbaasTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CIPA Sample Questions

Caricato da

warbaasCopyright:

Formati disponibili

Copyright protected © - AAOIFI

1. Which of the following is true?

a) The credit balance of Hamish Jiddiyyah is presented in the asset side of the

statement of financial position.

b) Istisna’ receivables are presented within the investments.

c) Deferred sales receivables are evaluated at fair value at the statement of

financial position date.

d) In income statement, the deferred sales income includes the effect of deferred

sales funded by unrestricted investment accounts.

Read the following and answer questions 2 and 3.

Ahmad invested USD 200000 in an Islamic bank on 1/10/2008 on the basis of mudaraba

contract in which he allowed to commingle his fund with the bank’s own funds and to

deduct 10% of profit as share of mudarib. The bank used the funds in funding a

murabaha operation done with client Mahmoud on 1/11/2008 with a nominal value of

USD 220000 (on 10 monthly installments). After 5 months of regular payments the

client Mahmoud declared his bankruptcy which forced the bank to seize the asset (subject

of murabaha contract) and sell it via auction at 1/4/2009 with a value of USD180000.

2. What is the accounting entry as at 1/4/2009?

a) Dr. Cash 180000

Dr. Sales receivables – deferred profit 10000

Cr. Sales receivables – Mahmoud 110000

Cr. Payables – Mahmoud 70000

Cr. Income – deferred sales 10000

b) Dr. Cash 180000

Cr. Sales receivables – Mahmoud 110000

Cr. Income – deferred sales 70000

c) Dr. Cash 180000

Cr. Sales receivables – Mahmoud 110000

Cr. Payables – Mahmoud 70000

d) Dr. Cash 180000

Dr. Sales receivables – deferred profit 10000

Cr. Sales receivables – Mahmoud 110000

Cr. Payables – Mahmoud 80000

Copyright protected © - AAOIFI 1

Copyright protected © - AAOIFI

3. What is the effect on the 3 parties?

a b c d

Ahmad 9000 10000 18000 - 20000

Bank 1000 1000 2000 0

Mahmoud - 30000 0 - 40000 0

4. Ahmad invested USD 200000 in an Islamic bank on the basis of unrestricted

mudaraba contract in which the parties will share profits evenly, and the

bank used these amounts in financing two operations. The first is a

mudaraba contract signed with client Mahmoud for a value of USD 60000 in

which they expect to have USD 5000 as profit and to share the profits on the

ratio of 40% for the bank and 60% for Mahmoud. The second operation is

musharaka contract signed with client Isam with a capital of USD 280000

funded equally with a profit distribution ratio 60% for the bank and 40% for

Isam.

If the results are USD1000 profit from mudaraba operation and USD 20000

losses from musharaka operation (with no due negligence), what is the effect

on the involving parties?

a b c d

Ahmad - 5800 - 10200 - 9800 - 20000

Bank -5800 200 200 0

Mahmoud 600 600 600 300

Isam - 8000 - 10000 - 10000 - 8000

5. Upon receiving a binding purchase order to buy a car with market value of

USD 11000, the bank collected from the client USD 1000 as Hamish

Jiddiyyah on 25/10/2008, then signed and executed the related Murabaha

contract at 1/11/2008 with the value of USD 10000 collectable via 10 monthly

installments (and Hamish Jiddiyah was considered as payment for the first

installment). Knowing that the car cost the bank USD 9000 and the client is

paying the installments on regular basis, what is the effect of the operation on

the bank accounts at 31/12/2008?

a b c d

Receivables -Client 8800 8000 8000 8000

Account

Income – deferred sales 2200 1000 200 200

Deferred profit 0 0 800 800

Unrecognized gains 0 1000 0 1000

Copyright protected © - AAOIFI 2

Copyright protected © - AAOIFI

6. Which of the following is false?

I. Debt owed by either the Mudarib or another party to the capital provider

can be used as capital in a Mudaraba contract.

II. In a Murabaha contract, the institution is prohibited from selling any item

before having acquired the item.

III. Tradable bonds can be issued based on the debt from a Salam contract.

IV. An Ijarah contract may be executed for an asset undertaken by the lessor

to be delivered to the lessee according to accurate specifications, even if

the asset so described is not owned by the lessor.

V. In a Mudaraba contract, the capital provider (rab al maal) always permits

the Mudarib to administer a Mudaraba fund without any restrictions.

Answer:

a) I and V

b) II, III and V

c) II, III, and IV

d) I, III and V

7. For the purposes of financial accounting for Islamic Financial Institutions, how

the effect of changes in the purchasing power of money is dealt with?

a) Financial Statements are restated to reflect the changes in the purchasing power or

money.

b) Effect of such changes are accounted for in the Statement of Equity

c) For the purposes of financial accounting, the stability of the purchasing power of

the monetary unit is assumed.

d) Effect of any changes in the purchasing power of money is accounted for in the

income statement.

8. Which of the following is not a qualitative characteristic of accounting

information?

I. Relevance

II. Substance over form

III. Accrual concept

IV. Reliability

V. Comparability

Answer:

a) I and V

Copyright protected © - AAOIFI 3

Copyright protected © - AAOIFI

b) I and II

c) II and III

d) III and IV

9. How will you treat a correction of an error in prior period financial

statements?

I. Correct the error retroactively by restating the financial statements for all

prior periods presented which have been affected by the error.

II. Carry out the adjustments in the financial statements for the year in which

the error was detected.

III. Merely disclosing the error in the financial statements for the year in

which the error was detected.

IV. Adjust the Retained Earnings at the beginning of the first period presented

to reflect the cumulative effect of the correction of the error on the periods

which are not presented but which were affected by the error.

Answer:

a) I

b) II and III

c) IV

d) I and IV

10. XYZ Ltd, the purchase orderer, in a binding promise under a Murabaha

contract with an Islamic Bank agrees to buy goods worth USD 5,500 and pays

USD 500 as Hamish Jiddiyyah. However, XYZ fails to fulfil its promise and, as a

result, the Islamic Bank sells the goods to another client for USD 3,000. The

accounting treatment for this in the Islamic Bank’s books will be (assuming cost

of goods for the bank was USD 5,000.)

a) Consider Hamish Jiddiyyah paid (USD 500) as an obligation and treat it as a

liability unless the Shari’a supervisory board of the Islamic Bank decides

otherwise.

b) To record the losses incurred (USD 2,000) from sale of asset to another client in

the income statement.

c) To deduct the losses incurred (USD 2,000) first from Hamish Jiddiyyah paid and

record the balance (USD 1,500) in income statement.

d) To deduct the amount of actual loss (USD 2,000) from Hamish Jiddiyyah and

record the balance losses (USD 1,500) as an amount due from the original

purchase orderer.

Copyright protected © - AAOIFI 4

Copyright protected © - AAOIFI

11. In Istisna’a contract the price can be:

a) Paid in advance

b) Payable within a stipulated time

c) Payable upon completion

d) Any of the above

12. The rent in a lease contract may be in the form of:

a) Use of asset.

b) A fixed cash amount to be paid at the end of the lease period.

c) An unspecified quantity of a commodity.

d) (a) and (b)

13. It is not permissible for an Islamic Bank to charge its customer a fee for a

Murabaha transaction, except for:

a) Commitment fee, in exchange for the right to contract the Murabaha transaction.

b) Credit facility fee, for the provision of the Murabaha credit facility.

c) Syndicated financing fee, if such syndicated facility is arranged.

d) None of the above

14. The owner of an asset can enter into;

a) A lease contract of immediate effect

b) A lease contract of future effect

c) (a) only.

d) (a) and (b).

15. In cases involving personal guarantee the guarantor may be entitled to;

a) A lump sum fee

b) A certain percentage of the guaranteed amount

c) Reimbursement of expenses

d) A reciprocating service

Copyright protected © - AAOIFI 5

Copyright protected © - AAOIFI

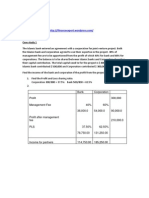

XYZ Bank Statement of Financial Position as at 31/12/2009

(Amounts in USD)

Current Year

Assets

Cash 50,000

Current Deposits 700,000

Net Murabaha Receivables 80,000,000

Deferred Profit from Murahaba Operations (5,000,000)

Parallel Salam 4,750,000

Mudarab Receivables 10,000,000

Other receivables 1,500,000

Net Fixed Assets 2,500,000

Provisions for doubtful "other receivables" (150,000)

Total Assets 94,350,000

Liabilities and Equities

Liabilities

Current Accounts Deposits 6,000,000

Hamish Jiddiyyah 4,000,000

Salam Financing 4,900,000

Suppliers 1,000,000

Long Term Financing 1,500,000

Payables - Profit Distribution for Unrestricted Investment Accounts 2,000,000

Equity of Unrestricted Investment Accounts Holders 52,850,000

General Provisions for Mudaraba Receivables 1,400,000

Total Liabilities 73,650,000

Owner's Equity

Paid Up Capital 10,000,000

Retained Earnings 3,000,000

Investment Risk Reserves 6,000,000

Profit Equalization Reserves 2,000,000

Total Owner's Equity 21,000,000

Total Liabilities and Equities 94,650,000

Based on the above Statement of Financial Position, and from general accounting point of

view, answer questions 16 to 20 (assuming that the trial balance that was used to prepare

this statement of financial position is balanced, that there is no omission of any accounts,

and that there is no mistake in the amounts).

Copyright protected © - AAOIFI 6

Copyright protected © - AAOIFI

16 - What is wrong with the item “Net Murabaha Receivables”?

A - Its amount, in relation to total assets, is too large.

B – “Hamish Jaddiyyah” should be deducted from “Murabaha Receivables” and thus

constitute a part of “Net Murabaha Receivables”.

C - “Deferred Profit from Murabaha Operations” should be included in “Net Murabaha

Receivables” which in turn should become USD75,000,000.

D - All of the above.

17 – The Statement of Financial Position is not balanced due to (assuming that the trial

balance that was used to prepare this statement of financial position is balanced, that

there is no omission of any accounts, and that there is no mistake in the amounts):

A - Calculation error

B – “Provision for doubtful “other receivables”” should be presented under liabilities.

C – “Salam Financing” should be presented under assets and Parallel Salam should be

presented under liabilities.

D - None of the above.

18 – Assuming that the historical cost of the Fixed Assets amounts to USD 4,000,000

while the depreciation expenses were USD 300,000 for 2009, and that the accounting

policies adopted by the bank do not allow revaluation of Fixed Assets, what is the amount

for accumulated depreciation of the Fixed Assets?

A – USD300,000.

B - USD1,500,000.

C – Nil.

D – USD2,500,000.

19 - What is your opinion about “Investment Risk Reserves” and “Profit Equalisation

Reserves”?

A - No opinion, due to the absence of detailed information.

B - No problem with these accounts.

C – “Profit Equalization Reserves” should be reflected in “Equity of Unrestricted

Investment Account” only.

D – “Investment Risk Reserves” should be presented in “Equity of Unrestricted

Investment Account” only.

20 - Which of the following is/are wrongly presented?

I – “Long Term Financing”.

II – “Payables - Profit Distribution for Unrestricted Investment Accounts”.

III – “General Provisions for Mudaraba Receivables”.

A – (II).

B – (III).

C – (II) and (III).

D – (I), (II) and (III).

Copyright protected © - AAOIFI 7

Potrebbero piacerti anche

- Introduction To Islamic Finance QuizDocumento3 pagineIntroduction To Islamic Finance QuizSaad Nadeem 090100% (4)

- Guidelines f0r Financial Reporting and Auditing of ProjectsDocumento24 pagineGuidelines f0r Financial Reporting and Auditing of ProjectsYadushreshtha Singh SirmathuraNessuna valutazione finora

- High School Chemistry Grade 10-12Documento486 pagineHigh School Chemistry Grade 10-12Todd95% (39)

- Pestel & Five ForcesDocumento42 paginePestel & Five ForceswarbaasNessuna valutazione finora

- Manual For Internal Audit On India Railways: Ministry of Railways (Railway Board) Government of IndiaDocumento85 pagineManual For Internal Audit On India Railways: Ministry of Railways (Railway Board) Government of IndiaKannan Chakrapani100% (1)

- Ijarah: Muhammad Ayman Bin A Yazid (1011065)Documento20 pagineIjarah: Muhammad Ayman Bin A Yazid (1011065)Ummu Atiqah ZainulabidNessuna valutazione finora

- SAP FI Certification Sample Question SetDocumento84 pagineSAP FI Certification Sample Question SetsureshNessuna valutazione finora

- Modes of Deployment of Fund by Islamic BanksDocumento30 pagineModes of Deployment of Fund by Islamic Banksvivekananda Roy100% (1)

- Islamic Banking McqsDocumento20 pagineIslamic Banking McqsAllauddinagha17% (6)

- Chapter 1 Introduction To Islamic Banking and FinanceDocumento42 pagineChapter 1 Introduction To Islamic Banking and Financebobktg82100% (8)

- Islamic FinanceDocumento13 pagineIslamic FinanceLAMOUCHI RIM0% (2)

- An Introduction To Islamic Accounting Theory and Practice PDFDocumento256 pagineAn Introduction To Islamic Accounting Theory and Practice PDFArif Witjaksoeno100% (6)

- Somali Business Review Special Final RevisedDocumento36 pagineSomali Business Review Special Final RevisedMohamed AliNessuna valutazione finora

- The CIMA Advanced Diploma in Islamic Finance (CADIF)Documento406 pagineThe CIMA Advanced Diploma in Islamic Finance (CADIF)digitalbooks100% (3)

- Marifas Practical Guide To Islamic Banking and FinanceDocumento244 pagineMarifas Practical Guide To Islamic Banking and FinanceClaudia Stefania100% (1)

- Cases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsDocumento6 pagineCases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsMuhammad DenialNessuna valutazione finora

- Chapter 1Documento22 pagineChapter 1Low Joey100% (1)

- IFQ Sample QsDocumento14 pagineIFQ Sample Qspuliyanam100% (1)

- Accounting For MurabahaDocumento10 pagineAccounting For MurabahanooramyNessuna valutazione finora

- MurabahaDocumento21 pagineMurabahaFiza kamran100% (1)

- The Salvage Law Act No. 2616: Sanilyn V. Ramirez Llb3Documento9 pagineThe Salvage Law Act No. 2616: Sanilyn V. Ramirez Llb3Syannil VieNessuna valutazione finora

- Textbook Islamic Finance. - Perasonpdf PDFDocumento64 pagineTextbook Islamic Finance. - Perasonpdf PDFfaizu21100% (1)

- Icwim PDFDocumento2 pagineIcwim PDFWolfgangNessuna valutazione finora

- Home Musharkah CalculatorDocumento10 pagineHome Musharkah CalculatorHuzaifa Ahmed0% (1)

- AAOIFI Past PaperDocumento43 pagineAAOIFI Past Papermohamed said omar100% (1)

- MCQ Islamic Finance 22Documento16 pagineMCQ Islamic Finance 22Faisal khan63% (8)

- CH 3 Accounting For Mudharabah Financing 1Documento32 pagineCH 3 Accounting For Mudharabah Financing 1Yusuf Hussein40% (5)

- This Study Resource Was: Murabahah QuizDocumento4 pagineThis Study Resource Was: Murabahah QuizMuhammad AbdullahNessuna valutazione finora

- Mudaraba Case Study 1,2 and 3Documento2 pagineMudaraba Case Study 1,2 and 3jmfaleel88% (8)

- CHAP 1 GEN. PRIN 7th PDFDocumento87 pagineCHAP 1 GEN. PRIN 7th PDFJericho Luis100% (9)

- Murabaha-Accounting Entries PDFDocumento17 pagineMurabaha-Accounting Entries PDFHasan Irfan Siddiqui100% (1)

- Equity ValuationDocumento13 pagineEquity ValuationSaraf Kushal100% (2)

- Mudarabah: Instructor: Dr. Abidullah KhanDocumento18 pagineMudarabah: Instructor: Dr. Abidullah KhanDavid Carl100% (1)

- AltaRock MidYear Letter 2010Documento9 pagineAltaRock MidYear Letter 2010adib_motiwala100% (1)

- Financial Instruments of Islamic Banking & FinanceDocumento41 pagineFinancial Instruments of Islamic Banking & FinanceAtta BaigNessuna valutazione finora

- Branch Manager - Job DescriptionDocumento2 pagineBranch Manager - Job DescriptionwarbaasNessuna valutazione finora

- IIBF - FIMMDA - Certified Treasury Dealer PDFDocumento16 pagineIIBF - FIMMDA - Certified Treasury Dealer PDFAshish mNessuna valutazione finora

- Mudaraba Case Study 4 - Islamic Finance Case StudyDocumento1 paginaMudaraba Case Study 4 - Islamic Finance Case Studyjmfaleel100% (1)

- Musharaka Case Study 1Documento1 paginaMusharaka Case Study 1jmfaleel75% (4)

- Murabaha Case Studies PDFDocumento4 pagineMurabaha Case Studies PDFHassham Yousuf100% (1)

- Contracts and Deals in Islamic Finance: A User�s Guide to Cash Flows, Balance Sheets, and Capital StructuresDa EverandContracts and Deals in Islamic Finance: A User�s Guide to Cash Flows, Balance Sheets, and Capital StructuresNessuna valutazione finora

- An Introduction To The Aaoifi Cipa Fellowship ProgramDocumento38 pagineAn Introduction To The Aaoifi Cipa Fellowship ProgramSaad Ali100% (1)

- Sukuk StructuresDocumento35 pagineSukuk StructuresCk Tham100% (1)

- CIPA enDocumento2 pagineCIPA eneakubmdNessuna valutazione finora

- Corporate Tax in SingaporeDocumento23 pagineCorporate Tax in SingaporeMaria Bulgaru100% (1)

- Case Studies MurabahaDocumento1 paginaCase Studies MurabahajmfaleelNessuna valutazione finora

- Bai Inah N TawaruqDocumento16 pagineBai Inah N TawaruqDayana Syafiqah100% (1)

- Case Studies MurabahaDocumento4 pagineCase Studies MurabahajmfaleelNessuna valutazione finora

- Sample Answers For The Questions of Final TermDocumento11 pagineSample Answers For The Questions of Final TermUsama Khan0% (1)

- Certified Islamic Professional Accountant (Cipa) ProgramDocumento13 pagineCertified Islamic Professional Accountant (Cipa) ProgramTijjani Ridwanulah AdewaleNessuna valutazione finora

- Chap 3 True FalseDocumento24 pagineChap 3 True FalseSaadat ShaikhNessuna valutazione finora

- Islamic Accounting AssignmentDocumento2 pagineIslamic Accounting AssignmentAhmad Saifuddin Che AbdullahNessuna valutazione finora

- Unit 7AccountingforMurabaha&AmpDocumento27 pagineUnit 7AccountingforMurabaha&AmpSon Go Han0% (1)

- Islamic Finance Qualification (IFQ) : What Is The IFQ? Key FeaturesDocumento2 pagineIslamic Finance Qualification (IFQ) : What Is The IFQ? Key FeaturesJazeel MuabrakNessuna valutazione finora

- Islamic Finance Project On TawarruqDocumento23 pagineIslamic Finance Project On Tawarruqmahakanwal.96100% (1)

- MR Khairul Nizam (AAOIFI - Governance and Auditing Standards) PDFDocumento46 pagineMR Khairul Nizam (AAOIFI - Governance and Auditing Standards) PDFisyrafhakim2314Nessuna valutazione finora

- Case Studies in Islamic Banking and FinanceDocumento6 pagineCase Studies in Islamic Banking and FinanceȠƛǝǝm KĦáńNessuna valutazione finora

- Musharaka Case Study 2Documento1 paginaMusharaka Case Study 2jmfaleelNessuna valutazione finora

- Case StudiesDocumento3 pagineCase StudiesjmfaleelNessuna valutazione finora

- Murabaha Part 1Documento40 pagineMurabaha Part 1sjawaidiqbal100% (3)

- Structuring Musharakah Project Financing - Case StudyDocumento30 pagineStructuring Musharakah Project Financing - Case StudyMuhammad-Suhaini67% (3)

- Ijarah (Islamic Leasing)Documento26 pagineIjarah (Islamic Leasing)hina ranaNessuna valutazione finora

- Chapter 5 AAOIFI and MASBDocumento21 pagineChapter 5 AAOIFI and MASBHeerlina PariuryNessuna valutazione finora

- E-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Documento50 pagineE-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Muhammad QuraisyNessuna valutazione finora

- An Analysis of The Courts' Decisions On Islamic Finance DisputesDocumento23 pagineAn Analysis of The Courts' Decisions On Islamic Finance DisputesMahyuddin KhalidNessuna valutazione finora

- Accounting Issues - Islamic BanksDocumento42 pagineAccounting Issues - Islamic BanksAbubakar Bakulka100% (1)

- 1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFDocumento111 pagine1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFAustinNessuna valutazione finora

- Project Report On Financial Statement / Accounting of Islamic BankingDocumento65 pagineProject Report On Financial Statement / Accounting of Islamic Bankingmohibkhan86Nessuna valutazione finora

- Final Accounts of Banking CompaniesDocumento52 pagineFinal Accounts of Banking CompaniesRohit VishwakarmaNessuna valutazione finora

- Islamic Finance MCQDocumento3 pagineIslamic Finance MCQYasmin Zainuddin100% (1)

- Financial Accounting For Islamic Banking Products: Learning ObjectivesDocumento21 pagineFinancial Accounting For Islamic Banking Products: Learning ObjectivesAbdelnasir HaiderNessuna valutazione finora

- BBADocumento9 pagineBBAAsad MsaNessuna valutazione finora

- Aaoifi PDFDocumento6 pagineAaoifi PDFInas BennaniNessuna valutazione finora

- Biology Exam 2021 f4Documento14 pagineBiology Exam 2021 f4jemal ahimedNessuna valutazione finora

- Worksheet One 2013Documento2 pagineWorksheet One 2013warbaasNessuna valutazione finora

- Oromo BasicsDocumento15 pagineOromo BasicswarbaasNessuna valutazione finora

- 01 Sharf ENGDocumento20 pagine01 Sharf ENGPuspa ArdianiNessuna valutazione finora

- Debit Card Charge Card and Credit CardDocumento16 pagineDebit Card Charge Card and Credit CardwarbaasNessuna valutazione finora

- Questions of 2015 - Final Exam and AnswerDocumento5 pagineQuestions of 2015 - Final Exam and AnswerwarbaasNessuna valutazione finora

- Chapter One Internal ControlDocumento25 pagineChapter One Internal ControlwarbaasNessuna valutazione finora

- MIS-ModuleDocumento90 pagineMIS-ModulewarbaasNessuna valutazione finora

- Oromo BasicsDocumento15 pagineOromo BasicswarbaasNessuna valutazione finora

- Index US CMA-Part1Documento6 pagineIndex US CMA-Part1Osama SanabaniNessuna valutazione finora

- Ijarah ContractsDocumento34 pagineIjarah ContractswarbaasNessuna valutazione finora

- US CMA Part 1 Syllabus 2N2Documento4 pagineUS CMA Part 1 Syllabus 2N2Zain rehmanNessuna valutazione finora

- Ijarah ContractsDocumento34 pagineIjarah ContractswarbaasNessuna valutazione finora

- UntitledDocumento1 paginaUntitledwarbaasNessuna valutazione finora

- ASIFI 6 External Shari27ah Audit Clean by ZAS 26 March 2018 FINAL For IssuanceDocumento32 pagineASIFI 6 External Shari27ah Audit Clean by ZAS 26 March 2018 FINAL For IssuancebadliNessuna valutazione finora

- Financial Reporting and Shariah Governance Dislcosure ChecklistDocumento3 pagineFinancial Reporting and Shariah Governance Dislcosure ChecklistwarbaasNessuna valutazione finora

- Charting A Company'sDirection Its Vision, Mission, Objectives, and StrategyDocumento35 pagineCharting A Company'sDirection Its Vision, Mission, Objectives, and StrategywarbaasNessuna valutazione finora

- Why Strategy Is ImportantDocumento17 pagineWhy Strategy Is ImportantwarbaasNessuna valutazione finora

- Interaction Effect of Strategic Leadership Behaviors PDFDocumento13 pagineInteraction Effect of Strategic Leadership Behaviors PDFwarbaasNessuna valutazione finora

- OKRSDocumento19 pagineOKRSwarbaasNessuna valutazione finora

- Interaction Effect of Strategic Leadership Behaviors PDFDocumento13 pagineInteraction Effect of Strategic Leadership Behaviors PDFwarbaasNessuna valutazione finora

- What's Swot in Strategic Analysis?: David W. Pickton and Sheila WrightDocumento9 pagineWhat's Swot in Strategic Analysis?: David W. Pickton and Sheila WrightYerson CcasaNessuna valutazione finora

- The Islamic Piety and The Issue of Wealth PDFDocumento18 pagineThe Islamic Piety and The Issue of Wealth PDFwarbaasNessuna valutazione finora

- Predicting Financial Distress of CompaniesDocumento54 paginePredicting Financial Distress of CompaniesIon BurleaNessuna valutazione finora

- LQ45 Company Profiles August 2019Documento186 pagineLQ45 Company Profiles August 2019Mitha AurellitaNessuna valutazione finora

- Unit 1: IATA Accreditation Requirements: Learning Objectives Key Learning PointsDocumento1 paginaUnit 1: IATA Accreditation Requirements: Learning Objectives Key Learning PointsSitakanta AcharyaNessuna valutazione finora

- Bank of OzarksDocumento9 pagineBank of OzarksAnonymous Ht0MIJNessuna valutazione finora

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Documento8 pagineSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Yasin ShaikhNessuna valutazione finora

- Introduction To Financial ManagementDocumento43 pagineIntroduction To Financial ManagementHazel Jane EsclamadaNessuna valutazione finora

- Value Added Tax (VAT)Documento1 paginaValue Added Tax (VAT)Parth UpadhyayNessuna valutazione finora

- Form Template Format Slip Gaji Karyawan Swasta Sederhana Dalam ExcelDocumento1 paginaForm Template Format Slip Gaji Karyawan Swasta Sederhana Dalam ExcelGita RahmayaniNessuna valutazione finora

- TGP Q3 18 Earnings Presentation vFINALDocumento22 pagineTGP Q3 18 Earnings Presentation vFINALDonne BrooksNessuna valutazione finora

- Concepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDocumento141 pagineConcepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDavid Clark100% (23)

- Ch19 Consolidated Fs With Minority InterestsDocumento5 pagineCh19 Consolidated Fs With Minority InterestsralphalonzoNessuna valutazione finora

- Ratio AnalysisDocumento4 pagineRatio AnalysisHassaan QaziNessuna valutazione finora

- Understanding You Pay Guide 2018Documento28 pagineUnderstanding You Pay Guide 2018Rodríguez CésarNessuna valutazione finora

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocumento10 pagineCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaNessuna valutazione finora

- Tally Accounting Book by Ca MD ImranDocumento6 pagineTally Accounting Book by Ca MD ImranMd ImranNessuna valutazione finora

- CPALE SyllabusDocumento9 pagineCPALE SyllabusAnna Dela CruzNessuna valutazione finora

- Chapter 2 WileyDocumento29 pagineChapter 2 Wileyp876468Nessuna valutazione finora

- 1) de Students CA IntercostingDocumento33 pagine1) de Students CA IntercostingVickyNessuna valutazione finora

- Accounting For ManagersDocumento61 pagineAccounting For ManagersSwapnil DeshpandeNessuna valutazione finora

- 2014 Annual ReportDocumento132 pagine2014 Annual Reportnaveen kumarNessuna valutazione finora

- Detail Project Report On Export of Bracken FernDocumento19 pagineDetail Project Report On Export of Bracken FernHarpy happyNessuna valutazione finora

- Lemon MaltDocumento33 pagineLemon MaltUmar AsifNessuna valutazione finora

- Ifive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityDocumento1 paginaIfive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityReymar BanaagNessuna valutazione finora