Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Topic 57 The Greek Letters

Caricato da

Soumava PalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Topic 57 The Greek Letters

Caricato da

Soumava PalCopyright:

Formati disponibili

Question #1 of 17 Question ID: 439424

Call and put option values are most sensitive to changes in the volatility of the underlying when:

A) both puts and calls are deep out-of-the-money.

B) both calls and puts are at-the-money.

C) both calls and puts are deep in-the-money.

D) calls are deep out-of-the-money and puts are deep in-the-money.

Question #2 of 17 Question ID: 439422

When an option's gamma is higher:

A) a delta hedge will be more effective.

B) a delta hedge will perform more poorly over time.

C) delta will be lower.

D) delta will be higher.

Question #3 of 17 Question ID: 439417

To create a delta-neutral portfolio, an investor who has written 5,000 call options that have deltas equal to 0.5 will be:

A) short 2,500 shares in the underlying and be short 2,500 more options.

B) long 2,500 shares in the underlying.

C) long 2,500 shares in the underlying and short 2,500 more options.

D) short 2,500 shares in the underlying.

Question #4 of 17 Question ID: 439418

The deltas of puts and calls are most sensitive to changes in the underlying when:

A) both calls and puts are at-the-money.

B) both puts and calls are deep out-of-the-money.

C) calls are deep out-of-the-money, but puts are deep in-the-money.

D) both calls and puts are deep in-the-money.

Question #5 of 17 Question ID: 439412

Which of the following is the best interpretation of delta for an option? Delta is the change in the option price for:

A) a change in the time until expiration of the option.

B) an instantaneous change in interest rates.

C) an instantaneous change in price of the underlying stock.

D) an instantaneous change in the volatility of the underlying stock.

Question #6 of 17 Question ID: 439423

Gamma is the greatest when an option:

A) is at the money.

B) is deep in the money.

C) has a shorter maturity.

D) is deep out of the money.

Question #7 of 17 Question ID: 439411

An option dealer is delta hedging a short call position on a stock. As the stock price increases, in order to maintain

the hedge, the dealer would most likely have to:

A) buy more shares of the stock.

B) sell some the shares of the stock.

C) short T-bills.

D) buy T-bills.

Question #8 of 17 Question ID: 439419

Which of the following is FALSE?

I. The delta of forwards and futures is 1.

II. Gamma is largest when options are at-the-money.

III. Two problems using stop-loss trading on naked options are transaction costs and stock price uncertainty.

IV. For a delta-neutral portfolio, although opposite in sign, theta can serve as a proxy for gamma.

A) II and IV only.

B) I and III only.

C) II only.

D) I only.

Question #9 of 17 Question ID: 439416

Ronald Franklin, CFA, has recently been promoted to junior portfolio manager for a large equity portfolio at

Davidson-Sherman (DS), a large multinational investment-banking firm. He is specifically responsible for the

development of a new investment strategy that DS wants all equity portfolio managers to implement. Upper

management at DS has instructed its portfolio managers to begin overlaying option strategies on all equity portfolios.

The relatively poor performance of many of their equity portfolios has been the main factor behind this decision. Prior

to this new mandate, DS portfolio managers had been allowed to use options at their own discretion, and the results

were somewhat inconsistent. Some portfolio managers were not comfortable with the most basic concepts of option

valuation and their expected return profiles, and simply did not utilize options at all. Upper management of DS wants

Franklin to develop an option strategy that would be applicable to all DS portfolios regardless of their underlying

investment composition. Management views this new implementation of option strategies as an opportunity to either

add value or reduce the risk of the portfolio.

Franklin gained experience with basic options strategies at his previous job. As an exercise, he decides to review the

fundamentals of option valuation using a simple example. Franklin recognizes that the behavior of an option's value

is dependent on many variables and decides to spend some time closely analyzing this behavior. His analysis has

resulted in the information shown in Exhibits 1 and 2 for European style options.

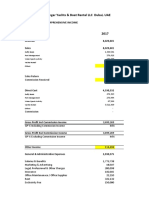

Exhibit 1: Input for European Options

Stock Price (S) 100

Strike Price (X) 100

Interest Rate (r) 0.07

Dividend Yield (q) 0.00

Time to Maturity (years) (t) 1.00

Volatility (Std. Dev.)(Sigma) 0.20

Black-Scholes Put Option Value $4.7809

Exhibit 2: European Option Sensitivities

Sensitivity Call Put

Delta 0.6736 -0.3264

Gamma 0.0180 0.0180

Theta -3.9797 2.5470

Vega 36.0527 36.0527

Rho 55.8230 -37.4164

Franklin wants to know if the option sensitivities shown in Exhibit 2 have minimum or maximum bounds. Which of the

following are the minimum and maximum bounds, respectively, for the put option delta?

A) -1 and 1.

B) -1 and 0.

C) -1 and no maximum bound.

D) There are no minimum or maximum bounds.

Questions #10-11 of 17

Ronald Franklin, CFA, has recently been promoted to junior portfolio manager for a large equity portfolio at

Davidson-Sherman (DS), a large multinational investment-banking firm. He is specifically responsible for the

development of a new investment strategy that DS wants all equity portfolio managers to implement. Upper

management at DS has instructed its portfolio managers to begin overlaying option strategies on all equity portfolios.

The relatively poor performance of many of their equity portfolios has been the main factor behind this decision. Prior

to this new mandate, DS portfolio managers had been allowed to use options at their own discretion, and the results

were somewhat inconsistent. Some portfolio managers were not comfortable with the most basic concepts of option

valuation and their expected return profiles, and simply did not utilize options at all. Upper management of DS wants

Franklin to develop an option strategy that would be applicable to all DS portfolios regardless of their underlying

investment composition. Management views this new implementation of option strategies as an opportunity to either

add value or reduce the risk of the portfolio.

Franklin gained experience with basic options strategies at his previous job. As an exercise, he decides to review the

fundamentals of option valuation using a simple example. Franklin recognizes that the behavior of an option's value

is dependent on many variables and decides to spend some time closely analyzing this behavior. His analysis has

resulted in the information shown in Exhibits 1 and 2 for European style options.

Exhibit 1: Input for European Options

Stock Price (S) 100

Strike Price (X) 100

Interest Rate (r) 0.07

Dividend Yield (q) 0.00

Time to Maturity (years) (t) 1.00

Volatility (Std. Dev.)(Sigma) 0.20

Black-Scholes Put Option Value $4.7809

Exhibit 2: European Option Sensitivities

Sensitivity Call Put

Delta 0.6736 -0.3264

Gamma 0.0180 0.0180

Theta -3.9797 2.5470

Vega 36.0527 36.0527

Rho 55.8230 -37.4164

Question #10 of 17 Question ID: 439414

Which of the following is the best estimate of the change in the put option when the underlying equity increases by

$1?

A) -$3.61.

B) -$0.33.

C) -$0.37.

D) $0.67.

Question #11 of 17 Question ID: 439415

Franklin computes the rate of change in the European put option delta value, given a $1 increase in the underlying

equity. Using the information in Exhibits 1 and 2, which of the following is the closest to Franklin's answer?

A) 0.6736.

B) 36.0527.

C) -0.3264.

D) 0.0180.

Question #12 of 17 Question ID: 439410

As an option approaches expiration, the value of rho for a put option:

A) decreases and tends toward zero.

B) decreases and tends toward negative infinity.

C) increases and tends toward zero.

D) increases and tends toward infinity.

Question #13 of 17 Question ID: 439425

Gamma-neutral hedging:

A) decreases sensitivity to small changes in asset prices.

B) decreases sensitivity to large changes in asset prices.

C) increases sensitivity to large changes in asset prices.

D) increases sensitivity to small changes in asset prices.

Question #14 of 17 Question ID: 439426

Which of the following is least accurate regarding a gamma hedge?

A) Gamma hedges require less frequent rebalancing than delta hedges.

B) More frequent rebalancing of a gamma hedge should result in higher returns.

C) Gamma measures the change in delta.

D) The gamma increases with larger changes in the stock price.

Question #15 of 17 Question ID: 439420

Which of the following is the best approximation of the gamma of an option if its delta is equal to 0.6 when the price of the

underlying security is 100 and 0.7 when the price of the underlying security is 110?

A) 1.00.

B) 0.01.

C) 0.00.

D) 0.10.

Question #16 of 17 Question ID: 439421

How is the gamma of an option defined? Gamma is the change in the:

A) delta as the price of the underlying security changes.

B) vega as the option price changes.

C) theta as the option price changes.

D) option price as the underlying security changes.

Question #17 of 17 Question ID: 439427

The following profit/loss diagram is for what type of position?

A) Short put.

B) Long put.

C) Long stock, short call (covered call).

D) Long stock, long put (portfolio insurance).

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 28 Nakshatras - The Real Secrets of Vedic AstrologyDocumento39 pagine28 Nakshatras - The Real Secrets of Vedic AstrologyMichal wojcik100% (4)

- Transactions 600 051949600 20220324 160153Documento2 pagineTransactions 600 051949600 20220324 160153Hemanth Kumar NNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Scientists of Ancient IndiaDocumento9 pagineScientists of Ancient IndiaViseshNessuna valutazione finora

- CPAR TOA Pre-Board FinalDocumento10 pagineCPAR TOA Pre-Board FinalJericho Pedragosa100% (1)

- Simple Kaali Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmDocumento4 pagineSimple Kaali Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmSoumava PalNessuna valutazione finora

- 28 1 22Documento1 pagina28 1 22Soumava PalNessuna valutazione finora

- Simple Mangala Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmDocumento4 pagineSimple Mangala Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmSoumava PalNessuna valutazione finora

- Simple Lalita Homa GuideDocumento4 pagineSimple Lalita Homa GuideSoumava PalNessuna valutazione finora

- Simple Saraswati Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmDocumento4 pagineSimple Saraswati Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmSoumava PalNessuna valutazione finora

- Topic 58 Prices, Discount Factors, and ArbitrageDocumento2 pagineTopic 58 Prices, Discount Factors, and ArbitrageSoumava PalNessuna valutazione finora

- GDocumento1 paginaGSoumava PalNessuna valutazione finora

- Avigya BooksDocumento1 paginaAvigya BooksSoumava PalNessuna valutazione finora

- Option sensitivities boundsDocumento11 pagineOption sensitivities boundsSoumava PalNessuna valutazione finora

- Simple Sani Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmDocumento4 pagineSimple Sani Homa: (1) Om Keśavāya Svāhā (2) Om Nārāya Āya Svāhā (3) Om Mādhavāya Svāhā OmSoumava PalNessuna valutazione finora

- Topic 60 Returns, Spreads and Yields - AnswersDocumento9 pagineTopic 60 Returns, Spreads and Yields - AnswersSoumava PalNessuna valutazione finora

- Topic 62 Multi-Factor Risk Metrics and Hedges - AnswersDocumento7 pagineTopic 62 Multi-Factor Risk Metrics and Hedges - AnswersSoumava PalNessuna valutazione finora

- Topic 59 Spot, Forward, and Par Rates - AnswersDocumento11 pagineTopic 59 Spot, Forward, and Par Rates - AnswersSoumava PalNessuna valutazione finora

- Topic 55 Binomial Trees - Answers PDFDocumento12 pagineTopic 55 Binomial Trees - Answers PDFSoumava PalNessuna valutazione finora

- Topic 59 Spot, Forward, and Par Rates - AnswersDocumento11 pagineTopic 59 Spot, Forward, and Par Rates - AnswersSoumava PalNessuna valutazione finora

- Stress Testing Questions and AnswersTITLEDocumento6 pagineStress Testing Questions and AnswersTITLESoumava PalNessuna valutazione finora

- Torrent Downloaded From ExtraTorrent - CCDocumento1 paginaTorrent Downloaded From ExtraTorrent - CCTalha HussainNessuna valutazione finora

- Topic 52 Quantifying Volatility in VaR Models - Answers PDFDocumento41 pagineTopic 52 Quantifying Volatility in VaR Models - Answers PDFSoumava PalNessuna valutazione finora

- (WWW - Entrance Exam - Net) SBI Bank PO Solved PapersDocumento6 pagine(WWW - Entrance Exam - Net) SBI Bank PO Solved PapersVasanth DevNessuna valutazione finora

- Topic 66 Operational RiskDocumento2 pagineTopic 66 Operational RiskSoumava PalNessuna valutazione finora

- Topic 52 Quantifying Volatility in VaR Models - Answers PDFDocumento41 pagineTopic 52 Quantifying Volatility in VaR Models - Answers PDFSoumava PalNessuna valutazione finora

- Stock Investor Plan - FYBRDocumento6 pagineStock Investor Plan - FYBRGagan Deep SinghNessuna valutazione finora

- Press Release: Media@mahabank - Co.inDocumento2 paginePress Release: Media@mahabank - Co.inSoumava PalNessuna valutazione finora

- (WWW - Entrance Exam - Net) SBI Bank PO Solved PapersDocumento6 pagine(WWW - Entrance Exam - Net) SBI Bank PO Solved PapersVasanth DevNessuna valutazione finora

- Stock Investor Plan - DIYDocumento7 pagineStock Investor Plan - DIYGagan Deep Singh100% (1)

- IMPDocumento1 paginaIMPSoumava PalNessuna valutazione finora

- Valuable. Eg. Class Notes, Research Papers, Presentations..Documento1 paginaValuable. Eg. Class Notes, Research Papers, Presentations..Soumava PalNessuna valutazione finora

- FDocumento9 pagineFedi putraNessuna valutazione finora

- DCF and Pensions The Footnotes AnalystDocumento10 pagineDCF and Pensions The Footnotes Analystmichael odiemboNessuna valutazione finora

- Working Capital of Vim Dye ChemDocumento15 pagineWorking Capital of Vim Dye ChemJIGAR SHAHNessuna valutazione finora

- Financial Highlights and ReviewsDocumento17 pagineFinancial Highlights and ReviewsThorapioMayNessuna valutazione finora

- 12 2 11Documento2 pagine12 2 11AshleyNessuna valutazione finora

- Shakey's Pizza Asia financial reports analysisDocumento76 pagineShakey's Pizza Asia financial reports analysisSheila Mae AramanNessuna valutazione finora

- Ibiz 040301778899563 20231001 20231021 1697900022059734617.Documento3 pagineIbiz 040301778899563 20231001 20231021 1697900022059734617.rezkykiky043Nessuna valutazione finora

- First Yacht Project - V1 - ActualsDocumento26 pagineFirst Yacht Project - V1 - ActualsRaja HindustaniNessuna valutazione finora

- Business CombinationDocumento9 pagineBusiness CombinationRoldan Arca PagaposNessuna valutazione finora

- Look Forward with ConfidenceDocumento290 pagineLook Forward with ConfidenceHafiz IqbalNessuna valutazione finora

- Financial Plan for Entrepreneurship (39Documento20 pagineFinancial Plan for Entrepreneurship (39Syed ArslanNessuna valutazione finora

- Financial Analysis - PT Telekomunikasi Indonesia TBKDocumento25 pagineFinancial Analysis - PT Telekomunikasi Indonesia TBKYuukiNessuna valutazione finora

- List of Important Sections Income Tax May 23 by CA Kishan KumarDocumento9 pagineList of Important Sections Income Tax May 23 by CA Kishan KumarNarayan choudharyNessuna valutazione finora

- MODIFIED INTERNAL RATE OF RETURN (MIRRDocumento5 pagineMODIFIED INTERNAL RATE OF RETURN (MIRRGaluh DewandaruNessuna valutazione finora

- Activity 5 - TolentinoDocumento2 pagineActivity 5 - TolentinoDJazel TolentinoNessuna valutazione finora

- FIN 500 Extra Problems Fall 20-21Documento4 pagineFIN 500 Extra Problems Fall 20-21saraNessuna valutazione finora

- Tax GuideDocumento10 pagineTax GuideossymbengwaNessuna valutazione finora

- Analyzing the Accuracy of the Springate, Zmijewski, and Altman Models in Predicting Financial Distress of Manufacturing Companies Listed on the Indonesia Stock ExchangeDocumento13 pagineAnalyzing the Accuracy of the Springate, Zmijewski, and Altman Models in Predicting Financial Distress of Manufacturing Companies Listed on the Indonesia Stock ExchangehanifNessuna valutazione finora

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF ScribdDocumento41 pagineInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF Scribdlauryn.corbett387100% (36)

- Revise Mid TermDocumento43 pagineRevise Mid TermThe FacesNessuna valutazione finora

- CH 4Documento21 pagineCH 4Amir HussainNessuna valutazione finora

- 13 Key Steps in M&a DealDocumento16 pagine13 Key Steps in M&a Dealshubham taoriNessuna valutazione finora

- FS Analysis PDFDocumento475 pagineFS Analysis PDFStephanie Espalabra100% (1)

- Management Advisory Services Financial Statement AnalysisDocumento1 paginaManagement Advisory Services Financial Statement AnalysisErica GaytosNessuna valutazione finora

- What Is A Dividend?: Key TakeawaysDocumento6 pagineWhat Is A Dividend?: Key TakeawaysShayan ZafarNessuna valutazione finora

- Bankruptcy Problems MirzaDocumento3 pagineBankruptcy Problems MirzaKesarapu Venkata ApparaoNessuna valutazione finora

- Chapter 15 - Answer-2Documento7 pagineChapter 15 - Answer-2Matthew Robert DesiderioNessuna valutazione finora

- Security Market and Stock Exchange: March 2023Documento6 pagineSecurity Market and Stock Exchange: March 2023Aman BaigNessuna valutazione finora

- 2022 CiDocumento22 pagine2022 CiK60 Lâm Nguyễn Minh TấnNessuna valutazione finora