Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Aa 498 Assignment

Caricato da

Meena SinghTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Aa 498 Assignment

Caricato da

Meena SinghCopyright:

Formati disponibili

1) Z has a house property in Delhi whose particulars are as under:

Municipal value- 500000

Standard Rent - 435000

Municipal Tax paid- 75000

Interest paid on money

Borrowed for acquiring the house property

for the assessment Year 2017-2018 170000

Period of Occupation for own Residence 2 Months

Compute the income form house property for the same assessment year 2017-18

2) An Indian citizen Mr. Prakash Kumar. A government employee has the following Taxable income

During Previous year 2017-2018

1)-Salary receive in a foreign country for service rendered in that country Rs 70000.

2)-Agricultural income from agricultural land in Pakistan Rs 40000.

3)-Dividend by an Indian Company payable outside India Rs.25000.

4)-Income from transfer of Long term capital asset situated in India Rs 35000.

5)-Interest earned & received in England from Bank deposit there Rs 75000.

Compute taxable Income of Mr. Prakash Kumar for the assessment year 2018-19 if he is-

(a) resident Indian (b) Non Ordinary resident.

3)

Following information is furnished by Mr. Sushil Kumar, an Indian citizen and resident for the year

ending 31 March, 2018 for determination of the total income:

1. Salary (per month) 12,000

2. Dearness Allowance (per month) 1,000

3. House Rent Allowance (per month) 1,200

4. House Rent paid (per month) 1,000

5. Interest on P.F. @ 9% per annum 9,000

6. House property is let-out a monthly rent of Rs. 3,000. The annual value of the house property is Rs.

45,000. Municipal tax paid annually Rs. 3,000 and Rs. 6,000 paid for interest on capital borrowed

for the construction of the house.

7. Repayment of House building loan: 5,000

to Friends 4,000

to Life Insurance Corporation 4,000

8. Bank interest 8,800

9. Income from units of Mutual Funds 4,000

10. Life Insurance Premium paid 6,000

11. Interest on NSC (VIII issue) 2,000

12. Health Insurance Premium 5,000

Calculate Total Income of Mr. Sushil Kumar for the assessment year 2018-19.

4) A is entitled to a basic salary including DA of 400000/- Per annum &. He is also entitled to

get HRA of 120000/- Per annum. He is actually paying rent of 180000/- per annum in Lucknow.

Compute Taxable HRA.

5) Throw light on the avenues of income generation after retirement of an individual.

6) Discuss any three deductions in detail available Under Section 80C to 80U for an individual

under the Income Tax Act 1961.

7) Highlight on the importance of Tax Planning.

Submission Date: 29/03/2019

Potrebbero piacerti anche

- Income Tax II Illustration Computation of Total Income PDFDocumento7 pagineIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNessuna valutazione finora

- 18222rtp PCC May10 Paper5Documento37 pagine18222rtp PCC May10 Paper5Kamesh IyerNessuna valutazione finora

- Tybms Sem5 DT Nov19Documento5 pagineTybms Sem5 DT Nov19omsantoshbhosale01Nessuna valutazione finora

- Income Tax Compulsory Paper-3: AHK/KW/19/4101Documento6 pagineIncome Tax Compulsory Paper-3: AHK/KW/19/4101Deepak ThomasNessuna valutazione finora

- 16UCO5MC03Documento4 pagine16UCO5MC03Ñìkíl G KårølNessuna valutazione finora

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Documento5 pagineUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- Income Tax II Illustration IFOS PDFDocumento5 pagineIncome Tax II Illustration IFOS PDFSubramanian SenthilNessuna valutazione finora

- House Propery QuestionsDocumento6 pagineHouse Propery QuestionsTauseef AzharNessuna valutazione finora

- I.TAx 302Documento4 pagineI.TAx 302tadepalli patanjaliNessuna valutazione finora

- TAXATION (Preps)Documento5 pagineTAXATION (Preps)Navya GulatiNessuna valutazione finora

- Questions 34nosDocumento21 pagineQuestions 34nosAshish TomsNessuna valutazione finora

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocumento3 pagineSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNessuna valutazione finora

- Business TaxationDocumento3 pagineBusiness TaxationmadhuvankumarNessuna valutazione finora

- Paper 4 Taxation For Nov 2011Documento51 paginePaper 4 Taxation For Nov 2011ACHAL JAINNessuna valutazione finora

- Other Sources Numerical SheetDocumento5 pagineOther Sources Numerical SheetDisha GuptaNessuna valutazione finora

- Income Tax Question BankDocumento8 pagineIncome Tax Question Banksurya.notes19Nessuna valutazione finora

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocumento8 pagineBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNessuna valutazione finora

- QP 1Documento7 pagineQP 1Shankar ReddyNessuna valutazione finora

- Taxation of Individuals QuestionsDocumento2 pagineTaxation of Individuals QuestionsPerpetua KamauNessuna valutazione finora

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocumento7 pagineCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNessuna valutazione finora

- Tax NumericalsDocumento11 pagineTax NumericalsRohit PanpatilNessuna valutazione finora

- 4) TaxationDocumento21 pagine4) TaxationKrushna MateNessuna valutazione finora

- MTP 1Documento7 pagineMTP 1Aman VithlaniNessuna valutazione finora

- Business TaxationDocumento4 pagineBusiness TaxationmadhuvankumarNessuna valutazione finora

- BC 501 Income Tax Law 740766763 PDFDocumento15 pagineBC 501 Income Tax Law 740766763 PDFSakshi JainNessuna valutazione finora

- Vol 1 31032019 PDFDocumento9 pagineVol 1 31032019 PDFPradeep KattimaniNessuna valutazione finora

- Direct Taxes Sem-Iii-20Documento22 pagineDirect Taxes Sem-Iii-20Pranita MandlekarNessuna valutazione finora

- September: (CBCS) (F +R) (2016-17 and Onwards)Documento7 pagineSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNessuna valutazione finora

- Problems On Income From Other SourcesDocumento3 pagineProblems On Income From Other Sourcesgoli pandeyNessuna valutazione finora

- 5.1 Questions On Income From House PropertyDocumento3 pagine5.1 Questions On Income From House PropertyAashi GuptaNessuna valutazione finora

- P.Y Question Paper Income Tax Delhi UniversityDocumento5 pagineP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Income Tax Law and PracticeDocumento4 pagineIncome Tax Law and PracticeShruthi VijayanNessuna valutazione finora

- 28 5 Income TaxDocumento50 pagine28 5 Income Taxemmanuel JohnyNessuna valutazione finora

- Examples & Practice Questions For Income From PropertyDocumento8 pagineExamples & Practice Questions For Income From PropertyAbdulAzeemNessuna valutazione finora

- Income Tax Model PaperDocumento5 pagineIncome Tax Model PaperSrinivas YerrawarNessuna valutazione finora

- QP 2 PDFDocumento7 pagineQP 2 PDFShankar ReddyNessuna valutazione finora

- Income From SalaryDocumento9 pagineIncome From Salaryvinod nainiwalNessuna valutazione finora

- IT QuestionDocumento3 pagineIT QuestionSathish SmartNessuna valutazione finora

- 120 Income Tax - IIDocumento21 pagine120 Income Tax - IIPriya Dharshini PdNessuna valutazione finora

- Taxation Paper EMBA 16042022Documento4 pagineTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocumento9 pagineMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNessuna valutazione finora

- Ifos WorksheetDocumento7 pagineIfos WorksheetjaoceelectricalNessuna valutazione finora

- Mba 3 Sem Tax Planning and Management Jan 2019Documento3 pagineMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNessuna valutazione finora

- BBAHDSE504Documento4 pagineBBAHDSE504shen kinoNessuna valutazione finora

- INCOME TAX COMPUTATION-SalariesDocumento3 pagineINCOME TAX COMPUTATION-SalariesNinad RautNessuna valutazione finora

- ICAP Income Tax Numericals Regards Awais Ali PDFDocumento52 pagineICAP Income Tax Numericals Regards Awais Ali PDFInam Ul Haq Minhas0% (2)

- Tax Laws Letures (13-07-2021 To 17-07-2021)Documento28 pagineTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNessuna valutazione finora

- Tax H Question 2021Documento3 pagineTax H Question 2021Aporupa BarNessuna valutazione finora

- PTP SolutionsDocumento5 paginePTP SolutionsSanah SahniNessuna valutazione finora

- QB Ipu 2024Documento2 pagineQB Ipu 2024uditnarayan8721663Nessuna valutazione finora

- Quiz 3 Chapter 8: Income From Property 50 Marks Name: SectionDocumento4 pagineQuiz 3 Chapter 8: Income From Property 50 Marks Name: SectionHadiNessuna valutazione finora

- (April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Documento4 pagine(April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNessuna valutazione finora

- Assessment 1Documento4 pagineAssessment 1lalshahbaz57Nessuna valutazione finora

- Income Tax S5 Set IDocumento5 pagineIncome Tax S5 Set ITitus ClementNessuna valutazione finora

- Model Question BBS 3rd Taxation in NepalDocumento6 pagineModel Question BBS 3rd Taxation in NepalAsmita BhujelNessuna valutazione finora

- 2 - House Property Problems 22-23Documento5 pagine2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANessuna valutazione finora

- Practice Questions: Question # 1 (A)Documento4 paginePractice Questions: Question # 1 (A)Hamid Rana khanNessuna valutazione finora

- Assignment MBA III: Business Taxation: TH THDocumento4 pagineAssignment MBA III: Business Taxation: TH THShubham NamdevNessuna valutazione finora

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Da EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Valutazione: 5 su 5 stelle5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Da EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- NTCC PatanjaliDocumento31 pagineNTCC PatanjaliMeena SinghNessuna valutazione finora

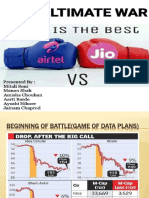

- MCD VS BK PrintDocumento27 pagineMCD VS BK PrintMeena SinghNessuna valutazione finora

- 92920184498214 (1).docxDocumento3 pagine92920184498214 (1).docxMeena SinghNessuna valutazione finora

- by MeenaDocumento18 pagineby MeenaMeena SinghNessuna valutazione finora

- FinanceDocumento20 pagineFinanceMeena SinghNessuna valutazione finora

- Mangroves 130101054426 Phpapp01Documento21 pagineMangroves 130101054426 Phpapp01Meena SinghNessuna valutazione finora

- After Planning and Selection of The Organization StructureDocumento1 paginaAfter Planning and Selection of The Organization StructureMeena SinghNessuna valutazione finora

- Artificial Intelligence Report by Ravindra SinghDocumento28 pagineArtificial Intelligence Report by Ravindra SinghMeena SinghNessuna valutazione finora

- Frontpage 161020171004Documento47 pagineFrontpage 161020171004Avinash KeshriNessuna valutazione finora

- SEGMENTATIONDocumento3 pagineSEGMENTATIONMeena SinghNessuna valutazione finora

- Project ReportDocumento25 pagineProject ReportMeena SinghNessuna valutazione finora

- Ch4: Havaldar and CavaleDocumento27 pagineCh4: Havaldar and CavaleShubha Brota Raha75% (4)

- Project Report On Jio Vs AirtelDocumento77 pagineProject Report On Jio Vs AirtelMeena Singh81% (69)

- Fundamental of AdvertisingDocumento10 pagineFundamental of AdvertisingMeena SinghNessuna valutazione finora

- EXPORT PROJECT Pre ShipmentDocumento14 pagineEXPORT PROJECT Pre ShipmentMeena SinghNessuna valutazione finora

- Company Analysis - OnePlusDocumento48 pagineCompany Analysis - OnePlusFaheem Qazi100% (1)

- MIS AbdullahDocumento12 pagineMIS AbdullahMeena SinghNessuna valutazione finora

- Brand MGMT by Ravindra SinghDocumento15 pagineBrand MGMT by Ravindra SinghMeena SinghNessuna valutazione finora

- A I ReportDocumento30 pagineA I ReportSidmandeliaNessuna valutazione finora

- MIS AbdullahDocumento12 pagineMIS AbdullahMeena SinghNessuna valutazione finora

- 44414Assignment-Sales ManagementDocumento1 pagina44414Assignment-Sales ManagementMeena Singh0% (2)

- MIS AbdullahDocumento12 pagineMIS AbdullahMeena SinghNessuna valutazione finora

- Nakshatrajewelryhemant 131123014002 Phpapp02Documento7 pagineNakshatrajewelryhemant 131123014002 Phpapp02Meena Singh100% (1)

- Marks & Spencer's: An Analysis On HRMDocumento27 pagineMarks & Spencer's: An Analysis On HRMMeena SinghNessuna valutazione finora

- NTCC HyundaisnehaDocumento57 pagineNTCC HyundaisnehaMeena SinghNessuna valutazione finora

- S.T.P Report On Jewelry IndustryDocumento10 pagineS.T.P Report On Jewelry IndustryMeena SinghNessuna valutazione finora

- Social 120920113223 Phpapp01Documento12 pagineSocial 120920113223 Phpapp01Meena SinghNessuna valutazione finora

- Marks & Spencer's: An Analysis On HRMDocumento27 pagineMarks & Spencer's: An Analysis On HRMMeena SinghNessuna valutazione finora

- TQMDocumento8 pagineTQMMeena SinghNessuna valutazione finora

- RTC JudgesDocumento35 pagineRTC JudgesMichael John Duavit Congress OfficeNessuna valutazione finora

- When It Is Legal To Put An Employee On Floating Status - HR Practitioner's GuideDocumento2 pagineWhen It Is Legal To Put An Employee On Floating Status - HR Practitioner's GuidemereselNessuna valutazione finora

- Affidavit of Loss PRC CardDocumento1 paginaAffidavit of Loss PRC CardMarie Jade Ebol AranetaNessuna valutazione finora

- Trust Deed of JMN/PVCHR: LatestDocumento10 pagineTrust Deed of JMN/PVCHR: LatestPeoples' Vigilance Committee on Human rightsNessuna valutazione finora

- Case of Koprivnikar v. SloveniaDocumento30 pagineCase of Koprivnikar v. SloveniavvvvNessuna valutazione finora

- Internship Report by Vamsi KrishnaDocumento7 pagineInternship Report by Vamsi KrishnaManikanta MahimaNessuna valutazione finora

- Waite v. Church of Jesus Christ, Latterday Saints Et Al - Document No. 126Documento19 pagineWaite v. Church of Jesus Christ, Latterday Saints Et Al - Document No. 126Justia.comNessuna valutazione finora

- Structural Prevention (Peace)Documento16 pagineStructural Prevention (Peace)geronsky06Nessuna valutazione finora

- Mayor Miguel Paderanga Vs Judge Cesar AzuraDocumento2 pagineMayor Miguel Paderanga Vs Judge Cesar AzuraewnesssNessuna valutazione finora

- Outline Civil WarDocumento1 paginaOutline Civil Wargmeeks137152Nessuna valutazione finora

- Shafer Vs Judge Nov 14, 1988Documento2 pagineShafer Vs Judge Nov 14, 1988Alvin-Evelyn GuloyNessuna valutazione finora

- ADMINISTRATIVE LAW NotesDocumento3 pagineADMINISTRATIVE LAW Notesasim khanNessuna valutazione finora

- 7 The Crown As Corporation by Frederick MaitlandDocumento14 pagine7 The Crown As Corporation by Frederick Maitlandarchivaris.archief6573Nessuna valutazione finora

- Fifa GovernanceDocumento39 pagineFifa GovernancecorruptioncurrentsNessuna valutazione finora

- Adw e 112 2002 PDFDocumento6 pagineAdw e 112 2002 PDFPaapu ChellamNessuna valutazione finora

- Failure To State OffenseDocumento7 pagineFailure To State OffenseThe Federalist0% (1)

- Reschenthaler DOD EcoHealth LetterDocumento2 pagineReschenthaler DOD EcoHealth LetterBreitbart News100% (1)

- Qesco Online BilllDocumento1 paginaQesco Online BilllZafar Iqbal Jmd100% (1)

- Dear ColleagueDocumento3 pagineDear ColleaguePeter SullivanNessuna valutazione finora

- Case 32Documento2 pagineCase 32Dianne Macaballug100% (1)

- Historical Background of The Philippine Democratic PoliticsDocumento7 pagineHistorical Background of The Philippine Democratic PoliticsJonathan Pigao CacabelosNessuna valutazione finora

- Sample Personal GuaranteeDocumento5 pagineSample Personal Guaranteekikocherry100% (6)

- Hijo Plantation V Central BankDocumento3 pagineHijo Plantation V Central BankAiken Alagban LadinesNessuna valutazione finora

- State Vs LegkauDocumento9 pagineState Vs LegkauJei Essa AlmiasNessuna valutazione finora

- E.Y. Industrial Sales, Inc. v. Shen Dar MachineryDocumento1 paginaE.Y. Industrial Sales, Inc. v. Shen Dar MachineryJoe HarveyNessuna valutazione finora

- BPI Vs Lifetime Marketing CorpDocumento8 pagineBPI Vs Lifetime Marketing CorpKim ArizalaNessuna valutazione finora

- PDS Word 2022 PrintDocumento4 paginePDS Word 2022 PrintMark Cesar VillanuevaNessuna valutazione finora

- Vnmci 506 - RDocumento28 pagineVnmci 506 - RPhebe JacksinghNessuna valutazione finora

- Airsoft Registration ApplicationDocumento2 pagineAirsoft Registration ApplicationDondie SantosNessuna valutazione finora