Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Intermacc Depreciation, Depletion, Revaluation, and Impairment Prelec Wa

Caricato da

Clarice Awa-ao0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

485 visualizzazioni1 paginaThis document contains a prelecture quiz on topics related to accounting for depreciation, depletion, revaluation, and impairment. It includes 14 multiple choice questions testing understanding of concepts such as depreciation methods, calculation of depreciation and depletion expenses, accounting for revaluations and impairment losses/reversals. The questions cover the straight-line and declining balance depreciation methods, calculation of depreciation and depletion amounts, accounting for revaluations and impairment of property, plant and equipment.

Descrizione originale:

Titolo originale

INTERMACC DEPRECIATION, DEPLETION, REVALUATION, AND IMPAIRMENT PRELEC WA.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document contains a prelecture quiz on topics related to accounting for depreciation, depletion, revaluation, and impairment. It includes 14 multiple choice questions testing understanding of concepts such as depreciation methods, calculation of depreciation and depletion expenses, accounting for revaluations and impairment losses/reversals. The questions cover the straight-line and declining balance depreciation methods, calculation of depreciation and depletion amounts, accounting for revaluations and impairment of property, plant and equipment.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

485 visualizzazioni1 paginaIntermacc Depreciation, Depletion, Revaluation, and Impairment Prelec Wa

Caricato da

Clarice Awa-aoThis document contains a prelecture quiz on topics related to accounting for depreciation, depletion, revaluation, and impairment. It includes 14 multiple choice questions testing understanding of concepts such as depreciation methods, calculation of depreciation and depletion expenses, accounting for revaluations and impairment losses/reversals. The questions cover the straight-line and declining balance depreciation methods, calculation of depreciation and depletion amounts, accounting for revaluations and impairment of property, plant and equipment.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

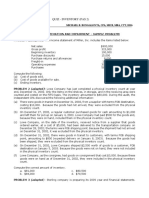

INTERMEDIATE ACCOUNTING

PRELECTURE QUIZ: DEPRECIATION, DEPLETION, REVALUATION, & IMPAIRMENT ODM

1. Which of the following uses the straight line method of depreciation?

a. Group method b. Composite method c. Double declining balance d. Both “a” and “b”

2. On January 1, 2013 FIGHTING Company purchased equipment for use in developing a new product. FIGHTING uses the straight line

depreciation. The equipment could provide benefits over a 10-year period, however, the new product development is expected to take

five years and the equipment can be used only for this project. FIGHTING’s 2013 expense equals

a. Total cost of the equipment c. One-fifth of the cost of the equipment

b. Zero d. One-tenth of the cost of the equipment

3. The straight line depreciation is not appropriate for

a. A company that is neither expanding nor contracting its investment in equipment because it is replacing equipment as the

equipment depreciates

b. Equipment on which repairs and maintenance increase substantially with age

c. Equipment with useful life that is not affected by the amount of use

d. Equipment used consistently every period

4. Which of the following statements regarding depreciation is true, according to IAS 16 – Property, Plant and Equipment?

a. An asset must be depreciated from the date of its purchase to the date of sale

b. The annual depreciation charge should be constant over the life of the asset

c. The total cost of an asset must eventually be depreciated

d. If the carrying amount of an asset is less than the residual value, depreciation is not charged

5. Depletion expense

a. Is usually part of cost of goods sold c. Includes tangible equipment cost in the depletable cost

b. Excludes restoration cost from the depletable cost d. Excludes intangible development cost from the depletable cost

6. This is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of

disposal, if the asset were already of the age and in the condition expected at the end of its useful life

a. Value in use b. Fair value less costs to sell c. Salvage value d. Depreciable value

7. An entity is required to begin depreciating an item of property, plant and equipment when

a. It is available for use and to continue depreciating it until it is derecognized, even if during that period the item is idle

b. It is available for use and to continue depreciating it until it is derecognized, unless during that period the item is idle

c. It is used and to continue depreciating it until it is derecognized, even if during that period the item is idle

d. It is used and to continue depreciating it until it is derecognized, unless during that period the item is idle

8. Which of the following is/are not false? Useful life is;

I. The period over which an asset is expected to be available for use by an entity

II. The number of production or similar units expected to be obtained from the asset by an entity

a. Both “I” and “II” b. I only c. II only d. Neither “I” nor “II”

9. On January 1, 2008, LABANLANG Company purchased equipment at a cost of ₱6,000,000. Depreciation was computed on the straight line

basis at 4% per year. On January 1, 2013, the building was revalued at a fair value of ₱8,000,000. The income tax rate is 30%. What is the

revaluation surplus on December 31, 2014?

a. ₱2,128,000 b. ₱2,240,000 c. ₱2,880,000 d. ₱2,016,000

10. In January 2013, GIVEYOURBEST Company purchased a mineral mine for ₱3,400,000 with removable ore estimated at 2,000,000 tons.

The property has an estimated value of ₱200,000 after the ore has been extracted. The entity incurred ₱1,000,000 of development cost

preparing the mine for production. During 2013, 500,000 tons were removed and 400,000 tons were sold. What is the amount of

depletion that should be expensed in 2013?

a. ₱640,000 b. ₱880,000 c. ₱840,000 d. ₱1,050,000

11. TIWALALANG Company reported an impairment loss of ₱1,600,000 in 2012. This loss was related to an item of property, plant and

equipment which was acquired on January 1, 2011 with cost of ₱10,000,000, useful life of 10 years and no residual value. On December

31, 2012, the entity reported this asset at its fair value on such date. On December 31, 2013, the entity determined that the fair value of

the impaired asset had increased to ₱7,200,000. The straight line method is used. What amount of gain on reversal of impairment should

be reported in 2013?

a. ₱1,600,000 b. ₱1,400,000 c. ₱600,000 d. ₱0

12. On January 1, 2013 WITHACTION Company bought machinery under a contract that required a down payment of ₱100,000, plus 24

monthly payments of ₱50,000 each, for the total cash payments of ₱1,300,000. The cash price of the machinery was ₱1,100,000. The

machinery has a useful life of 10 years and residual value of ₱50,000. WITHACTION uses straight line depreciation. What amount should

WITHACTION report as depreciation for 2013?

a. ₱105,000 b. ₱110,000 c. ₱125,000 d. ₱130,000

13. On July 1, 2008, NOEXCUSES Co., a calendar year company, purchased the rights to mine. The total purchase price was ₱13,200,000, of

which ₱400,000 was allocable to the land. Estimated reserves were ₱1,600,000 tons. NOEXCUSES expects to extract and sell 25,000 tons

per month. NOEXCUSES purchased new equipment on July 1, 2008. The equipment cost ₱6,600,000 and had a useful life of 8 years.

However, after all the resource is removed, the equipment will be of no use and will be sold for ₱200,000. What is the amount of

depreciation for 2008?

a. ₱400,000 b. ₱800,000 c. ₱600,000 d. ₱300,000

14. DOIT Co. purchased equipment on January 2, 2006 for ₱50,000. The equipment had an estimated 5-year service life. DOIT’s policy for

five-year assets is to use the 200% declining depreciation method for the first two years of the asset’s life, and then switch to the straight

line depreciation method. In its December 31, 2008 balance sheet, what amount should DOIT report as accumulated depreciation for

equipment? (2 points)

a. ₱30,000 b. ₱38,000 c. ₱39,200 d. ₱42,000

It is only in the dictionary where you will find “Success” before “Work”

-Anonymous

INTERMACC: PRELEC – DEPN, DEPLN, REVLN, & IMPRMNT Page 1 of 1

Potrebbero piacerti anche

- Intermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementDocumento15 pagineIntermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementMJ Legaspi0% (1)

- Chapter 21 - Teacher's Manual - Far Part 1BDocumento19 pagineChapter 21 - Teacher's Manual - Far Part 1BPacifico HernandezNessuna valutazione finora

- Case 1 - Computations of GW or IFADocumento3 pagineCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- Intermacc Inventories and Bio Assets Postlec WaDocumento2 pagineIntermacc Inventories and Bio Assets Postlec WaClarice Awa-aoNessuna valutazione finora

- Statement of Financial PositionDocumento3 pagineStatement of Financial Positionlyka0% (1)

- Ppe, Intangiblke InvestmentgfdgfdDocumento12 paginePpe, Intangiblke Investmentgfdgfdredearth2929Nessuna valutazione finora

- Quiz Inventory-Fa1Documento9 pagineQuiz Inventory-Fa1penny coronado100% (1)

- Conceptual FrameworkDocumento65 pagineConceptual FrameworkKatKat OlarteNessuna valutazione finora

- Activity - Audit of InventoryDocumento2 pagineActivity - Audit of InventoryRyan DueÑas GuevarraNessuna valutazione finora

- Ncrcup FarDocumento13 pagineNcrcup FarKenneth RobledoNessuna valutazione finora

- ACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFDocumento19 pagineACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFJenever Leo SerranoNessuna valutazione finora

- MAS - ElimDocumento5 pagineMAS - ElimSVTKhsiaNessuna valutazione finora

- Solution To Chapter 23Documento11 pagineSolution To Chapter 23Cindy Pausanos Paradela100% (1)

- Chap 003Documento37 pagineChap 003ChuyuZhang100% (2)

- 1911 Investments Investment in Associate and Bond InvestmentDocumento13 pagine1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNessuna valutazione finora

- p1 IaDocumento1 paginap1 IaLeika Gay Soriano OlarteNessuna valutazione finora

- AFAR Set CDocumento12 pagineAFAR Set CRence GonzalesNessuna valutazione finora

- Lecture Notes: Nature of Intangible Assets RecognitionDocumento5 pagineLecture Notes: Nature of Intangible Assets RecognitionRyan Carta50% (2)

- DLSA AP Intangibles For DistributionDocumento7 pagineDLSA AP Intangibles For DistributionJan Renee EpinoNessuna valutazione finora

- Audit of InvestmentsDocumento9 pagineAudit of InvestmentsGirlie SisonNessuna valutazione finora

- Property, Plant and Equipment Property, Plant and EquipmentDocumento5 pagineProperty, Plant and Equipment Property, Plant and EquipmentWertdie stanNessuna valutazione finora

- Auditing Problems Intangibles Impairment and Revaluation PDFDocumento44 pagineAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNessuna valutazione finora

- Audit of PPE - Homework - AnswersDocumento15 pagineAudit of PPE - Homework - AnswersMarnelli CatalanNessuna valutazione finora

- 272 M S Q MDocumento2 pagine272 M S Q MAdnan AzizNessuna valutazione finora

- CH 19Documento29 pagineCH 19Emey CalbayNessuna valutazione finora

- DocDocumento3 pagineDocWansy Ferrer BallesterosNessuna valutazione finora

- ReviewerDocumento5 pagineReviewermaricielaNessuna valutazione finora

- Quiz 5Documento5 pagineQuiz 5Mickaellah MacasNessuna valutazione finora

- Interim and Segment ReportingDocumento6 pagineInterim and Segment Reportingallforgod19Nessuna valutazione finora

- Aud Application 2 - Handout 7 Wasting Asset (UST)Documento5 pagineAud Application 2 - Handout 7 Wasting Asset (UST)RNessuna valutazione finora

- MAS CompiledDocumento5 pagineMAS CompiledadorableperezNessuna valutazione finora

- MASDocumento7 pagineMASHelen IlaganNessuna valutazione finora

- NU - Correction of Errors Single Entry Cash To AccrualDocumento8 pagineNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNessuna valutazione finora

- Far 17 Investment PropertyDocumento12 pagineFar 17 Investment PropertyTeresaNessuna valutazione finora

- Far NosolnDocumento11 pagineFar NosolnStela Marie CarandangNessuna valutazione finora

- Partnership FormationDocumento13 paginePartnership FormationGround ZeroNessuna valutazione finora

- MASDocumento46 pagineMASKyll Marcos0% (1)

- P1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Documento2 pagineP1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Patrick Kyle Agraviador0% (1)

- Name: - Section: - Schedule: - Class Number: - DateDocumento6 pagineName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2Nessuna valutazione finora

- Fin Acc 2 Review MaterialsDocumento17 pagineFin Acc 2 Review Materialsmaria evangelistaNessuna valutazione finora

- Far 6673Documento4 pagineFar 6673Marinel Felipe0% (1)

- Notes Part 1 & 2 QuizDocumento2 pagineNotes Part 1 & 2 QuizElla Mae LayarNessuna valutazione finora

- Overhead Costs Have Been Increasing Due To All of The Following EXCEPTDocumento13 pagineOverhead Costs Have Been Increasing Due To All of The Following EXCEPTElla Mae TuratoNessuna valutazione finora

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocumento15 pagineAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNessuna valutazione finora

- CH 11Documento72 pagineCH 11Joshua GibsonNessuna valutazione finora

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDocumento7 pagine2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- Other Long Term InvestmentsDocumento1 paginaOther Long Term InvestmentsShaira MaguddayaoNessuna valutazione finora

- Q Manacc1 Bep 2019Documento5 pagineQ Manacc1 Bep 2019Deniece RonquilloNessuna valutazione finora

- Practical Accounting 1 Mockboard 2014Documento8 paginePractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Practical Accounting - Part 1Documento17 paginePractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- First QuizDocumento4 pagineFirst QuizArn HicoNessuna valutazione finora

- Answers - Chapter 5 Vol 2Documento5 pagineAnswers - Chapter 5 Vol 2jamfloxNessuna valutazione finora

- ACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentDocumento8 pagineACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentAnn Marie Dela FuenteNessuna valutazione finora

- ACN002 Midterm Exam PDFDocumento5 pagineACN002 Midterm Exam PDFjennie kyutiNessuna valutazione finora

- Acctg3 QuizDocumento2 pagineAcctg3 QuizSyril SarientasNessuna valutazione finora

- Accounting 102 Depreciation, Depletion, Revaluation, Impairment Summary QuizDocumento8 pagineAccounting 102 Depreciation, Depletion, Revaluation, Impairment Summary Quizjhean dabatosNessuna valutazione finora

- Chapter 10: Plant Assets, Natural Resources and Intangibles Important TermsDocumento2 pagineChapter 10: Plant Assets, Natural Resources and Intangibles Important TermsMarwan DawoodNessuna valutazione finora

- Accounting 102 Intermediate Accounting Depreciation QuizDocumento6 pagineAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNessuna valutazione finora

- MQ3 Spr08gDocumento10 pagineMQ3 Spr08gjhouvanNessuna valutazione finora

- Practice ProblemsDocumento14 paginePractice ProblemsJeselle HyungSikNessuna valutazione finora

- Awa-Ao, Comparative AnalysisDocumento4 pagineAwa-Ao, Comparative AnalysisClarice Awa-aoNessuna valutazione finora

- 5 Self ConceptDocumento5 pagine5 Self ConceptClarice Awa-aoNessuna valutazione finora

- Management and Organization: Margarita B. HernandezDocumento28 pagineManagement and Organization: Margarita B. HernandezClarice Awa-aoNessuna valutazione finora

- Sexual Self Survey 1Documento27 pagineSexual Self Survey 1Clarice Awa-aoNessuna valutazione finora

- Self-Esteem: Name: ID No.: SectionDocumento3 pagineSelf-Esteem: Name: ID No.: SectionClarice Awa-aoNessuna valutazione finora

- Philosophical PerspectiveDocumento33 paginePhilosophical PerspectiveClarice Awa-aoNessuna valutazione finora

- 4 Self DifferentiationDocumento10 pagine4 Self DifferentiationClarice Awa-aoNessuna valutazione finora

- Intermacc Inventories and Bio Assets Postlec WaDocumento2 pagineIntermacc Inventories and Bio Assets Postlec WaClarice Awa-ao100% (1)

- Intermacc Inventories and Bio Assets Prelec WaDocumento1 paginaIntermacc Inventories and Bio Assets Prelec WaClarice Awa-aoNessuna valutazione finora

- Intermediate Accounting: Prelecture Quiz: Receivables and Receivable Financing ODMDocumento2 pagineIntermediate Accounting: Prelecture Quiz: Receivables and Receivable Financing ODMClarice Awa-ao50% (4)

- Intermacc Receivables Postlec WaDocumento3 pagineIntermacc Receivables Postlec WaClarice Awa-aoNessuna valutazione finora

- Intermacc Property, Plant and Equipment Prelec WaDocumento2 pagineIntermacc Property, Plant and Equipment Prelec WaClarice Awa-aoNessuna valutazione finora

- Written Assignment Unit 4 Health ScienceDocumento6 pagineWritten Assignment Unit 4 Health SciencesafsdaNessuna valutazione finora

- ATRT66Documento10 pagineATRT66luunhauyen.pisaNessuna valutazione finora

- B737-800 Air ConditioningDocumento7 pagineB737-800 Air ConditioningReynaldoNessuna valutazione finora

- BDC 6566Documento6 pagineBDC 6566jack.simpson.changNessuna valutazione finora

- Notes, MetalsDocumento7 pagineNotes, MetalsindaiNessuna valutazione finora

- Design and Details of Elevated Steel Tank PDFDocumento10 pagineDesign and Details of Elevated Steel Tank PDFandysupaNessuna valutazione finora

- طبى 145Documento2 pagineطبى 145Yazan AbuFarhaNessuna valutazione finora

- WCC PSV PDFDocumento40 pagineWCC PSV PDFAlejandro RamelaNessuna valutazione finora

- AUDCISE Unit 1 WorksheetsDocumento2 pagineAUDCISE Unit 1 WorksheetsMarjet Cis QuintanaNessuna valutazione finora

- Cat 880620 R11Documento60 pagineCat 880620 R11pawelprusNessuna valutazione finora

- 2008 03 20 BDocumento8 pagine2008 03 20 BSouthern Maryland OnlineNessuna valutazione finora

- Aquamine 50.01Documento17 pagineAquamine 50.01Armando RelajoNessuna valutazione finora

- ASK-M 72cells Monocrystalline Module: Key FeaturesDocumento2 pagineASK-M 72cells Monocrystalline Module: Key FeaturesNam Tran HoangNessuna valutazione finora

- Philips Healthcare: Field Change Order ServiceDocumento5 paginePhilips Healthcare: Field Change Order ServiceJimNessuna valutazione finora

- 7 LevelDocumento5 pagine7 LevelACHREF RIHANINessuna valutazione finora

- Epoxy Data - AF35LVE TDS - ED4 - 11.17Documento8 pagineEpoxy Data - AF35LVE TDS - ED4 - 11.17HARESH REDDYNessuna valutazione finora

- Foundation Engineering. 02 Soil CompressibilityDocumento63 pagineFoundation Engineering. 02 Soil Compressibilitysammy lopezNessuna valutazione finora

- An Enhanced Model of Thermo Mechanical Loading On A Vaccum Insulated GlazingDocumento29 pagineAn Enhanced Model of Thermo Mechanical Loading On A Vaccum Insulated GlazingNguyễn SơnNessuna valutazione finora

- Report Text: General ClassificationDocumento7 pagineReport Text: General Classificationrisky armala syahraniNessuna valutazione finora

- OBESITY - Cayce Health DatabaseDocumento4 pagineOBESITY - Cayce Health Databasewcwjr55Nessuna valutazione finora

- Rate Break Up 15500Documento1 paginaRate Break Up 15500Yash Raj Bhardwaj100% (1)

- Broucher Design - 02Documento8 pagineBroucher Design - 02ಉಮೇಶ ಸಿ. ಹುಕ್ಕೇರಿ ಹುಕ್ಕೇರಿNessuna valutazione finora

- 3 14 Revision Guide Organic SynthesisDocumento6 pagine3 14 Revision Guide Organic SynthesisCin D NgNessuna valutazione finora

- Additional Activity 3 InsciDocumento3 pagineAdditional Activity 3 InsciZophia Bianca BaguioNessuna valutazione finora

- ZL Ap381Documento10 pagineZL Ap381micyNessuna valutazione finora

- CHAPTER 8 f4 KSSMDocumento19 pagineCHAPTER 8 f4 KSSMEtty Saad0% (1)

- KL 4 Unit 6 TestDocumento3 pagineKL 4 Unit 6 TestMaciej Koififg0% (1)

- Case Exercise On Layer Unit (2000 Birds)Documento2 pagineCase Exercise On Layer Unit (2000 Birds)Priya KalraNessuna valutazione finora

- Electronic Price List June 2022Documento55 pagineElectronic Price List June 2022MOGES ABERANessuna valutazione finora

- DTC P1602 Deterioration of Battery: DescriptionDocumento5 pagineDTC P1602 Deterioration of Battery: DescriptionEdy SudarsonoNessuna valutazione finora