Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rbi Releases 'Quarterly Statistics On Deposits and Credit of SCBS: December 2018'

Caricato da

Vivek ThakurTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Rbi Releases 'Quarterly Statistics On Deposits and Credit of SCBS: December 2018'

Caricato da

Vivek ThakurCopyright:

Formati disponibili

प्रेस प्रकाशनी PRESS RELEASE

भारतीय �रज़वर् ब�क

RESERVE BANK OF INDIA

संचार �वभाग, क�द्र�य कायार्लय, एस.बी.एस.मागर्, मुंबई-400001

_____________________________________________________________________________________________________________________

0 : www.rbi.org.in/hindi

वेबसाइट

DEPARTMENT OF COMMUNICATION, Central Office, S.B.S.Marg, Mumbai-400001 Website : www.rbi.org.in

फोन/Phone: 022 2261 0835 फैक्स/Fax: 91 22 22660358 इ-मेल email: helpdoc@rbi.org.in

February 28, 2019

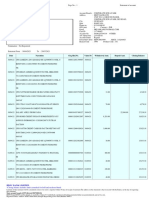

RBI releases 'Quarterly Statistics on Deposits and Credit of SCBs: December 2018’

Today, the Reserve Bank released its web publication entitled Quarterly Statistics

on Deposits and Credit of Scheduled Commercial Banks (SCBs), December 2018 on its

Database on Indian Economy (DBIE) portal (web-link:

https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!3). Data on deposits, disaggregated

by type and total credit are classified by states, districts, centres, population groups and

bank groups, are collected from all SCBs, including regional rural banks (RRBs) and small

finance banks (SFBs), under the basic statistical return (BSR) – 7 system.

Highlights:

• Bank credit growth (y-on-y) remained in double digits across all population groups

(rural/ semi-urban / urban / metropolitan).

• Private sector bank group recorded over 20 per cent credit growth (y-on-y) for the

fifth successive quarter; whereas it was recorded at 8.4 per cent for public sector

banks.

• Aggregate deposits growth (y-on-y) continued to accelerate; it increased for all

population groups and all bank groups (except for RRBs) in the latest quarter.

• Private sector banks continued to lead deposit mobilisation; deposit growth for

public sector banks remained low, though it has been picking up gradually.

• Metropolitan bank branches contribute more than half of aggregate deposits (51.3

per cent) and have the largest share of total bank credit (63.9 per cent).

• The share of current account and savings account (CASA) deposits of SCBs

remained stable at 41.3 per cent.

• Seven states (viz., Maharashtra, National Capital Territory of Delhi, Tamil Nadu,

Karnataka, Uttar Pradesh, Gujarat and West Bengal) accounted for about two-thirds

of deposits as well as credit.

• The banking system’s all-India credit-deposit (C-D) ratio improved to 77.6 per cent

in December 2018 (76.4 per cent a quarter ago); metropolitan branches had the

highest C-D ratio of 96.6 per cent.

Ajit Prasad

Press Release : 2018-2019/2062 Assistant Adviser

Potrebbero piacerti anche

- J6Hooo009310710000r0313131DE64F521 PDFDocumento1 paginaJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNessuna valutazione finora

- RAKUB Loan DisbursementDocumento47 pagineRAKUB Loan DisbursementSumon Rahman100% (1)

- Great Eastern Toys (A) PDFDocumento9 pagineGreat Eastern Toys (A) PDFsdNessuna valutazione finora

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexDa EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNessuna valutazione finora

- ICICI Home Loans Project ReportDocumento109 pagineICICI Home Loans Project ReportJohn Paul86% (21)

- Asia International Auctioneers, Inc. v. CIRDocumento1 paginaAsia International Auctioneers, Inc. v. CIRJulie Ann Edquila Padua100% (1)

- HDFC Bank Project ReportDocumento52 pagineHDFC Bank Project Reportkamdica43% (7)

- RBI Releases December 2018 Financial Stability ReportDocumento2 pagineRBI Releases December 2018 Financial Stability ReportThermo MadanNessuna valutazione finora

- State Budgets StudyDocumento2 pagineState Budgets Studypls2019Nessuna valutazione finora

- July 2019 Financial Stability Report - June 2019: Press ReleaseDocumento1 paginaJuly 2019 Financial Stability Report - June 2019: Press ReleaseKanakadurga BNessuna valutazione finora

- Rbi NoticeDocumento1 paginaRbi NoticeSunil Prasad100% (1)

- Pilot Survey On Indian Startup Sector - Major FindingsDocumento1 paginaPilot Survey On Indian Startup Sector - Major FindingsVasu Ram JayanthNessuna valutazione finora

- Rbi ActionDocumento1 paginaRbi Actionsritha_87Nessuna valutazione finora

- RBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian MarketsDocumento1 paginaRBI Working Paper No. 05/2019: Term Premium Spillover From The US To Indian MarketsVasu Ram JayanthNessuna valutazione finora

- REleaseW DocumentDocumento1 paginaREleaseW DocumentAnupam KumarNessuna valutazione finora

- DICGC Raises To Rs. 5.00 Lakh RCC7BDocumento1 paginaDICGC Raises To Rs. 5.00 Lakh RCC7BsroyNessuna valutazione finora

- Bit CoinDocumento1 paginaBit CoinVipul S. AgarwalNessuna valutazione finora

- RBI Releases Financial Literacy Material: Guide Diary 16 PostersDocumento1 paginaRBI Releases Financial Literacy Material: Guide Diary 16 PostersShrishailamalikarjunNessuna valutazione finora

- SGB40 Issue PriceDocumento1 paginaSGB40 Issue PriceAkashTripathiNessuna valutazione finora

- RBI Bulletin June 2021Documento2 pagineRBI Bulletin June 2021Punjab And Sind Bank Legal CellNessuna valutazione finora

- Concept Paper On Card Acceptance Infrastructure Emailed: Press ReleaseDocumento1 paginaConcept Paper On Card Acceptance Infrastructure Emailed: Press ReleasedotpolkaNessuna valutazione finora

- Planning, Strategy & Economic Intelligence Dept: Bank of IndiaDocumento3 paginePlanning, Strategy & Economic Intelligence Dept: Bank of IndiaLakshmi MuvvalaNessuna valutazione finora

- Rbi Advisory Mastercard 14july21Documento1 paginaRbi Advisory Mastercard 14july21Mahtab KhanNessuna valutazione finora

- Governor, RBI Launches ANTARDRIHSTI FINANACIAL INCLUSION DASHBOARDDocumento1 paginaGovernor, RBI Launches ANTARDRIHSTI FINANACIAL INCLUSION DASHBOARDambarishramanuj8771Nessuna valutazione finora

- PR5006Documento1 paginaPR5006TrollTrends inc.Nessuna valutazione finora

- Beepedia Weekly Current Affairs (Beepedia) 1st - 8th August 2023Documento44 pagineBeepedia Weekly Current Affairs (Beepedia) 1st - 8th August 2023Mansi SaxenaNessuna valutazione finora

- psl12 PDFDocumento2 paginepsl12 PDFsgjatharNessuna valutazione finora

- 01.03.2023 - Morning Financial News UpdatesDocumento5 pagine01.03.2023 - Morning Financial News UpdatesSunit PareekNessuna valutazione finora

- Monthly BeePedia January 2021Documento134 pagineMonthly BeePedia January 2021Anish AnishNessuna valutazione finora

- Vsit Rohit ProjectDocumento10 pagineVsit Rohit ProjectNaresh KhutikarNessuna valutazione finora

- Click Here: Department of CommunicationDocumento2 pagineClick Here: Department of CommunicationNDTVNessuna valutazione finora

- Rbi National Financial Inclusion 1Documento1 paginaRbi National Financial Inclusion 1unwantedaccountno1Nessuna valutazione finora

- RBI Monetary Policy 2019Documento14 pagineRBI Monetary Policy 2019desikanttNessuna valutazione finora

- Executive Summery SONALI 11111111Documento68 pagineExecutive Summery SONALI 11111111idealNessuna valutazione finora

- IERP1050DP0111Documento1 paginaIERP1050DP0111kkalashNessuna valutazione finora

- Banking & Economy PDF - March 2023 by AffairsCloud 1Documento168 pagineBanking & Economy PDF - March 2023 by AffairsCloud 1datwbfaqsjvmsNessuna valutazione finora

- Sbi Rural PubDocumento6 pagineSbi Rural PubAafrinNessuna valutazione finora

- PRB81Documento1 paginaPRB81ashishNessuna valutazione finora

- Daily Current Affairs (Beepedia) 2nd November 2023Documento12 pagineDaily Current Affairs (Beepedia) 2nd November 2023shivamraghav1052000Nessuna valutazione finora

- January 2016 1451979191 13Documento4 pagineJanuary 2016 1451979191 13amit yadavNessuna valutazione finora

- Residential Asset Price Monitoring SurveyDocumento5 pagineResidential Asset Price Monitoring SurveyfinaarthikaNessuna valutazione finora

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Documento17 pagineB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudNessuna valutazione finora

- Project Report (ITM) : Prof. Kalyan AgrawalDocumento11 pagineProject Report (ITM) : Prof. Kalyan AgrawalKajal singhNessuna valutazione finora

- .Non Performing Assets (NPA) of Regional Rural Banks of Maharashtra A Comparative AnalysisDocumento5 pagine.Non Performing Assets (NPA) of Regional Rural Banks of Maharashtra A Comparative AnalysisLinconJeetNessuna valutazione finora

- RBL LTD - IPODocumento7 pagineRBL LTD - IPOKalpeshNessuna valutazione finora

- RBI Releases Its IT Vision Document For 2011-17Documento2 pagineRBI Releases Its IT Vision Document For 2011-17Ashwinkumar Poojary100% (1)

- August 19, 2015: Press ReleaseDocumento1 paginaAugust 19, 2015: Press ReleaseChandreshSinghNessuna valutazione finora

- A Project Report ON National Bank For Agriculture and Rural DevelopmentDocumento30 pagineA Project Report ON National Bank For Agriculture and Rural DevelopmentraviveerakhaniNessuna valutazione finora

- RRBsDocumento19 pagineRRBsProf S P GargNessuna valutazione finora

- BANK INDUSTRY ANALYSIS (AutoRecovered)Documento9 pagineBANK INDUSTRY ANALYSIS (AutoRecovered)AntraNessuna valutazione finora

- FINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIADocumento11 pagineFINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIAAarushi PawarNessuna valutazione finora

- NABARD SMFI 2019-20 - CompressedDocumento338 pagineNABARD SMFI 2019-20 - CompressedPrajwal BNessuna valutazione finora

- Beepedia Monthly Current Affairs (Beepedia) June 2023Documento180 pagineBeepedia Monthly Current Affairs (Beepedia) June 2023Sahil KalerNessuna valutazione finora

- Comparative Study On Regional Rural BankDocumento8 pagineComparative Study On Regional Rural Bankzoyaansari11365Nessuna valutazione finora

- Expert Committee To Review The Extant Economic Capital FrameworkDocumento3 pagineExpert Committee To Review The Extant Economic Capital FrameworkashrayNessuna valutazione finora

- UntitledDocumento109 pagineUntitledRohit SharmaNessuna valutazione finora

- RbiDocumento2 pagineRbigganageNessuna valutazione finora

- Financial Performance of Commercial Banks in IndiaDocumento11 pagineFinancial Performance of Commercial Banks in IndiaPARAMASIVAN CHELLIAHNessuna valutazione finora

- Analysis of Financial Statement of Punjab National Bank and Icici Bank-RevisedDocumento56 pagineAnalysis of Financial Statement of Punjab National Bank and Icici Bank-Revisedniharika1310Nessuna valutazione finora

- Icici Rural ExpansionDocumento10 pagineIcici Rural ExpansionANiket BharadiyaNessuna valutazione finora

- Beepedia Monthly Current Affairs (Beepedia) October 2023Documento121 pagineBeepedia Monthly Current Affairs (Beepedia) October 2023Vikram SharmaNessuna valutazione finora

- Bank Industry AnalysisDocumento9 pagineBank Industry AnalysisAntraNessuna valutazione finora

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th January 2023Documento38 pagineBeepedia Weekly Current Affairs (Beepedia) 1st-8th January 2023Sovan KumarNessuna valutazione finora

- Priority Sector Lending Prescriptions by Reserve Bank of India (A Case Study of IDBI Bank LTD.)Documento7 paginePriority Sector Lending Prescriptions by Reserve Bank of India (A Case Study of IDBI Bank LTD.)SKIT Research JournalNessuna valutazione finora

- BQPrime-RBI Financial Stability Report June 2023 - Key Highlights - ICICI Securities - CompressedDocumento3 pagineBQPrime-RBI Financial Stability Report June 2023 - Key Highlights - ICICI Securities - CompressedheenaNessuna valutazione finora

- IJTRD7784 (1) Customer Perception IntroductionDocumento3 pagineIJTRD7784 (1) Customer Perception IntroductionVivek ThakurNessuna valutazione finora

- Chapter 2Documento36 pagineChapter 2Vivek ThakurNessuna valutazione finora

- IJTRD7784Documento3 pagineIJTRD7784Vivek ThakurNessuna valutazione finora

- Document (14) HDocumento26 pagineDocument (14) HVivek ThakurNessuna valutazione finora

- 13 Chapter2Documento31 pagine13 Chapter2Vivek ThakurNessuna valutazione finora

- "Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationDocumento145 pagine"Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationVivek ThakurNessuna valutazione finora

- ObjectivesDocumento1 paginaObjectivesVivek ThakurNessuna valutazione finora

- Typing Instructions PPSC SR Asst Posts PDFDocumento4 pagineTyping Instructions PPSC SR Asst Posts PDFVivek ThakurNessuna valutazione finora

- Typing Instructions PPSC SR Asst Posts PDFDocumento4 pagineTyping Instructions PPSC SR Asst Posts PDFVivek ThakurNessuna valutazione finora

- 11Documento40 pagine11Vivek ThakurNessuna valutazione finora

- Foreign Exchange ExposureDocumento15 pagineForeign Exchange ExposurePrateek HerpersadNessuna valutazione finora

- Foreign Exchange ExposureDocumento15 pagineForeign Exchange ExposurePrateek HerpersadNessuna valutazione finora

- Final Accounts Assistant Adv-EnglishDocumento8 pagineFinal Accounts Assistant Adv-EnglishSATYAM KUMARNessuna valutazione finora

- Nalabothula Pavani BZYPN6603G: Data Marshall Private LimitedDocumento1 paginaNalabothula Pavani BZYPN6603G: Data Marshall Private LimitedRamana ReddyNessuna valutazione finora

- State Bank of India January 2008 Question Paper (Fully Solved)Documento1 paginaState Bank of India January 2008 Question Paper (Fully Solved)Senthil KumarNessuna valutazione finora

- JLL Research 1q21 Metro Manila Pmo enDocumento34 pagineJLL Research 1q21 Metro Manila Pmo enMcke YapNessuna valutazione finora

- Introduction To Macroeconomics: Mcgraw-Hill/IrwinDocumento17 pagineIntroduction To Macroeconomics: Mcgraw-Hill/IrwinAli HamzaNessuna valutazione finora

- Instruction Sheet - GIC-19100468Documento5 pagineInstruction Sheet - GIC-19100468Ashraf ShaikhNessuna valutazione finora

- Data Coffee Consumption in IndiaDocumento1 paginaData Coffee Consumption in IndiaAshok NagarajanNessuna valutazione finora

- Paper - Iv - Economy and Development of India and Andhra PradeshDocumento3 paginePaper - Iv - Economy and Development of India and Andhra PradeshlavanNessuna valutazione finora

- Export-Import Logistics Process in Korea 1st PDFDocumento17 pagineExport-Import Logistics Process in Korea 1st PDFNurul May ApriyaniNessuna valutazione finora

- The Political Economy of International TradeDocumento16 pagineThe Political Economy of International TradeWilsonNessuna valutazione finora

- Economic Development in SingaporeDocumento8 pagineEconomic Development in SingaporeAvengers ShakiburNessuna valutazione finora

- 110219ForwardRates PDFDocumento2 pagine110219ForwardRates PDFTiso Blackstar GroupNessuna valutazione finora

- Xii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021Documento3 pagineXii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021mekavinashNessuna valutazione finora

- Sro 967 (I) 2022Documento3 pagineSro 967 (I) 2022Hassan MujtabaNessuna valutazione finora

- Cross Rates - November 1 2019Documento1 paginaCross Rates - November 1 2019Anonymous jP4lPgNessuna valutazione finora

- Solved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonDocumento1 paginaSolved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonAnbu jaromiaNessuna valutazione finora

- Impact of War On Indian Economy AssignmentDocumento2 pagineImpact of War On Indian Economy AssignmentGITANJALI PANDEYNessuna valutazione finora

- Chapter Overview: Importance of International EconomicsDocumento19 pagineChapter Overview: Importance of International Economicsliz charNessuna valutazione finora

- T1-Global MarketDocumento27 pagineT1-Global Marketcristell rodriguezNessuna valutazione finora

- What Does The G20 DoDocumento9 pagineWhat Does The G20 DoParvez ShakilNessuna valutazione finora

- Examples of Expansionary Fiscal Policy PDFDocumento2 pagineExamples of Expansionary Fiscal Policy PDFraj chauhanNessuna valutazione finora

- China's Exhibition Industry: Conference & Exhibition Management Services Pte LTD SingaporeDocumento22 pagineChina's Exhibition Industry: Conference & Exhibition Management Services Pte LTD SingaporeChristine YaoNessuna valutazione finora

- Samir BanerjeeDocumento2 pagineSamir BanerjeeshishusoniNessuna valutazione finora

- PLAN Evaluate Four Ways in Which Economic Growth and Development Might Be Promoted in Developing CountriesDocumento2 paginePLAN Evaluate Four Ways in Which Economic Growth and Development Might Be Promoted in Developing Countriesandreas panayiotouNessuna valutazione finora

- Impact of Technology On Indian EconomyDocumento6 pagineImpact of Technology On Indian Economyp_saini0% (1)

- Chapter - 4 Industrial Development: Merits of PrivatizationDocumento2 pagineChapter - 4 Industrial Development: Merits of PrivatizationGhalib HussainNessuna valutazione finora

- Case Study - GCC Economic Outlook PDFDocumento18 pagineCase Study - GCC Economic Outlook PDFMhmd KaramNessuna valutazione finora

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento25 pagineDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVicky GunaNessuna valutazione finora