Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Debt Collector Script

Caricato da

Elcana Mathieu0%(1)Il 0% ha trovato utile questo documento (1 voto)

1K visualizzazioni4 pagineDebt Collector Script

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoDebt Collector Script

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0%(1)Il 0% ha trovato utile questo documento (1 voto)

1K visualizzazioni4 pagineDebt Collector Script

Caricato da

Elcana MathieuDebt Collector Script

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

Debt Collection Script #1 - You DO NOT believe the debt is valid

Collector: "Hello, is Bill Debtor there?" (Or is this Bill's wife)?

You: "Who is calling please?" (Do not let the use of your first name throw you off guard,

always confirm who you are speaking with. Under the FDCPA, collectors must identify

themselves and their company)

Collector: "This is Mr. Collector from ABC collections, the agency representing XYZ

Creditor on your outstanding balance of $3,700. I need to know if you are able to take

care of this past due bill at this time.

" You: "Hold on while I turn on my tape recorder." (After turning on recorder ask the

caller to repeat his or her name, company and reason for calling.) Then say, "I do not

believe I owe this debt. Send me the information on this debt according to the Fair Debt

Collection Practices Act so that I may review it."

Expect the collector to use questions or statements in an attempt to get you to admit the

debt is yours. Do not answer these questions, stick to the answer outlined above and

insist on the collector following the FDCPA by sending you the proper information - stay

focused

Their script tells them to ignore your response and press on with asking you a bunch of

questions. By refusing to take the "bait" you frustrate their efforts because your answer

is not on their script. At this point, many collectors are unsure of what to say or do next

so they resort to anger, derogatory phrases, threats, and so forth. Remain calm and be

sure your tape recorder is on!

NOTE: Once you've verbally disputed a debt, there is only one legitimate question that

you need to answer:

Collector: "Please verify your address?"

You: Go ahead and provide your correct address.

DO NOT answer any additional questions! If the collector insists on asking questions,

terminate the call. Expect the collector to call right back. Turn on your recorder and

answer the phone. Don't say anything except, "I am recording this call and, since I

disputed this debt during your last call, this call from you violates the FDCPA and forces

me to report your violation to my State Attorney General. Then, terminate the call again

Top Debt Collection Script #2 - The debt might be valid, but you're unsure and

need evidence to be sure.

Collector: "Hello, is Bill Debtor there?" (Or is this Bill's wife)?

You: "Who is calling please?" (Do not let the use of your first name throw you off guard,

always confirm who you are speaking with. Under the FDCPA, collectors must identify

themselves and their company)

Collector: "This is Mr. Collector from ABC collections, the collection agency representing

EZ Car Credit on your outstanding balance of $1,400. I need to know if you are able to

take care of this past due bill at this time."

You: "Hold on while I turn on my tape recorder."

Take your time and THINK before saying anything. Is it possible the debt has expired?

See statute of limitations (SoL) If the SoL has expired (or you're not sure) revert to script

#1. Does the debt belong to someone else (ex-spouse, family member, etc.) If so, use

script #1.

If the SoL has not expired, then ask,

You: "Are you collecting on behalf of a creditor, your employer or yourself?" Until the

collector answers this question DO NOT answer any other questions.

IMPORTANT: If the debt is new, the collector is probably working for the creditor. If the

debt is more more than six months old, it's a good bet the debt was sold and this

collector (or his company) purchased it.

If the collector owns the debt and you do NOT wish to pay the debt state: (be sure your

tape recorder is on beforehand).

You: "It is my policy to never deal with debt collectors who are not representing the

creditor. Give me your address so that I may send you a cease and desist letter in

accordance with the FDCPA."

Be prepared for any and all of the questions below and consider each question carefully

before answering. Remember; you do NOT have to answer any questions. However, if

you choose to answer questions, see the "questions you can answer" section below for

which questions you should answer and which ones you should consider carefully

heavily BEFORE giving a stranger your information.

If the collector owns the debt and you still wish to pay it, then you must decide on how

much to pay. Just remember Junk Debt Buyers purchase old debts for pennies on the

dollar.

Questions you can answer:

Do I have your address right at (street), (city) and (state) and (zip code)?

Is this (or what is) your daytime phone ___________?

Note: After answering this question, inform the caller that any future calls between

(hours) and on (days) are inconvenient.

Where do you work?

What is the address and phone number of your employer.

Note: Collectors are allowed to call and verify employment BUT that is all! They are not

allowed to discuss your information, nor are they entitled to any information about your

income or any other personal information.

Questions you do NOT have to answer:

Are you paid weekly or biweekly?

How much is your take-home pay?

Is your spouse working?

If so where, how paid, amount, etc.)

Do you have other sources of income: (child support, part-time work, in home

day care and so forth)?

Do you rent or own?

How much per month? Is it current?

How much is your car payment? Is it current?

What are the make, model, and year of your car(s)?

Where do you bank? (checking and savings, name of bank)

Do you have any bank loans? How much do you owe? Are they current?

Have you ever borrowed money from (parents, relatives, and friends) in the past?

If so, how long ago? How much? Did you pay it back?

If you answered any of the above questions then expect the collector to put you on hold

while he figures out the best suggestion (for him) for paying off the debt. Typically they

will come back with, "If I could show you a way to pay this debt off, would you be willing

to work with me?

Unless they suggest a payment plan that you can afford DO NOT agree to anything!

They'll suggest borrowing from others, refinancing your home or car loan, or putting the

debt on another credit card. Using these options means robbing Peter to pay Paul and,

more than likely, will just push you deeper in debt.

Consider your answer carefully!! Counter offer with a payment agreement of your own

(only suggest what you can truly afford) and ask about credit reporting information. You

want to keep it off your credit reports so make this part of your payment agreement.

Collectors are generally trained to dun (collect or ask for payment) in the following

priority...

Balance in full;

Settlement (in no more than two payments);

Payments over 3 or more months, usually not to exceed 6 months;

Good faith payment while you ask others for a loan (parents, friends, bank etc.)

...and since they want the full amount as quick as possible, they will refuse just about

anything you offer and try to force you to agree to their terms.

Unless you're extremely good at negotiating, never negotiate terms on the phone, you'll

lose every time. Offer your terms once (maybe twice) and if they refuse to work with

you, end the conversation!

WARNING! Be absolutely certain the of the statute of limitation (SoL) has not expired

before agreeing to anything, but especially before making a token payment! In many

states, a token payment or an agreement (verbal or written) to pay resets the SoL clock!

Collection agencies, bill collectors and junk debt buyers are generally trained to get

payments in the following priority:

1. Auto Pay: involves withdrawals from your bank accounts via post-dated checks,

automatic electronic withdrawals or similar methods.

2. Priority Mail

3. Certified Mail

NOTE: Although collectors will insist on you paying by their preferred method, there is

no law compelling you to pay by any of these methods! Pay by any method that does

not provide information about your bank account to the collector. The best method is to

pay by bank draft and send it via official mail.

WARNING! Never pay by post-dated check or an automatic withdrawal process. I've

seen it happen too many times where the check is cashed early or more funds are

withdrawn than authorized! This causes even more problems with returned checks and

overdrawn charges!

Once they have a payment agreement, collectors usually end the call by saying:

"Please repeat the arrangement to be sure I've documented it correctly."

"What guarantee can you give me that you'll send the payment?"

"For what reason would you not send the payment?"

Hopefully you have been taking good notes or, even better, tape recording the call

(inform the caller at the beginning of the call that you are taping the call) so you can also

keep accurate records of what actions were agreed upon.

WARNING! Do NOT send any money until you have a signed payment agreement letter

in your possession!

Potrebbero piacerti anche

- Student Loan BankFraudDocumento34 pagineStudent Loan BankFraudSalaam Bey®100% (18)

- Tough Debt Validation Letter 1Documento2 pagineTough Debt Validation Letter 1Elcana Mathieu90% (10)

- Tough Debt Validation Letter 1Documento2 pagineTough Debt Validation Letter 1Elcana Mathieu90% (10)

- REASONS TO DISPUTE INACCURATE CREDIT REPORT INFORMATIONDocumento2 pagineREASONS TO DISPUTE INACCURATE CREDIT REPORT INFORMATIONMaurice Austin, Jr.100% (2)

- Clear Your Credit Card DebtDocumento48 pagineClear Your Credit Card DebtYash ANessuna valutazione finora

- Loan Schemes and Car Recovery Procedure of HDFC Bank - 2011Documento98 pagineLoan Schemes and Car Recovery Procedure of HDFC Bank - 2011rohitkh28100% (2)

- Complaint For Monetary Damages and Other Relief National Consumer Law Center PL94Ch07Documento77 pagineComplaint For Monetary Damages and Other Relief National Consumer Law Center PL94Ch07Charlton ButlerNessuna valutazione finora

- About Charge-Offs: Collection Agent Has The Right To Collect The Entire BalanceDocumento4 pagineAbout Charge-Offs: Collection Agent Has The Right To Collect The Entire BalanceBhakta Prakash75% (4)

- Collections 101Documento0 pagineCollections 101pacopepe7750% (2)

- Safe GoodwillLetters123Documento4 pagineSafe GoodwillLetters123gabby macaNessuna valutazione finora

- Making Cents of Business EbookDocumento31 pagineMaking Cents of Business EbookJawan StarlingNessuna valutazione finora

- Credit Card Late Payment Removal LetterDocumento1 paginaCredit Card Late Payment Removal LetterElcana Mathieu75% (4)

- Arbitration Assn Application SATCOMM911Documento8 pagineArbitration Assn Application SATCOMM911CK in DC0% (1)

- Debt validation request and collector disclosure formDocumento6 pagineDebt validation request and collector disclosure formMichael Plaster100% (4)

- Request For Credit File From InnovisDocumento2 pagineRequest For Credit File From InnovisYaw Mensah Amun Ra100% (4)

- Dispute Letter With Electronic FormDocumento2 pagineDispute Letter With Electronic FormWilliam ScheilNessuna valutazione finora

- Credit RestorationDocumento4 pagineCredit RestorationFreedomofMindNessuna valutazione finora

- 87 Things You Need To Know Before You File Before You FileDocumento45 pagine87 Things You Need To Know Before You File Before You FilenguyenthaimyanNessuna valutazione finora

- Guide to Repairing Credit Scores and Re-Establishing CreditDocumento44 pagineGuide to Repairing Credit Scores and Re-Establishing CreditScrid4me2Nessuna valutazione finora

- Goodwill Repair Status LetterDocumento1 paginaGoodwill Repair Status LetterElcana MathieuNessuna valutazione finora

- Goodwill Repair Status LetterDocumento1 paginaGoodwill Repair Status LetterElcana MathieuNessuna valutazione finora

- Debt Validation: The ultimate weapon against aggressive collection callsDocumento6 pagineDebt Validation: The ultimate weapon against aggressive collection callsNate NartestNessuna valutazione finora

- Chexsystems Prove It 2Documento2 pagineChexsystems Prove It 2Elcana MathieuNessuna valutazione finora

- (Company Name) Is Willing To Work With Me On Erasing This Mark From My Credit Reports. I HaveDocumento2 pagine(Company Name) Is Willing To Work With Me On Erasing This Mark From My Credit Reports. I Havegabby macaNessuna valutazione finora

- Fair Debt Collection Practice ActDocumento56 pagineFair Debt Collection Practice ActJessica Ortiz100% (3)

- Credit Repair Made Easy Through Expert AdviceDocumento3 pagineCredit Repair Made Easy Through Expert AdviceCredit Repair Made Easy Through Expert AdviceNessuna valutazione finora

- Pay For Delete LetterDocumento1 paginaPay For Delete LetterElcana MathieuNessuna valutazione finora

- Optional Credit RemovalDocumento3 pagineOptional Credit RemovalKNOWLEDGE SOURCENessuna valutazione finora

- Bank, Credit or Thrift? Which One Is Right For MeDocumento7 pagineBank, Credit or Thrift? Which One Is Right For MeAnna TrimbleNessuna valutazione finora

- Sample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedDocumento12 pagineSample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedKNOWLEDGE SOURCE100% (1)

- Excellent Document - Notice of Fraud To Collection Agency IIDocumento2 pagineExcellent Document - Notice of Fraud To Collection Agency IICK in DCNessuna valutazione finora

- Receipt and Remittance of TreasureDocumento11 pagineReceipt and Remittance of Treasuremevrick_guyNessuna valutazione finora

- Islami Bank Bangladesh LTD: Jhikorgacha Br.,JessoreDocumento1 paginaIslami Bank Bangladesh LTD: Jhikorgacha Br.,JessoreMd.saydur RahmanNessuna valutazione finora

- Follow Up Letter Debt CollectionDocumento1 paginaFollow Up Letter Debt CollectionkokoripolloNessuna valutazione finora

- Remove Inquires Now LetterDocumento2 pagineRemove Inquires Now LetterElcana Mathieu50% (2)

- Remove Inquires Now LetterDocumento2 pagineRemove Inquires Now LetterElcana Mathieu50% (2)

- Credit Cleanup Instructions: 4 Easy StepsDocumento1 paginaCredit Cleanup Instructions: 4 Easy StepsMichael KovachNessuna valutazione finora

- Receipt 1Documento4 pagineReceipt 1Tiago SheikNessuna valutazione finora

- Sample of Complaint About A Billing ErrorDocumento1 paginaSample of Complaint About A Billing ErrorRebecca GutierrezNessuna valutazione finora

- How To Defend A Credit Card CaseDocumento18 pagineHow To Defend A Credit Card CaseMartialArtist24100% (2)

- Certified MailDocumento2 pagineCertified MailKNOWLEDGE SOURCENessuna valutazione finora

- 40168collections Lawyer: The Good, The Bad, and The UglyDocumento3 pagine40168collections Lawyer: The Good, The Bad, and The UglyheldazddsnNessuna valutazione finora

- Discover Bank v. ShimerDocumento4 pagineDiscover Bank v. ShimerKenneth SandersNessuna valutazione finora

- Validation of Debt Disbute LetterDocumento2 pagineValidation of Debt Disbute LetterElcana MathieuNessuna valutazione finora

- Sample Debt Validation Letter For Debt CollectorsDocumento7 pagineSample Debt Validation Letter For Debt Collectorsgabby macaNessuna valutazione finora

- 609 System OverviewDocumento12 pagine609 System OverviewFreedomofMind100% (1)

- Closed Account Please Remove LetterDocumento1 paginaClosed Account Please Remove LetterElcana MathieuNessuna valutazione finora

- Closed Account Please Remove LetterDocumento1 paginaClosed Account Please Remove LetterElcana MathieuNessuna valutazione finora

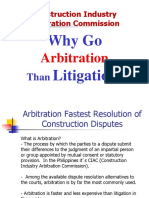

- Arbitration ProcessDocumento47 pagineArbitration ProcessLemuel Kim TabinasNessuna valutazione finora

- FCRA Notice To FurnishersDocumento3 pagineFCRA Notice To Furnishersfox_pae_pevmou100% (1)

- Quiz 3 Cash Bank Recon Past Exam CompressDocumento8 pagineQuiz 3 Cash Bank Recon Past Exam CompressAubrey Shaiyne OfianaNessuna valutazione finora

- Please Remove Credit InquiriesDocumento1 paginaPlease Remove Credit InquiriesElcana MathieuNessuna valutazione finora

- Please Remove Credit InquiriesDocumento1 paginaPlease Remove Credit InquiriesElcana MathieuNessuna valutazione finora

- Personal - ChexSystems Security Freeze Fee Information TableDocumento4 paginePersonal - ChexSystems Security Freeze Fee Information TableEmpresarioNessuna valutazione finora

- Debt RecoveryDocumento5 pagineDebt RecoveryTanushree100% (1)

- Validation of Debt Disbute LetterDocumento2 pagineValidation of Debt Disbute Lettercolemanbe07Nessuna valutazione finora

- 1 - Debt Collector LetterDocumento1 pagina1 - Debt Collector LetterDebbieCook59Nessuna valutazione finora

- The Fair Debt Collection Practices ActDocumento7 pagineThe Fair Debt Collection Practices ActJohnson DamitaNessuna valutazione finora

- Sample Letter 12 Notification of LawsuitDocumento2 pagineSample Letter 12 Notification of LawsuitJulian GarciaNessuna valutazione finora

- Negotiable Instrument Act, 1881Documento24 pagineNegotiable Instrument Act, 1881siddharth devnaniNessuna valutazione finora

- Chexsystems Prove It 2 (Gentle)Documento1 paginaChexsystems Prove It 2 (Gentle)Elcana MathieuNessuna valutazione finora

- Sample Letter - Reminder To RespondDocumento2 pagineSample Letter - Reminder To RespondJ Stocker0% (1)

- Business Tax Credit For Research And Development A Complete Guide - 2020 EditionDa EverandBusiness Tax Credit For Research And Development A Complete Guide - 2020 EditionNessuna valutazione finora

- Welcome LetterDocumento1 paginaWelcome LetterRajesh ExperisNessuna valutazione finora

- Credit Management CounselingDocumento47 pagineCredit Management CounselingKaren LaccayNessuna valutazione finora

- I Was Not 30,60,90,120 Days LateDocumento1 paginaI Was Not 30,60,90,120 Days LateElcana MathieuNessuna valutazione finora

- I Was Not 30,60,90,120 Days LateDocumento1 paginaI Was Not 30,60,90,120 Days LateElcana MathieuNessuna valutazione finora

- Letter To Collection Agency On Medical Account Reporting As Paid Dispute Letter For BothDocumento4 pagineLetter To Collection Agency On Medical Account Reporting As Paid Dispute Letter For BothKNOWLEDGE SOURCENessuna valutazione finora

- Bankruptcy Act of 1984 Under Chapter 67 of The Brunei Darussalam Laws.Documento11 pagineBankruptcy Act of 1984 Under Chapter 67 of The Brunei Darussalam Laws.Madison SheenaNessuna valutazione finora

- Donna Soutter v. Equifax Information Services, 4th Cir. (2012)Documento19 pagineDonna Soutter v. Equifax Information Services, 4th Cir. (2012)Scribd Government DocsNessuna valutazione finora

- Verified.": Name of Account Account Number Provide Physical VerificationDocumento2 pagineVerified.": Name of Account Account Number Provide Physical VerificationElcana MathieuNessuna valutazione finora

- Debt Validation LetterDocumento1 paginaDebt Validation LetterRichardNessuna valutazione finora

- PDFDocumento2 paginePDFDonna SmithNessuna valutazione finora

- Opt Out InstructionsDocumento1 paginaOpt Out InstructionsKNOWLEDGE SOURCENessuna valutazione finora

- Fraud: The Following Concepts Will Be Developed in This ChapterDocumento24 pagineFraud: The Following Concepts Will Be Developed in This ChapterAnonymous SmPtG2AHNessuna valutazione finora

- Chexsystems Disbute LetterDocumento1 paginaChexsystems Disbute LetterElcana MathieuNessuna valutazione finora

- Debt Collector Dispute Letter 1Documento1 paginaDebt Collector Dispute Letter 1Elcana MathieuNessuna valutazione finora

- Request For Chexsystem LetterDocumento1 paginaRequest For Chexsystem LetterElcana MathieuNessuna valutazione finora

- Soft Debt Collector Verification LetterDocumento1 paginaSoft Debt Collector Verification LetterElcana MathieuNessuna valutazione finora

- Soft First Dispute LetterDocumento1 paginaSoft First Dispute LetterElcana MathieuNessuna valutazione finora

- Soft First Dispute LetterDocumento1 paginaSoft First Dispute LetterElcana MathieuNessuna valutazione finora

- Soft Debt Collector Verification LetterDocumento1 paginaSoft Debt Collector Verification LetterElcana MathieuNessuna valutazione finora

- Credit Letter Opt Out LetterDocumento1 paginaCredit Letter Opt Out LetterElcana MathieuNessuna valutazione finora

- Verified.": Name of Account Account Number Provide Physical VerificationDocumento2 pagineVerified.": Name of Account Account Number Provide Physical VerificationElcana MathieuNessuna valutazione finora

- Request For Chexsystem LetterDocumento1 paginaRequest For Chexsystem LetterElcana MathieuNessuna valutazione finora

- Credit Card Intrest Rate Rejection LetterDocumento1 paginaCredit Card Intrest Rate Rejection LetterElcana MathieuNessuna valutazione finora

- Debt Collector Dispute Letter 1Documento1 paginaDebt Collector Dispute Letter 1Elcana MathieuNessuna valutazione finora

- Debt Collector Dispute Letter 1Documento1 paginaDebt Collector Dispute Letter 1Elcana MathieuNessuna valutazione finora

- Sources and Uses of Short-Term and Long - Term FundsDocumento20 pagineSources and Uses of Short-Term and Long - Term FundsMichelle RotairoNessuna valutazione finora

- Statement 1672413844644Documento11 pagineStatement 1672413844644Rachna GuptaNessuna valutazione finora

- Final Project of Allahabad BankDocumento22 pagineFinal Project of Allahabad BankNipul Bafna33% (3)

- Case Study of Canara BankDocumento44 pagineCase Study of Canara BankAasrith KandulaNessuna valutazione finora

- Simple InterestDocumento7 pagineSimple Interestsimbu619Nessuna valutazione finora

- BKG Reg ActDocumento27 pagineBKG Reg ActKaran GulatiNessuna valutazione finora

- BUSINESS FINANCE Module 2Documento4 pagineBUSINESS FINANCE Module 2Jes M. MoñezaNessuna valutazione finora

- Robert's Business Transactions in January 2011Documento2 pagineRobert's Business Transactions in January 2011Karl William Sorima0% (1)

- Swot Analysis of MCBDocumento5 pagineSwot Analysis of MCBzaighum sultanNessuna valutazione finora

- Comparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsDocumento2 pagineComparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsMazbahul IslamNessuna valutazione finora

- Easy WebDocumento1 paginaEasy WebMary MacLellanNessuna valutazione finora

- Credit Monitoring Policy For 2020 ExamDocumento8 pagineCredit Monitoring Policy For 2020 ExamSrikanth TanguturuNessuna valutazione finora

- Assessment of Credit Reference Bureaus On The Management of Nonperforming Loans in The Banking Industry in KenyaDocumento8 pagineAssessment of Credit Reference Bureaus On The Management of Nonperforming Loans in The Banking Industry in KenyaAlexander DeckerNessuna valutazione finora

- MSME Loan Application Form: A. Business InformationDocumento5 pagineMSME Loan Application Form: A. Business InformationManjiri JoshiNessuna valutazione finora

- 2018 Us Consumer Payment Study PDFDocumento52 pagine2018 Us Consumer Payment Study PDFAshishBohraNessuna valutazione finora

- Business 4079: Assignment 2 Suggested AnswersDocumento8 pagineBusiness 4079: Assignment 2 Suggested AnswersyodhisaputraNessuna valutazione finora

- A Study of BANKING SECTOR A FINANCIAL TOOL FOR TODAY'SDocumento80 pagineA Study of BANKING SECTOR A FINANCIAL TOOL FOR TODAY'STasmay EnterprisesNessuna valutazione finora

- TILA Presentation Slides From The Mortgage Bankers AssociationDocumento31 pagineTILA Presentation Slides From The Mortgage Bankers Association83jjmackNessuna valutazione finora

- Banking Law PPT 1Documento84 pagineBanking Law PPT 1Manoj KumarNessuna valutazione finora

- Facturas Invicta StoreDocumento4 pagineFacturas Invicta StoreLesly BehaineNessuna valutazione finora

- UPI Error and Response Codes 2 9Documento73 pagineUPI Error and Response Codes 2 9shailshasabeNessuna valutazione finora

- Prof. Bhambwani'S Reliable Classes Syjc (Recording) Word File (Chapter Wise) Bills of ExchangeDocumento2 pagineProf. Bhambwani'S Reliable Classes Syjc (Recording) Word File (Chapter Wise) Bills of ExchangekmrfromNessuna valutazione finora

- POPULARITY OF CREDIT CARDS ISSUED BY DIFFERENT BANKSDocumento25 paginePOPULARITY OF CREDIT CARDS ISSUED BY DIFFERENT BANKSNaveed Karim Baksh75% (8)

- Practice Multiple Choice Test 5: I.J K IDocumento8 paginePractice Multiple Choice Test 5: I.J K Iapi-3834751Nessuna valutazione finora

- Crowdfunding PolicyDocumento7 pagineCrowdfunding PolicyFuaad DodooNessuna valutazione finora

- SHR STPDocumento86 pagineSHR STPshraddha chauhanNessuna valutazione finora