Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BIR Abatement Form

Caricato da

Jecky Delos ReyesCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BIR Abatement Form

Caricato da

Jecky Delos ReyesCopyright:

Formati disponibili

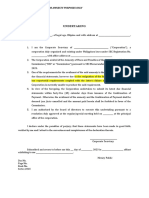

“ANNEX A”

Republika ng Pilipinas Application for Abatement or Cancellation BIR Form No.

Kagawaran ng Pananalapi

of Tax, Penalties and/or Interest

Kawanihan ng Rentas Internas

Under Rev. Reg. No. __________ 2110

September 2001

________________________

(Date)

The Commissioner of Internal Revenue

BIR National Office Building

Diliman, Quezon City

Sir:

I/We hereby apply for the abatement/cancellation of my/our _________________________________________tax liability

(kind of tax/interest/surcharge/compromise penalties)

amounting to P________________________, for the taxable year ________________ arising from

Reasons: (Please check appropriate box)

¨ Filing of the return/payment of the tax is made at the wrong venue

¨ Mistake in payment of tax due to erroneous written official advice of a revenue officer

¨ Failure to file the return and pay the tax on time due to substantial losses from prolonged labor dispute, force

majeure, and legitimate business reverses

¨ Non-compliance due to difficult interpretation of the law

¨ Failure to file the return and pay the correct tax on time due to circumstances beyond taxpayer’s control

¨ Late payment of tax under meritorious circumstances

¨ Penalties imposed on assessment confirmed by lower court but appealed by the taxpayer to a higher court

¨ Penalties imposed on withholding tax assessment under meritorious circumstances

¨ Penalties imposed on delayed installment payment under meritorious circumstances

¨ Penalties imposed on assessment reduced after reinvestigation but taxpayer is still contesting reduced assessment

¨ Others (please specify) _______________________________________________

_______________________________________________

I offer to pay the amount of P____________________ as basic ____________________ tax due and P______________,

(kind of tax)

as interest, for the taxable year ______________.

I/We declare under the penalties of perjury, that this statement has been made in good faith, verified by me/us and to the

best of my/our knowledge and belief is a true, correct and complete declaration.

SIGNATURE OVER PRINTED NAME OF TIN TAX AGENT

TP/ TP AUTHORIZED REPRESENTATIVE

ADDRESS TAX AGENT ACCREDITATION NO.

To be filled-up by BIR

Received by: _______________________ Date Received: _____________________

Processed by: ______________________ RDO No.: _________________________

Reviewed by: ______________________ RR No. : __________________________

National Office

Head, Technical Working Committee: ________________________

DCIR – Operations Group : ________________________

DCIR - Legal & Inspection Group : ________________________

APPROVED/DISAPPROVED:

¨ Approved the amount of P__________________ representing abatement/cancellation of

¨ Basic Tax

¨ Surcharge

¨ Interest

¨ Compromise Penalty

¨ Disapproved

Reason for disapproval: ____________________________________________________________________

________________________________

Commissioner of Internal Revenue

Date:

Potrebbero piacerti anche

- War crimes and crimes against humanity in the Rome Statute of the International Criminal CourtDa EverandWar crimes and crimes against humanity in the Rome Statute of the International Criminal CourtNessuna valutazione finora

- SECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignDocumento13 pagineSECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignCarloAysonNessuna valutazione finora

- TH ST RDDocumento2 pagineTH ST RDVivo MayvelNessuna valutazione finora

- Penalties - Expired AtpDocumento1 paginaPenalties - Expired AtpCherry ChaoNessuna valutazione finora

- BOI Citizen's CharterDocumento32 pagineBOI Citizen's CharterPam MarceloNessuna valutazione finora

- Extrajudicial SettlementDocumento1 paginaExtrajudicial SettlementArnel Gaballo AwingNessuna valutazione finora

- Notice of Cancellation MOADocumento1 paginaNotice of Cancellation MOAJose Vicente Nuguid ErictaNessuna valutazione finora

- 4.5M Tagaytay Property Contract To SellDocumento3 pagine4.5M Tagaytay Property Contract To SellChristoffer Allan LiquiganNessuna valutazione finora

- Auditor Affidavit - EDITEDDocumento4 pagineAuditor Affidavit - EDITEDdaryl canozaNessuna valutazione finora

- Bir Ruling No. Dac168 519-08Documento12 pagineBir Ruling No. Dac168 519-08Jasreel DomasingNessuna valutazione finora

- SEC Opinion 11-44 PDFDocumento11 pagineSEC Opinion 11-44 PDFJf ManejaNessuna valutazione finora

- Hsac Case Form No. 3 AnswerDocumento4 pagineHsac Case Form No. 3 AnswerPaolo Lucion100% (1)

- PD 1529 - Register of Deeds CasesDocumento86 paginePD 1529 - Register of Deeds CasesGracey Sagario Dela TorreNessuna valutazione finora

- Reg. of Accounting FirmsDocumento2 pagineReg. of Accounting FirmsDaniel GalzoteNessuna valutazione finora

- Contract of LeaseDocumento3 pagineContract of LeaseJenn TorrenteNessuna valutazione finora

- Bi MR Letter - Liu ShuaiDocumento1 paginaBi MR Letter - Liu ShuaiLORENZONessuna valutazione finora

- Supplement To The POGO Rules and RegulationsDocumento1 paginaSupplement To The POGO Rules and RegulationsnuttystaxNessuna valutazione finora

- SMDC With Logo Reservation Agreement MaleDocumento5 pagineSMDC With Logo Reservation Agreement Maleapi-244931185Nessuna valutazione finora

- Is Foreign Equity Possible in The Philippine Book Publishing Industry?Documento12 pagineIs Foreign Equity Possible in The Philippine Book Publishing Industry?Ed Sabalvoro MPANessuna valutazione finora

- Waiver of Banks LiabilityDocumento1 paginaWaiver of Banks LiabilityMaureen Encarnacion MalazarteNessuna valutazione finora

- Affidavit of CommitmentDocumento1 paginaAffidavit of Commitmentf card100% (1)

- Demand Letter SampleDocumento3 pagineDemand Letter Sampleken adamsNessuna valutazione finora

- Acknowledgement Receipt: Rendered, Rental Payments, Partial Payments or For Any Other Payment That Needs AcknowledgementDocumento1 paginaAcknowledgement Receipt: Rendered, Rental Payments, Partial Payments or For Any Other Payment That Needs AcknowledgementMarx AndreiOscar Villanueva YaunNessuna valutazione finora

- Secretary's Certificate - Full Client ControlDocumento4 pagineSecretary's Certificate - Full Client ControlseanNessuna valutazione finora

- Mortgage Contract: JOSEPH DUMULONG, Filipino, of Legal Age, Residing at 16 Property ST., GSIS VillageDocumento2 pagineMortgage Contract: JOSEPH DUMULONG, Filipino, of Legal Age, Residing at 16 Property ST., GSIS VillageRalph Carlo SumaculubNessuna valutazione finora

- FSED 001 - Application Form FSECDocumento1 paginaFSED 001 - Application Form FSECKristine BarrettoNessuna valutazione finora

- Omnibus Motion For Vcon and ResettingDocumento4 pagineOmnibus Motion For Vcon and ResettingPaul AndreNessuna valutazione finora

- SICI Cosigner's StatementDocumento2 pagineSICI Cosigner's StatementFei XiaoNessuna valutazione finora

- CBF 22.4A - Party's Terms of ReferenceDocumento6 pagineCBF 22.4A - Party's Terms of ReferenceGeneve MasahudNessuna valutazione finora

- Authority To AppearDocumento1 paginaAuthority To AppearChassey Jaine EspinaNessuna valutazione finora

- Video ConferenceDocumento2 pagineVideo ConferenceAtty. Glace OngcoyNessuna valutazione finora

- Conditional Deed of Sale of Motor VehicleDocumento2 pagineConditional Deed of Sale of Motor VehicleMyco MemoNessuna valutazione finora

- Draft Service AgreementDocumento2 pagineDraft Service AgreementIzo SeremNessuna valutazione finora

- New SMDC Reservation Form English 0123 2019 V14.principalDocumento2 pagineNew SMDC Reservation Form English 0123 2019 V14.principalKim Dacanay50% (4)

- Motion For New Trial 2Documento2 pagineMotion For New Trial 2dhunojoanNessuna valutazione finora

- Pre Termination LetterDocumento1 paginaPre Termination LetterManlapaz Law OfficeNessuna valutazione finora

- Escrow AgreementDocumento2 pagineEscrow Agreementlexman88Nessuna valutazione finora

- Motion To Release - Motor Vehicle-MagsinoDocumento2 pagineMotion To Release - Motor Vehicle-MagsinoMervin C. Silva-CastroNessuna valutazione finora

- Spa SampleDocumento1 paginaSpa Samplemarivic buenaflorNessuna valutazione finora

- Motion To Admit Belated Comment (CA Cebu) .9.2022Documento3 pagineMotion To Admit Belated Comment (CA Cebu) .9.2022Cyrus CalayaNessuna valutazione finora

- Final Board ResolutionDocumento3 pagineFinal Board ResolutionWACHNessuna valutazione finora

- Picpa (Functions)Documento18 paginePicpa (Functions)Rheneir MoraNessuna valutazione finora

- Scholarship Service Contract FormDocumento3 pagineScholarship Service Contract FormFrancis Thomas LimNessuna valutazione finora

- Sample Board ResolutionDocumento2 pagineSample Board ResolutionJen GamilNessuna valutazione finora

- Tua vs. Mangrobang, GR No. 170701 (January 22, 2014)Documento10 pagineTua vs. Mangrobang, GR No. 170701 (January 22, 2014)Escanor GrandineNessuna valutazione finora

- Consent For Publication FormDocumento1 paginaConsent For Publication FormKentKawashimaNessuna valutazione finora

- Tax ExemptionDocumento2 pagineTax ExemptionHeber BacolodNessuna valutazione finora

- Affidavit Financial SupportDocumento2 pagineAffidavit Financial SupportciryajamNessuna valutazione finora

- Bureau of Trademarks: Intellectual Property Office of The PhilippinesDocumento1 paginaBureau of Trademarks: Intellectual Property Office of The PhilippinesJerry SerapionNessuna valutazione finora

- Affidavit of SupportDocumento1 paginaAffidavit of SupportJustin Jomel ConsultaNessuna valutazione finora

- Excerpt From The Minutes of The Board of Directors? Meeting Held On February 5, 2015Documento2 pagineExcerpt From The Minutes of The Board of Directors? Meeting Held On February 5, 2015JBS RINessuna valutazione finora

- Acknowledgement Receipt (Sample) NotarizedDocumento1 paginaAcknowledgement Receipt (Sample) NotarizedMichael Ramirez SorbitoNessuna valutazione finora

- 2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22Documento5 pagine2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22jonely kantimNessuna valutazione finora

- BSP Pawnshop RegistrationDocumento3 pagineBSP Pawnshop RegistrationGeneral DuNessuna valutazione finora

- 4.27.18 MOA With NHA and R.R. Encabo ZaldyDocumento8 pagine4.27.18 MOA With NHA and R.R. Encabo ZaldyJanet BattungNessuna valutazione finora

- 1905 (Encs) 2000Documento4 pagine1905 (Encs) 2000Loss Pokla100% (1)

- Plaintiff,: Urgent Motion To Suspend/Stay Proceedings COMES NOW The Defendant by The Undersigned Counsel, and UntoDocumento2 paginePlaintiff,: Urgent Motion To Suspend/Stay Proceedings COMES NOW The Defendant by The Undersigned Counsel, and UntoMOSB10Nessuna valutazione finora

- Reply To Opposition by JedDocumento12 pagineReply To Opposition by JedrichardgomezNessuna valutazione finora

- Application For Abatement or Cancellation of Tax, Penalties And/or Interest Under Rev. Reg. No.Documento2 pagineApplication For Abatement or Cancellation of Tax, Penalties And/or Interest Under Rev. Reg. No.anamergalNessuna valutazione finora

- RR 11-2018 Income Payor Sworn DeclarationDocumento1 paginaRR 11-2018 Income Payor Sworn DeclarationMaricel Valerio CanlasNessuna valutazione finora

- Deed of Assignment With AssumptionDocumento3 pagineDeed of Assignment With AssumptionJecky Delos ReyesNessuna valutazione finora

- SPECIAL POWER OF ATTORNEY - Various Transactions PropertyDocumento2 pagineSPECIAL POWER OF ATTORNEY - Various Transactions PropertyJecky Delos Reyes100% (1)

- FS UndertakingDocumento1 paginaFS UndertakingJecky Delos ReyesNessuna valutazione finora

- AFFIDAVIT-personal Details For HongkongDocumento1 paginaAFFIDAVIT-personal Details For HongkongJecky Delos ReyesNessuna valutazione finora

- REVISED CITIZENS CHARTER-NWRB Dec 10 2013 PDFDocumento41 pagineREVISED CITIZENS CHARTER-NWRB Dec 10 2013 PDFJecky Delos ReyesNessuna valutazione finora

- Excerpts Decision Re Moral DamagesDocumento5 pagineExcerpts Decision Re Moral DamagesJecky Delos ReyesNessuna valutazione finora

- Data Privacy ActDocumento2 pagineData Privacy ActJecky Delos ReyesNessuna valutazione finora

- Deed of Exchange of Two PropertiesDocumento3 pagineDeed of Exchange of Two PropertiesJecky Delos ReyesNessuna valutazione finora

- HLURB Board Resolution On ETDDocumento7 pagineHLURB Board Resolution On ETDJecky Delos ReyesNessuna valutazione finora

- HOA WithdrawalDocumento13 pagineHOA WithdrawalJecky Delos ReyesNessuna valutazione finora

- Completion of Development HLURBDocumento37 pagineCompletion of Development HLURBJecky Delos ReyesNessuna valutazione finora

- Renewal Employment AgreementDocumento4 pagineRenewal Employment AgreementJecky Delos ReyesNessuna valutazione finora

- RisingDocumento12 pagineRisingJecky Delos ReyesNessuna valutazione finora

- FILIPINO Deed of Absolute Sale, Acknowledgment Receipt and SPADocumento7 pagineFILIPINO Deed of Absolute Sale, Acknowledgment Receipt and SPAJecky Delos ReyesNessuna valutazione finora

- Deed of Donation FormsDocumento5 pagineDeed of Donation FormsJecky Delos Reyes100% (1)

- Government Laws and Regulations of Compensation, Incentives and BenefitsDocumento33 pagineGovernment Laws and Regulations of Compensation, Incentives and BenefitsJacobfranNessuna valutazione finora

- Law of Torts-IDocumento4 pagineLaw of Torts-IMasoom RezaNessuna valutazione finora

- 241 - Shrimp Specialist, Inc. v. Fuji-Triumph, 7 December 2009Documento2 pagine241 - Shrimp Specialist, Inc. v. Fuji-Triumph, 7 December 2009Reynaldo Lepatan Jr.Nessuna valutazione finora

- 4 Activity - Mapping - Report-Karnataka PDFDocumento190 pagine4 Activity - Mapping - Report-Karnataka PDFSMNessuna valutazione finora

- Cengage Advantage Books Business Law Text and Cases The First Course 1st Edition Miller Test Bank 1Documento13 pagineCengage Advantage Books Business Law Text and Cases The First Course 1st Edition Miller Test Bank 1helen100% (31)

- 4/6 Profile: The Human Design SystemDocumento3 pagine4/6 Profile: The Human Design SystemOla Ola100% (2)

- Nistar Patrak and Regulation of FishingDocumento39 pagineNistar Patrak and Regulation of FishingPoonam SharmaNessuna valutazione finora

- Indemnity & Insurance in Respect of Personal InjuriesDocumento18 pagineIndemnity & Insurance in Respect of Personal InjuriesAkiff Md ZinNessuna valutazione finora

- Types of Business Entities in PhilippinesDocumento1 paginaTypes of Business Entities in PhilippineslingneNessuna valutazione finora

- Two Concepts of AccountabilityDocumento4 pagineTwo Concepts of AccountabilityjaesaraujoNessuna valutazione finora

- Marina Llemos Et Al. vs. Romeo Llemos Et Al. G.R. No. 150162, January 26, 2007 Austria-Martinez, J.: DoctrineDocumento2 pagineMarina Llemos Et Al. vs. Romeo Llemos Et Al. G.R. No. 150162, January 26, 2007 Austria-Martinez, J.: DoctrineTootsie GuzmaNessuna valutazione finora

- (D) FC - Kheng Soon Finance BHD V MK Retnam HoldingsDocumento9 pagine(D) FC - Kheng Soon Finance BHD V MK Retnam HoldingsRita LakhsmiNessuna valutazione finora

- Economics of Money Banking and Financial Markets 12th Edition Mishkin Solutions ManualDocumento3 pagineEconomics of Money Banking and Financial Markets 12th Edition Mishkin Solutions Manualalexanderyanggftesimjac100% (15)

- EPG Construction Vs CA (Digest)Documento2 pagineEPG Construction Vs CA (Digest)カルリー カヒミNessuna valutazione finora

- Acceptance and Presentment For AcceptanceDocumento27 pagineAcceptance and Presentment For AcceptanceAndrei ArkovNessuna valutazione finora

- Banking OmbudsmanDocumento26 pagineBanking OmbudsmanVIVEKNessuna valutazione finora

- Special People V CandaDocumento5 pagineSpecial People V CandaTom SumawayNessuna valutazione finora

- Layos vs. VillanuevaDocumento10 pagineLayos vs. VillanuevaPamela TambaloNessuna valutazione finora

- Deed of Sale of Parcel of LandDocumento2 pagineDeed of Sale of Parcel of LandLex DagdagNessuna valutazione finora

- Chapter 1 - General Provisions Art. 1156. An Obligation Is A Juridical Necessity To Give, TodoornottodoDocumento6 pagineChapter 1 - General Provisions Art. 1156. An Obligation Is A Juridical Necessity To Give, TodoornottodoNinaNessuna valutazione finora

- Exposé Sur La Corruption Au Burkina FasoDocumento4 pagineExposé Sur La Corruption Au Burkina FasoDavidNessuna valutazione finora

- CSE Internship Certificates 2020-21 PDFDocumento430 pagineCSE Internship Certificates 2020-21 PDFAbhinav GaurNessuna valutazione finora

- LAW203 - Yu Ming Jin - Prof Maartje de VisserDocumento55 pagineLAW203 - Yu Ming Jin - Prof Maartje de VisserLEE KERNNessuna valutazione finora

- Cometa vs. CADocumento6 pagineCometa vs. CAjegel23Nessuna valutazione finora

- Taylor v. Peguese Et Al - Document No. 6Documento2 pagineTaylor v. Peguese Et Al - Document No. 6Justia.comNessuna valutazione finora

- GBL Internship Letter-SidraDocumento4 pagineGBL Internship Letter-SidraSIDRA ALI MA ECO DEL 2021-23Nessuna valutazione finora

- XT-1 DiaryDocumento2 pagineXT-1 Diarygautisingh100% (1)

- Samsung S7 Black, (Herein After Referred To As "Cellular Phone") PhoneDocumento3 pagineSamsung S7 Black, (Herein After Referred To As "Cellular Phone") PhoneFranz GarciaNessuna valutazione finora

- Legal Environment of Business and Online Commerce 7th Edition Cheeseman Test BankDocumento18 pagineLegal Environment of Business and Online Commerce 7th Edition Cheeseman Test BankJudyWatsonofseb100% (21)

- Vibar RPH Lesson 4 ActivityDocumento2 pagineVibar RPH Lesson 4 ActivityAlwin LantinNessuna valutazione finora