Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Glossary: Public Sector Debt Statistics Manual.) The Term "Public

Caricato da

vinturis_cezaraTitolo originale

Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoGlossary: Public Sector Debt Statistics Manual.) The Term "Public

Caricato da

vinturis_cezaraGLOSSARY

Cyclical balance Cyclical component of the overall includes financial and nonfinancial public enterprises and

fiscal balance, computed as the difference between cyclical the central bank.)

revenues and cyclical expenditures. The latter are typically

Net debt Gross debt minus financial assets

computed using country-specific elasticities of aggregate

corresponding to debt instruments. These financial

revenue and expenditure series with respect to the output

assets are monetary gold and special drawing rights;

gap. Where unavailable, standard elasticities (0,1) are

currency and deposits; debt securities; loans, insurance,

assumed for expenditure and revenue, respectively.

pensions, and standardized guarantee programs; and other

Cyclically adjusted balance (CAB) Difference accounts receivable. In some countries, the reported net

between the overall balance and the automatic stabilizers; debt can deviate from this definition based on available

equivalently, an estimate of the fiscal balance that would information and national fiscal accounting practices.

apply under current policies if output were equal to

Nonfinancial public sector General government

potential.

plus nonfinancial public corporations.

Cyclically adjusted primary balance

Output gap Deviation of actual from potential GDP,

(CAPB) Cyclically adjusted balance excluding net

in percent of potential GDP.

interest payments.

Overall fiscal balance (also “headline” fiscal

Fiscal buffer Fiscal space created by saving budgetary

balance) Net lending and borrowing, defined as the

resources and reducing public debt in good times.

difference between revenue and total expenditure, using

Fiscal space Extent to which a government can the IMF’s 2001 Government Finance Statistics Manual

generate and allocate resources for a given purpose without (GFSM 2001). Does not include policy lending. For

prejudicing liquidity or long-term public debt sustainability. some countries, the overall balance is still based on the

GFSM 1986, which defines it as total revenue and grants

Fiscal stabilization Contribution of fiscal policy to

minus total expenditure and net lending.

output stability through its impact on aggregate demand.

Potential output Estimate of the level of GDP

General government All government units and all

that can be reached if the economy’s resources are fully

nonmarket, nonprofit institutions that are controlled

employed.

and mainly financed by government units comprising

the central, state, and local governments; includes social Primary balance Overall balance excluding net

security funds, and does not include public corporations interest payment (interest expenditure minus interest

or quasi-corporations. revenue).

Gross debt All liabilities that require future Public debt See gross debt.

payment of interest and/or principal by the debtor to

Public sector The general government sector

the creditor. This includes debt liabilities in the form

plus government-controlled entities, known as public

of special drawing rights, currency, and deposits; debt

corporations, whose primary activity is to engage in

securities; loans; insurance, pension, and standardized

commercial activities.

guarantee programs; and other accounts payable. (See the

IMF’s 2001 Government Finance Statistics Manual and Structural fiscal balance Difference between the

Public Sector Debt Statistics Manual.) The term “public cyclically adjusted balance and other nonrecurrent effects

debt” is used in the Fiscal Monitor, for simplicity, as that go beyond the cycle, such as one-off operations and

synonymous with gross debt of the general government, other factors whose cyclical fluctuations do not coincide

unless specified otherwise. (Strictly speaking, public debt with the output cycle (for instance, asset and commodity

refers to the debt of the public sector as a whole, which prices and output composition effects).

International Monetary Fund | April 2016 61

Potrebbero piacerti anche

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentDa EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentValutazione: 1 su 5 stelle1/5 (1)

- FmglossarypdfDocumento2 pagineFmglossarypdfSanjaya AriyawansaNessuna valutazione finora

- Public Debt and Fiscal Consolidation: A Closer Look at Public DebtsDocumento7 paginePublic Debt and Fiscal Consolidation: A Closer Look at Public DebtsVinn EcoNessuna valutazione finora

- 6.1 Introduction To Public Finance Management N Lrgal FrameworkDocumento14 pagine6.1 Introduction To Public Finance Management N Lrgal Frameworkjoseph mbuguaNessuna valutazione finora

- Budget For Our StateDocumento13 pagineBudget For Our StateDia AgarwalNessuna valutazione finora

- Bam 145 - RealDocumento52 pagineBam 145 - RealGlenn Sabanal GarciaNessuna valutazione finora

- Lesson 05 - Fiscal Policy and StabilizationDocumento48 pagineLesson 05 - Fiscal Policy and StabilizationMetoo ChyNessuna valutazione finora

- Lecture 10 - Public DebtDocumento34 pagineLecture 10 - Public DebtSidra NazirNessuna valutazione finora

- Public Finance GROUP 4Documento18 paginePublic Finance GROUP 4Roby IbeNessuna valutazione finora

- How To Assess Fiscal Risks From State-Owned Enterprises - Benchmarking and Stress TestingDocumento14 pagineHow To Assess Fiscal Risks From State-Owned Enterprises - Benchmarking and Stress TestingAlexNessuna valutazione finora

- Concepts in EconomicsDocumento8 pagineConcepts in EconomicsAggyapal Singh JimmyNessuna valutazione finora

- Def 4Documento7 pagineDef 4Guezil Joy DelfinNessuna valutazione finora

- II. Fiscal Policy in Relation To Overall Development PolicyDocumento8 pagineII. Fiscal Policy in Relation To Overall Development PolicyOliver SantosNessuna valutazione finora

- Deficits, Debt, and The Economy: An Introduction: Updated April 15, 2019Documento16 pagineDeficits, Debt, and The Economy: An Introduction: Updated April 15, 2019Jacen BondsNessuna valutazione finora

- Leec 105Documento19 pagineLeec 105Pradeep NairNessuna valutazione finora

- Fiscal Policy: With Respect To InvestmentDocumento36 pagineFiscal Policy: With Respect To Investmentn2oh1Nessuna valutazione finora

- Union Budget 2018 UPSCDocumento36 pagineUnion Budget 2018 UPSCamit2688Nessuna valutazione finora

- Demand Sided Policy: Spending/g)Documento9 pagineDemand Sided Policy: Spending/g)Umesh SharmaNessuna valutazione finora

- Public Debt in IndiaDocumento20 paginePublic Debt in IndiaKushagra AgrawalNessuna valutazione finora

- Government BudgetDocumento2 pagineGovernment BudgetParth NataniNessuna valutazione finora

- Module 7 Fiscal Accounts Analysis and ForecastingDocumento38 pagineModule 7 Fiscal Accounts Analysis and ForecastingDaisy LalasNessuna valutazione finora

- 2022 - Fiscal PolicyDocumento48 pagine2022 - Fiscal PolicySwapnil JaiswalNessuna valutazione finora

- Unit 1: Like This Study Set? Create A Free Account To Save ItDocumento5 pagineUnit 1: Like This Study Set? Create A Free Account To Save ItdissidentmeNessuna valutazione finora

- Classification: Institutional SectorsDocumento4 pagineClassification: Institutional SectorsKarolNessuna valutazione finora

- 08 STMTDocumento14 pagine08 STMTririnminipurwasiNessuna valutazione finora

- Unit Two Government Budget 2.1. The Definition of BudgetDocumento15 pagineUnit Two Government Budget 2.1. The Definition of BudgetnarrNessuna valutazione finora

- BRISKResources Andre Proite Asset Liability Managementin Developing Countries ABalance Sheet ApproachDocumento36 pagineBRISKResources Andre Proite Asset Liability Managementin Developing Countries ABalance Sheet ApproachZainab ShahidNessuna valutazione finora

- What Is Debt Sustainability BasicsDocumento2 pagineWhat Is Debt Sustainability BasicsR SHEGIWALNessuna valutazione finora

- Chapter 2Documento12 pagineChapter 2Yitera SisayNessuna valutazione finora

- Leec 105Documento19 pagineLeec 105pradyu1990Nessuna valutazione finora

- Public Debt AccountingDocumento50 paginePublic Debt AccountingAshmini PershadNessuna valutazione finora

- Definitions of World Development IndicatorsDocumento9 pagineDefinitions of World Development IndicatorsAnonymous tkeB2kXUDMNessuna valutazione finora

- Fy 2013 July UpdateDocumento281 pagineFy 2013 July UpdateNick ReismanNessuna valutazione finora

- Public Debt and BudgetDocumento12 paginePublic Debt and BudgetaaNessuna valutazione finora

- Fy 19 Enac FPDocumento440 pagineFy 19 Enac FPThe Capitol PressroomNessuna valutazione finora

- 5.1 G B - M C: Overnment Udget Eaning AND ITS OmponentsDocumento19 pagine5.1 G B - M C: Overnment Udget Eaning AND ITS OmponentsKarthi KannanNessuna valutazione finora

- The Cash Basis IPSAS An Alternative ViewDocumento7 pagineThe Cash Basis IPSAS An Alternative ViewInternational Consortium on Governmental Financial ManagementNessuna valutazione finora

- Introduction To Public FinanceDocumento36 pagineIntroduction To Public FinancedevmakloveNessuna valutazione finora

- Introduction To Public FinanceDocumento36 pagineIntroduction To Public FinanceNeelabh KumarNessuna valutazione finora

- Deficit Measurement in IndiaDocumento3 pagineDeficit Measurement in IndiaRupesh PatraNessuna valutazione finora

- Economics Concept Series - Test 02 (Solutions)Documento10 pagineEconomics Concept Series - Test 02 (Solutions)Vivek JhaNessuna valutazione finora

- Economics TermsDocumento11 pagineEconomics TermsAhmad Zia JamiliNessuna valutazione finora

- Economics Project: Meaning of Revenue DeficitDocumento22 pagineEconomics Project: Meaning of Revenue DeficitAuro BhattacharyaNessuna valutazione finora

- 5 Important Concepts of Budgetary Deficit Is As FollowsDocumento9 pagine5 Important Concepts of Budgetary Deficit Is As FollowsDipesh TekchandaniNessuna valutazione finora

- Global Markets Exam PrepDocumento14 pagineGlobal Markets Exam Prepbaler73561Nessuna valutazione finora

- Class 12 Macro Economics Chapter 5 - Revision NotesDocumento4 pagineClass 12 Macro Economics Chapter 5 - Revision NotesROHIT SHANessuna valutazione finora

- Managerial Economics Topic 8Documento71 pagineManagerial Economics Topic 8Aka GNessuna valutazione finora

- Shreyash Raj-A039-Public Debt in IndiaDocumento4 pagineShreyash Raj-A039-Public Debt in IndiaShreyash RajNessuna valutazione finora

- Governement Budget Abiodun MarquisDocumento12 pagineGovernement Budget Abiodun MarquisOluwamurewa FadareNessuna valutazione finora

- Fakultas Ekonomi Universitas Hasanuddin 2011: Rizky Khaerany A311 09 265Documento7 pagineFakultas Ekonomi Universitas Hasanuddin 2011: Rizky Khaerany A311 09 265271215Nessuna valutazione finora

- Annex I Contingent LiabilitiesDocumento2 pagineAnnex I Contingent Liabilitiesfareha riazNessuna valutazione finora

- Responsibility of Fiscal Policy UPDATEDDocumento24 pagineResponsibility of Fiscal Policy UPDATEDFiona RamiNessuna valutazione finora

- Final Project CompDocumento81 pagineFinal Project Compshahsam17Nessuna valutazione finora

- External Debt ManagementDocumento55 pagineExternal Debt Managementajayajay83Nessuna valutazione finora

- Indian Fiscal PolicyDocumento2 pagineIndian Fiscal PolicyBhavya Choudhary100% (1)

- Metadata 17 01 02Documento6 pagineMetadata 17 01 02fakhrul.biznessNessuna valutazione finora

- Macro - I: Introduction To Financial Programming First PartDocumento48 pagineMacro - I: Introduction To Financial Programming First PartThiago FigueredoNessuna valutazione finora

- Finance BOLT PDFDocumento31 pagineFinance BOLT PDFMadhusudan KumarNessuna valutazione finora

- China and the US Foreign Debt Crisis: Does China Own the USA?Da EverandChina and the US Foreign Debt Crisis: Does China Own the USA?Nessuna valutazione finora

- LBST 2102 Final EssayDocumento9 pagineLBST 2102 Final Essayapi-318174977Nessuna valutazione finora

- Precertification Worksheet: LEED v4.1 BD+C - PrecertificationDocumento62 paginePrecertification Worksheet: LEED v4.1 BD+C - PrecertificationLipi AgarwalNessuna valutazione finora

- Newspaper OrganisationDocumento20 pagineNewspaper OrganisationKcite91100% (5)

- Emma The Easter BunnyDocumento9 pagineEmma The Easter BunnymagdaNessuna valutazione finora

- English HL P1 Nov 2019Documento12 pagineEnglish HL P1 Nov 2019Khathutshelo KharivheNessuna valutazione finora

- Basics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalDocumento7 pagineBasics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalHRISHIKESH PRAKASH JAISWAL100% (1)

- Past Simple of BeDocumento2 paginePast Simple of BeRoxana ClepeNessuna valutazione finora

- Human Development IndexDocumento17 pagineHuman Development IndexriyaNessuna valutazione finora

- Jurnal Perdata K 1Documento3 pagineJurnal Perdata K 1Edi nur HandokoNessuna valutazione finora

- 059 Night of The Werewolf PDFDocumento172 pagine059 Night of The Werewolf PDFomar omar100% (1)

- Manhole DetailDocumento1 paginaManhole DetailchrisNessuna valutazione finora

- Prof. Monzer KahfDocumento15 pagineProf. Monzer KahfAbdulNessuna valutazione finora

- Picc Lite ManualDocumento366 paginePicc Lite Manualtanny_03Nessuna valutazione finora

- DH 0507Documento12 pagineDH 0507The Delphos HeraldNessuna valutazione finora

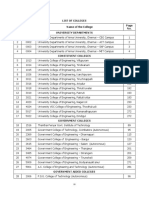

- TNEA Participating College - Cut Out 2017Documento18 pagineTNEA Participating College - Cut Out 2017Ajith KumarNessuna valutazione finora

- Ulster Cycle - WikipediaDocumento8 pagineUlster Cycle - WikipediazentropiaNessuna valutazione finora

- Packing List Night at Starlodge Adventure SuitesDocumento2 paginePacking List Night at Starlodge Adventure SuitesArturo PerezNessuna valutazione finora

- Thomas HobbesDocumento3 pagineThomas HobbesatlizanNessuna valutazione finora

- Product Training OutlineDocumento3 pagineProduct Training OutlineDindin KamaludinNessuna valutazione finora

- Contract of Lease (711) - AguilarDocumento7 pagineContract of Lease (711) - AguilarCoy Resurreccion Camarse100% (2)

- Death and The King's Horseman AnalysisDocumento2 pagineDeath and The King's Horseman AnalysisCelinaNessuna valutazione finora

- Meditation For AddictionDocumento2 pagineMeditation For AddictionharryNessuna valutazione finora

- Specification - Pump StationDocumento59 pagineSpecification - Pump StationchialunNessuna valutazione finora

- Green and White Zero Waste Living Education Video PresentationDocumento12 pagineGreen and White Zero Waste Living Education Video PresentationNicole SarileNessuna valutazione finora

- Ikramul (Electrical)Documento3 pagineIkramul (Electrical)Ikramu HaqueNessuna valutazione finora

- Abnormal PsychologyDocumento4 pagineAbnormal PsychologyTania LodiNessuna valutazione finora

- National Rural Employment Guarantee Act, 2005Documento17 pagineNational Rural Employment Guarantee Act, 2005praharshithaNessuna valutazione finora

- The Eaglet - Vol. 31, No. 3 - September 2019Documento8 pagineThe Eaglet - Vol. 31, No. 3 - September 2019Rebecca LovettNessuna valutazione finora

- TIMELINE - Philippines of Rizal's TimesDocumento46 pagineTIMELINE - Philippines of Rizal's TimesAntonio Delgado100% (1)

- AMUL'S Every Function Involves Huge Human ResourcesDocumento3 pagineAMUL'S Every Function Involves Huge Human ResourcesRitu RajNessuna valutazione finora