Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Deepak Esidential Status - Important Note

Caricato da

Deepak YadavDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Deepak Esidential Status - Important Note

Caricato da

Deepak YadavCopyright:

Formati disponibili

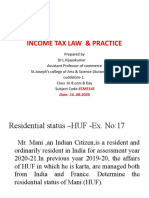

Residential Status

Important Notes

Scope of Income Sec. 5

1. ROR:- Global (All) income of is taxable except:

i. Past untaxed profit

ii. Agricultural Income from Land in India

iii. Dividend from Indian co.

iv. Gifts from relatives

v. other incomes which are exempt.

2. RNOR and NR:-

For both Income earned or received in India are taxable. The only difference is:-

For NR any type of income earned outside India is not taxable in India. But for RNOR income of

outside India shall be taxable if it is from business which is controlled from India.

Income deemed to be earned in India- Section 9

1. If income is first received in India then only it shall be taxable. If first received outside India and then

remitted to India, then not treated as received in India.

2. If business located in India and controlled from outside India then also taxable.

E.g. Profit from a branch in Chennai controlled from USA is taxable.

3. Salary for services rendered in India but received outside India then taxable as per sec.9 like pension

from a former employer.

4. If the Indian govt. employee received salary/ remuneration from Indian govt. for the services

rendered outside India then it is taxable. e.g. Indian Embassy’s outside India(u/s 9)

5. If rent received from a house property then also allowed 30% standard deduction.

6. Interest from deposits with an Indian Co. received outside India, then it is assumed that deposits

used in India. Hence it shall be taxable in all cases.

7. In case of interest/ royalty/fees just check that where amount borrowed/patent etc./services are

used.

E.g. Architect sitting in UK made design of Taj Hotel in Mumbai shall be taxable.

8. Exports, News and films in India are not taxable only for non-residents.

Income from shooting of a cinematograph film in India is taxable done a citizen of India.

Residential status Section 6

9. As soon as you find Indian citizen/POI dont check 2nd basic condition. Decide properly whether

POI/ Indian citizen or not. If Relatives born in Undivided India, then it does not make the assessee

person of Indian origin, for that parents & grandparents birth place before 1947 is relevant.

10. If the person initially an Indian citizen but after cancelled his Indian citizenship then any of the two

basic conditions can be checked.

11. For the additional conditions, if both are satisfied then only the assesses will be ROR.

12. For other than Individual/HUF don’t check additional conditions. If resident then global income as

of ROR shall be taxable.

13. Only different treatment for foreign company(entire control in India to be treated as Resident). HUF,

firm, club etc. even if partly controlled from India, shall become resident.

14. Profits received from a partnership firm is exempt in the hands of partners but if the firm is situated

outside India and share of income from such firm is deemed to accrue or arise in India, then such

share of income shall be taxable in the respective partner’s hand.

Potrebbero piacerti anche

- Accounting QuizDocumento3 pagineAccounting QuizMisty Tranquil0% (1)

- (John O' Connor, Eamonn Galvin, Martin Evans) (UTS)Documento454 pagine(John O' Connor, Eamonn Galvin, Martin Evans) (UTS)Fahmi Alfaroqi100% (1)

- Vendor Agreement SampleDocumento7 pagineVendor Agreement Samplebaibhavjauhari100% (1)

- 1a.residential Status - Important NoteDocumento1 pagina1a.residential Status - Important NoteDeepak YadavNessuna valutazione finora

- Residential Status - May 2024 & Nov 2024Documento2 pagineResidential Status - May 2024 & Nov 2024Rahul NegiNessuna valutazione finora

- Income Tax Law & Practice: Unit 1Documento30 pagineIncome Tax Law & Practice: Unit 1jaspreet kaurNessuna valutazione finora

- Income Deemed To Arise in IndiaDocumento7 pagineIncome Deemed To Arise in IndiaDebaNessuna valutazione finora

- Residential Status and Incidence of Tax - Study MaterialDocumento6 pagineResidential Status and Incidence of Tax - Study MaterialEmeline SoroNessuna valutazione finora

- Short Notes of Residential StatusDocumento3 pagineShort Notes of Residential StatusutsavNessuna valutazione finora

- Direct Tax Summary NotesDocumento88 pagineDirect Tax Summary NotesAlisha LukeNessuna valutazione finora

- Resdential Status Questionsby Garun Kumar GDCM SrikakulamDocumento9 pagineResdential Status Questionsby Garun Kumar GDCM Srikakulamgeddadaarun100% (1)

- Day4 Residential Status and Incidence of Tax (9 Oct)Documento12 pagineDay4 Residential Status and Incidence of Tax (9 Oct)1986anuNessuna valutazione finora

- E Text Week 1 Module 1.5Documento5 pagineE Text Week 1 Module 1.5bsc slpNessuna valutazione finora

- Incidence of TaxDocumento53 pagineIncidence of TaxAnurag SindhalNessuna valutazione finora

- ch-11 Taxation of NRIsDocumento25 paginech-11 Taxation of NRIsdean.socNessuna valutazione finora

- Residential StatusDocumento17 pagineResidential Statussaif aliNessuna valutazione finora

- DTP 2nd ModuleDocumento6 pagineDTP 2nd ModuleVeena GowdaNessuna valutazione finora

- CTPM ProblemsDocumento31 pagineCTPM ProblemsViraja GuruNessuna valutazione finora

- e Book PDF PDFDocumento91 paginee Book PDF PDFGiri SukumarNessuna valutazione finora

- Income Tax Law & PracticeDocumento32 pagineIncome Tax Law & PracticeGautam TamtaNessuna valutazione finora

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocumento6 pagineResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaNessuna valutazione finora

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Documento10 pagineCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamNessuna valutazione finora

- Residential Status Cma IndaDocumento10 pagineResidential Status Cma IndaKiran ChristyNessuna valutazione finora

- 3.2 Incidence of TaxDocumento5 pagine3.2 Incidence of Taxswathi jaiganeshNessuna valutazione finora

- Residential Status and Tax IncidenceDocumento3 pagineResidential Status and Tax Incidenceambarishan mrNessuna valutazione finora

- Semester V Direct Tax Residence & Scope of Total Income A/087/Divya KamaliyaDocumento14 pagineSemester V Direct Tax Residence & Scope of Total Income A/087/Divya KamaliyaHarsh KamaliyaNessuna valutazione finora

- Caa0eresidential StatusDocumento13 pagineCaa0eresidential StatusShashwat MishraNessuna valutazione finora

- Scope of Total Income U/S. 5: Presented To:-Prof. SeemaDocumento17 pagineScope of Total Income U/S. 5: Presented To:-Prof. SeemaRaksha ShettyNessuna valutazione finora

- Types of Income: Incidence of Tax For Different Residential StatusDocumento1 paginaTypes of Income: Incidence of Tax For Different Residential StatussadathnooriNessuna valutazione finora

- Basis of Charge and Scope of TotalDocumento24 pagineBasis of Charge and Scope of TotalSujithNessuna valutazione finora

- Tax Planning For An NRI: Pratul JainDocumento3 pagineTax Planning For An NRI: Pratul Jainjanardhan lalwaniNessuna valutazione finora

- Personal Tax Planning 201718Documento79 paginePersonal Tax Planning 201718Deepak JainNessuna valutazione finora

- Income Tax Planning-1Documento32 pagineIncome Tax Planning-1Ashutosh ShuklaNessuna valutazione finora

- Notes LLB Tax Nav 2Documento12 pagineNotes LLB Tax Nav 2amit HCSNessuna valutazione finora

- Summary Book Nov 2022Documento41 pagineSummary Book Nov 2022Krrish KelwaniNessuna valutazione finora

- Section 9 of Income Tax Act 1961Documento55 pagineSection 9 of Income Tax Act 1961Bharath SimhaReddyNaiduNessuna valutazione finora

- Introduction To ResidenceDocumento4 pagineIntroduction To ResidenceNiya Maria NixonNessuna valutazione finora

- Presentation On Residential Status & Its Incidence On Tax LiabilityDocumento13 paginePresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniNessuna valutazione finora

- It - Lesson 3Documento14 pagineIt - Lesson 3Sugandha AgarwalNessuna valutazione finora

- Residential StatusDocumento11 pagineResidential StatusSaurav MedhiNessuna valutazione finora

- Corporate SampleDocumento3 pagineCorporate SampleLalitha BaiNessuna valutazione finora

- Residential Status and Taxation For Individuals - Taxguru - inDocumento2 pagineResidential Status and Taxation For Individuals - Taxguru - inSubhamNessuna valutazione finora

- Scope of Total Income and Residential StatusDocumento3 pagineScope of Total Income and Residential StatusSandeep SinghNessuna valutazione finora

- Note 19 - RESIDENTIAL STATUS OF HUF, FIRM AND COMPANYDocumento4 pagineNote 19 - RESIDENTIAL STATUS OF HUF, FIRM AND COMPANYSumit BainNessuna valutazione finora

- Income Tax Law PracticeDocumento16 pagineIncome Tax Law PracticeTholai Nokku [ தொலை நோக்கு ]Nessuna valutazione finora

- Income Tax FinalDocumento20 pagineIncome Tax FinalSiddarood KumbarNessuna valutazione finora

- Residential Status Under Income-Tax Act, 1961Documento6 pagineResidential Status Under Income-Tax Act, 1961Bharat Tailor100% (1)

- Income Tax Summary BookDocumento40 pagineIncome Tax Summary BookMaithili SUBRAMANIANNessuna valutazione finora

- Residential Status and Tax IncidenceDocumento46 pagineResidential Status and Tax IncidenceÄbhíñävJäíñNessuna valutazione finora

- Unit 3Documento20 pagineUnit 3Ram KrishnaNessuna valutazione finora

- Notes LLB Tax NavDocumento33 pagineNotes LLB Tax Navamit HCSNessuna valutazione finora

- Income Tax 1Documento26 pagineIncome Tax 1Vismaya CholakkalNessuna valutazione finora

- Tax NotesDocumento11 pagineTax NotesVishal DeshwalNessuna valutazione finora

- Residential Status DC 2023-24Documento11 pagineResidential Status DC 2023-24avinashhpv7785Nessuna valutazione finora

- Subject: Taxation Law-I: Chanakya National Law University, PatnaDocumento20 pagineSubject: Taxation Law-I: Chanakya National Law University, PatnaKritika SinghNessuna valutazione finora

- Fundamental of Taxation inDocumento11 pagineFundamental of Taxation inprashmishah23Nessuna valutazione finora

- Income Tax Brief DemoDocumento20 pagineIncome Tax Brief DemoZam HiaNessuna valutazione finora

- Sia - Itax-2018-19Documento17 pagineSia - Itax-2018-19Abhay Pethani.Nessuna valutazione finora

- Residential Status True or FalseDocumento2 pagineResidential Status True or FalseSarvar PathanNessuna valutazione finora

- Chapter-2 Residential StatusDocumento5 pagineChapter-2 Residential StatusBrinda RNessuna valutazione finora

- Relationship Between Residential Status and Incidence of TaxDocumento5 pagineRelationship Between Residential Status and Incidence of Taxsuyash dugarNessuna valutazione finora

- Income Tax Law & Practice-I (Ucm20302J) Unit IDocumento7 pagineIncome Tax Law & Practice-I (Ucm20302J) Unit IRohithNessuna valutazione finora

- HUNGERDocumento1 paginaHUNGERA3 VenturesNessuna valutazione finora

- Lesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSDocumento6 pagineLesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSMayeng MonayNessuna valutazione finora

- Foss, Patricia ResumeDocumento2 pagineFoss, Patricia Resumepattifoss626Nessuna valutazione finora

- Homework Problems-Futures (Fin. 338) - Updated (With Answers)Documento3 pagineHomework Problems-Futures (Fin. 338) - Updated (With Answers)Duc ThaiNessuna valutazione finora

- Blue DartDocumento19 pagineBlue DartB.v. SwethaNessuna valutazione finora

- Facts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentDocumento2 pagineFacts of The Case:: (G.R. No. 32329. March 23, 1929.) in Re Luis B. Tagorda Duran & Lim For RespondentCherry BepitelNessuna valutazione finora

- Syllabus Labor Law Rev Plus CasesDocumento219 pagineSyllabus Labor Law Rev Plus CasesMarivicTalomaNessuna valutazione finora

- Janet Wooster Owns A Retail Store That Sells New andDocumento2 pagineJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNessuna valutazione finora

- 6 - ProfDaniel - Kaizen Exprience in Ethiopia31Documento38 pagine6 - ProfDaniel - Kaizen Exprience in Ethiopia31Henry DunaNessuna valutazione finora

- PDFDocumento4 paginePDFgroovercm15Nessuna valutazione finora

- The Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Documento23 pagineThe Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Sanjay ParekhNessuna valutazione finora

- Import SampleDocumento17 pagineImport SampleZED AAR LOGISTICSNessuna valutazione finora

- PR2 Group 1Documento3 paginePR2 Group 1Deborah BandahalaNessuna valutazione finora

- Securities Dealers and Brokers From MamDocumento7 pagineSecurities Dealers and Brokers From MamRica Angela Manahan MillonteNessuna valutazione finora

- PPP in MP TourismDocumento1 paginaPPP in MP TourismPrathap SankarNessuna valutazione finora

- Autonomous, Connected, Electric and Shared VehiclesDocumento52 pagineAutonomous, Connected, Electric and Shared VehiclesAmatek Teekay 特克纳Nessuna valutazione finora

- Excel 2013: Pivot TablesDocumento18 pagineExcel 2013: Pivot TablesKhuda BukshNessuna valutazione finora

- Arrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupDocumento2 pagineArrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupPR.comNessuna valutazione finora

- CCPStatement 1Documento3 pagineCCPStatement 1Kristina WoodNessuna valutazione finora

- GST Invoice: Cdho Jilla Panchayat JunagadhDocumento1 paginaGST Invoice: Cdho Jilla Panchayat JunagadhOmkar DaveNessuna valutazione finora

- Appendix 14 - Instructions - BURSDocumento1 paginaAppendix 14 - Instructions - BURSthessa_starNessuna valutazione finora

- Anna University - B.Tech - BIOTECHNOLOGY Syllabus - GE1451 Total Quality Management 1. IntroductionDocumento79 pagineAnna University - B.Tech - BIOTECHNOLOGY Syllabus - GE1451 Total Quality Management 1. IntroductionSakib ShaikhNessuna valutazione finora

- Purchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousDocumento2 paginePurchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousJosephSousNessuna valutazione finora

- CEO or Head of Sales & MarketingDocumento3 pagineCEO or Head of Sales & Marketingapi-78902079Nessuna valutazione finora

- Axxerion WorkflowDocumento13 pagineAxxerion WorkflowKonrad SzakalNessuna valutazione finora

- Blank Bill of Lading FormDocumento1 paginaBlank Bill of Lading FormRuben UrdanetaNessuna valutazione finora

- $24.5K Paid From Office of Chicago Public School CEO Arne Duncan To Save-A-Life Foundation, 9/6+28/05Documento2 pagine$24.5K Paid From Office of Chicago Public School CEO Arne Duncan To Save-A-Life Foundation, 9/6+28/05deanNessuna valutazione finora