Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Estate Exercise 3

Caricato da

Zer Min SimTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Estate Exercise 3

Caricato da

Zer Min SimCopyright:

Formati disponibili

Pedro and Juana were married in 2016.

On October 2015, Pedro while still single received

through donation from his father Toyota Fortuner valued at Php 1,500,000.00 and with loan

balance of Php500,000.00 which Pedro paid, (at the time of Pedro’s death the car was valued at

Php1,000,00000 ) and a house and lot located in Manila valued at Php 10,000,000.00 with

loan balance of Php I,000,000. ( property was later constituted as Pedro’s family home) and a

lot located in Batangas valued at Php5,000,000.00. Upon marriage of Juana and Pedro, the

spouses acquired two cars valued at Php1,000,000.00 each and three house and lots with

the following value : Php 12,000,000.00 for a condo unit located in Hong Kong ; Php 6,000.000

for Tagaytay used by the parent , brother and sisters of Juana ; Php 2,000,000 in Laguna with

balance on mortgage amounting to Php500,000. They were able to save money in the bank in

the amount of Php10,000,000 pesos. They also bought 100 shares of PLDT at the cost of P

1500 each, valued at P1000 each at the time Pedro died . Pedro also has a life insurance with

Juana as the irrevocable beneficiary in the amount of Php1,000,000 . Pedro died of heart

attack while having nightmare on October 10, 2018. The funeral expense for Pedro was Php

100,000. Pedro left Php200,000 credit card balance which he used to pay the tuition fee of his

nephew and nieces . Pedro made a will donating the Batangas property to the City government

for the construction of a Public School building.

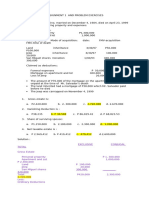

a) Compute the estate tax of Pedro assuming that he is single with all the properties

enumerated

b) Compute the estate that of Pedro as married individual . ( community and conjugal )

As Single

The property Community Exclusive

1 Toyota Fortuner P1,000,000 1,000,000.00

(500k) u.m

2. H&L Manila P10,000,000.00 10,000,000.00

Family Home

(-1m) um

3. Lot Batangas P5,000,000.00 P5,000,000

(donated)

4. 2 Cars ( 1 m each) P2,000,000.00 P2,000,000.00

5 Hong Kong Condo P12,000,000.00 P12,000,000.00

6. Tagaytay property P6,000,000 P6,000,000

7 Laguna Property P2,000,000.00 P2,000,000.00

(500K) um

8 Bank P10,000,000 P10,000,000

9 PLDT share P100,000.00 P100,000.00

Total 48,100,000.0

Deductions

Claim against the estate 200,000.00

Claim against insolvent None

Person

Unpaid Mortgages Php1,500,000.00

1. 1,000,000.00

7. 500,000.00

Taxes None

losses None

Property previously P 258,212.06 P 258,212.06

taxed

Transfer for public use P5,000,000.00 P5,000,000.00

Family Home P10,000,000.00 P10,000,000.00

RA 4917 None none

Standard Deduction P5,000,000.00 P5,000,000.00

Share in the Community/ n/a

Conjugal prop.

Total 21,758,212.06

Vanishing deduction

1m- 500k =500,000

500k/ 41,200,000.0 x 7m= P84,951.45

P500,000 less P84,951.45 = Php 415,048.55

Community

The property Exclusive Community

1 Toyota Fortuner P1,000,000 1,000,000.00

(500k) u.m

2. H&L Manila P10,000,000.00 10,000,000.00

Family Home

(-1m) um

3. Lot Batangas P5,000,000.00 P5,000,000

(donated)

4. 2 Cars ( 1 m each) P2,000,000.00 P2,000,000.00

5 Hong Kong Condo P12,000,000.00 P12,000,000.00

6. Tagaytay property P6,000,000 P6,000,000

7 Laguna Property P2,000,000.00 P2,000,000.00

(500K) um

8 Bank P10,000,000 P10,000,000

9 PLDT share P100,000.00 P100,000.00

Total 48,100,000.0

Deductions

Claim against the estate 200,000.00

Claim against insolvent None

Person

Unpaid Mortgages Php1,500,000.00

1. 1,000,000.00

7. 500,000.00

Taxes None

losses None

Property previously P 273,804.57 P 273,804.57

taxed

Transfer for public use P2,500,000.00 P2,500,000.00

Family Home P5,000,000.00 P5,000,000.00

RA 4917 None none

Standard Deduction P5,000,000.00 P5,000,000.00

Share in the Community/ 46,400,000 / 2 = n/a 23,200,000

Conjugal prop. 23,200,000

Total 21,758,212.06

Gross Estate - Total deductions = ___ x .6

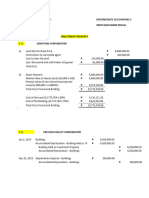

Conjugal

The property Community Exclusive

1 Toyota Fortuner P1,000,000 1,000,000.00

(500k) u.m

2. H&L Manila P10,000,000.00 10,000,000.00

Family Home

(-1m) um

3. Lot Batangas P5,000,000.00 P5,000,000

(donated)

4. 2 Cars ( 1 m each) P2,000,000.00 P2,000,000.00

5 Hong Kong Condo P12,000,000.00 P12,000,000.00

6. Tagaytay property P6,000,000 P6,000,000

7 Laguna Property P2,000,000.00 (500K) P2,000,000.00

um

8 Bank P10,000,000 P10,000,000

9 PLDT share P100,000.00 P100,000.00

Total 35,100,000 48,100,000.0

Deductions

Claim against the estate 200,000 200,000

Claim against insolvent None

Person

Unpaid Mortgages 2. 1,000,000.00 Php1,500,000.00

7. 500,000.00

Taxes None

losses none

Property previously tax P 258,212.06 P 258,212.06

Transfer for public use P5,000,000.00 P5,000,000.00

Family Home P10,000,000.00 P10,000,000.00

RA 4917 none none

Standard Deduction P5,000,000.00 P5,000,000.00

Share in the Community/ 16,700,000.00 16,700,000.00

Conjugal prop.

Total Php 38,608,212.06

(G.E.) 48,100,000 - (Deductions) 38,608,212.06 = 9,441,787.94 X .06 = 566,507.28 ESTATE

TAX

Vanishing deduction

1m- 500k =500,000

500k/ 41,200,000.0 x 7m= P84,951.45

P500,000 less P84,951.45 = Php 415,048.55

Php 35,100,000.00 less Php2,000,000.00/2 = 16,550.00

Casimira died on June 19, 2017 after three weeks of confinement due to an unsuccessful liver

transplant. For her confinement, she had incurred substantial medical expenses that she financed

through personal loans secured by mortgages on her real properties. Her heirs are still in the

process of making an inventory of her assets that can be used to pay the estate taxes, if any, which

are due on December 19, 2017.

(a) Are the medical expenses, personal loans and mortgages incurred by Casimira

deductible from her gross estate? Explain your answer.(5%)

(b) May the heirs of Casimira file the estate tax return and pay the corresponding estate tax

beyond December 19, 2017 without incurring interest and surcharge? Explain your

answer.(3%)

CMI School, Inc., a non-stock, non-profit corporation, donated its three parcels of idle land situated in

the Municipality of Cuyapo, Nueva Ecija to SLC University, another non-stock, non-profit corporation,

in recognition of the latter's contribution to and participation in the spiritual and educational

development of the former.

(a) Is CMI School, Inc. liable for the payment of donor's tax? Explain your answer. (2.5%)

(b) If SLC University later sells the three parcels of idle land to Puregold Supermarket, Inc., a

stock corporation, will SLC University be liable for capital gains tax? Explain your answer.

(3%)

(c) If SLC University donates the three parcels of idle land in favor of the Municipality of

Cuyapo, Nueva Ecija, will SLC University be liable for donor's tax? Explain your answer.

(2.5%)

Potrebbero piacerti anche

- Solutions To Problems: Pe On Estate TaxDocumento11 pagineSolutions To Problems: Pe On Estate TaxErica NicolasuraNessuna valutazione finora

- Tax Return in CanadaDocumento75 pagineTax Return in CanadaAlejandro VelizNessuna valutazione finora

- Compilation of MCQDocumento34 pagineCompilation of MCQDaphnie Bolo100% (1)

- Estate Tax ProblemDocumento2 pagineEstate Tax ProblemClaricel JoyNessuna valutazione finora

- Final and Capital Gains TaxDocumento7 pagineFinal and Capital Gains TaxElla Marie LopezNessuna valutazione finora

- Pe On Estate TaxDocumento25 paginePe On Estate TaxErica NicolasuraNessuna valutazione finora

- Problem 23-1, Page 650 Erica Company: Required: # Debit CreditDocumento14 pagineProblem 23-1, Page 650 Erica Company: Required: # Debit CreditDeanne LumakangNessuna valutazione finora

- HCL PayslipDocumento1 paginaHCL PayslipkrishnaNessuna valutazione finora

- Answer Key TaxDocumento12 pagineAnswer Key TaxLocklaim Cardinoza100% (1)

- Employee Compensation + Payroll DeductionsDocumento14 pagineEmployee Compensation + Payroll Deductionsrommel legaspi25% (4)

- Persons - Republic V de GraciaDocumento1 paginaPersons - Republic V de GraciascfsdNessuna valutazione finora

- Chapter 3 Income Taxation Tabag 2019 Sol ManDocumento21 pagineChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- 1181 - 1190 Pure and Conditional ObligationsDocumento11 pagine1181 - 1190 Pure and Conditional ObligationsscfsdNessuna valutazione finora

- 8.2 Assignment - Regular Income Tax For IndividualsDocumento8 pagine8.2 Assignment - Regular Income Tax For Individualssam imperialNessuna valutazione finora

- Sample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersDocumento8 pagineSample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersRachel Green0% (1)

- Donors Tax Problem 1 With SolutionDocumento4 pagineDonors Tax Problem 1 With SolutionAngel DaohogNessuna valutazione finora

- (PDF) Re Letter of Tony Q Valenciano (Digest) - CompressDocumento3 pagine(PDF) Re Letter of Tony Q Valenciano (Digest) - CompressscfsdNessuna valutazione finora

- Illustration Deduction and Taxable EstateDocumento8 pagineIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNessuna valutazione finora

- Router Invoice PDFDocumento1 paginaRouter Invoice PDFNikhil HatiskarNessuna valutazione finora

- CIR V CA, CTA, YMCADocumento2 pagineCIR V CA, CTA, YMCAChil Belgira100% (3)

- Corporation PDFDocumento28 pagineCorporation PDFJorufel PapasinNessuna valutazione finora

- Xviiib2 - Mapa V SandiganbayanDocumento2 pagineXviiib2 - Mapa V SandiganbayanscfsdNessuna valutazione finora

- Xviiib2 - Mapa V SandiganbayanDocumento2 pagineXviiib2 - Mapa V SandiganbayanscfsdNessuna valutazione finora

- Taxation Cup SeriesDocumento5 pagineTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- MadlangbayanDocumento2 pagineMadlangbayanscfsdNessuna valutazione finora

- Basic Principles of TaxationDocumento33 pagineBasic Principles of TaxationHenicel Diones San Juan100% (1)

- CRIM - People vs. Morilla GR. No. 189833Documento2 pagineCRIM - People vs. Morilla GR. No. 189833scfsd100% (1)

- Accounting For Corporation Reviewer 1 PDFDocumento27 pagineAccounting For Corporation Reviewer 1 PDFKrisha SaltaNessuna valutazione finora

- Property Exclusive Total DeductionsDocumento6 pagineProperty Exclusive Total DeductionsRiann DevereuxNessuna valutazione finora

- Activity 6Documento4 pagineActivity 6Mystic LoverNessuna valutazione finora

- ActivityDocumento4 pagineActivityDom PaciaNessuna valutazione finora

- Answer To Assignment No. 2Documento1 paginaAnswer To Assignment No. 2Sophia Angelica Marie MarasiganNessuna valutazione finora

- Answer: 2,000,000 Solution:: Sample ProblemDocumento17 pagineAnswer: 2,000,000 Solution:: Sample ProblemJohayra AbbasNessuna valutazione finora

- Answers To Assignment 1 and Problem Exercises Taxation2Documento4 pagineAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNessuna valutazione finora

- EXERCISE 4-2. PROBLEMS (De Vera, Jazreel S. BS Accountancy V-B)Documento2 pagineEXERCISE 4-2. PROBLEMS (De Vera, Jazreel S. BS Accountancy V-B)Jazreel de VeraNessuna valutazione finora

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership LiquidationDocumento3 pagineNUDJPIA FAR AND AFAR SOLUTIONS - Partnership LiquidationKyla Artuz Dela CruzNessuna valutazione finora

- Assets 2 PDFDocumento4 pagineAssets 2 PDFMarigold CalendulaNessuna valutazione finora

- Valencia Chap 5 Estate TaxDocumento11 pagineValencia Chap 5 Estate TaxCha DumpyNessuna valutazione finora

- 04 - Task - Performance - 1 (10) BUSTAXDocumento5 pagine04 - Task - Performance - 1 (10) BUSTAXAries Christian S PadillaNessuna valutazione finora

- Bryan Moises PDFDocumento5 pagineBryan Moises PDFMary DenizeNessuna valutazione finora

- Minimum Paidup CapitalDocumento4 pagineMinimum Paidup CapitalBenj OrtizNessuna valutazione finora

- 07 Review 1Documento1 pagina07 Review 1Maricar EgnpNessuna valutazione finora

- Coop Trade Fair Overall Budget3Documento2 pagineCoop Trade Fair Overall Budget3chrisliquiganNessuna valutazione finora

- EncodedDocumento8 pagineEncodedMary Benedict AbraganNessuna valutazione finora

- De Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSADocumento11 pagineDe Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAJohn Francis RosasNessuna valutazione finora

- Question No. 2: Module 6: Discussion 1Documento4 pagineQuestion No. 2: Module 6: Discussion 1Camille BonaguaNessuna valutazione finora

- This Study Resource Was: Problem 1Documento7 pagineThis Study Resource Was: Problem 1?????Nessuna valutazione finora

- Composition of The Gross Estate of A DecedentDocumento16 pagineComposition of The Gross Estate of A DecedentBill BreisNessuna valutazione finora

- Donor's TaxDocumento1 paginaDonor's TaxJan ernie MorillaNessuna valutazione finora

- Midterm Exam IntaxDocumento20 pagineMidterm Exam IntaxJane TuazonNessuna valutazione finora

- Assignment#1Documento9 pagineAssignment#1hae1234Nessuna valutazione finora

- Chapter 20Documento12 pagineChapter 20FireBNessuna valutazione finora

- Solution - Hand Out - Problems 16 and 17Documento14 pagineSolution - Hand Out - Problems 16 and 17Anne Clarisse ConsuntoNessuna valutazione finora

- 2dd3c613 1670283438180Documento8 pagine2dd3c613 1670283438180Kyla Gacula NatividadNessuna valutazione finora

- IRA No. 2 Answer KeyDocumento2 pagineIRA No. 2 Answer KeyProlen AcantoNessuna valutazione finora

- Chapter2aa1sol 2012 PDFDocumento18 pagineChapter2aa1sol 2012 PDFMatt David Kenneth ReyesNessuna valutazione finora

- Explore ACTIVITY 1. Fill Me In: Current AssetsDocumento4 pagineExplore ACTIVITY 1. Fill Me In: Current AssetsCOD CODNessuna valutazione finora

- Installment SalesDocumento6 pagineInstallment SalesJeramae M. artNessuna valutazione finora

- Tandem Activity GE Allowable DeductionsDocumento6 pagineTandem Activity GE Allowable DeductionsErin CruzNessuna valutazione finora

- Gross Estate Activity PDFDocumento5 pagineGross Estate Activity PDFJaypee Verzo SaltaNessuna valutazione finora

- Aec10 - Business Taxation Solution Tabag CH4Documento8 pagineAec10 - Business Taxation Solution Tabag CH4EdeksupligNessuna valutazione finora

- ACCO20093Documento7 pagineACCO20093jfcNessuna valutazione finora

- Taxation Suggested SolutionsDocumento3 pagineTaxation Suggested SolutionsSteven Mark MananguNessuna valutazione finora

- 11170189-Tugas AKL 2 11170189 - Eki AmosDocumento17 pagine11170189-Tugas AKL 2 11170189 - Eki AmosAmouse ManaluNessuna valutazione finora

- Accounting Midterm AssignmentDocumento1 paginaAccounting Midterm AssignmentTRIXIEJOY INIONNessuna valutazione finora

- Illustrations PDFDocumento3 pagineIllustrations PDFCharrey Leigh FormaranNessuna valutazione finora

- Exercise - Vanishing DeductionsDocumento1 paginaExercise - Vanishing DeductionsAndree PereaNessuna valutazione finora

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationDocumento3 pagineNUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationKyla Artuz Dela CruzNessuna valutazione finora

- Chapter 5Documento6 pagineChapter 5Briggs Navarro BaguioNessuna valutazione finora

- M6 - Estate Tax Payable Students'Documento17 pagineM6 - Estate Tax Payable Students'micaella pasionNessuna valutazione finora

- CHP 3 Assignment 1 (Sarte)Documento14 pagineCHP 3 Assignment 1 (Sarte)2080288Nessuna valutazione finora

- Rental Housing: Lessons from International Experience and Policies for Emerging MarketsDa EverandRental Housing: Lessons from International Experience and Policies for Emerging MarketsValutazione: 5 su 5 stelle5/5 (1)

- ConstitutionalLaw1 CaseSummaries IBP Ocampo VinuyaDocumento20 pagineConstitutionalLaw1 CaseSummaries IBP Ocampo VinuyascfsdNessuna valutazione finora

- G.R. No. L-37251 August 31, 1981 CITY OF MANILA and CITY TREASURER, Petitioners-Appellants, Manila and ESSO PHILIPPINES, INC.,Respondents-Appellees. Aquino, J.Documento4 pagineG.R. No. L-37251 August 31, 1981 CITY OF MANILA and CITY TREASURER, Petitioners-Appellants, Manila and ESSO PHILIPPINES, INC.,Respondents-Appellees. Aquino, J.scfsdNessuna valutazione finora

- Palomera, Joshua Carl L. United Haulers Association, Inc., Et Al. vs. Oneida-Herkimer Solid Waste Management Authority, Et Al., 550 U.S. 330Documento3 paginePalomera, Joshua Carl L. United Haulers Association, Inc., Et Al. vs. Oneida-Herkimer Solid Waste Management Authority, Et Al., 550 U.S. 330scfsdNessuna valutazione finora

- Owner StatementDocumento8 pagineOwner StatementJack LeeNessuna valutazione finora

- Bill 05 04 2021Documento2 pagineBill 05 04 2021Marcelo RivellinoNessuna valutazione finora

- Cliffton Valley Price ListDocumento2 pagineCliffton Valley Price Listsishir mandalNessuna valutazione finora

- Dr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillDocumento7 pagineDr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillsyuhadahNessuna valutazione finora

- Taxation Question BankDocumento3 pagineTaxation Question BankRishikesh BhujbalNessuna valutazione finora

- Tax1a Preliminary ExamDocumento7 pagineTax1a Preliminary ExamCharmaine PamintuanNessuna valutazione finora

- GST Management System: A Project Report ONDocumento5 pagineGST Management System: A Project Report ONRohit GadekarNessuna valutazione finora

- Net of Withholding Kailangan Niyo I Gross Up, KayaDocumento7 pagineNet of Withholding Kailangan Niyo I Gross Up, KayaJPNessuna valutazione finora

- Reply For 16Documento1 paginaReply For 16Abhay NandaNessuna valutazione finora

- Sap hr1Documento4 pagineSap hr1zafer nadeemNessuna valutazione finora

- Lumbera LectureDocumento3 pagineLumbera LectureRyeNessuna valutazione finora

- Tax Lecture Gross IncomeDocumento6 pagineTax Lecture Gross IncomeAngelojason De LunaNessuna valutazione finora

- AMEND SEC 27 (C), RA No. 10026Documento4 pagineAMEND SEC 27 (C), RA No. 10026Bing MendozaNessuna valutazione finora

- Gas Taxes in FloridaDocumento9 pagineGas Taxes in FloridaGary DetmanNessuna valutazione finora

- Purchase GST Nagarajan GodownDocumento4 paginePurchase GST Nagarajan GodownsamaadhuNessuna valutazione finora

- 10357670-001 G0061847656Documento5 pagine10357670-001 G0061847656Syed Muhammad Imam100% (1)

- Electricity BillDocumento1 paginaElectricity BillPaul LivesNessuna valutazione finora

- Employee DataDocumento1 paginaEmployee DataDinesh RNessuna valutazione finora

- Crossword MoneyDocumento3 pagineCrossword MoneyÁgnes JassóNessuna valutazione finora

- Ajio FN0334206010 1655992237774Documento1 paginaAjio FN0334206010 1655992237774Deepak RaguNessuna valutazione finora

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDocumento1 paginaBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNessuna valutazione finora

- Asian Paints DCF ValuationDocumento64 pagineAsian Paints DCF Valuationsanket patilNessuna valutazione finora