Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Forecasting Financial Statements: Learning Objectives - Coverage by Question

Caricato da

RF EnggTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Forecasting Financial Statements: Learning Objectives - Coverage by Question

Caricato da

RF EnggCopyright:

Formati disponibili

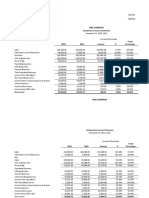

Module 11

Forecasting Financial Statements

Learning Objectives – coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Explain the process of

forecasting financial 1-5 1-3 1 1 1, 2

statements.

LO2 – Forecast revenues and

6-7 4-9 2-11 2-4 3-5

the income statement.

LO3 – Forecast the balance

8-10 10-16 12-17 2-4 5

sheet.

LO4 – Forecast the statement

11, 2 17-21 18-20 5, 6 6

of cash flows.

LO5 – Prepare multiyear

forecasts of financial 13 22 21, 22 7 -

statements.

LO6 – Implement a

parsimonious method for

multiyear forecasting of net 14, 15 23-25 23-25 8-10 7

operating profit and net

operating assets.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-1

Module 11: Forecasting Financial Statements

True/False

Topic: Eliminating Transitory Activities

LO: 1

1. To forecast future performance, we should first create a set of financial statements that reflects items

we expect to persist.

Answer: True

Rationale: Persistent activities are those that will recur – that is the point of forecasting, to predict

what will recur.

Topic: Conservatism versus Optimism

LO: 1

2. When forecasting future events, it is better to take a more conservative view for items such as

revenue growth and profit margins.

Answer: False

Rationale: The best forecasts are the most realistic ones. Being overly conservative can lead to

missed opportunities.

Topic: Bias Resulting from Accruals

LO: 1

3. Accruals can be used to bias financial statements in order to achieve certain reporting objectives.

Answer: True

Rationale: Managers can use accruals to depress current period income by writing off an excessive

amount of assets and accruing an excessive amount of liabilities (big bath). Managers can also

increase current period income by accruing an insufficient allowance for uncollectible accounts, for

example.

Topic: Adjusting Process

LO: 1

4. The adjusting process is useful for historical analysis, but not for prospective analysis.

Answer: False

Rationale: The adjusting process parses the financial statements into operating/nonoperating and

core/transitory components. It is useful for both historical and prospective analysis.

Topic: Order of Projections

LO: 1

5. The usual financial statement projection process is completed in the following order: balance sheet,

income statement, statement of cash flows.

Answer: False

Rationale: The usual projection process begins with the income statement, followed by the balance

sheet, and finished with the statement of cash flows.

©Cambridge Business Publishers, 2015

11-2 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting Revenues

LO: 2

6. An unbiased approach to forecasting future revenues gives equal weight to historical organic revenue

growth and revenue growth from mergers and acquisitions.

Answer: False

Rationale: The most accurate forecast of future revenue is one that considers future organic versus

M&A revenue growth. Historic numbers are informative to the extent that we expect past trends to

continue.

Topic: Projecting Revenues

LO: 2

7. Revenue forecasts derived from unit sales and current prices are usually more accurate than those

derived from dollar sales.

Answer: True

Rationale: Using units and prices allows the forecaster to alter each separately which is a more

dynamic and usually more accurate way to forecast demand and revenue.

Topic: Projections Using Most Current Ratios

LO: 3

8. Projecting balance sheet items is most accurate if we use the most recent ratios.

Answer: False

Rationale: For accurate forecasts, we want to use the most stable and relevant ratios concerning the

company’s financial condition. Sometimes, the most recent ratios are not stable.

Topic: Projecting Property, Plant, and Equipment (PPE)

LO: 3

9. To forecast property, plant, and equipment (PPE) we first determine capital expenditures (CAPEX)

and add that to historical PPE.

Answer: True

Rationale: We do not forecast disposals unless the MD&A specifically mentions them.

Topic: Projection of Cash

LO: 3

10. The forecasting process assumes that the cash on the balance sheet reflects an economically

appropriate balance that we forecast similarly for the next fiscal year.

Answer: True

Rationale: Our forecasting process is to forecast a cash balance and adjust the level of investment

securities or short-term debt to balance the balance sheet.

Topic: Projected Cash Flow Statement

LO: 4

11. The forecasted statement of cash flows uses either the forecasted income statement or the balance

sheet.

Answer: False

Rationale: The statement of cash flow uses both to explain the change in cash on the balance sheet.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-3

Topic: Depreciation Expense on the Statement of Cash Flows

LO: 4

12. Depreciation expense, determined as a percentage of actual property, plant, and equipment, is added

back to net income in the operating cash flow section.

Answer: True

Rationale: Depreciation is a noncash expense that does not affect cash.

Topic: Multiyear Forecast

LO: 5

13. The drawback of a multiyear forecast is that the same revenue growth assumption must be used for

each year and this may not be the most accurate assessment of future revenue growth especially for

firms that have not yet reached maturity.

Answer: False

Rationale: Assumptions may vary for each year’s forecast.

Topic: Parsimonious Method of Projection

LO: 6

14. The parsimonious projection method relies on sales growth, net operating profit margin (NOPM), and

asset turnover (AT) to project net operating profit after tax and net operating assets.

Answer: False

Rationale: The parsimonious projection method relies on net operating asset turnover (NOAT) and

not total asset turnover (AT).

Topic: Projecting Property Plant and Equipment with Parsimonious Method

LO: 6

15. The parsimonious projection method is the more efficient method for projecting property, plant and

equipment.

Answer: False

Rationale: The parsimonious projection method does not project individual income statement and

balance sheet items; it is used to project net operating profit (NOPAT) and net operating assets

(NOA).

©Cambridge Business Publishers, 2015

11-4 Financial & Managerial Accounting for MBAs, 4th Edition

Multiple Choice

Topic: Adjusting Operating Cash Flows

LO: 1

1. Which of the following should an analyst consider moving out of operating cash flows for analysis

purposes?

A) Decreases in accounts payable

B) Decreases in accounts receivable from securitization

C) Increases in inventory

D) Increases in environmental liabilities

E) None of the above

Answer: B

Rationale: Companies often securitize (sell-off) their account receivables which removes the

receivables from the balance sheet, resulting in an increase in operating cash flows. Many analysts

consider this to be a financing, not an operating, activity.

Topic: Adjusting the Income Statement

LO: 1

2. Which of the following is not a typical adjustment made to the income statement for projection

purposes?

A) Adjusting net income for perceived under- or over-accruals

B) Adjusting revenues to only include organic revenue growth

C) Separating operating and non-operating items

D) Removing transitory items such as restructuring charges

E) None of the above

Answer: B

Rationale: Distinguishing between organic and acquired income is important because acquired

growth is expensive. However, the acquired income should be considered for projection purposes as

long as the expenditures to acquire that income are included in the projections.

Topic: Adjusting the Balance Sheet

LO: 1

3. What adjustments might you consider making to the balance sheet before you began the forecasting

process?

A) Capitalization of operating leases

B) Consolidation of equity method investments

C) Elimination of impaired goodwill not recognized yet by the company

D) All of the above

Answer: D

Rationale: All of these adjustments are legitimate, helpful adjustments.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-5

Topic: Projecting Revenue (Numerical calculations required)

LO: 2

4. Leahy Enterprises reports 2013 and 2014 total revenues of $80 million and $92 million respectively. If

we expect prior growth to persist, we would forecast a revenue growth rate of:

A) 15%

B) 35%

C) 20%

D) 25%

E) None of the above

Answer: A

Rationale: ($92 / $80) – 1 = 0.15 = 15%

Topic: Projecting Revenue (Numerical calculations required)

LO: 2

5. Following are financial statement numbers and ratios for Snap-On Incorporated for the year ended

December 28, 2013 (in millions). If we expected revenue growth of 4% in the next year, what would

projected revenue be for the year ended December 30, 2014?

NOPAT 397.3

NOA 2,884.6

Net operating profit margin (NOPM) 13.0%

Net operating asset turnover (NOAT) 1.06

A) $3,281.9 million

B) $3,455.0 million

C) $3,057.7 million

D) $3,178.4 million

E) None of the above

Answer: D

Rationale: $397.3 million / 13.0% = $3,056.1 million in revenue for 2013. 2014 projected revenue

would be $3,056.2 million x 1.04 = $3,178.4 million

Topic: Projecting Revenue (Numerical calculations required)

LO: 2

6. Following are financial statement numbers and ratios for Lockheed Martin Corp. for the year ended

December 31, 2013. If we expected revenue growth of 2.25% in the next year, what would projected

revenue be for 2014?

Total revenue (in millions) $45,358

Net operating profit margin (NOPM) 6.3%

Net operating asset turnover (NOAT) 5.4

A) $46,378.6 million

B) $48,215.6 million

C) $47,807.3 million

D) $55,563.6 million

E) None of the above

Answer: A

Rationale: $45,358 million × 1.0225 = $46,378.6 million

©Cambridge Business Publishers, 2015

11-6 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projected COGS (Numerical calculations required)

LO: 2

7. McKinnon Inc. reports in its 2013 annual report 10-K, sales of $2,045 million and cost of goods sold of

$818 million. For next year, you project that sales will grow by 5% and that cost of goods sold

percentage will be 2 percentage points higher.

Projected cost of goods sold for 2014 will be:

A) $834 million

B) $902 million

C) $859 million

D) $861 million

E) There is not enough information to determine the amount.

Answer: B

Rationale: $2,045 million ×1.05 × (($818 / $2,045) + 2%) = $902 million

Topic: Projected Interest Expense (Numerical calculations required)

LO: 2

8. Mullen Company reports in its 2014 10-K, sales of $83 million, long-term debt of $9 million, and

interest expense of $720,000. If sales are projected to increase by 5.2% next year, projected interest

expense for 2014 will be:

A) $757,440

B) $468,000

C) $662,400

D) $720,000

E) None of the above

Answer: D

Rationale: The most common approach to non-operating expenses is to assume that they do not

change from year to year.

Topic: Projected Tax Expense (Numerical calculations required)

LO: 2

9. Howell, Inc., reports 2014 sales of $202 million, income before income taxes of $51.2 million and tax

expense of $9.10 million. If sales are projected to increase by 3.8% next year, projected tax expense

for 2014 will be:

A) $ 9.10 million

B) $ 9.68 million

C) $11.05 million

D) $ 9.45 million

E) There is not enough information to determine the amount.

Answer: E

Rationale: The tax expense will be a function of forecasted pre-tax income. Knowing the sales growth

rate is insufficient to determine pre-tax income because certain expenses may remain unchanged

from prior dollar levels.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-7

Topic: Implication of Projected Short-Term Investments

LO: 3

10. When forecasting balance sheet financials, an unusually high projected short-term investment

balance suggests which of the following?

A) Sales are projected to increase in coming years.

B) The company will need to sell additional stock.

C) The company could pay off debt in the next year.

D) Account receivables have dipped to an unacceptable level.

E) None of the above

Answer: C

Rationale: If initial balance sheet projection produces a high amount of short-term investments, the

company may decrease short or long-term debt if it exists.

Topic: Projected PPE Based on Forecasted Sales (Numerical calculations required)

LO: 3

11. CVS Caremark reported sales of $126,761 million and property, plant and equipment (PPE), net of

$8,615 million in 2013. If sales are projected to increase 10% per year over the next five years, what

is the projected capital expenditures (purchases of new PPE) for 2014?

A) $ 8,615 million

B) $ 9,477 million

C) $12,676 million

D) $ 9,000 million

E) There is not enough information to determine the amount.

Answer: E

Rationale: We do not know the proportion of 2013 sales spent on CAPEX that year, so we are unable

to determine the 2014 CAPEX.

Topic: Projected Accounts Receivable (Numerical calculations required)

LO: 3

12. The 2013 financial statements of CVS Caremark reported sales of $126,761 million and accounts

receivable of $8,729 million. If sales are projected to increase 3% next year, what is the projected

accounts receivable balance for 2014?

A) $12,532 million

B) $ 9,009 million

C) $10,928 million

D) $ 9,139 million

E) $ 8,729 million

Answer: B

Rationale: $8,729 / $126,761 = 6.9%.

$126,761 million × 1.03 = $130,564 million x 6.9% = $9,009 million

©Cambridge Business Publishers, 2015

11-8 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projected Marketable Securities (Numerical calculations required)

LO: 3

13. Jensen and Associates has a projected balance sheet that includes the following accounts. What is

the projected marketable securities balance?

Cash $ 225,000

Marketable securities ?

Accounts receivable 680,000

Inventory 940,000

Non-current assets, net 1,420,000

Current liabilities 375,000

Total liabilities 1,060,000

Total equity 2,985,000

A) $0

B) $1,565,000

C) $780,000

D) $1,155,000

E) None of the above

Answer: C

Rationale: $780,000. Marketable securities is calculated as a plug value by subtracting assets from

projected total assets. Total assets equals total liabilities and equity.

Topic: Projected Marketable Securities (Numerical calculations required)

LO: 3

14. Lexington Company has a projected balance sheet that includes the following accounts. What is the

projected marketable securities balance?

Cash $ 110,000

Marketable securities ?

Accounts receivable 950,000

Inventory 875,000

Non-current assets, net 1,650,000

Total liabilities 1,525,000

Total equity 2,300,000

A) $0

B) $775,000

C) $650,000

D) $240,000

E) None of the above

Answer: D

Rationale: $240,000. Marketable securities is calculated as a plug value by subtracting assets from

projected total assets. Total assets equals total liabilities and equity.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-9

Topic: Interpreting Forecasted Balance Sheet

LO: 3

15. When projecting the balance sheet, what happens when the initial balance sheet yields estimated

total assets greater than the sum of total liabilities and equity?

A) The company will need additional financing from external sources.

B) The company will not be able to pay for expenses in the future.

C) The company projected a loss.

D) The company has negative stockholders’ equity.

E) None of the above

Answer: A

Rationale: The company will need additional financing from debt or equity providers in the future in

order to support company growth.

Topic: Projecting Nonoperating Assets

LO: 3

16. Which of the following is a common method for forecasting nonoperating assets?

A) Use prior-year common-sized balance sheet ratio

B) Apply forecasted sales growth rate to historic balance

C) Assume no change in the account balance

D) Plug the amount based on other balance sheet accounts

E) None of the above

Answer: C

Rationale: Unless operating assets are very significant and the company’s 10-K discusses anticipated

changes, the most common procedure is to assume nonoperating assets do not change.

Topic: Forecasting CAPEX (Numerical calculations required)

LO: 4

17. In its 2014 annual report, Manchester Corp. reports the following:

2014 2013

Total revenue $320,000 $270,000

Property, plant, equipment, gross 25,000 21,000

Asset disposals 0 0

If revenue is projected to increase by 10% in 2015, projected 2015 capital expenditures would be:

A) $4,440

B) $4,000

C) $4,400

D) $0

E) None of the above

Answer: C

Rationale: 2014 CAPEX = 2014 PPE – 2013 PPE = $4,000 because there are no asset disposals.

Historical CAPEX rate = 2014 CAPEX / 2014 sales = 1.25%. Forecasted CAPEX = 2015 forecasted

revenue × 1.25% = $4,400

©Cambridge Business Publishers, 2015

11-10 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting Operating Cash Flows

LO: 4

18. When projecting the statement of cash flows, the following represent operating cash outflows (check

all that apply):

A) Decrease in accounts receivable.

B) Increase in inventory

C) Decrease in long-term debt

D) Increase in accounts payable

E) Increase in property, plant, and equipment

Answer: B and C

Rationale: A projected increase in current assets or a decrease in current liabilities results in a

projected cash outflow. Acquiring PPE is not an operating cash flow.

Topic: Projected Depreciation Expense

LO: 4

19. Which of the following describes the analytic process to determine the depreciation expense included

in the forecasted statement of cash flows?

A) Depreciation is a non-cash expense, thus it is not included in the statement of cash flows.

B) The year-over-year change in property, plant and equipment on the balance sheet is equal to

depreciation expense.

C) Property, plant, and equipment from the prior year multiplied by depreciation rate reported in the

footnotes.

D) Gross property, plant, and equipment from the prior year + Capital expenditures – Forecasted

gross property, plant, and equipment

E) None of the above

Answer: E

Rationale: Depreciation expense is calculated from historical average depreciation expense, not the

footnoted rates.

Topic: Forecasting Depreciation Expense (Numerical calculations required)

LO: 4

20. In its 2014 annual report, Savannah Company reports the following (in thousands):

2014 2013

Total revenue $53,950 $50,745

Property, plant, equipment, gross 12,200 11,800

Property, plant, equipment, net 7,250 6,950

Depreciation expense 413 381

If revenue growth is projected to be 4.8%, the 2015 forecasted depreciation expense to be added

back on the statement of cash flows is:

A) $433 thousand

B) $427 thousand

C) $413 thousand

D) $519 thousand

E) None of the above

Answer: B

Rationale: Historical depreciation rate = $413 thousand (2014 depreciation expense) / $11,800

thousand (PPE, gross at end of 2013) = 3.50%. Depreciation expense is forecasted as PPE: $12,200

thousand (gross at end of 2014) × 3.50% = $427 thousand.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-11

Topic: Projected Dividends (Numerical calculations required)

LO: 4

21. In its 2013 annual report, Lockheed Martin reported net earnings of $2,981 million and dividends paid

of $1,540 million. Your forecast of net income for Lockheed Martin for 2014 is $3,130 million.

What are projected dividends for the company for 2014?

A) $1,617 million

B) $1,540 million

C) $1,467 million

D) $1,000 million

E) None of the above

Answer: A

Rationale: $3,130 million × ($1,540 million / $2,981 million) = $1,617 million

Topic: Multiyear Forecasts (Numerical calculations required)

LO: 5

22. In its 2014 annual report, Teller Company reported sales of $900 million. If you anticipate that sales

will grow by 7% each year for the foreseeable future, what will 2017 forecasted sales be?

A) $1,102.5 million

B) $ 963.0 million

C) $1,030.4 million

D) $1,179.7 million

E) None of the above

Answer: A

Rationale: 2014 Sales × (1.07)3 = $1,102.5 million

Topic: Parsimonious Multiyear Forecasts

LO: 6

23. Which of the following variables is/are not required input(s) for parsimonious multiyear forecasting?

A) Net operating asset turnover (NOAT)

B) Net operating profits after tax (NOPAT)

C) Sales growth

D) Net operating assets (NOA)

E) Both B and D

Answer: E

Rationale: NOPAT and NOA are what parsimonious multiyear forecasting method predicts. The

required inputs are sales growth, net operating asset turnover (NOAT), and net operating profit

margin (NOPM). When we know all three, we can predict NOPAT and NOA.

©Cambridge Business Publishers, 2015

11-12 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting NOPAT (Numerical calculations required)

LO: 6

24. Following are financial statement numbers and ratios for CVS Caremark for the year ended

December 31, 2013. If we anticipate a 4% sales growth in 2014, what is the company’s projected net

operating profit after tax (NOPAT) for 2014?

2013

Total revenue (in millions) $126,761

Net operating profit margin (NOPM) 3.9%

Net operating asset turnover (NOAT) 2.7

A) $ 4,944 million

B) $ 5,141 million

C) $46,949 million

D) $48,826 million

E) None of the above

Answer: B

Rationale: $126,761 million × 1.04 × 0.039 = $5,141 million

Topic: Projecting NOA (Numerical calculations required)

LO: 6

25. Following are financial statement numbers and ratios for CVS Caremark for the year ended

December 31, 2013. If we anticipate a 4% sales growth in 2014, what is the company’s projected net

operating assets (NOA) for 2014?

2013

Total revenue (in millions) $126,761

Net operating profit margin (NOPM) 3.9%

Net operating asset turnover (NOAT) 2.7

A) $ 4,944 million

B) $ 5,141 million

C) $46,949 million

D) $48,826 million

E) None of the above

Answer: D

Rationale: $126,761 million × 1.04 / 2.7 = $48,826 million

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-13

Exercises

Topic: Forecasting Process

LO: 1

1. Briefly describe how analysts typically forecast each of the following items: Sales, Cost of Sales,

Inventory, and Tax expense.

Answer:

Sales are forecast as prior-year sales increased by the expected sales growth for the coming year.

We typically forecast cost of sales to be the same percentage as the prior year. Forecasted cost of

sales is forecasted sales multiplied by the prior-year cost of sales percentage. Inventory is typically

forecast as a constant percentage of sales. Tax expense is forecast using forecasted pretax income

and the same effective tax rate as in prior years.

Topic: Estimating Sales Growth Rate

LO: 2

2. Everett’s Enterprises reported the following income statement data for 2010-2014. What would be an

appropriate sales growth rate based on the historical data?

2014 2013 2012 2011 2010

Net Sales $1,023.5 $1,049.1 $1,079.2 $1,063.4 $1,085.7

Answer:

Net sales have been consistently declining. The sales growth rate from 2010 to 2011 was –2.1%,

from 2011 to 2012 was 1.5%, for 2012 to 2013 it was -2.8%, for 2013 to 2014 it was –2.4%. An

appropriate sales growth rate would be –2.4%, the rate from 2013 - 2014 or –1.5%, the average of

the four figures.

Topic: Projecting Revenue

LO: 2

3. Inverness Industries reported net revenues of $25,153 million and $23,985 million for fiscal years

2014 and 2013 respectively. The company reported a gross profit margin of 44.5% in 2014. Project

sales and cost of goods sold for Inverness Industries for 2015.

Answer:

Estimated growth rate = ($25,153 / $23,985) - 1 = 1.049 - 1= 4.9%.

2015 Sales = $25,153 ×1.049 = $26,385 million

2015 Cost of goods sold = $26,385 × (1 - 44.5%) = $14,644 million

©Cambridge Business Publishers, 2015

11-14 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Revenue Growth Across Segments

LO: 2

4. Intuit Inc. reports the following revenues for the fiscal year ended July 31, 2011 through 2013.

In millions 2013 2012 2011

Net revenue:

Product $ 1,515 $ 1,479 $ 1,480

Service and other 2,656 2,329 1,969

Total net revenue $4,171 $3,808 $3,449

a. What is Intuit’s total net revenue growth during 2013?

b. Compare the growth rates for Product versus Service revenues in 2013.

c. How would these growth rates affect your projection of Intuit’s 2014 income statement?

Answer:

a. Total net revenue grew by 9.53% calculated as follows:

($4,171 / $3,808) – 1 = 0.0953 = 9.53%

b. The different types of revenue grew at different rates, as follows:

Product 2.43%

Service 14.04%

c. The 2014 and onward revenues could be separately projected and costs more closely projected to

match the growth in each related revenue. For example, costs and expenses associated with

Product could grow approximately 2.4%, whereas those associated with Service and other could

be projected to grow at 14.0%.

Topic: Organic versus Acquired Revenue Growth

LO: 2

5. Kohl’s Corp. lists the following table in its 2012 Annual Report:

In millions 2012 2011 2010

Net sales $19,279 $18,804 $18,391

Number of stores open at end of period 1,146 1,127 1,089

Sales growth:

All stores 2.5% 2.2% 7.1%

Comparable stores 0.3% 0.5% 4.4%

Net sales per selling square foot $213 $220 $222

a. What is Kohl’s total sales growth in 2012?

b. What is Kohl’s organic sales growth?

c. How does this information impact your assessment of Kohl’s revenue growth and profitability?

Answer:

a. In 2012, Kohl’s experienced a 2.5% increase in total sales.

b. The 2012 data show comparable store sales, organic growth, increased by an average of 0.3%.

c. Because sales growth at new stores impacted the overall growth so significantly, an analyst may

question Kohl’s ability to generate new sales from its existing stores, i.e. grow sales organically.

This is a concern because acquired growth is often more expensive than organic growth.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-15

Topic: Estimating Tax Rate

LO: 2

6. Fuller Inc. reported the following income statement data for 2010-2014. What would be an

appropriate tax rate for forecasting 2015 financial statements?

($ in millions) 2014 2013 2012 2011 2010

Combined federal and state

statutory tax rate 37.1% 36.9% 36.2% 37.0% 36.7%

Pretax income $2,850 $2,640 $2,700 $2,245 $2,526

Tax provision $923 $551 $878 $725 $810

Answer:

($ in millions) 2014 2013 2012 2011 2010

Pretax income $2,850 $2,640 $2,700 $2,245 $2,526

Tax provision 923 $551 $878 $725 $810

Average tax rate 32.4% 20.9% 32.5% 32.3% 32.1%

An appropriate tax rate would be 32.3%. This is the company’s long-term average tax rate if we

ignore 2013. In 2013, the tax provision is comparatively low (20.9%) which is likely due to a one-time

item. The statutory rate is not appropriate because the company has not recorded taxes at that rate in

the past 5 years. More information from the tax footnote would help refine the tax rate to be used to

project 2015 financial information.

Topic: Projecting Gross Profit

LO: 2

7. CVS Caremark Corporation reported 2013 net sales of $126,761 million and cost of revenues of

$102,978 million. Project the company’s 2014 gross profit assuming a 3% sales-growth rate.

Answer:

2013 gross profit margin = 1 - ($102,978 / $126,761) = 18.8%.

2014 forecasted sales = $126,761 million × 1.03 = $130,564 million

2014 forecasted gross profit = $130,564 million × 0.188 = $24,546 million

Topic: Projecting Gross Profit

LO: 2

8. Cambridge Company reported 2014 net sales of $1,086,550 and a gross profit margin (in percentage

terms) of 28%. The company anticipates that sales will decrease by 2% in 2015 but that the gross profit

margin will be the same as 2014. Project the company’s 2015 cost of sales.

Answer:

2015 forecasted sales = $1,086,550 × 98% = $1,064,819

2015 forecasted cost of sales = $1,064,819 × (1 – 28%) = $766,670

©Cambridge Business Publishers, 2015

11-16 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting an Income Statement

LO: 2

9. Barrington Inc. reported the following 2014 income statement (in millions):

Sales $825.3

Cost of goods sold 570.7

Gross profit 254.6

Selling, general and administrative 202.2

R&D expenses 20.3

Other expenses, net 12.6

Operating profit 19.5

Interest expense 27.9

Loss before taxes ($8.4)

Project the 2015 income statement for Barrington Inc. assuming a 3% decrease in net sales and a

continuation of the 2014 gross profit margin and percentage relation to net sales for each of the other

expenses except for interest expense which will remain the same.

Answer:

Projected

($ in millions) Calculation 2015

Sales $825.3 × 0.97 $800.5

Cost of goods sold $800.5 × 0.692 553.9

Gross profit 246.6

Selling, general and administrative $800.5 × 0.245 196.1

R&D expenses $800.5 × 0.025 20.0

Other expenses, net $800.5 × 0.015 12.0

Operating profit 18.5

Interest expense No change 27.9

Loss before taxes ($9.4)

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-17

Topic: Projecting an Income Statement

LO: 2

10. Arrow Inc. reported the following 2014 income statement

Total revenue $6,400,250

Cost of revenue 2,980,300

Gross profit 3,419,950

Selling and administrative expenses 1,875,200

Operating income 1,544,750

Interest expense 263,900

Income before income taxes 1,280,850

Income tax expense 473,915

Net income $ 806,935

Project Arrow’s income statement assuming a 4% increase in sales, a 37% effective tax rate, and a

continuation of the 2014 percentage relation to net sales for expenses except for interest where the

company projects no change.

Answer:

Computation 2015

Total revenue $6,400,250 × 1.04 $6,656,260

Cost of revenue 46.6% 3,101,817

Gross profit 3,554,443

Selling and administrative expenses 29.3% 1,950,284

Operating income 1,604,159

Interest expense No change 263,900

Income before income taxes 1,340,259

Income tax expense 37% 495,896

Net income $844,363

Topic: Projecting an Income Statement

LO: 2

11. Sharp Inc. reported the following 2014 income statement ($ thousands):

2014

Total Revenue $100,640

Cost of Revenue 43,285

Gross Profit 57,355

Selling, General and Administrative Expenses 20,205

Other Expenses 6,870

Operating Income $ 30,280

Project 2015 operating income assuming a 2% decrease in sales. Assume that the 2014 percentage

relation of expenses to total revenue continue to hold in 2015.

Answer:

($ thousands) Computation 2015

Total Revenue $100,640 × 0.98 $98,627

Cost of Revenue $98,627 × 43.0% 42,410

Gross Profit 56,217

Selling, General and

Administrative Expenses $98,627 × 20.0% 19,725

Other Expenses $98,627 × 6.8% 6,707

Operating Income $ 29,785

©Cambridge Business Publishers, 2015

11-18 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting Balance Sheet Items

LO: 3

12. Lockheed Martin’s 2013 financial statements include the following:

(millions) 2013 2012

Sales $45,358 $47,182

Accounts receivable 5,834 6,563

Inventory 2,977 2,937

Accounts payable 1,397 2,038

Project accounts receivable, inventory, and accounts payable for 2014 given that sales are expected

to grow by 2% in 2014.

Answer:

Projected 2014 sales: $45,358 million x 1.02 = $46,265 million

Accounts receivable: 2014: $46,265 million × 0.129 = $5,968 million

Inventory: $46,265 million × 0.066 = $3,053 million

Accounts payable: $46,265 million × 0.031 = $1,434 million

Topic: Projecting Balance Sheet Items

LO: 3

13. Snap-On Corp 2013 financial statements include the following:

(millions) 2013 2012

Sales 3,056.5 2,937.9

Accounts receivable 531.6 497.9

Inventory 434.4 404.2

Accounts payable 155.6 142.5

Project accounts receivable, inventory, and accounts payable for 2014 given that sales are expected

to grow by 4% in 2014.

Answer:

Projected 2014 sales: $3,056.5 million x 1.04 = $3,178.8 million

Accounts receivable: 2014: $3,178.8 million × 0.174 = $553.1 million

Inventory: $3,178.8 million × 0.142= $451.4 million

Accounts payable: $3,178.8 million × 0.051 = $162.1 million

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-19

Topic: Projecting Inventories

Note to Instructor: This problem requires students to use an inventory turnover rate to project

inventory.

LO: 3

14. Marcus Industries reports the following information.

2014 Inventory turnover rate 6.80

2015 Projected net sales $52,850

2015 Projected cost of goods sold $30,800

Sales growth during 2014 12%

a. What did Marcus Industries report as Inventory in 2014?

b. Forecast Inventory for the company for 2015.

Answer:

a. 2014 cost of goods sold = $30,800 / 1.12 = $27,500 / 6.80 = 2014 Inventory = $4,044

b. Projected Inventory = Projected Cost of Goods Sold / Inventory Turnover rate = $30,800 / 6.80

= $4,529

Topic: Projecting Property and Equipment

LO: 3

15. Lockheed Martin Corporation reports property, plant and equipment, gross of $12,645 million in 2013

and $12,116 million in 2012. Sales revenue in 2013 was $45,358 million and capital expenditures

were $836 million.

a. Project 2014 capital expenditures (CAPEX) for property, plant and equipment assuming sales are

forecasted to grow at 5%.

b. What will be the forecasted amount for property, plant and equipment, gross, at the end of 2014?

c. What may be a more refined approach to projecting long-term assets?

Answer:

a. Projected CAPEX for 2014 = ($836 million / $45,358 million) = 1.8%;

($45,358 million x 1.05) = $47,626; $47,626 x 1.8% = $857 million

b. PPE 2013 + CAPEX for 2014 = PPE 2014

= $12,645 million + $857 million = $13,502 million

c. It is important to consider the components of property, plant and equipment and to separately

project CAPEX for each component. Also, we could refine our projections by identifying and

excluding any nonoperating assets. A company may hold property that is not being used for its

ongoing operations but rather for investment purposes (or any other purpose).

©Cambridge Business Publishers, 2015

11-20 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projected Marketable Securities

LO: 3

16. Foster Inc. has a projected balance sheet that includes the following accounts. What is the projected

marketable securities balance?

Cash $ 275,000

Marketable securities ??

Accounts receivable 440,000

Inventory 720,000

Non-current assets, net 1,250,000

Current liabilities 285,000

Total liabilities 900,000

Total equity 2,450,000

Answer:

$665,000: Marketable securities is calculated as a plug value by subtracting all other assets from

projected total assets. Total assets equals total liabilities and equity.

Topic: Projected Marketable Securities

LO: 3

17. Fey Corporation has a projected balance sheet that includes the following accounts. What is the

company’s projected marketable securities balance?

Cash 85,000

Marketable securities ?

Accounts receivable 520,000

Inventory 450,000

Non-current assets, net 1,100,000

Total liabilities 800,000

Total equity 1,850,000

Answer:

$495,000: Marketable securities is calculated as a plug value by subtracting all other assets from

projected total assets. Total assets equals total liabilities and equity.

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-21

Topic: Projecting Investing Cash Flow

LO: 4

18. Ventura Inc. anticipates that sales in 2015 will grow by 6%. The company reports the following in its

December 2014 financial statements:

Sales $95,362.8

Property plant and equipment, Dec. 31, 2014 $9,016.1

Property plant and equipment, Dec. 31, 2013 $6,741.7

2014 Depreciation expense / Property plant and

equipment, Dec. 31, 2013 7.6%

2014 Capital expenditures / 2014 Sales 1.8%

Project the company’s 2015 Sales, depreciation expense, and cash outflow to acquire new Property,

plant and equipment.

Answer:

Computation 2015 Projected

Sales $95,362.8 × 1.06 $101,084.6

Depreciation expense $9,016.1 × 7.6% $685.2

Cash for new PPE acquisitions $101,084.6 × 1.8% $1,819.5

Topic: Projecting Investing Cash Flow

LO: 4

19. Innovative Components reports gross property and equipment of $24 million in 2014 and $21 million

in 2013. Sales revenue in 2014 was $187.5 million. 2014 capital expenditures were $3 million.

a. Project 2015 capital expenditures (CAPEX) for property and equipment assuming sales are

forecasted to grow at 10%.

b. What will be the forecasted amount for property and equipment, gross, at the end of 2015?

c. What may be a more refined approach to projecting long-term assets?

Answer:

a. Projected CAPEX for 2015 = $187.5 million x 1.05 = $206.3 million 2015 sales; CAPEX 2014 /

Sales 2014 = 1.6%; $206.3 x 1.6% = $3.3 million

b. PPE 2014 + CAPEX for 2015 = PPE 2015 = $27.3 million

c. It is important to consider the components of the Property and equipment and to identify and

exclude any nonoperating assets. A company may hold property that is not being used for its

ongoing operations but rather for investment purposes (or any other purpose).

©Cambridge Business Publishers, 2015

11-22 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting Dividends in the Statement of Cash Flows

LO: 4

20. Lockheed Martin Corp. reports the following in its 2013 financial statements (in millions):

2013 2012

Sales $43,358 $47,182

Net earnings 2,981 2,745

Dividends paid 1,540 1,352

a. If you project sales for 2014 of $44,225 million and net earnings for 2014 of $3,140 million, what

dividends would you include in the projected 2014 statement of cash flows?

b. Explain where dividends would appear in the projected 2014 statement of cash flows.

Answer:

a. 2014 Net earnings × (2013 dividends / 2013 net earnings) = $1,622 million

b. Dividends are an outflow of cash reported in the financing activities section of the statement of

cash flows.

Topic: Multiyear Forecasts

LO: 5

21. Finley Corp. reports the following in its 2014 financial statements (in thousands):

Sales $38,080

Net income 4,170

Dividends paid 556

Retained earnings 14,210

Sales and net income are forecasted to grow by 5% per year.

a. What will forecasted sales be in 2015 and 2016?

b. Determine the balance in retained earnings at the end of 2015 and 2016 assuming forecasted net

income is $4,740 thousand for 2015 and $5,055 thousand for 2016.

Answer:

a. 2015: $39,984 thousand; 2016: $41,983 thousand

b. 2015: $14,210 + $4,740 – [$4,740 x ($556 / $4,170) = $18,318 thousand

2016: $18,318 + $5,055 – [$5,055 x ($556 / $4,170) = $22,699 thousand

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-23

Topic: Multiyear Forecasts

LO: 5

22. Belvidere Inc. reports the following in its 2014 financial statements (in millions):

Sales 5,045.4

Net income 627.5

Dividends paid 125.5

Retained earnings 9,284.3

Sales and net income are forecasted to grow by 6% per year for the next few years.

a. What will forecasted sales be in 2015 and 2016?

b. Determine the balance in retained earnings at the end of 2015 and 2016 assuming forecasted net

income is $702.3 million for 2015 and $758.2 million for 2016.

Answer:

a. 2015: $5,348.1 million; 2016: $5,669.0 million

b. 2015: $9,284.3 + $702.3 – [$702.3 x ($125.5 / $627.5) = $9,846.1 million

2016: $9,846.1 + $758.2 – [$758.2 x ($125.5 / $627.5) = $10,452.7 million

Topic: Projecting NOPAT (Numerical calculations required)

LO: 6

23. Following are financial statement numbers and ratios for Jordan Corp. for the year ended December

31, 2014 (in thousands). What is the company’s projected net operating profit after tax (NOPAT) for

2014 and 2015?

Total revenue (thousands) $175,852.3

Total revenue growth rate 2%

Net operating profit margin (NOPM) 13%

Net operating asset turnover (NOAT) 1.2

Answer:

2014: $175,852.3 thousand × 0.13 = $22,861 thousand

2015: $175,852.3 thousand × 1.02 × 0.13 = $23,318 thousand

Topic: Projecting NOPAT (Numerical calculations required)

LO: 6

24. Following are financial statement numbers and ratios for CVS Caremark for the year ended

December 31, 2013. What is the company’s projected net operating profit after tax (NOPAT) for

2014?

Total revenue (in millions) $126,761

Total revenue growth rate 8%

Net operating profit margin (NOPM) 3.9%

Net operating asset turnover (NOAT) 2.7

Answer:

$126,761 million × 1.08 × 0.039 = $5,339 million

©Cambridge Business Publishers, 2015

11-24 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting Net Operating Assets (NOA)

LO: 6

25. Following are financial statement numbers and ratios for CVS Caremark for the year ended

December 31, 2013. What is the company’s projected net operating assets (NOA) for 2014?

Total revenue $126,761

Total revenue growth rate 8%

Net operating profit margin (NOPM) 3.9%

Net operating asset turnover (NOAT) 2.7

Answer:

$126,761 × 1.08 / 2.7 = $50,704

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-25

Problems

Topic: Adjusting the Income Statement

LO: 1

1. Madison Inc. reported the following 2014 income statement (in millions):

Madison Inc.

Income statement for the year ended September 30, 2014

Sales $184,450

Cost of goods sold 95,584

Gross profit 88,866

Selling, general and administrative 40,030

Research and development expenses 10,132

Restructuring charge 2,852

Litigation settlement 12,500

Pension curtailment gain (340)

Other expenses, net 7,802

Total expenses 72,976

Operating profit 15,890

Interest expense 6,092

Gain on sale of long-term investments (3,257)

Income before taxes 13,055

Provision for income tax 5,106

Effect of change in accounting principle 8,231

Net loss $ (282)

Footnotes to Madison Inc.’s MD&A and financial statements disclose the following information:

1) Restructuring charges include accruals for severance packages and losses on asset write-downs.

The company does not anticipate further restructuring activity.

2) A lawsuit related to product malfunctions was settled and ongoing lawsuits will not materially

affect future income.

3) Changes to the company’s pension plan resulted in a one-time gain.

4) Securities were sold during the year to fund the litigation settlement.

5) Tax-law changes resulted in nondeductibility of certain expenses. The company anticipates a

37% tax rate for 2015 onward.

Required:

What adjustments would you make to Madison’s income statement before you started to forecast

earnings for 2015? Prepare an adjusted income statement.

©Cambridge Business Publishers, 2015

11-26 Financial & Managerial Accounting for MBAs, 4th Edition

Answer:

The following income statement reflects some adjustments that could be made before forecasting

2015 earnings.

Sales $184,450

Cost of goods sold 95,584

Gross profit 88,866

Selling, general and administrative 40,030

R&D expenses 10,132

Restructuring charge 0

Pension curtailment gain 0

Litigation settlement 0

Other expenses, net 7,802

Total expenses 57,964

Operating profit 30,902

Other expense (income)

Interest expense 6,092

Gain on sale of securities 0

Income before taxes 24,810

Provision for income tax (37%) 9,180

Effect of change in accounting principle 0

Net income $ 15,630

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-27

Topic: Projecting the Income Statement and Balance Sheet

LO: 2, 3

2. Following are the financial statements of Snap-On Inc. for the year ended December 31, 2013.

Prepare a forecasted income statement and balance sheet for the company for the next year.

Snap-On Incorporated

Consolidated Balance Sheets

2013 2012

(in millions)

Cash and cash equivalents $ 217.6 $ 214.5

Trade and other accounts receivable-net 531.6 497.9

Finance receivables-net 374.6 323.1

Contract receivables-net 68.4 62.7

Inventories, net 434.4 404.2

Deferred income tax assets 85.4 81.8

Prepaid expenses and other assets 84.2 84.8

Total current assets 1,796.2 1,669.0

Property and equipment, net 392.5 375.2

Deferred income tax assets 57.1 110.4

Long-term finance receivables-net 560.6 494.6

Long-term contract receivables-net 217.1 194.4

Goodwill 838.8 807.4

Other intangibles, net 190.5 187.2

Other assets 57.2 64.1

Total assets $4,110.0 $3,902.3

Notes payable and current maturities of LT debt $ 113.1 $ 5.2

Accounts payable 155.6 142.5

Accrued benefits 48.1 50.6

Accrued compensation 95.5 88.3

Franchise deposits 59.4 54.7

Other accrued liabilities 243.7 247.9

Total current liabilities 715.4 589.2

Long-term debt 858.9 970.4

Deferred income tax liabilities 143.8 127.1

Retiree health care benefits 41.7 48.4

Pension liabilities 135.8 260.7

Other long-term liabilities 84.0 87.5

Total liabilities 1,979.6 2,083.3

Shareholders’ equity attributable to Snap-On Inc.

Common stock 67.4 67.4

Additional paid-in capital 225.1 204.6

Retained earnings 2,324.1 2,067.0

Accumulated other comprehensive loss (44.8) (124.2)

Treasury stock at cost (458.6) (412.7)

Total shareholders’ equity attributable to Snap-On Inc. 2,113.2 1,802.1

Noncontrolling interests 17.2 16.9

Total shareholders’ equity 2,130.4 1,819.0

Total liabilities and shareholders’ equity $4,110.0 $3,902.3

©Cambridge Business Publishers, 2015

11-28 Financial & Managerial Accounting for MBAs, 4th Edition

Snap-On Incorporated

Consolidated Statements of Earnings

For the Fiscal Year

(in millions) 2013 2012

Net sales $ 3,056.5 $ 2,937.9

Cost of goods sold (1,583.6) (1,547.9)

Gross profit 1,472.9 1,390.0

Operating expenses, net (1,012.4) (980.3)

Operating earnings before financial services 460.5 409.7

Financial services revenue 181.0 161.3

Financial services expenses (55.3) (54.6)

Operating earnings from financial services 125.7 106.7

Operating earnings 586.2 516.4

Interest expense (56.1) (55.8)

Other income (expense)-net (3.9) (0.4)

Earnings before income taxes and equity earnings 526.2 460.2

Income tax expense (166.7) (148.2)

Earnings before equity earnings 359.5 312.0

Equity earnings, net of tax 0.2 2.6

Net earnings 359.7 314.6

Net earnings attributable to noncontrolling interests (9.4) (8.5)

Net earnings attributable to Snap-On Incorporated $ 350.3 $ 306.1

To forecast the financial statements, make the following assumptions. For accounts that are not

included in the list below, assume that the amount will not change for the forecasted year.

Net sales growth 4.0%

Cost of goods sold margin 51.8%

Operating expenses to net sales 33.1%

Financial services revenue growth 12.0%

Financial services expenses to financial services revenue 30.6%

Income taxes to income before tax 31.7%

Noncontrolling interest net earnings to net earnings 2.6%

Cash and cash equivalents to net sales 7.1%

Trade A/R to net sales 17.4%

Inventory to net sales 14.2%

CAPEX to net sales 2.3%

Depreciation to start of year PPE, net 12.3%

Amortization expense to start of year intangibles, net 13.6%

A/P to net sales 5.1%

Other accrued liabilities to net sales 8.0%

Snap-on dividends to net earnings 26.3%

Noncontrolling interest dividends to net earnings 2.5%

Notes payable and current maturities of long-term debt $0

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-29

Answer:

Snap-On Incorporated

Forecasted Statement of Earnings

(in millions) 2013 actual 2014 forecast

Net sales $ 3,056.5 $3,056.5 × 1.04 $ 3,178.8

Cost of goods sold (1,583.6) $3,178.8 × 51.8% (1,646.6)

Gross profit 1,472.9 1,532.2

Operating expenses, net (1,012.4) $3,178.8 × 33.1% (1,052.2)

Operating earnings before financial services 460.5 480.0

Financial services revenue 181.0 $181 × 1.12 202.7

Financial services expenses (55.3) $202.7 × 30.6% (62.0)

Operating earnings from financial services 125.7 140.7

Operating earnings 586.2 620.7

Interest expense (56.1) No change (56.1)

Other income (expense)-net (3.9) No change (3.9)

Earnings before income taxes and equity earnings 526.2 560.7

Income tax expense (166.7) $560.7 × 31.7% (177.7)

Earnings before equity earnings 359.5 383.0

Equity earnings, net of tax 0.2 No change 0.2

Net earnings 359.7 383.2

Net earnings attributable to noncontrolling interests (9.4) $383.2 × 2.6% (10.0)

Net earnings attributable to Snap-on Incorporated $ 350.3 $ 373.2

continued next page

©Cambridge Business Publishers, 2015

11-30 Financial & Managerial Accounting for MBAs, 4th Edition

Snap-On Incorporated

Forecasted Balance Sheet

2013 2014

actual forecasted

(in millions)

Cash and cash equivalents $ 217.6 $3,178.8 × 7.1% $225.7

Marketable securities PLUG 131.3

Trade and other accounts receivable-net 531.6 $3,178.8 × 17.4% 553.1

Finance receivables-net 374.6 No change 374.6

Contract receivables-net 68.4 No change 68.4

Inventories, net 434.4 $3,178.8 × 14.2% 451.4

Deferred income tax assets 85.4 No change 85.4

Prepaid expenses and other assets 84.2 No change 84.2

Total current assets 1,796.2 1,974.1

Property and equipment, net 392.5 $392.5 + ($3,178.8 × 2.3%) - ($392.5 × 12.3%) 417.3

Deferred income tax assets 57.1 No change 57.1

Long-term finance receivables-net 560.6 No change 560.6

Long-term contract receivables-net 217.1 No change 217.1

Goodwill 838.8 No change 838.8

Other intangibles, net 190.5 $190.5 - ($190.5 × 13.6%) 164.6

Other assets 57.2 No change 57.2

Total assets $4,110.0 $4,286.8

Notes payable and current maturities

of long-term debt $ 113.1 Given $ 0

Accounts payable 155.6 $3,178.8 × 5.1% 162.1

Accrued benefits 48.1 No change 48.1

Accrued compensation 95.5 No change 95.5

Franchise deposits 59.4 No change 59.4

Other accrued liabilities 243.7 $3,178.8 × 8.0% 254.3

Total current liabilities 715.4 619.4

Long-term debt 858.9 No change 858.9

Deferred income tax liabilities 143.8 No change 143.8

Retiree health care benefits 41.7 No change 41.7

Pension liabilities 135.8 No change 135.8

Other long-term liabilities 84.0 No change 84.0

Total liabilities 1,979.6 1,883.6

Shareholders’ equity attributable to

Snap-On Inc.

Common stock 67.4 No change 67.4

Additional paid-in capital 225.1 No change 225.1

Retained earnings 2,324.1 $2,324.1 + $373.2 - ($383.2 × 26.3%) 2,596.5

Accumulated other comprehensive loss (44.8) No change (44.8)

Treasury stock at cost (458.6) No change (458.6)

Total shareholders’ equity attributable to

Snap-On Inc. 2,113.2 2,385.6

Noncontrolling interests 17.2 $17.2 + $10.0 - ($383.2 × 2.5%) 17.6

Total shareholders’ equity 2,130.4 2,403.2

Total liabilities and shareholders’ equity $4,110.0 $4,286.8

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-31

Topic: Projecting the Income Statement and Balance Sheet

LO: 2, 3

3. Following are the financial statements of CVS Caremark Corporation for the year ended December

31, 2013. Prepare a forecasted income statement and balance sheet for the company for the next

year.

CVS Caremark Corporation

Consolidated Balance Sheets

Dec. 31, Dec. 31,

In millions 2013 2012

Cash and cash equivalents $ 4,089 $ 1,375

Short-term investments 88 5

Accounts receivable, net 8,729 6,479

Inventories 11,045 11,032

Deferred income taxes 902 693

Other current assets 472 577

Total current assets 25,325 20,161

Property and equipment, net 8,615 8,632

Goodwill 26,542 26,395

Intangible assets, net 9,529 9,753

Other assets 1,515 1,280

Total assets $71,526 $66,221

Accounts payable $ 5,548 $ 5,070

Claims and discounts payable 4,548 3,974

Accrued expenses 4,768 4,411

Short-term debt 0 690

Current portion of long-term debt 561 5

Total current liabilities 15,425 14,150

Long-term debt 12,841 9,133

Deferred income taxes 3,901 3,784

Other long-term liabilities 1,421 1,501

Common stock, par value $0.01 17 17

Treasury stock, at cost (20,169) (16,270)

Shares held in trust (31) (31)

Capital surplus 29,777 29,120

Retained earnings 28,493 24,998

Accumulated other comprehensive loss (149) (181)

Total shareholders’ equity 37,938 37,653

Total liabilities and shareholders’ equity $71,526 $66,221

©Cambridge Business Publishers, 2015

11-32 Financial & Managerial Accounting for MBAs, 4th Edition

CVS Caremark Corporation

Consolidated Statements of Income

Dec. 31, Dec. 31,

In millions 2013 2012

Net revenues $126,761 $123,120

Cost of revenues 102,978 100,632

Gross profit 23,783 22,488

Total operating expenses 15,746 15,278

Operating profit 8,037 7,210

Interest expense, net 509 557

Loss on early extinguishment of debt 0 348

Income before income tax provision 7,528 6,305

Income tax provision 2,928 2,436

Income from continuing operations 4,600 3,869

Income (loss) from discontinued operations, net (8) (7)

Net income 4,592 3,862

Net loss attributable to noncontrolling interest 0 2

Net income attributable to CVS Caremark $ 4,592 $3,864

To forecast the financial statements, make the following assumptions. For accounts that are not

included in the list below, assume that the amount will not change for the forecasted year.

Growth in net revenues 5.0%

Gross profit margin percentage 18.8%

Operating expenses to net revenues 12.4%

Income tax provision to income before income tax provision 38.9%

Loss from discontinued operations $0

Cash and cash equivalents to net revenues 3.2%

A/R to net revenues 6.9%

Inventories to net revenues 8.7%

CAPEX to net revenues 1.6%

Forecasted depreciation expense ($ millions) $1,119

Forecasted amortization of intangible assets ($ millions) $271

Long-term debt due 2015 ($ millions) $576

A/P to net revenues 4.4%

Dividends to net earnings 23.9%

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-33

Answer:

Forecasted Statement of Operations for year ended December 2014 (in millions)

Net revenues $126,761 × (1 + 5.0%) $133,099

Cost of revenues 108,076

Gross profit $133,099 × 18.8% 25,023

Total operating expenses $133,099 × 12.4% 16,504

Operating profit 8,519

Interest expense, net No change 509

Income before income tax provision 8,010

Income tax provision $8,010 × 38.9% 3,116

Income from continuing operations 4,894

Loss from discontinued operations Non-persistent item -

Net income 4,894

Net loss attributable to noncontrolling interest No change 0

Net income attributable to CVS Caremark $4,894

Forecasted Consolidated Balance Sheet for December 2014 (in millions)

Cash and cash equivalents $133,099 × 3.2% $ 4,259

Short-term investments PLUG 1,659

Accounts receivable, net $133,099 × 6.9% 9,184

Inventories $133,099 × 8.7% 11,580

Deferred income taxes No change 902

Other current assets No change 472

Total current assets 28,056

Property and equipment, net $8,615 + ($133,099 × 1.6%) - $1,119 9,626

Goodwill No change 26,542

Intangible assets $9,529 - $271 9,258

Other assets No change 1,515

Total assets $74,997

Accounts payable $133,099 × 4.4% $ 5,856

Claims and discounts payable No change 4,548

Accrued expenses No change 4,768

Short-term debt No change 0

Current portion of long-term debt Given 576

Total current liabilities 15,748

Long-term debt $12,841 - $576 12,265

Deferred income taxes No change 3,901

Other long-term liabilities No change 1,421

Common stock No change 17

Treasury stock, at cost No change (20,169)

Shares held in trust No change (31)

Capital surplus No change 29,777

Retained earnings $28,493 + 4,894 - ($4,894 x 23.9%) 32,217

Accumulated other comprehensive loss No change (149)

Total CVS shareholders’ equity 41,662

Total liabilities and shareholders’ equity $74,997

©Cambridge Business Publishers, 2015

11-34 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting the Income Statement and Balance Sheet

LO: 2, 3

4. Following are the financial statements of Lockheed Martin Corporation for the year ended December

31, 2013. Prepare a forecasted income statement and balance sheet for the company for the next

year.

Lockheed Martin Corporation

Consolidated Balance Sheet

At December 31,

(In millions) 2013 2012

Cash and equivalents $ 2,617 $ 1,898

Receivables, net 5,834 6,563

Inventories, net 2,977 2,937

Deferred income taxes 1,088 1,269

Other current assets 813 1,188

Total current assets 13,329 13,855

Property, plant and equipment, net 4,706 4,675

Goodwill 10,348 10,370

Deferred income taxes 2,850 4,809

Other noncurrent assets 4,955 4,948

Total assets $36,188 $38,657

Accounts payable $ 1,397 $ 2,038

Customer advances and amounts in excess of costs 6,349 6,503

Salaries, benefits and payroll taxes 1,809 1,649

Current portion of long-term debt -- 150

Other current liabilities 1,565 1,815

Total current liabilities 11,120 12,155

Long-term debt, net 6,152 6,158

Accrued pension liabilities 9,361 15,278

Other postretirement benefit liabilities 902 1,220

Other noncurrent liabilities 3,735 3,807

Total liabilities 31,270 38,618

Common stock 319 321

Retained earnings 14,200 13,211

Accumulated other comprehensive (loss) (9,601) (13,493)

Total stockholders’ equity 4,918 39

Total liabilities and stockholders’ equity $36,188 $38,657

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-35

Lockheed Martin Corporation

Consolidated Income Statement

For the year ended December 31,

(In millions) 2013 2012

Net sales

Products $35,691 $37,817

Services 9,667 9,365

Total net sales 45,358 47,182

Cost of sales

Products 31,346 33,495

Services 8,588 8,383

Goodwill impairment charge 195 --

Severance and other charges 201 48

Other unallocated corporate costs 841 1,060

Total cost of sales 41,171 42,986

Gross profit 4,187 4,196

Other operating income 318 238

Operating profit 4,505 4,434

Interest expense 350 383

Other nonoperating income -- 21

Earnings before income taxes 4,155 4,072

Income tax expense 1,205 1,327

Net earnings from continuing operations 2,950 2,745

Net earnings (loss) from discontinued operations 31 --

Net earnings $ 2,981 $ 2,745

To forecast the financial statements, make the following assumptions. For accounts that are not

included in the list below, assume that the amount will not change for the forecasted year.

Growth in Net sales: Products 1.5%

Growth in Net sales: Services 3.0%

Cost of sales margin - Products 87.8%

Cost of sales margin - Services 88.8%

Goodwill impairment charge $0

Severances and other charges $0

Other nonoperating income $0

Income tax expense to earnings before tax 29.0%

Earnings from discontinued operations $0

Cash and cash equivalents to total net sales 5.8%

A/R to total net sales 12.9%

Inventories to Net sales: Products 8.3%

Depreciation expense to start of year PPE, net 21.2%

CAPEX to total net sales 1.8%

A/P to total net sales 3.1%

Customer advances to total net sales 14.0%

Salaries, benefits and payroll taxes to total net sales 4.0%

Accrued pension liabilities to total net sales 20.6%

Other postretirement benefit liabilities to total net sales 2.0%

Dividends to net earnings 51.7%

©Cambridge Business Publishers, 2015

11-36 Financial & Managerial Accounting for MBAs, 4th Edition

Answer:

Forecasted income statement 2014 ($ millions)

Net sales

Products $35,691 × (1 + 1.5%) $36,226

Services $9,667× (1 + 3.0%) 9,957

Total net sales 46,183

Cost of sales

Products $36,226 × 87.8% 31,806

Services $9,957 × 88.8% 8,842

Other unallocated corporate costs No change 841

Total cost of sales 41,489

Gross profit 4,694

Other operating income No change 318

Operating profit 5,012

Interest expense No change 350

Earnings before income taxes 4,662

Income tax expense $4,662 × 29.0% 1,352

Net earnings $ 3,310

Forecasted Balance Sheet 2014 ($ millions)

Cash and equivalents $46,183 × 5.8% $ 2,679

Short-term investments PLUG 1,915

Receivables, net $46,183 × 12.9% 5,958

Inventories, net $36,226 × 8.3% 3,007

Deferred income taxes No change 1,088

Other current assets No change 813

Total current assets 15,460

Property, plant and equipment, net $4,706 + ($46,183 × 1.8%) - ($4,706 × 21.2%) 4,539

Goodwill No change 10,348

Deferred income taxes No change 2,850

Other assets No change 4,955

$38,152

Accounts payable $46,183 x 3.1% $ 1,432

Customer advances $46,183 x 14.0% 6,466

Salaries, benefits and payroll taxes $46,183 x 4.0% 1,847

Other current liabilities No change 1,565

Total current liabilities 11,310

Long-term debt, net No change 6,152

Accrued pension liabilities $46,183 x 20.6% 9,514

Other postretirement benefit liabilities $46,183 x 2. 0% 924

Other liabilities No change 3,735

Total liabilities 31,635

Common stock No change 319

Retained earnings $14,200 + [$3,310 × (1 - 51.7%)] 15,799

Accumulated other comprehensive (loss) No change (9,601)

Total stockholders’ equity 6,517

Total liabilities and stockholders’ equity $38,152

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-37

Topic: Projecting the Statement of Cash Flows

LO: 4

5. Following are the forecasted income statement and balance sheet for Lockheed Martin Corporation

for the year ended December 31, 2014. Prepare a forecasted statement of cash flows for the

company for 2014.

Lockheed Martin Corporation

Consolidated Balance Sheet

At December 31,

2014 2013

(In millions) forecasted actual

Cash and equivalents $ 2,679 $ 2,617

Short-term investment 1,915 --

Receivables, net 5,958 5,834

Inventories, net 3,007 2,977

Deferred income taxes 1,088 1,088

Other current assets 813 813

Total current assets 15,460 13,329

Property, plant and equipment, net 4,539 4,706

Goodwill 10,348 10,348

Deferred income taxes 2,850 2,850

Other assets 4,955 4,955

$38,152 $36,188

Accounts payable $ 1,432 $ 1,397

Customer advances and amounts in excess of costs 6,466 6,349

Salaries, benefits and payroll taxes 1,847 1,809

Other current liabilities 1,565 1,565

Total current liabilities 11,310 11,120

Long-term debt, net 6,152 6,152

Accrued pension liabilities 9,514 9,361

Other postretirement benefit liabilities 924 902

Other liabilities 3,735 3,735

Total liabilities 31,635 31,270

Common stock 319 319

Retained earnings 15,799 14,200

Accumulated other comprehensive (loss) (9,601) (9,601)

Total stockholders’ equity 6,517 4,918

Total liabilities and stockholders’ equity $38,152 $36,188

©Cambridge Business Publishers, 2015

11-38 Financial & Managerial Accounting for MBAs, 4th Edition

Lockheed Martin Corporation

Consolidated Income Statement

For the year ended December 31,

2014 2013

(In millions) forecasted actual

Net sales

Products $36,226 $35,691

Services 9,957 9,667

Total net sales 46,183 45,358

Cost of sales

Products 31,806 31,346

Services 8,842 8,588

Severance and other charges -- 195

-- 201

Other unallocated corporate costs 841 841

Total cost of sales 41,489 41,171

Gross profit 4,694 4,187

Other operating income 318 318

Operating profit 5,012 4,505

Interest expense 350 350

Earnings before income taxes 4,662 4,155

Income tax expense 1,352 1,205

Net earnings from continuing operations $ 3,310 2,950

Net earning (loss) from discontinued op. -- 31

Net earnings $ 3,310 $ 2,981

The following assumptions were used to develop the forecasted financial statements:

Depreciation expense to start of year PPE, net 21.2%

CAPEX to total net sales 1.8%

Dividends to net earnings 51.7%

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-39

Answer:

Forecasted Statement of Cash Flows for 2014 ($ millions)

Net earnings $ 3,310

Adjustments to reconcile net earnings to cash

from operations

Depreciation expense $4,706 × 21.2% 998

Changes in operating assets and liabilities:

Increase in receivables $5,834 - $5,958 (124)

Increase in inventory $2,977 - $3,007 (30)

Increase in accounts payable $1,397 - $1,432 35

Increase in customer advance $6,349 - $6,466 117

Increase in salaries, benefits and payroll taxes $1,809 - $1,847 38

Increase in accrued pension liabilities $9,361 - $9,514 153

Increase in other postretirement benefit liabilities $902 - $924 22

Net cash provided by operating activities 4,519

Expenditures for property, plant and equipment $46,183 × 1.8% (831)

Purchase of short-term investments Plug in balance sheet (1,915)

Net cash used for investing activities (2,746)

Common stock dividends $3,310 × 51.7% (1,711)

Net cash used for financing activities (1,711)

Net increase in cash and cash equivalents 62

Cash and cash equivalents at beginning of year 2,617

Cash and cash equivalents at end of year $ 2,679

©Cambridge Business Publishers, 2015

11-40 Financial & Managerial Accounting for MBAs, 4th Edition

Topic: Projecting the Statement of Cash Flows

LO: 4

6. Following are the forecasted income statement and balance sheet for Snap-On Corporation for the year

ended December 31, 2014. Prepare a forecasted statement of cash flows for the company for 2014.

Snap-On Incorporated

Consolidated Balance Sheets

2014 2013

(in millions) (forecasted) (actual)

Cash and cash equivalents $ 225.7 $ 217.6

Marketable securities 131.3 --

Trade and other accounts receivable-net 553.1 531.6

Finance receivables-net 374.6 374.6

Contract receivables-net 68.4 68.4

Inventories, net 451.4 434.4

Deferred income tax assets 85.4 85.4

Prepaid expenses and other assets 84.2 84.2

Total current assets 1,974.1 1,796.2

Property and equipment, net 417.3 392.5

Deferred income tax assets 57.1 57.1

Long-term finance receivables-net 560.6 560.6

Long-term contract receivables-net 217.1 217.1

Goodwill 838.8 838.8

Other intangibles, net 164.6 190.5

Other assets 57.2 57.2

Total assets $4,286.8 $4,110.0

Notes payable and current maturities of LT debt $ 0 $ 113.1

Accounts payable 162.1 155.6

Accrued benefits 48.1 48.1

Accrued compensation 95.5 95.5

Franchise deposits 59.4 59.4

Other accrued liabilities 254.3 243.7

Total current liabilities 619.4 715.4

Long-term debt 858.9 858.9

Deferred income tax liabilities 143.8 143.8

Retiree health care benefits 41.7 41.7

Pension liabilities 135.8 135.8

Other long-term liabilities 84.0 84.0

Total liabilities 1,883.6 1,979.6

Shareholders’ equity attributable to Snap-on Inc.

Common stock 67.4 67.4

Additional paid-in capital 225.1 225.1

Retained earnings 2,596.5 2,324.1

Accumulated other comprehensive loss (44.8) (44.8)

Treasury stock at cost (458.6) (458.6)

Total shareholders’ equity attributable to Snap-On Inc. 2,385.6 2,113.2

Noncontrolling interests 17.6 17.2

Total shareholders’ equity 2,403.2 2,130.4

Total liabilities and shareholders’ equity $4,286.8 $4,110.0

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-41

Snap-On Incorporated

Consolidated Statements of Earnings

For the Year Ended

2014 2013

(in millions) (forecasted) (actual)

Net sales $ 3,178.8 $ 3,056.5

Cost of goods sold (1,646.6) (1,583.6)

Gross profit 1,532.2 1,472.9

Operating expenses, net (1,052.2) (1,012.4)

Operating earnings before financial services 480.0 460.5

Financial services revenue 202.7 181.0

Financial services expenses (62.0) (55.3)

Operating earnings from financial services 140.7 125.7

Operating earnings 620.7 586.2

Interest expense (56.1) (56.1)

Other income (expense)-net (3.9) (3.9)

Earnings before income taxes and equity earnings 560.7 526.2

Income tax expense (177.7) (166.7)

Earnings before equity earnings 383.0 359.5

Equity earnings, net of tax 0.2 0.2

Net earnings 383.2 359.7

Net earnings attributable to noncontrolling interests (10.0) (9.4)

Net earnings attributable to Snap-on Incorporated $ 373.2 $ 350.3

The following assumptions were used to develop the forecasted financial statements:

CAPEX to net sales 2.3%

Depreciation to start of year PPE, net 12.3%

Amortization expense to start of year intangibles, net 13.6%

Snap-on dividends to net earnings 26.3%

Noncontrolling interest dividends to net earnings 2.5%

©Cambridge Business Publishers, 2015

11-42 Financial & Managerial Accounting for MBAs, 4th Edition

Answer:

Forecasted Consolidated Statement of Cash Flows for 2014

($ millions)

Net earnings $383.2

Adjustments to reconcile net earnings to net cash

provided (used) by operating activities:

Depreciation $392.5 × 12.3% 48.3

Amortization of other intangibles $190.5 × 13.6% 25.9

Changes in operating assets and liabilities, net of

effects of acquisitions:

Increase in receivables $553.1 - $531.6 (21.5)

Increase in inventories $451.4 - $434.4 (17.0)

Increase in accounts payable $162.1 - $155.6 6.5

Increase in accruals $254.3 - $243.7 10.6

Net cash provided by operating activities 436.0

Capital expenditures $3,178.8 × 2.3% (73.1)

Purchase marketable securities (131.3)

Net cash used by investing activities (204.4)

Payment on long-term debt (113.1)

Cash dividends paid $383.2 × (26.3% + 2.5%) (110.4)

Net cash used by financing activities (223.5)

Increase (decrease) in cash and cash equivalents 8.1

Cash and cash equivalents at beginning of year 217.6

Cash and cash equivalents at end of year $225.7

©Cambridge Business Publishers, 2015

Test Bank, Module 11 11-43

Topic: Projecting the Income Statement for Multiple Years

LO: 5

7. Following is the income statement for NetFlix Inc. for the year ended December 31, 2013. Prepare

forecasted income statements for the company for 2014 and 2015.

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

Year ended December 31, 2013 2012 2011

Revenues $4,374,562 $3,609,282 $3,204,577

Cost of revenues 3,083,256 2,625,866 2,039,901

Gross profit 1,291,306 983,416 1,164,676

Operating expenses:

Marketing 503,889 465,400 381,269

Technology and development 378,769 329,008 259,033

General and administrative 180,301 139,016 148,306

Total operating expenses 1,062,959 933,424 788,608

Operating income 228,347 49,992 376,068

Other income (expense):

Interest expense (29,142) (19,986) (20,025)

Interest and other

income(expense) (3,002) 474 3,479

Loss on extinguishment of

debt (25,129) - -

Income before income taxes 171,074 30,480 359,522

Provision for income taxes 58,671 13,328 133,396

Net income $ 112,403 $17,152 $ 226,126

Use the following assumptions to develop the forecasted income statements:

Revenue growth 10.0%

Costs to revenues 70.5%

Marketing 11.5%

Technology and development to revenues 8.7%

General and administrative to revenues 4.1%

Interest expense No change

Loss on extinguishment of debt………………………………………… $0

Interest and other income No change

Provision for income taxes to Income before income taxes 34.3%

©Cambridge Business Publishers, 2015

11-44 Financial & Managerial Accounting for MBAs, 4th Edition

Answer:

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

Year ended December 31, 2013 2014 2015

Revenues $4,374,562 $4,374,562 × 1.10 4,812,018 $4,812,018 × 1.10 $5,293,220