Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CB vs Organization Banking Activities

Caricato da

John Marco Lopez0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

233 visualizzazioni3 pagineThe Central Bank (CB) issued an opinion stating that the First Mutual Savings and Loan Organization (Organization) was engaging in banking activities without authorization. This included accepting deposits from the public and lending funds. A search warrant was subsequently issued against the Organization on these grounds. The Organization challenged the search warrant, arguing abuse of discretion. The court ruled that the Organization was indeed engaged in banking activities by openly accepting deposits from the public, lending deposited funds, and placing authority over the funds with its board of trustees. As such, it was subject to the requirements of Republic Act No. 337 which regulates banking.

Descrizione originale:

Special Commercial Law Case Digest

Titolo originale

Central Bank vs. Hon. Morfe

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe Central Bank (CB) issued an opinion stating that the First Mutual Savings and Loan Organization (Organization) was engaging in banking activities without authorization. This included accepting deposits from the public and lending funds. A search warrant was subsequently issued against the Organization on these grounds. The Organization challenged the search warrant, arguing abuse of discretion. The court ruled that the Organization was indeed engaged in banking activities by openly accepting deposits from the public, lending deposited funds, and placing authority over the funds with its board of trustees. As such, it was subject to the requirements of Republic Act No. 337 which regulates banking.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

233 visualizzazioni3 pagineCB vs Organization Banking Activities

Caricato da

John Marco LopezThe Central Bank (CB) issued an opinion stating that the First Mutual Savings and Loan Organization (Organization) was engaging in banking activities without authorization. This included accepting deposits from the public and lending funds. A search warrant was subsequently issued against the Organization on these grounds. The Organization challenged the search warrant, arguing abuse of discretion. The court ruled that the Organization was indeed engaged in banking activities by openly accepting deposits from the public, lending deposited funds, and placing authority over the funds with its board of trustees. As such, it was subject to the requirements of Republic Act No. 337 which regulates banking.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

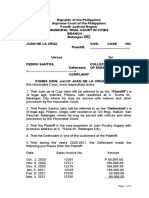

Central Bank vs. Hon.

Morfe

G.R. No. L-20119, June 30, 1967

Topic: General Banking Act; Elements

Facts:

The First Mutual Savings and Loan Organization

(Organization) is a registered non-stock corporation, the main

purpose of which is to "to encourage . . . and implement savings

and thrift among its members, and to extend financial assistance

in the form of loans," to them.

The Central Bank (CB) rendered an opinion to the effect that

“the Organization and others of similar nature are banking

institutions, falling within the purview of the Central Bank Act

HAVE NEVER BEEN AUTHORIZED BY THE MONETARY BOARD OF

THE CENTRAL BANK OF THE PHILIPPINES TO ACCEPT DEPOSIT

OF FUNDS FROM THE PUBLIC NOR TO ENGAGE IN THE BANKING

BUSINESS NOR TO PERFORM ANY BANKING ACTIVITY OR

FUNCTION IN THE PHILIPPINES.”

Soon thereafter, a search warrant against the Organization

was issued upon the allegation that "after close observation and

personal investigation, the premises at No. 2745 Rizal Avenue,

Manila" — in which the offices of the Organization were housed —

"are being used unlawfully," because said Organization is illegally

engaged in banking activities, "by receiving deposits of money for

deposit, disbursement, safekeeping or otherwise or transacts the

business of a savings and mortgage bank and/or building and

loan association . . . without having first complied with the

provisions of Republic Act No. 337.

The Organization filed with the CFI a petition for certiorari

with a writ of preliminary injunction, to annul the aforementioned

search warrant on the ground of grave abuse of discretion.

Issue: Whether or not the Organization is engaged in banking

activities?

Ruling: Yes.

The main purpose thereof, according to its By-laws, is "to

extend financial assistance, in the form of loans, to its members,"

with funds deposited by them. It is true, that such funds are

referred to — in the Articles of Incorporation and the By-laws —

as their "savings." and that the depositors thereof are designated

as "members," but, even a cursory examination of said

documents will readily show that anybody can be a depositor and

thus be a "participating member." In other words, the

Organization is, in effect:

1. open to the "public" for deposit accounts, and

2. the funds so raised may be lent by the Organization.

3. the power to so dispose of said funds is placed under the

exclusive authority of the "founder members," and

4. "participating members" are expressly denied the right to

vote or be voted for, their "privileges and benefits," if

any, being limited to those which the board of trustees may,

in its discretion, determine from time to time.

As a consequence, the "membership" of the "participating

members" is purely nominal in nature. This situation is fraught,

precisely, with the very dangers or evils which Republic Act No.

337 seeks to forestall, by exacting compliance with the

requirements of said Act, before the transactions in question

could be undertaken.

Potrebbero piacerti anche

- All POB NOTESDocumento249 pagineAll POB NOTESTyra Robinson74% (23)

- 01 - Mango Financial Management Essentials (232p)Documento232 pagine01 - Mango Financial Management Essentials (232p)Book File100% (6)

- RCBC v. Royal CargoDocumento2 pagineRCBC v. Royal Cargod2015memberNessuna valutazione finora

- Comparative Study Between Public and Private BankDocumento40 pagineComparative Study Between Public and Private BankRashmi ShuklaNessuna valutazione finora

- Republic v. EugenioDocumento16 pagineRepublic v. EugenioEd Von Fernandez CidNessuna valutazione finora

- SIA v. CADocumento2 pagineSIA v. CAEmmanuel Princess Zia SalomonNessuna valutazione finora

- Metrobank vs. CADocumento2 pagineMetrobank vs. CAAlex RabanesNessuna valutazione finora

- Court Upholds Guarantor Liability in Loan Collection CaseDocumento2 pagineCourt Upholds Guarantor Liability in Loan Collection Casejust wafflesNessuna valutazione finora

- Real Estate Mortgage DisputeDocumento3 pagineReal Estate Mortgage DisputeMae SampangNessuna valutazione finora

- Commonwealth v. RCBCDocumento1 paginaCommonwealth v. RCBCAna AltisoNessuna valutazione finora

- BPI Vs de Reny Fabric Industries Inc, 35 SCRA 253Documento2 pagineBPI Vs de Reny Fabric Industries Inc, 35 SCRA 253Courtney TirolNessuna valutazione finora

- SuretyDocumento2 pagineSuretyTeacherEliNessuna valutazione finora

- 49) The International Corporate Bank, Inc. vs. CA and PNBDocumento2 pagine49) The International Corporate Bank, Inc. vs. CA and PNBAlexandraSoledadNessuna valutazione finora

- RBSM v. MB, G.R. No. 150886Documento1 paginaRBSM v. MB, G.R. No. 150886xxxaaxxxNessuna valutazione finora

- Rosa Villa Monna vs. Guillermo Garcia Bosque, F. H. GOULETTE, and R. G. FRANE: Partial substitution of agency did not authorize release of debtors from contractDocumento2 pagineRosa Villa Monna vs. Guillermo Garcia Bosque, F. H. GOULETTE, and R. G. FRANE: Partial substitution of agency did not authorize release of debtors from contractJohn Michael VidaNessuna valutazione finora

- BPI Vs IACDocumento1 paginaBPI Vs IACcmv mendozaNessuna valutazione finora

- Case Digest 1Documento4 pagineCase Digest 1Sealtiel VillarealNessuna valutazione finora

- 56 Co-Pitco vs. YuloDocumento3 pagine56 Co-Pitco vs. YuloYaz CarlomanNessuna valutazione finora

- UCPB v. Beluso: Foreclosure Legal Despite Excessive AmountDocumento1 paginaUCPB v. Beluso: Foreclosure Legal Despite Excessive AmountDes GerardoNessuna valutazione finora

- Leongson V CADocumento1 paginaLeongson V CAChelsea PastranaNessuna valutazione finora

- GSIS Vs BPI Case DigestDocumento6 pagineGSIS Vs BPI Case DigestEfi of the IsleNessuna valutazione finora

- Philippines Supreme Court upholds strict enforcement of procedural rulesDocumento8 paginePhilippines Supreme Court upholds strict enforcement of procedural rulesJaja Ordinario Quiachon-AbarcaNessuna valutazione finora

- SC Rules Contracts Were Mortgages Not AntichresisDocumento3 pagineSC Rules Contracts Were Mortgages Not AntichresisBibi Jumpol0% (1)

- Ang V AngDocumento33 pagineAng V Angkrys_elleNessuna valutazione finora

- Ursua v. CA (Case Brief)Documento2 pagineUrsua v. CA (Case Brief)Jon Joshua FalconeNessuna valutazione finora

- 49 AGAG V ALPHA FINANCINGDocumento2 pagine49 AGAG V ALPHA FINANCINGFelix Gerard Jr. LeysonNessuna valutazione finora

- Tolentino v. Sy ChiamDocumento2 pagineTolentino v. Sy ChiamEricka Harriet CaballesNessuna valutazione finora

- Cruz V Yaneza Rule 114 Sec 17 Ver2.0Documento7 pagineCruz V Yaneza Rule 114 Sec 17 Ver2.0Donna Jane SimeonNessuna valutazione finora

- Atty found guilty notarizing fake deedDocumento2 pagineAtty found guilty notarizing fake deedAndrei Da JoseNessuna valutazione finora

- Allied Banking v CA - Guarantors Liable Despite No ProtestDocumento2 pagineAllied Banking v CA - Guarantors Liable Despite No ProtestYPENessuna valutazione finora

- 3 Litonjua vs. L & R CorporationDocumento1 pagina3 Litonjua vs. L & R CorporationJemNessuna valutazione finora

- 2 - Van Twest Vs CADocumento9 pagine2 - Van Twest Vs CAJesi CarlosNessuna valutazione finora

- Naguiat v. CADocumento2 pagineNaguiat v. CAdelayinggratificationNessuna valutazione finora

- Banco de Oro-Epci, Inc. vs. Japrl Development Corporation, Rapid Forming Corporation and Jose U. Arollado G.R. No. 179901 April 14, 2008 FactsDocumento2 pagineBanco de Oro-Epci, Inc. vs. Japrl Development Corporation, Rapid Forming Corporation and Jose U. Arollado G.R. No. 179901 April 14, 2008 FactsAdi LimNessuna valutazione finora

- Liong Vs LeeDocumento2 pagineLiong Vs LeeKen TuazonNessuna valutazione finora

- People of The Philippines vs. Danny GodoyDocumento7 paginePeople of The Philippines vs. Danny GodoyDales BatoctoyNessuna valutazione finora

- McCullough v. VelosoDocumento3 pagineMcCullough v. VelosoKobe Lawrence VeneracionNessuna valutazione finora

- Sps. Roque, Et. Al. v. Aguado Case DigestDocumento3 pagineSps. Roque, Et. Al. v. Aguado Case DigestDon SumiogNessuna valutazione finora

- Ladjaalam and Celino - PD 1866 CasesDocumento3 pagineLadjaalam and Celino - PD 1866 CasesDanilo LauritoNessuna valutazione finora

- Civil Service Commission Orders Reinstatement of Employees to Former PositionsDocumento9 pagineCivil Service Commission Orders Reinstatement of Employees to Former PositionsNurz A TantongNessuna valutazione finora

- 1 Roman V ABCDocumento1 pagina1 Roman V ABCFatima AreejNessuna valutazione finora

- People V MontejoDocumento1 paginaPeople V MontejoJunmer OrtizNessuna valutazione finora

- Ibaan Rural Bank Vs CADocumento1 paginaIbaan Rural Bank Vs CAxsar_xNessuna valutazione finora

- Office of The Ombudsman V Samaniego 2008Documento3 pagineOffice of The Ombudsman V Samaniego 2008Where Did Macky GallegoNessuna valutazione finora

- FRIA NotesDocumento11 pagineFRIA NotesDanice MuñozNessuna valutazione finora

- Philippine Collection CaseDocumento3 paginePhilippine Collection CaseLaika HernandezNessuna valutazione finora

- Nego Ebc Vs IacDocumento4 pagineNego Ebc Vs IacMon CheNessuna valutazione finora

- Concurrence and Preference of CreditsDocumento1 paginaConcurrence and Preference of CreditsHenry LNessuna valutazione finora

- VIVAS Vs THE MONETARY BOARDDocumento4 pagineVIVAS Vs THE MONETARY BOARDIan Joshua RomasantaNessuna valutazione finora

- South City Vs BA Finance (Digest)Documento2 pagineSouth City Vs BA Finance (Digest)12345678Nessuna valutazione finora

- 021 Pcib Vs CaDocumento2 pagine021 Pcib Vs CaAlan GultiaNessuna valutazione finora

- 390 VILLAMIEL Spouses Belo v. Philippine National BankDocumento2 pagine390 VILLAMIEL Spouses Belo v. Philippine National BankCarissa CruzNessuna valutazione finora

- Prudential Vs AlviarDocumento2 paginePrudential Vs AlviarAnselmo Rodiel IVNessuna valutazione finora

- Unbroken Possession and CultivationDocumento9 pagineUnbroken Possession and CultivationBea BaloyoNessuna valutazione finora

- Nyco Sales Corporation v. BA Finance Corporation Case DigestDocumento1 paginaNyco Sales Corporation v. BA Finance Corporation Case DigestMarionnie SabadoNessuna valutazione finora

- PP vs. Buesa (G.R. No. 237850, September 16, 2020)Documento4 paginePP vs. Buesa (G.R. No. 237850, September 16, 2020)Tokie TokiNessuna valutazione finora

- Yujuico vs. QuiambaoDocumento17 pagineYujuico vs. QuiambaoKayelyn LatNessuna valutazione finora

- PEOPLE Vs JOSEPH ESTRADA - ASTIDocumento1 paginaPEOPLE Vs JOSEPH ESTRADA - ASTIRamon Khalil Erum IVNessuna valutazione finora

- Completion Examination: ND RDDocumento5 pagineCompletion Examination: ND RDNicole DeocarisNessuna valutazione finora

- Phil. American Life Insurance vs. Pineda 175 SCRA 416Documento1 paginaPhil. American Life Insurance vs. Pineda 175 SCRA 416Nehemiah MontecilloNessuna valutazione finora

- 07 People v. GoDocumento1 pagina07 People v. GoAnonymous bOncqbp8yiNessuna valutazione finora

- Deed of Sale vs Equitable MortgageDocumento3 pagineDeed of Sale vs Equitable MortgagejafernandNessuna valutazione finora

- Central Bank V Morfe IncompleteDocumento2 pagineCentral Bank V Morfe IncompletecinNessuna valutazione finora

- Title: Marynette R. Gamboa VS. Marlou C. Chan Citation: G.R. No. 193636. July 24, 2012 Topic: Habeas DataDocumento3 pagineTitle: Marynette R. Gamboa VS. Marlou C. Chan Citation: G.R. No. 193636. July 24, 2012 Topic: Habeas DataJohn Marco LopezNessuna valutazione finora

- A.M. 03-02-05-SC - Rules On GuardianshipDocumento7 pagineA.M. 03-02-05-SC - Rules On GuardianshipQueenie SabladaNessuna valutazione finora

- Liquidation vs Rehabilitation of Philippine Veterans BankDocumento2 pagineLiquidation vs Rehabilitation of Philippine Veterans BankJohn Marco LopezNessuna valutazione finora

- Legal Forms GuideDocumento386 pagineLegal Forms GuideDaniel AcusarNessuna valutazione finora

- Villamor Vs CADocumento2 pagineVillamor Vs CAmelinda elnarNessuna valutazione finora

- Admin Principles Prelims PDFDocumento17 pagineAdmin Principles Prelims PDFJohn Marco LopezNessuna valutazione finora

- 2016 BAR EXAMINATIONS (With Suggested Answers)Documento16 pagine2016 BAR EXAMINATIONS (With Suggested Answers)Susan Sabilala Mangalleno92% (50)

- Dr. Li Not Liable for Child's DeathDocumento4 pagineDr. Li Not Liable for Child's DeathJohn Marco LopezNessuna valutazione finora

- Admin Principles Prelims PDFDocumento17 pagineAdmin Principles Prelims PDFJohn Marco LopezNessuna valutazione finora

- Labor Case DigestsDocumento302 pagineLabor Case DigestsKristine N.93% (15)

- Protecting Bank CustomersDocumento19 pagineProtecting Bank CustomersMUHAMMAD REVITO ADRIANSYAHNessuna valutazione finora

- Standard Terms and ConditionsDocumento11 pagineStandard Terms and ConditionsOmkar DesaiNessuna valutazione finora

- Press Release - Dec 2019Documento2 paginePress Release - Dec 2019RISHI KESHNessuna valutazione finora

- Initial Public OfferingDocumento23 pagineInitial Public OfferingDyheeNessuna valutazione finora

- Exim Bank of India: A Comprehensive Guide to Products and ServicesDocumento21 pagineExim Bank of India: A Comprehensive Guide to Products and ServicesPrathap AnNessuna valutazione finora

- Financial Performance Analysis of Nepalese Commercial BanksDocumento83 pagineFinancial Performance Analysis of Nepalese Commercial Bankssps fetrNessuna valutazione finora

- Guide To Big Data For FinanceDocumento14 pagineGuide To Big Data For FinancePedro Alam SargesNessuna valutazione finora

- Sources of Business Finance ExplainedDocumento39 pagineSources of Business Finance ExplainedCarry MinatiNessuna valutazione finora

- Associated Bank vs. CA (G.R. No. 123793 June 29, 1998) - 6Documento9 pagineAssociated Bank vs. CA (G.R. No. 123793 June 29, 1998) - 6Amir Nazri KaibingNessuna valutazione finora

- SAP Business ByDesign - ServiceDocumento136 pagineSAP Business ByDesign - ServicekameswarkumarNessuna valutazione finora

- Document Checklist: Salaried Segment Self Employed OriginalDocumento1 paginaDocument Checklist: Salaried Segment Self Employed OriginalWaqas LuckyNessuna valutazione finora

- Banking and Financial InstitutionsDocumento6 pagineBanking and Financial InstitutionsCristell BiñasNessuna valutazione finora

- WHLP 5 Quarter1 Week1Documento24 pagineWHLP 5 Quarter1 Week1selle magatNessuna valutazione finora

- Thomson Reuters Knowledge to Act OverviewDocumento19 pagineThomson Reuters Knowledge to Act OverviewSashi DandamudiNessuna valutazione finora

- SOC-Citygem 30062021Documento2 pagineSOC-Citygem 30062021Super 247Nessuna valutazione finora

- The Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleDocumento114 pagineThe Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleMakoy BixenmanNessuna valutazione finora

- Deed of UndertakingDocumento5 pagineDeed of UndertakingPeter Roderick M. OlpocNessuna valutazione finora

- A Study On Credit Management of Sahayogi Bikas Bank LTDDocumento31 pagineA Study On Credit Management of Sahayogi Bikas Bank LTDShivam KarnNessuna valutazione finora

- Instructor'S Manual: International Payment Terms or Documentary CreditDocumento2 pagineInstructor'S Manual: International Payment Terms or Documentary CreditNorhidayah N ElyasNessuna valutazione finora

- LITERATURE REVIEW ON ASSET-LIABILITY MANAGEMENTDocumento9 pagineLITERATURE REVIEW ON ASSET-LIABILITY MANAGEMENTAnkur Upadhyay0% (1)

- Case Study DeutscheDocumento2 pagineCase Study DeutscheaniketNessuna valutazione finora

- Business Ethics ProjectDocumento23 pagineBusiness Ethics ProjectGarima SinghalNessuna valutazione finora

- Financial Statement 2014Documento355 pagineFinancial Statement 2014Akmal Idrus100% (1)

- Dissertation On Financial Crisis 2008Documento115 pagineDissertation On Financial Crisis 2008Brian John SpencerNessuna valutazione finora

- Direct Tax NotesDocumento16 pagineDirect Tax NotesLakshmiNessuna valutazione finora

- VISADocumento74 pagineVISAዝምታ ተሻለNessuna valutazione finora

- Punjab National Bank V Surendra Prasad SinhaDocumento3 paginePunjab National Bank V Surendra Prasad SinhaRenuNessuna valutazione finora