Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PN B Met Life Mera Term Plan

Caricato da

Sanjay RaghuvanshiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PN B Met Life Mera Term Plan

Caricato da

Sanjay RaghuvanshiCopyright:

Formati disponibili

PNB MetLife Mera Term Plan

PNB MetLife Mera Term Plan

A Non-Linked, Non-Participating Term Plan

Life offers us choices and these choices make our life interesting. Why not have choices to design your financial

plan? At PNB MetLife our constant endeavor is to offer simple solution which helps you to protect the financial

future of your loved ones.

A pure protection plan with a range of additional coverage options is the ideal way for you to protect financial

future of your loved ones and PNB MetLife Mera Term Plan has been designed to address all your protection needs

at an affordable cost.

Key Features of this Plan

Coverage at affordable cost

Customize your plan with various options

Life stage protection for your changing protection needs

Coverage of upto 75 99 years

Preferred rates if you are a non- smoker

Tax benefits as per prevailing tax rules*

What are the various options available for me under this Plan?

Option 1: Under this option, the Death Sum Assured shall be payable as ‘Lump Sum’ on death.

Lump sum

payment on death

Option 2: Under this option, 50% of the Death Sum Assured shall be payable as ‘Lump Sum’ on death

Lump sum + and the balance will be paid as level monthly instalment over 120 months (10 years). The

Monthly Income level Monthly Income shall be 0.58% of the Base Sum Assured.

for 10 years

Option 3: Under this option, 50% of the Death Sum Assured shall be payable as ‘Lump Sum’ on death

Lump sum + and the balance shall be payable as increasing monthly instalment over 120 months (10

Increasing years), increasing @ 12% per annum at simple rate of interest. The first year Monthly

Monthly Income Income shall be 0.39% of the Base Sum Assured.

for 10 years.

UIN: 117N092V02 Page 1 of 8

PNB MetLife Mera Term Plan

Option 4: This option shall only be available to policyholders with child age less than or equal to 15

Lump sum + years. 50% of the Death Sum Assured shall be payable as ‘Lump Sum’ and the balance shall

monthly income be payable as level monthly instalment till the nominated child attains age of 21 years. The

till child ages 21: level Monthly Income shall be in proportion to the Base Sum Assured and shall vary basis

(Child education attained age of child at the time of the death of the Person Insured. The level monthly

support) benefit details are calculated based on the following factors.

Level Monthly Income Factor (as a proportion of Base

Attained Age of child

Sum Assured)

0 0.37%

1 0.38%

2 0.39%

3 0.40%

4 0.41%

5 0.42%

6 0.44%

7 0.46%

8 0.48%

9 0.51%

10 0.54%

11 0.58%

12 0.63%

13 0.68%

14 0.76%

15 0.86%

16 1.00%

17 1.21%

18 1.57%

19 2.28%

20 4.43%

If the nominated child attaining 21 years, the policy shall continue with the full Death Sum

Assured and the death benefit shall be as lump sum.

In case the nominated child predeceases, the policyholder shall have the following options:

Nominate any other child, having age less than 21 years; or

Continue the Policy with the Death Sum Assured as lump sum death benefit

payable.

However, in case the nominated child dies during the pay-out period of death benefit, then

the pay-outs shall continue to be paid to the legal heirs of the insured.

UIN: 117N092V02 Page 2 of 8

PNB MetLife Mera Term Plan

Additional Protection Benefits available as mentioned below,

Life Stage Benefit The policyholder shall have the option to buy an additional Online term policy as per the

then prevailing age and premium table without any medical examination. The option to

increase the Sum Assured over the various ‘Life Stages’ will be

On Policyholder’s marriage: Equal to 50% of the original cover subject to

maximum of Rs. 5,000,000.

On the birth of the first child: Equal to 25% of the original cover subject to

maximum of Rs. 2,500,000.

On the birth of the second child: Equal to 25% of the original cover subject to

maximum of Rs. 2,500,000.

The enhancement of the coverage will be subject additional premiums. The additional

premium for the enhanced cover shall be calculated based on the attained age of the

policyholder and the prevailing standard premium rates for term assurance cover at the

time of exercising the option (i.e., on happening of defined life events) without any medical

examination. The maximum additional sum assured put together under all these events will

be Rs. 50,00,000.

The Policyholder needs to indicate if he/she wishes to avail the Life Stage Benefit - Option

to increase the Sum Assured at the inception of the Policy. However, once the Policyholder

opts for this benefit, the Policyholder can choose to increase the Sum Assured at specified

life events as mentioned above, if he/she desires to do so. This option is not available if the

Policyholder opts for Joint Life Coverage.

Joint Life Cover Under the Joint Life Coverage Option, both the Policyholder (the First life) and his/her

spouse (the Second Life) are covered. This option needs to be chosen at the inception of the

Policy. The coverage to the Second life shall be equal to 50% of the Sum Assured chosen by

the Policyholder subject to a maximum of Rs. 50 lacs. Under this option

In case of death of the First life the death sum assured in respect of the First life

will be paid. The policy continues with future premium being waived. On the death

of Second life thereafter death sum assured in respect of Second Life is paid and

the policy is terminated.

In case of Second Life predeceasing the First Life, the death sum assured in respect

of the Second Life is paid. The policy shall continue with the base premium.

If case of death of the both lives simultaneously the death sums assured in respect

of both the First Life and the Second Life will be paid and the policy is terminated.

Once the Joint Life Cover is chosen the policyholder cannot discontinue the

coverage of the particular life, unless it is due to the events as mentioned above.

The option shall only be available where the sum assured of First Life greater than

equal to Rs. 50 lacs.

Death sum assured for ‘Second life’ is defined as higher of 10 times the additional premium

or 105% of all additional premiums paid for Second Life cover as on the date of death of the

second life or any absolute amount to be paid on death of second life; wherein; Absolute

amount paid on death of second life is the Sum Assured payable under this option.

UIN: 117N092V02 Page 3 of 8

PNB MetLife Mera Term Plan

Riders available with Base Plan:

Critical Illness Under this option, Critical Illness (CI) Cover shall be payable upon the first

Benefit diagnosis of one of the two covered Critical Illnesses – Please refer the MetLife

Critical Illness Rider brochure for full details

Accidental Death Under this option, the chosen ADB (Accidental Death Benefit) Sum Assured shall

Benefit be payable as ‘Lump Sum’ upon death due to accident – Please refer the MetLife

Accidental Death Benefit Plus Rider for full details

Accidental Under this option, the chosen Accidental Disability Benefit shall be payable upon

Disability Benefit the life insured meeting with an accident that results in him/ her being impaired –

Please refer the MetLife Accidental Death Benefit Rider for full details

Serious Illness Under this option, Critical Illness (CI) Cover shall be payable upon the first

Cover diagnosis of one of the listed 10 covered Critical Illnesses – Please refer the

MetLife Serious Illness Rider brochure for full details

Who can buy this plan?

If you are between the following age bands, you may buy this plan

Minimum Entry Age* 18 years

Maximum Entry Age* 65 years

Maximum Maturity age* 99 years for all options (except Joint

Life cover option)

Joint Life Cover option: 75 years

(applicable for both Primary &

Secondary life)

*All references to age are as on last birthday

What is my Coverage Period?

You can choose any term from 10 years to 81 years for all options (except Joint Life Cover option) & 10 years to 40

years for Joint life Cover option (applicable for both Primary & Secondary life), subject to maximum maturity age.

How long do I have to pay premiums?

You have to pay premiums for the chosen coverage period

At what frequencies I can pay premium?

At Yearly & Monthly frequencies you may pay applicable premiums. Following factors will be applicable on

Annualized premiums for calculating premiums you may have to pay.

UIN: 117N092V02 Page 4 of 8

PNB MetLife Mera Term Plan

Modal Factors

Mode of Premium Multiplicative Factor

Yearly 1.0000

Monthly (Only ECS) 0.0886

What are the coverage Options under this Plan?

You may choose from below minimum and maximum Sum Assured from various benefit options

Sum Assured

Sections Min Max

Lumpsum Rs. 10,00,000 Rs. 5,000,000,000

Mera Family payout Monthly Income Rs. 10,00,000 Rs. 5,000,000,000

Increasing Monthly Income Rs. 10,00,000 Rs. 5,000,000,000

Child Education Support Rs. 10,00,000 Rs. 5,000,000,000

Mera Family Benefits Joint Life Cover Rs. 25,00,000 Rs. 50,00,000

(For Second Life)

Life Stage Protection Rs. 25,00,000 Rs. 50,00,000

Accidental Death Benefit Rs. 5,00,000 Rs. 2,00,00,000

Accidental Disability Benefit Rs. 5,00,000 Rs. 2,00,00,000

Mera Additional Benefits

Serious Illness Cover Rs.5,00,000 Rs.50,00,000

Critical Illness Cover Rs. 5,00,000 Rs. 50,00,000

How can I buy this Plan?

You just have to follow 4 simple steps to customize and purchase PNB MetLife Mera Term Plan

Make your own Plan: Choose Base Sum Assured; Choose one option from Mera Family Payout options; Choose one

from Mera Family Coverage Option; Choose one or all from Mera Additional Benefits; Sum Assured; Coverage

Term; Premium payment frequency.

Generate Premium quote: For generating premium quote you have to enter to Age; gender; answer to the

questions, if you consume tobacco or not.

Fill in relevant information: Your Personal Details; your occupation details; your lifestyle details; family medical

history; nominee details.

UIN: 117N092V02 Page 5 of 8

PNB MetLife Mera Term Plan

Pay Premiums: Your policy will be sent to your subject to acceptance of the application as per Policy Terms and

Conditions.

What are the benefits?

Upon the death of the insured before the end of the Policy Term, the Death Sum Assured will be paid as the death

benefit as per the ‘Mera Family Payout’ option chosen the Policyholder. The Death Sum Assured is defined as

higher of 10 times the annualized premium or 105% of all premiums paid as on the date of death or the

guaranteed sum assured on maturity or any absolute amount to be paid on death.

Absolute amount paid on death is the Base Sum Assured of the Policy and the guaranteed sum assured on maturity

is zero as it is a pure term product.

What will happen if nothing happens to me during the chosen policy term?

This Plan does not have any maturity or survival benefit.

What will happen if I stop paying premiums?

If premiums are not paid on their due dates, a Grace period of 30 days from the due date of unpaid premium (15

days for monthly mode) for you to make premium payment. During the Grace period the Policy shall continue to

be in force for all the Insured events.

Should a valid claim arise under the Policy during the grace period, but before the payment of due premium, we

shall still honor the claim. In such cases, the due and unpaid premium will be deducted from any benefit payable.

In case you do not pay premiums before the end of the grace period, the policy will lapse. All risk covers will cease

and no benefits will be payable in case of lapsed policies.

Can I surrender the Policy?

You may surrender the Policy any time during the policy term. There will be no surrender benefit payable.

Who will get the benefit?

You can nominate a person to receive the policy benefits as per the provisions of Section 39 of the Insurance Act,

1938 as amended from time to time.

Free look period

You have a period of 30 days from the date of receipt of the Policy document to review the terms and conditions

of this Policy. If you have any objections to any of the terms and conditions, you have the option to return the

Policy stating the reasons for the objections and you shall be entitled to a refund of the premium paid subject only

to a deduction of a proportionate premium for the time on risk that we have borne in addition to the expenses

incurred towards medical examination, if any and stamp duty charges.

Policy Loan

No Policy loan is allowed under this Policy

UIN: 117N092V02 Page 6 of 8

PNB MetLife Mera Term Plan

Revival

You can revive your Policy during the Policy Term but within a period of two years from the date of first unpaid

premium by submitting the proof of continued insurability to the satisfaction of the Company and making the

payment of all due premiums together with interest payment at the rate that may be prevailing at the time of

payment depending on the Government Bond Yield. At present, we charge an interest rate of 9% p.a. upon such

policy revivals. The Company reserves the right to change this interest rate, subject to approval from IRDA of India.

For reviving a lapsed policy, the proof of continued insurability, as required by the Company, is to be provided by

the Policyholder / Person Insured at his/ her own cost. On revival of the policy, the policy benefits will be revived.

A surrendered Policy cannot be revived.

The Company reserves the right to revive the lapsed policy by imposing such extra premium as it deems fit as per

the Board approved underwriting policy.

Alteration between different modes of premium payment is allowed at any Policy Anniversary on request.

No other alterations are allowed under this Plan.

Goods & Services tax

Goods & Services tax will be applied as per current service tax laws, GST is applicable on the life insurance

premiums. Any other indirect tax or statutory levy becoming applicable in future may become payable by you by

any method we deem appropriate including by levy of an additional monetary amount in addition to premiums

What is not covered?

In the event the Policyholder, or the Second Life (if the Joint Life Cover Option is chosen), commits suicide,

whether sane or insane at that time, within one year from the Date of Inception of the Policy, the insurance cover

for both the First Life and the Second Life shall be void. The Company shall pay 80% of the premium(s) received

without interest.

In the event the Policyholder, or the Second Life (if the Joint Life Cover Option is choosen), commits suicide,

whether sane or insane at that time, within one year from the date of revival of the Policy, the insurance cover for

both the First Life and the Second Life shall be void. In such a case, the Company shall pay higher of the Surrender

Value on the date of death or 80% of the premiums paid till the date of death, provided the policy is in-force.

Am I entitled to claim tax benefits on premiums paid?

Tax benefits under this plan are available as per the provisions and conditions of the Income Tax Act and are

subject to any changes made in the tax laws in future. Please consult your tax advisor for advice on the availability

of tax benefits for the premiums paid and proceeds received under the policy.

About PNB MetLife

PNB MetLife India Insurance Company Limited (PNB MetLife) is a joint venture where MetLife, Inc. and Punjab

National Bank (PNB) are the majority shareholders. MetLife India has been present in India since 2001.

UIN: 117N092V02 Page 7 of 8

PNB MetLife Mera Term Plan

PNB MetLife brings together the financial strength of one of the world’s leading life insurance providers, MetLife,

Inc., and the credibility and reliability of Punjab National Bank, one of India's oldest and leading nationalised banks.

The vast distribution reach of PNB together with the global insurance expertise and product range of MetLife

makes PNB MetLife a strong and trusted insurance provider.

The Company is present in 115 locations across the country and serves customers in more than 7,000 locations

through its bank partnerships with PNB, the Jammu & Kashmir Bank Limited and Karnataka Bank Limited.

PNB MetLife provides a wide range of protection and retirement products through its Agency sales of over 6,000

financial advisors and bank partners, and provides access to employee benefit plans to over 1,200 unique

corporate clients in India.

For more information, visit www.pnbmetlife.com

Disclaimer

Extract of Section 41 of the Insurance Act, 1938, as amended from time to time states

(1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take

out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any

rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy,

nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as

may be allowed in accordance with the published prospectuses or tables of the insurer

(2) Any Person making default in complying with the provisions of this section shall be punishable with fine which

may extend to ten lakh rupees.

Fraud and misrepresentation

Treatment will be as per Section 45 of the Insurance Act, 1938 as amended from time to time.

Please read this Sales brochure carefully before concluding any sale.

This product brochure is only indicative of terms, conditions, warranties and exceptions contained in the

insurance policy. The detailed Terms and Conditions are contained in the Policy Document.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS, IRDA of India clarifies to public that;

• IRDA of India or its officials do not involve in activities like sale of any kind of insurance or financial products nor

invest premiums.

IRDA of India does not announce any bonus. Public receiving such phone calls are requested to lodge a police

complaint along with details of phone call number.

Communication / Correspondence

PNB MetLife India Insurance Company Limited,

Registered office: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -

560001, Karnataka.

Call us Toll-free at 1-800-425-6969,

Website: www.pnbmetlife.com,

Email: indiaservice@pnbmetlife.co.in or

Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai –

400062. Phone: +91-22-41790000, Fax: +91-22-41790203

UIN: 117N092V02 Page 8 of 8

Potrebbero piacerti anche

- LIC's Single Premium Group Insurance PlanDocumento5 pagineLIC's Single Premium Group Insurance PlanAditya SharmaNessuna valutazione finora

- Super Series BrochureDocumento20 pagineSuper Series Brochuremantoo kumarNessuna valutazione finora

- Invest Builder - Product SummaryDocumento30 pagineInvest Builder - Product SummaryJun Rui ChngNessuna valutazione finora

- MANAV PPT ProjectDocumento37 pagineMANAV PPT ProjectDrVivek SansonNessuna valutazione finora

- Ewealth Insurance - BrochureDocumento16 pagineEwealth Insurance - BrochurerajendranrajendranNessuna valutazione finora

- Met Sukh: Accumulation PlanDocumento4 pagineMet Sukh: Accumulation PlanShunmuga RajanNessuna valutazione finora

- With Insurance: Make Smart Moves To Grow Your WealthDocumento16 pagineWith Insurance: Make Smart Moves To Grow Your Wealthchethanhg526Nessuna valutazione finora

- FAQs On NPS - HDFC - v3Documento16 pagineFAQs On NPS - HDFC - v3Pratap ReddyNessuna valutazione finora

- EFU Savings and Life ProtectionDocumento12 pagineEFU Savings and Life ProtectionGhafoor khanNessuna valutazione finora

- Profit PlusDocumento5 pagineProfit Plusap87Nessuna valutazione finora

- Liquidity FundDocumento3 pagineLiquidity Fundtangkc09Nessuna valutazione finora

- 934 Sales Brochure Jeevan TarunDocumento16 pagine934 Sales Brochure Jeevan TarunRV Ranveer SharmaNessuna valutazione finora

- I Growth KF FinalDocumento1 paginaI Growth KF FinalManohar PoosarlaNessuna valutazione finora

- SAVE FOR YOUR FUTURE WITH EFU BETTER LIFE SAVINGS PLANDocumento14 pagineSAVE FOR YOUR FUTURE WITH EFU BETTER LIFE SAVINGS PLANqasimhkNessuna valutazione finora

- Sales Brochure LIC S Jeevan Lakshya PDFDocumento11 pagineSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10Nessuna valutazione finora

- (For Regular Pay Variant) : PPT PTDocumento10 pagine(For Regular Pay Variant) : PPT PTVikash SharmaNessuna valutazione finora

- Enhanced Income Select OverviewDocumento2 pagineEnhanced Income Select OverviewdjdazedNessuna valutazione finora

- SIPDocumento20 pagineSIPSanket Bhondage0% (1)

- Isecure LoanDocumento8 pagineIsecure Loansameer hNessuna valutazione finora

- Pension Plus: Plan For Pension .. Plan For Lifelong Celebration .Documento10 paginePension Plus: Plan For Pension .. Plan For Lifelong Celebration .Abhinav VermaNessuna valutazione finora

- Standardized Product: TrainingDocumento44 pagineStandardized Product: TrainingHannington KondeNessuna valutazione finora

- Handbook 2Documento28 pagineHandbook 2Shamrao ChakaneNessuna valutazione finora

- Know Your Jeevan Tarun Child PlanDocumento4 pagineKnow Your Jeevan Tarun Child PlanDhirendra DubeyNessuna valutazione finora

- E-RateBook - A-Life Legasi Builder - FinalDocumento64 pagineE-RateBook - A-Life Legasi Builder - FinalBig DaddyCoolNessuna valutazione finora

- 831 J Sangam IntroDocumento6 pagine831 J Sangam IntroJames WilliamsNessuna valutazione finora

- Lender 1cqhdubbv - 478333Documento45 pagineLender 1cqhdubbv - 478333DGLNessuna valutazione finora

- Policy Terms and Conditions FAQDocumento5 paginePolicy Terms and Conditions FAQRahul SaswadkarNessuna valutazione finora

- Kotak Money Back PlanDocumento2 pagineKotak Money Back PlanRupran RaiNessuna valutazione finora

- Kotak Money Back PlanDocumento2 pagineKotak Money Back PlanDriptendu MaitiNessuna valutazione finora

- Great Flexi Wealth: A Solution That Takes Your Savings FurtherDocumento8 pagineGreat Flexi Wealth: A Solution That Takes Your Savings Furthersharil86Nessuna valutazione finora

- Meezan ExampleDocumento5 pagineMeezan ExampleAmna NawazNessuna valutazione finora

- ICICI Ulip PlansDocumento6 pagineICICI Ulip Plansshibin.johneyNessuna valutazione finora

- Sales Talk Pension PlusDocumento4 pagineSales Talk Pension PlustsrajanNessuna valutazione finora

- Benefits:: Participation in ProfitsDocumento10 pagineBenefits:: Participation in Profitslakshman777Nessuna valutazione finora

- EFU Aggressive Growth PlanDocumento14 pagineEFU Aggressive Growth PlanGhafoor khanNessuna valutazione finora

- Premier Money Back PlanDocumento12 paginePremier Money Back PlanPraveen Kumar JeyaprakashNessuna valutazione finora

- Sales Brochure LIC Jeevan LakshyaDocumento16 pagineSales Brochure LIC Jeevan LakshyaPraveen latteNessuna valutazione finora

- Sales Brochure LIC Jeevan LakshyaDocumento16 pagineSales Brochure LIC Jeevan LakshyaRai BrijNessuna valutazione finora

- Saral+Swadhan+Plus +Brochure+NewDocumento8 pagineSaral+Swadhan+Plus +Brochure+NewChittaranjan GhantaNessuna valutazione finora

- Sales Brochure LIC Jeevan LakshyaDocumento16 pagineSales Brochure LIC Jeevan LakshyaRajnish SinghNessuna valutazione finora

- LIC Jeevan Anand HomeDocumento3 pagineLIC Jeevan Anand HomeAnkit AgarwalNessuna valutazione finora

- Lic English Leaflet Jeevan Saral4x9 Inches WXHDocumento12 pagineLic English Leaflet Jeevan Saral4x9 Inches WXHEkta SinhaNessuna valutazione finora

- Adamjee Life Parvaaz Education and Marriage PlanDocumento1 paginaAdamjee Life Parvaaz Education and Marriage PlanAbdul WaheedNessuna valutazione finora

- EFU Education and Marriage PlanDocumento12 pagineEFU Education and Marriage PlanGhafoor khanNessuna valutazione finora

- Happiness.: Take Simple Steps Towards Wealth ofDocumento12 pagineHappiness.: Take Simple Steps Towards Wealth ofnipat29bajajNessuna valutazione finora

- BAI Insurance CIADocumento21 pagineBAI Insurance CIAMehraan ZoroofchiNessuna valutazione finora

- ET Zindagi PlusDocumento34 pagineET Zindagi PlussandeepmNessuna valutazione finora

- NPS at a Glance: Costs, Funds, Pros & Cons of India's National Pension SchemeDocumento5 pagineNPS at a Glance: Costs, Funds, Pros & Cons of India's National Pension SchemeKarthikeyanNessuna valutazione finora

- A Study On Consumer Buying Behaviour For Individual Health Insurance in BhubaneswarDocumento20 pagineA Study On Consumer Buying Behaviour For Individual Health Insurance in Bhubaneswarprasanta818Nessuna valutazione finora

- Max Life Insuranceinga PDFDocumento9 pagineMax Life Insuranceinga PDFRashi GandhNessuna valutazione finora

- Jeevan UtsavDocumento23 pagineJeevan Utsavgtvikram08Nessuna valutazione finora

- LIC Nivesh-Plus - Brochure - 9-Inch-X-8-InchDocumento17 pagineLIC Nivesh-Plus - Brochure - 9-Inch-X-8-InchanooppattazhyNessuna valutazione finora

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Documento16 pagineLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNessuna valutazione finora

- Sales Brochure - LIC S New Children S Money Back PlanDocumento11 pagineSales Brochure - LIC S New Children S Money Back Planamit_saxena_10Nessuna valutazione finora

- Sales Brochure - LIC S Bhagya Lakshmi PlanDocumento6 pagineSales Brochure - LIC S Bhagya Lakshmi PlanAbhinavHarshalNessuna valutazione finora

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocumento13 pagineLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNessuna valutazione finora

- PNBMet Life Mera Term PlanDocumento5 paginePNBMet Life Mera Term PlanK RamanadhanNessuna valutazione finora

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingDa EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNessuna valutazione finora

- Wbi 37162Documento16 pagineWbi 37162Sanjay RaghuvanshiNessuna valutazione finora

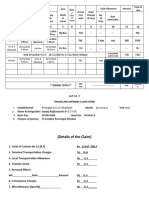

- (Details of The Claim) : 1 2 3 4 5 6 7 8 9 10 11 12 by Bus - 74/ - 74/ - 74/ - 1 Day 180 254Documento2 pagine(Details of The Claim) : 1 2 3 4 5 6 7 8 9 10 11 12 by Bus - 74/ - 74/ - 74/ - 1 Day 180 254Sanjay RaghuvanshiNessuna valutazione finora

- 2020031215848486Documento27 pagine2020031215848486Sanjay RaghuvanshiNessuna valutazione finora

- Vehicle Systems and Components QuizDocumento27 pagineVehicle Systems and Components QuizSanjay Raghuvanshi100% (1)

- Vehicle Systems and Components QuizDocumento27 pagineVehicle Systems and Components QuizSanjay Raghuvanshi100% (1)

- HPPSC Recruitment for Finance and Accounts ServiceDocumento13 pagineHPPSC Recruitment for Finance and Accounts ServiceSanjay RaghuvanshiNessuna valutazione finora

- © Ncert Not To Be Republished: O Kikjh) JKTK VKSJ RHFKZ K KHDocumento12 pagine© Ncert Not To Be Republished: O Kikjh) JKTK VKSJ RHFKZ K KHAshish KushwahaNessuna valutazione finora

- PHP in HindiDocumento56 paginePHP in HindiRitesh Bagwale100% (1)

- CS GATE'2017 Paper 02 Key SolutionDocumento32 pagineCS GATE'2017 Paper 02 Key Solutionvarsha1504Nessuna valutazione finora

- IETS-HP - Installation Document-Ver1.1Documento27 pagineIETS-HP - Installation Document-Ver1.1Sanjay Raghuvanshi100% (1)

- Subject Utilization ReportDocumento1 paginaSubject Utilization ReportSanjay RaghuvanshiNessuna valutazione finora

- INA Award List in RDocumento1 paginaINA Award List in RSanjay RaghuvanshiNessuna valutazione finora

- Java ScriptttDocumento8 pagineJava ScriptttSanjay RaghuvanshiNessuna valutazione finora

- SBI Life Poorna Suraksha BrochureDocumento24 pagineSBI Life Poorna Suraksha BrochureSanjay RaghuvanshiNessuna valutazione finora

- Digital SystemsDocumento675 pagineDigital SystemsvikramjhaNessuna valutazione finora

- Almost Complete Database of Gate 2012 Cs ResultsDocumento319 pagineAlmost Complete Database of Gate 2012 Cs ResultsSanjay RaghuvanshiNessuna valutazione finora

- Improving Buffalo Breeding Through Genetics and ManagementDocumento12 pagineImproving Buffalo Breeding Through Genetics and ManagementrichardikNessuna valutazione finora

- Iit PatnaDocumento8 pagineIit PatnaSanjay RaghuvanshiNessuna valutazione finora

- ISS22 ShababiDocumento36 pagineISS22 ShababiAderito Raimundo MazuzeNessuna valutazione finora

- 5 Nodal PricingDocumento13 pagine5 Nodal PricingJatin100% (1)

- Interview With Holcim - Finacial ExpressDocumento3 pagineInterview With Holcim - Finacial ExpressMM Fakhrul IslamNessuna valutazione finora

- ESDEP Vol0101ADocumento64 pagineESDEP Vol0101Aaladinmf1100% (1)

- Chapter 3Documento143 pagineChapter 3Ashik Uz ZamanNessuna valutazione finora

- Inventory Optimization Problems and FormulasDocumento6 pagineInventory Optimization Problems and FormulasShreya GanguliNessuna valutazione finora

- AdfeDocumento11 pagineAdfeIbrahim SalahudinNessuna valutazione finora

- Indian shipping industry holds ocean of opportunitiesDocumento17 pagineIndian shipping industry holds ocean of opportunitiesASHOKNessuna valutazione finora

- IBPS CLERK MAINS 2018 Memory Based Quant SOL PDFDocumento13 pagineIBPS CLERK MAINS 2018 Memory Based Quant SOL PDFAishwarya Devkar PatilNessuna valutazione finora

- Newmont MiningDocumento38 pagineNewmont MiningHenry JenkinsNessuna valutazione finora

- Endogeneity, Simultaneity and Logit Demand Analysis of Competitive Pricing and AdvertisingDocumento28 pagineEndogeneity, Simultaneity and Logit Demand Analysis of Competitive Pricing and AdvertisingbhaskkarNessuna valutazione finora

- Sebi Grade A 2020: Economics-Consumption & Investment FunctionDocumento11 pagineSebi Grade A 2020: Economics-Consumption & Investment FunctionThabarak ShaikhNessuna valutazione finora

- Standard Costing AnalysisDocumento106 pagineStandard Costing AnalysisUsama RiazNessuna valutazione finora

- Sample Company ProfileDocumento3 pagineSample Company ProfileiosfusfNessuna valutazione finora

- MNP Transfer PricingDocumento2 pagineMNP Transfer PricingNational PostNessuna valutazione finora

- NTA UGC NET Economics Syllabus PDFDocumento8 pagineNTA UGC NET Economics Syllabus PDFKajal RathiNessuna valutazione finora

- International Market Entry Course Cost Sheet AssignmentsDocumento7 pagineInternational Market Entry Course Cost Sheet AssignmentsRajvi ChatwaniNessuna valutazione finora

- A Perpetual System ToDocumento16 pagineA Perpetual System ToCharmine de la CruzNessuna valutazione finora

- 15-IFRS 15 - SummaryDocumento6 pagine15-IFRS 15 - SummaryhusseinNessuna valutazione finora

- Nivea 13 FullDocumento4 pagineNivea 13 FullNikhil AlvaNessuna valutazione finora

- Project Feasibility Study Output-MarketingDocumento8 pagineProject Feasibility Study Output-MarketingViancaPearlAmoresNessuna valutazione finora

- Variance Analysis Lecture NotesDocumento5 pagineVariance Analysis Lecture NotesIena IenaNessuna valutazione finora

- Analyzing Costs and Profits in Perfect CompetitionDocumento5 pagineAnalyzing Costs and Profits in Perfect CompetitionFrany IlardeNessuna valutazione finora

- Machinery, Expenses, Ratios, Cash Flow AnalysisDocumento3 pagineMachinery, Expenses, Ratios, Cash Flow AnalysisAjit KumarNessuna valutazione finora

- CH 12 Student KrajewskiDocumento28 pagineCH 12 Student KrajewskiprasanthmctNessuna valutazione finora

- Advance Futures & OptionsDocumento6 pagineAdvance Futures & OptionsJkNessuna valutazione finora

- COSTING Chapter 2Documento14 pagineCOSTING Chapter 2Raksha ShettyNessuna valutazione finora

- Strategic FitDocumento49 pagineStrategic FitMayank PrakashNessuna valutazione finora

- BVT 1 SolDocumento5 pagineBVT 1 SolJimmy JenkinsNessuna valutazione finora

- Healthcare Reform Timeline For Self-Funded PlansDocumento1 paginaHealthcare Reform Timeline For Self-Funded PlansPayerFusionNessuna valutazione finora