Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bloomberg Activist Hedge Fund Quarz Sees 40% Upside in Sunningdale 13 Dec 2018

Caricato da

qpmoerzhDescrizione originale:

Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Bloomberg Activist Hedge Fund Quarz Sees 40% Upside in Sunningdale 13 Dec 2018

Caricato da

qpmoerzhCopyright:

13/12/2018

Activist Hedge Fund Quarz Sees 40% Upside

in Sunningdale

• Investor urges company to increase dividend yield to 7 percent

• Quarz says Singapore plastics firm is “severely undervalued”

(Bloomberg) – Activist hedge fund Quarz

Capital Management Ltd. said

Singapore’s Sunningdale Tech Ltd. is

“severely undervalued” and urged the

company’s management to boost investor

confidence by providing more information on

its products, businesses and strategic plans.

Quarz has accumulated an almost 5 percent

stake in the company, which makes and sells

plastic components for medical, consumer

and automotive products, and is looking to

buy more, the firm said in an open letter

obtained by Bloomberg News. It believes Sunningdale investors could see the stock rally more than 40 percent

by 2020.

The company’s shares rose 4.3 percent to S$1.46 on Thursday, with trading volume of five times the three-

month daily average. The gains trimmed Sunningdale’s loss for the year to 24 percent.

Sunningdale “welcomes constructive feedback from its shareholders and is encouraged by active shareholders

participation,” the company said in a statement to the Singapore Exchange after the market close. It will

“continue to explore all options that may unlock value for shareholders” and Quarz Capital’s recommendations

will “receive the appropriate consideration.”

Co-founded in 2011 by ex-UBS Group AG investment banker Jan Moermann, Quarz has publicly targeted four

Singapore companies since 2016. Last year, it asked International Healthway Corp. to oust its board, saying

the company was deeply undervalued and poorly run. And in 2016, it called on Metro Holdings Ltd.

to return excess cash to shareholders.

Quarz said Sunningdale should distribute more than 60 percent of its core net profit to provide an “attractive

dividend yield” of around 7 percent, while maintaining about S$25 million ($18 million) for investment and around

S$17 million of cash flow. It sees Sunningdale’s free cash flow and balance sheet strengthening next year

because the company has already invested significant capital expenditure in 2018. Core net profit should reach

at least S$31 million in 2019, Quarz estimated. Net income in 2017 was S$22.7 million.

Sunningdale has been undervalued by shareholders who don’t understand its “engineering expertise, products,

recurring cash flow, growth catalysts and strong corporate governance,” and have a short-term focus on foreign-

exchange gains and quarterly earnings, Quarz said.

The company is a “global player in precision plastic engineering” with long-term clients such as German car-

parts maker Continental AG, pharmaceutical firm Roche Holding AG and HP Inc., the hedge fund said. It also

said Sunningdale should return more than 50 percent of its proceeds from the proposed sale of a factory in

China to investors.

Sunningdale’s largest owners include Chairman Koh Boon Hwee, who has a 15.7 percent stake, and Singapore

tycoon Goi Seng Hui, who owns 8 percent, Bloomberg data show.

Livia Yap

Page 1 / 1

Potrebbero piacerti anche

- A Study of the Supply Chain and Financial Parameters of a Small BusinessDa EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNessuna valutazione finora

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessDa EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNessuna valutazione finora

- The Edge Quarz Urges Sunningdale To Raise Dividend Distribution To 60% of Core Net Profit 13 Dec 2018Documento2 pagineThe Edge Quarz Urges Sunningdale To Raise Dividend Distribution To 60% of Core Net Profit 13 Dec 2018qpmoerzhNessuna valutazione finora

- SolaraDocumento23 pagineSolarapratham2508arora.slNessuna valutazione finora

- Quarz Capital Management Open Letter Sunningdale Tech Dec 2018 FINALDocumento4 pagineQuarz Capital Management Open Letter Sunningdale Tech Dec 2018 FINALqpmoerzhNessuna valutazione finora

- Ar2019 PDFDocumento132 pagineAr2019 PDFsrikrishnanp825Nessuna valutazione finora

- Ratio Analysis of Hero Fin Copr Srinagar GarhwlDocumento49 pagineRatio Analysis of Hero Fin Copr Srinagar GarhwlswetaNessuna valutazione finora

- ACT1202.Case Study 1 - StudentDocumento6 pagineACT1202.Case Study 1 - StudentKeight NuevaNessuna valutazione finora

- Umakant Project 22Documento89 pagineUmakant Project 22Deepak SinghalNessuna valutazione finora

- 65abf67cefcc6 Invest-O-Spective Round 1 CaseDocumento4 pagine65abf67cefcc6 Invest-O-Spective Round 1 CaseVishnu PNessuna valutazione finora

- Financial AccountingDocumento23 pagineFinancial AccountingAnkit SinghNessuna valutazione finora

- Refrigerator Business PlanDocumento25 pagineRefrigerator Business PlanKunu Gabriel100% (1)

- Idea Cellular LTD.Documento10 pagineIdea Cellular LTD.saurabhkumar0664Nessuna valutazione finora

- Hexaware Sustainability ReportDocumento72 pagineHexaware Sustainability ReportMNessuna valutazione finora

- RC Capital Management - INA000004088: Is A SEBI Registered Investment Advisor Registration NumberDocumento44 pagineRC Capital Management - INA000004088: Is A SEBI Registered Investment Advisor Registration NumberBhalani VijayNessuna valutazione finora

- Cera Sanitaryware Limited 1Documento58 pagineCera Sanitaryware Limited 1Parul KatiyarNessuna valutazione finora

- Hikal ResearchNote 09oct2012Documento15 pagineHikal ResearchNote 09oct2012equityanalystinvestorNessuna valutazione finora

- A Study On The Financial Analysis of Reliance InduDocumento14 pagineA Study On The Financial Analysis of Reliance InduSukhmanNessuna valutazione finora

- Final Strama PaperDocumento62 pagineFinal Strama PaperHelen Meriz Sagun100% (1)

- Saratoga Investor Relation Presentation 9M19 Final - PublicDocumento15 pagineSaratoga Investor Relation Presentation 9M19 Final - Publicsigitsutoko8765Nessuna valutazione finora

- He Study of Working Capital Management"Documento32 pagineHe Study of Working Capital Management"DineshNessuna valutazione finora

- Chapter 1 - Introduction A. Company ProfileDocumento63 pagineChapter 1 - Introduction A. Company ProfileRengie SalesNessuna valutazione finora

- DG Khan Cement Final Report AreebDocumento23 pagineDG Khan Cement Final Report AreebAreeb AsifNessuna valutazione finora

- BFN6013 Ia 20190674Documento19 pagineBFN6013 Ia 20190674RS UNIQUE STUDIONessuna valutazione finora

- HDFC Report (Repaired)Documento92 pagineHDFC Report (Repaired)Archana AgarwalNessuna valutazione finora

- IntroductionDocumento13 pagineIntroductionAbhishek KoriNessuna valutazione finora

- Mock 1Documento30 pagineMock 1Raghav NagarajanNessuna valutazione finora

- Vijaya Bank Single FileDocumento55 pagineVijaya Bank Single Filedivya ReddyNessuna valutazione finora

- NATCO FinalDocumento19 pagineNATCO FinalSagar BhardwajNessuna valutazione finora

- Apcotex - Stocks ReportDocumento6 pagineApcotex - Stocks ReportVed-And-TechsNessuna valutazione finora

- First Quarter 2022 Earnings Presentation May 5, 2022Documento30 pagineFirst Quarter 2022 Earnings Presentation May 5, 2022ignaciaNessuna valutazione finora

- Consus - Information MemorandumDocumento51 pagineConsus - Information MemorandumNisha PunjabiNessuna valutazione finora

- Project Report On Working Capital ManagementDocumento43 pagineProject Report On Working Capital ManagementChinmay Joshi100% (6)

- JLL Ar2012-13Documento180 pagineJLL Ar2012-13Gundeep Singh KapoorNessuna valutazione finora

- Acme Laboratories Ltd. - Unsolicited-PtdDocumento13 pagineAcme Laboratories Ltd. - Unsolicited-PtdnasirNessuna valutazione finora

- Crisil Annual Report 2019 PDFDocumento256 pagineCrisil Annual Report 2019 PDFYoYoNessuna valutazione finora

- International Financial Management: Dr. Gajavelli V.SDocumento10 pagineInternational Financial Management: Dr. Gajavelli V.SZaid K HussainNessuna valutazione finora

- PR NCLT Demerger Pel Aug 12 2022 002Documento2 paginePR NCLT Demerger Pel Aug 12 2022 002Piramal GroupNessuna valutazione finora

- 2014 CFA Level 3 Mock Exam AfternoonDocumento30 pagine2014 CFA Level 3 Mock Exam AfternoonElsiiieNessuna valutazione finora

- Sample 1 Information MemorandumDocumento66 pagineSample 1 Information Memorandumgordon.fridgeNessuna valutazione finora

- Annual Report 2018 PDFDocumento100 pagineAnnual Report 2018 PDFjaganyallaNessuna valutazione finora

- Case Studies and Hot TopicsDocumento24 pagineCase Studies and Hot TopicsAnit DevesiyaNessuna valutazione finora

- Stock Rationale IOP-V2Documento20 pagineStock Rationale IOP-V2kunjal mistryNessuna valutazione finora

- Mansi CaseDocumento6 pagineMansi CaseMansi VermaNessuna valutazione finora

- Tolins Study ReportDocumento34 pagineTolins Study ReportBalu Jagadish50% (2)

- April 2022Documento43 pagineApril 2022Indraneel MahantiNessuna valutazione finora

- Financial Analysis of Havells India Ltd.Documento55 pagineFinancial Analysis of Havells India Ltd.Bhuwan Gaur100% (3)

- Fine Organic Industries - R - 17012020Documento8 pagineFine Organic Industries - R - 17012020Sameer NaikNessuna valutazione finora

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Documento74 paginePiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203Nessuna valutazione finora

- Hero Motocorp Annual Report 2012-13Documento155 pagineHero Motocorp Annual Report 2012-13Apurv GuptaNessuna valutazione finora

- Minor Project PresentationDocumento18 pagineMinor Project PresentationShubham AgarwalNessuna valutazione finora

- Project of Global BusinessDocumento6 pagineProject of Global BusinessArpit BohreNessuna valutazione finora

- Working CapitalDocumento31 pagineWorking CapitalHiya SanganiNessuna valutazione finora

- Global AM 2020 Survey Industry Deck - PublicDocumento15 pagineGlobal AM 2020 Survey Industry Deck - PublicValerio ScaccoNessuna valutazione finora

- Assignment MmeiDocumento12 pagineAssignment Mmeisheela ShashiitharanNessuna valutazione finora

- Proctor and Gamble Strategic ManagementDocumento15 pagineProctor and Gamble Strategic ManagementAdeelNessuna valutazione finora

- Final Strama PaperDocumento68 pagineFinal Strama Paperthrezce_1350% (2)

- A Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofDocumento58 pagineA Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofYatin BhardwajNessuna valutazione finora

- CEREC 01.01.2021 Presentation PDFDocumento34 pagineCEREC 01.01.2021 Presentation PDFqpmoerzhNessuna valutazione finora

- The Edge Sabana REIT's Untapped GFA Could Raise NAV As New Tech Park Undergoes AEI 18 Nov 2019Documento2 pagineThe Edge Sabana REIT's Untapped GFA Could Raise NAV As New Tech Park Undergoes AEI 18 Nov 2019qpmoerzhNessuna valutazione finora

- CEREC 01.01.2021 Presentation PDFDocumento34 pagineCEREC 01.01.2021 Presentation PDFqpmoerzhNessuna valutazione finora

- CEREC 2.4 E++.pagesDocumento277 pagineCEREC 2.4 E++.pagesqpmoerzhNessuna valutazione finora

- The Edge Quarz Capital Hedge Fund Manager Writes Open Letter To ESR 14 Nov 2019Documento1 paginaThe Edge Quarz Capital Hedge Fund Manager Writes Open Letter To ESR 14 Nov 2019qpmoerzhNessuna valutazione finora

- Business Times Ascendas Hospitality Trust Should Merge With Ascott REIT, Says Quarz Capital 25 April 2019Documento2 pagineBusiness Times Ascendas Hospitality Trust Should Merge With Ascott REIT, Says Quarz Capital 25 April 2019qpmoerzhNessuna valutazione finora

- Bloomberg Activist Fund Urges Singapore REIT Merger To Boost Value 25 April 2019Documento2 pagineBloomberg Activist Fund Urges Singapore REIT Merger To Boost Value 25 April 2019qpmoerzhNessuna valutazione finora

- Quarz Capital Management CSE Global Presentation FINAL 26th Feb 2018Documento23 pagineQuarz Capital Management CSE Global Presentation FINAL 26th Feb 2018qpmoerzhNessuna valutazione finora

- Quarz Capital Management Open Letter Sabana REIT and ESR Cayman Nov 2019 FINALDocumento6 pagineQuarz Capital Management Open Letter Sabana REIT and ESR Cayman Nov 2019 FINALqpmoerzh100% (1)

- Quarz - Capital Sunningdale TechDocumento23 pagineQuarz - Capital Sunningdale TechqpmoerzhNessuna valutazione finora

- The Impact of Shareholder Activism - Cover Story - The Edge MalaysiaDocumento3 pagineThe Impact of Shareholder Activism - Cover Story - The Edge Malaysiaqpmoerzh100% (1)

- QCA Open Letter To LendingClub Board and Management 9 May 2018 FINALDocumento5 pagineQCA Open Letter To LendingClub Board and Management 9 May 2018 FINALqpmoerzhNessuna valutazione finora

- Lending Club Shares Surge On Brighter EarningsDocumento2 pagineLending Club Shares Surge On Brighter EarningsqpmoerzhNessuna valutazione finora

- Quarz Capital Management Open Letter To CSE Global FINAL 26th Feb 2018Documento6 pagineQuarz Capital Management Open Letter To CSE Global FINAL 26th Feb 2018qpmoerzhNessuna valutazione finora

- Quarz Capital ASIA Financial Analyst InternDocumento1 paginaQuarz Capital ASIA Financial Analyst InternqpmoerzhNessuna valutazione finora

- Straits Times HG Metal To Undertake Capital Reduction Return Cash To Shareholders 25 Sept 2017Documento1 paginaStraits Times HG Metal To Undertake Capital Reduction Return Cash To Shareholders 25 Sept 2017qpmoerzhNessuna valutazione finora

- PR Newswire QCM Open Letter To The Board of Directors of HG Metal 31 May 2017Documento5 paginePR Newswire QCM Open Letter To The Board of Directors of HG Metal 31 May 2017qpmoerzhNessuna valutazione finora

- Activist Investing in Asia Sept 2017Documento20 pagineActivist Investing in Asia Sept 2017qpmoerzhNessuna valutazione finora

- Quarz Capital Management International Healthway Corp FINAL Presentation 17 Jan 2017Documento18 pagineQuarz Capital Management International Healthway Corp FINAL Presentation 17 Jan 2017qpmoerzhNessuna valutazione finora

- The Gould Standard Capital Crusaders On The March 10 Dec 2015Documento3 pagineThe Gould Standard Capital Crusaders On The March 10 Dec 2015qpmoerzhNessuna valutazione finora

- Activist Insight Dissident Win Proxy Contest at International Healthway 23 Jan 2017Documento1 paginaActivist Insight Dissident Win Proxy Contest at International Healthway 23 Jan 2017qpmoerzhNessuna valutazione finora

- Barrons This Singaporean Stock Could Be More Than 60% Undervalued 1 June 2017Documento3 pagineBarrons This Singaporean Stock Could Be More Than 60% Undervalued 1 June 2017qpmoerzhNessuna valutazione finora

- QCM HG Metal Manufacturing Limited Presentation 31 May 2017Documento21 pagineQCM HG Metal Manufacturing Limited Presentation 31 May 2017qpmoerzhNessuna valutazione finora

- Quarz Capital Management PR NEWSWIRE Final Open Letter To International Healthway Corp 13 Jan 2017Documento5 pagineQuarz Capital Management PR NEWSWIRE Final Open Letter To International Healthway Corp 13 Jan 2017qpmoerzhNessuna valutazione finora

- Straits Times Activist Investor Targets International Healthway Jan 14 2017Documento2 pagineStraits Times Activist Investor Targets International Healthway Jan 14 2017qpmoerzhNessuna valutazione finora

- Bloomberg IHC Shareholders Vote To Replace Board As OUE Buys 208m Shares 24 Jan 2017Documento1 paginaBloomberg IHC Shareholders Vote To Replace Board As OUE Buys 208m Shares 24 Jan 2017qpmoerzhNessuna valutazione finora

- Fama French (2015) - International Tests of A Five-Factor Asset Pricing ModelDocumento23 pagineFama French (2015) - International Tests of A Five-Factor Asset Pricing ModelBayu D. PutraNessuna valutazione finora

- Executive Summery-Integrated Steel CompanyDocumento2 pagineExecutive Summery-Integrated Steel Companyjeet3184Nessuna valutazione finora

- Cheat SheetDocumento9 pagineCheat SheetIndra VijayakumarNessuna valutazione finora

- Pmr201006 Michael Van Biema InterviewDocumento9 paginePmr201006 Michael Van Biema InterviewPradeep RaghunathanNessuna valutazione finora

- SSRN Id2317650 PDFDocumento12 pagineSSRN Id2317650 PDFOutage StoppedNessuna valutazione finora

- Adjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Documento14 pagineAdjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Shyam SunderNessuna valutazione finora

- 2-Factors HJM Estimation and Hedging For Oil and GasDocumento60 pagine2-Factors HJM Estimation and Hedging For Oil and GasSamy-AdrienAkmNessuna valutazione finora

- Chapter 15Documento2 pagineChapter 15Asep KurniaNessuna valutazione finora

- FNCE 30001 Week 12 Portfolio Performance EvaluationDocumento83 pagineFNCE 30001 Week 12 Portfolio Performance EvaluationVrtpy Ciurban100% (1)

- Financial ManagementDocumento51 pagineFinancial Managementamish rajNessuna valutazione finora

- JHHFGHKDocumento5 pagineJHHFGHKhkcity250Nessuna valutazione finora

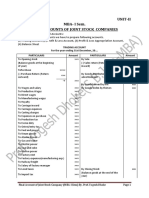

- UNIT II Final Account CollegeDocumento36 pagineUNIT II Final Account CollegeyogeshNessuna valutazione finora

- How Securities Are TradedDocumento15 pagineHow Securities Are TradedReham HegazyNessuna valutazione finora

- Damodaran PDFDocumento79 pagineDamodaran PDFLokesh Damani0% (1)

- Difference Between Large Mid Small Cap FundsDocumento14 pagineDifference Between Large Mid Small Cap FundsNaresh KotrikeNessuna valutazione finora

- 2 - Financial ModelingDocumento22 pagine2 - Financial Modelinggracelee541Nessuna valutazione finora

- PFRS 3 Business CombinationsDocumento11 paginePFRS 3 Business CombinationsRonalynPuatuNessuna valutazione finora

- 2 DDMDocumento5 pagine2 DDMSilvani Margaretha SimangunsongNessuna valutazione finora

- Financial ManagementDocumento6 pagineFinancial ManagementAshish PrajapatiNessuna valutazione finora

- CORFISER SIMI Fund CV SEPTEMBER 2012 +3.1397% For A YTD of +41.4916Documento2 pagineCORFISER SIMI Fund CV SEPTEMBER 2012 +3.1397% For A YTD of +41.4916Finser GroupNessuna valutazione finora

- Maa Takaful Shariah Investment - Linked FundsDocumento3 pagineMaa Takaful Shariah Investment - Linked FundsdikirNessuna valutazione finora

- Edelweiss Hexagon PMSDocumento33 pagineEdelweiss Hexagon PMSAnkur100% (2)

- 10 Year Financials of AAPL - Apple Inc. - GuruFocusDocumento2 pagine10 Year Financials of AAPL - Apple Inc. - GuruFocusEchuOkan1Nessuna valutazione finora

- P2 06Documento9 pagineP2 06Darrel100% (1)

- Liquidity-Adjusted Asset Pricing ModelDocumento16 pagineLiquidity-Adjusted Asset Pricing ModelismaelovNessuna valutazione finora

- Indicaters of StocksDocumento5 pagineIndicaters of StocksarshadalicaNessuna valutazione finora

- JPMorgan SystematicStrategiesAcrossAssetsRiskFactorApproachtoAssetAllocation Dec 11 2013 PDFDocumento205 pagineJPMorgan SystematicStrategiesAcrossAssetsRiskFactorApproachtoAssetAllocation Dec 11 2013 PDFMark CastellaniNessuna valutazione finora

- Fama&MacBeth PresentationDocumento16 pagineFama&MacBeth PresentationAntonio J FernósNessuna valutazione finora

- Cityam 20213-01-18Documento27 pagineCityam 20213-01-18City A.M.Nessuna valutazione finora