Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bir Ruling No 477-2013

Caricato da

Jaz SumalinogCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bir Ruling No 477-2013

Caricato da

Jaz SumalinogCopyright:

Formati disponibili

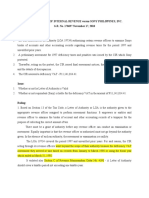

BIR RULING NO.

477-2013

December 19, 2013

FACTS:

Marlow Navigation Training Center, Inc is a non-stock, non-profit educational institution duly

organized under Philippine laws. Its purpose is to provide in-house training to seafarers.

Through its president, they requested the BIR for tax exemption under Sec.30(H) and value-added

tax (VAT) exemption under Sec.109(H) of the 1997 Tax Code.

ISSUE: WON Marlow Navigation Training Center as non-stock, non-profit educational institution must

be granted tax and VAT exemption.

RULING: YES, Marlow Navigation Training Center is granted tax and VAT exemption but with

prohibitions.

Par.3, Sec.4, Art.XIV of the 1987 Constitution provides that, “All revenues and assets of non-stock,

non-profit educational institutions used actually, directly and exclusively for educational purposes shall

be exempt from taxes and duties.” Likewise, non-stock and non-profit institution is exempted from tax

on corporation under Sec.30(H) of the 1997 Tax Code. The exemption refers to internal revenue taxes

imposed by the National Government on all revenues and assets of non-stock, non-profit educational

institutions used for educational purposes.

On the other hand, non-stock, non-profit educational institutions whose gross income from unrelated

trade, business or other activity does not exceed 50% of their total gross income derived from all

sources, shall pay 10% on their taxable income except those covered by Sec.27(D) of the Tax Code.

However, the same shall be subject to regular corporate income tax rate prescribed by law if their gross

income from unrelated trade, business or other activity exceeds 50%.

In this request, Marlow Navigation Training Center as a non-stock and non-profit educational institution

shall be exempt from the payment of taxes and duties on all its revenues and assets used actually,

directly and exclusively for educational purposes. Its gross receipts from operations are likewise

exempt from from VAT. However, it shall be subject to internal revenue taxes on income from trade,

business or other activity, the conduct of which is unrelated to the exercise or performance by such

educational institutions of their educational purposes or functions. Other activities involving sale of

goods and services not in connection with its primary purposes are also subject to 12% VAT imposed

under Secs.106 nd 108 of the Tax Code, as amended, or 3% percentage tax imposed under Sec.116 in

relation to Sec.109(V) of teh same Code if gross sales or receipts from such sale of goods and

services do not exceed P1,919,500 which tax payment may legitimately be passed on to buyers of

such goods and services. Hence, as long as Marlow Navigation Training Center wil not engage in the

regular conduct or pursuit of a commercial or economic activity, including transactions incidental

thereto, it will remain exempt from VAT

Potrebbero piacerti anche

- Top Delinquent TaxpayersDocumento13 pagineTop Delinquent TaxpayersRosemary McCoyNessuna valutazione finora

- Wells Fargo Combined Statement of AccountsDocumento6 pagineWells Fargo Combined Statement of AccountsEverardo HaroNessuna valutazione finora

- 2020 Guide to Small Business Tax PlanningDa Everand2020 Guide to Small Business Tax PlanningNessuna valutazione finora

- Francisco V PeopleDocumento2 pagineFrancisco V PeopleJaz SumalinogNessuna valutazione finora

- CIR V DLSU 2009 DigestDocumento5 pagineCIR V DLSU 2009 DigestCelina Marie Panaligan100% (1)

- Electric Kiwi Invoice - 051020 To 031120Documento2 pagineElectric Kiwi Invoice - 051020 To 031120Mary Anne JamisolaNessuna valutazione finora

- Pre Week 2018 Taxation Law Cabaneiro PDFDocumento420 paginePre Week 2018 Taxation Law Cabaneiro PDFPatrice De CastroNessuna valutazione finora

- A Guide To Street Design in Urban India: Better Streets, Better Cities 2012Documento178 pagineA Guide To Street Design in Urban India: Better Streets, Better Cities 2012Vaishnavi JayakumarNessuna valutazione finora

- 1040 Exam Prep: Module I: The Form 1040 FormulaDa Everand1040 Exam Prep: Module I: The Form 1040 FormulaValutazione: 1 su 5 stelle1/5 (3)

- Go v. Bureau of ImmigrationDocumento4 pagineGo v. Bureau of ImmigrationJaz SumalinogNessuna valutazione finora

- Preferential TaxationDocumento8 paginePreferential TaxationMary Jane PabroaNessuna valutazione finora

- Taxation Law CabaneiroDocumento420 pagineTaxation Law CabaneiroJared Libiran75% (4)

- Tax 2 - Compilation - Case Digest - Part 2Documento12 pagineTax 2 - Compilation - Case Digest - Part 2Andrea Patricia DaquialNessuna valutazione finora

- Frivaldo Vs COMELECDocumento2 pagineFrivaldo Vs COMELECJaz SumalinogNessuna valutazione finora

- CIR v. DLSUDocumento2 pagineCIR v. DLSUJoseph DimalantaNessuna valutazione finora

- Republic Act No 9337Documento31 pagineRepublic Act No 9337Mie TotNessuna valutazione finora

- Tan JR V HosanaDocumento2 pagineTan JR V HosanaJaz SumalinogNessuna valutazione finora

- People V Whisenhunt GR No. 123819, 14 Nov 2001 FactsDocumento3 paginePeople V Whisenhunt GR No. 123819, 14 Nov 2001 FactsJaz SumalinogNessuna valutazione finora

- University of Nueva Caceres College of Business and Accountancy J. Hernandez Avenue, Naga City Prelim Exam Intermediate Accounting One JdmanaogDocumento10 pagineUniversity of Nueva Caceres College of Business and Accountancy J. Hernandez Avenue, Naga City Prelim Exam Intermediate Accounting One JdmanaogJustin ManaogNessuna valutazione finora

- People V PugayDocumento1 paginaPeople V PugayJaz SumalinogNessuna valutazione finora

- Commissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Documento3 pagineCommissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Violet Parker100% (1)

- Bayot V CA GR No. 155635, 7 Nov 2008 Topic: Citizenship Via Recognition FactsDocumento2 pagineBayot V CA GR No. 155635, 7 Nov 2008 Topic: Citizenship Via Recognition FactsJaz SumalinogNessuna valutazione finora

- People Vs DomasianDocumento2 paginePeople Vs DomasianJaz SumalinogNessuna valutazione finora

- People Vs EganDocumento2 paginePeople Vs EganJaz SumalinogNessuna valutazione finora

- People V PO1 TrestizaDocumento2 paginePeople V PO1 TrestizaJaz SumalinogNessuna valutazione finora

- Steel Corporation of The Philippines V BOCDocumento2 pagineSteel Corporation of The Philippines V BOCJaz SumalinogNessuna valutazione finora

- CIR V DLSU G.R. 196596 Nov. 9 2016Documento4 pagineCIR V DLSU G.R. 196596 Nov. 9 2016Howard ClarkNessuna valutazione finora

- Aguirre V SOJDocumento2 pagineAguirre V SOJJaz Sumalinog0% (1)

- People V YauDocumento1 paginaPeople V YauJaz SumalinogNessuna valutazione finora

- Timoner V PeopleDocumento1 paginaTimoner V PeopleJaz Sumalinog100% (1)

- RMC 78-2022Documento3 pagineRMC 78-2022Ian PalmaNessuna valutazione finora

- March BIR RulingsDocumento13 pagineMarch BIR Rulingscarlee014Nessuna valutazione finora

- Tax On ServiceDocumento21 pagineTax On ServiceHazel-mae LabradaNessuna valutazione finora

- Categories of Income and Tax RatesDocumento5 pagineCategories of Income and Tax RatesRonel CacheroNessuna valutazione finora

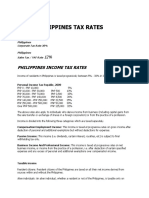

- Philippines Tax RatesDocumento7 paginePhilippines Tax RatesRonel CacheroNessuna valutazione finora

- CIR Vs DLSUDocumento3 pagineCIR Vs DLSUHaniya Solaiman GuroNessuna valutazione finora

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSDocumento9 pagineMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47Nessuna valutazione finora

- Corporate Income Tax Part 2Documento8 pagineCorporate Income Tax Part 2Pilyang SweetNessuna valutazione finora

- Taxation Affecting Tourism Industry in The PhilippinesDocumento33 pagineTaxation Affecting Tourism Industry in The Philippinesrheaangelique_triasNessuna valutazione finora

- Lawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocumento31 pagineLawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledMarie Nickie BolosNessuna valutazione finora

- Philippines Income Tax RatesDocumento6 paginePhilippines Income Tax RatesKristina AngelieNessuna valutazione finora

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocumento26 pagineBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDeeteroseNessuna valutazione finora

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocumento35 pagineBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledKevin MatibagNessuna valutazione finora

- CIR v. DLSU - CONSTI IIDocumento4 pagineCIR v. DLSU - CONSTI IIJan Chrys MeerNessuna valutazione finora

- Philippines Tax RatesDocumento7 paginePhilippines Tax RatesJL GEN0% (1)

- CIR v. DLSUDocumento2 pagineCIR v. DLSURodri JamesNessuna valutazione finora

- Section 1. Section 27 of The National Internal Revenue Code of 1997, AsDocumento55 pagineSection 1. Section 27 of The National Internal Revenue Code of 1997, AsVladimir Reyes100% (1)

- Tax On CorporationsDocumento6 pagineTax On CorporationsJumen Gamaru TamayoNessuna valutazione finora

- Tax DiscussionDocumento10 pagineTax DiscussionMaisie ZabalaNessuna valutazione finora

- Ra 9337Documento39 pagineRa 9337KcompacionNessuna valutazione finora

- Income Taxation Finals - CompressDocumento9 pagineIncome Taxation Finals - CompressElaiza RegaladoNessuna valutazione finora

- 09 Ra 9337 PDFDocumento41 pagine09 Ra 9337 PDFHonorio John P. ZingapanNessuna valutazione finora

- Ra 9337Documento41 pagineRa 9337Arianne MarzanNessuna valutazione finora

- BirDocumento4 pagineBirAnonymous fnlSh4KHIgNessuna valutazione finora

- RMC 76 2003Documento1 paginaRMC 76 2003Dorothy PuguonNessuna valutazione finora

- Ra 9337Documento34 pagineRa 9337Inayab AtienzaNessuna valutazione finora

- Study For Tax DeductionsDocumento4 pagineStudy For Tax DeductionsHei Nah MontanaNessuna valutazione finora

- CIR v. DLSUDocumento3 pagineCIR v. DLSUCarlyle Esquivias ChuaNessuna valutazione finora

- TRUE OR FALSE (p.179,180)Documento2 pagineTRUE OR FALSE (p.179,180)Aberin GalenzogaNessuna valutazione finora

- Sir Lectures Final TaxDocumento12 pagineSir Lectures Final TaxCrystal KateNessuna valutazione finora

- Evat CaseDocumento45 pagineEvat CaseJo BatsNessuna valutazione finora

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocumento45 pagineBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledJo BatsNessuna valutazione finora

- 20 CIR V Dlsu DigestDocumento5 pagine20 CIR V Dlsu DigestARCHIE AJIASNessuna valutazione finora

- Income Tax On Individuals Part 2Documento22 pagineIncome Tax On Individuals Part 2mmhNessuna valutazione finora

- Income Taxation of Proprietary Educational InstitutionsDocumento2 pagineIncome Taxation of Proprietary Educational InstitutionsRegina Grace GadoNessuna valutazione finora

- Taxation ReportDocumento3 pagineTaxation ReportBernard Jayson LausNessuna valutazione finora

- Title Ii Chapter IvDocumento8 pagineTitle Ii Chapter IvMae CarpilaNessuna valutazione finora

- General Tax Liabilities of Domestic CorpsDocumento5 pagineGeneral Tax Liabilities of Domestic CorpsCora EleazarNessuna valutazione finora

- Goods Sold' Shall Include The Invoice Cost of TheDocumento9 pagineGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaNessuna valutazione finora

- Commissioner of Internal Revenue Versus Sony Philippines, Inc. G.R. No. 178697 November 17, 2010 FactsDocumento46 pagineCommissioner of Internal Revenue Versus Sony Philippines, Inc. G.R. No. 178697 November 17, 2010 FactsJuan AntonioNessuna valutazione finora

- Corporate Taxes in The PhilippinesDocumento2 pagineCorporate Taxes in The PhilippinesAike SadjailNessuna valutazione finora

- Tax CasesDocumento11 pagineTax CasesJesse AlindoganNessuna valutazione finora

- Cir V. Ca/ComasercoDocumento2 pagineCir V. Ca/ComasercoEdward Kenneth KungNessuna valutazione finora

- A.1.Income Tax SystemsDocumento25 pagineA.1.Income Tax SystemsAVNessuna valutazione finora

- Philippine Corporate TaxDocumento3 paginePhilippine Corporate TaxRaymond FaeldoñaNessuna valutazione finora

- Taxation 1 Case 4Documento6 pagineTaxation 1 Case 4regine rose bantilanNessuna valutazione finora

- Cir V. Dlsu: Tax RemediesDocumento18 pagineCir V. Dlsu: Tax Remediesesmeralda de guzmanNessuna valutazione finora

- RR 20-01Documento5 pagineRR 20-01matinikkiNessuna valutazione finora

- G.R. No. 120988, Aug. 11, 1997: People v. Dela CruzDocumento1 paginaG.R. No. 120988, Aug. 11, 1997: People v. Dela CruzJaz SumalinogNessuna valutazione finora

- People V Campuhan GR No. 129433, 30 Mar 2000 FactsDocumento2 paginePeople V Campuhan GR No. 129433, 30 Mar 2000 FactsJaz SumalinogNessuna valutazione finora

- Cayao Vs Del Mundo PDFDocumento9 pagineCayao Vs Del Mundo PDFRille Ephreim AsisNessuna valutazione finora

- Bayan V ZamoraDocumento4 pagineBayan V ZamoraJaz SumalinogNessuna valutazione finora

- Quinto V Andres GR No. 155791, 16 Mar 2005 FactsDocumento2 pagineQuinto V Andres GR No. 155791, 16 Mar 2005 FactsJaz SumalinogNessuna valutazione finora

- Tan V CADocumento2 pagineTan V CAJaz SumalinogNessuna valutazione finora

- People V SanidadDocumento2 paginePeople V SanidadJaz Sumalinog0% (1)

- People V RocheDocumento1 paginaPeople V RocheJaz SumalinogNessuna valutazione finora

- People Vs CA and TanganDocumento1 paginaPeople Vs CA and TanganJaz SumalinogNessuna valutazione finora

- Altajeros V ComelecDocumento2 pagineAltajeros V ComelecJaz SumalinogNessuna valutazione finora

- Valenzuela V People GR No. 160188, 21 June 2007 FactsDocumento3 pagineValenzuela V People GR No. 160188, 21 June 2007 FactsJaz SumalinogNessuna valutazione finora

- People V AlapanDocumento1 paginaPeople V AlapanJaz SumalinogNessuna valutazione finora

- Risos-Vidal V COMELECDocumento3 pagineRisos-Vidal V COMELECJaz SumalinogNessuna valutazione finora

- Miranda V Deportation BoardDocumento1 paginaMiranda V Deportation BoardJaz SumalinogNessuna valutazione finora

- People V SanidadDocumento2 paginePeople V SanidadJaz Sumalinog0% (1)

- Pangan Vs GarbaliteDocumento2 paginePangan Vs GarbaliteJaz SumalinogNessuna valutazione finora

- NEFT Form - South Indian BankDocumento1 paginaNEFT Form - South Indian BankNETWAY SOLUTIONS KAYAMKULAMNessuna valutazione finora

- March 10th ReportDocumento33 pagineMarch 10th ReportMitch RyalsNessuna valutazione finora

- Bd/Saraswathy PPA Membership ApplicationDocumento2 pagineBd/Saraswathy PPA Membership ApplicationPranavaghanan MurugeshNessuna valutazione finora

- May-19-3084Documento4 pagineMay-19-3084Rizvan MasroorNessuna valutazione finora

- BPI Payment ProcedureDocumento2 pagineBPI Payment ProcedureSarina Asuncion Gutierrez100% (1)

- Materi Training Excel#Pivot GraphicDocumento14 pagineMateri Training Excel#Pivot GraphicSatria AtyantaNessuna valutazione finora

- PaytmDocumento10 paginePaytmKunal randhirNessuna valutazione finora

- Government Accounting Disbursements Definition of TermsDocumento7 pagineGovernment Accounting Disbursements Definition of Termsralph macahiligNessuna valutazione finora

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocumento21 pagine2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNessuna valutazione finora

- 509 Bob Statement PDFDocumento1 pagina509 Bob Statement PDFMansuri SalmanNessuna valutazione finora

- Banking: Commercial Bank and Central Bank: Learning ObjectivesDocumento8 pagineBanking: Commercial Bank and Central Bank: Learning Objectivesanon_792919970Nessuna valutazione finora

- Car Rental ReceiptDocumento1 paginaCar Rental ReceiptabrshNessuna valutazione finora

- Rmo 29-2014 Annex ADocumento1 paginaRmo 29-2014 Annex AteekeiseeNessuna valutazione finora

- Supply Chain Management-Historical PerspectiveDocumento7 pagineSupply Chain Management-Historical PerspectiveTalha SaeedNessuna valutazione finora

- Muhammad Osaid Ahmed: ExperienceDocumento2 pagineMuhammad Osaid Ahmed: ExperienceosaidahmedNessuna valutazione finora

- 375x Full Capture XBOX Hits (UHQ) - @SpawnGoStockDocumento44 pagine375x Full Capture XBOX Hits (UHQ) - @SpawnGoStockbeyeb58041Nessuna valutazione finora

- Logistics Driven PackagingDocumento20 pagineLogistics Driven PackagingnixamaniNessuna valutazione finora

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Documento4 pagineThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021Ramit PramanickNessuna valutazione finora

- Andina FreightDocumento73 pagineAndina FreightReynolds TorresNessuna valutazione finora

- BA0150036 - Rishi EswarDocumento81 pagineBA0150036 - Rishi EswarNimalanNessuna valutazione finora

- Oracle Apps - Third Party Payments in Oracle Payables R12 PDFDocumento6 pagineOracle Apps - Third Party Payments in Oracle Payables R12 PDFAhmed ElhendawyNessuna valutazione finora

- Manish Srivastava-TDS ConfigrationDocumento14 pagineManish Srivastava-TDS ConfigrationTaneesha YadavNessuna valutazione finora

- Chapter One Introduction To Taxation and Tax AccountingDocumento69 pagineChapter One Introduction To Taxation and Tax AccountingMelat Gebretsion100% (2)

- Brian Le Sar and David Porteous (2013) - "Introduction To The National Payments SystemDocumento2 pagineBrian Le Sar and David Porteous (2013) - "Introduction To The National Payments SystemShemair LewisNessuna valutazione finora

- Insurance Policy BIDocumento5 pagineInsurance Policy BILakshav KapoorNessuna valutazione finora