Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PO For Text Testing

Caricato da

Sumit BabaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PO For Text Testing

Caricato da

Sumit BabaCopyright:

Formati disponibili

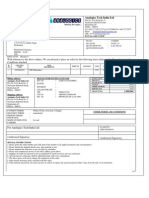

*** TEST DOCUMENT ONLY ***

Sold To:

Honeywell International (India) Pvt.Ltd. Purchase order

Plot No 2-A, 1st Floor Malviya Nagar, Corner Market Number Version Date

110017 NEW DELHI

India 4400515929 0 26-MAY-2010

Honeywell's Purchase Order number and line item number must appear on all

invoices, shipping documents and notices, bills of lading, and all

correspondence related to this order. Unless prohibited by law or otherwise

indicated on the face of this Purchase Order, all Payment terms shall

commence from the date upon which both (i) a correct invoice is received at

the specified "Bill to - mailing" address and in accordance with the Net terms

of payment indicated below subject to Honeywell's normally scheduled twice

monthly payment runs and (ii) all goods and/or services are received in

Vendor Address: conformance with the Purchase Order.

BW Technologies by Honeywell

Calgary, Canada

2840 - 2nd Avenue S.E. Bill To - mailing address:

ALBERTA AB T2A 7X9

Honeywell International (India) Pvt. Ltd

Canada

Attention : Mr. Abid Hussain

Sector - 36, Pace City - 2

122004 GURGAON,HARYANA

India

Your Vendor Number with us: P310156

Tel: 6303776674

Ship to: Honeywell Contact:

Honeywell International (India) Pvt.Ltd. Buyer: Name: Hussain, Abid

Sector - 36, Pace City -II Tel: +91-124-4752716

122004 GURGAON Fax: +91-124-4752750

India Email: abid.hussain@honeywell.com

Accts Tel: +91-124-4752700

Payable: Email: ap-ggn.systemsensor@honeywell.com

Terms of payment : Net zero days - I/C

Currency : USD

Terms of delivery : EXW(Ex Works) /EX-WORKS

Notes:

1) Please send the order confirmation within 24 hours from the receipt of this Purchase Order.

2) Vendor Code, PO No.,Item No. & description must be quoted in all correspondence, Invoice, documents & Material.

3) The Order is subject to terms and conditions mentioned overleaf until otherwise specified.

4) Send photocopies of G/R, Invoice, Airway Bill/Bill of Landing and other documents through fax immediately after dispatch.

5) All material ordered should comply to QMS standards or as per our Internal Standards.

With effect from 1st April, 2010, as per new provisions (section 206AA) in the Income Tax Act, 1961 every vendor providing

service needs to have Permanent Account Number (PAN). If the same is not there then Tax(TDS) shall be deducted at 20%

from the amount of the bill. Kindly provide scan copy of your PAN card and also mention the same on your bill so that

we can update the same in our system. Kindly ensure that your PAN is updated properly in our system.

Item Material/Description Quantity UoM Unit Price Net Amount TAX

10 TESTMAT2 10.00 EA 23.00 / EA 230.00 N

TEST MATERIAL

This Purchase order line is in reference to contract 4600001462 Item 00010

Delivery Date: 07-JUN-2010

This is contract Text.

This is info record text.

_________________

Total net value excl. tax USD 230.00

Approved by: Hussain, Abid

TIN No. - TIN: 06961922937 Commissionerate - DELHI - III

ECC No. - AABCA7954KXD001 Range - XI

Division - III, HSIDC, Gurgaon

Page 1 of 1

Potrebbero piacerti anche

- Tax Invoice: Realike InternationalDocumento1 paginaTax Invoice: Realike InternationalsumitNessuna valutazione finora

- Po 609 AlphaDocumento2 paginePo 609 AlphapavanNessuna valutazione finora

- Chile (DHL) - 500CS TOCOMFREE S929 PLUS+500PCS USB WIFI Price Invoice PI NO - HY01 - 2016050601 2016-05-06)Documento26 pagineChile (DHL) - 500CS TOCOMFREE S929 PLUS+500PCS USB WIFI Price Invoice PI NO - HY01 - 2016050601 2016-05-06)Felipe Catalan GalvezNessuna valutazione finora

- Höegh Autoliners AS: Bill of LadingDocumento2 pagineHöegh Autoliners AS: Bill of LadingkNessuna valutazione finora

- Sh05 Export InvoiceDocumento1 paginaSh05 Export InvoiceGanesh BharaneNessuna valutazione finora

- Commercial Invoice: WUXI Gezhiling Machanical&Electrical CO.,LTDDocumento1 paginaCommercial Invoice: WUXI Gezhiling Machanical&Electrical CO.,LTDkishinheidanNessuna valutazione finora

- More Than Just A Home Away From HomeDocumento1 paginaMore Than Just A Home Away From HomeMirza ZunnurainNessuna valutazione finora

- Receipt PDFDocumento1 paginaReceipt PDFMamun MozidNessuna valutazione finora

- 9019100097Documento1 pagina9019100097ramanNessuna valutazione finora

- Commercial Invoice: Shipper / Exportir / Manufacturers / BeneficiaryDocumento1 paginaCommercial Invoice: Shipper / Exportir / Manufacturers / BeneficiaryAlif RiskyNessuna valutazione finora

- 09050313-Windshield Quote CoveredDocumento2 pagine09050313-Windshield Quote CoveredJaineNessuna valutazione finora

- 0527 BillDocumento2 pagine0527 Billnamitjain98Nessuna valutazione finora

- GRIZZARD08252011Documento2 pagineGRIZZARD08252011frontroyalNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceRPGERNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shyam SundarNessuna valutazione finora

- 2023 PF 0000003Documento1 pagina2023 PF 0000003Shadowless EDNessuna valutazione finora

- Invoice 114Documento1 paginaInvoice 114bshari93_918887308Nessuna valutazione finora

- Tax Invoice: Billing Address: Shipping AddressDocumento7 pagineTax Invoice: Billing Address: Shipping AddressAnkit JainNessuna valutazione finora

- Union Bank of India (Tarnaka) : Signature Not VerifiedDocumento6 pagineUnion Bank of India (Tarnaka) : Signature Not VerifiedAnil AsangiNessuna valutazione finora

- Esfahan Badr Co, 20118476ADocumento1 paginaEsfahan Badr Co, 20118476AHamed HoseiniNessuna valutazione finora

- Ajio FL0114477630 1564208353305Documento2 pagineAjio FL0114477630 1564208353305sravanNessuna valutazione finora

- Mainfre InvDocumento1 paginaMainfre InvDragoslav DzolicNessuna valutazione finora

- Atlassian PaymentConfirmation AT-100742483 PDFDocumento3 pagineAtlassian PaymentConfirmation AT-100742483 PDFDeni Kurnianto NugrohoNessuna valutazione finora

- Import Manifest Proforma Invoice: Ìpmftiç&J6"È1Dar/22Novç45 R (È/106/Usd/KayandavîDocumento1 paginaImport Manifest Proforma Invoice: Ìpmftiç&J6"È1Dar/22Novç45 R (È/106/Usd/KayandavîRimzone Trading Co LtdNessuna valutazione finora

- PAG Invoice-6477675&630003486Documento1 paginaPAG Invoice-6477675&630003486GodsNessuna valutazione finora

- 4035311479Documento10 pagine4035311479K VinayNessuna valutazione finora

- Sample Invoice PDFDocumento3 pagineSample Invoice PDFMarcus OlivieraaNessuna valutazione finora

- Account Statement 280821 271121Documento26 pagineAccount Statement 280821 271121Prince KashyapNessuna valutazione finora

- Commercial Invoice: Shipped From: Shipped To/Sold ToDocumento1 paginaCommercial Invoice: Shipped From: Shipped To/Sold ToCheyerGcNessuna valutazione finora

- Invoice 7218770Documento2 pagineInvoice 7218770Johanny SantosNessuna valutazione finora

- INVOICEDocumento1 paginaINVOICEirfan dadiNessuna valutazione finora

- Invoice NoDocumento2 pagineInvoice Nodhiec100% (1)

- Po Tlaxcala Plant 1105869707Documento2 paginePo Tlaxcala Plant 1105869707Jade CastanedaNessuna valutazione finora

- BL, 3rd, DhakapowerDocumento2 pagineBL, 3rd, DhakapowerbappysaNessuna valutazione finora

- Invoice 39618325Documento1 paginaInvoice 39618325sam huangNessuna valutazione finora

- Coindirect CDD Form - Filled - NN 2Documento7 pagineCoindirect CDD Form - Filled - NN 2ginaNessuna valutazione finora

- Invoice Report For Cooley Law FirmDocumento1 paginaInvoice Report For Cooley Law FirminforumdocsNessuna valutazione finora

- ARROW Order # WEB-SO24774805 Has An Invoice WI00361291Documento7 pagineARROW Order # WEB-SO24774805 Has An Invoice WI00361291Raghunandan SubramanianNessuna valutazione finora

- 017517-Proforma Invoices FY 2019-20 PDFDocumento1 pagina017517-Proforma Invoices FY 2019-20 PDFMEDICAL SUPERINTENDENTNessuna valutazione finora

- MR - Augustin Mathew: Page 1 of 1 M-6163060Documento1 paginaMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWNessuna valutazione finora

- Invoice: Withdrawal Payment AdviceDocumento1 paginaInvoice: Withdrawal Payment AdviceBagus PrakosoNessuna valutazione finora

- Commercial Invoice: 070-1711-610 (USD) 070-1711-602 (IDR)Documento1 paginaCommercial Invoice: 070-1711-610 (USD) 070-1711-602 (IDR)Allyms FajrNessuna valutazione finora

- CustomInvoice 2488574255Documento1 paginaCustomInvoice 2488574255Man Hok WaiNessuna valutazione finora

- Commercial Invoice Vishvamata WOODWARD FINAL DRIVER BOXDocumento1 paginaCommercial Invoice Vishvamata WOODWARD FINAL DRIVER BOXSiva RamanNessuna valutazione finora

- T1 General PDFDocumento4 pagineT1 General PDFbatmanbittuNessuna valutazione finora

- Detailed Statement: Indianoil Citibank Titanium Credit CardDocumento7 pagineDetailed Statement: Indianoil Citibank Titanium Credit CardJ MuniyandiNessuna valutazione finora

- Purchase Order #T5470002173Documento2 paginePurchase Order #T5470002173Hasnain KhanNessuna valutazione finora

- Oop InvoiceDocumento1 paginaOop InvoiceNurulFachriNessuna valutazione finora

- Usps PDFDocumento1 paginaUsps PDFAdil KhanNessuna valutazione finora

- 1 InvoiceDocumento1 pagina1 InvoiceMohit GargNessuna valutazione finora

- Invoice TNTDocumento1 paginaInvoice TNTAbas AbasariNessuna valutazione finora

- RI22507945 - Dec 28 2022 - 183245Documento2 pagineRI22507945 - Dec 28 2022 - 183245vijayNessuna valutazione finora

- Nanavati PODocumento1 paginaNanavati POAnonymous SXTKyUsNessuna valutazione finora

- Statement Apr 20 XXXXXXXX0674 PDFDocumento12 pagineStatement Apr 20 XXXXXXXX0674 PDFmarikumar289Nessuna valutazione finora

- Invoice WetransferDocumento1 paginaInvoice Wetransfernoibagng928krNessuna valutazione finora

- Invoice OD121103752274883000Documento1 paginaInvoice OD121103752274883000Rahul DeyNessuna valutazione finora

- Sto Deccan Sale - 2 PDFDocumento1 paginaSto Deccan Sale - 2 PDFvicky gadekarNessuna valutazione finora

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Documento2 pagineSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNessuna valutazione finora

- UPS ReceiptDocumento2 pagineUPS Receiptbhadec05Nessuna valutazione finora

- Purchase OrderDocumento6 paginePurchase OrderCristian DiblaruNessuna valutazione finora

- Explain The Purpose and The Functions of HRMDocumento3 pagineExplain The Purpose and The Functions of HRMSujit DuwalNessuna valutazione finora

- FM (4th) May2019Documento2 pagineFM (4th) May2019DISHU GUPTANessuna valutazione finora

- COBECON - Math ProblemsDocumento16 pagineCOBECON - Math ProblemsdocumentsNessuna valutazione finora

- BusFin PT 5Documento5 pagineBusFin PT 5Nadjmeah AbdillahNessuna valutazione finora

- Lecture 3 - Introduction To International Business TradeDocumento13 pagineLecture 3 - Introduction To International Business TradeCAMELLENessuna valutazione finora

- Agnes Hanson's ResumeDocumento1 paginaAgnes Hanson's ResumeAgnes HansonNessuna valutazione finora

- CN WWF 20191021Documento14 pagineCN WWF 20191021Maria Fernanda ZuluagaNessuna valutazione finora

- MGT 314Documento21 pagineMGT 314Tonmoy Proffesional100% (1)

- Lead - Talent Management & ODDocumento2 pagineLead - Talent Management & ODanshatNessuna valutazione finora

- ABC Practice Problems Answer KeyDocumento10 pagineABC Practice Problems Answer KeyKemberly AribanNessuna valutazione finora

- Introduction To Human Resource ManagementDocumento5 pagineIntroduction To Human Resource ManagementJe SacdalNessuna valutazione finora

- (Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREDocumento31 pagine(Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREAndroid Boy71% (7)

- Risk Management: Case Study On AIGDocumento8 pagineRisk Management: Case Study On AIGPatrick ChauNessuna valutazione finora

- Case Study AnalysisDocumento4 pagineCase Study AnalysisZohaib Ahmed JamilNessuna valutazione finora

- Danone Universal Registration Document 2020 ENGDocumento319 pagineDanone Universal Registration Document 2020 ENGJosh VeigaNessuna valutazione finora

- David Graeber InterviewDocumento7 pagineDavid Graeber InterviewOccupyEconomicsNessuna valutazione finora

- Distribution Channel of United BiscuitsDocumento5 pagineDistribution Channel of United BiscuitsPawan SharmaNessuna valutazione finora

- Bank Statement (Various Formats)Documento48 pagineBank Statement (Various Formats)Araman AmruNessuna valutazione finora

- AAO Promotion Exam NewSyllabus ItDocumento35 pagineAAO Promotion Exam NewSyllabus ItSRanizaiNessuna valutazione finora

- Analiza SWOTDocumento15 pagineAnaliza SWOTSilviu GheorgheNessuna valutazione finora

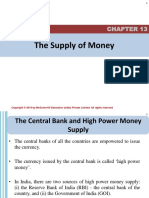

- MAC CH 12 Money Supply CC PDFDocumento20 pagineMAC CH 12 Money Supply CC PDFBerkshire Hathway coldNessuna valutazione finora

- Econ Notes From 25Documento5 pagineEcon Notes From 25Ayisa YaoNessuna valutazione finora

- Engg Eco Unit 2 D&SDocumento129 pagineEngg Eco Unit 2 D&SSindhu PNessuna valutazione finora

- BBB EXAM REVIEW 2023Documento12 pagineBBB EXAM REVIEW 2023osbros10Nessuna valutazione finora

- Managerial Economics Presentation On Gulf AirlinesDocumento16 pagineManagerial Economics Presentation On Gulf AirlinesSaquib SiddiqNessuna valutazione finora

- Business Intelligence AutomotiveDocumento32 pagineBusiness Intelligence AutomotiveElsaNessuna valutazione finora

- CH 13Documento21 pagineCH 13Ahmed Al EkamNessuna valutazione finora

- Nigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDocumento3 pagineNigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDung Rwang PamNessuna valutazione finora

- Boulevard 51 250516 Sales Kit 2016Documento54 pagineBoulevard 51 250516 Sales Kit 2016api-340431954Nessuna valutazione finora

- Notes 4Documento8 pagineNotes 4HARINessuna valutazione finora