Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

A-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018

Caricato da

Reiki Channel Anuj BhargavaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

A-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018

Caricato da

Reiki Channel Anuj BhargavaCopyright:

Formati disponibili

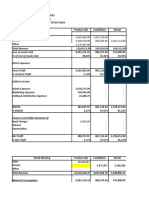

Bikanervala Foods Pvt. Ltd.

A-28, Lawrence Road, , New Delhi - 110035

Delhi

Pay Slip for the month of January-2018

Employee Code : BFPL03885 Father Name : Sh.Baboo Ram

Name : Mr. Bhupendra Singh Location : Lawrence Road Factory

Department : Revenue Department Sub location : Lucknow LR_51968

Sub Department : Man Power Reimbursement Bank Ac No. : 50100171504478 (HDFC Bank)

Designation : Unit Manager IFSC Code : HDFC0000158

Grade : M4 PF No. : -DLCPM00270910000004107

Date Of Joining : 23 Mar 2017 Esi No. :

Payable Days : 31.00 PAN : BZHPS6425C

LWP : 0.00 UAN No. : 100747773589

Arrear Days : 6.00

Leave Name Opening Balance Availed Leave Closing Balance

Casual Leave 7.00 1.00 6.00

Sick Leave 2.36 2.00 0.95

Priviledge Leave 5.76 0.00 7.01

Comp Off 4.00 4.00 0.00

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 13448.00 13448.00 2603.00 16051.00 PF 1926.00

HRA 6724.00 6724.00 1301.00 8025.00

Medical Reimbursement 1250.00 1250.00 242.00 1492.00

Conveyance 1600.00 1600.00 310.00 1910.00

Others 10598.00 10598.00 2051.00 12649.00

GROSS EARNINGS 33620.00 33620.00 6507.00 40127.00 GROSS DEDUCTIONS 1926.00

Net Pay : 38,201.00

Net Pay in words : INR Thirty Eight Thousand Two Hundred One Only

Income Tax Worksheet for the Period April 2017 - March 2018(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Variable Salary 13440.00 0.00 13440.00 Investments u/s 80C ExemptedQualifying Rent Paid 0.00

Basic 159583.00 0.00 159583.00 PROVIDENT FUND 19151.52 150000.00 From 01/04/2017

HRA 79791.00 0.00 79791.00 To 31/03/2018

Medical Reimbursement 14833.00 0.00 14833.00 1. Actual HRA 79791.00

Conveyance 18987.00 18987.00 0.00 2. 40% or 50% of Basic 63833.00

Others 125763.00 0.00 125763.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 79791.00

Gross 412397.00 18987.00 393410.00 Total of Investments u/s 80C 19151.52 150000.00

Deductions U/S 80C 19151.52 150000.00 TDS Deducted Monthly

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 19151.52 150000.00 Month Amount

Professional Tax 0.00 April-2017 0.00

Under Chapter VI-A 19151.52 May-2017 538.00

Any Other Income 0.00 June-2017 0.00

Taxable Income 374258.00 July-2017 554.00

Total Tax 6213.00 August-2017 783.00

Marginal Relief 0.00 September-2017 560.00

Tax Rebate 0.00 October-2017 661.00

Surcharge 0.00 November-2017 660.00

Tax Due 0.00 December-2017 0.00

Educational Cess 186.00 January-2018 0.00

Net Tax 6399.00 Tax Deducted on Perq. 0.00

Tax Deducted (Previous Employer) 0.00 Total 3756.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 3756.00

Tax to be Deducted 2643.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 0.00

Tax Deduction for this month 0.00

Personal Note: This is a system generated payslip, does not require any signature.

..................................................... Cut Here .....................................................

Potrebbero piacerti anche

- CRM Services Payslip for September 2021Documento1 paginaCRM Services Payslip for September 2021Phagun BehlNessuna valutazione finora

- CRM Services India Private Limited: Earnings DeductionsDocumento1 paginaCRM Services India Private Limited: Earnings DeductionsInnama SayedNessuna valutazione finora

- ServletController PDFDocumento1 paginaServletController PDFManiNessuna valutazione finora

- PDF 750277940261022Documento1 paginaPDF 750277940261022Ayush AgrawalNessuna valutazione finora

- PAYSLIPSDocumento52 paginePAYSLIPSrishichauhan25Nessuna valutazione finora

- DIVAKAR - M - May 2021 - PayslipDocumento1 paginaDIVAKAR - M - May 2021 - PayslippandiyanNessuna valutazione finora

- Sharath - BDE AprilDocumento1 paginaSharath - BDE AprilShaRath ShaRuNessuna valutazione finora

- Chemplast Sanmar September 2010 pay slip for Mohamed AnsariDocumento1 paginaChemplast Sanmar September 2010 pay slip for Mohamed AnsariMohamed AnsariNessuna valutazione finora

- 22 23 AkDocumento1 pagina22 23 AkAarti ThdfcNessuna valutazione finora

- Payslip MayDocumento1 paginaPayslip MaySATHEESH PAPINENINessuna valutazione finora

- Spectrum Consultants India Pvt Ltd November 2022 PayslipDocumento1 paginaSpectrum Consultants India Pvt Ltd November 2022 PayslipKiran PawarNessuna valutazione finora

- Pay Slip November 22Documento1 paginaPay Slip November 22JAGDISH KUMARNessuna valutazione finora

- Quess Corp pay slip Jan 2023Documento2 pagineQuess Corp pay slip Jan 2023AKM Enterprises Pvt LtdNessuna valutazione finora

- Payslip MayDocumento1 paginaPayslip Mayhdfccreditcard328Nessuna valutazione finora

- Senthil Vel - June 2023 - Salary SlipDocumento1 paginaSenthil Vel - June 2023 - Salary SlipJenish Christin rajNessuna valutazione finora

- WebPay 4.2 title for Gi Staffing Services Pvt. Ltd. November 2021 payslipDocumento1 paginaWebPay 4.2 title for Gi Staffing Services Pvt. Ltd. November 2021 payslipmahendraNessuna valutazione finora

- Noc For Embassy (Annexure 3a)Documento1 paginaNoc For Embassy (Annexure 3a)deepa deneshNessuna valutazione finora

- Syntel payslip November 2018Documento1 paginaSyntel payslip November 2018gssNessuna valutazione finora

- Ack MCZPS2922L 2022-23 135862180050523 PDFDocumento1 paginaAck MCZPS2922L 2022-23 135862180050523 PDFsandeep kuamr ChoubeyNessuna valutazione finora

- CRM INDIA SERVICES PVT LTD PAYSLIPDocumento2 pagineCRM INDIA SERVICES PVT LTD PAYSLIPParveen SainiNessuna valutazione finora

- Anuja Tejinkar3Documento1 paginaAnuja Tejinkar3javed9890Nessuna valutazione finora

- TMPL Payslip E645Documento2 pagineTMPL Payslip E645MMjagpreetNessuna valutazione finora

- Salary - APRIL2022 2Documento1 paginaSalary - APRIL2022 2katihariNessuna valutazione finora

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Documento2 pagineFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesNessuna valutazione finora

- Aion Infotech October 2019 PayslipDocumento1 paginaAion Infotech October 2019 Payslipsandeepreddy2427125Nessuna valutazione finora

- Payslip AnalysisDocumento1 paginaPayslip AnalysisJasmine SinglaNessuna valutazione finora

- Contoh PaySlipDocumento1 paginaContoh PaySlipIlyas ArdiansyahNessuna valutazione finora

- DDICGDIAP72DINOV22Documento1 paginaDDICGDIAP72DINOV22raghav bharadwajNessuna valutazione finora

- March 2023 Payslip for Vinay Kumar of Innova ESI Pvt LtdDocumento1 paginaMarch 2023 Payslip for Vinay Kumar of Innova ESI Pvt Ltdcredit cardNessuna valutazione finora

- April Pay SlipDocumento1 paginaApril Pay SlipBandari GoverdhanNessuna valutazione finora

- April 21 PayslipDocumento1 paginaApril 21 PayslipStephen SNessuna valutazione finora

- Jan 2023 PDFDocumento1 paginaJan 2023 PDFBEPF 32 Sharma RohitNessuna valutazione finora

- Noraini June 2023 Pay Slip PDFDocumento2 pagineNoraini June 2023 Pay Slip PDFNoraini NasimamNessuna valutazione finora

- Payslip Jan 2023Documento1 paginaPayslip Jan 2023Palanivelan KamarajNessuna valutazione finora

- Salary Slip For The Month of February 2014: Design & Engineering LTDDocumento1 paginaSalary Slip For The Month of February 2014: Design & Engineering LTDSaraswatapalitNessuna valutazione finora

- PAYSLIP Nov-2022 - NareshDocumento3 paginePAYSLIP Nov-2022 - NareshDharshan RajNessuna valutazione finora

- PayslipEncrypted 024297 May2021Documento1 paginaPayslipEncrypted 024297 May2021Sarvesh KumarNessuna valutazione finora

- Arunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Documento1 paginaArunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Ganesh KumarNessuna valutazione finora

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Documento1 paginaDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNessuna valutazione finora

- Annual Tax Statement Data for 2023Documento4 pagineAnnual Tax Statement Data for 2023shryeasNessuna valutazione finora

- Payslip Lyka Labs-Ramjeet PalDocumento1 paginaPayslip Lyka Labs-Ramjeet PalPankaj PandeyNessuna valutazione finora

- Payslips BigcDocumento1 paginaPayslips BigcjaganNessuna valutazione finora

- Zakiriya ItDocumento1 paginaZakiriya Itp. r ravichandraNessuna valutazione finora

- Payslip-34 (Lankalapalli Durga Prasad) Jul 2022Documento2 paginePayslip-34 (Lankalapalli Durga Prasad) Jul 2022Durga PrasadNessuna valutazione finora

- LG PayslipDocumento1 paginaLG PayslipDipendra TOMARNessuna valutazione finora

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocumento1 paginaATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNessuna valutazione finora

- Oct PayslipDocumento1 paginaOct PayslipPandu RjNessuna valutazione finora

- THVSH01176780000411504 PDFDocumento1 paginaTHVSH01176780000411504 PDFKamini Sumit ChouhanNessuna valutazione finora

- Ayslip For The Month of PR: No.184, Aveda Meta, Bangalore - 38Documento1 paginaAyslip For The Month of PR: No.184, Aveda Meta, Bangalore - 38HanumanthNessuna valutazione finora

- RPT Pay SlipDocumento1 paginaRPT Pay SlipAllia sharmaNessuna valutazione finora

- NCC Limited Payslip March 2019Documento1 paginaNCC Limited Payslip March 2019Mohan PraveenNessuna valutazione finora

- MIOT Hospitals pay slip Oct 2022Documento1 paginaMIOT Hospitals pay slip Oct 2022jesten jadeNessuna valutazione finora

- Aug - 23 Salary SlipDocumento1 paginaAug - 23 Salary SlipBack-End MarketingNessuna valutazione finora

- MABARA MANUFACTURING PAY SLIP FOR JUNE 2022Documento2 pagineMABARA MANUFACTURING PAY SLIP FOR JUNE 2022Parveen SainiNessuna valutazione finora

- CT13529 Payslip Feb2024Documento1 paginaCT13529 Payslip Feb2024Vikash SinghNessuna valutazione finora

- View Generated DocsDocumento2 pagineView Generated Docsvanshikakataria554Nessuna valutazione finora

- UnknownDocumento1 paginaUnknownrahulagarwal33Nessuna valutazione finora

- Report 3 PDFDocumento1 paginaReport 3 PDFBala JiNessuna valutazione finora

- ACK431792790120723Documento1 paginaACK431792790120723ThiruNessuna valutazione finora

- Employee DataDocumento2 pagineEmployee DataJitender singhNessuna valutazione finora

- Scanned BooksDocumento4 pagineScanned BooksReiki Channel Anuj BhargavaNessuna valutazione finora

- MCE BrochureDocumento10 pagineMCE BrochureReiki Channel Anuj BhargavaNessuna valutazione finora

- Scanned Books DetailDocumento4 pagineScanned Books DetailReiki Channel Anuj BhargavaNessuna valutazione finora

- Prabhat FeesDocumento1 paginaPrabhat FeesReiki Channel Anuj BhargavaNessuna valutazione finora

- Urgently Require Office Co-Ordinator (Male/Female) in Bengali Colony # 9266674160 # 7503874160Documento3 pagineUrgently Require Office Co-Ordinator (Male/Female) in Bengali Colony # 9266674160 # 7503874160Reiki Channel Anuj BhargavaNessuna valutazione finora

- Hindi PaperDocumento8 pagineHindi PaperReiki Channel Anuj BhargavaNessuna valutazione finora

- Cap MRKTDocumento4 pagineCap MRKTReiki Channel Anuj BhargavaNessuna valutazione finora

- AddDocumento4 pagineAddReiki Channel Anuj BhargavaNessuna valutazione finora

- MahindraDocumento3 pagineMahindraReiki Channel Anuj BhargavaNessuna valutazione finora

- Service MarketignDocumento4 pagineService MarketignReiki Channel Anuj BhargavaNessuna valutazione finora

- Urgently Require Office Co-Ordinator (Male/Female) in Bengali Colony # 9266674160 # 7503874160Documento1 paginaUrgently Require Office Co-Ordinator (Male/Female) in Bengali Colony # 9266674160 # 7503874160Reiki Channel Anuj BhargavaNessuna valutazione finora

- NotesDocumento4 pagineNotesReiki Channel Anuj BhargavaNessuna valutazione finora

- Symbiosis Centre For: Distance LearningDocumento3 pagineSymbiosis Centre For: Distance LearningReiki Channel Anuj BhargavaNessuna valutazione finora

- Project AddressDocumento4 pagineProject AddressReiki Channel Anuj BhargavaNessuna valutazione finora

- To Whom So Ever It May ConcernDocumento1 paginaTo Whom So Ever It May ConcernReiki Channel Anuj BhargavaNessuna valutazione finora

- To Whom So Ever It May ConcernDocumento1 paginaTo Whom So Ever It May ConcernReiki Channel Anuj BhargavaNessuna valutazione finora

- QuestionnaireDocumento3 pagineQuestionnaireReiki Channel Anuj BhargavaNessuna valutazione finora

- Symbiosis Centre For: Distance LearningDocumento4 pagineSymbiosis Centre For: Distance LearningReiki Channel Anuj BhargavaNessuna valutazione finora

- Nahi Jeena Tere Bina - Punjabi Song Lyrics About Missing A LoverDocumento1 paginaNahi Jeena Tere Bina - Punjabi Song Lyrics About Missing A LoverReiki Channel Anuj BhargavaNessuna valutazione finora

- Question-1 What Is The Definition and Concept of Business? Explain The Nature and Scope of Business? AnsDocumento100 pagineQuestion-1 What Is The Definition and Concept of Business? Explain The Nature and Scope of Business? AnsReiki Channel Anuj BhargavaNessuna valutazione finora

- Description: Tags: MouDocumento4 pagineDescription: Tags: Mouanon-351445Nessuna valutazione finora

- Appointment LetterDocumento1 paginaAppointment LetterReiki Channel Anuj BhargavaNessuna valutazione finora

- Symbiosis Centre For Distance Learning Symbiosis Bhawan, 1065 B, Gokhale Cross Road, Model Colony, Pune, Maharastra, INDIA 411016 PH: 020-66211000Documento3 pagineSymbiosis Centre For Distance Learning Symbiosis Bhawan, 1065 B, Gokhale Cross Road, Model Colony, Pune, Maharastra, INDIA 411016 PH: 020-66211000Reiki Channel Anuj BhargavaNessuna valutazione finora

- Sample Mo A TemplateDocumento4 pagineSample Mo A TemplateReiki Channel Anuj BhargavaNessuna valutazione finora

- AanandmathDocumento3 pagineAanandmathReiki Channel Anuj BhargavaNessuna valutazione finora

- Report PDF 1Documento3 pagineReport PDF 1Reiki Channel Anuj BhargavaNessuna valutazione finora

- Sample Mo A TemplateDocumento2 pagineSample Mo A TemplateardiandwikmNessuna valutazione finora

- Alternate SlotsDocumento4 pagineAlternate SlotsReiki Channel Anuj BhargavaNessuna valutazione finora

- Publication 5 13656 31Documento7 paginePublication 5 13656 31Sikakolli Venkata Siva KumarNessuna valutazione finora

- Morality of Corporate GovernanceDocumento19 pagineMorality of Corporate GovernanceSimbahang Lingkod Ng Bayan100% (1)

- ToA.1830 - Accounting Changes and Errors - OnlineDocumento3 pagineToA.1830 - Accounting Changes and Errors - OnlineJolina ManceraNessuna valutazione finora

- Doing Business in DubaiDocumento23 pagineDoing Business in DubaiAmira MohamedNessuna valutazione finora

- First Rate Intelligence: Part of Living Well Is Thinking Well - by Thomas Oppong - Kaizen Habits - O PDFDocumento1 paginaFirst Rate Intelligence: Part of Living Well Is Thinking Well - by Thomas Oppong - Kaizen Habits - O PDFkerahNessuna valutazione finora

- How To Be The Luckiest Person Alive - ExcerptDocumento9 pagineHow To Be The Luckiest Person Alive - Excerptannawitkowski88100% (1)

- 2 Taxation of International TransactionsDocumento7 pagine2 Taxation of International TransactionssumanmehtaNessuna valutazione finora

- Powerol - Monthly MIS FormatDocumento34 paginePowerol - Monthly MIS Formatdharmender singhNessuna valutazione finora

- Klse 20180306Documento46 pagineKlse 20180306Edwin AngNessuna valutazione finora

- 2007-08 VodafonecrDocumento378 pagine2007-08 VodafonecrManisha BishtNessuna valutazione finora

- Tanzania'S Oil and Gas Contract Regime, Investments and MarketsDocumento45 pagineTanzania'S Oil and Gas Contract Regime, Investments and Marketssamwel danielNessuna valutazione finora

- Topics SDADocumento1 paginaTopics SDAThinkLink, Foreign Affairs www.thinklk.comNessuna valutazione finora

- Ias 33 EpsDocumento55 pagineIas 33 EpszulfiNessuna valutazione finora

- 5.1 Role of Commercial BanksDocumento5 pagine5.1 Role of Commercial Banksbabunaidu2006Nessuna valutazione finora

- AssesmentDocumento31 pagineAssesmentLoudie ann MarcosNessuna valutazione finora

- Greg Simon #1 v7Documento9 pagineGreg Simon #1 v7ogangurelNessuna valutazione finora

- Doubling, Nick Leeson's Trading StrategyDocumento24 pagineDoubling, Nick Leeson's Trading Strategyapi-3699016Nessuna valutazione finora

- SM EntertainmentDocumento14 pagineSM EntertainmentSaeful AzisNessuna valutazione finora

- Mba Project Report On Financial PerformanceDocumento3 pagineMba Project Report On Financial PerformanceAmeen MtNessuna valutazione finora

- FinaMan Final TermDocumento15 pagineFinaMan Final TermHANNAH ROSS BAELNessuna valutazione finora

- Abilene Reflector ChronicleDocumento8 pagineAbilene Reflector ChronicleARCEditorNessuna valutazione finora

- Introduction To AgribusinessDocumento5 pagineIntroduction To AgribusinessEufemia GumbanNessuna valutazione finora

- Opportunities and Challenges of Green Marketing:: A Study of Small & Medium Scale Manufacturer Units in LudhianaDocumento41 pagineOpportunities and Challenges of Green Marketing:: A Study of Small & Medium Scale Manufacturer Units in LudhianatanuswtuNessuna valutazione finora

- Corporate Finance Trial Questions 2Documento11 pagineCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNessuna valutazione finora

- Group 7 - FPT - Financial AnalysisDocumento2 pagineGroup 7 - FPT - Financial AnalysisNgọcAnhNessuna valutazione finora

- Financial Markets QuestionsDocumento54 pagineFinancial Markets QuestionsMathias VindalNessuna valutazione finora

- Ultratech Cement: Margin Stays Firm Outlook Remains HealthyDocumento9 pagineUltratech Cement: Margin Stays Firm Outlook Remains HealthyHarsh ShahNessuna valutazione finora

- 2016 Level I IFT Mock Exam 1 Morning SAMPLEDocumento4 pagine2016 Level I IFT Mock Exam 1 Morning SAMPLEMuhibUrRasoolNessuna valutazione finora

- Limit Pricing, Entry Deterrence and Predatory PricingDocumento16 pagineLimit Pricing, Entry Deterrence and Predatory PricingAnwesha GhoshNessuna valutazione finora

- Icici Cheque PayinslipDocumento1 paginaIcici Cheque PayinslipSHAM LAL0% (1)

- Iif 8 Epcm Contracts Feb16 3Documento22 pagineIif 8 Epcm Contracts Feb16 3Jorge RammNessuna valutazione finora