Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cash and Securities Department

Caricato da

HAMMADHRDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cash and Securities Department

Caricato da

HAMMADHRCopyright:

Formati disponibili

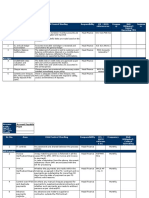

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 1 of 38

CASH AND SECURITIES DEPARTMENT

Preamble:

a. The Auditors shall carry out audit & checking of end-to-end processes under the head and gather &

document evidences after a reasonable testing of transactions as per sampling criteria envisaged in

Chapter No-8 of Internal Audit Manual.

b. Each & every outstanding balance/ head of SAP GL, as on date of audit, its break up (entry-wise) shall

be checked & verified as per subsidiary ledgers/manual ledgers with vouchers/supportive documents/

reports / files/Record/statement.

c. Balancing of manually maintained ledgers(if any) shall be checked with SAP GL Balances and the

issues related to manual ledgers and in case maintained in MS-Excel files have been pointed out/

escalated.

d. Control breaches/lapses/violations shall be pointed out with associated risks alongwith

recommendations for management to take appropriate measures/steps to safeguard the bank’s

interest.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 2 of 38

Index

1. Cash in Hand-Local Currency

2. Foreign Currency Notes

3. Automated Teller Machine

4. National Prize Bonds

5. US $ Special Bond

6. Blank Forms of DSCs, NIT Units, FEBCs, DBCs, FCBCs, FIBs, and Special US $ Bond

7. Stamped & Unstamped Forms

8. Pak Rupees Travelers Cheques

9. Foreign Travelers Cheque

10. Cash and Security Stationery

11. Strong Room and Security Arrangements

12. Physical Verification of Keys

13. Cash Receipt and Payment Books

14. Clean Note Policy(CNP) as per Inst Cir. 66/2015 dated 29.05.2015

15. Forged Notes

16. Insurance of Cash

17. Articles in Safe Deposit

18. Safe Custody of Shares and Securities

19. Postage & Stamps

20. Security Documents (POs, DDs, MTs, TTs)

21. Tokens

22. Branch Documents/Control Documents/Banks Instructions

23. Cash Supplied to & Received From Branches

24. Utility Bills Collection

25. Regulatory requirements for safety & security of Strong Room.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 3 of 38

Instructions

Internal auditors are required to understand the standard procedures pertaining to cash and

Security Department through study of relevant material given in SPM and latest circulars, if any.

In order to verify the existence of keys risks defined below, auditors should check / review the

working of branch covering audit period using sample techniques as mentioned in Internal Audit

Manual by at-least adopting the following audit procedure / check lists. The auditors may also

check and highlight other significant areas of concerns as he / she observed during the course

of audit.

Level of

Definition of Risk levels

risk

Observations that can seriously compromise the system of internal control and

data integrity resulted in material financial/ reputational loss required to be

High Risk

considered as High Risk (H). Higher volume of Violations related to Non

compliance of Regulatory Requirements should also be considered.

The control weakness is more likely to result in material loss of the bank's revenue

or goodwill or material non-compliance with the statutory requirements or the

Moderate

Bank’s policies and procedures. Compensating controls are generally not present

Risk

to reduce the likelihood of any such loss or non-compliance. These areas would be

considered as Moderate Risk (M).

- The control weakness less likely to result in a loss of the bank's revenue or

goodwill or non-compliance with the statutory requirements or the Bank’s

policies and procedures (not being a material loss or non-compliance).

However, compensating controls generally exist to reduce likelihood of any such

Low Risk

loss or non-compliance; or

- The observation is more in the nature of a procedural improvement rather than a

control weakness.

These areas would be considered as Low Risk (L)

A - CASH IN HAND – LOCAL CURRENCY

Audit Objectives

1. To ensure that the procedures relating to the cash handling are complied with.

2. To ensure that the procedures relating to chest/ sub- chest are complied with.

Key Risks

1. Instances of cash shortages may be frequent in branch and not have reported to concerned

regional office.

2. Branch may not be in compliance with procedures relating to the cash shortage/excess,

head cashier’s hand balance and surplus cash.

Audit Checklist

Remarks of

Yes / No Risk

Audit Procedures Auditor/Audit

or NA H/M/L

Observations

Verification of Cash Balances

Review the Cash Balance Book and note the H

instances of cash shortages and ensure the following:

1. Whether the instances of cash shortage were

reported to controlling office and appropriate

measures were taken to find out the root causes

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 4 of 38

of shortage and recovery thereof?

2. Whether the physical cash on hand balances H

agreed with the balances given in the Cash

Balance Book?

3. Does the head cashier make the shortage H

good on the same day of its occurrence? If not

made on the same day, is the shortage debited to

Protested Bills Account under advice to controlling

office?

4. Check excess cash found over counter M

credited to a newly opened account [GL Code:

2050100129 Title: Excess Cash instead of -

Branch Income which will remain in branch books

for six months, after which it will be transferred to

FCD as per Annexure "Ill" for its final disposal in

line with SBP instructions as per Inst Cir No-

22/2016 dated 04.03.2016.

Deposit of Surplus Cash with Chest / Sub- Chest Branch/ SBP

5. Is cash in Chest/Sub-Chest within holding H

capacity?

6. Is surplus cash over the insured limit

deposited with Chest/Sub-Chest/SBP? If so,

obtain the evidence or inquire the reasons if there

is any non-compliance.

Compliance with Procedures in respect of Head Cashier’s Hand Balance

7. Is head cashier’s hand balance matched with H

the figure appearing in the cash balance book?

8. Is head cashier’s hand balance kept in a M

separate box with his key?

Compliance with Procedures in respect of checking of Branch Cash Balance by

Manager / Supervising officer

9. Does branch manager check, at least once a M

week on different days, entire cash balance and

record his remarks on Cash Book (B-52) under his

full signature?

10. Obtain the following Book and Registers and

perform the procedures from Point-9 to 13

Safeguards against Counterfeit Notes

Authenticity of Registers

Special Considerations for Currency Chest

and Small Coins Depot

Currency Chest Book, Currency Chest Vault

Register and Small Coins Depot Register

11. Is currency chest book maintained in duplicate M

(one copy is kept with Senior Cashier and the other is

in strong room)?

12. Is the currency chest book written by M

Accountant (joint custodian)?(Treasury Rule

Volume I, Page 17-57)

13. Are the currency chest book, currency chest M

vault register and small coins depot register

properly maintained, updated, checked and

initialed by the head cashier and supervising

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 5 of 38

official?

14. Is the small coins depot register kept in strong M

room?

15. Are Instant verification (IV) markers and ultra M

violet (UV) lamps available and being used as per

Instruction Circular No-53/2014 dated 20.06.2014

for checking & detection of fake currency?

16. To check on random sample basis from the

previous day’s passed cheques(of audit date) that

the usage of IV markers is being practiced in

branches or not. It could be checked from the

marker’s ink spot on the cheques as evidence as

on the fake cheques and on the plan papers the IV

markers leaves no ink lines.

17. To check (in one day transactions as per H

sampling criteria) that branch is not using debit

vouchers in lieu of cheque books to affect

withdrawal from the checking accounts of the

customers.(with exception where it is permissible

under bank's instructions (e.g. Office A/c and

Government Collection A/c etc.) or where special

permission to use debit voucher has been allowed

as per Bank's Policy by the competent authority

(Refer Instruction Circular 51-2018 2018 & 54-

2018 dated 16.05.2018 & 16.05.2018 respecively)

Weekly Physical Verification

18. Review the currency chest book and small M

coins depot register for the audit period and check

the evidence of weekly count by supervising

official.

Remarks of

Yes / No Risk

Audit Procedures Auditor/Audit

or NA H/M/L

Observations

Submission of Weekly Certificate to Regional Officer

19. Is weekly certificate Form (F-151) of currency M

chest and small coin deposit balances submitted

to the Regional Office throughout the period under

audit? (Vol-I-paragraph no.46)

20. Select any 10 weekly certificates for checking M

the correct preparation of the certificates.

Quarterly Cash Verification

21. Does Regional Office carry out quarterly cash H

verification?

Reporting to Currency Officer of SBP

22. Are all transactions on the currency chest and M

in small coin depot promptly advised to Currency

Officer of SBP of the area in which branch is

situated on Form TE-2 and F-142 respectively on

daily basis?

23. Timely & correct reporting of transaction

affected at NBP Currency Chest to avoid SBP

penalty on account of violation of SBP cash

management directives as per Inst Cir. 147/2015

dated 16.11.2015.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 6 of 38

24. Check the designated chest branch is H

deducting and remitting 0.12% service charges on

cash deposited by the banks on the plea that the

cash balances are being taken as deposits in

accounts of banks rather than surplus cash

received on behalf of other banks as per as per

Instruction Circular No-52/2017 dated 09.05.2017.

Cash Balances with other Banks, Cash Balances Remarks of

Yes / No Risk

of other Banks with the Branch And Arrangements Auditor/Audit

or NA H/M/L

for Collection of Cheques Observations

Verification of Balances with other Banks

25. In case branch maintains account with other

Banks/ SBP, does the branch regularly obtain the

M

balance confirmation slips and statements of

account and reconcile the accounts periodically?

Running Cash Count Activity

26. Whether surprisingly Running Cash Count H

Activity done in the branch during the course of

audit, in order to identify and highlight intra-day

pocketing of cash/unauthorized accommodation to

valued clients?

Check compliance of Clean Note Policy(CNP) as per Inst Cir. 66/2015 dated 29.05.2015

with respect to following directives:

27. Proper cash sorting into issuable and non-

issuable currency notes.

28. Non-stamping of /removing staple pins from

re-issuable packets.

29. Use of paper / rubber band for banding

packets of all denomination.

30. Affixing of SORTED stamp on packets.

31. Facilitation for exchange of currency notes and

coins.

32. Detection and notification of fake currency

notes.

33. Assurance that ATM cash does not have any

fake currency note.

34. Issuance of new/fresh currency notes to

general public as per quota and procedure

prescribed by SBP.

B - FOREIGN CURRENCY NOTES

Audit Objectives

1. To ensure that the correct rates are applied on the sale and purchase of foreign currency

notes.

Key Risks

1. Foreign exchange rates are not correctly applied on the sale and purchase of FC notes.

Audit Checklist

Remarks of

Yes / No Risk

Audit Procedures Auditor/Audit

or NA H/M/L

Observations

Checking of Entries in the Register

35. Is cash indent made on bank’s prescribed form H

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 7 of 38

Remarks of

Yes / No Risk

Audit Procedures Auditor/Audit

or NA H/M/L

Observations

and is the form serially numbered, signed and tested

by two authorized officers?

36. Select the entries of material value for purchase H

and sales of FC notes and verify these with the

relevant vouchers.

Application of Correct Rates

37. Whether correct / approved exchange rate has H

been applied on FX transactions?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 8 of 38

C - AUTOMATED TELLER MACHINE (ATM)

Audit Objectives

1. To physically verify the “Cash in ATM” and check that the physically counted cash

denomination wise is in agreement with the figure appearing in the ATM Audit Roll.

2. To verify by work back / calculation that cash in ATM match / reconcile with the figures

appearing in the General Ledger.

3. To ensure that keys of ATM is in the safe custody of the authorized officials.

4. To ensure that practice to tally Cash in ATM at each day end.

Key Risks

1. Authorized official may not be observing the head office instructions, which may lead to

misuse of ATM facility.

2. Cash shortages in ATM may have been frequent in branch.

3. Loose control over keys / cash replenishment may lead towards

misappropriation/pocketing of cash.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Physical Verification

38. Physically count and note the Cash in ATM H

of each denomination on the date of

commencement of audit of this section, and

ensure that physically counted cash is in

agreement with the figure appeared in the

General Ledger. Physical cash must be tallied

with the figures appearing on ATM Slip, for

balancing of figures appearing in GL auditor

needs to prepare ATM reconciliation taking into

account all the transactions executed after

EOD till the time of physical counting of cash.

Daily Settlement of Cash in ATM & ATM

Reports

39. Is Cash in ATM tallied / settled at each day H

end and reconciled with the figure appearing in

ATM reports?

40. Are ATM reports duly checked and verified M

by the authorized official?

41. Whether the cash replenish in ATMs twice H

a day? (Instruction circular 106/2016)

42. Whether branch ensures availability of H

cash and printing rolls stock? (Instruction

circular 106/2016)

Custody of Keys

43. Is opening key of ATM in the custody of the H

cashier in charge?

44. Are the duplicate key / combination change H

key kept in a sealed envelope with other

duplicate keys packet in the safe of the

branch?

45. Branches maintain log of captured cards/

captured card and keep under dual control in

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 9 of 38

violation of para a (3) PSD master circular no.

1 of 2008

46. Captured ATM cards were delivered by the

branch with proper due diligence in violation

of para 4, PSD circular no 1 of 2008

47. Captured cards sent to CFC of the bank

after waiting for the customer for two days in

violation of PSD circular no 01 of 2008

48. Details of captured ATM cards reported to

card facilitation in violation of SBP PSD

circular no. 1 of 2008

D - NATIONAL PRIZE BONDS

Audit Objectives

1. To ensure that branch is in compliance with the Govt / SBP instructions regarding the sale

and purchase of NBPs.

Key Risks

1. NPBs are being reportedly sold during the shut period.

2. Non-reporting of unsold prize bonds held with the branches for onward sharing with SBP.

Audit Checklist

Remarks of

Yes / No Risk

Audit Procedures Auditor/Audit

or NA H/M/L

Observations

49. Verify the value with the figures appearing H

under the sub-head “National Prize Bonds On

Hand Account” in the GL?

50. Are the general entries for sale and H

purchase of NPBs verified with the relevant

vouchers?

51. Has branch prepared a list of unsold prize H

bonds on the commencement of shut period

and reported the same to HO? Also verify the

relevant bonds on hand with the list prepared

by Branch.

52. Is commission on sale / purchase of new M

prize bonds received from SBP and credited to

commission account?

53. Is the list of prize bond on hand checked M

by branch with the result of draw to ascertain

the prize?

54. Has the prize money won credited to M

commission account or treated as per HO

Instructions?

55. Whether immediately after draw, the listed H

prize bonds held by the branch were matched

with the published list of winners and the prize

winning bonds were duly segregated and

referred to SBP through a forwarding letter

with the request to credit the amount of prize

money payable on the winning prize bonds to

Govt. Account and its/their face value to NBP

account maintained with SBP. (Refer to SBP

Circular no. PBD/U-2-A/6090/Misc./2011 dated

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 10 of 38

May 17, 2011)?

56. Whether CTR was done by the branch if H

the sale in cash exceeds the threshold limit of

SBP?

F - BLANK FORMS OF DSCs, NIT UNITS, FEBCs, DBCs, FCBCs, PIBs

Audit Objectives

1. To ensure that the documents (specified in the documentation checklist) are properly

maintained, updated, and checked by the authorized official.

2. To ensure that the branch has complied with Government / SBP Instructions.

3. To ensure that all the blank forms are kept under safe custody / dual control.

Key Risks

1. Branch may not be in compliance with Government/SBP instruction.

2. Mis-utilization of security stationery may result into financial as well as reputational loss

for the bank.

Audit Checklist

Yes / No Risk Remarks of

Audit Procedures or NA H/M/L Auditor/Audit

Observations

57. Are the entries in respect of receipt / M

issuance of instruments verified from the

vouchers?

58. Is the register properly maintained, M

updated, checked and initialed by the

authorized official?

59. Are application forms for issuance of M

security instruments serially numbered and

kept in paste file?

60. Are sale proceeds promptly remitted to the H

concerned department/ SBP?

61. Are withholding tax and Zakat recovered H

and remitted to the concerned department/

SBP?

62. Whether Income tax deducted by bank

under any section has been deposited with

Government treasury within 07 days from the

end of each week ending on every Sunday

63. Is the stock of security instruments M

physically checked on monthly basis? If so,

obtain the evidence or inquire reasons for

reporting in case of non-compliance?

64. Whether CTR was done by the branch if H

the sale in cash exceeds the threshold limit of

SBP?

G - STAMPED AND UNSTAMPED FORMS – STAMP ACCOUNT

Audit Objectives

1. To ensure that practice for balancing stamp account on quarterly basis exists as per bank’s

instructions.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 11 of 38

Key Risks

1. Under stamped / obsolete forms may not have surrendered to the concerned treasury for

additional stamping / claim of refund.

2. Practice of balancing the stamp account on quarterly basis may not in place.

Audit Checklist

Yes / No Risk Remarks of

Audit Procedures or NA H/M/L Auditor/Audit

Observations

65. Is practice in place to balance stamp H

account on quarterly basis in accordance with

bank’s instructions? If so, obtain evidence for

the same.

66. Are under stamped / obsolete forms, if H

any, surrendered to the concerned treasury

for additional stamping or claim of refund?

H. PAK RUPEES TRAVELERS CHEQUES

Audit Objectives

1. To ensure that the documents (specified in the documents checklist) are maintained,

updated and checked by authorized official.

2. To ensure that the branch has complied with procedures and head office instructions.

3. To ensure that all the PRTCs stock is kept under safe custody / dual control.

Key Risks

1. Inadequate scrutiny might have lead to encashment of PRTCs, which were reported as

lost/ stolen.

2. PRTCs may have placed with unauthorized officer.

3. Non observance of dual control may lead towards pocket banking / parallel banking.

Yes / Risk Remarks of

Audit Procedures No or H/M/L Auditor/Audit

NA Observations

67. Whether the physical stocks on hand of the H

PRTCs agree with the quantity given in the

PRTCs Stock Register?

68. Carry out stock count of the PRTCs of each H

denomination on the date of commencement of

the audit of this section and compare these

with the figures appearing in stock register and

general ledger.

69. Circularize the confirmation letter to the

controlling unit (Chappal Plaza Branch) in order

to confirm the quantity and value of PRTCs

held by the branch

70. Are the entries in respect of receipt of M

PRTCs from Chappal Plaza Branch (Controlling

Unit of PRTCs) verified with requisition letters

and vouchers?

71. Are the entries in respect of sale / issuance H

of PRTCs verified with the following supporting

documents and signed by both the customer

and the branch officer?

a) Purchase Agreement (F-617)

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 12 of 38

b) Debit Vouchers (F-50)

c) CNIC of the Purchasers

72. Are the entries in respect of encashment of M

PRTCs verified from the relevant vouchers?

73. Does the practice exist in branch for M

referring list of stolen / lost PRTCs at the time

of encashment?

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

74. Is the amount stated in the sale report M

remitted to Controlling Unit with respective

RBVs on every Monday?

75. Are proceeds of PRTCs encashed by M

branch received from the Chappal Plaza

Branch on the following Wednesday from the

day of encashment?

76. Is the practice in place for reconciliation M

of stock of PRTCs on monthly basis? If so,

obtain the evidence or inquire reasons for

reporting in case of non-compliance.

Controlling Unit of PRTCs (Hasrat Mohani Road, Branch, Karachi)

77. Does the authorized official of the branch M

properly record the stock from the delivery

notes in the Stock Register/ Katcha

Register?

78. Are the details of receipts of the stock of M

PRTCs fed into the system at the time of

receipt?

79. Are the stock supplied to the other M

Branches on their requisition letters and

does the authorized official prepare delivery

notes and maintain these in a file?

80. Are the details of PRTCs supplied to M

other branches recorded in the Stock Katcha

Register and fed into the system?

81. Does the authorized officer thoroughly H

check the following particulars of Mail

Transfer Advice and Fanfolds (F-15) on the

receipt of weekly issuance report from other

branches?

a) Amount of sale proceeds

b) Signatures of two authorized officials

c) Check Signal and verification thereof

82. Are the details of sale of PRTCs by other M

branches fed into the system and the

computer print outs of Issuance Report and

Dak Register taken?

83. Does the concerned official check the H

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 13 of 38

following before weekly reimbursement of

the amount of encashed PRTCs to

branches?

Details of the encashed PRTCs

on the prescribed format

Genuineness of the Original paid

PRTCs Received from the Branches

84. Does the concerned official feed the M

details of encashment into the system and

are the encashment report and encashment

Dak report printed and checked by the

authorized official?

85. Whether the Debit / Credit RBVs H

originated by the TC issuing / encashing

branches are responded very next day at

Hasrat Mohani Br. and no window dressing

of deposits or NBP General Account is

done?

86. Whether PRTCs were credited into the H

account in whose favor the instrument was

issued?

87. Whether single PRTC paid twice by the H

branch?

88. Whether unclaimed PRTCs remained H

unpaid beyond 10 years from the date of

issuance were surrendered to SBP?

89. Whether CTR was done by the branch if H

the sale in cash exceeds the threshold limit

of SBP?

I. FOREIGN CURRENCY TRAVELERS CHEQUES

A) Issuance of FCTCs

Audit Objectives

1. To ensure that the FCTCs are issued in accordance with the prescribed procedures.

2. To ensure that the physically counted FCTCs and their values are in agreement with the

balance appearing in stock register/general ledger.

3. To ensure the physical security of the unutilized FCTCs.

Key Risks

1. FCTCs are not issued as per SBP / NBP laid down instructions.

2. Issuance of FCTCs may not be correctly recorded in the issuance register.

3. Inadequate scrutiny of FCTCs may lead to fraudulent encashment.

4. Bank’s charges are not recovered as per the latest tariff of Bank charges.

5. Inadequate control may have over the safe custody of FCTCs.

6. FCTCs are issued in excess of the prescribed limit.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

90. Carry out stock count of the FCTCs of each H

denomination on the date of commencement of

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 14 of 38

the audit of this section and compare these with

the figures appearing in stock register and

general ledger.

91. Does branch manager check regularly the H

whole stock of FCTCs and authenticate the cutoff

point for control purposes?

92. Does the concerned official check the M

genuineness and validity of following documents

before issuing FCTCs? Return Air

ticket/Visa/Passport/NIC

93. Does the branch recover bank’s charges as H

per latest tariff?

94. Does the branch maintain serial numbers and M

denomination of FCTCs?

95. Does the branch issue FCTCs after adequate M

introduction of applicant?

96. In case of lost FCTCs, does the concerned H

official obtain the evidence and maintain its

record and report it to issuing office?

97. Does the branch circularize the confirmation H

letter to the respective bank to confirm the

quantity and value of FCTCs held in stock by the

branch?

98. Is denomination-wise stock register M

maintained by the authorized official?

99. Does the branch maintain register containing H

record of FCTCs sold / purchased?

100. Does the branch issue FCTCs within the M

prescribed limits i.e. US$ 2100?

101. Are the entries in respect of receipt of FCTCs M

from the respective bank verified with the

following supporting documents?

a) Requisition letters

b) Acknowledge receipt and

c) Vouchers

102. Does the branch keep copies of the following H

documents in their record?

a) Pages 1, 2 & 3 of the passport

along with the title page and that page on

which endorsement of release of foreign

exchange is made.

b) First coupon of air / steamer

ticket.

c) Visa

103. Is the amount of TCs remitted timely to H

concern Bank (issuer)?

B) Encashment of FCTCs

Audit Objectives

1. To ensure the supports provided by the beneficiary at the time of encashment.

2. To ensure the accuracy of buying rate at the time of encashment.

Key Risks

1. Incorrect buying rates are applied at the time of encashment.

2. Payment of FCTCs may not be correctly recorded.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 15 of 38

3. Bank’s charges may not be recovered as per the latest tariff.

4. FCTCs may be stolen.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

104. Does the concerned official obtain the H

countersignatures of the beneficiary

before encashing FCTC?

105. Does the concerned official examine H

the Passport/NIC of the beneficiary and

verify the copy of issuance slip of FCTC

before encashment?

106. Does the concerned official apply the H

correct buying rate at the time of

encashment of FCTCs?

107. Whether applicable charges, if any, H

recovered by the branch and recorded

into correct GL head?

J. CASH AND SECURITY STATIONERY

Audit Objectives

1. To carry out count of all items (specified in the audit check list) and verify the balances with

the respective records.

2. To ensure that all items are kept under dual control and custody of head cashier and other authorized officer.

3. To ensure that the currency notes are properly arranged in packets and are in countable condition.

4. To ensure that the branch has lodged soiled/mutilated notes with SBP for claim of new currency notes.

Key Risks

1. Physical balance may not be in agreement with the records.

2. Items may not have kept under the dual control.

3. Holding of high value of mutilated and soiled notes may expose the branch to

misappropriation of cash.

4. Concerned official may not keep the tokens in a locked box in the strong room.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

108. On arrival at the branch in the

morning, obtain the Manager’s set of

strong room keys and retain them until the

physical count is completed.

109. Before the start of business, open the

strong room in the presence of the

manager / operations manager /

supervising official and joint custodian

head cashier and carry out physical count

of the following:

a) Cash on hand local currency notes

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 16 of 38

b) Foreign Currency Notes

c) Small Coins Depot

d) Postage, Stamps and Stamped and

unstamped Forms on hand

e) Prize Bonds

f) Foreign Currency Travellers Cheques

g) Pak Rupee Travellers Cheques

h) Blank Forms of Defence Savings

Certificates, NIT Units, FEBCs/ DBCs,

PIBs etc.

i) Tokens

j) Any other items including Petty Cash

In case of material differences the matter

should be immediately reported to

concern Audit Chief.

110. Match quantity as per physical count H

with that as per records, and resolve

difference if any.

111. Whether above items are kept under H

dual control and custody of head cashier

and other authorized officer?

Compliance of SBP Circular No. Cy-1537-1579/1(Poly)-2002 dated 02-10-2002 as amended

vides SBP BSC Circular No.Cy / 01 / 01 dated 22-04-2003

112. Whether Daily Closing H

Cash Balance Statement was prepared by

the branch? (violation will attract penalty

of Rs.5000/- per instance + Rs.500/- per

day during which the default continues)

113. Whether branch has maintained H

minimum surplus cash balance in sorted

re-issuable balances of at least “ONE

DAY’S” average requirement/payment to

customers for the preceding month?

(violation will attract penalty of Rs.5000/-

per instance + Rs.500/- per day during

which the default continues)

114. Whether currency notes / packets / H

bundles were segregated into issuable /

non-issuable condition over the payment

counters? (violation will attract penalty of

Rs.5000/- per instance + Rs.500/- per

packet of un-sorted / non-issuable

currency notes of any denomination, if

caught, being pushed into circulation)

115. Whether on-spot sorting of bank H

notes over the counter in case where

average daily payments exceed

Rs. 1.500 million, was done? (violation

will attract penalty of Rs.5000/- per

instance)

116. Whether "SORTED" stamps on H

packets of currency notes was found

affixed? (violation will attract penalty of

Rs. 500/- per packet of any denomination

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 17 of 38

is caught during on-site examination &

Rs.500/- per packet in case any

stakeholder along with evidence of the

same lodges a complaint)

117. Whether branches remove H

staple pins from packets of Rs 5/- and Rs

10/- denomination bank notes and also

properly banding them? (violation will

attract penalty of Rs.500/- per packet)

118. Whether branch was accepting small H

denomination bank notes of Rs. 5/- & 10/-

as well as cut / soiled / mutilated and

defective notes? (violation will attract

Rs.10000/- per case with evidence)

119. Are notes of each denomination M

sorted / arranged in packets of 100 and

bundled as per procedure?

120. Whether Important / Emergency M

telephone numbers were displayed in the

strong room?

Mutilated / Soiled Notes

121. Are mutilated (soiled) / Non issuable M

notes kept separately from other currency

notes?

122. Does the branch deposit the mutilated

and soiled with cash feeding branch? M

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Currency Chest And Small Coins Depot

123. Are the physically counted cash and H

coins (total number of bags and contents

in terms of correct denominations and

genuineness) verified with the figures

appearing in the Currency Chest Vault

Register and Currency Chest Book and

Small Coins Depot Register respectively?

124. Is slip on Form F-140, showing the L

description of coins, duly signed by the

concerned official and is it found placed

inside of each bag?

125. Also obtain the Certificate of Currency H

Chest and Small Coin depot balances as

of the date of the audit from Currency

officer of the area concerned to verify the

balances with the physical count and the

above Registers. Report the difference if

any.

126. Whether the actual number of official H

Police Guards deployed at the chest

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 18 of 38

branches match with the approved

quantity and their record of attendance

and payment of salary has been

maintained effectively?

Regulatory requirements for safety & security of Strong Room & Cash balances

127. The walls of the Strong Room were

coal-tarred up-to a height of 2 feet off the

floor as per requirements.

128. Chest Vault opened at 8.30 a.m.

129. Police Guard Attendance Register is

maintained properly.

130. Inspecting Officer’s certificate and

DPO’s order was hanged within the strong

room as required vide Para (IV) of I.D

Manual.

131. Holding capacity matched with

volume of transaction of Chest.

132. Balance held by the chest is in

accordance to chest holding capacity

during the year.

133. Chest Balance is not being use by the

Branch for their commercial banking

operations.

134. B-34 & PB-35 was maintained.

135. Sorting of currency notes of all

denomination was exercised in light of

SBP clean note policy.

136. Note Binding and coin counting

machines were in order.

137. Box balance books were maintained

denomination wise.

138. Arrangements for emergency light are

intact.

139. Indent book was being maintained for

supply of notes from Box balance to

counters.

140. Exchange counter was being operated

by the official holding charge of Box

balance and all transactions were

recorded in relevant registers.

141. Balances of the currency chest are

proved and signed at every transaction by

the Officer Incharge of the chest, as

provided in Para 14(ii) of part XIV of

Treasury Rules Volume I.

142. Irregularities committed by the chest

in the last inspection have been rectified

properly.

143. Weekly /Monthly verification of chest

balances were ensured.

144. Annual fitness certificate of Vault for

Fiscal Year was hanged in the vault.

145. Daily /Weekly/Monthly verification

certificate of Chest officer

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 19 of 38

146. Staff and Branch Management are

fully conversant with Chest Rules and

Regulations.

147. Guard Commander was present at

the time of Vault opening/closing.

148. Position of Police guard was

defined/prescribed as required

149. Register of opening/closing of Vault

was signed/check by Operation Manager

and Branch Manager.

150. All CCTV cameras of Branch were in

order and CCTV cameras were sufficient

to cover entire Branch.

151. Necessary stationary items were

placed within and vicinity of the

Vault/strong Room.

152. Entry register of vault was maintained

by the Branch.

153. Bin book were properly maintained

and signed

154. Fire extinguishers, Buckets of Sand

and water were in strong Room

155. Security alarm system was installed in

strong Room

156. Branch using Currency Chest

Reporting System (CCRS) on daily basis

for submission of TE-2.

157. Walking through gate was installed at

Main entrance.

158. Cash exchange counter was operated

separately by the Branch.

159. All signals Books (Black & Brown

covers) were available in the Branch.

160. The clearing house is working

properly (where ever applicable).

161. Ultra violet lamps/Counterfeit note

detectors in order (At least 2).

162. Weight machine was in order.

163. Vault was properly sealed with

embossed brass seal.

164. Police guard duty was changed on

daily basis.

165. Fire alarm system was installed in

strong Room.

166. There was enough space around the

vault for guard’s patrolling.

167. Insurance coverage was within limit.

168. F-157 was maintained at Chest

Branch.

169. Proper Electric wiring is placed in the

vault/strong Room.

170. Cash was not found short.

171. Cash in vault was cross examined

through surprise cash verifications by the

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 20 of 38

Manager/Operations Manager at least

three times in a month.

172. Barber Wires were available around

the premises.

173. Chest balances are kept inside the

Almirahs.

174. Prize bond of various denominations

kept in almirahs should be included in the

chest balance.

175. Branch was holding Old designed

notes of various denominations.

176. Standard weights and scales along

with coin counting and note counting

machine are available in the Chest

branch.

K - STRONG ROOM AND SECURITY ARRANGEMENTS

Audit Objectives

1. To ensure that branch has complied with head office / SBP instructions in respect of the

security arrangements.

2. To ensure that security personnel are restricted to their assigned duties.

3. To ensure that the strong room is under dual control of authorized officials.

4. To ensure that all the safety equipments are in order.

Key Risks

1. Safety measures at the branch may not be adequate.

2. Burglary alarm may not be in working order.

3. Security personnel may have found performing operational duties.

4. Unauthorized persons may have access to cash department and strong room.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

177. Visit the strong room on the date of

commencement of the audit of this

section and check the following:

178. Is strong room under the dual control H

of the senior/ head cashier and the

supervising official / manager?

179. Are security guards posted at the H

entrance of the strong room?

180. Are cashier’s enclosure safe and its H

access restricted to authorized person

only?

181. Is burglary alarm in working order and H

connected with nearest police station/

house/ shop?

182. Are armed police/ guards found H

standing at a secured place during

counter hours?

183. Are cash counters covered with grills H

and do the railing separate cash

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 21 of 38

department?

184. Are the back doors of the branch H

closed and properly guarded during the

banking hours?

185. Are guns of security guards loaded? H

186. Has the Strong room/ vaults were H

used for other purposes like store, kitchen

etc?

187. Does the branch hold full set of M

firefighting equipment?

188. Are the installed fire extinguishers in M

working order and not found expired?

189. Is guard posted applying security

apparatus(metallic detector) on every

entrant with politeness and decency?

190. Are telephone numbers of Police and

security company available with the

responsible officials?

Special Considerations for Chest/ Sub-Chest Branches

191. Is authority letter, issued by SBP,

regarding with-holding capacity of the

Strong Room held on branch record?

192. Is valid safety certificate regarding

fitness of strong room available and found

inside the strong room?

193. Has the Chest branch segregated the

branch cash from SBP Chest cash?

L - PHYSICAL VERIFICATION OF KEYS

Audit Objectives

1. To verify the keys of strong room, safes and almirahs with the number appeared in the Key

Register and to ensure that keys are operative, kept in strong room under the custody of

authorized officials.

2. To ensure that sealed packet of duplicate keys is deposited for safe custody in the nearest

branch or any other bank or SBP or with local treasury as per instruction of regional office.

Key Risks

1. The keys obtained for verification may not be in agreement with the numbers appeared in

the Key Register.

2. Keys may not be kept under the custody of authorized officials.

3. Sealed Packet of duplicate keys may not be deposited for safe custody in the nearest

branch or any other bank or SBP or with local treasury as per instruction of regional office?

Audit Check List

Audit Procedures Yes / Risk Remarks of

No or H/M/L Auditor/Audit

NA Observations

194. Obtain all keys of strong room, safes,

almirahs and the ‘Key Register’ and perform

the following procedures:

195. Are the number of keys obtained H

correctly reflected and matched with the

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 22 of 38

number appeared in the key register?

196. Is the sealed packet of duplicate keys H

deposited for safe custody in the nearest

branch or any other bank or SBP or with

local treasury as per instruction of regional

office?

197. Open the sealed packets of duplicate H

keys in the presence of the manager and the

head cashier and check that keys are

operative.

198. Is it locked in a box and is the key of H

which kept by the manager or

accountant/head cashier?

199. Has the fact of withdrawl /re-deposited M

been advised to regional office?

200. Are duplicate keys withdrawn at the time M

of change of incumbency of the present

manager/joint custodian and head cashier or

at the time of audit?

201. Whether keys are physically held by the H

staff member whose name is appearing in

the Key Register?

202. Whether keys are physically rotated H

during absence / leave of the actual holder of

the respective key and key register updated

accordingly?

203. Whether branch has designated the back H

up of key custodians in such a way that

individuals who have already held one key to

a safe or strong room do not hold the other

key to the same safe/ strong room even at a

later date?

204. Do branch manager and head cashier H

jointly hold keys of strong room?

205. Does the branch manager / joint H

custodian personally operate strong room

with his own keys? (He should not hand over

his key to his joint custodian under trust in

any circumstances)?

M - CASH RECEIPT AND PAYMENT BOOKS

Audit Objectives

1. To ensure that the receipt and payment transactions are correctly entered in the books and

these are supported with vouchers and other instruments.

2. To ensure that the vouchers and other instruments are approved by the authorized officials

within their prescribed limit.

Key Risks

1. Entries in the books are not verified with the supporting vouchers/other instruments.

2. Passing officials may pass the vouchers / instruments of amounts exceeding their

prescribed limits.

3. Branch may not be complying with Prudential Regulations in respect of restriction of cash

payments outside the bank’s authorized place of business.

4. Misappropriation / Pocketing / Parallel Banking.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 23 of 38

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

206. Cast the total of receipts and payments L

of the selected days and verify the totals

with the balances appearing in the cashier’s

receipt and payment books and with the

balances appearing in the cash balance

book / main cash scroll.

207. Are the entries appearing in the H

cashier’s /tellers Journal of the selected

days verified from the relevant vouchers

and others supporting documents?

208. Whether transaction was recorded with H

correct amount and in correct account on

same day?

209. Are the entries appearing in the H

cashier’s/Tellers Journal of the selected

days verified from the relevant vouchers

and other supporting documents?

210. Are the Cashier’s receipts and H

payments books daily balanced, closed and

signed by the concerned cashiers?

211. Are the books properly maintained, M

updated, checked and initialed by the joint

custodian/ authorized official?

212. Do the authorized passing officials pass H

the vouchers/ instruments as per their

prescribed limit? In case of deviations, note

the instances and inquires the reasons for

reporting.

213. Whether supervisor authorized the H

transaction himself/herself on the computer

screen of teller? In case of non adherence

of password sharing instances should be

reported.

Cash Payments outside the Bank’s Authorized Place

214. Does the branch comply with Prudential H

Regulations in respect of restriction of cash

payments outside the bank’s authorized

place of business?

215. Is cash received stamp kept under H

custody of an authorized official?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 24 of 38

O - INSURANCE OF CASH AND CASH EQUIVALENT

Audit Objectives

1. To ensure that insurance policy of cash (Local and Foreign Currency) is adequate, valid

and covers the entire cash and cash equivalent at counter and in vault.

2. To ensure that documents (specified in the documentation checklist) are properly

maintained, updated and checked by the authorized official.

Key Risks

1. There might be frequent instances of excess of cash at counter and in vault over the limit

of insurance cover and these so without reporting to competent authority.

2. The insurance limit may have inadequate considering the cash transactions in the

branch.

3. Insurance policy may have expired and is not being followed up with concerned regional

office for its renewal.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

216. Is the cash insurance policy valid and in H

force?

217. Does insurance policy cover all margin risks H

such as theft, robbery, embezzlement,

misappropriation, fire etc.?

218. Is the cash holding capacity of the branch H

within the prescribed limit of insurance policy?

219. Has the branch ensure diversion of surplus H

balance over and above the holding capacity of

SBP Chest?

220. Are Branches maintaining minimum cash

(cash in excess of need transferred to Main

Branch)?

P - ARTICLES IN SAFE DEPOSIT

Audit Objectives

1. To ensure that safe deposit register is properly maintained, updated and checked by the

authorized official.

2. To ensure that the concerned official of the branch is strictly following the procedures

regarding handling of applications, deposit of articles in safe and its delivery to the

constituents/ depositors.

3. To ensure that branch is complying with half yearly physical verification of articles.

4. To ensure that safe deposit charges are regularly recovered from depositors as per

bank’s tariff.

Key Risks

1. Authorized official may deliver the articles without obtaining the deposit receipt or

duplicate receipt or indemnity.

2. Measures for recovery of safe deposit charges from defaulting customers may not be

adequate.

Audit Checklist

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 25 of 38

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 26 of 38

221. Is all safe deposit applications obtained M

on the prescribed application form and

processed / approved as per procedure?

222. Are securities and articles delivered to H

the constituents / depositors on the

production of the acknowledgement deposit

receipt F-163 & F176 respectively?

223. In case constituent has lost the receipt, H

does the authorized official obtain a stamped

indemnity on Form F-165 / duplicate receipt

at the time of the delivery of the articles?

224. In case delivery is made to the authority H

holder, does the authorized official obtain the

confirmation of the same from the depositor

and is such confirmation kept on record?

225. Is the instruction/direction, in respect of M

mode of delivery, obtained from the joint safe

deposit holders on the prescribed form F-

177?

226. Does the concerned authorized official M

also record the mode of delivery on the

receipts and Safe Deposit Register?

227. Is all the record of cancelled safe M

deposits properly maintained and verified

from the cancelled safe deposit receipts /

acknowledgements?

228. Does the manager sign the packet of M

duplicate keys deposited by other branch?

229. Are the remarks “Deliverable on the Joint M

Signatures of the Manager and Head

Cashier” written or printed on the packet?

230. Does both the Branch Manager and M

Head Cashier discharge the cancelled / paid

safe deposit receipts F-176 pertaining to the

duplicate keys under bank’s official stamp at

the time of delivery?

231. Does the authorized official verify the M

safe deposit articles on half-yearly basis?

232. Are safe deposit charges regularly H

recovered as per bank’s tariff?

233. Is number of seals affixed on the packet M

and mode of withdrawals disclosed on the

packet?

Q - SAFE CUSTODY OF SHARES AND SECURITIES

Audit Objectives

1. To ensure the relevant registers, ledgers and documents (specified in the documentation

checklist) are properly maintained, updated, consistent with supporting documents, and duly

checked by concerned officials.

2. To observe the procedure of receipt and delivery of shares and securities from / to the

constituents to confirm whether they are in conformity with bank’s procedure.

Key Risks

1. Shares and securities pledged against advances are saved-in with other securities.

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 27 of 38

Audit Checklist

Audit Procedures Yes / Risk Remarks of

No H/M/L Auditor/Audit

or Observations

NA

234. Are the balances of safe custody security M

register (B-63) in agreement with the balances

appearing in safe custody security ledger (B-

62)?

235. Are deposits receipts on F-163 issued and M

their serial number entered in the relevant

account and column in the safe custody

ledger?

236. Are deposit and with-drawl entries properly M

recorded in safe custody and security ledger

(B-62)?

237. In case of constituents instructions H

regarding the collection of profit on securities

have been noted; check the following:

a) Are due dates of collection of interest/

profit on securities entered in the

diary?

b) Has interest or profit on securities been

Collected on due dates?

c) Has such interest been credited to

constituent’s account?

d) In case of realization of credit, have

securities been recorded in the Profit

Register (B-64)?

e) Are all entries in Profit Register

checked and initialed by the authorized

officer?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 28 of 38

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Safe Custody Charges

238. Is safe custody fee charged as per H

tariff?

239. Are securities delivered to the H

constituent on the production of deposit

receipt (F-163)?

240. In case of non –production of the H

above receipt on the part of constituent,

is a stamped indemnity on F-165 taken?

241. Have acknowledgement receipts for H

the delivery of securities been obtained

on prescribed Form –160 from the

constituents and kept in file?

242. In case of joint account holder, are M

instructions regarding the delivery noted

on prescribed Form?

Shares and Securities against Advances

243. Are the shares and securities H

against advances kept separately in the

safe deposit?

244. Are such shares and securities M

properly recorded in the safe custody

and security register?

R - POSTATAGE & STAMPS

Audit Objectives

1. To ensure that the documents (specified in the documentation checklist) are properly

maintained, updated and checked by the authorized official.

2. To ensure that the amount drawn and advance for postage are properly accounted for in

the books.

Key Risks

1. Authorized official may not be transferring the unexpended postage advance to the

charges account in time.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

245. Postage Book & Registered Letters

Dispatched Register

246. Are the entries in the postage book in M

respect of amount drawn for postage

made under the full signature of the

branch manager?

247. Are the entries in the postage book in M

respect of postage advance verified with

the relevant vouchers and entries in

Charges Account “Postage & Stamps”?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 29 of 38

248. Are mail dispatched under registered M

post/through courier services entered in

Registered Letters Dispatched Register?

249. Are postal receipts numbers duly M

recorded with cost of postage in the

relevant column of the Registered Letters

Dispatched Register?

250. Are the registers / books properly M

maintained, updated, duly checked and

initialed by the authorized official?

251. Are the postage balance / stamps M

physically checked by authorized official

on weekly and monthly basis?

252. Is unexpended postage advance H

transferred to charges account “Postage”

at the end of each month?

253. Is the Franklin machine operative and M

being used for the given purpose?

S - SECURITY DOCUMENTS -CHEQUE BOOKS, POs, DDs,

Audit Objectives

1. To ensure that the documents (specified in the document checklist) are maintained,

updated, and checked by the authorized official.

2. To ensure the approvals and confirmations have been obtained from the competent

authority and kept on record.

Key Risks

1. Non-observance of bank’s procedure in respect of daily balancing of security forms in hand.

2. Non-observance of bank’s standard procedure in respect of joint custody of security forms.

Audit Checklist

Yes / No Risk Remarks of

Audit Procedures or NA H/M/L Auditor/Audit

Observations

254. Has each and every book been H

checked and initialed by authorized

officer of the branch once these receive

from the head office?

255. Are the entries in respect of receipt of M

security forms and blank cheque books

verified from the debit vouchers and

requisition card/requisition slip?

256. Are entries in respect of withdrawal M

of security forms and blank cheque

books verified from the credit vouchers?

257. Are the registers properly M

maintained, updated, checked and

initialed by the authorized official?

258. Compliance with bank’s procedure in

respect of daily balancing of leaves of

security forms in hand.

259. Check the abstract, maintained in a H

portion of stamped and unstamped forms

register or any other subsidiary register

to facilitate the balancing, of the audit

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 30 of 38

date to verify the correctness of the

same.

260. Has prior approval / subsequent M

confirmation in respect of supply of

security documents to other branches

been obtained from the competent

authority and kept on record?

S. Tokens/ Que Management System

Audit Objectives

1. To ensure that the Token Register is properly maintained, updated, and checked by the

authorized official.

2. To ensure that the concerned officials strictly follow the procedures in respect of

issuance of tokens, daily checking of the tokens and their placement in the strong room

in a locked box.

3. To ensure that the concerned official promptly report the missing tokens to the

supervising official and the supervising official institute the enquiry for the recovery of the

missing tokens.

Key Risks

1. Paying cashier may not be aware of missing tokens.

2. Concerned official may not be promptly reporting the missing/ lost tokens to the

supervising official / competent authority, which may delay to institute the enquiries for

the recovery of lost tokens.

Audit Check List

Audit Procedures Yes / Risk Remarks of

No or H/M/L Auditor/Audit

NA Observations

261. Has the supervising official instituted the H

enquiry for the recovery of the missing

token?

262. In case on non-recovery, does the H

concerned official prepare the list of missing

tokens and notify the same to the

competent authority?

263. Does the concerned staff prepare the H

lists of existing and missing tokens?

264. Does the paying cashier keep the list of H

missing tokens with him for the purpose of

avoiding fraudulent payment against the

cheque bearing the missing token number?

265. Does the supervising official M

authenticate the opening entries of the

register?

266. Are the tokens in use entered in the M

respective columns of the token register?

267. Is the token register properly M

maintained, updated and checked by the

authorized official?

Que Management System

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 31 of 38

268. Is QMS availability & & functional?

269. Is QMS System with all its displays in

working order and is used daily?

U - BRANCH DOCUMENTS/CONTROL DOCUMENTS/BANK’S INSTRUCTIONS

Audit Objectives

1. To ensure that the control documents are available at Branch and in the custody of

authorized official, obsolete branch documents are removed from the live documents

and documents are updated.

2. To ensure that two sets of test keys are not kept with one officer.

Key Risks

1. Controlled documents may not be in the custody of authorized official, which may lead to

the loss of documents.

2. Two sets of test keys remain with one officer, which leads to loose control over the

security of the test keys.

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Custody of Controlled Documents

270. Are the following control documents H

in the custody of the custodian and are

these updated?

271. NBP Code Book/SBP Code

Book/NBP Check Signal/ Test Keys Parts

I & II/Correspondents lists and agency

arrangements are available.

Audit Procedures Yes / Risk Remarks of

No or H/M/L Auditor/Audit

NA Observations

272. Check availability of Specimen

signatures booklets of officers &

executives/Test Key of foreign

Correspondents Banks/Standard Procedure

Checklist/Opening Branch License/Licenses

for commencement of FEX Business, if

applicable/License of opening of

Booths/Head Cashier Agreement for

holding cash, valuables etc/Cash Staff

Security /Deposit Account Pass

Books/Fidelity Guarantee Insurance

Policies of Staff/Letter of Locumtenance (F-

18)/Zakat Exemption Declarations/Copy of

Bank Byelaws/Copy of Bank

Ordinance/Treasury Rules of Federal

Government (Volume I & II)/Head office

circulars/Indemnity Bonds in respect of

disbursement of balances of deceased

accounts and issuance of duplicate DDs,

etc./Safe Deposit Receipt of branch

duplicate Keys/Advance Deposit Receipt of

cash security electricity/telephone/Lease

Agreements

273. Has present custodian of branch H

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 32 of 38

initialed the branch documents register at

the time of taking over the charge?

274. Have obsolete branch documents been M

removed from the current documents after

marking disposal against each entry in the

register and kept separate from the live

documents?

275. Has branch manager authorized the 2nd H

custodian in writing as joint custodian of

telegraphic test key?

276. Has acknowledgement in respect of H

table IV been obtained from the 2nd joint

custodian?

277. Have names of both the custodian of H

check signals been advised to regional

office as per bank’s instructions?

278. Do the two sets of test keys not remain H

with one officer?

279. Is Test Key Charge Register being H

maintained? Is 1st set of Test Key retained

with the Manager or Operations Manager

(not below the rank of OG-1)?

V - CASH SUPPLIED TO & RECEIVED FROM BRANCHES

Audit Objectives

1. To ensure that cash supplied to and received from other branches/SBP is properly

accounted for in the Cash Remittance Register/ Cash Payment & Receipt Registers.

2. To ensure that the weekly Cash Received / Paid Statement is correctly prepared, timely

sent, and reconciled at feeding branch/ Regional office.

3. To ensure that the procedures for cash remittance, as laid down in the agreement with

the private security agency, are duly complied with.

Key Risks

1. Cash supplied to and received from branches may have not been accounted for on the

same day of its remittance.

2. Joint custodian/ Head Cashier may not be checking the consignment (cash) before

delivering to and receiving from the private security agency.

3. Cash received /paid statement may have not been correctly prepared and reconciled.

4. Insurance policy may not be valid at the time of the audit.

5. Authorized officer may not be verifying the signatures of indenting branch manager on

the cash indents before remitting the cash.

Audit Checklist

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

280. Are signatures of cash indenting H

branch manager and head cashier along

with check signal appended on the cash

indents?

281. Have the concerned official verified H

cash indents before remitting the cash?

282. Does the authorized official obtain the M

signatures of the person delivering indent

on the back of stubs?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 33 of 38

283. Are the cash remittance received / H

drawn from other branches and / or SBP

properly accounted for in the books on the

same day from the cash remittance

invoices?

284. Does the branch obtain the M

acknowledgement of cash deposit from the

other branches?

285. Are cash remittance invoices on Form M

F-369 prepared in quad ruplicate?

286. Are signatures of the receiving branch H

official on such invoices verified when

these were received back?

287. Are weekly Cash Received / Paid M

Statement correctly prepared by the

concerned official?

288. Is the statement timely sent and M

reconciled at feeding branch and regional

office?

289. Are proceeds of local collection of M

cheques recorded in the Cash Remittance

Register?

290. Is copy of agreement with private L

security agency available with branch?

291. Are signatures of the representative of H

security agency obtained on the register?

292. Do Joint Custodian/ Head Cashier sign H

shipment delivery receipt to confirm that

consignment received from the private

security agency is in perfect condition and

duly sealed?

293. Are dates of acknowledgements M

marked off in the relative column of the

cash remittance register?

294. Are amount and date of insurance L

premium paid recorded in the relative

column of the cash remittance register?

295. Is the register properly maintained, M

updated, checked and initialed by the

authorized official?

W - BRANCH UTILITY BILLS COLLECTION OVER THE COUNTER

Audit Procedures Yes / No Risk Remarks of

or NA H/M/L Auditor/Audit

Observations

Utility Bills Collection over the Counter

296. Whether branch has opened single H

collection account for collection of bills

through UBPS-OTC?

297. Whether authorized User ID and H

password issued by IT Center is

available in branch?

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 34 of 38

298. Branch has required expertise to use H

the system?

299. Whether there is any manual bill H

receipt entertained after implementation

of UBPS?

300. Whether stubs(lower portion) of bills H

are available in branch?

301. Whether there any bill reflected in H

SAF?

302. Whether Cash and Transfer are H

made by single teller?

303. Any other discrepancy as per Inst H

Circular No-150/2015 dated 19.11.2015

Checklist on Cash & Management- under Core Banking Application (CBA)

Revised Checklist on Cash & Securities Department has been developed considering the

changes in process after implementation of CBA, the undermentioned checklist pertains to only

Cash Management System under Core Banking Application (CBA).

Observations Risk Level Auditors Remarks

304. Whether the Branch defined its cash limits of

Vault/Strong Room & Counter in CBA according to High

the insurance coverage?

305. Whether Head cashier Transferred Cash from

SBP’s Vault to NBP branch Vault using a special

Transaction code developed for this purpose in High

Profile (ZSBPCR) and is transferred to branch

vault using transaction code ‘VCI’ (If applicable)?

306. Whether the Head cashier entered the cash

received from NBP, Chest Branch using a special

Transaction code developed for this purpose in High

Profile (ZNBPCR) and is transferred to branch

vault using transaction code ‘VCI’?

307. Whether in case cash holding in vault

increased from the assigned limit the Head cashier

has transferred the exceeding holding to SBP/NBP

chest using the transaction code defined for it

High

(VCO & ZSBPDR/ZNBPDR) and is transferred

from branch vault using transaction code ‘VCO’ or

the branch has requested for arrangement of

overnight insurance from FCD?

308. Whether at the start of day/during the day

Head Cashier distributes cash to all tellers in the

branch by transferring out cash from branch vault

High

using transaction code ‘VCO’ and handing over to

teller using transaction code ‘TO’. Corresponding

activity for the completion of transfer?

309. Whether teller receives the cash and Transfer

in the cash to its counter by using transaction code High

“CI” and “TI”?

310. Whether at the start of day/during the day High

Head Cashier transfer Prize Bond using

Controlled Copy, DO NOT Duplicate For Internal Purpose Only

National Bank of Pakistan Branch Audit Checklist

Cash and Securities Department Doc. No. 2 November-2018 Page 35 of 38

Observations Risk Level Auditors Remarks

transaction code ‘VPZBO’ and handing over to

teller using transaction code ‘TO’. Corresponding

activity for the completion of transfer?

311. Whether teller receives the Prize Bond and

Transfer in the same to its counter by using High

transaction code “PZBI” and “TI”?

312. Whether at the start of day/during the day

Head Cashier distributes Foreign Currencies to all

tellers in the branch by transferring out cash from

branch vault using transaction code ‘VFEXO’ and

handing over to teller using transaction code ‘TO’.

Corresponding activity for the completion of

transfer?

High

EX in transaction code will be replaced with codes of

foreign currencies:

VFUSO –USD

VFEUO–Euros

VFJPO–Japanese Yen

VFGBO– Great Britain Pounds

VOFCO–Other Currencies

313. Whether teller receives the Foreign Currency