Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Treasury - Jan 2019 Shutdown Letter Re Anti-Deficiencies Act - 1.22.2019

Caricato da

MarkWarner0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

192 visualizzazioni3 pagineU.S. Sen. Mark R. Warner (D-VA), a member of the Senate Finance, Banking, Budget and Rules committees and Vice Chairman of the Senate Select Committee on Intelligence, today wrote to the heads of several federal Departments raising questions about the Trump Administration's compliance with the Antideficiency Act, which prohibits federal agencies from obligating or expending federal funds not appropriated by Congress.

Copyright

© © All Rights Reserved

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoU.S. Sen. Mark R. Warner (D-VA), a member of the Senate Finance, Banking, Budget and Rules committees and Vice Chairman of the Senate Select Committee on Intelligence, today wrote to the heads of several federal Departments raising questions about the Trump Administration's compliance with the Antideficiency Act, which prohibits federal agencies from obligating or expending federal funds not appropriated by Congress.

Copyright:

© All Rights Reserved

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

192 visualizzazioni3 pagineTreasury - Jan 2019 Shutdown Letter Re Anti-Deficiencies Act - 1.22.2019

Caricato da

MarkWarnerU.S. Sen. Mark R. Warner (D-VA), a member of the Senate Finance, Banking, Budget and Rules committees and Vice Chairman of the Senate Select Committee on Intelligence, today wrote to the heads of several federal Departments raising questions about the Trump Administration's compliance with the Antideficiency Act, which prohibits federal agencies from obligating or expending federal funds not appropriated by Congress.

Copyright:

© All Rights Reserved

Sei sulla pagina 1di 3

MARK R. WARNER comer

Wnited States Senate suooet

WASHINGTON, D¢ 20510-4606 ww

ULES ANO ADMANSTRATION

Jan. 22, 2019

‘The Honorable Steven Mauchin

Secretary

Department of the ‘Treasury

1500 Pennsylvania Ave., NW

Washington, DC 20220

Dear Secretary Mnuchin,

Iiwrite to voice my concerns about the context in which the Treasury Department has recently

recalled furloughed employees and to ask for the legal justification behind such actions to ensure

accordance with Congress's constitutionally-delegated powers as well as the Anti-Deficiency

Act.

Government shutdowns are never good, the current one being no exception, and they never

produce positive results. Our hard-working federal employees deserve to be paid for their work,

and to be paid in a timely manner rather than waiting weeks, months, or even years for a

shutdown to end. Rather than finding ways to minimize the impact of the current government

shutdown, and straining legal bounds to do so, it is my strong belief that the best way to fix the

current situation is to simply end the shutdown,

For context, I believe it is important to note relevant laws that apply under the current

circumstances. First, Congress's power of the purse is made clear by the constitutional

requirement that “No Money shall be drawn from the Treasury, but in Consequence of

Appropriations made by Law.”! Second, in situations where no appropriations measure has been

passed by Congress (such as the current situation), the Anti-Deficiency Act “restricts employing

the services of employees to perform government functions beyond authorized levels to

‘emergency situations, where the failure to perform those functions would result in an imminent

threat to the safety of human life or the protection of property.”

As you know, when the government entered the current partial shutdown on Dee. 22, 2018,

affected federal agencies were required to follow particular procedures, in accordance with the

2U,S, Const. art. I, §9, cl. 7.

2 DOI Office of Legal Counsel's “Government Appropriations in the Event ofa Lapse in Appropriation

Supplemental Opinions of the OLC (1995), p. 3 In relevant part, the Anti-Deficiency Act reads: “An officer or

‘employee ofthe United States Government or ofthe District of Columbia government may not accept voluntary

services for either government or employ personal services exceeding that authorized by law except for emergencies

involving the safety of human life or the protection of property... As used in tis section, the term ‘emergencies

involving the safety of human life or the protection of property” does not include ongoing, regular functions of

government the suspension of which would not imminently threaten the safety of human life or the protection of

property.” 31 U.S.C. § 1342.

1

law, to furlough large numbers of their employees while deeming others essential (or

“excepted”) to allow them to continue performing critical functions despite not receiving pay.

Yet on January 7, 2019, your department recalled hundreds of IRS employees to do routine work

of processing tax transcripts used to verify borrowers’ incomes before they are granted home

loans. This decision was taken, reportedly, after direct lobbying from top mortgage industry

officials. Unlike other federal employees who are not getting paid, it has been reported that

Treasury is using a highly unorthodox method of temporarily funding the IRS clerks’ salaries

through industry user fees, when they are normally funded through congressional

appropriations.*

‘The Department's authority to abide by Congressional direction of resources to these activities

under normal circumstances is clear. Under current circumstances, however, it is unclear that

these activities could be described as “emergencies involving the safety of human life or the

protection of property” that would allow for excepted employees to perform these duties while

Congress has not appropriated funding for your agency.

For these reasons, I ask that you provide a response to the following questions as soon as

possible.

‘* What circumstances changed between Dec. 22 and Jan. 7 that prompted you to change

plans and return furloughed employees to conduct routine work of processing tax

transcripts?

‘* How do the Department's activities identified above comply with the Anti-Deficiency

Act, where “emergencies involving the safety of human life or the protection of property’

does not include “ongoing, regular functions of government the suspension of which

‘would not imminently threaten the safety of human life or the protection of property”

* Does the Administration continue to consider the opinion of DOJ’s Office of Legal

Counsel, “Authority for the Continuance of Government Functions During a Temporary

Lapse in Appropriations,” 5 Op. O.L.C. I (1981) as modified by the OLC’s “Government

Appropriations in the Event of a Lapse in Appropriations,” Supplemental Opinions of the

OLC (1995) (the two opinions together, the “OLC Opinions”), to be the Administration's

interpretation of the permissible scope of government operations during a lapse in

appropriations? Does the Administration still consider this OLC guidance authoritative?

© If not, are there additional OLC opinions on which the Administration is relying

when making determinations about which employees are excepted? Please

provide us with a copy of any subsequent guidance on which the Administration

has relied or now considers authoritative

‘© How are the Department’s recent decisions identified above consistent with the

views expressed in the OLC Opinions?

> Could you make these guys essential?": Mortgage industry gets shutdown relief after appeal to senior Treasury

atolin” Lin en sod it Bn, Woohinghen Pet So, 11,28,

https.//www, washingtonpost com/polities/c

talctaferaupealto senor neanseoffeaiseGfotiL Tae ae

136fa44b80ba_story.him!Putm_term=,9d129bS9475e,

‘* Has any White House, DOJ or Office of Management and Budget (OMB) employee

provided any formal or informal guidance or instructions to the Department relating to

the operation of agencies during a shutdown subsequent to the December 22, 2018

guidance entitled “Special Instructions for Agencies Affected by a Possible Lapse in

Appropriations Starting on December 22, 2018"?

(© Please provide us with a copy of any such written guidance, or a description of

any guidance or instructions,

© Please provide us with any Department justification for changes in guidance ot

instructions since December 22, 2018.

* Has any White House, OMB or agency legal counsel made any determinations or issued

any guidance since December 1, 2018, regarding the employees or groups of employees

who would be considered excepted or “non-excepted” for purposes of the Anti-

Deficiency Act?

© Please provide us with a copy of any such determinations or guidance.

© Please provide us with any Department justification for changes in determinations

or guidance issued since December 22, 2018.

It is important that the Administration respect the proper roles of each branch of government,

particularly Congress's power of the purse, as well as the laws that Congress has passed. The

current situation should not give the Administration license to substitute its own determination of

proper spending priorities for that of Congress, as has been made clear through passage of the

Anti-Deficiency Act.

Thank you for your attention to this matter. I look forward to hearing your response to the above

‘questions as soon as possible.

Sincerely,

Mt R Mmez

MARK R. WARNER,

United States Senator

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Cecil Rhodes, The Roundtable Movement and EugenicsDocumento5 pagineCecil Rhodes, The Roundtable Movement and EugenicsMatthew Ehret100% (1)

- Michael - Cox, - G. - John - Ikenberry, - Takashi - Inoguchi - American Democracy PromotionDocumento366 pagineMichael - Cox, - G. - John - Ikenberry, - Takashi - Inoguchi - American Democracy PromotionmemoNessuna valutazione finora

- Mudimbe-Boyi - Beyond Dichotomies Histories, Identities, Cultures, and The Challenge of Globalization (2002)Documento344 pagineMudimbe-Boyi - Beyond Dichotomies Histories, Identities, Cultures, and The Challenge of Globalization (2002)Joe-Black100% (1)

- GOE19968Documento17 pagineGOE19968MarkWarner100% (1)

- Deepfakes Letter To PinterestDocumento2 pagineDeepfakes Letter To PinterestMarkWarnerNessuna valutazione finora

- Insurance Commission Signed LetterDocumento2 pagineInsurance Commission Signed LetterMarkWarnerNessuna valutazione finora

- Signed Pre-Ex LetterDocumento4 pagineSigned Pre-Ex LetterMarkWarner100% (1)

- Resolution Honoring Hispanic Heritage MonthDocumento6 pagineResolution Honoring Hispanic Heritage MonthMarkWarnerNessuna valutazione finora

- Deepfakes Letter To TikTokDocumento2 pagineDeepfakes Letter To TikTokMarkWarnerNessuna valutazione finora

- Deepfakes Letter To TumblrDocumento2 pagineDeepfakes Letter To TumblrMarkWarnerNessuna valutazione finora

- Deepfakes Letter To TwitchDocumento2 pagineDeepfakes Letter To TwitchMarkWarnerNessuna valutazione finora

- Deepfakes Letter To YouTubeDocumento2 pagineDeepfakes Letter To YouTubeMarkWarnerNessuna valutazione finora

- MCG 19647 LatestDocumento3 pagineMCG 19647 LatestMarkWarnerNessuna valutazione finora

- US Customs and Border Protection Contractor Breach LetterDocumento2 pagineUS Customs and Border Protection Contractor Breach LetterMarkWarner0% (1)

- 2019.09.23 Warner USIP China SpeechDocumento13 pagine2019.09.23 Warner USIP China SpeechMarkWarnerNessuna valutazione finora

- ILLICIT CASH Act, As IntroducedDocumento133 pagineILLICIT CASH Act, As IntroducedMarkWarner100% (1)

- The Illicit Cash Act One PagerDocumento2 pagineThe Illicit Cash Act One PagerMarkWarner100% (1)

- MobileXUSA Letter23Documento2 pagineMobileXUSA Letter23MarkWarnerNessuna valutazione finora

- 9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceDocumento2 pagine9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceMarkWarnerNessuna valutazione finora

- MCG 19610Documento3 pagineMCG 19610MarkWarnerNessuna valutazione finora

- Letter To Congressional Leadership Re Miners Healthcare and PensionsDocumento2 pagineLetter To Congressional Leadership Re Miners Healthcare and PensionsMarkWarnerNessuna valutazione finora

- Letter To EsperDocumento2 pagineLetter To EsperMarkWarnerNessuna valutazione finora

- Letter To DOJDocumento1 paginaLetter To DOJMarkWarnerNessuna valutazione finora

- President VCWarner 31JUL19Documento2 paginePresident VCWarner 31JUL19MarkWarnerNessuna valutazione finora

- CPSC Correspondence Re Beach UmbrellasDocumento4 pagineCPSC Correspondence Re Beach UmbrellasMarkWarnerNessuna valutazione finora

- Minge-Kalman - The Industrial Revolution and The European Family The Institutionalization of 'Childhood' As A Market For Family LaborDocumento16 pagineMinge-Kalman - The Industrial Revolution and The European Family The Institutionalization of 'Childhood' As A Market For Family LaborXoxoOlveraNessuna valutazione finora

- Essential Questions of American History AnsweredDocumento12 pagineEssential Questions of American History AnsweredZak NelsonNessuna valutazione finora

- 3.0 Main Body 3.1. The Impact of Globalisation On The Growth of The International SystemDocumento4 pagine3.0 Main Body 3.1. The Impact of Globalisation On The Growth of The International SystemAed SarumpaetNessuna valutazione finora

- Talk About ImbalancesDocumento1 paginaTalk About ImbalancesforbesadminNessuna valutazione finora

- Drive Thru History-American History Episode 6Documento8 pagineDrive Thru History-American History Episode 6hiNessuna valutazione finora

- Angus Maddison Growth and Interaction in The World EconomyDocumento104 pagineAngus Maddison Growth and Interaction in The World Economyjsrplc7952Nessuna valutazione finora

- !camp Arifjans Corruption Indicted and ConvictedDocumento58 pagine!camp Arifjans Corruption Indicted and ConvictedTrafficked_by_ITT100% (1)

- Diamond (Industrial)Documento12 pagineDiamond (Industrial)RusefFandiNessuna valutazione finora

- Richard White-The Imagined WestDocumento19 pagineRichard White-The Imagined WestleonabrahamzapruderNessuna valutazione finora

- Ilhan Omar FEC ComplaintDocumento22 pagineIlhan Omar FEC ComplaintAndrew KerrNessuna valutazione finora

- Mercyhurst Magazine - Fall 1985Documento36 pagineMercyhurst Magazine - Fall 1985hurstalumni0% (1)

- Ang Pilipinas Ay Isang Demokratiko at Republikanong EstadoDocumento5 pagineAng Pilipinas Ay Isang Demokratiko at Republikanong EstadoAshley PascualNessuna valutazione finora

- Macroeconomics - Theory Through ApplicationDocumento680 pagineMacroeconomics - Theory Through ApplicationANup AK100% (1)

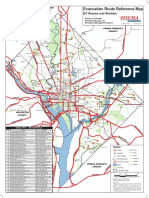

- D.C.-Area Evacuation Route Reference MapDocumento2 pagineD.C.-Area Evacuation Route Reference Mapwamu885Nessuna valutazione finora

- The Functions of Political PartiesDocumento2 pagineThe Functions of Political Partiesapi-239995826Nessuna valutazione finora

- NSA Review Board's ReportDocumento308 pagineNSA Review Board's ReportThe Washington Post100% (1)

- The Political Economy of Commodity ChainsDocumento162 pagineThe Political Economy of Commodity Chainsrafigold100% (1)

- Test Bank For Intercultural Communication in Contexts 6th Edition MartinDocumento14 pagineTest Bank For Intercultural Communication in Contexts 6th Edition Martinurticatepoundet7gNessuna valutazione finora

- Electoral College Webquest 2020Documento4 pagineElectoral College Webquest 2020api-476923692Nessuna valutazione finora

- U S History II CurriculumDocumento48 pagineU S History II CurriculumjameseisenbergNessuna valutazione finora

- Manifest Destiny-Power of PerspectiveDocumento5 pagineManifest Destiny-Power of Perspectiveapi-233755289Nessuna valutazione finora

- King Michael PanamaDocumento33 pagineKing Michael PanamaOana HereaNessuna valutazione finora

- Identity and MulticulturalismDocumento57 pagineIdentity and MulticulturalismbastajelenaNessuna valutazione finora

- Blackfeet NationDocumento2 pagineBlackfeet NationCeylin Arden UzunNessuna valutazione finora

- Nucor FinalDocumento16 pagineNucor FinalNhamie Castillo100% (1)

- SME'sDocumento92 pagineSME'sRana ToseefNessuna valutazione finora

- Cavusgil Ib5 PPT 02-20190917112345Documento41 pagineCavusgil Ib5 PPT 02-20190917112345NUR AFRINA BINTI ABASNessuna valutazione finora