Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PT Kalbe Farma Tbk. Financial Summary 2011

Caricato da

Khaerudin RangersDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PT Kalbe Farma Tbk. Financial Summary 2011

Caricato da

Khaerudin RangersCopyright:

Formati disponibili

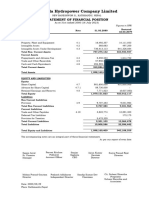

PT Kalbe Farma Tbk.

Pharmaceuticals

Head Office KALBE Building Summary of Financial Statement

Jl. Letjend. Suprapto Kav. 4, Jakarta 10510

Phone (021) 4287-3888 (Million Rupiah)

Fax (021) 4287-3678 2009 2010 2011

Website: www.kalbe.co.id Total Assets 6,482,447 7,032,497 8,274,554

Current Assets 4,696,168 5,031,545 5,956,123

Factory Kawasan Industri Delta Silicon of which

Jl. MH. Thamrin Blok A3-I Cash and cash equivalents 1,562,664 1,901,872 2,291,336

Time deposits 62,596 5,316 113,871

Lippo Cikarang, Bekasi 17550 Trade receivables 1,203,941 1,262,711 1,529,992

Phone (021) 8990-7337, 8990-7333 Inventories 1,561,382 1,550,829 1,705,189

Fax (021) 8990-7360 Non-Current Assets 1,786,279 2,000,952 2,318,431

of which

Business Pharmaceuticals Fixed Assets-Net 1,398,128 1,605,266 1,860,288

Company Status PMDN Deffered Tax Assets-Net 29,354 34,774 37,352

Investments 37,404 48,429 53,708

Financial Performance: Net income in 2011 in- Other Assets 20,252 37,325 97,433

crease to IDR 1.539 trillion compared to IDR 1.346 trillion Liabilities 1,691,775 1,260,580 1,758,619

Current Liabilities 1,574,137 1,146,489 1,630,589

booked in 2010. of which

Brief History: Established in 1966, PT Kalbe Farma Short-term debt

Trade payables

339,132

481,511

24,290

488,241

140,057

850,398

Tbk. (“the Company” or “Kalbe”) has gone a long way from its Accrued expenses 359,977 301,962 283,138

Taxes payable 273,181 192,635 154,287

humble beginnings as a garage-operated pharmaceutical busi- Non-Current Liabilities 117,637 114,091 128,031

ness in North Jakarta. Throughout its more than 40-year his- Shareholders' Equity 4,790,672 5,771,917 6,515,935

tory, the Company has expanded by strategic acquisitions of Paid-up capital 507,801 507,801 507,801

Paid-up capital

pharmaceutical companies, building a leading brand positioning in excess of par value 2,640 4,441 4,441

and reaching to international markets to transform itself into Revaluation of fixed assets

Retained earnings (accumulated loss)

n.a

4,280,231

n.a

5,259,675 6,003,693

n.a

an integrated consumer health and nutrition enterprise with

Net Sales 9,087,348 10,226,789 10,911,860

unrivalled innovation, marketing, branding, distribution, finan- Cost of Goods Sold 4,575,407 5,060,404 5,360,687

cial strength and R&D and production expertise to promote its Gross Profit

Operating Expenses

4,511,940

2,946,066

5,166,386

3,375,482

5,551,173

3,608,737

mission to improve health for a better life. Operating Profit 1,565,875 1,790,904 1,942,437

Other Income (Expenses) (94,803) (20,469) 44,823

The Kalbe Group has an extensive and strong portfolio of Profit (Loss) before Taxes 1,471,072 1,770,435 1,987,259

brands in the prescription pharmaceuticals, OTC pharmaceuti- Comprehensive Profit (Loss) 929,004 1,346,098 1,539,721

cals, energy drink and nutrition products, complemented with a Per Share Data (Rp)

Earnings (Loss) per Share 91 133 152

robust packaging and distribution arm that reaches over 1 million Equity per Share 472 568 642

outlets. The Company has succeeded in promoting its brands Dividend per Share 25 n.a 95

Closing Price 1,300 3,250 3,400

as the undisputed market leaders not only in Indonesia but also

Financial Ratios

in the international markets, establishing such household names PER (x) 14.21 24.52 22.43

across all healthcare and pharmaceutical segments as Promag, PBV (x) 2.76 5.72 5.30

Dividend Payout (%) 27.33 n.a 62.66

Mixagrip, Woods, Komix, Prenagen and Extra Joss. Also, foster- Dividend Yield (%) 5.30 n.a 14.81

ing and expanding alliances with international partners have ac- Current Ratio (x) 2.98 4.39 3.65

celerated Kalbe’s advances in international markets and sophis- Debt to Equity (x) 0.35 0.22 0.27

Leverage Ratio (x) 0.26 0.18 0.21

ticated R&D ventures as well as the latest pharmaceutical and Gross Profit Margin (x) 0.50 0.51 0.51

healthcare developments, including stem cell and cancer research. Operating Profit Margin (x)

Net Profit Margin (x)

0.17

0.10

0.18

0.13

0.18

0.14

The Group’s consolidation in 2005 has further enhanced pro- Inventory Turnover (x) 2.93 3.26 3.14

Total Assets Turnover (x) 1.40 1.45 1.32

duction, marketing and financial capabilities, providing greater ROI (%) 14.33 19.14 18.61

leverage to widen local and international exposure. Today, ROE (%) 19.39 23.32 23.63

Kalbe is the largest publicly-listed pharmaceutical company in PER = 24,15x ; PBV = 6,25x (June 2012)

Southeast Asia with over US$ 1 billion in market capitalization Financial Year: December 31

Public Accountant: Purwantono, Suherman & Surja

and revenues of over Rp 7 trillion. Its cashrich position today

also provides for unlimited expansion opportunities in the fu- (million rupiah)

ture. 2012 2011

Total Assets 9,141,116 7,894,851

Shareholders Current Assets 6,618,140 5,804,657

PT Gira Sole Prima 10.17% Non-Current Assets 2,522,976 2,090,194

PT Santa Seha Sanadi 9.62% Liabilities 2,710,057 2,049,757

PT Diptanala Bahana 9.49% Shareholders' Equity 6,135,876 5,845,094

Net Sales 6,243,947 4,948,716

PT Lucasta Murni Cemerlang 9.47%

Profit after Taxes 825,977 692,856

PT Ladang Ira Panen 9.22%

PT Bina Artha Charisma 8.66% ROI (%) 9.04 8.78

PT Kalbe Farma Tbk (Buy Back) 7.69% ROE (%) 13.46 11.85

Public 35.68% In June

444 Indonesian Capital Market Directory 2012

PT Kalbe Farma Tbk. Pharmaceuticals

Board of Commissioners Board of Directors

President Commissioner Drs. Johannes Setijono President Director Bernadette Ruth Irawati Setiady

Commissioners Santoso Oen, BA, Jozef Darmawan Angkasa, Directors Budi Dharma Wireksoatmodjo, Vidjongtius,

Ferdinand Aryanto, Farid A. Moeloek, Ongkie Tedjasurja, Herman Widjaja

Wahjudi Prakarsa Number of Employees 9,752

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 1991 1991 10,000,000 10,000,000

2 Partial Listing 1991 1992 10,000,000 20,000,000

3 Cooperative 1992 1999 500,000 20,500,000

4 Company Listing 1992 1992 29,500,000 50,000,000

5 Bonus Shares 1992 1992 50,000,000 100,000,000

6 Right Issue 1993 1993 8,000,000 108,000,000

7 Bonus Shares 1994 1994 75,600,000 183,600,000

8 Dividend Shares 1994 1994 32,400,000 216,000,000

9 Stock Split 1996 1996 216,000,000 432,000,000

10 Stock Split 1999 1999 1,728,000,000 2,160,000,000

11 Bonus Shares 2000 2000 1,900,800,000 4,060,800,000

12 Stock Split 2-Jan-04 2-Jan-04 4,060,800,000 8,121,600,000

13 Additional Listing (Merger) 21-Dec-05 21-Dec-05 2,034,414,422 10,156,014,422

Underwriters PT Ing Barings Securities, PT Merincorp

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price Shares Traded Trading Listed Market

Month High Low Close Volume Value Frequency Day Shares Capitalization

(Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

January-11 3,375 2,450 2,825 512,854.00 1,539,793.00 31,889 21 10,156,014,422 28,690,741.00

February-11 3,000 2,700 2,925 175,174.00 503,579.00 12,472 18 10,156,014,422 29,706,342.00

March-11 3,400 2,875 3,400 409,546.00 1,256,625.00 26,005 23 10,156,014,422 34,530,449.00

April-11 3,725 3,350 3,575 366,099.00 1,318,778.00 21,717 20 10,156,014,422 36,307,752.00

May-11 3,600 3,225 3,575 309,123.00 1,078,937.00 27,352 21 10,156,014,422 36,307,752.00

June-11 3,575 3,225 3,375 206,133.00 693,300.00 19,396 20 10,156,014,422 34,276,549.00

July-11 3,700 3,400 3,475 357,183.00 1,269,992.00 23,402 21 10,156,014,422 35,292,150.00

August-11 3,550 2,900 3,475 192,858.00 638,119.00 18,325 19 10,156,014,422 35,292,150.00

September-11 3,725 2,650 3,250 249,601.00 835,454.00 22,062 20 10,156,014,422 33,007,047.00

October-11 3,550 2,975 3,475 182,564.00 622,602.00 26,568 21 10,156,014,422 35,292,150.00

November-11 3,600 3,300 3,525 129,667.00 451,000.00 17,036 22 10,156,014,422 35,799,951.00

December-11 3,600 3,300 3,400 343,677.00 1,182,729.00 12,427 21 10,156,014,422 34,530,449.00

January-12 3,650 3,375 3,525 122,271.00 428,028.00 15,399 21 10,156,014,422 35,799,951.00

February-12 3,600 3,400 3,500 172,533.00 602,764.00 18,914 21 10,156,014,422 35,546,050.00

March-12 3,550 3,375 3,550 283,565.00 982,054.00 18,538 21 10,156,014,422 36,053,851.00

April-12 4,050 3,400 4,025 485,446.00 1,795,766.00 31,628 20 10,156,014,422 40,877,958.00

May-12 4,025 3,750 3,875 454,029.00 1,783,899.00 39,920 21 10,156,014,422 39,354,556.00

June-12 4,000 3,700 3,775 384,956.00 1,485,524.00 30,929 21 10,156,014,422 38,338,954.00

Stock Price and Traded Chart

Institute for Economic and Financial Research 445

Potrebbero piacerti anche

- Rmba - Icmd 2011 (B02)Documento2 pagineRmba - Icmd 2011 (B02)annisa lahjieNessuna valutazione finora

- Inru ICMD 2009Documento2 pagineInru ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocumento2 paginePT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNessuna valutazione finora

- PT Mustika Ratu TBK.: Summary of Financial StatementDocumento2 paginePT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNessuna valutazione finora

- Kbri ICMD 2009Documento2 pagineKbri ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocumento2 paginePT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNessuna valutazione finora

- PT Inti Agri ResourcestbkDocumento2 paginePT Inti Agri ResourcestbkmeilindaNessuna valutazione finora

- PT Astra Agro Lestari Tbk Financial Summary 2010Documento2 paginePT Astra Agro Lestari Tbk Financial Summary 2010Intan Maulida SuryaningsihNessuna valutazione finora

- PT Gozco Plantations TBK.: Summary of Financial StatementDocumento2 paginePT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNessuna valutazione finora

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocumento2 paginePT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNessuna valutazione finora

- Abmm PDFDocumento2 pagineAbmm PDFTRI HASTUTINessuna valutazione finora

- Aces ICMD 2009Documento2 pagineAces ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- Spma ICMD 2009Documento2 pagineSpma ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- GGRM - Icmd 2011 (B02)Documento2 pagineGGRM - Icmd 2011 (B02)annisa lahjieNessuna valutazione finora

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocumento2 paginePT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNessuna valutazione finora

- Abba PDFDocumento2 pagineAbba PDFAndriPigeonNessuna valutazione finora

- Abda PDFDocumento2 pagineAbda PDFTRI HASTUTINessuna valutazione finora

- Fasw ICMD 2009Documento2 pagineFasw ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Documento2 paginePT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Mhd FadilNessuna valutazione finora

- IcbpDocumento2 pagineIcbpdennyaikiNessuna valutazione finora

- PT Aqua Golden Mississippi Tbk. Financial SummaryDocumento2 paginePT Aqua Golden Mississippi Tbk. Financial SummaryMila DiasNessuna valutazione finora

- Icmd 2010Documento2 pagineIcmd 2010meilindaNessuna valutazione finora

- PT Tri Banyan Tirta TBK.: Summary of Financial StatementDocumento2 paginePT Tri Banyan Tirta TBK.: Summary of Financial StatementAndre Bayu SaputraNessuna valutazione finora

- Interim Financial Statement Ashwin End 2077Documento37 pagineInterim Financial Statement Ashwin End 2077Manoj mahatoNessuna valutazione finora

- PT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007Documento2 paginePT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007patriaNessuna valutazione finora

- BPPL Holdings PLCDocumento15 pagineBPPL Holdings PLCkasun witharanaNessuna valutazione finora

- Research For OBUDocumento14 pagineResearch For OBUM Burhan SafiNessuna valutazione finora

- Net Cash Flows From Financing Activities 108,523 49,112 2,996Documento11 pagineNet Cash Flows From Financing Activities 108,523 49,112 2,996Hong NguyenNessuna valutazione finora

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Documento5 pagineQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417Nessuna valutazione finora

- Tesla, Inc. (TSLA) : Cash FlowDocumento239 pagineTesla, Inc. (TSLA) : Cash FlowAngelllaNessuna valutazione finora

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Documento4 pagineSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNessuna valutazione finora

- HSC Báo Cáo Tài ChínhDocumento8 pagineHSC Báo Cáo Tài ChínhNgọc Dương Thị BảoNessuna valutazione finora

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocumento30 pagineRastriya Banijya Bank Limited: Interim Financial StatementsNepal LoveNessuna valutazione finora

- Financial PlanDocumento25 pagineFinancial PlanAyesha KanwalNessuna valutazione finora

- Takaful Companies - Overall: ItemsDocumento6 pagineTakaful Companies - Overall: ItemsZubair ArshadNessuna valutazione finora

- Cakes Inside: Biratnagar, NepalDocumento23 pagineCakes Inside: Biratnagar, NepalDenimNessuna valutazione finora

- Weismanna Health Care Private Limited Plot No.44 & 45, Industrial Estate Kurnool Road, Ongole-523002 BALANCE SHEET AS ON 31 ST March, 2013Documento37 pagineWeismanna Health Care Private Limited Plot No.44 & 45, Industrial Estate Kurnool Road, Ongole-523002 BALANCE SHEET AS ON 31 ST March, 2013phani raja kumarNessuna valutazione finora

- Acc AssignmentDocumento25 pagineAcc AssignmentMyustafizzNessuna valutazione finora

- Financial performance of a company from 2004-2013Documento2 pagineFinancial performance of a company from 2004-2013Jomar JordasNessuna valutazione finora

- Different Touch LTD.: Trading AccountsDocumento8 pagineDifferent Touch LTD.: Trading AccountsMd. JubarajNessuna valutazione finora

- PT Ades Waters Indonesia Tbk Financial Performance 2005-2007Documento2 paginePT Ades Waters Indonesia Tbk Financial Performance 2005-2007Mhd FadilNessuna valutazione finora

- Quarter Report May 12Documento27 pagineQuarter Report May 12Babita neupaneNessuna valutazione finora

- Robi Retail Holdings Inc. annual income statement analysisDocumento19 pagineRobi Retail Holdings Inc. annual income statement analysisDyrelle ReyesNessuna valutazione finora

- Hade PDFDocumento2 pagineHade PDFMaradewiNessuna valutazione finora

- Nabil Bank Q1 FY 2021Documento28 pagineNabil Bank Q1 FY 2021Raj KarkiNessuna valutazione finora

- Ceres SpreadsheetDocumento1 paginaCeres SpreadsheetShannan RichardsNessuna valutazione finora

- PayslipDocumento1 paginaPayslipRijaa ArshadNessuna valutazione finora

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocumento2 paginePT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNessuna valutazione finora

- 6tb Sched 1Documento43 pagine6tb Sched 1Darwin Competente LagranNessuna valutazione finora

- Metodos Flujos de Caja, Ejemplo AltriaDocumento5 pagineMetodos Flujos de Caja, Ejemplo AltriaEsteban BustamanteNessuna valutazione finora

- Interim Financial StatementsDocumento22 pagineInterim Financial StatementsShivam KarnNessuna valutazione finora

- A. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VIDocumento32 pagineA. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VITammy DaoNessuna valutazione finora

- Abda ICMD 2009Documento2 pagineAbda ICMD 2009abdillahtantowyjauhariNessuna valutazione finora

- Financial in WebsiteDocumento38 pagineFinancial in WebsiteJay prakash ChaudharyNessuna valutazione finora

- Quarter Report April 20 2022Documento29 pagineQuarter Report April 20 2022Binu AryalNessuna valutazione finora

- For Fixed AssetsDocumento27 pagineFor Fixed AssetsaryalsajaniNessuna valutazione finora

- Bangladesh q3 Report 2020 Tcm244 556009 enDocumento8 pagineBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3Nessuna valutazione finora

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocumento2 paginePT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNessuna valutazione finora

- Enterprise Valuation of BEACON PharmaceuticalsDocumento35 pagineEnterprise Valuation of BEACON PharmaceuticalsMD.Thariqul Islam 1411347630Nessuna valutazione finora

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDa EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNessuna valutazione finora

- ReadmeDocumento1 paginaReadmefellow23Nessuna valutazione finora

- OutputDocumento1 paginaOutputKhaerudin RangersNessuna valutazione finora

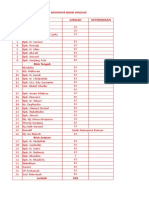

- Daftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraDocumento1 paginaDaftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraKhaerudin RangersNessuna valutazione finora

- PT Semen Gresik (Persero) Tbk. Financial Summary and RatiosDocumento2 paginePT Semen Gresik (Persero) Tbk. Financial Summary and RatiosKhaerudin RangersNessuna valutazione finora

- Astra Financial Summary 2011Documento2 pagineAstra Financial Summary 2011Khaerudin RangersNessuna valutazione finora

- Jurnal 1.hubungan Pengetahuan Dan Sikap Ibu Hamil Dengan Status GiziDocumento7 pagineJurnal 1.hubungan Pengetahuan Dan Sikap Ibu Hamil Dengan Status GiziToni SubarkahNessuna valutazione finora

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocumento2 paginePT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNessuna valutazione finora

- Noori Mosque Amsterdam Qasida Burda ShariefDocumento44 pagineNoori Mosque Amsterdam Qasida Burda ShariefAza JunūdīNessuna valutazione finora

- Book 1Documento7 pagineBook 1Khaerudin RangersNessuna valutazione finora

- CoverDocumento2 pagineCoverKhaerudin RangersNessuna valutazione finora

- Muhammad Abduh'S Contributions To Modernity: Ahmad N. Amir, Abdi O. Shuriye, Ahmad F. IsmailDocumento13 pagineMuhammad Abduh'S Contributions To Modernity: Ahmad N. Amir, Abdi O. Shuriye, Ahmad F. IsmailAhmad YusryNessuna valutazione finora

- ReadmeDocumento1 paginaReadmeHermantonoNessuna valutazione finora

- ReadmeDocumento1 paginaReadmeHermantonoNessuna valutazione finora

- Business Finance PPT 1Documento10 pagineBusiness Finance PPT 1angelica beatriceNessuna valutazione finora

- Introduction to Risk and ReturnDocumento23 pagineIntroduction to Risk and ReturnIqbal AzharNessuna valutazione finora

- BUSINESS TRANSACTIONS AND ACCOUNT TITLESDocumento4 pagineBUSINESS TRANSACTIONS AND ACCOUNT TITLESPAIN SAMANessuna valutazione finora

- Notes For Completing Form R40Documento12 pagineNotes For Completing Form R40hrpwmv83Nessuna valutazione finora

- 1129-Article Text-2064-1-10-20210405Documento2 pagine1129-Article Text-2064-1-10-20210405Nguyễn DươngNessuna valutazione finora

- Historical Data Analysis: (DIGI: Appendix 6.0-8.0)Documento9 pagineHistorical Data Analysis: (DIGI: Appendix 6.0-8.0)Ayame DelanoNessuna valutazione finora

- Sbi Eqty 12 Combined Form MFDocumento55 pagineSbi Eqty 12 Combined Form MFanywheremechanical78Nessuna valutazione finora

- IAS 41 - AgricultureDocumento4 pagineIAS 41 - AgricultureRashedNessuna valutazione finora

- 10 Best Trading Chart Patterns PDF GuideDocumento43 pagine10 Best Trading Chart Patterns PDF Guidemcjn.commercialNessuna valutazione finora

- Reverse Iron Condor Spread-1023Documento7 pagineReverse Iron Condor Spread-1023ramojiraNessuna valutazione finora

- MeetFounders North America June 2021 HandoutDocumento10 pagineMeetFounders North America June 2021 HandoutAndrew BottNessuna valutazione finora

- Exam FmiDocumento11 pagineExam FmiWinkel GroteNessuna valutazione finora

- The Knowledge ToolboxDocumento13 pagineThe Knowledge ToolboxJoham GutierrezNessuna valutazione finora

- Week 11 Chapter 15Documento35 pagineWeek 11 Chapter 15No PromisesNessuna valutazione finora

- Section e - QuestionsDocumento4 pagineSection e - QuestionsAhmed Raza MirNessuna valutazione finora

- Chapter 2 - Interest RatesDocumento52 pagineChapter 2 - Interest Ratesnguyennhatminh111975Nessuna valutazione finora

- Kotak Mahindra Bank Limited FY 2020 21Documento148 pagineKotak Mahindra Bank Limited FY 2020 21Harshvardhan PatilNessuna valutazione finora

- Accountancy MSDocumento13 pagineAccountancy MSJas Singh DevganNessuna valutazione finora

- BUS 349 Summer 2021 Assignment 1 Chapter QuestionsDocumento5 pagineBUS 349 Summer 2021 Assignment 1 Chapter QuestionsAnhad SinghNessuna valutazione finora

- Chicago's largest public companies in 2007Documento8 pagineChicago's largest public companies in 2007mayankpdNessuna valutazione finora

- Working Capital Management ApproachesDocumento19 pagineWorking Capital Management ApproachesDayana SyazwaniNessuna valutazione finora

- Advanced Valuation Solutions for Company GrowthDocumento28 pagineAdvanced Valuation Solutions for Company Growthneoss1190% (1)

- Pakistan's Economy & Financial MarketsDocumento11 paginePakistan's Economy & Financial MarketsXeeshan Bashir100% (1)

- Answer To Exercises-Capital BudgetingDocumento18 pagineAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDocumento27 pagineSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNessuna valutazione finora

- Acctg 207B Final ExamDocumento5 pagineAcctg 207B Final ExamJERROLD EIRVIN PAYOPAYNessuna valutazione finora

- Asgmt FinancialDocumento37 pagineAsgmt FinancialRusna Ahmad100% (1)

- Forward Markets Commission (India) PDFDocumento3 pagineForward Markets Commission (India) PDFkinjal_1ymailcomNessuna valutazione finora

- Currency Derivatives ExplainedDocumento57 pagineCurrency Derivatives ExplainedNagireddy KalluriNessuna valutazione finora

- APPLEDocumento12 pagineAPPLEenockNessuna valutazione finora