Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CIMA F3 Syllabus

Caricato da

Shah Kamal0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni8 pagineCIMA F3 syllabus

Titolo originale

CIMA F3 syllabus

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCIMA F3 syllabus

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni8 pagineCIMA F3 Syllabus

Caricato da

Shah KamalCIMA F3 syllabus

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

Syllabus overview

F3 focuses on the formulation and implementation of financial strategy to support the overall strategy of the organisation. Using insights gained

from F1 and F2, it provides the competencies to evaluate the financing requirements of organisations and the relative merits of alternative

sources of finance to meet these requirements. Finally, it develops the competencies required to value investment opportunities including the

valuation of corporate entities for mergers, acquisitions and divestments.

Syllabus outline

Weight Syllabus topic

25% A. Formulation of financial strategy

35% B. Financing and dividend decisions

40% C. Corporate finance

Assessment strategy

F3 – A. FORMULATION OF FINANCIAL STRATEGY (25%)

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

1 evaluate strategic financial and non-financial (a) advise on the overall strategic financial and non- Overall strategic financial objectives (e.g. value

objectives of different types of entities. financial objectives of different types of entities for money, maximising shareholder wealth,

providing a surplus) of different types of entities

(e.g. incorporated, unincorporated, quoted,

unquoted, private sector, public sector, for-profit

and not-for-profit).

Non-financial objectives (e.g. human, intellectual,

natural, and social and relationship).

Financial strategy in the context of international

operations.

(b) evaluate financial objectives of for-profit entities Financial objectives (e.g. earnings growth,

dividend growth, gearing) and assessment of

attainment.

Sensitivity of the attainment of financial objectives

to changes in underlying economic (e.g. interest

rates, exchange rates, inflation) and business

variables (e.g. margins, volumes).

(c) advise on the use of sustainability and integrated Limitations of financial statements for

reporting to inform stakeholders of relevant incorporated entities, prepared in accordance with

information concerning the interaction of a International Accounting Standards (IAS), to

business with society and the natural reflect the value and stewardship of the non-

environment. financial capital base.

Principles and scope of reporting social and

environmental issues (e.g. Global Reporting

Initiative’s Sustainability Reporting Framework

and International Integrated Reporting Council

guidance).

2 evaluate strategic financial management (a) evaluate the interrelationship between Investment, financing and dividend decisions and

policy decisions. investment, financing and dividend decisions for the interrelationship between them in meeting the

an incorporated entity cash needs of the entity.

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

Sensitivity of forecast financial statements and

future cash position to investment, financing and

dividend decisions.

Consideration of the interests of shareholders and

other stakeholders in investment, financing and

dividend decisions (e.g. impact on investor and

lender ratios, compliance with debt covenants and

attainment of financial objectives).

Determine financing requirements and cash

available for payment of dividends based on the

overall consideration of the forecast future cash

flows arising from investment decisions, business

strategy and forecast business and economic

variables.

(b) advise on the development of financial strategy Lenders’ assessment of creditworthiness (e.g.

for an entity taking into account taxation and business plans, liquidity ratios, cash forecasts,

other external influences credit rating, quality of management).

Financial strategy in the context of regulatory

requirements (e.g. price and service controls

exercised by industry regulators).

Consideration of taxation regulations (domestic

and international) in setting financial strategy.

(c) evaluate the impact of the adoption of hedge The accounting treatment of hedge accounting

accounting and disclosure of financial risk on (cash flow, fair value and net investment), IFRS 9

financial statements and stakeholder (or IAS 39, before effective date for IFRS 9).

assessment. Impact of adoption of hedge accounting on

financial statements and on stakeholder

assessment.

Disclosure of financial risk, including policies for

managing such risk (IFRS 7 Financial

Instruments: Disclosures).

F3 – B. FINANCING AND DIVIDEND DECISIONS (35%)

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

1 evaluate the financing requirements of an (a) evaluate the impact of changes in capital Capital structure theories (traditional theory,

entity and recommend a strategy for meeting structure for an incorporated entity on Modigliani and Miller’s (MM) theories with and

those requirements. shareholders and other stakeholders without tax and practical considerations and

calculations using MM formulae).

Calculation of cost of equity or weighted average

cost of capital (WACC) to reflect a change in

capital structure.

Modelling impact of choice of capital structure on

financial statements and key performance

measures (e.g. ratios of interest to investors and

lenders and compliance with debt covenants).

Structuring the debt/equity profile of group

companies, including tax implications and thin

capitalisation rules

(b) evaluate and compare alternative methods of Criteria for selecting appropriate debt instruments

raising long-term debt finance (e.g. bank borrowings, bonds, convertible bonds,

commercial paper).

Target debt profile (e.g. interest, currency and

maturity profile) to manage interest, currency and

refinancing risk.

Use of cross-currency swaps and interest rate

swaps to change the currency or interest rate

profile of debt.

Tax considerations in the selection of debt

instruments.

Procedures for issuing debt securities (private

placement and capital market issues, role of

advisers and underwriters).

Debt covenants (e.g. interest cover, net

debt/EBITDA, debt/debt and equity).

The lease or buy decision (for both operating and

finance leases).

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

(c) evaluate and compare alternative methods of Methods of flotation and implications for the

raising equity finance. management of the entity and for its stakeholders.

Use of rights issues, including choice of discount

rate, impact on shareholder wealth and

calculation of the theoretical ex-rights price

(TERP) and yield-adjusted TERP.

2 evaluate dividend policies for an incorporated (a) evaluate alternatives to cash dividends and their Impact of scrip dividends on shareholder value

entity that meet the needs and expectations of impact on shareholder wealth and entity and entity value/financial statements/performance

shareholders. performance measures measures.

Impact of share repurchase programmes on

shareholder value and entity value/financial

statements/performance measures

(b) recommend appropriate dividend policies, Implications for shareholder value of alternative

including consideration of shareholder dividend policies including MM theory of dividend

expectations and the cash needs of the entity. irrelevancy.

Development of appropriate dividend policy,

taking into account the interests of shareholders

and the cash needs of the entity.

F3 – C. CORPORATE FINANCE (40%)

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

1 evaluate opportunities for acquisition, merger (a) evaluate the financial and strategic implications Recognition of the interests of different

and divestment. of proposals for an acquisition, merger or stakeholder groups.

divestment, including taxation implications. Reasons for and against acquisitions, mergers

and divestments (e.g. strategic position,

synergistic benefits, Big Data opportunities, risks

and tax implications).

Taxation implications (group loss relief,

differences in taxation rates, withholding tax,

double tax treaties).

Process and implications of a management buy-

out, including potential conflicts of interest.

Role/function/implications of acquisition by private

equity or venture capitalist.

Role and scope of competition authorities in

relation to mergers and acquisitions.

2 evaluate the value of entities. (a) calculate the value of a whole entity (quoted or Asset valuation (e.g. historic cost, replacement

unquoted), a subsidiary entity or division using a cost and realisable value).

range of methods including taxation Forms of intangible asset (including intellectual

property rights, brands etc) and methods of

valuation.

Share prices (quoted on stock market or private

sale for non-quoted entities).

Earnings valuation (e.g. price/earnings multiples

and earnings yield).

Dividend valuation (e.g. dividend growth model,

including estimating growth from past or forecast

figures and including non-constant growth

assumptions).

Discounted free cash flow valuation (including

taxation, risk-adjusted discount rate, foreign

currency cash flows and sensitivity analysis).

Ideas of diversifiable risk (unsystematic risk) and

systematic risk.

Learning outcomes

On completion of their studies, students should be able to: Indicative syllabus content

Lead Component

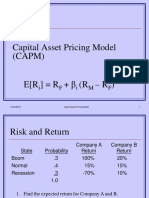

Capital asset pricing model (CAPM), including the

meaning and derivation of the component, and

the ability to gear and un-gear betas.

Calculation of an appropriate cost of capital for

use in discounted cash flow analysis (e.g. cost of

equity or WACC) by reference to the nature of the

transaction (e.g. division or an entire entity),

including use of CAPM, dividend valuation model

and MM WACC formula.

Efficient market hypothesis and its relevance for

the valuation of quoted entities.

Impact of government incentives on entity value

(e.g. capital or revenue grants).

(b) evaluate the validity of the valuation methods Strengths and weaknesses of each valuation

used and the results obtained in the context of a method.

given scenario. Validity of the results for use in decision making

according to the nature of the target entity (e.g. a

division, a whole entity, quoted or unquoted).

3 evaluate pricing issues and post-transaction (a) evaluate alternative pricing structures and bid Forms of consideration and terms for acquisitions

issues. process including taxation implications (e.g. cash, shares, convertibles and earn-out

arrangements), and their impact on shareholders,

including taxation impact.

Treatment of target entity debt (settlement,

refinancing).

Methods/implications of financing a cash offer and

refinancing target entity debt.

Bid negotiation (e.g. managing a hostile bid)

including agency issues.

(b) evaluate post-transaction issues. Potential post-transaction value for both acquirer

and seller (e.g. taking into account synergistic

benefits, forecast performance and market

response).

Integration of management/systems and effective

realisation of synergistic benefits.

Types of exit strategies and their implications.

Potrebbero piacerti anche

- The Four Walls: Live Like the Wind, Free, Without HindrancesDa EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesValutazione: 5 su 5 stelle5/5 (1)

- Syllabus PGDM FMDocumento73 pagineSyllabus PGDM FMyash_meetuNessuna valutazione finora

- MF0004 (MF0013) ) Solved Assignment (Set 1 & 2)Documento29 pagineMF0004 (MF0013) ) Solved Assignment (Set 1 & 2)wasimsiddiqui03Nessuna valutazione finora

- Book - SFM Suggested AnswersDocumento356 pagineBook - SFM Suggested AnswersasadNessuna valutazione finora

- Pathfinder May 2018 SkillsDocumento155 paginePathfinder May 2018 SkillsOgunmola femiNessuna valutazione finora

- Assignment Brief of Unit 2 For Sem 3Documento8 pagineAssignment Brief of Unit 2 For Sem 3uzair123465Nessuna valutazione finora

- Human Resource ManagementDocumento30 pagineHuman Resource ManagementSardar Aashik MunnaNessuna valutazione finora

- Advanced Financial Managment FinalDocumento9 pagineAdvanced Financial Managment FinalMohit BNessuna valutazione finora

- Management of Financial Resources and Performance - Syllabus - Level 7Documento5 pagineManagement of Financial Resources and Performance - Syllabus - Level 7Muhammad RafiuddinNessuna valutazione finora

- BBIM4103 International Marketing: Assoc Prof DR Maznah Ghazali Assoc Prof DR Rosli SalehDocumento215 pagineBBIM4103 International Marketing: Assoc Prof DR Maznah Ghazali Assoc Prof DR Rosli SalehLâm TháiNessuna valutazione finora

- What Is Strategic Financial ManagementDocumento10 pagineWhat Is Strategic Financial Managementpra leshNessuna valutazione finora

- Competitiveness Strategy and ProductivityDocumento34 pagineCompetitiveness Strategy and ProductivityRaymuel BelarminoNessuna valutazione finora

- SCM-StudyNotes M5Documento7 pagineSCM-StudyNotes M5Anoop MadangarliNessuna valutazione finora

- CAF2-Intorduction To Economics and Finance - QuestionbankDocumento188 pagineCAF2-Intorduction To Economics and Finance - Questionbankrambo100% (1)

- Mba 503Documento215 pagineMba 503Mugume JosephNessuna valutazione finora

- Ignou Sovled Assignment Ms01Documento22 pagineIgnou Sovled Assignment Ms01Jugal MaharjanNessuna valutazione finora

- Syllabus: Diploma in Entrepreneurship Development and Small Business Management (DEDSBM)Documento5 pagineSyllabus: Diploma in Entrepreneurship Development and Small Business Management (DEDSBM)biswasdipankar05Nessuna valutazione finora

- Caf 7 Far2 ST PDFDocumento278 pagineCaf 7 Far2 ST PDFZahidNessuna valutazione finora

- Financial Management - Meaning, Objectives and FunctionsDocumento29 pagineFinancial Management - Meaning, Objectives and FunctionsNardsdel RiveraNessuna valutazione finora

- Pearson BTEC Level 5 HND Diploma in Business (Management) : Course HandbookDocumento32 paginePearson BTEC Level 5 HND Diploma in Business (Management) : Course HandbookJeet SinghNessuna valutazione finora

- Module 2 - ED - 14MBA26Documento21 pagineModule 2 - ED - 14MBA26Uday Gowda100% (1)

- Terry Tesco's Long Shelf LifeDocumento7 pagineTerry Tesco's Long Shelf Lifesamar009100% (1)

- Strategic Human Resource Management: Table of ContentDocumento16 pagineStrategic Human Resource Management: Table of ContentZaeem Uddin QaziNessuna valutazione finora

- ICMAP New Reshuffled Courses Schedule 2012Documento3 pagineICMAP New Reshuffled Courses Schedule 2012KhAliq KHanNessuna valutazione finora

- Management of Financial Resources and PerformanceDocumento4 pagineManagement of Financial Resources and PerformanceAhmed Riza Mohamed0% (1)

- Strategic Management 2022-2023Documento252 pagineStrategic Management 2022-2023Thảo Thanh100% (1)

- Acc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalDocumento11 pagineAcc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalHaris AliNessuna valutazione finora

- LSCM NotesDocumento55 pagineLSCM NotesNikhil KhobragadeNessuna valutazione finora

- UNIT - I - Strategic Financial Management: - SBAA7003Documento125 pagineUNIT - I - Strategic Financial Management: - SBAA7003prakash kamble100% (1)

- Financial ManagementDocumento48 pagineFinancial ManagementAishu SathyaNessuna valutazione finora

- Research Methods For Strategic ManagersDocumento46 pagineResearch Methods For Strategic ManagersMuhammad Mubasher Rafique67% (3)

- LM Leadership Mangement - A1 (Sunderland BTEC)Documento23 pagineLM Leadership Mangement - A1 (Sunderland BTEC)Minh AnhNessuna valutazione finora

- ''Personal Development As A Strategic Manager: WO Leaders With Global IdentityDocumento10 pagine''Personal Development As A Strategic Manager: WO Leaders With Global IdentityMohamed Rafi0% (1)

- Written AssignmentDocumento28 pagineWritten AssignmentBerries ViolettaNessuna valutazione finora

- Business StrategyDocumento18 pagineBusiness StrategySam Sah100% (1)

- DEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."Documento190 pagineDEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."katta swathi100% (1)

- Organization Behaviour - Tesco Vs SiemenDocumento22 pagineOrganization Behaviour - Tesco Vs SiemenMinh LợiNessuna valutazione finora

- PGDBM 416 - Block1Documento246 paginePGDBM 416 - Block1koushik VeldandaNessuna valutazione finora

- Mo A1.1Documento22 pagineMo A1.1Minh AnhNessuna valutazione finora

- Finance For Strategic ManagerDocumento15 pagineFinance For Strategic ManagerAdil MahmudNessuna valutazione finora

- SFM PDFDocumento328 pagineSFM PDFZainNessuna valutazione finora

- Solved Question Papers - MonaDocumento62 pagineSolved Question Papers - MonaVinay SinghNessuna valutazione finora

- Advance Financial ManagementDocumento6 pagineAdvance Financial Management03217925346Nessuna valutazione finora

- Final AssignmentDocumento44 pagineFinal AssignmentRoshana MohamedNessuna valutazione finora

- Bba SyllabusDocumento41 pagineBba SyllabusManoj KumarNessuna valutazione finora

- Business Research MethodologyDocumento12 pagineBusiness Research MethodologykarthikkrishnagokulNessuna valutazione finora

- Indian Financial System and Management of Financial InstitutionsDocumento276 pagineIndian Financial System and Management of Financial InstitutionsSudhanshu Sharma bchd21Nessuna valutazione finora

- Mim Set 17 ESBMDocumento18 pagineMim Set 17 ESBMTaukir Ahmed100% (1)

- ABE Level 5 Diploma in Business ManagementDocumento3 pagineABE Level 5 Diploma in Business ManagementDuy DoNessuna valutazione finora

- 403 Ib Ibe Course NotesDocumento45 pagine403 Ib Ibe Course NotesDr. Rakesh BhatiNessuna valutazione finora

- LM A1.2Documento12 pagineLM A1.2Khanh NguyenNessuna valutazione finora

- Strategic Finance Course OutlineDocumento9 pagineStrategic Finance Course OutlineDavid Mason100% (1)

- PGDFMDocumento6 paginePGDFMAvinashNessuna valutazione finora

- Strategic Marketing ManagementDocumento20 pagineStrategic Marketing ManagementNabeelAhmedSiddiqi100% (4)

- Ethics in FinanceDocumento17 pagineEthics in FinancepamsinghNessuna valutazione finora

- Culture and SustainabilityDocumento4 pagineCulture and SustainabilityArchana ArchuNessuna valutazione finora

- Activity 4Documento2 pagineActivity 4Alysa dawn CabrestanteNessuna valutazione finora

- PQ 2019 - Financial Management SyllabusDocumento7 paginePQ 2019 - Financial Management SyllabusJulius O. BasalloNessuna valutazione finora

- PQ 2019 - Financial Management SyllabusDocumento7 paginePQ 2019 - Financial Management Syllabuszspjsz333Nessuna valutazione finora

- PQ 2022 Financial Management SyllabusDocumento7 paginePQ 2022 Financial Management SyllabusJahanzaib AhmedNessuna valutazione finora

- 15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?Documento8 pagine15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?johnlemNessuna valutazione finora

- Financial Instrument-Recogniton, MeasurementDocumento60 pagineFinancial Instrument-Recogniton, MeasurementShah KamalNessuna valutazione finora

- F3 StudyText CIMA Kaplan 2015 Ver2 PDFDocumento434 pagineF3 StudyText CIMA Kaplan 2015 Ver2 PDFShah Kamal100% (2)

- Industry Analysis TopicsDocumento5 pagineIndustry Analysis TopicsShah KamalNessuna valutazione finora

- Capital Asset Pricing ModelDocumento25 pagineCapital Asset Pricing ModelShah KamalNessuna valutazione finora

- Summary - Differences Currency RM TechniquesDocumento1 paginaSummary - Differences Currency RM TechniquesShah KamalNessuna valutazione finora

- Project Stages - PlanningDocumento20 pagineProject Stages - PlanningShah KamalNessuna valutazione finora

- Revenue and Its MeasurementDocumento42 pagineRevenue and Its MeasurementShah KamalNessuna valutazione finora

- Conceptual FrameworksDocumento17 pagineConceptual FrameworksShah KamalNessuna valutazione finora

- IAS#16Documento17 pagineIAS#16Shah KamalNessuna valutazione finora

- Accounting Theory - Joint Conceptual Framework.Documento15 pagineAccounting Theory - Joint Conceptual Framework.Shah KamalNessuna valutazione finora

- Recent Changes in FASB FrameworkDocumento6 pagineRecent Changes in FASB FrameworkShah KamalNessuna valutazione finora

- Financial Instrument ClassificationDocumento43 pagineFinancial Instrument ClassificationShah KamalNessuna valutazione finora

- Ias#32. 39 Ifrs 7Documento38 pagineIas#32. 39 Ifrs 7Shah KamalNessuna valutazione finora

- IAS08Documento29 pagineIAS08Shah KamalNessuna valutazione finora

- Chapter 5: Revenue (IAS 18) and Construction Contracts (IAS 11) MMPA - 501 Financial AccountingDocumento50 pagineChapter 5: Revenue (IAS 18) and Construction Contracts (IAS 11) MMPA - 501 Financial AccountingShah KamalNessuna valutazione finora

- IAS#38Documento43 pagineIAS#38Shah KamalNessuna valutazione finora

- Ifrs 8Documento11 pagineIfrs 8TasminNessuna valutazione finora

- Ifrs 5: Noncurrent Assets Held: For Sale and Discontinued OperationsDocumento14 pagineIfrs 5: Noncurrent Assets Held: For Sale and Discontinued OperationsShah Kamal100% (1)

- IAS#16Documento17 pagineIAS#16Shah KamalNessuna valutazione finora

- IAS#36Documento31 pagineIAS#36Shah KamalNessuna valutazione finora

- IAS07Documento22 pagineIAS073tsdu13Nessuna valutazione finora

- IAS 11 - Construction ContractDocumento13 pagineIAS 11 - Construction ContractShah KamalNessuna valutazione finora

- IAS#12Documento31 pagineIAS#12Shah KamalNessuna valutazione finora

- Ias 23Documento18 pagineIas 23Shah KamalNessuna valutazione finora

- IAS 19 - Employee BenefitDocumento49 pagineIAS 19 - Employee BenefitShah Kamal100% (2)

- Present Value TableDocumento1 paginaPresent Value TableShah KamalNessuna valutazione finora

- Ias 34Documento11 pagineIas 34Shah Kamal100% (1)

- Ias 37Documento22 pagineIas 37Shah KamalNessuna valutazione finora

- Aoa of Reliance PowerDocumento182 pagineAoa of Reliance PowerRaghavendra Sudhir RaghavendraNessuna valutazione finora

- Kingfisher Scam in IndiaDocumento5 pagineKingfisher Scam in IndiaGurudas GaonkarNessuna valutazione finora

- MCQ Bcom II Principles of Insurance 1 PDFDocumento16 pagineMCQ Bcom II Principles of Insurance 1 PDFNaïlêñ Trïpūrå Jr.100% (1)

- The Karnataka Pawnbrokers Act, 1961Documento17 pagineThe Karnataka Pawnbrokers Act, 1961Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್Nessuna valutazione finora

- grp3 Digested Civil Law CasesDocumento29 paginegrp3 Digested Civil Law CaseskenNessuna valutazione finora

- Final LoiDocumento3 pagineFinal LoiGirish SharmaNessuna valutazione finora

- SALES Annotated SyllabusDocumento60 pagineSALES Annotated SyllabusRodrigo ChavezNessuna valutazione finora

- Larry Milberg and Irene Milberg v. Lawrence Cedarhurst Federal Savings and Loan Association, Bernhard Bronheim and Gloria Bronheim v. Franklin Society Federal Savings and Loan Association, 496 F.2d 523, 2d Cir. (1974)Documento3 pagineLarry Milberg and Irene Milberg v. Lawrence Cedarhurst Federal Savings and Loan Association, Bernhard Bronheim and Gloria Bronheim v. Franklin Society Federal Savings and Loan Association, 496 F.2d 523, 2d Cir. (1974)Scribd Government DocsNessuna valutazione finora

- Serrano v. Central Bank of The PhilippinesDocumento10 pagineSerrano v. Central Bank of The PhilippinesCatherine OlaveriaNessuna valutazione finora

- TaxationDocumento9 pagineTaxationGio PacayraNessuna valutazione finora

- Documentation Requirement - Salaried Segment OriginalDocumento3 pagineDocumentation Requirement - Salaried Segment OriginalAli Azhar KhanNessuna valutazione finora

- DBP v. Secretary of LaborDocumento2 pagineDBP v. Secretary of LaborGlyssa Camille SorianoNessuna valutazione finora

- Home Loan Lap Login ChecklistDocumento1 paginaHome Loan Lap Login ChecklistAditya KhareNessuna valutazione finora

- (CPR) Petelo v. RiveraDocumento8 pagine(CPR) Petelo v. RiveraChristian Edward CoronadoNessuna valutazione finora

- Springfield, Vermont Annual Report 2015Documento195 pagineSpringfield, Vermont Annual Report 2015Springfield VT NewsNessuna valutazione finora

- FRIADocumento122 pagineFRIAMj Anaud100% (1)

- EF3e Int Filetest 2aDocumento6 pagineEF3e Int Filetest 2aJhony EspinozaNessuna valutazione finora

- Osei-Nyarko GeorgeDocumento71 pagineOsei-Nyarko Georgechetan joshiNessuna valutazione finora

- Tokenization An IntroductionDocumento17 pagineTokenization An IntroductionAnupam Gupta100% (1)

- Chapter 4 TVM EditedDocumento24 pagineChapter 4 TVM EditedWonde BiruNessuna valutazione finora

- OPPT-SA Awareness Drive 01Documento4 pagineOPPT-SA Awareness Drive 01Anton CloeteNessuna valutazione finora

- Lopez vs. Orosa, Jr. and Plaza Theatre, Inc.Documento1 paginaLopez vs. Orosa, Jr. and Plaza Theatre, Inc.Marion Nerisse KhoNessuna valutazione finora

- Duration Dependence of Real Estate Price in ChinaDocumento12 pagineDuration Dependence of Real Estate Price in ChinaNational Graduate ConferenceNessuna valutazione finora

- Adekunmi A.O and B.O Adisa 2011-1Documento9 pagineAdekunmi A.O and B.O Adisa 2011-1ismaildejiNessuna valutazione finora

- Soal Asis 3 - Jordy - AJPDocumento1 paginaSoal Asis 3 - Jordy - AJPJordy TangNessuna valutazione finora

- Prospectus of First Security BankDocumento123 pagineProspectus of First Security BankKhalid FirozNessuna valutazione finora

- OLFM Training1Documento36 pagineOLFM Training1Srinibas Mohanty100% (1)

- PLV RFBT Sales and Credit Transactions 2019Documento16 paginePLV RFBT Sales and Credit Transactions 2019Kcidram PeraltaNessuna valutazione finora

- Supena V Dela Rosa Digested CaseDocumento1 paginaSupena V Dela Rosa Digested CaseEarl Larroder100% (1)

- Bankers Notice of Accept PrestmDocumento13 pagineBankers Notice of Accept Prestmapi-374440888% (34)