Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Brochure City Gas Distribution in India March2018 PDF

Caricato da

Kunal BadhwarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Brochure City Gas Distribution in India March2018 PDF

Caricato da

Kunal BadhwarCopyright:

Formati disponibili

Organisers: Supported by:

Smart Utilities

13th Annual Conference on

CITY GAS DISTRIBUTION IN INDIA

Network Development: Strategies and Solutions

March 12-113, 2018, Le Meridien, New Delhi

Lead sponsor*: Co-sponsors*:

*Lead and Co-sponsorship slots available

CITY GAS DISTRIBUTION IN INDIA

Mission

z The prospects of the city gas distribution (CGD) sector have improved in the past couple of years. Fresh licences have been issued at a much

faster pace. Gas availability has increased due to the priority being given to the compressed natural gas (CNG) and piped natural gas (PNG)

segments. This has enabled companies to cut prices and regain competitiveness. In addition, permitting asset-owning CGD companies to

freely price their products has removed uncertainties in pricing.

z In terms of network, PNG connections have grown at a compound annual growth rate of 17 per cent, while CNG stations have grown by about

10 per cent in the past five years. Total sales in 2015-16 were close to 15 mmscmd.

z However, for the sector to maintain this momentum, a number of issues need to be dealt with. Better prospects have led to increased interest

due to which aggressive bidding has been witnessed in recent rounds. This poses a long-term risk for CGD entities, given the tough Minimum

Work Programme and service standards set by the Petroleum and Natural Gas Regulatory Board (PNGRB).

z CGD players face many challenges. Projects are exposed to high execution risks associated with huge capital expenditure and the slow pace

of pipeline build-up. Besides, low sales and customer penetration, and high cost of providing last mile connectivity adversely affect project

viability. Many of the geographical areas (GAs) in the 7th and 8th bidding rounds have not received any bids due to these reasons.

z The government recognises these challenges and is taking measures to address these. PNGRB has formed a committee that has finalised its

recommendations for alternative bidding models for the CGD network. Some of the key suggestions are increasing the exclusivity period for

operating pipelines to 10 years and increasing the minimum net worth criteria.

z Other challenges that require urgent attention include delays in obtaining clearances, high restoration charges by local authorities, asset

management, pipeline network safety, leakage detection and metering.

z Going forward, there is significant opportunity for all stakeholders in the sector. PNGRB has identified 223 GAs for future bidding depending

on the gas connectivity spread and demand scenario in the areas. There is also a huge opportunity for technology players as most of the CGD

operators are testing world-class technologies and best practices to ensure effective operations.

z The mission of this conference is to analyse the trends, developments, challenges and opportunities in the CGD sector. The conference will

also provide a platform to showcase new technologies, best practices and noteworthy projects.

Target Audience

The conference is targeted at:

- Gas distributors - Engineering and design firms - Consulting and legal firms

- Gas marketers/suppliers - Pipeline manufacturers - Pipeline operators

- Policymakers and regulators - Leak detection solution providers - Industrial consumers

- Infrastructure builders - Technology providers - IT solution providers (SCADA, GIS, ERP, etc.)

- Natural gas producers - Meter manufacturers - Financial institutions

- State development agencies - Material technology providers - Etc.

Organisers

The conference is being organised by India Infrastructure Publishing, the leading provider of information on the infrastructure sectors.

The company publishes Indian Infrastructure, Smart Utilities, Power Line and Renewable Watch. It also publishes the City Gas Distribution

Report, Gas in India report, Oil & Gas News (a weekly newsletter) and the Oil & Gas Directory and Yearbook.

To register: Call +91-111-446038152, 41034615, +91-88585900089, email: conferencecell@indiainfrastructure.com, or visit us at www.indiainfrastructure.com

March 12-113, 2018, Le Meridien, New Delhi

AGENDA/STRUCTURE

TRENDS AND OUTLOOK COSTS AND TARIFFS AND VIABILITY

What have been the key trends and developments in the past one year? What factors determine the commercial viability of CGD projects?

What is the outlook? What are the new opportunities? What are the key cost components and the revenue sources?

What are the key challenges? What are the trends in network tariffs across states? What is the tariff outlook?

CGD OPERATORS’ PERSPECTIVE PROJECT MANAGEMENT

How do the operators perceive the CGD sector currently? What are the various aspects of project management from concept to

How attractive is the CGD business? commissioning (planning, engineering, design, etc.)?

What are the new business opportunities? What are the key statutory requirements (land, environment, safety, etc.)?

What are the key challenges? What are the success factors for project execution and technical evaluation in

the sector?

REGULATORY UPDATE: PNGRB’s PERSPECTIVE What are the biggest challenges?

What is the progress on the various bidding rounds?

What are the key policy initiatives in the pipeline? O&M OF CGD NETWORKS

What are the changes expected in bidding strategies for the upcoming rounds? What has been the experience so far in leveraging IT for the O&M of CGD

What are the targets for the next few years? networks/assets?

What are the most promising technologies (GIS, SCADA, ERP, etc.)?

ACCELERATING DEPLOYMENT OF CGD INFRASTRUCTURE FOR A What are the global best practices?

SUSTAINABLE INDIA What are the emerging IT-OT requirements for asset optimisation?

What are the key hurdles in rolling out CGD infrastructure in new geographical

areas? How can IT help accelerate roll-outs? PIPELINE INTEGRITY AND SAFETY MANAGEMENT

How can IT be used to achieve more precise and predictable outcomes during What are the key risks and challenges in ensuring safety and security in CGD

the project phase? pipeline networks?

How can cloud-based IT platforms be used to optimise software deployment and What are the innovations/technologies available in driving integrity and safety

costs during the project phase? (leak detection, repair/rehabilitation, etc.)?

Will the IT model of “start small” and “leverage large” be beneficial for new What are the global best practices?

CGD companies?

How can a CGD company accelerate customer acquisition by leveraging IT? SMART METERING AND BILLING

What has been the experience so far in metering and billing?

DOMESTIC GAS AND LNG SUPPLY OUTLOOK What are the new metering technologies being considered for deployment?

What is the current status of gas supply? What are the key challenges?

What are the current sourcing options? Have they changed in the past one year? How can IT support the emerging smart metering and billing requirements?

What is the outlook for gas supply?

CUSTOMER SERVICE

PIPELINE INFRASTRUCTURE DEVELOPMENT What are the emerging requirements of customer service?

What is the status of pipeline infrastructure? How can world class services be offered at affordable costs?

What is the progress on pipelines under construction? What are the global best practices?

What are the plans for the next few years?

FOCUS ON MATERIALS AND FITTINGS

FOCUS ON CNG NETWORKS What are the key materials/fittings being used in CGD pipelines?

What are the specific requirements of setting up CNG networks? What are the latest innovations in the Indian market?

How are the CGD companies ensuring effective operations of networks? What are the global best practices?

What are the different technology options?

What has been the experience so far? PROJECT SHOWCASE: EXISTING AND NEW GAs

Which are some of the noteworthy projects (operational and upcoming)?

FOCUS ON PNG NETWORKS What are their key features (network size, design, milestones, etc.)?

What are the specific requirements of setting up PNG networks? What lessons can be learnt from the experience of these projects?

What are the different technology options?

What has been the experience so far?

To register: Call +91-111-446038152, 41034615, +91-88585900089, email: conferencecell@indiainfrastructure.com, or visit us at www.indiainfrastructure.com

CITY GAS DISTRIBUTION IN INDIA

The city gas distributors that have participated in the conference include: Last year’s keynote speakers:

(In alphabetical order)

Ashutosh Jindal,

Joint Secretary (IC&GP),

Additional Charge (Marketing), MoPNG

Narendra Kumar,

Managing Director,

Indraprastha Gas Limited

Rajeev Mathur,

Managing Director,

Mahanagar Gas Limited

Dr B. Mohanty,

Member,

Petroleum and Natural Gas Regulatory Board

Nitin Patil,

Chief Executive Officer,

Gujarat Gas

Shridhar Tambraparni,

Joint President,

Adani Energy

The companies that participated in our previous conferences on “City Gas Distribution in India” included Aarvi Encon Private Limited, ABB, ACME, Adani Gas, Agi-G Glaspac,

Al Aziz, Allard India Private Limited, AMP Capital Advisors India Private Limited, Anacon Process Control, APGIC, Ario Infrastructure, Arrukn Consultation, Asahi Glass,

Ashoka Buildcon Limited (Unison Enviro Pvt Ltd), Assam Gas Limited, AT Kearney, Auctus Advisors, Avantha Power & Infra, Avantika Gas Limited, Avineon, Basell Polyofins

India, BASG, Berry Plastics, BG Exploration and Production India Limited , Bhagyanagar Gas, Bharat Petroleum Corporation Limited, Bhotika Pipeline, Borouge (India) Pvt

Ltd, BP Exploration (Alpha) India, Bridge and Roof, Burckhardt Compression, Cairn India Limited, Calcutta Fluid System Components(Tubacex Group), Caterpillar

Commercial, CEIL, Central UP Gas, Chemtrols, Chevron, Chicago Pnuematics, Clarke Energy, CPL Energy India, CRISIL, Cryogas, Cryostar India, Cyient, Daniel

Measurement Solutions, Denso International India (P) Limited, Directorate General of Hydrocarbons, DNV-G GL , Dolat Capital Market, Duraline, East India Petroleum,

Eastern Gas, EIL, Elara Capital, Elster-IInstromet, Emerson, ESAB, ESP Safety Pvt Ltd, Essar Oil, Evonik, ExxonMobil, EY, Feedback Business Consulting Services Pvt Ltd,

Feedback Ventures, Ferranti, Fike Safety, Fluid Controls Private Limited, Fujitsu, GAIL, Gail Gas Limited, Gas Natural Fenosa, Gasvigil Technologies (P) Limited, GE Oil &

Gas, GE Oil and Gas, GE Sensing, Genus Power Infrastructures, Georg Fischer Piping Systems Pvt Ltd, Germanischer Lloyd Industrial Services GmbH, GLNoble Denton,

Glynwed, GMMCO, GMR Energy, Goa Natural Gas Pvt Ltd, Green Gas Limited, GSPC, Gujarat Gas Limited, Gujarat Glass, Haridwar Natural Gas Pvt Ltd, Haryana City Gas

Distribution, HCC, Hitachi, Hoerbiger India Pvt Ltd, Honeywell, HPCL, ICF, ICICI Bank, ICPCI, ICRA, IDBI, IDCO, IDFC, IFC, IGL, Imkemex, Indian Oil Corporation Limited,

Indraprashtha Gas Limited, Inel Gas Controls Private Limited, Intertek, IRM Energy Private Limited, Ispat Energy, Itron, Jai Hind Projects, Jain Irrigation Systems Ltd, Jubilant

Energy, Katlax, Kawasaki, Kerala State Industrial Development Corporation, Kimplas Piping, Kirloskar Oil Engines, Kirloskar Pneumatics, Kotak Mahindra, Kotak Securities,

KPMG, KSIDC, L&T Valves, Lanco Infratech, Leister Technology India Pvt.Ltd, Magnatech Smartgrid Solutions Pvt Ltd, Mahanagar Gas Limited, Maharashtra Natural Gas,

Maharashtra Seamless, Mahesh Gas, Makwana Engineering, McElroy, Mehta Brothers & Co.(Oventrop), Mecon, MIDC, Mitsui & Co., MoPNG, Morgan Stanley, Motilal

Oswal Securities Ltd, Mott Macdonald, MSA (India) Limited, Natural Gas Society, NCC, NTPC, Oil India, ONGC, Oracle, Parker Hannifin, PDIL, Petronet LNG, Pinnacle

Engines India, Plutus Smart Energy Solutions Pvt Ltd, PNGRB, PPAC, Pratibha Industries, Protos Engineering, Quippo Energy, Rajasthan State Gas, Ramboll Oil & Gas,

Ratnamani Metals & Tubes Ltd, Raychem RPG (P) Ltd, Reliance , Reliance Natural Resources, RMG Autometers, RMSI, Rockwin Flowmeters, Rolls Royce, Romet,

Rosewood Projects, RPG Raychem, Sabarmati Gas Ltd, Safire Capital, Sandvik Asia, Sangir Plastics, SAP, Saumya DSM, Savair Energy, SBI Capital, Seal For Life India

Pvt Ltd, Secured Meters, SGB Scaffolding and Industrial Services Private Limited, Shell, Sick India Private Limited, Simon Carves, Singhania System Technologists Pvt

Ltd, Siti Energy, Spark Capital Advisors (India) Pvt Ltd, Spice Energy, SRG Engineering Pvt Ltd, SSP Fittings, State Bank of Hyderabad, Sterling & Wilson, Suraksha

Products, Swagelok, Tata Power, TDW India, Technip KT, TGE Engineering, The Corporate Profile, TIL, Torrent Power Limited, Toyota Kirloskar Motor, Tractebel Engineering,

Tractors India Private Limited, Trimble Navigation, Tripura Natural Gas Co.Ltd, Tulip Energy Pvt Ltd, U3S Chemsolutions Private Limited, Vargo Petro-TTech, Varicon Pumps

& Systems Pvt Ltd, VCS Quality Services, Veekay Plast, Warburg Pincus, Wärtsilä, Welspun Infratech, Wipro, etc.

To register: Call +91-111-446038152, 41034615, +91-88585900089, email: conferencecell@indiainfrastructure.com, or visit us at www.indiainfrastructure.com

SNAPSHOTS FROM PREVIOUS YEAR

Sponsorship Opportunities:

Lead sponsors (up to two): Co-ssponsors:

- Up to six delegate registrations from the sponsoring company - Up to four delegate registrations from the sponsoring company

- One speaker slot - Stall space at the conference

- Stall space at the conference - Mention on all conference promotional material (mailings, ads, etc.)

- Mention on all conference promotional material (mailings, ads, etc.) - Distribution of sponsor promotional material to each delegate

- Distribution of sponsor promotional material to each delegate - Logo presence at the conference (backdrop, vertical panel, etc.)

- Prominent logo presence at the conference (backdrop, vertical panel, etc.)

For sponsorship opportunities, contact: Deavanjan Ranjan, Tel: +91-111-446038152, 8585900089

13th Annual Conference on

CITY GAS DISTRIBUTION IN INDIA

Network Development: Strategies and Solutions

March 12-13, 2018, Le Meridien, New Delhi

Registration Form

I would like to register for the conference. I am enclosing Rs___________________ vide cheque/demand draft no.___________________

drawn on ______________________dated ______________ Company GST No. _______________in favour of India Infrastructure Publishing

Pvt. Ltd. payable at New Delhi.

Please send wire transfer payments to: Bank Account No. 094179587002

Sponsorship

Beneficiary India Infrastructure Publishing Private Limited Swift Code HSBCINBB

opportunities are

Bank Name The Hongkong and Shanghai Banking Corporation Ltd IFSC Code HSBC0110006 available

Bank Address R-47, Greater Kailash-1, New Delhi-110048, India GSTIN 07AAACI5880R1ZV

Name(s)/Designation (IN BLOCK LETTERS)

Company

Mailing Address

Phone Mobile

Fax

Registration Fee

Fee

Delegates INR GST @ 18% Total INR Total USD

One delegate 22,500 4,050 26,550 418

Two delegates 37,500 6,750 44,250 732

Three delegates 52,500 9,450 61,950 1,045

Four delegates 67,500 12,150 79,650 1,359

z GST @ 18 per cent is applicable on the registration fee.

z Registration will be confirmed on the receipt of payment. To register online, please log on to http://indiainfrastructure.com/conf.html

Payment Policy:

z Full payment must be received prior to the conference.

Cover pic courtesy: shutterstock images

z Conference fees cannot be substituted for any other product or service being extended by India Infrastructure Publishing Pvt. Ltd.

z Conference fee includes lunch, tea/coffee and conference material.

For delegate registrations, contact: Khushboo Khanna For sponsorship opportunities, contact: Deavanjan Ranjan

Tel: +91-111- 46113913 , 41034615 | Mob: +91- 7982733496 Tel: +91-111-446038152, 41034615 | Mob: +91-88585900089

Conference Cell, India Infrastructure Publishing Pvt. Ltd., B-117, Qutab Institutional Area, New Delhi 110016.

Fax: +91-111-226531196, 46038149. E-m mail: conferencecell@indiainfrastructure.com

Potrebbero piacerti anche

- Brochure - City Gas DistributionDocumento3 pagineBrochure - City Gas DistributionIE_kumarNessuna valutazione finora

- Frequently Asked Questions On Natural Gas - Hindustan Petroleum Corporation Limited, IndiaDocumento5 pagineFrequently Asked Questions On Natural Gas - Hindustan Petroleum Corporation Limited, IndiaDAYARNAB BAIDYANessuna valutazione finora

- Journal E: Industry & Practice Development & Technology Conferences & SeminarsDocumento72 pagineJournal E: Industry & Practice Development & Technology Conferences & SeminarsNitzOONessuna valutazione finora

- Natural Gas Chromatograph (NGC) 8206: Data Sheet 2101164-AGDocumento5 pagineNatural Gas Chromatograph (NGC) 8206: Data Sheet 2101164-AGishibhoomiNessuna valutazione finora

- Using MODBUS For Process Control and Automation (1) - EEPDocumento3 pagineUsing MODBUS For Process Control and Automation (1) - EEPAbhishek DasNessuna valutazione finora

- الغاز الطبيعي PDFDocumento418 pagineالغاز الطبيعي PDFHaider AlIraqiNessuna valutazione finora

- FloBoss IO ModulesDocumento5 pagineFloBoss IO ModulesAdeel HassanNessuna valutazione finora

- The Design of Natural Gas PipelinesDocumento7 pagineThe Design of Natural Gas PipelineshiyeonNessuna valutazione finora

- TDW Offshore Pig BrochureDocumento4 pagineTDW Offshore Pig Brochuremunuchwa01100% (2)

- FCDocumento46 pagineFCJcRodriguezNessuna valutazione finora

- Pressure Operated Valves 2 - 2 Air Operated 290 CAT 00047GBDocumento8 paginePressure Operated Valves 2 - 2 Air Operated 290 CAT 00047GBNelson AlvarezNessuna valutazione finora

- Presentation On Gas Metering: by SNGPL-Metering DepartmentDocumento276 paginePresentation On Gas Metering: by SNGPL-Metering DepartmentIrfan RazaNessuna valutazione finora

- Natural Gas Dynamics - Mod 2Documento44 pagineNatural Gas Dynamics - Mod 2sujaysarkar85Nessuna valutazione finora

- Natural Gas AssignmentDocumento9 pagineNatural Gas AssignmentJagathisswary SatthiNessuna valutazione finora

- Natural Gas Fuel Consumption ChartDocumento1 paginaNatural Gas Fuel Consumption ChartOdunlamiNessuna valutazione finora

- Filtration / Separation Products & Services: Making The World Safer, Healthier and More ProductiveDocumento16 pagineFiltration / Separation Products & Services: Making The World Safer, Healthier and More Productivesuraj pandeyNessuna valutazione finora

- Pipeline Cleaning Case StudyDocumento5 paginePipeline Cleaning Case StudyJason MooreNessuna valutazione finora

- CNGDocumento8 pagineCNGShruti PatilNessuna valutazione finora

- Sizing Flow Meter 300Documento3 pagineSizing Flow Meter 300MansNessuna valutazione finora

- Vortex Pilot Gas Heater Over Temperature ProtectionDocumento17 pagineVortex Pilot Gas Heater Over Temperature ProtectionDon BettonNessuna valutazione finora

- 650 01 GB 0111 01Documento12 pagine650 01 GB 0111 01Phan HaiNessuna valutazione finora

- Lawal KA 2011 PHD ThesisDocumento327 pagineLawal KA 2011 PHD Thesispedro aguilar100% (1)

- Natural Gas EmissionDocumento8 pagineNatural Gas EmissionvisutsiNessuna valutazione finora

- Gas Reconciliation Report For JUNE FF'19Documento42 pagineGas Reconciliation Report For JUNE FF'19RanjanKumarNessuna valutazione finora

- (Job Title #1) / (Job Title #2) : (NAME)Documento3 pagine(Job Title #1) / (Job Title #2) : (NAME)Rashid Mahmood JaatNessuna valutazione finora

- Mdpe Tpi Questions AnswerDocumento29 pagineMdpe Tpi Questions AnswerShashi ChouhanNessuna valutazione finora

- Series Piping Final 2Documento52 pagineSeries Piping Final 2SHOBHIT KUMARNessuna valutazione finora

- Digital Technologies Transforming CGD Value Chain From Source To ConsuDocumento24 pagineDigital Technologies Transforming CGD Value Chain From Source To ConsuTrichy srplshiftNessuna valutazione finora

- Society of Petroleum GeophysicistsDocumento57 pagineSociety of Petroleum Geophysicistsdinesh_hsenidNessuna valutazione finora

- GgsDocumento21 pagineGgsKrishna KumarNessuna valutazione finora

- Domestic Gas MetersDocumento3 pagineDomestic Gas MetersSrinivas Venkatraman0% (1)

- Natural Gas DistributionDocumento46 pagineNatural Gas DistributionscribdmisraNessuna valutazione finora

- Rotork GP & GH RangeDocumento8 pagineRotork GP & GH RangeJavier BarreraNessuna valutazione finora

- About Gas Expoison 1. English Lampung, Indonesia. A Lampung Man Suffered Severe Burns After ADocumento13 pagineAbout Gas Expoison 1. English Lampung, Indonesia. A Lampung Man Suffered Severe Burns After AnfinisaNessuna valutazione finora

- Slam Shut Off FlowgridDocumento16 pagineSlam Shut Off FlowgridmateuNessuna valutazione finora

- Natural Gas InfrastructureDocumento42 pagineNatural Gas InfrastructurefarizzamzamNessuna valutazione finora

- Pipeline Pigging BrochureDocumento14 paginePipeline Pigging BrochureMiguel Gonzalez100% (1)

- (TP0A002) Pipeline Meter SelectionDocumento3 pagine(TP0A002) Pipeline Meter SelectionRoberto Carlos TeixeiraNessuna valutazione finora

- Minor Project Report On: "LPG Detector"Documento28 pagineMinor Project Report On: "LPG Detector"Gaurav SharmaNessuna valutazione finora

- Natural Gas SolutionsDocumento74 pagineNatural Gas SolutionsViorel Ciocoiu100% (1)

- Pipeline Equipment - Ball Valves EtcDocumento43 paginePipeline Equipment - Ball Valves Etckrish69Nessuna valutazione finora

- FloBoss™ S600+ Flow Computer Instruction Manual PDFDocumento152 pagineFloBoss™ S600+ Flow Computer Instruction Manual PDFSibabrata ChoudhuryNessuna valutazione finora

- CityGasDistributionDocumento46 pagineCityGasDistributionsujaysarkar850% (1)

- Dirok Draft Firm Gas Sales and Purchase AgreementDocumento29 pagineDirok Draft Firm Gas Sales and Purchase AgreementDimple SinghNessuna valutazione finora

- FItrLTERS PDFDocumento4 pagineFItrLTERS PDFAriz Joelee ArthaNessuna valutazione finora

- PLC CurriculumDocumento4 paginePLC CurriculummanisegarNessuna valutazione finora

- Gas DesighDocumento81 pagineGas DesighNetra Nanda100% (1)

- 399ADocumento24 pagine399ADana Mera100% (2)

- Flow Measurement: 6 November 2012 PMI Revision 00 1Documento57 pagineFlow Measurement: 6 November 2012 PMI Revision 00 1narendra_nucleusNessuna valutazione finora

- EZR Installation ManualDocumento40 pagineEZR Installation ManualRoberto Aldayuz HerediaNessuna valutazione finora

- Chapter 3 - Gas Gathering Transportation - V2 (Part 1)Documento34 pagineChapter 3 - Gas Gathering Transportation - V2 (Part 1)Qieya SaniNessuna valutazione finora

- Type Ezr EstancoDocumento40 pagineType Ezr EstancoJuan JuanNessuna valutazione finora

- Natural Gas Process InstrumentationDocumento4 pagineNatural Gas Process InstrumentationaaashfNessuna valutazione finora

- Basic CGD Concept (Elaborative)Documento81 pagineBasic CGD Concept (Elaborative)Shubhanker NandiNessuna valutazione finora

- SG Actuator Gas Over OilDocumento4 pagineSG Actuator Gas Over Oiltoader56Nessuna valutazione finora

- Project ManagementDocumento21 pagineProject ManagementViraja GuruNessuna valutazione finora

- Weather Dominates Fundamentals: Global Equity ResearchDocumento19 pagineWeather Dominates Fundamentals: Global Equity ResearchForexliveNessuna valutazione finora

- In-Line Inspection of Multi-Diameter Pipelines: Standardized Development and Testing For A Highly Efficient Tool FleetDocumento10 pagineIn-Line Inspection of Multi-Diameter Pipelines: Standardized Development and Testing For A Highly Efficient Tool FleetNikhil Mohan100% (1)

- Brochure City Gas Distribution in India March2017Documento6 pagineBrochure City Gas Distribution in India March2017Sourav RathNessuna valutazione finora

- City Gas Distribution IndiaDocumento6 pagineCity Gas Distribution IndiaS Sinha Ray0% (1)

- Online Bus Pass Geraneration and Renewal System Using Mobile ApplicationDocumento3 pagineOnline Bus Pass Geraneration and Renewal System Using Mobile ApplicationInternational Journal of Trendy Research in Engineering and TechnologyNessuna valutazione finora

- The Art of Intrusion - IDPS ReportDocumento48 pagineThe Art of Intrusion - IDPS Reportbheng avilaNessuna valutazione finora

- Cyber Law Compliance AuditDocumento13 pagineCyber Law Compliance AuditTwinkleNessuna valutazione finora

- Search InternetDocumento61 pagineSearch InternetIsrael EyasuNessuna valutazione finora

- Wrap-Up OpenWorld 2014Documento73 pagineWrap-Up OpenWorld 2014catalinsilicaNessuna valutazione finora

- Cloud Infrastructure and Services v2Documento4 pagineCloud Infrastructure and Services v2Nguyen Hoang AnhNessuna valutazione finora

- Coc DocumentDocumento73 pagineCoc DocumentDagim Fekadu AmenuNessuna valutazione finora

- Instructions IL AC16 1aDocumento2 pagineInstructions IL AC16 1aSidra Ashfaq0% (1)

- HeidiSQL HelpDocumento23 pagineHeidiSQL HelpmauhibNessuna valutazione finora

- Bim Cmms Flow ChartDocumento1 paginaBim Cmms Flow ChartNakorn P.Nessuna valutazione finora

- WS-011 Windows Server 2019 AdministrationDocumento34 pagineWS-011 Windows Server 2019 AdministrationAlbert JeremyNessuna valutazione finora

- Release Notes Reference Manual: Awstats Logfile Analyzer 7.4 DocumentationDocumento103 pagineRelease Notes Reference Manual: Awstats Logfile Analyzer 7.4 DocumentationSuvashreePradhanNessuna valutazione finora

- Oracle Autonomous Database 2021 Specialist (1Z0-931-21)Documento14 pagineOracle Autonomous Database 2021 Specialist (1Z0-931-21)ArifNessuna valutazione finora

- 6 +Athena,+QuickSight,+EMRDocumento63 pagine6 +Athena,+QuickSight,+EMRAhmad HammadNessuna valutazione finora

- Apache JMeter - User's Manual - Building An Advanced Web Test Plan-6Documento2 pagineApache JMeter - User's Manual - Building An Advanced Web Test Plan-6RamamurthyNessuna valutazione finora

- Brainstorming Persons: Software Requirements SpecificationDocumento10 pagineBrainstorming Persons: Software Requirements SpecificationAshish GuptaNessuna valutazione finora

- E S4HCON2023 CertDocumento6 pagineE S4HCON2023 CertvladolesajNessuna valutazione finora

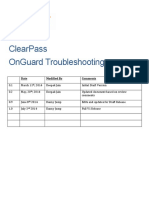

- ClearPass OnGuard TroubleshootingDocumento90 pagineClearPass OnGuard TroubleshootingEduardo ParedesNessuna valutazione finora

- Advanced Org of DatabaseDocumento7 pagineAdvanced Org of DatabaseAnonymous pJW5IcNessuna valutazione finora

- Oracle APEX + Node - JS: John Edward Scott Kscope14Documento69 pagineOracle APEX + Node - JS: John Edward Scott Kscope14Mwigo Jonathan MarkNessuna valutazione finora

- Siebel 1Documento17 pagineSiebel 1eric_ericNessuna valutazione finora

- Antivirus Software: HistoryDocumento7 pagineAntivirus Software: HistorysarayooNessuna valutazione finora

- Test Bank For Python For Everyone 2nd EditionDocumento24 pagineTest Bank For Python For Everyone 2nd Editionniopomadness0oi6100% (37)

- Mos 365 Excel Od 2022Documento2 pagineMos 365 Excel Od 2022Mai Hương HoàngNessuna valutazione finora

- BLUECAT Data Sheet ADAPTIVE DNSDocumento5 pagineBLUECAT Data Sheet ADAPTIVE DNSTa MendozaNessuna valutazione finora

- Collab365 2017 - Building Single Page Applications (SPAs) in SharePoint With JavaScriptDocumento15 pagineCollab365 2017 - Building Single Page Applications (SPAs) in SharePoint With JavaScriptManueNessuna valutazione finora

- 5 THDocumento13 pagine5 THAnurag MaithaniNessuna valutazione finora

- Cbis Eis, Dss & KMDocumento9 pagineCbis Eis, Dss & KMbhuneeNessuna valutazione finora

- Interview QuesDocumento11 pagineInterview Quesdeep37233Nessuna valutazione finora