Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Management (FM) : Syllabus and Study Guide

Caricato da

Muhammad Zahid FaridTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Management (FM) : Syllabus and Study Guide

Caricato da

Muhammad Zahid FaridCopyright:

Formati disponibili

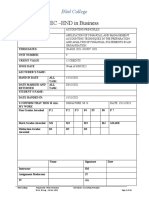

September 2018

to

June 2019

Financial

Management

(FM)

Syllabus and study guide

Financial Management (FM)

Guide to structure of the Detailed syllabus

syllabus and study guide This shows the breakdown of the main

capabilities (sections) of the syllabus

into subject areas. This is the blueprint

Overall aim of the syllabus

for the detailed study guide.

This explains briefly the overall objective

Approach to examining the syllabus

of the syllabus and indicates in the

broadest sense the capabilities to be

This section briefly explains the

developed within the exam.

structure of the examination and how it

is assessed.

Relational diagram of linking

Financial Management (FM) with

Study Guide

other ACCA exams

This is the main document that students,

This diagram shows direct and indirect

education and content providers should

links between this exam and other

use as the basis of their studies,

exams preceding or following it. It

instruction and materials. Examinations

indicates where you are expected to

will be based on the detail of the study

have underpinning knowledge and

guide which comprehensively identifies

where it would be useful to review

what could be assessed in any

previous learning before undertaking

examination session. The study guide is

study.

a precise reflection and breakdown of

the syllabus. It is divided into sections

Main capabilities

based on the main capabilities identified

in the syllabus. These sections are

The aim of the syllabus is broken down

divided into subject areas which relate to

into several main capabilities which

the sub-capabilities included in the

divide the syllabus and study guide into

detailed syllabus. Subject areas are

discrete sections.

broken down into sub-headings which

describe the detailed outcomes that

Relational diagram of the main

could be assessed in examinations.

capabilities

These outcomes are described using

verbs indicating what exams may

This diagram illustrates the flows and

require students to demonstrate, and the

links between the main capabilities

broad intellectual level at which these

(sections) of the syllabus and should be

may need to be demonstrated

used as an aid to planning teaching and

(*see intellectual levels below).

learning in a structured way.

Syllabus rationale

This is a narrative explaining how the

syllabus is structured and how the main

capabilities are linked. The rationale

also explains in further detail what the

examination intends to assess and why.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Intellectual Levels Learning Hours and

The syllabus is designed to

Education Recognition

progressively broaden and deepen the

The ACCA qualification does not

knowledge, skills and professional

prescribe or recommend any particular

values demonstrated by the student on

number of learning hours for

their way through the qualification.

examinations because study and

learning patterns and styles vary greatly

The specific capabilities within the

between people and organisations. This

detailed syllabuses and study guides are

also recognises the wide diversity of

assessed at one of three intellectual or

personal, professional and educational

cognitive levels:

circumstances in which ACCA students

find themselves.

Level 1: Knowledge and

comprehension

As a member of the International

Level 2: Application and analysis

Federation of Accountants, ACCA seeks

Level 3: Synthesis and evaluation

to enhance the education recognition of

its qualification on both national and

Very broadly, these intellectual levels

international education frameworks, and

relate to the three cognitive levels at

with educational authorities and partners

which the Applied Knowledge,

globally. In doing so, ACCA aims to

the Applied Skills and the Strategic

ensure that its qualifications are

Professional exams

recognised and valued by governments,

are assessed.

regulatory authorities and employers

across all sectors. To this end, ACCA

Each subject area in the detailed study

qualifications are currently recognised

guide included in this document is given

on the education frameworks in several

a 1, 2, or 3 superscript, denoting

countries. Please refer to your national

intellectual level, marked at the end of

education framework regulator for

each relevant line. This gives an

further information.

indication of the intellectual depth at

which an area could be assessed within

Each syllabus contains between 20 and

the examination. However, while level 1

35 main subject area headings

broadly equates with Applied

depending on the nature of the subject

Knowledge , level 2 equates to Applied

and how these areas have been broken

Skills and level 3 to Strategic

down.

Professional, some lower level skills can

continue to be assessed as the student

progresses through each level. This

reflects that at each stage of study there

will be a requirement to broaden, as well

as deepen capabilities. It is also

possible that occasionally some higher

level capabilities may be assessed at

lower levels.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Guide to ACCA ACCA’s regulatory approved quality

assurance process.

Examination Structure

The total exam time is therefore 3 hours

The structure of examinations varies and 20 minutes. Prior to the start of the

within and between levels. exam candidates are given an extra 10

minutes to read the exam instructions.

The Applied Knowledge examinations

contain 100% compulsory questions to Paper-based exams

encourage candidates to study across

the breadth of each syllabus. These are For paper-based exams 15 minutes are

assessed by a two-hour computer based added to the three hours to reflect the

examination. manual effort required as compared to

computer-based exams. All paper-

The Corporate and Business Law exam based and computer-based questions

is a two-hour computer-based objective have been subject to the same quality

test examination for English and Global, assurance process. There will be time

and available as a paper based version awarded by the invigilator to read the

for all variants. exam instructions.

The other Applied Skills examinations Strategic Business Leader is ACCA’s

(PM, TX-UK, FR, AA, and FM) case study examination at the Strategic

contain a mix of objective and longer Professional level and is examined as a

type questions with a duration of three closed book exam of four hours,

hours for 100 marks; these questions including reading, planning and

directly contribute towards the candidate reflection time which can be used

result. These exams are available in flexibly within the examination. There is

computer-based and paper-based no pre-seen information and all exam

formats. Prior to the start of each exam related material, including case

there will be time allocated for students information and exhibits are available

to be informed of the exam instructions. within the examination. Strategic

Business Leader is an exam based on

Computer-based exams one main business scenario which

involves candidates completing several

For the Applied Skills (PM, TX-UK, FR, tasks within which additional material

AA and FM) computer-based exams may be introduced. All questions are

candidates will be delivered an extra 10 compulsory and each examination will

marks of objective test content (either contain a total of 80 technical marks and

five single OT questions or five OT 20 Professional Skills marks. The detail

questions based around a single of the structure of this exam is described

scenario), for which candidates are in the Strategic Business Leader

given an extra 20 minutes. These syllabus and study guide document.

questions are included to ensure

fairness, reliability and security of The other Strategic Professional exams

exams. These questions do not directly are all of three hours and 15 minutes

contribute towards the candidate’s duration. All contain two

score. Candidates will not be able to Sections and all questions are

differentiate between the questions that compulsory. These exams all contain

contribute to the result and those that do four professional marks. The detail of

not. All questions have been subject to

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

the structure of each of these exams is

described in the individual syllabus and

study guide documents.

ACCA encourages students to take time

to read questions carefully and to plan

answers but once the exam time has

started, there are no additional

restrictions as to when candidates may

start writing in their answer books.

Time should be taken to ensure that all

the information and exam requirements

are properly read and understood.

The pass mark for all ACCA

Qualification examinations is 50%.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Guide to ACCA

Examination Assessment

ACCA reserves the right to examine

anything contained within the study

guide at any examination session. This

includes knowledge, techniques,

principles, theories, and concepts as

specified. For the financial accounting,

audit and assurance, law and tax exams

except where indicated otherwise,

ACCA will publish examinable

documents once a year to indicate

exactly what regulations and legislation

could potentially be assessed within

identified examination sessions.

For examinations, regulation issued or

legislation passed on or before 31

August annually, will be examinable

from 1 September of the following year

to 31 August of the year after that.

Please refer to the examinable

documents for the exam (where

relevant) for further information.

Regulation issued or legislation passed

in accordance with the above dates may

be examinable even if the effective date

is in the future.

The term issued or passed relates to

when regulation or legislation has been

formally approved.

The term effective relates to when

regulation or legislation must be applied

to an entity transactions and business

practices.

The study guide offers more detailed

guidance on the depth and level at

which the examinable documents will be

examined. The study guide should

therefore be read in conjunction with the

examinable documents list.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Financial Management (FM) Syllabus and study guide

This syllabus and study guide is designed to help with planning study and to provide

detailed information on what could be assessed in any examination session.

Aim

To develop the knowledge and skills

expected of a finance manager, in Syllabus

relation to investment, financing, and

dividend policy decisions.

Relational diagram

This diagram shows direct and indirect

links between this exam and other

exams preceding or following it. Some

exams are directly underpinned by other

exams such as Advanced Financial

Management by Financial Management.

These links are shown as solid line

arrows. Other exams only have indirect relationships with each other such as links

existing between the accounting and auditing exams. The links between these are

shown as dotted line arrows. This diagram indicates where you are expected to

have underpinning knowledge and where it would be useful to review previous

learning before undertaking study.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Main capabilities

On successful completion of this exam, candidates should be able to:

A Discuss the role and purpose of the financial management function

B Assess and discuss the impact of the economic environment on financial

management

C Discuss and apply working capital management techniques

D Carry out effective investment appraisal

E Identify and evaluate alternative sources of business finance

F Discuss and apply principles of business and asset valuations

G Explain and apply risk management techniques in business.

This diagram illustrates the flows and links between the main capabilities (sections)

of the syllabus and should be used as an aid to planning teaching and learning in a

structured way.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Rationale

The syllabus for Financial Management

is designed to equip candidates with the

skills that would be expected from a

finance manager responsible for the

finance function of a business. It

prepares candidates for more advanced

and specialist study in Advanced

Financial Management.

The syllabus, therefore, starts by

introducing the role and purpose of the

financial management function within a

business. Before looking at the three

key financial management decisions of

investing, financing, and dividend policy,

the syllabus explores the economic

environment in which such decisions are

made.

The next section of the syllabus is the

introduction of investing decisions. This

is done in two stages - investment in

(and the management of) working

capital and the appraisal of long-term

investments.

The next area introduced is financing

decisions. This section of the syllabus

starts by examining the various sources

of business finance, including dividend

policy and how much finance can be

raised from within the business. It also

looks at the cost of capital and other

factors that influence the choice of the

type of capital a business will raise. The

principles underlying the valuation of

business and financial assets, including

the impact of cost of capital on the value

of business, is covered next.

The syllabus finishes with an

introduction to, and examination of, risk

and the main techniques employed in

managing such risk.

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Detailed syllabus 3. Adjusting for risk and uncertainty in

investment appraisal

A Financial management function 4. Specific investment decisions (lease

or buy; asset replacement, capital

1. The nature and purpose of financial rationing)

management

E Business finance

2. Financial objectives and relationship

with corporate strategy 1. Sources of, and raising, business

finance

3. Stakeholders and impact on 2. Estimating the cost of capital

corporate objectives

3. Sources of finance and their relative

4. Financial and other objectives in not- costs

for-profit organisations

4. Capital structure theories and

B Financial management practical considerations

environment

5. Finance for small- and medium-

1. The economic environment for sized entities

business

F Business valuations

2. The nature and role of financial

markets and institutions 1. Nature and purpose of the valuation

of business and financial assets

3. The nature and role of money

markets 2. Models for the valuation of shares

C Working capital management 3. The valuation of debt and other

financial assets

1. The nature, elements and

importance of working capital 4. Efficient market hypothesis (EMH)

and practical considerations in the

2. Management of inventories, valuation of shares

accounts receivable, accounts

payable and cash G Risk management

3. Determining working capital needs 1. The nature and types of risk and

and funding strategies approaches to risk management

D Investment appraisal 2. Causes of exchange rate differences

and interest rate fluctuations

1. Investment appraisal techniques

3. Hedging techniques for foreign

2. Allowing for inflation and taxation in currency risk

investment appraisal

4. Hedging techniques for interest rate

risk

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Approach to examining the syllabus

The syllabus is assessed by a three-hour examination available in both computer-

based and paper-based formats.*

*For paper-based exams there is an extra 15 minutes to reflect the manual effort

required.

All questions are compulsory. The exam will contain both computational and

discursive elements.

Some questions will adopt a scenario/case study approach.

Computer-based exams

*For computer-based exams an extra 20 minutes is provided to candidates to reflect

the additional content as per below. The total exam time is therefore 3 hours and 20

minutes. Prior to the start of the exam candidates are given an extra 10 minutes to

read the exam instructions.

Section A of the computer-based exam comprises 15 objective test questions of 2

marks each plus additional content as per below.

Section B of the computer-based exam comprises three questions each containing

five objective test questions plus additional content as per below.

For the computer-based exam candidates will be delivered an extra 10 marks of

objective test content (either five single OT questions OR five OT questions based

around a single scenario), for which candidates are given an extra 20

minutes. These questions are included to ensure fairness, reliability and security of

exams. These questions do not directly contribute towards the candidate’s

score. Candidates will not be able to differentiate between the questions that

contribute to the result and those that do not.

Section C of the exam comprises two 20 mark constructed response questions.

The two 20-mark questions will mainly come from the working capital management,

investment appraisal and business finance areas of the syllabus. The section A and

section B questions can cover any areas of the syllabus.

Candidates are provided with a formulae sheet and tables of discount and annuity

factors

Paper-based exams

*For paper-based exams an extra 15 minutes is provided to candidates to reflect the

manual effort required as compared to the time needed for the computer-based

exams. The total exam time is therefore three hours and 15 minutes. Prior to the

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

start of the exam candidates are given an extra 10 minutes to read the exam

instructions.

Section A of the paper-based exam comprises 15 multiple choice questions of 2

marks each

Section B of the exam comprises three scenarios consisting of 15 multiple choice

questions of 2 marks each

Section C of the exam comprises two 20 mark questions.

The two 20-mark questions will mainly come from the working capital management,

investment appraisal and business finance areas of the syllabus. The section A and

section B questions can cover any areas of the syllabus.

Candidates are provided with a formulae sheet and tables of discount and annuity

factors

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Study Guide i) ratio analysis, using appropriate

ratios such as return on

capital employed, return on

A. Financial management equity, earnings per share and

dividend per share

function

ii) changes in dividends and share

1. The nature and purpose of prices as part of total

shareholder return

financial management

e) Explain ways to encourage the

a) Explain the nature and purpose of

achievement of stakeholder

financial management.[1]

objectives, including: [2]

i) managerial reward schemes

b) Explain the relationship between such as share options and

financial management and financial performance-related pay

and management accounting.[1] ii) regulatory requirements such as

corporate governance codes of

2. Financial objectives and the best practice and stock

relationship with corporate exchange listing regulations

strategy

4. Financial and other objectives in

a) Discuss the relationship between not-for-profit organisations

financial objectives, corporate

objectives and corporate strategy.[2] a) Discuss the impact of not-for-profit

status on financial and other

objectives.[2]

b) Identify and describe a variety of

financial objectives, including: [2] b) Discuss the nature and importance

i) shareholder wealth maximisation of Value for Money as an objective

ii) profit maximisation in not-for-profit organisations.[2]

iii) earnings per share growth.

c) Discuss ways of measuring the

achievement of objectives in not-for-

3. Stakeholders and impact on

profit organisations.[2]

corporate objectives

a) Identify the range of stakeholders

B. Financial management

and their objectives [2] environment

b) Discuss the possible conflict 1. The economic environment for

between stakeholder objectives [2] business

c) Discuss the role of management in a) Identify and explain the main

meeting stakeholder objectives, macroeconomic policy targets.[1]

including the application of agency

theory.[2] b) Define and discuss the role of fiscal,

monetary, interest rate and

d) Describe and apply ways of exchange rate policies in achieving

measuring achievement of corporate macroeconomic policy targets.[1]

objectives including:[2]

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

c) Explain how government economic b) Explain the role of banks and other

policy interacts with planning and financial institutions in the operation

decision-making in business.[2] of the money markets.[2]

d) Explain the need for, and the c) Explain the characteristics and role

interaction with, planning and of the principal money market

decision-making in business of: [1] instruments:[2]

i) competition policy i) interest-bearing instruments

ii) government assistance for ii) discount instruments

business iii) derivative products.

iii) green policies

iv) corporate governance C. Working capital

regulation.[2] management

2. The nature and role of financial

markets and institutions 1. The nature, elements and

importance of working capital

a) Identify the nature and role of money

and capital markets, both nationally a) Describe the nature of working

and internationally.[2] capital and identify its elements.[1]

b) Explain the role of financial b) Identify the objectives of working

intermediaries.[1] capital management in terms of

liquidity and profitability, and discuss

c) Explain the functions of a stock the conflict between them.[2]

market and a corporate bond

market.[2] c) Discuss the central role of working

capital management in financial

d) Explain the nature and features of management.[2]

different securities in relation to the

risk/return trade-off.[2] 2. Management of inventories,

accounts receivable, accounts

3. The nature and role of money payable and cash

markets

a) Explain the cash operating cycle and

a) Describe the role of the money

the role of accounts payable and

markets in:[1]

accounts receivable.[2]

i) providing short-term liquidity to

the private sector and the public b) Explain and apply relevant

sector accounting ratios, including: [2]

i) current ratio and quick ratio

ii) providing short-term trade ii) inventory turnover ratio, average

finance collection period and average

payable period

iii) allowing an organisation to

iii) sales revenue/net working

manage its exposure to foreign

capital ratio.

currency risk and interest rate

risk. c) Discuss, apply and evaluate the use

of relevant techniques in managing

inventory, including the Economic

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Order Quantity model and Just-in- i) the length of the working capital

Time techniques.[2] cycle and terms of trade

ii) an organisation’s policy on the

d) Discuss, apply and evaluate the use level of investment in current

of relevant techniques in managing assets

accounts receivable, including: iii) the industry in which the

i) assessing creditworthiness [1] organisation operates.

ii) managing accounts receivable [1]

iii) collecting amounts owing [1] b) Describe and discuss the key factors

iv) offering early settlement in determining working capital

discounts [2] funding strategies, including:[2]

v) using factoring and invoice i) the distinction between

discounting [2] permanent and fluctuating

vi) managing foreign accounts current assets

receivable.[2] ii) the relative cost and risk of short-

term and long-term finance

e) Discuss and apply the use of iii) the matching principle

relevant techniques in managing iv) the relative costs and benefits of

accounts payable, including: aggressive, conservative and

i) using trade credit effectively [1] matching funding policies

ii) evaluating the benefits of v) management attitudes to risk,

discounts for early settlement previous funding decisions and

and bulk purchase [2] organisation size.[1]

iii) managing foreign accounts

payable.[1]

D. Investment appraisal

f) Explain the various reasons for

holding cash, and discuss and apply 1. Investment appraisal techniques

the use of relevant techniques in

managing cash, including:[2] a) Identify and calculate relevant cash

i) preparing cash flow forecasts to flows for investment projects.[2]

determine future cash flows and

cash balances b) Calculate payback period and

ii) assessing the benefits of discuss the usefulness of payback

centralised treasury as an investment appraisal

management and cash control method.[2]

iii) cash management models, such

as the Baumol model and the c) Calculate discounted payback and

Miller-Orr model discuss its usefulness as an

iv) investing short-term. investment appraisal method.[2]

3. Determining working capital d) Calculate return on capital

needs and funding strategies employed (accounting rate of

return) and discuss its usefulness

a) Calculate the level of working capital as an investment appraisal

investment in current assets and method.[2]

discuss the key factors determining

this level, including:[2] e) Calculate net present value and

discuss its usefulness as an

investment appraisal

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

method.[2] d) Apply and discuss other techniques

of adjusting for risk and uncertainty

f) Calculate internal rate of return and in investment appraisal, including:

discuss its usefulness as an i) simulation [1]

investment appraisal ii) adjusted payback [1]

method.[2] iii) risk-adjusted discount rates [2]

g) Discuss the superiority of 4. Specific investment decisions

discounted cash flow (DCF) (Lease or buy; asset

methods over non-DCF methods.[2] replacement; capital rationing)

h) Discuss the relative merits of NPV a) Evaluate leasing and borrowing to

and IRR.[2] buy using the before-and after-tax

costs of debt.[2]

2. Allowing for inflation and

taxation in DCF b) Evaluate asset replacement

decisions using equivalent annual

a) Apply and discuss the real-terms cost and equivalent annual

and nominal-terms approaches to benefit.[2]

investment appraisal.[2]

c) Evaluate investment decisions

b) Calculate the taxation effects of under single-period capital

relevant cash flows, including the rationing, including:[2]

tax benefits of tax-allowable

depreciation and the tax liabilities of i) the calculation of profitability

taxable profit.[2] indexes for divisible investment

projects

c) Calculate and apply before- and ii) the calculation of the NPV of

after-tax discount rates.[2] combinations of non-divisible

investment projects

3. Adjusting for risk and uncertainty iii) a discussion of the reasons for

in investment appraisal capital rationing.

a) Describe and discuss the difference E. Business finance

between risk and uncertainty in

relation to probabilities and 1. Sources of and raising business

increasing project life.[2] finance

b) Apply sensitivity analysis to

a) Identify and discuss the range of

investment projects and discuss the

short-term sources of finance

usefulness of sensitivity analysis in

available to businesses, including:[2]

assisting investment decisions.[2]

i) overdraft

ii) short-term loan

c) Apply probability analysis to

iii) trade credit

investment projects and discuss the

iv) lease finance.

usefulness of probability analysis in

assisting investment decisions.[2]

b) Identify and discuss the range of

long-term sources of finance

available to businesses, including:[2]

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

i) equity finance 2. Estimating the cost of capital

ii) debt finance

iii) lease finance a) Estimate the cost of equity

iv) venture capital. including:[2]

i) application of the dividend

c) Identify and discuss methods of growth model and discussion of

raising equity finance, including:[2] its weaknesses.

i) rights issue ii) explanation and discussion of

ii) placing systematic and unsystematic

iii) public offer risk.

iv) stock exchange listing. iii) relationship between portfolio

theory and the capital asset

d) Identify and discuss methods of pricing model (CAPM)

raising short and long term iv) application of the CAPM, its

Islamic finance, including[1] assumptions, advantages and

disadvantages.

i) major difference between Islamic

finance and the other forms of b) Estimating the cost of debt:

business finance. i) irredeemable debt

ii) The concept of riba (interest) and ii) redeemable debt

how returns are made by iii) convertible debt

Islamic financial securities. iv) preference shares

iii) Islamic financial instruments v) bank debt.

availableto businesses

including: c) Estimating the overall cost of capital

i) murabaha (trade credit) including:[2]

ii) ijara (lease finance) i) distinguishing between average

iii) mudaraba equity finance) and marginal cost of capital

iv) sukuk (debt finance) ii) calculating the weighted average

v) musharaka (venture cost of capital (WACC) using

capital). book value and market value

(note: calculations are not required) weightings.

e) Identify and discuss internal 3. Sources of finance and their

sources of finance, including:[2] relative costs

i) retained earnings

ii) increasing working capital a) Describe the relative risk-return

management efficiency relationship and the relative costs of

iii) the relationship between equity and debt.[2]

dividend policy and the financing

decision b) Describe the creditor hierarchy and

iv) the theoretical approaches to, its connection with the relative costs

and the practical influences on, of sources of finance.[2]

the dividend decision, including

legal constraints, liquidity, c) Identify and discuss the problem of

shareholding expectations and high levels of gearing.[2]

alternatives to cash dividends.

d) Assess the impact of sources of

finance on financial position,

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

financial risk and shareholder 5. Finance for small and medium

wealth using appropriate measures, sized entities (SMEs)

including:[2]

i) ratio analysis using statement of a) Describe the financing needs of

financial position gearing, small businesses.[2]

operational and financial gearing,

interest coverage ratio and other b) Describe the nature of the financing

relevant ratios problem for small businesses in

ii) cash flow forecasting terms of the funding gap, the

iii) leasing or borrowing to buy. maturity gap and inadequate

security.[2]

e) Impact of cost of capital on

investments including:[2] c) Explain measures that may be taken

i) the relationship between to ease the financing problems of

company value and cost of SMEs, including the responses of

capital. government departments and

ii) the circumstances under which financial institutions.[1]

WACC can be used in

investment appraisal d) Identify and evaluate the financial

iii) the advantages of the CAPM impact of sources of finance for

over WACC in determining a SMEs, including sources already

project-specific cost of capital. referred to in syllabus section E1

iv) the application of CAPM in and also [2]

calculating a project-specific i) Business angel financing

discount rate. ii) Government assistance

iii) Supply chain financing

4. Capital structure theories and iv) Crowdfunding / peer-to-peer

practical considerations funding.

a) Describe the traditional view of

capital structure and its

F Business valuations

assumptions.[2]

1. Nature and purpose of the

b) Describe the views of Miller and valuation of business and

Modigliani on capital structure, both financial assets

without and with corporate taxation,

and their assumptions.[2] a) Identify and discuss reasons for

valuing businesses and financial

c) Identify a range of capital market assets.[2]

imperfections and describe their

impact on the views of Miller and b) Identify information requirements for

Modigliani on capital structure.[2] valuation and discuss the limitations

of different types of information.[2]

d) Explain the relevance of pecking

order theory to the selection of 2. Models for the valuation of shares

sources of finance.[1]

a) Discuss and apply asset-based

valuation models, including:[2]

i) net book value (statement of

financial

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

position) basis G Risk Management

ii) net realisable value basis

iii) net replacement cost basis. 1. The nature and types of risk and

approaches to risk management

b) Discuss and apply income-based

valuation models, including:[2] a) Describe and discuss different types

i) price/earnings ratio method of foreign currency risk:[2]

ii) earnings yield method. i) translation risk

ii) transaction risk

c) Discuss and apply cash flow-based iii) economic risk.

valuation models, including:[2]

i) dividend valuation model and the b) Describe and discuss different types

dividend growth model of interest rate risk:[1]

ii) discounted cash flow basis. i) gap exposure

ii) basis risk.

3. The valuation of debt and other

financial assets 2. Causes of exchange rate

differences and interest rate

a) Discuss and apply appropriate fluctuations

valuation methods to:[2]

i) irredeemable debt a) Describe the causes of exchange

ii) redeemable debt rate fluctuations, including:

iii) convertible debt i) balance of payments [1]

iv) preference shares. ii) purchasing power parity theory [2]

iii) interest rate parity theory [2]

4. Efficient Market Hypothesis (EMH) iv) four-way equivalence.[2]

and practical considerations in

the valuation of shares b) Forecast exchange rates using:[2]

i) purchasing power parity

a) Distinguish between and discuss ii) interest rate parity.

weak form efficiency, semi-strong

form efficiency and strong form c) Describe the causes of interest rate

efficiency.[2] fluctuations, including: [2]

i) structure of interest rates and

b) Discuss practical considerations in yield curves

the valuation of shares and ii) expectations theory

businesses, including:[2] iii) liquidity preference theory

i) marketability and liquidity of iv) market segmentation.

shares

ii) availability and sources of 3. Hedging techniques for foreign

information currency risk

iii) market imperfections and pricing

anomalies a) Discuss and apply traditional and

iv) market capitalisation. basic methods of foreign currency

risk management, including:

c) Describe the significance of investor i) currency of invoice [1]

speculation and the explanations of ii) netting and matching [2]

investor decisions offered by iii) leading and lagging [2]

behavioural finance.[1] iv) forward exchange contracts [2]

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

v) money market hedging [2]

vi) asset and liability management.[1]

b) Compare and evaluate traditional

methods of foreign currency risk

management.[2]

c) Identify the main types of foreign

currency derivatives used to hedge

foreign currency risk and explain

how they are used in hedging.[1]

(No numerical questions will be set on

this topic)

4. Hedging techniques for interest

rate risk

a) Discuss and apply traditional and

basic methods of interest rate risk

management, including:

i) matching and smoothing [1]

ii) asset and liability management [1]

iii) forward rate agreements.[2]

b) Identify the main types of interest

rate derivatives used to hedge

interest rate risk and explain how

they are used in hedging.[1]

(No numerical questions will be set on

this topic)

© ACCA 2018-2019 All rights reserved.

Financial Management (FM)

Summary of changes to Financial Management (FM)

ACCA periodically reviews its qualification syllabuses so that they fully meet the needs of

stakeholders such as employers, students, regulatory and advisory bodies and learning providers.

Amendments /additions

There have been no amendments to the Financial Management (FM) study guide from the 2017 –

2018 study guide.

Table 1 – Amendments to Financial Management

Section and subject area Syllabus content

F2 and Verbs added to learning 2. Models for the valuation of shares

F3 outcomes to clarify that students

are expected to be able to a) Discuss and apply asset-based

discuss and apply these methods valuation models, including:[2]

i) net book value (statement of

financial

position) basis

ii) net realisable value basis

iii) net replacement cost basis.

b) Discuss and apply income-based

valuation models, including:[2]

i) price/earnings ratio method

ii) earnings yield method.

c) Discuss and apply cash flow-based

valuation models, including:[2]

i) dividend valuation model and the

dividend growth model

ii) discounted cash flow basis.

3. The valuation of debt and other

financial assets

a) Discuss and apply appropriate

valuation methods to:[2]

i) irredeemable debt

ii) redeemable debt

iii) convertible debt

iv) preference shares.

© ACCA 2018-2019 All rights reserved.

Potrebbero piacerti anche

- PM SG Sept18 Jun19 PDFDocumento19 paginePM SG Sept18 Jun19 PDFSansNessuna valutazione finora

- Study Guide For F5Documento19 pagineStudy Guide For F5Muhammad SadiqNessuna valutazione finora

- AA Syllab and Study Guide 2018-9Documento19 pagineAA Syllab and Study Guide 2018-9Arikata LoveNessuna valutazione finora

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocumento20 pagineAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyNessuna valutazione finora

- LW GloDocumento17 pagineLW Gloasdfghjkl5464Nessuna valutazione finora

- Corporate and Business Law (LW) (MLA) : Syllabus and Study GuideDocumento16 pagineCorporate and Business Law (LW) (MLA) : Syllabus and Study GuideVinodh RavindaranNessuna valutazione finora

- Corporate and Business Law (LW) (LSO) : Syllabus and Study GuideDocumento17 pagineCorporate and Business Law (LW) (LSO) : Syllabus and Study Guidezulaa bNessuna valutazione finora

- FR Syllab and Study Guide 2018-9Documento20 pagineFR Syllab and Study Guide 2018-9pnareshpnkNessuna valutazione finora

- ACCA Strategic Business Leader SyllabusDocumento25 pagineACCA Strategic Business Leader SyllabusSeng Cheong Khor100% (2)

- Acca PDFDocumento14 pagineAcca PDFtepconNessuna valutazione finora

- Strategic Business Leader: September 2018 To June 2019Documento25 pagineStrategic Business Leader: September 2018 To June 2019Li QianNessuna valutazione finora

- Financial Management (F9) September 2017 To June 2018Documento14 pagineFinancial Management (F9) September 2017 To June 2018asad babaNessuna valutazione finora

- Ma1 SG s17 Aug18 PDFDocumento9 pagineMa1 SG s17 Aug18 PDFsaadatNessuna valutazione finora

- Advanced Financial Management (P4) September 2017 To June 2018Documento14 pagineAdvanced Financial Management (P4) September 2017 To June 2018Dlamini SiceloNessuna valutazione finora

- Advanced Performance Management (P5) September 2017 To June 2018Documento13 pagineAdvanced Performance Management (P5) September 2017 To June 2018Jessica RoseNessuna valutazione finora

- F4eng Dec2013 PDFDocumento10 pagineF4eng Dec2013 PDFasad babaNessuna valutazione finora

- Strategic Business Reporting With Table Sepember 2018Documento19 pagineStrategic Business Reporting With Table Sepember 2018nasrciaNessuna valutazione finora

- Financial Management (F9) September 2017 To June 2018Documento14 pagineFinancial Management (F9) September 2017 To June 2018Ed TeddyNessuna valutazione finora

- f6 VNM SG 2013Documento12 paginef6 VNM SG 2013Đàm TrangNessuna valutazione finora

- p5 Study Guide PDFDocumento15 paginep5 Study Guide PDFIleo AliNessuna valutazione finora

- f9 Syll sg2011Documento14 paginef9 Syll sg2011YuenNessuna valutazione finora

- Fab f1 SG Sep17 Aug18Documento15 pagineFab f1 SG Sep17 Aug18sraoaccaNessuna valutazione finora

- ACCA F2 Management Accounting - Syllabus and Study Guide 2010 & June 2011 PDFDocumento10 pagineACCA F2 Management Accounting - Syllabus and Study Guide 2010 & June 2011 PDFSadi SeyidovNessuna valutazione finora

- Taxation - United Kingdom (TX-UK) (F6) : Syllabus and Study GuideDocumento26 pagineTaxation - United Kingdom (TX-UK) (F6) : Syllabus and Study GuideJemasonNessuna valutazione finora

- p2-uk-SyllandSG 2013Documento13 paginep2-uk-SyllandSG 2013deltaeagleNessuna valutazione finora

- Taxation - Czech Republic (TX-CZE) : Syllabus and Study GuideDocumento18 pagineTaxation - Czech Republic (TX-CZE) : Syllabus and Study GuideIvan ShcNessuna valutazione finora

- Advanced Performance Management (P5) June and December 2011Documento14 pagineAdvanced Performance Management (P5) June and December 2011superrebeccachan7692Nessuna valutazione finora

- Advance Performance Management APMDocumento18 pagineAdvance Performance Management APMpaknet0% (1)

- F8 Syllabus 2011Documento14 pagineF8 Syllabus 2011Rajeshwar NagaisarNessuna valutazione finora

- ACCA F3 Syllabus and Study GuideDocumento13 pagineACCA F3 Syllabus and Study GuideArsalanACCA100% (1)

- Taxation - South Africa (TX-ZAF) (F6) SyllandSG 2018 - Final - With Late Change For SPDocumento20 pagineTaxation - South Africa (TX-ZAF) (F6) SyllandSG 2018 - Final - With Late Change For SPEpik HomesNessuna valutazione finora

- F3int Syll SGDocumento13 pagineF3int Syll SGchandarkhemaniNessuna valutazione finora

- p4 Syllabus2012 PDFDocumento13 paginep4 Syllabus2012 PDFYuenNessuna valutazione finora

- Corporate and Business Law (GLO) (F4) June 2008Documento10 pagineCorporate and Business Law (GLO) (F4) June 2008api-19836745Nessuna valutazione finora

- Agement Accounting Man (F2) June & December 2010Documento11 pagineAgement Accounting Man (F2) June & December 2010gahayfordNessuna valutazione finora

- Audit and Assurance (INT) (F8) June 2009Documento12 pagineAudit and Assurance (INT) (F8) June 2009Syed Asad AliNessuna valutazione finora

- Nting Ber Management Accou (F2) June & Decem 2010 and June 2011Documento11 pagineNting Ber Management Accou (F2) June & Decem 2010 and June 2011Gulraiz ChamanNessuna valutazione finora

- P7 DetailsDocumento15 pagineP7 DetailsMuhammad Abbas SandhuNessuna valutazione finora

- Performance Management (F5) June 2009Documento11 paginePerformance Management (F5) June 2009khengmaiNessuna valutazione finora

- Audit and Assurance (UK) (F8)Documento12 pagineAudit and Assurance (UK) (F8)Srivatsan SogathurNessuna valutazione finora

- Taxation - Vietnam (TX-VNM) (F6) SASG 2021 SP Amends - FinalDocumento20 pagineTaxation - Vietnam (TX-VNM) (F6) SASG 2021 SP Amends - FinalXuân PhạmNessuna valutazione finora

- F4eng 0608Documento9 pagineF4eng 0608api-19836745Nessuna valutazione finora

- F7uk June2014 PDFDocumento14 pagineF7uk June2014 PDFasad babaNessuna valutazione finora

- f5 Syll SGDocumento11 paginef5 Syll SGracoon_zhangNessuna valutazione finora

- Taxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - FinalDocumento22 pagineTaxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - Finalkucing kerongNessuna valutazione finora

- Advanced Taxation - South Africa (ATX-ZAF) (P6) Syllan SG 2018 - Final - With Late Change For SPDocumento21 pagineAdvanced Taxation - South Africa (ATX-ZAF) (P6) Syllan SG 2018 - Final - With Late Change For SPLoyana futhiNessuna valutazione finora

- Performance Management (F5) June 2008Documento11 paginePerformance Management (F5) June 2008anon-902659100% (2)

- Corporate & Business Law Syllabus June-2011Documento9 pagineCorporate & Business Law Syllabus June-2011Amit KarnNessuna valutazione finora

- Analysis (P3) June 2009 BusinessDocumento14 pagineAnalysis (P3) June 2009 Businessmannan21usNessuna valutazione finora

- Taxation - Singapore (SGP) (F6) Exams in The Year 1 April 2017 To 31 March 2018Documento12 pagineTaxation - Singapore (SGP) (F6) Exams in The Year 1 April 2017 To 31 March 2018Drift SirNessuna valutazione finora

- Financial Accounting (FA) /FFA September 2018 To August 2019Documento15 pagineFinancial Accounting (FA) /FFA September 2018 To August 2019Ahmed Abbas ZaidiNessuna valutazione finora

- Management Accounting (F2/FMA) December 2011Documento13 pagineManagement Accounting (F2/FMA) December 2011teddy4everNessuna valutazione finora

- Guidance f6-vnm-sg-2017Documento12 pagineGuidance f6-vnm-sg-2017Loii GnoiiNessuna valutazione finora

- Financial Accounting (F3/FFA) September 2015 To August 2016 (For CBE Exams Up To 22 September 2016)Documento14 pagineFinancial Accounting (F3/FFA) September 2015 To August 2016 (For CBE Exams Up To 22 September 2016)VoTrieuAnhNessuna valutazione finora

- F6 - SyllabusDocumento15 pagineF6 - SyllabusRajeshwar NagaisarNessuna valutazione finora

- Advanced Taxation - United Kingdom (ATX-UK) (P6) : Syllabus and Study GuideDocumento24 pagineAdvanced Taxation - United Kingdom (ATX-UK) (P6) : Syllabus and Study GuideLuciferNessuna valutazione finora

- Corporate Reporting (UK) (P2) September 2017 To June 2018Documento13 pagineCorporate Reporting (UK) (P2) September 2017 To June 2018deltaeagleNessuna valutazione finora

- Important Study FileDocumento11 pagineImportant Study FileMuhammad SadiqNessuna valutazione finora

- Teaching College-Level Disciplinary Literacy: Strategies and Practices in STEM and Professional StudiesDa EverandTeaching College-Level Disciplinary Literacy: Strategies and Practices in STEM and Professional StudiesJuanita C. ButNessuna valutazione finora

- (Written Examination) : Policies & ProtocolsDocumento1 pagina(Written Examination) : Policies & ProtocolsMuhammad Zahid FaridNessuna valutazione finora

- 05 s601 SFM PDFDocumento4 pagine05 s601 SFM PDFMuhammad Zahid FaridNessuna valutazione finora

- 05 s601 SFM - 3 PDFDocumento4 pagine05 s601 SFM - 3 PDFMuhammad Zahid FaridNessuna valutazione finora

- s601-sfm Sans PDFDocumento7 pagines601-sfm Sans PDFMuhammad Zahid FaridNessuna valutazione finora

- Notification November2018 Examinatio PDFDocumento1 paginaNotification November2018 Examinatio PDFMuhammad Zahid FaridNessuna valutazione finora

- C CCDebitEasyAccess SampleReport PDFDocumento1 paginaC CCDebitEasyAccess SampleReport PDFMuhammad Zahid FaridNessuna valutazione finora

- Schedule For Winter2018 (Written) Examinations PDFDocumento1 paginaSchedule For Winter2018 (Written) Examinations PDFMuhammad Zahid FaridNessuna valutazione finora

- Muhammad Zahid Farid - Resume PDFDocumento2 pagineMuhammad Zahid Farid - Resume PDFMuhammad Zahid FaridNessuna valutazione finora

- 01 s601 SFM - 2 PDFDocumento4 pagine01 s601 SFM - 2 PDFMuhammad Zahid FaridNessuna valutazione finora

- 13a PDFDocumento3 pagine13a PDFMuhammad Zahid FaridNessuna valutazione finora

- Pes4 PDFDocumento19 paginePes4 PDFMuhammad Zahid FaridNessuna valutazione finora

- S601 SFM PDFDocumento4 pagineS601 SFM PDFMuhammad Zahid FaridNessuna valutazione finora

- Cir Winter2018 Written Examinations PDFDocumento2 pagineCir Winter2018 Written Examinations PDFMuhammad Zahid FaridNessuna valutazione finora

- Ubl Operational BranchesDocumento23 pagineUbl Operational BranchesMusa Lal100% (1)

- RISM Competency Guide (F)Documento12 pagineRISM Competency Guide (F)zili yeNessuna valutazione finora

- AC5021 2015-16 Resit Exam Questions ASPDocumento8 pagineAC5021 2015-16 Resit Exam Questions ASPyinlengNessuna valutazione finora

- Chapter Three Basic Concepts of Audit PlanningDocumento20 pagineChapter Three Basic Concepts of Audit PlanningNigussie BerhanuNessuna valutazione finora

- DPO 2022-4641 Designation of Sub-CART For CHD, Hospitals, and TRCsDocumento4 pagineDPO 2022-4641 Designation of Sub-CART For CHD, Hospitals, and TRCsKian PerezNessuna valutazione finora

- Umair Bashir CV - Copy 3Documento4 pagineUmair Bashir CV - Copy 3Umair BashirNessuna valutazione finora

- ASSR AA STF NEW L8 PM8.5.1C Accounts Payable Substantive Procedures Participant InstructionsDocumento3 pagineASSR AA STF NEW L8 PM8.5.1C Accounts Payable Substantive Procedures Participant InstructionsJimmieNessuna valutazione finora

- Control, Governance and Risk ManagementDocumento6 pagineControl, Governance and Risk Managementadamazing25Nessuna valutazione finora

- Advantages and Disadvantages of ISO CertificationDocumento2 pagineAdvantages and Disadvantages of ISO CertificationJeni Cho ChweetNessuna valutazione finora

- AUD 1.2 Client Acceptance and PlanningDocumento10 pagineAUD 1.2 Client Acceptance and PlanningAimee Cute100% (1)

- Bill of Material: Components ConsumptionDocumento13 pagineBill of Material: Components ConsumptionVarun MehrotraNessuna valutazione finora

- Questions Tracker (Q&A)Documento16 pagineQuestions Tracker (Q&A)The Brain Dump PHNessuna valutazione finora

- The Impact of Information Technology On Internal Auditing PDFDocumento17 pagineThe Impact of Information Technology On Internal Auditing PDFIndra Pramana100% (2)

- Energy Management Solution PDFDocumento37 pagineEnergy Management Solution PDFNareshNessuna valutazione finora

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocumento5 pagineConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNessuna valutazione finora

- CA Inter Law Suggested Answer Nov 2022Documento20 pagineCA Inter Law Suggested Answer Nov 2022V DHARSHININessuna valutazione finora

- PRO FormaDocumento2 paginePRO FormaNovie Marie Balbin AnitNessuna valutazione finora

- Postal Office Tel - DirectoryDocumento16 paginePostal Office Tel - DirectoryJun San Diego100% (1)

- Kerala Minerals and Metals LimitedDocumento29 pagineKerala Minerals and Metals LimitedRavibalanNessuna valutazione finora

- 1z0 1055 21 DemoDocumento6 pagine1z0 1055 21 Demoshakhir mohunNessuna valutazione finora

- The Role of Customs DepartmentDocumento19 pagineThe Role of Customs DepartmentMohd Zu SyimalaienNessuna valutazione finora

- Hartigan Nominees and Another V RydgeDocumento2 pagineHartigan Nominees and Another V RydgeAngela Au100% (1)

- School-UACF-PERM v4Documento2.732 pagineSchool-UACF-PERM v4Alvin JerusNessuna valutazione finora

- Definition of Assessee' - Section 2 (7) of Income TaxDocumento7 pagineDefinition of Assessee' - Section 2 (7) of Income Taxekta singhNessuna valutazione finora

- ResumeDocumento4 pagineResumesagardhasNessuna valutazione finora

- Millen Ap AssignmentDocumento40 pagineMillen Ap Assignmentsamson mutukuNessuna valutazione finora

- Cost and Management Accounting (VJuly 2016)Documento629 pagineCost and Management Accounting (VJuly 2016)Dipen AdhikariNessuna valutazione finora

- Philippine Standard On Auditing 300Documento6 paginePhilippine Standard On Auditing 300HavanaNessuna valutazione finora

- Chapter 08 AnsDocumento7 pagineChapter 08 AnsDave Manalo50% (2)

- Annual Report 2017 SOPBDocumento170 pagineAnnual Report 2017 SOPBHj AroNessuna valutazione finora

- MCB ReportDocumento80 pagineMCB ReportAminullah DawarNessuna valutazione finora