Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

For Holders: Automated Income Tax Calculation

Caricato da

maruf048Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

For Holders: Automated Income Tax Calculation

Caricato da

maruf048Copyright:

Formati disponibili

AUTOMATED

INCOME TAX CALCULATION

For Private Service Holders

According to the rules of 2018

Developed by

MD MAHBUB HOSSAIN

Squadron Leader, Finance

Bangladesh Air Force

Please convey your valuable suggestion and comments by

e-mail mahbub9256@yahoo.com

Mobile : 01610171064, 01720171064,

FOR TAX YEAR 2018-2019

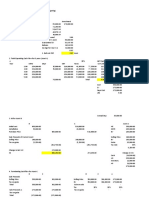

TAX CALCULATION FOR TAX YEAR 2018-2019

Type of Tax Payer Rate % Income Tax

Male 250,000 0%

400,000 10%

500,000 15%

600,000 20%

3,000,000 25%

Rest 30%

Total=

(Tax on Interest on Saving certificates @ 5% Tax, Agricultural Income Tax Free, ) Tax paid/to be paid at Reduced rate 50,000.00

Tax Leviable

Tax Rebate 0.00

Select Area

Dhaka City Corporation Minimum Tax 5,000.00

Tax Payable

TOTAL TAXABLE INCOME (Excluding Tax Exempted/Reduced Tax Rated Income)

Total Income Tax Paid or To be

Total Taxable Income (Total Income Part-II, SL-34) paid at reduced Rate

Less: Exempted/Reduced Tax Rated Incomes Income Tax

Interest on Saving certificates @ 5% Tax 1,000,000.00 50,000.00

Agricultural Income Tax Free

Total Taxable Income (Excluding Tax Exempted /

Reduced Tax Rated Income)

SURCHARGE CALCULATION FOR TAX YEAR 2018-2019

Net Wealth Tax Payable Rate of %

IT-10B, Serial-16) Part II, Serial-37 Surcharge Applicable

Rate

0.00 22,500,000 0%

50,000,000 10%

Surcharge Leviable= Tax Payable X 0% 100,000,000 15%

0%

= #VALUE! 150,000,000 20%

Minimum Surcharge = 3,000 200,000,000 25%

Surcharge Payable = Rest 30%

TAX REBATE CALCULATION

1. Total Taxable Income (Excluding reduced rated/exempted tax Incomes) Tk (1,000,000.00)

Total Taxable Income (Total Income Part-II, SL-34) Tk 0.00

Less: Exempted/Reduced tax rated incomes

Interest on Saving certificates @ 5% Tax Tk 1,000,000.00

Agricultural Income Tax Free Tk -

-

Total Income Tk (1,000,000.00)

2. Elegible Amount The smallest of a, b or c (Schedule 24D, SL-14)Tk 600,000.00

a. Total allowable investment, contribution (Schedule 24D, SL-13) Tk 600,000.00

b. 25% of the Total income [excluding any income for which tax exemption

or a reduced rate is applicable] Total Income X 25% = -10,00,000.00 X 25% = Tk (250,000.00)

c. Maximum Limit for Investment Tk 15,000,000.00

3. Tax Rebate Calculation Rebate is Tk -

Total Income Rate of Eligible Amount

Tk (1,000,000.00) Rebate Tk 600,000.00 Rebate Calculation Rebate Amount

Up to 1,000,000.00 15% of Eligible Amount

Up to 3,000,000.00 15% of 250,000.00

12% of Next Rest amount

Above 3,000,000.00 15% of 250,000.00 -

12% of Next 500,000.00 -

10% of Next Rest amount -

National Board of Revenue IT-11GA2016

www.nbr.gov.bd

RETURN OF INCOME

For an Individual Assessee

The following schedules shall be the integral part of this return and must be annexed to

return in the following cases:

Schedule 24A if you have income from Salaries Photo

Schedule 24B if you have income from house property

Schedule 24C if you have income from business or profession

Schedule 24D if you claim tax rebate

PART I

Basic information

01 Assessment Year 02 Return submitted under section 82BB?

(tick one)

2 0 1 8 - 1 9 Yes P No

03 Name of the Assessee 04 Gender (tick one) M P F

05 Twelve-digit TIN 06 Old TIN

07 Circle 08 Zone

09 Resident Status (tick one) Resident P Non-resident

10 Tick on the box(es) below if you are:

10A A gazetted war-wounded 10B A person with disability

freedom fighter

10C Aged 65 years or more 10D A parent/legal guardian of a person

with disability

11 Date of birth (DD-MM-YYYY) 12 Income Year

### 01 July 2017 to 30 June 2018

13 If employed, employer’s name

14 Spouse Name 15 Spouse TIN (if any)

16 Father's Name 17 Mother’s Name

18 Present Address 19 Permanent Address

20 Contact Telephone 21 E-mail

22 National Identification Number 23 Business Identification Number(s)

PART II

Particulars of Income and Tax

TIN:

Particulars of Total Income Amount Tk

24 Salaries (annex Schedule 24A) S.21

25 Interest on securities S.22

26 Income from house property (annex Schedule 24B) S.24

27 Agricultural income S.26

28 Income from business or profession (annex Schedule 24C) S.28

29 Capital gains S.31

30 Income from other sources S.33

31 Share of income from firm or AOP

32 Income of minor or spouse under section 43(4) S.43

33 Foreign income

34 Total income (aggregate of 24 to 33) 0.00

Tax Computation and Payment Amount Tk

35 Gross tax before tax rebate

36 Tax rebate (annex Schedule 24D) 0.00

37 Net tax after tax rebate

38 Minimum tax Dhaka City Corporation

5,000.00

39 Net wealth surcharge

40 Interest or any other amount under the Ordinance (if any)

41 Total amount payable 0.00

42 Tax deducted or collected at source (attach proof)

43 Advance tax paid (attach proof)

44 Adjustment of tax refund [mention assessment year(s) of refund]

45 Amount paid with return (attach proof) 0.00

46 Total amount paid and adjusted (42+43+44+45) 0.00

47 Deficit or excess (refundable) (41-46) 0.00

48 Tax exempted income 0.00

PART III

Instruction, Enclosures and Verification

TIN

49 Instructions

1. Statement of assets, liabilities and expenses (IT-10B2016) and statement of life style expense

(IT-10BB2016) must be furnished with the return unless you are exempted from furnishing

such statement(s) under section 80.

2. Proof of payments of tax, including advance tax and withholding tax and the proof of

investment for tax rebate must be provided along with return.

3. Attach account statements and other documents where applicable

50 If you are a parent of a person with disability, has your spouse Yes No P

availed the extended tax exemption threshold? (tick one)

51 Are you required to submit a statement of assets, liabilities and Yes P No

expenses (IT-10B2016) under section 80(1)? (tick one)

52 Schedules annexed

(tick all that are applicable) 24A P 24B 24C 24D P

53 Statements annexed

(tick all that are applicable) IT-10B2016 P IT-10BB2016 P

54 Other statements, documents, etc. attached (list all)

a. Monthly Salary Statement

b.

c.

d.

e.

f.

g.

Verification and signature

55 Verification

I solemnly declare that to the best of my knowledge and belief the information given in this retur

and statements and documents annexed or attached herewith are correct and complete.

Name Signature

Date of Signature (DD-MM-YYYY) Place of Signature

2 0 1 8

For official use only

Return Submission Information

Date of Submission (DD-MM-YYYY) Tax Office Entry Number

National Board of Revenue Individual

www.nbr.gov.bd

ACKNOWLEDGEMENT RECEIPT OF

RETURN OF INCOME

Assessment Year Return under section 82BB? (tick one)

2 0 1 8 - 1 9 Yes

P No

Name of Assessee

Twelve-digit TIN Old TIN

Circle Taxes Zone

Total income shown (serial 34)

৳ -

Amount payable (serial 41) Amount paid and adjusted (serial 46)

৳ - ৳ -

Amount of net wealth shown in IT-10B2016 Amount of net wealth surcharge paid

৳ - ৳

Date of Submission (DD-MM-YYYY) Tax Office Entry Number

0 0 0 0 2 0 1 8

Signature and seal of the official receiving the return

Date of Signature Contact Number of Tax Office

SCHEDULE 24A

Particulars of income from Salaries

Annex this Schedule to the return of income if you have income from Salaries

01 Assessment Year 02 TIN

2 0 1 8 - 1 9

Particulars Amount Tax exempted Taxable

(A) (B) (C = A-B)

03 Basic pay

04 Special pay

05 Arrear pay (if not included in taxable income

earlier)

06 Dearness allowance

07 House rent allowance

08 Medical allowance

09 Conveyance allowance

10 Festival Allowance

11 Allowance for support staff

12 Leave allowance

13 Honorarium/ Reward/Fee

14 Overtime allowance

15 Bonus / Ex-gratia

16 Other allowances

17 Employer’s contribution to a recognized provident

fund

18 Interest accrued on a recognized provident fund

19 Deemed income for transport facility N/A

20 Deemed income for free furnished/unfurnished

accommodation N/A

21 Other, if any (give detail)

22 Total

All figures of amount are in taka (৳)

Name Signature & Date

SCHEDULE 24B

Particulars of income from house property

Annex this Schedule to the return of income if you have income from house property

01 Assessment Year 02 TIN

2 0 1 8 - 1 9

For each house property

03 Description of the house property

03A Address of the property 03B Total area

03C Share of the assessee (%)

Income from house property Amount Tk

04 Annual Value

05 Deductions (aggregate of 05A to 05G) 0.00

05A Repair, Collection, etc. (Residential Purpose Rent)

05B Municipal or Local Tax

05C Land Revenue

Interest on Loan/Mortgage/Capital Charge

05D

05E Insurance Premium

05F Vacancy Allowance

05G Other, if any

06 Income from house property (04-05) 0.00

07 In case of partial ownership, the share of income

Provide information if income from more than one house property

08 Aggregate of income of all house properties (1+2+3+- - - )

(provide additional papers if necessary)

Tk 0.00

1 (Income from house property 1)

Tk 0.00

2 (Income from house property 2)

Tk

3 (Income from house property 3)

Tk

Name Signature & Date

SCHEDULE 24C

Summary of income from business or profession

To be annexed to return by an assessee having income from business or profession

01 Assessment Year 02 TIN

2 0 1 8 - 1 9

03 Type of main business or profession

04 Name(s) of the business or profession (as 05 Address(es)

in trade licence)

Use serial numbers if more names and addresses

Summary of Income Amount Tk

06 Sales/ Turnover/ Receipts

07 Gross Profit

08 General, administrative, selling and other expenses

09 Net Profit (07-08)

0.00

Summary of Balance Sheet Amount Tk

10 Cash in hand & at bank

11 Inventories

12 Fixed assets

13 Other assets

14 Total assets (10+11+12+13)

0.00

15 Opening capital

16 Net profit

0.00

17 Withdrawals in the income year

18 Closing capital (15+16-17)

19 Liabilities

20 Total capital and liabilities (18+19)

Name Signature & Date

SCHEDULE 24D

Particulars of tax credit/rebate

To be annexed to return by an assessee claiming investment tax credit

(Attach the proof of claimed investment, contribution, etc.)

01 Assessment Year 02 TIN

2 0 1 8 - 1 9

Particulars of rebatable investment, contribution, etc. Amount Tk

03 Life insurance premium 600,000.00

04 Contribution to deposit pension scheme (DPS) (not exceeding allowable

limit Tk 60,000.)

05 Investment in approved savings certificate

06 Investment in approved debenture or debenture stock, Stock or Shares

07 Contribution to provident fund to which Provident Fund Act, 1925

applies

08 Self contribution and employer’s contribution to Recognized Provident

Fund

09 Contribution to Super Annuation Fund

10 Contribution to Benevolent Fund and Group Insurance Premium

11 Contribution to Zakat Fund

12 Others, if any ( give details )

13

Total allowable investment, contribution etc. 600,000.00

14

Eligible amount for rebate (the lesser of 14A, 14B or 14C) 600,000.00

14A Total allowable investment, contribution, etc. (as in 13) 600,000.00

14B 25% of the total income [excluding any income for which a

exemptiontaxor a reduced rate is applicable under sub-section (4) of

section 44 or any income from any source or sources mentioned

in clause (a) of sub-section (2) of section 82C.]

14C 1.5 crore 15,000,000.00

15 Amount of tax rebate calculated on eligible amount (Serial 14) under

0.00

section 44(2)(b)

Name Signature & Date

National Board of Revenue IT-10B2016

www.nbr.gov.bd

STATEMENT OF ASSETS, LIABILITIES AND EXPENSES

under section 80(1) of the Income Tax Ordinance, 1984 (XXXVI of 1984)

1. Mention the amount of assets and liabilities that you have at the last date of the income year. All

items shall be at cost value include legal, registration and all other related costs;

2. 2. If your spouse or minor children and dependent(s) are not assessee, you have to include their

assets

and liabilities in your statement;

3. 3. Schedule 25 is the integral part of this Statement if you have business capital or agriculture or

non-

agricultural property. Provide additional papers if necessary.

01 Assessment Year 02 Statement as on (DD-MM-YYYY)

2 0 1 8 - 1 9 3 0 0 6 2 0 1 8

03 Name of the Assessee 04 TIN

Particulars Amount Tk

05 Business capital (05A+05B)

05A Business capital other than 05B

05B Director’s shareholdings in limited companies (as in Schedule 25)

06 06A Non-agricultural property (as in Schedule

25)

06B Advance made for non-agricultural property (as in Schedule25)

07 Agricultural property (as in Schedule25)

08 Financial assets value (08A+08B+08C+08D+08E)

Share, debentures

08A etc.

08B Savings certificate, bonds and other government securities

08C Fixed deposit, Term deposits and DPS

08D Loans given to others (mention name and TIN)

08E Other financial assets (give details)

09 Motor car (s) (use additional papers if more than two cars) Shown before

Sl. Brand Name Engine (CC) Registrtiion No.

1

2

10 Gold, diamond, gems and other items (mention quantity)

Jewellery

11 Furniture, equipment and electronic items

12 Other assets of significant value

Particulars Amount Tk

13 Cash and fund outside business (13A+13B+13C+13D)

13A Notes and currencies Taka

13B Banks, cards and other electronic cash

13C Provident fund and other fund Balance as on 30 June 2018

13D Other deposits, balance and advance (other than 08)

14 Gross wealth (aggregate of 05 to 13) 0.00

15 Liabilities outside business (15A+15B+15C) 0.00

15A Borrowings from banks and other financial institutions

15B Unsecured loan (mention name and TIN)

15C Other loans or overdrafts

16 Net wealth (14-15) 0.00

17 Net wealth at the last date of the previous income year

18 Change in net wealth (16-17)

19 Other fund outflow during the income year (19A+19B+19C)

19A Annual living expenditure and tax payments (as IT-10BB2016)

19B Loss, deductions, expenses, etc. not mentioned in IT-10BB2016

19C Gift, donation and contribution (mention name of recipient)

20 Total fund outflow in the income year (18+19)

21 Sources of fund (21A+21B+21C) 0.00

21A Income shown in the return 0.00

21B Tax exempted income and allowance 0.00

21C Other receipts and sources

22 Shortage of fund, if any (21-20) Please, write all relevant values above. #VALUE!

Verification and signature

23 Verification

I solemnly declare that to the best of my knowledge and belief the information given in this

statement and the schedule annexed herewith are correct and complete.

Name Signature & Date

SCHEDULE 25

to be annexed to the Statement of Assets, Liabilities and Expenses (IT-10B2016)

01 Assessment Year 02 TIN

2 0 1 8 - 1 9

03 Shareholdings in limited companies as director No. of shares Value Tk

1

2

3

4

04 Non-agricultural property at cost value or Value at the increased/decrea Value at the last

any advance made for such property Start of income sed during the date of income

(description, location and size) year income year year

Tk Tk Tk

1

-

(Advance)

2

-

3

-

4

-

05 Agricultural property at cost value Value at the increased/decrea Value at the last

(description, location and size) Start of income sed during the date of icome

year income year year

Tk Tk Tk

1

-

2

-

3

-

4

-

(Provide additioal paper if necessary)

Name Signature & Date

National Board of Revenue IT-10BB2016

www.nbr.gov.bd

STATEMENT OF EXPENSES RELATING TO LIFESTYLE

under section 80(2) of the Income Tax Ordinance, 1984 (XXXVI of 1984)

01 Assessment Year 02 Statement as on (DD-MM-YYYY)

2 0 1 8 - 1 9 3 0 0 6 2 0 1 8

03 Name of the Assessee 04 TIN

Particulars Amount Tk Comment

05 Expenses for food, clothing and other

essentials

06 Housing expense

07 Auto and transportation expenses (07A+07B)

07A Driver’s salary, fuel and maintenance

07B Other transportation

08 Household and utility expenses

(08A+08B+08C+08D)

08A Electricity

08B Gas, water, sewer and garbage

08C Phone, internet, TV channels subscription

08D Home-support staff and other expenses

09 Children’s education expenses

10 Special expenses (10A+10B+10C+10D)

10A Festival, party, events and gifts

10B Domestic and overseas tour, holiday, etc.

10C Donation, philanthropy, etc.

10D Other special expenses

11 Any other expenses

12 Total expense relating to lifestyle 0.00

(05+06+07+08+09+10+11)

13 Payment of tax, charges, etc. (13A+13B)

13A Payment of tax at source

13B Payment of tax, surcharge or other amount

14 Total amount of expense and tax (12+13) 0.00

Verification and signature

15 Verification

I solemnly declare that to the best of my knowledge and belief the information given in this

statement is correct and complete.

Name Signature & Date

Government of the People’s Republic of Bangladesh

National Board of Revenue

Income Tax Wing

INCOME TAX CERTIFICATE

(a). Name :

(b). Father's Name :

(c). Present Address :

(d). Permanent Address :

(e). Status : Individual

(f). Tax Payer's Identification :

Number (e-TIN)

Old TIN Number (TIN)

(g). Business Identification :

Number (BIN)

This is to certify that is an assessee of Taxes Circle-, Taxes Zone-

The assessment has been completed under section 82BB of the I.T. Ordinance, 1984 for

the assessment year 2018-2019, and Tax paid as per his case. Total income shown in return :

Tk. 0.00 and Tax Paid Tk. .00

Assistant Commissioner of Taxes

Circle-, Taxes Zone-

Potrebbero piacerti anche

- Income Tax - TRAINDocumento27 pagineIncome Tax - TRAINSteveNessuna valutazione finora

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocumento37 pagineIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Income Taxation - Chapter 2 - Individual TaxpayersDocumento5 pagineIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNessuna valutazione finora

- The Dps Ultimate Guide To Photography Terms - Glossary of Common Word and Phrases v2 2-ReducedDocumento42 pagineThe Dps Ultimate Guide To Photography Terms - Glossary of Common Word and Phrases v2 2-Reducedapi-566677930Nessuna valutazione finora

- Principles of Taxation-ReviewerDocumento36 paginePrinciples of Taxation-ReviewerNikki Coleen SantinNessuna valutazione finora

- Cotton Guide August 2013 Small PDFDocumento365 pagineCotton Guide August 2013 Small PDFSaravana Kumar S S100% (1)

- Relay Settings: Operation CurveDocumento6 pagineRelay Settings: Operation Curvemaruf048Nessuna valutazione finora

- IT-11GA (New Form) For Private Service Tax Year 2020-21 19 Oct 20 - PDFDocumento16 pagineIT-11GA (New Form) For Private Service Tax Year 2020-21 19 Oct 20 - PDFMASUD RANANessuna valutazione finora

- Yarn BrochureDocumento16 pagineYarn Brochurepiloja7308Nessuna valutazione finora

- Income Tax TableDocumento6 pagineIncome Tax TableMarian's PreloveNessuna valutazione finora

- General and Subsidiary Ledgers ExplainedDocumento57 pagineGeneral and Subsidiary Ledgers ExplainedSavage NicoNessuna valutazione finora

- Yarn Consumption + Costing CalculationDocumento113 pagineYarn Consumption + Costing CalculationSALIMNessuna valutazione finora

- 2022 03 01 Photoshop Elements The Complete ManualDocumento152 pagine2022 03 01 Photoshop Elements The Complete Manualuinx100% (1)

- Over Current Earth Fault Setting Calculations PDFDocumento33 pagineOver Current Earth Fault Setting Calculations PDFsnitin260% (1)

- Basics of PhotographyDocumento68 pagineBasics of PhotographyBidhan RajkarnikarNessuna valutazione finora

- BEST Transformer Test Procedures enDocumento50 pagineBEST Transformer Test Procedures enPrem Kumar Nepal100% (9)

- Tumey V Ohio (Judge Compensation Issue) HTMDocumento18 pagineTumey V Ohio (Judge Compensation Issue) HTMlegalmattersNessuna valutazione finora

- Eastern Assurance Vs Secretary of LaborDocumento2 pagineEastern Assurance Vs Secretary of LaborGui EshNessuna valutazione finora

- English Idioms and Expressions (Tests) (With Answers) (170 P) PDFDocumento170 pagineEnglish Idioms and Expressions (Tests) (With Answers) (170 P) PDFPep EscondiolaNessuna valutazione finora

- Basic Digital Photography - Aric W. DutelleDocumento100 pagineBasic Digital Photography - Aric W. DutelleGMDMNessuna valutazione finora

- MANUAL MODE GUIDEDocumento1 paginaMANUAL MODE GUIDELukaDzaricNessuna valutazione finora

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocumento8 pagineCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNessuna valutazione finora

- Faults in Electrical Power SystemDocumento4 pagineFaults in Electrical Power Systemmaruf048Nessuna valutazione finora

- Individuals Assign3Documento7 pagineIndividuals Assign3jdNessuna valutazione finora

- LTE CS Fallback (CSFB) Call Flow Procedure - 3GLTEInfoDocumento10 pagineLTE CS Fallback (CSFB) Call Flow Procedure - 3GLTEInfoClive MangwiroNessuna valutazione finora

- Barrons Essential 333 Words PDFDocumento5 pagineBarrons Essential 333 Words PDFGoutham RNessuna valutazione finora

- Court of Appeals Upholds Dismissal of Forcible Entry CaseDocumento6 pagineCourt of Appeals Upholds Dismissal of Forcible Entry CaseJoseph Dimalanta DajayNessuna valutazione finora

- CC DisputeFormDocumento1 paginaCC DisputeFormAmalina ZainalNessuna valutazione finora

- Customer Satisfaction Study For The Drivers of Sodium Salphet at Grasim Industries Ltd. by Gaurav Soral - MarketingDocumento59 pagineCustomer Satisfaction Study For The Drivers of Sodium Salphet at Grasim Industries Ltd. by Gaurav Soral - MarketingVinod PandeyNessuna valutazione finora

- IT-11UMA FormDocumento11 pagineIT-11UMA FormasmjewelNessuna valutazione finora

- Tata Textile IntroductionDocumento7 pagineTata Textile IntroductionManisha BhanushaliNessuna valutazione finora

- Tomato ProductionDocumento78 pagineTomato ProductionNGANJANI WALTERNessuna valutazione finora

- G.Tech Company Profile, Chittagong, BangladeshDocumento14 pagineG.Tech Company Profile, Chittagong, Bangladeshjubair ahmedNessuna valutazione finora

- Month Net Taxable Income Tax Slabs Tax RateDocumento2 pagineMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiNessuna valutazione finora

- R2. TAX (M.L) Solution CMA May-2023 ExamDocumento5 pagineR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNessuna valutazione finora

- Module 07 - Overview of Regular Income TaxationDocumento32 pagineModule 07 - Overview of Regular Income TaxationTrixie OnglaoNessuna valutazione finora

- TAXATION ON INDIVIDUALS Lecture NotesDocumento4 pagineTAXATION ON INDIVIDUALS Lecture NotesLucille Rose MamburaoNessuna valutazione finora

- Answer 1Documento5 pagineAnswer 1mayetteNessuna valutazione finora

- Tax Calculator AY 2021-22Documento1 paginaTax Calculator AY 2021-22mehedi hasanNessuna valutazione finora

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocumento5 pagineQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNessuna valutazione finora

- Ques. Defered TaxDocumento40 pagineQues. Defered TaxKALYANI JAYAKRISHNAN 2022155Nessuna valutazione finora

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocumento9 pagineHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNessuna valutazione finora

- CAF 2 Spring 2021Documento8 pagineCAF 2 Spring 2021Muhammad Ahsan RiazNessuna valutazione finora

- Taxation Assignment 1Documento2 pagineTaxation Assignment 1Alviya FatimaNessuna valutazione finora

- Sols-Dr RajniDocumento5 pagineSols-Dr Rajnialex breymannNessuna valutazione finora

- Taxation 1Documento12 pagineTaxation 1Lady Zyanien DevarasNessuna valutazione finora

- Only Fill Yellow Cells: WorkingsDocumento2 pagineOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNessuna valutazione finora

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Documento2 pagineTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNessuna valutazione finora

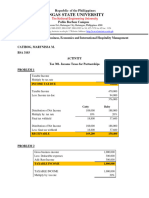

- Catibog, Marynissa M. - Activity On Income Taxes For PartnershipsDocumento2 pagineCatibog, Marynissa M. - Activity On Income Taxes For PartnershipsMarynissa CatibogNessuna valutazione finora

- How To Save Tax For Salary Above 20 LakhsDocumento12 pagineHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNessuna valutazione finora

- Dividend Tax CalculatorDocumento2 pagineDividend Tax Calculatornoonetwothreefour56Nessuna valutazione finora

- Tax Calculation for CorporationsDocumento5 pagineTax Calculation for CorporationsClaire BarbaNessuna valutazione finora

- Tax NotesDocumento2 pagineTax NotesHyeju SonNessuna valutazione finora

- Faq'S & Guidlines On Income TaxDocumento50 pagineFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNessuna valutazione finora

- Individual Income Tax May 2020Documento6 pagineIndividual Income Tax May 2020ziikerr99Nessuna valutazione finora

- Module 1 - Cherry Alfuerte - Train LawDocumento41 pagineModule 1 - Cherry Alfuerte - Train Lawgerry dacerNessuna valutazione finora

- 3DMC Income Tax Assignment 1Documento30 pagine3DMC Income Tax Assignment 1Sato TsuyoshiNessuna valutazione finora

- Model Solution: Page 1 of 6Documento6 pagineModel Solution: Page 1 of 6ShuvonathNessuna valutazione finora

- Income Tax Ready Reckoner PDFDocumento15 pagineIncome Tax Ready Reckoner PDFtushar sharmaNessuna valutazione finora

- Acc501 GDB 1 Sol Fall 2022Documento1 paginaAcc501 GDB 1 Sol Fall 2022Sth. Bilal BashirNessuna valutazione finora

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Documento4 pagineLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNessuna valutazione finora

- OSD and NOLCODocumento2 pagineOSD and NOLCOAccounting FilesNessuna valutazione finora

- Finacc 6 A3 1Documento4 pagineFinacc 6 A3 1200617Nessuna valutazione finora

- Tax Slabs: Ca. Dipayan DasDocumento4 pagineTax Slabs: Ca. Dipayan DasNoob GamerNessuna valutazione finora

- Traditional Theory Approach: Illustrations 1Documento7 pagineTraditional Theory Approach: Illustrations 1PRAMOD VNessuna valutazione finora

- November 6 - CorporationsDocumento2 pagineNovember 6 - CorporationsDarius DelacruzNessuna valutazione finora

- Effect of Tax Rate Changes on Deferred TaxesDocumento52 pagineEffect of Tax Rate Changes on Deferred TaxesMhamza KarachiNessuna valutazione finora

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocumento28 pagineTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNessuna valutazione finora

- Finals Exam SolutionsDocumento6 pagineFinals Exam SolutionsZhengzhou CalNessuna valutazione finora

- Tax HomeworkDocumento4 pagineTax HomeworkMatthew WittNessuna valutazione finora

- Individual Income TaxDocumento207 pagineIndividual Income TaxMarianeNessuna valutazione finora

- Income TaxesDocumento3 pagineIncome TaxesCENTENO, JOAN R.Nessuna valutazione finora

- To Do ListDocumento1 paginaTo Do Listmaruf048Nessuna valutazione finora

- To Do ListDocumento1 paginaTo Do Listmaruf048Nessuna valutazione finora

- To Do ListDocumento1 paginaTo Do Listmaruf048Nessuna valutazione finora

- This Is The Book Which Will Describe How To Choose Best Camera Out of So Many Camera Out ThereDocumento1 paginaThis Is The Book Which Will Describe How To Choose Best Camera Out of So Many Camera Out Theremaruf048Nessuna valutazione finora

- GE Transformer and Short Circuit CalculatorDocumento7 pagineGE Transformer and Short Circuit CalculatorZoran NesicNessuna valutazione finora

- Contactors and Starter RatingsDocumento34 pagineContactors and Starter RatingsMilan StefanovicNessuna valutazione finora

- MiCOM IDMT Curves CalculatorDocumento2 pagineMiCOM IDMT Curves CalculatorYigit SarıkayaNessuna valutazione finora

- To Do List: Priority DUE Date What WHO IN Progress DoneDocumento1 paginaTo Do List: Priority DUE Date What WHO IN Progress Donemaruf048Nessuna valutazione finora

- 1YHB00000001460 Motor Drive Control Unitmdc2 For Truck Motor Aux Voltage 48vdc For El and CL VDDocumento1 pagina1YHB00000001460 Motor Drive Control Unitmdc2 For Truck Motor Aux Voltage 48vdc For El and CL VDmaruf048Nessuna valutazione finora

- 1YHB00000001460 Motor Drive Control Unitmdc2 For Truck Motor Aux Voltage 48vdc For El and CL VD PDFDocumento1 pagina1YHB00000001460 Motor Drive Control Unitmdc2 For Truck Motor Aux Voltage 48vdc For El and CL VD PDFmaruf048Nessuna valutazione finora

- Ref601 Cei Um Sp1 1mdu07205-Yn EnfDocumento96 pagineRef601 Cei Um Sp1 1mdu07205-Yn Enfmaruf048Nessuna valutazione finora

- Comparison Between High Impedance and Low Impedance Bus Differential ProtectionDocumento15 pagineComparison Between High Impedance and Low Impedance Bus Differential Protectionmaruf048Nessuna valutazione finora

- Cheatsheet Googles Shortcuts PDFDocumento3 pagineCheatsheet Googles Shortcuts PDFmaruf048Nessuna valutazione finora

- L-04 (GDR) (Et) ( (Ee) Nptel)Documento12 pagineL-04 (GDR) (Et) ( (Ee) Nptel)alovingsightNessuna valutazione finora

- (Single+Three) Phase Induction Motors Interview Questions SetDocumento18 pagine(Single+Three) Phase Induction Motors Interview Questions SetrajshahieeeNessuna valutazione finora

- REF615 Standard ConfigurationDocumento11 pagineREF615 Standard Configurationmaruf048Nessuna valutazione finora

- CV FormatiDocumento3 pagineCV FormatixxnakuxxNessuna valutazione finora

- National Holidays 2014 RSC Transcom FoodsDocumento2 pagineNational Holidays 2014 RSC Transcom Foodsmaruf048Nessuna valutazione finora

- Understanding unbalanced loads in 3-phase systemsDocumento22 pagineUnderstanding unbalanced loads in 3-phase systemsmaruf048Nessuna valutazione finora

- Problem Solving On D C Machines PDFDocumento16 pagineProblem Solving On D C Machines PDFSelvaraj ParamasivanNessuna valutazione finora

- Word ArchitectureDocumento2 pagineWord Architecturemaruf048Nessuna valutazione finora

- Vocabagrams PDFDocumento1 paginaVocabagrams PDFmaruf048Nessuna valutazione finora

- DescriptionDocumento1 paginaDescriptionmaruf048Nessuna valutazione finora

- Mark Minervini - Master Trader Program 2022 Volume 1-241-281Documento41 pagineMark Minervini - Master Trader Program 2022 Volume 1-241-281thuong vuNessuna valutazione finora

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocumento7 pagineAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNessuna valutazione finora

- AGAG v. Alpha FinancingDocumento5 pagineAGAG v. Alpha Financinghermione_granger10Nessuna valutazione finora

- INTERNATIONAL ACCOUNTING FINAL TEST 2020Documento8 pagineINTERNATIONAL ACCOUNTING FINAL TEST 2020Faisel MohamedNessuna valutazione finora

- BatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Documento2 pagineBatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Gleizuly VaughnNessuna valutazione finora

- COA DBM JOINT CIRCULAR NO 1 S, 2022Documento7 pagineCOA DBM JOINT CIRCULAR NO 1 S, 2022AnnNessuna valutazione finora

- BC t?ng tr??ng User Internet Banking có g?n TK TGTT- Xu?t chi ti?tDocumento12 pagineBC t?ng tr??ng User Internet Banking có g?n TK TGTT- Xu?t chi ti?tMy TruongNessuna valutazione finora

- Cignal: Residential Service Application FormDocumento10 pagineCignal: Residential Service Application FormJUDGE MARLON JAY MONEVANessuna valutazione finora

- United States v. Walter Swiderski and Maritza de Los Santos, 548 F.2d 445, 2d Cir. (1977)Documento9 pagineUnited States v. Walter Swiderski and Maritza de Los Santos, 548 F.2d 445, 2d Cir. (1977)Scribd Government DocsNessuna valutazione finora

- 5.17.18 FIRST STEP ActDocumento28 pagine5.17.18 FIRST STEP ActSenator Cory BookerNessuna valutazione finora

- Safety Data Sheet: Zetpol 1020Documento8 pagineSafety Data Sheet: Zetpol 1020henrychtNessuna valutazione finora

- CHM580Documento7 pagineCHM580Azreen AnisNessuna valutazione finora

- Zoleta Vs SandiganbayanDocumento9 pagineZoleta Vs SandiganbayanMc Alaine Ligan100% (1)

- Constraint Manager User's Manual: Release PADS VX.2.7Documento228 pagineConstraint Manager User's Manual: Release PADS VX.2.7Mokorily PalmerstonNessuna valutazione finora

- Guidelines For The Writing of An M.Phil/Ph.D. ThesisDocumento2 pagineGuidelines For The Writing of An M.Phil/Ph.D. ThesisMuneer MemonNessuna valutazione finora

- Wrongful Detention Claim Over Missing Cows DismissedDocumento12 pagineWrongful Detention Claim Over Missing Cows DismissedA random humanNessuna valutazione finora

- GAISANO INC. v. INSURANCE CO. OF NORTH AMERICADocumento2 pagineGAISANO INC. v. INSURANCE CO. OF NORTH AMERICADum DumNessuna valutazione finora

- Wolters History of Philippine Taxation SystemDocumento28 pagineWolters History of Philippine Taxation SystemRonald FloresNessuna valutazione finora

- Case Study 1 StudDocumento11 pagineCase Study 1 StudLucNessuna valutazione finora

- Financial Accounting and Reporting: HTU CPA In-House Review (HCIR)Documento4 pagineFinancial Accounting and Reporting: HTU CPA In-House Review (HCIR)AnonymousNessuna valutazione finora

- Tutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisDocumento2 pagineTutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisClaire Anne BernardoNessuna valutazione finora

- Case StudyDocumento6 pagineCase StudyGreen Tree0% (1)

- 1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645Documento2 pagine1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645BaViNessuna valutazione finora

- Wa0008.Documento8 pagineWa0008.Md Mehedi hasan hasanNessuna valutazione finora