Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

19 ST Lukes Vs CIR

Caricato da

Anonymous MikI28PkJcTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

19 ST Lukes Vs CIR

Caricato da

Anonymous MikI28PkJcCopyright:

Formati disponibili

J.

Maboloc

Sec 22 to 30, Case 19. CIR vs. St. Luke’s Medical Center vs CIR G.R. No. 203514

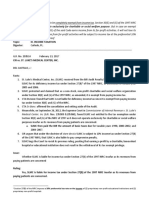

Facts: St. Luke’s Medical Center (SLMC) received an assessment from BIR for deficiency income

tax; Php 78,617.434.54 and Php 57,119,867.33 for taxable years 2005 and 2006 respectively.

SLMC filed with CIR an administrative protest with respect to the assessments because as a non-

stock, non-profit charitable and social welfare organization it is exempt from paying income tax

under Section 30(E) and (G) of the NIRC. SLMC received CIR’s final decision on the Disputed

Assessment increasing the deficiency income for the taxable year 2005 tax to Php 82,419,522.21

and for 2006 in the amount of Php 60,259,885.94. SLMC elevated the matter to the CTA to which

the latter ruled to their favor finding it is not liable for deficiency income tax. Such decision was

also affirmed by the CTA en banc. Hence, CIR filed a petition before the SC contending that the

CTA en banc erred in exempting SLMC from the payment of income tax. Pending resolution of

the petition, the SC rendered a decision in another case involving the same parties finding SLMC

not entitled to the tax exemption under Section 30(E) and (G) of the NIRC as it does not operate

exclusively for charitable or social welfare purposes insofar as its revenues from paying patients

are concerned.

Issue: Whether or not SLMC is exempt from paying income tax with respect to its revenues from

paying patients.

Ruling: No, SLMC is not exempt. Hence, it is liable for income tax under Section 27(B) of the

NIRC insofar as its revenues from paying patients are concerned because that said law does not

remove the income tax exemption of proprietary non-profit hospitals under Section 30(E) and (G).

The effect of the introduction of Section 27(B) is to subject the taxable income of two specific

institutions, namely proprietary non-profit educational institutions and proprietary non-profit

hospitals. The SC found that SLMC is a corporation that is not 'operated exclusively' for charitable

or social welfare purposes insofar as its revenues from paying patients are concerned. NIRC

requires that an institution be 'operated exclusively' for charitable or social welfare purposes to be

completely exempt from income tax, SLMC failed to meet this requirement. However, it remains

a proprietary non-profit hospital under Section 27(B) of the NIRC as long as it does not distribute

any of its profits to its members and such profits are reinvested pursuant to its corporate purposes.

In sum, for an institution to be completely exempt from income tax, Section 30(E) and (G) of the

1997 NIRC requires said institution to operate exclusively for charitable or social welfare purpose.

But in case an exempt institution under Section 30(E) or (G) of the said Code earns income from

its for-profit activities, it will not lose its tax exemption. However, its income from for-profit activities

will be subject to income tax at the preferential 10% rate pursuant to Section 27(B) thereof.

Potrebbero piacerti anche

- CIR vs. ST Lukes DigestDocumento2 pagineCIR vs. ST Lukes DigestKath Leen100% (4)

- CIR vs. St. Luke's Medical CenterDocumento2 pagineCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- St. Luke's Medical Center Tax CaseDocumento2 pagineSt. Luke's Medical Center Tax CaseEmmanuel Yrreverre100% (1)

- SC rules SLMC subject to 10% taxDocumento1 paginaSC rules SLMC subject to 10% taxVel June50% (2)

- FEZ Imports Exempt from VAT and Excise TaxDocumento1 paginaFEZ Imports Exempt from VAT and Excise TaxJosh CelajeNessuna valutazione finora

- Commissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Documento3 pagineCommissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Violet Parker100% (1)

- 1 Case Digest of Nursery Care Vs AcevedoDocumento2 pagine1 Case Digest of Nursery Care Vs AcevedoChrissy Sabella100% (2)

- CASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Documento2 pagineCASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Lyka Angelique Cisneros100% (2)

- CIR Vs The Estate of TodaDocumento3 pagineCIR Vs The Estate of TodaLDNessuna valutazione finora

- ING Banking vs. CIR (Digest)Documento2 pagineING Banking vs. CIR (Digest)Theodore Dolar100% (1)

- Villanueva V City of IloiloDocumento3 pagineVillanueva V City of IloiloPatricia Gonzaga100% (1)

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDocumento2 pagineDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusNessuna valutazione finora

- Pagcor V Bir Gr. No. 215427Documento1 paginaPagcor V Bir Gr. No. 215427Oro ChamberNessuna valutazione finora

- Pepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)Documento1 paginaPepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)AycNessuna valutazione finora

- CIR V Marubeni CorpDocumento2 pagineCIR V Marubeni CorpJaz Sumalinog75% (8)

- Tax exemptions apply for full tax yearDocumento1 paginaTax exemptions apply for full tax yearMark Anthony Javellana SicadNessuna valutazione finora

- 5 Case Digest Cir Vs Estate of TodaDocumento2 pagine5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- LRTA V Quezon CityDocumento4 pagineLRTA V Quezon CityShanica100% (1)

- Air Canada v. CIR DigestDocumento2 pagineAir Canada v. CIR Digestpinkblush717100% (3)

- CIR Vs General Foods DigestDocumento1 paginaCIR Vs General Foods DigestCJNessuna valutazione finora

- Herrera vs. Quezon City Board of Assessment AppealsDocumento1 paginaHerrera vs. Quezon City Board of Assessment AppealsGeoanne Battad Beringuela100% (3)

- CIR Vs de La SalleDocumento2 pagineCIR Vs de La SalleOlenFuerte100% (6)

- CIR v. Algue, Inc., G.R. No. L-28896Documento1 paginaCIR v. Algue, Inc., G.R. No. L-28896fay garneth buscato100% (2)

- Diaz Vs Secretary of FinanceDocumento3 pagineDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Domingo vs. GarlitosDocumento2 pagineDomingo vs. GarlitosMichelleNessuna valutazione finora

- CIR V CA, CTA, YMCADocumento2 pagineCIR V CA, CTA, YMCAChil Belgira100% (3)

- Used Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesDocumento2 pagineUsed Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesJasper Alon100% (2)

- Lung Center v. Quezon City DIGESTDocumento2 pagineLung Center v. Quezon City DIGESTJor LonzagaNessuna valutazione finora

- Lung Center VS Quezon CityDocumento4 pagineLung Center VS Quezon CityJesstonieCastañaresDamayoNessuna valutazione finora

- 35 GR 175772 Mitsubishi vs. CIRDocumento2 pagine35 GR 175772 Mitsubishi vs. CIRJoshua Erik Madria100% (1)

- Case Digest Cir vs. BoacDocumento1 paginaCase Digest Cir vs. BoacAnn SC100% (5)

- Creba v. Romulo Case DigestDocumento2 pagineCreba v. Romulo Case DigestApril Rose Villamor60% (5)

- Tax Refund Case Analysis for Toledo Power CompanyDocumento2 pagineTax Refund Case Analysis for Toledo Power CompanyClar Napa100% (1)

- Angeles Univ Foundation vs. City of AngelesDocumento2 pagineAngeles Univ Foundation vs. City of AngelesDave Jonathan Morente100% (2)

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestDocumento1 paginaCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroNessuna valutazione finora

- China Banking Corporation Vs CADocumento2 pagineChina Banking Corporation Vs CARahl SulitNessuna valutazione finora

- Banco de Oro Vs RepublicDocumento2 pagineBanco de Oro Vs RepublicDanica Faye100% (4)

- MERALCO V Province of LagunaDocumento2 pagineMERALCO V Province of LagunaJaz Sumalinog100% (1)

- Commissioner vs Isabela CulturalDocumento2 pagineCommissioner vs Isabela CulturalKim Lorenzo Calatrava100% (2)

- CIR vs. Filinvest Development Corp.Documento2 pagineCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- SUBA (Detailed) - Gutierrez v. CIRDocumento3 pagineSUBA (Detailed) - Gutierrez v. CIRPaul Joshua SubaNessuna valutazione finora

- American Bible Society Vs City of ManilaDocumento2 pagineAmerican Bible Society Vs City of ManilaTeacherEli100% (2)

- CBK Power Co LTD Vs CIRDocumento2 pagineCBK Power Co LTD Vs CIRIshNessuna valutazione finora

- Cs Garment, Inc. vs. Commissioner of Internal RevenueDocumento1 paginaCs Garment, Inc. vs. Commissioner of Internal RevenueKia Bi100% (1)

- ANPC v. BIR rules membership fees non-taxableDocumento2 pagineANPC v. BIR rules membership fees non-taxableDerek C. Egalla100% (2)

- G.R. No. L-53961Documento1 paginaG.R. No. L-53961Jannie Ann DayandayanNessuna valutazione finora

- CIR V Solidbank CorporationDocumento1 paginaCIR V Solidbank CorporationFrancis Ray Arbon FilipinasNessuna valutazione finora

- Pepsi-Cola v. TanauanDocumento2 paginePepsi-Cola v. TanauanIshNessuna valutazione finora

- (Digest) Obillos V CIRDocumento2 pagine(Digest) Obillos V CIRGR100% (3)

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Documento4 pagineCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- #33 CIR Vs British Overseas Airways CorporationDocumento2 pagine#33 CIR Vs British Overseas Airways CorporationTeacherEliNessuna valutazione finora

- Reyes v. AlmanzorDocumento5 pagineReyes v. AlmanzorPatricia BautistaNessuna valutazione finora

- G.R. No. L - 41383Documento2 pagineG.R. No. L - 41383siahky100% (2)

- RCPI vs. Provincial Assesor of South Cotabato (G.R. No. 144486. April 13, 2005) - H DIGESTDocumento1 paginaRCPI vs. Provincial Assesor of South Cotabato (G.R. No. 144486. April 13, 2005) - H DIGESTHarleneNessuna valutazione finora

- Eastern Telecommunications Phil Inc V CIR - DigestDocumento1 paginaEastern Telecommunications Phil Inc V CIR - DigestKate GaroNessuna valutazione finora

- Cir v. St. Luke's - BassigDocumento2 pagineCir v. St. Luke's - Bassigynahbassig100% (1)

- Case Title: BAR SUBJECT: TAX Tax Exemption For Charitable InstitutionsDocumento1 paginaCase Title: BAR SUBJECT: TAX Tax Exemption For Charitable InstitutionsRed HoodNessuna valutazione finora

- CIR vs. St. Luke's Medical Center (2017)Documento17 pagineCIR vs. St. Luke's Medical Center (2017)Phulagyn CañedoNessuna valutazione finora

- CIR V ST Lukes 1 and 2Documento4 pagineCIR V ST Lukes 1 and 2Jane CuizonNessuna valutazione finora

- CIR v. St. Luke's Medical CenterDocumento3 pagineCIR v. St. Luke's Medical CenterZandra LeighNessuna valutazione finora

- What Happens at The End of A Fixed Term ContractDocumento3 pagineWhat Happens at The End of A Fixed Term ContractAnonymous MikI28PkJcNessuna valutazione finora

- Tax DecDocumento2 pagineTax DecAnonymous MikI28PkJcNessuna valutazione finora

- 123456789ADRrr PDFDocumento27 pagine123456789ADRrr PDFSarang PalewarNessuna valutazione finora

- Know Your Rights: A Citizen's Primer On Law EnforcementDocumento50 pagineKnow Your Rights: A Citizen's Primer On Law EnforcementJoan AdvinculaNessuna valutazione finora

- ADR Law of 2004Documento8 pagineADR Law of 2004Anonymous MikI28PkJcNessuna valutazione finora

- Reckless Imprudence Rsulting To Multiple HomicideDocumento10 pagineReckless Imprudence Rsulting To Multiple HomicideAnonymous MikI28PkJcNessuna valutazione finora

- ADRDocumento1 paginaADRAnonymous MikI28PkJcNessuna valutazione finora

- Recto LAWDocumento1 paginaRecto LAWIman BundaNessuna valutazione finora

- Litigation OverviewDocumento9 pagineLitigation OverviewAnonymous MikI28PkJcNessuna valutazione finora

- ADR AlanGultiaDocumento1 paginaADR AlanGultiaAnonymous MikI28PkJcNessuna valutazione finora

- Cyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqDocumento4 pagineCyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqAnonymous MikI28PkJcNessuna valutazione finora

- QuotesDocumento1 paginaQuotesAnonymous MikI28PkJcNessuna valutazione finora

- Supreme Court of the Philippines rules on civil liability arising from crimesDocumento2 pagineSupreme Court of the Philippines rules on civil liability arising from crimesSherwin Anoba CabutijaNessuna valutazione finora

- Extend Martial LawDocumento3 pagineExtend Martial LawAnonymous MikI28PkJcNessuna valutazione finora

- Sarasola and Philippine Rabbit CaseDocumento2 pagineSarasola and Philippine Rabbit CaseMRose Serrano50% (2)

- Sarasola v. Trinidad, 40 Phil. 252Documento58 pagineSarasola v. Trinidad, 40 Phil. 252Anonymous MikI28PkJcNessuna valutazione finora

- Nestle CasesDocumento10 pagineNestle CasesAnonymous MikI28PkJcNessuna valutazione finora

- CommRev Notes For Corpo2Documento55 pagineCommRev Notes For Corpo2Anonymous MikI28PkJcNessuna valutazione finora

- WorldwidetaxvsterritorialDocumento2 pagineWorldwidetaxvsterritorialAnonymous MikI28PkJcNessuna valutazione finora

- RA 8504 AIDS Prevention and Control Act of 1998Documento10 pagineRA 8504 AIDS Prevention and Control Act of 1998Anonymous MikI28PkJcNessuna valutazione finora

- Revenue Regulations No 3-98Documento9 pagineRevenue Regulations No 3-98Anonymous MikI28PkJcNessuna valutazione finora

- White Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Documento2 pagineWhite Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Coyzz de Guzman100% (1)

- Stricter Anti-Carnapping LawDocumento3 pagineStricter Anti-Carnapping LawKen DG CNessuna valutazione finora

- ADR AlanGultiaDocumento1 paginaADR AlanGultiaAnonymous MikI28PkJcNessuna valutazione finora

- Estafa or BP 22Documento2 pagineEstafa or BP 22Anonymous MikI28PkJcNessuna valutazione finora

- Know Your Rights: A Citizen's Primer On Law EnforcementDocumento50 pagineKnow Your Rights: A Citizen's Primer On Law EnforcementJoan AdvinculaNessuna valutazione finora

- Chua V TorresDocumento4 pagineChua V TorresDhin CaragNessuna valutazione finora

- Yolanda Mercado Vs AMA, DigestDocumento1 paginaYolanda Mercado Vs AMA, DigestAlan Gultia100% (1)

- Extend Martial LawDocumento3 pagineExtend Martial LawAnonymous MikI28PkJcNessuna valutazione finora

- Stricter Anti-Carnapping LawDocumento3 pagineStricter Anti-Carnapping LawKen DG CNessuna valutazione finora

- Flight: Head To HeadDocumento68 pagineFlight: Head To HeadSaleh1fNessuna valutazione finora

- Mobitel Upahara PackageDocumento6 pagineMobitel Upahara PackageRantharu AttanayakeNessuna valutazione finora

- Cash Book: Cash Book Is A Book of Original Entry in WhichDocumento10 pagineCash Book: Cash Book Is A Book of Original Entry in WhichCT SunilkumarNessuna valutazione finora

- Audit Procedures For CashDocumento24 pagineAudit Procedures For CashGizel Baccay100% (1)

- Audit Committees ChecklistDocumento8 pagineAudit Committees ChecklistTarryn Jacinth NaickerNessuna valutazione finora

- S&P 1000 Index - Dividends and Implied Volatility Surfaces ParametersDocumento8 pagineS&P 1000 Index - Dividends and Implied Volatility Surfaces ParametersQ.M.S Advisors LLCNessuna valutazione finora

- PwC's Role in the Satyam ScamDocumento17 paginePwC's Role in the Satyam ScamAishwarya Baid100% (1)

- 2011-12 Semester Two Examination TimetableDocumento5 pagine2011-12 Semester Two Examination TimetableHugo QianNessuna valutazione finora

- Jamuna BankDocumento88 pagineJamuna BankMasood PervezNessuna valutazione finora

- Chapter 6 Risk and ReturnDocumento6 pagineChapter 6 Risk and Returnsheeraz_255650545Nessuna valutazione finora

- Offshore Shell Games 2014Documento56 pagineOffshore Shell Games 2014Global Financial IntegrityNessuna valutazione finora

- 5Cs Consolidaiton of Fragmented IndustriesDocumento20 pagine5Cs Consolidaiton of Fragmented Industriesxavier25100% (2)

- Challan FormDocumento1 paginaChallan FormAhmer KhanNessuna valutazione finora

- Invoice For Greg Chee Eng KiatDocumento328 pagineInvoice For Greg Chee Eng Kiathweemiem_kohNessuna valutazione finora

- Business Directories 2017Documento8 pagineBusiness Directories 2017Amjad ShareefNessuna valutazione finora

- Open Letter To Kuwait Capital Markets Authority From NEW GFH Re Leeds United and GFHDocumento3 pagineOpen Letter To Kuwait Capital Markets Authority From NEW GFH Re Leeds United and GFHNEWGFHNessuna valutazione finora

- RJR Nabisco LBODocumento14 pagineRJR Nabisco LBONazir Ahmad BahariNessuna valutazione finora

- Consulting Career PrimerDocumento19 pagineConsulting Career PrimerAsgar AliNessuna valutazione finora

- GDIC Performance EvaluationDocumento17 pagineGDIC Performance EvaluationZinnia khanNessuna valutazione finora

- The Changing Role of Managerial Accounting in A Global Business EnvironmentDocumento14 pagineThe Changing Role of Managerial Accounting in A Global Business EnvironmentNastia Putri PertiwiNessuna valutazione finora

- DICGCDocumento8 pagineDICGCsatur123Nessuna valutazione finora

- An Introduction To The Nielsen CompanyDocumento17 pagineAn Introduction To The Nielsen CompanysinghbabitaNessuna valutazione finora

- CV Philip Aarsman, Business LeaseDocumento5 pagineCV Philip Aarsman, Business LeaseOana GrosanuNessuna valutazione finora

- Catherine A. Rojo Commission # Notary Public - California Comm Exres Jun 26201 Los Angeles CountyDocumento3 pagineCatherine A. Rojo Commission # Notary Public - California Comm Exres Jun 26201 Los Angeles CountyChapter 11 DocketsNessuna valutazione finora

- Government Grants: Responsi UTS Akkeu 2Documento7 pagineGovernment Grants: Responsi UTS Akkeu 2Angel Valentine TirayoNessuna valutazione finora

- Business Forum: Lipstick Won't Help This Pig: Valerie GundersonDocumento3 pagineBusiness Forum: Lipstick Won't Help This Pig: Valerie GundersonValerie MartinNessuna valutazione finora

- RRB Exam Previous Year ModelDocumento3 pagineRRB Exam Previous Year ModelShijumon XavierNessuna valutazione finora

- SA220Documento22 pagineSA220Laura D'souza0% (1)

- SIA - Siklus Produksi Dan Buku BesarDocumento4 pagineSIA - Siklus Produksi Dan Buku BesarPutridyahNessuna valutazione finora

- Corpo (Law 106) Book 1 ReviewerDocumento106 pagineCorpo (Law 106) Book 1 ReviewerMil RamosNessuna valutazione finora