Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AutoPay Output Documents PDF

Caricato da

Anonymous QZuBG2IzsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AutoPay Output Documents PDF

Caricato da

Anonymous QZuBG2IzsCopyright:

Formati disponibili

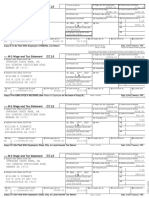

2017 W-2 and EARNINGS SUMMARY

Employee Reference Copy This blue Earnings Summary section is included with your W-2 to help describe portions in more detail.

Wage and Tax

W-2 Statement

Copy C for employee’s records.

2017

OMB No. 1545-0008

The reverse side includes general information that you may also find helpful.

1. The following information reflects your final 2017 pay stub plus any adjustments submitted by your employer.

d Control number Dept. Corp. Employer use only Gross Pay Social Security OR. State Income Tax

6076.20 352.74 174.18

014085 SEAT/AU0 000480 T 125 Tax Withheld Box 17 of W-2

c Employer’s name, address, and ZIP code Box 4 of W-2 SUI/SDI

APORT LLC Box 14 of W-2

Fed. Income 266.87 Medicare Tax 82.50

6233 NE 78TH COURT Tax Withheld Withheld

PORTLAND OR 97218 Box 2 of W-2 Box 6 of W-2

2. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch #01145

Wages, Tips, other Social Security Medicare OR. State Wages,

e/f Employee’s name, address, and ZIP code Compensation Wages Wages Tips, Etc.

Box 1 of W-2 Box 3 of W-2 Box 5 of W-2 Box 16 of W-2

SCOTT R SWAYZE

814 SE 178TH AVENUE Gross Pay 6,076.20 6,076.20 6,076.20 6,076.20

PORTLAND OR 97233 Less Other Cafe 125 386.88 386.88 386.88 386.88

Reported W-2 Wages 5,689.32 5,689.32 5,689.32 5,689.32

b Employer’s FED ID number a Employee’s SSA number

93-1157983 541-94-6949

1 Wages, tips, other comp. 2 Federal income tax withheld

5689.32 266.87

3 Social security wages 4 Social security tax withheld

5689.32 352.74

5 Medicare wages and tips 6 Medicare tax withheld

5689.32 82.50

7 Social security tips 8 Allocated tips

9 Verification Code 10 Dependent care benefits 3. Employee W-4 Profile. To change your Employee W-4 Profile Information, file a new W-4 with your payroll dept.

1568-5113-0af9-6f62

11 Nonqualified plans 12a See instructions for box 12

12b

DD 1240.20 SCOTT R SWAYZE Social Security Number:541-94-6949

14 Other 814 SE 178TH AVENUE Taxable Marital Status: SINGLE

12c

12d PORTLAND OR 97233 Exemptions/Allowances:

____________________

13 Stat emp. Ret. plan 3rd party sick pay FEDERAL: 3

STATE: 3

15 State Employer’s state ID no. 16 State wages, tips, etc.

OR 00818975-6 5689.32

17 State income tax 18 Local wages, tips, etc.

174.18

19 Local income tax 20 Locality name ¤ 2017 ADP, LLC

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

5689.32 266.87 5689.32 266.87 5689.32 266.87

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

5689.32 352.74 5689.32 352.74 5689.32 352.74

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

5689.32 82.50 5689.32 82.50 5689.32 82.50

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

014085 SEAT/AU0 000480 T 125 014085 SEAT/AU0 000480 T 125 014085 SEAT/AU0 000480 T 125

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

APORT LLC APORT LLC APORT LLC

6233 NE 78TH COURT 6233 NE 78TH COURT 6233 NE 78TH COURT

PORTLAND OR 97218 PORTLAND OR 97218 PORTLAND OR 97218

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

93-1157983 541-94-6949 93-1157983 541-94-6949 93-1157983 541-94-6949

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 Verification Code 10 Dependent care benefits 9 Verification Code 10 Dependent care benefits 9 Verification Code 10 Dependent care benefits

1568-5113-0af9-6f62

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

DD 1240.20 DD 1240.20 DD 1240.20

14 Other 12b 14 Other 12b 14 Other 12b

12c 12c 12c

12d 12d 12d

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

SCOTT R SWAYZE SCOTT R SWAYZE SCOTT R SWAYZE

814 SE 178TH AVENUE 814 SE 178TH AVENUE 814 SE 178TH AVENUE

PORTLAND OR 97233 PORTLAND OR 97233 PORTLAND OR 97233

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

OR 00818975-6 5689.32 OR 00818975-6 5689.32 OR 00818975-6 5689.32

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

174.18 174.18 174.18

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Federal Filing Copy OR.State Reference Copy OR.State Filing Copy

Wage and Tax Wage and Tax Wage and Tax

W-2 Statement

Copy B to be filed with employee’s

OMB

2017 No. 1545-0008

Federal Income Tax Return.

W-2 Statement 2017

OMB No. 1545-0008

Copy 2 to be filed with employee’s State Income Tax Return.

W-2 Statement OMB

2017

Copy 2 to be filed with employee’s State Income Tax Return.

No. 1545-0008

Instructions for Employee Box 12. The following list explains the codes shown in box 12. You P—Excludable moving expense reimbursements paid directly to

may need this information to complete your tax return. Elective employee (not included in boxes 1, 3, or 5)

Box 1. Enter this amount on the wages line of your tax return. deferrals (codes D, E, F, and S) and designated Roth contributions Q—Nontaxable combat pay. See the instructions for Form 1040 or

Box 2. Enter this amount on the federal income tax withheld line of (codes AA, BB, and EE) under all plans are generally limited to a total Form 1040A for details on reporting this amount.

your tax return. of $18,000 ($12,500 if you only have SIMPLE plans; $21,000 for R—Employer contributions to your Archer MSA. Report on Form 8853,

Box 5. You may be required to report this amount on Form 8959, section 403(b) plans if you qualify for the 15-year rule explained in Archer MSAs and Long-Term Care Insurance Contracts.

Additional Medicare Tax. See the Form 1040 instructions to Pub. 571). Deferrals under code G are limited to $18,000. Deferrals

under code H are limited to $7,000. S—Employee salary reduction contributions under a section 408(p)

determine if you are required to complete Form 8959. SIMPLE plan (not included in box 1)

Box 6. This amount includes the 1.45% Medicare Tax withheld on However, if you were at least age 50 in 2017, your employer may

have allowed an additional deferral of up to $6,000 ($3,000 for section T—Adoption benefits (not included in box 1). Complete Form 8839,

all Medicare wages and tips shown in box 5, as well as the 0.9% 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is Qualified Adoption Expenses, to compute any taxable and nontaxable

Additional Medicare Tax on any of those Medicare wages and tips not subject to the overall limit on elective deferrals. For code G, the amounts.

above $200,000. limit on elective deferrals may be higher for the last 3 years before you V—Income from exercise of nonstatutory stock option(s) (included in

Box 8. This amount is not included in boxes 1, 3, 5, or 7. For reach retirement age. Contact your plan administrator for more boxes 1, 3 (up to social security wage base), and 5). See Pub. 525,

information on how to report tips on your tax return, see your Form information. Amounts in excess of the overall elective deferral limit Taxable and Nontaxable Income, for reporting requirements.

1040 instructions. must be included in income. See the “Wages, Salaries, Tips, etc.” line W—Employer contributions (including amounts the employee elected

You must file Form 4137, Social Security and Medicare Tax on instructions for Form 1040. to contribute using a section 125 (cafeteria) plan) to your health

Unreported Tip Income, with your income tax return to report at Note: If a year follows code D through H, S, Y, AA, BB, or EE, you savings account. Report on Form 8889, Health Savings Accounts

least the allocated tip amount unless you can prove that you made a make-up pension contribution for a prior year(s) when you (HSAs).

received a smaller amount. If you have records that show the actual were in military service. To figure whether you made excess deferrals, Y—Deferrals under a section 409A nonqualified deferred

amount of tips you received, report that amount even if it is more or consider these amounts for the year shown, not the current year. If no compensation plan

less than the allocated tips. On Form 4137 you will calculate the year is shown, the contributions are for the current year. Z—Income under a nonqualified deferred compensation plan that fails

social security and Medicare tax owed on the allocated tips shown A—Uncollected social security or RRTA tax on tips. Include this tax on to satisfy section 409A. This amount is also included in box 1. It is

on your Form(s) W-2 that you must report as income and on other Form 1040. See “Other Taxes” in the Form 1040 instructions. subject to an additional 20% tax plus interest. See “Other Taxes” in

tips you did not report to your employer. By filing Form 4137, your B—Uncollected Medicare tax on tips. Include this tax on Form 1040. the Form 1040 instructions.

social security tips will be credited to your social security record See “Other Taxes” in the Form 1040 instructions. AA—Designated Roth contributions under a section 401(k) plan

(used to figure your benefits). C—Taxable cost of group-term life insurance over $50,000 (included in BB—Designated Roth contributions under a section 403(b) plan

Box 9. If you are e-filing and if there is a code in this box, enter it boxes 1, 3 (up to social security wage base), and 5) DD—Cost of employer-sponsored health coverage. The amount

when prompted by your software. This code assists the IRS in D—Elective deferrals to a section 401(k) cash or deferred arrangement. reported with Code DD is not taxable.

validating the W-2 data submitted with your return. The code is not Also includes deferrals under a SIMPLE retirement account that is part EE—Designated Roth contributions under a governmental section

entered on paper-filed returns. of a section 401(k) arrangement. 457(b) plan. This amount does not apply to contributions under a tax-

Box 10. This amount includes the total dependent care benefits that E—Elective deferrals under a section 403(b) salary reduction exempt organization section 457(b) plan.

your employer paid to you or incurred on your behalf (including agreement FF—Permitted benefits under a qualified small employer health

amounts from a section 125 (cafeteria) plan). Any amount over F—Elective deferrals under a section 408(k)(6) salary reduction SEP reimbursement arrangement

$5,000 is also included in box 1. Complete Form 2441, Child and G—Elective deferrals and employer contributions (including Box 13. If the “Retirement plan” box is checked, special limits may

Dependent Care Expenses, to compute any taxable and nontaxable nonelective deferrals) to a section 457(b) deferred compensation plan apply to the amount of traditional IRA contributions you may deduct.

amounts. H—Elective deferrals to a section 501(c)(18)(D) tax-exempt See Pub. 590-A, Contributions to Individual Retirement Arrangements

Box 11. This amount is (a) reported in box 1 if it is a distribution organization plan. See “Adjusted Gross Income” in the Form 1040 (IRAs).

made to you from a nonqualified deferred compensation or instructions for how to deduct. Box 14. Employers may use this box to report information such as

nongovernmental section 457(b) plan, or (b) included in box 3 J—Nontaxable sick pay (information only, not included in boxes 1, 3, state disability insurance taxes withheld, union dues, uniform

and/or 5 if it is a prior year deferral under a nonqualified or section or 5) payments, health insurance premiums deducted, nontaxable income,

457(b) plan that became taxable for social security and Medicare K—20% excise tax on excess golden parachute payments. See “Other educational assistance payments, or a member of the clergy's

taxes this year because there is no longer a substantial risk of Taxes” in the Form 1040 instructions. parsonage allowance and utilities. Railroad employers use this box to

forfeiture of your right to the deferred amount. This box shouldn’t report railroad retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax,

L—Substantiated employee business expense reimbursements Medicare tax and Additional Medicare Tax. Include tips reported by the

be used if you had a deferral and a distribution in the same (nontaxable)

calendar year. If you made a deferral and received a distribution employee to the employer in railroad retirement (RRTA) compensation.

in the same calendar year, and you are or will be age 62 by the M—Uncollected social security or RRTA tax on taxable cost of Note: Keep Copy C of Form W-2 for at least 3 years after the due date

end of the calendar year, your employer should file Form group-term life insurance over $50,000 (former employees only). See for filing your income tax return. However, to help protect your social

SSA-131, Employer Report of Special Wage Payments, with the “Other Taxes” in the Form 1040 instructions. security benefits, keep Copy C until you begin receiving social

Social Security Administration and give you a copy. N—Uncollected Medicare tax on taxable cost of group-term life security benefits, just in case there is a question about your work

insurance over $50,000 (former employees only). See “Other Taxes” in record and/or earnings in a particular year.

the Form 1040 instructions. Department of the Treasury - Internal Revenue Service

NOTE: THESE ARE SUBSTITUTE WAGE AND TAX STATEMENTS AND ARE ACCEPTABLE FOR FILING WITH YOUR FEDERAL, STATE AND LOCAL/CITY INCOME TAX RETURNS.

This information is being furnished to the Internal

Revenue Service. If you are required to file a tax Notice to Employee

return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and Do you have to file? Refer to the Form 1040 instructions

you fail to report it. to correct any name, SSN, or money amount error

to determine if you are required to file a tax return. Even if reported to the SSA on Form W-2. Be sure to get your

IMPORTANT NOTE: you don’t have to file a tax return, you may be eligible for a copies of Form W-2c from your employer for all

In order to insure efficient processing,

refund if box 2 shows an amount or if you are eligible for corrections made so you may file them with your tax

attach this W-2 to your tax return like this

any credit. return. If your name and SSN are correct but aren’t the

(following agency instructions): Earned income credit (EIC). You may be able to take the same as shown on your social security card, you should

EIC for 2017 if your adjusted gross income (AGI) is less ask for a new card that displays your correct name at any

than a certain amount. The amount of the credit is based SSA office or by calling 1-800-772-1213. You also may

on income and family size. Workers without children could visit the SSA at www.SSA.gov.

qualify for a smaller credit. You and any qualifying children Cost of employer-sponsored health coverage (if such

must have valid social security numbers (SSNs). You can’t cost is provided by the employer). The reporting in box

take the EIC if your investment income is more than the 12, using code DD, of the cost of employer-sponsored

TAX RETURN specified amount for 2017 or if income is earned for health coverage is for your information only. The amount

services provided while you were an inmate at a penal reported with code DD is not taxable.

institution. For 2017 income limits and more information, Credit for excess taxes. If you had more than one

visit www.irs.gov/eitc. Also see Pub. 596, Earned Income employer in 2017 and more than $7,886.40 in social

THIS Credit. Any EIC that is more than your tax liability is security and/or Tier 1 railroad retirement (RRTA) taxes

OTHER

FORM refunded to you, but only if you file a tax return. were withheld, you may be able to claim a credit for the

W-2’S

W-2 Clergy and religious workers. If you aren’t subject to excess against your federal income tax. If you had more

social security and Medicare taxes, see Pub. 517, Social than one railroad employer and more than $4,630.50 in

Security and Other Information for Members of the Clergy Tier 2 RRTA tax was withheld, you also may be able to

and Religious Workers. claim a credit. See your Form 1040 or Form 1040A

Corrections. If your name, SSN, or address is incorrect, instructions and Pub. 505, Tax Withholding and

correct Copies B, C, and 2 and ask your employer to Estimated Tax.

correct your employment record. Be sure to ask the

employer to file Form W-2c, Corrected Wage and Tax

Statement, with the Social Security Administration (SSA)

Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service

Potrebbero piacerti anche

- 2014 TaxReturnDocumento25 pagine2014 TaxReturnNguyen Vu CongNessuna valutazione finora

- W21225760934 0 PDFDocumento2 pagineW21225760934 0 PDFAnonymous czHLQeLPB4Nessuna valutazione finora

- 2018 W-2 and Earnings SummaryDocumento2 pagine2018 W-2 and Earnings SummaryAdam Olsen100% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Documento2 pagineSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNessuna valutazione finora

- U.S. Individual Income Tax Return: Popescu 879-47-5788 MariusDocumento8 pagineU.S. Individual Income Tax Return: Popescu 879-47-5788 MariusMarius Popescu0% (1)

- 2019 W-2 and Earnings SummaryDocumento1 pagina2019 W-2 and Earnings SummaryGeorge LucasNessuna valutazione finora

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Documento2 pagineJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Selection 26 144Documento1 paginaSelection 26 144Anonymous fu1jUQNessuna valutazione finora

- 2018 Coleman Tax Return PDFDocumento46 pagine2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- TranscriptDocumento6 pagineTranscriptjohn doeNessuna valutazione finora

- MH0ihh081h6754910230616041100202 PDFDocumento2 pagineMH0ihh081h6754910230616041100202 PDFLogan GoadNessuna valutazione finora

- Dennis w2Documento5 pagineDennis w2Dennis GieselmanNessuna valutazione finora

- 2016 W-2 and EARNINGS SUMMARYDocumento2 pagine2016 W-2 and EARNINGS SUMMARYaccount.enquiry6770Nessuna valutazione finora

- Printw2 PDFDocumento1 paginaPrintw2 PDFJhhghiNessuna valutazione finora

- Dan Simon 2016 W2 PDFDocumento2 pagineDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNessuna valutazione finora

- W2 FinalDocumento1 paginaW2 FinalWaqar Hussain100% (1)

- OMB No. 1545-0008 OMB No. 1545-0008Documento2 pagineOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocumento10 pagineFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyNessuna valutazione finora

- PDF W2Documento1 paginaPDF W2John LittlefairNessuna valutazione finora

- Adriano Alessandro Averzano 2019 Tax ReturnDocumento21 pagineAdriano Alessandro Averzano 2019 Tax ReturnMucho FacerapeNessuna valutazione finora

- 2018 Turbo Tax ReturnDocumento5 pagine2018 Turbo Tax ReturnAnfacNessuna valutazione finora

- 2021 W-2 Earnings SummaryDocumento2 pagine2021 W-2 Earnings Summaryseguins0% (1)

- Ioana w2 PDFDocumento1 paginaIoana w2 PDFBlueberry13KissesNessuna valutazione finora

- StubsDocumento2 pagineStubsAnonymous 8C2bCutL0100% (2)

- Filename PDFDocumento3 pagineFilename PDFIvette PizarroNessuna valutazione finora

- W-2 Form DetailsDocumento6 pagineW-2 Form Detailsjacqueline corral0% (1)

- 20 TR 08894502584200889450Documento2 pagine20 TR 08894502584200889450Josh JasperNessuna valutazione finora

- File Your 2019 Federal Tax Return by April 15Documento7 pagineFile Your 2019 Federal Tax Return by April 15Kevin Osorio100% (2)

- Evans W-2sDocumento2 pagineEvans W-2sAlmaNessuna valutazione finora

- W 2Documento3 pagineW 2Bar ChenNessuna valutazione finora

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocumento11 pagineElectronic Filing Instructions For Your 2019 Federal Tax ReturnCoughman Matt67% (3)

- TaxReturn PDFDocumento7 pagineTaxReturn PDFChristine WillisNessuna valutazione finora

- Tax FormsDocumento2 pagineTax Formswilliam schwartz50% (2)

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocumento2 pagine0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNessuna valutazione finora

- Tax 2020 PDFDocumento7 pagineTax 2020 PDFAshley Morales100% (4)

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocumento6 pagineElectronic Filing Instructions For Your 2019 Federal Tax ReturnSindy Cruz100% (1)

- Wage and Tax StatementDocumento6 pagineWage and Tax StatementNick RubleNessuna valutazione finora

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocumento2 pagineW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- How to File Your 2020 W-2 FormDocumento5 pagineHow to File Your 2020 W-2 FormVincent NewsonNessuna valutazione finora

- AutoPay Output Documents PDFDocumento2 pagineAutoPay Output Documents PDFAnonymous QZuBG2IzsNessuna valutazione finora

- 2018 TaxReturn PDFDocumento6 pagine2018 TaxReturn PDFDavid LeeNessuna valutazione finora

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Documento2 pagineMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNessuna valutazione finora

- 2018 TaxReturn PDFDocumento139 pagine2018 TaxReturn PDFGregory GoodNessuna valutazione finora

- Elina Shinkar w2 2014Documento2 pagineElina Shinkar w2 2014api-318948819Nessuna valutazione finora

- FTF 2019-05-02 1556819863569 PDFDocumento5 pagineFTF 2019-05-02 1556819863569 PDFWilliam Davis0% (1)

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocumento2 pagineU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- 9YWwhh55h5384810244629010109102 PDFDocumento2 pagine9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- 9YWwhh55h5384810244629010109102 PDFDocumento2 pagine9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- W-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsDocumento2 pagineW-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsRebecca AtesNessuna valutazione finora

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIDocumento3 pagineU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduNessuna valutazione finora

- File Your 2016 Taxes ElectronicallyDocumento10 pagineFile Your 2016 Taxes ElectronicallybrynsteinNessuna valutazione finora

- I Pay Statements ServncoDocumento2 pagineI Pay Statements ServncoPablito Padilla100% (2)

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Documento2 pagineSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNessuna valutazione finora

- Rangel Taxes 2019Documento38 pagineRangel Taxes 2019Josue Perez VelezNessuna valutazione finora

- HERBERT HERNANDEZ 2019 Tax Return PDFDocumento31 pagineHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- Marie Aladin 2019 Tax PDFDocumento60 pagineMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- 2020 Tax Return: Prepared ByDocumento5 pagine2020 Tax Return: Prepared ByAdam MasonNessuna valutazione finora

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDocumento6 pagineDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- Consent To Disclose Your Information For The Credit Karma OfferDocumento4 pagineConsent To Disclose Your Information For The Credit Karma OfferDonald PetersonNessuna valutazione finora

- 120s Az FormDocumento19 pagine120s Az FormStacey CanaleNessuna valutazione finora

- DDDDDocumento21 pagineDDDDRed Rapture67% (3)

- 2019 Louisiana Resident - 2DDocumento4 pagine2019 Louisiana Resident - 2Djamo christine100% (1)

- Downloadfile 30 PDFDocumento114 pagineDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Boost Employee Morale at Waterway IndustriesDocumento5 pagineBoost Employee Morale at Waterway IndustriesReg Lagarteja100% (1)

- TAXES w2 REGAL HospitalityDocumento2 pagineTAXES w2 REGAL Hospitalityoskar_herrera2012Nessuna valutazione finora

- FY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFDocumento16 pagineFY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFTony MorganNessuna valutazione finora

- Your Benefit Statement Tax Year 2019Documento2 pagineYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- Dependent Student SheetDocumento4 pagineDependent Student SheetMaria GomezNessuna valutazione finora

- Exhibit A PRA 06-30-17Documento26 pagineExhibit A PRA 06-30-17L. A. PatersonNessuna valutazione finora

- IRS Code 6055 & 6056 New Filing Under HCRDocumento3 pagineIRS Code 6055 & 6056 New Filing Under HCRAutomotive Wholesalers Association of New EnglandNessuna valutazione finora

- SolutionsDocumento23 pagineSolutionsapi-3817072Nessuna valutazione finora

- Abdul Rahim Abdul Wahab - Employee Benefits - Saudi EOSB - Actuarial Val - IAS19 - 13 Dec 2016 - SendDocumento98 pagineAbdul Rahim Abdul Wahab - Employee Benefits - Saudi EOSB - Actuarial Val - IAS19 - 13 Dec 2016 - SendSadiq1981Nessuna valutazione finora

- C H A P T E R: Gross Income: ExclusionsDocumento32 pagineC H A P T E R: Gross Income: Exclusionsdragon67Nessuna valutazione finora

- Vax 92Documento264 pagineVax 92dyfhgfxjNessuna valutazione finora

- Fringe Benefit FSLGDocumento92 pagineFringe Benefit FSLGkashfrNessuna valutazione finora

- Premium Only Plan (POP) SummaryDocumento5 paginePremium Only Plan (POP) SummaryseanNessuna valutazione finora

- Heroes Act SummaryDocumento71 pagineHeroes Act SummaryFedSmith Inc.100% (2)

- Chap 012Documento36 pagineChap 012Shailesh VishvakarmaNessuna valutazione finora

- Citi PlansDocumento312 pagineCiti PlansFireNessuna valutazione finora

- US Internal Revenue Service: Irb07-39Documento72 pagineUS Internal Revenue Service: Irb07-39IRSNessuna valutazione finora

- Bridgeport City Supervisors Association ContractDocumento50 pagineBridgeport City Supervisors Association ContractBridgeportCTNessuna valutazione finora

- Income SourcesDocumento6 pagineIncome SourcesCatalina GrigoreNessuna valutazione finora

- KIPP DC Employee HandbookDocumento52 pagineKIPP DC Employee HandbookIshmael OneyaNessuna valutazione finora

- Fit Chap012Documento53 pagineFit Chap012biomed12Nessuna valutazione finora

- La Pryor Isd 2019-2020 Handbook ApprovedDocumento54 pagineLa Pryor Isd 2019-2020 Handbook ApprovedMDSBACK UPFILESNessuna valutazione finora

- Concepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1Documento73 pagineConcepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1hiedi100% (34)

- Benefits Summary YahDocumento3 pagineBenefits Summary YahJohn NixonNessuna valutazione finora

- 60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSDocumento4 pagine60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSFedSmith Inc.100% (1)

- 403SavingPlans PDFDocumento20 pagine403SavingPlans PDFEscalation ACN WhirlpoolNessuna valutazione finora