Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LT Emerging Businesses Fund

Caricato da

FjjdCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LT Emerging Businesses Fund

Caricato da

FjjdCopyright:

Formati disponibili

Multicap

Smallcap Fund

fund

Ride the next wave

of opportunity

Invest in L&T Emerging Businesses Fund

call 1800 2000 400

www.ltfs.com

An open-ended equity scheme with focus on investing in small cap stocks.

Historically, small cap companies have outperformed other segments of the market cap in the long term, paving

the way for tremendous growth potential for investors. It is a well known fact that while large cap companies

are extensively researched, small cap stocks are under researched and under owned. Small cap stocks often

present an attractive opportunity in terms of performance from a medium term perspective.

What are Emerging Businesses?

Emerging businesses are relatively small size companies with the potential to grow at a much faster rate than established businesses. They

represent the entrepreneurial economy, typically falling into one of the following categories:

• Companies in evolving industries

• Smaller players in a large industry catering to niche segments

• Smaller players looking to acquire share of unorganized players in a large industry

Why invest in L&T Emerging Businesses Fund?

What if you had the chance to invest in an IT company when it was a fledgling and has now become a big name globally? Take the

example of Infosys, once an emerging business, built around a scalable opportunity with strong leadership, good governance and strong

balance sheet, today it has rewarded its investors handsomely.

Small cap stocks have a higher potential for growth in the long run. L&T Emerging Businesses Fund invests in smaller size businesses in

their early stage of development. These businesses have huge growth potential in revenue and profits as compared to broader market

with relatively higher risk.

Key Benefits

Invests in evolving Invests in businesses Ability to turn emerging

smaller players that are catering to niche businesses into opportunities

a part of larger industry segments to be the next success story

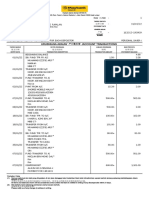

Scheme Performance vs. benchmarks (as on June 29, 2018)

(Regular Plan) CAGR returns % (period) Since inception

1 year 3 years 5 years Date of CAGR PTP Returns*

inception of Returns (%) (in Rs.)

the Scheme

L&T Emerging Businesses Fund 8.75% 22.32% NA 12/05/14 25.59% 25,647.00

S&P BSE Small Cap TRI 4.75% 14.03% NA 20.71% 21,776.51

S&P BSE SENSEX TRI^ 16.21% 9.90% NA 12.04% 15,997.56

Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized. Dividends are assumed to be reinvested and bonus

is adjusted. Load is not taken into consideration. Benchmark: S&P BSE Small Cap TRI.

Portfolio Positioning

Sectors Consumer Consumer Energy Financials Health Care Industrials Information Materials Telecom Utilities Real

Discretionary Staples Technology Services Estate

Marketcap

Top 100

stocks

Next 150 6.1 1.9

3.5 6.0 2.2 7.0

stocks

Next 250

17.6 0.7 6.9 3.2 17.8 17.4 0.2 1.4

stocks

Sectors Weight in Weight in Fund Facts

Scheme (%) benchmark (%)

Minimum Application Amount

Materials 24.4 17.9 Lump sum: Initial investment: Rs.5,000 per application

Industrials 23.8 20.4 Additional investment: Rs.1,000 per application

Consumer Discretionary 21.0 19.9 SIP: Rs.500 (minimum 6 monthly installments or minimum 4 quarterly

installments)

Financials 12.9 12.9

Asset Allocation

Health Care 5.4 6.2

65% - 100% in equity and equity-related securities1 (including Indian

Telecommunication Services 2.1 1.0 and foreign equity securities as permitted by SEBI/RBI)

Real Estate 1.4 3.1 0% - 35% in debt and money market instruments

Energy 0.7 1.2 Load

Consumer Staples 0.0 4.9 Entry Load: Nil; Exit Load: 1% if redeemed within 1 year

Information Technology 0.0 6.3 Fund Manager

Mr. S. N. Lahiri and Mr. Karan Desai (for investments in foreign

Utilities 0.0 2.8 securities)

Source: Bloomberg, ICRA MFIE, Internal. Data as on June 29, 2018 Benchmark: S&P BSE Small Cap TRI Index. 165% of total assets in

small cap stocks.

Vide our Notice Cum Addendum dated November 27, 2017, the daily

investment limit via Lump sum, SIP, STP and Switch-ins is capped to

Rs.2 lakhs for L&T Emerging Businesses Fund.

Funds managed by Mr. Karan Desai

Funds managed by Mr. S. N. Lahiri (for investments in foreign securities)

CAGR Returns (%) CAGR Returns (%)

3 year 3 year

Top 3 performing funds Top 3 performing funds

L&T Emerging Businesses Fund - Regular Plan (G) 22.32% L&T India Value Fund - Regular Plan (G) 13.38%

L&T Midcap Fund - Regular Plan (G) 16.32% L&T Business Cycles Fund - Regular Plan (G) 7.79%

L&T Infrastructure Fund - Regular Plan (G) 13.77% L&T India Large Cap Fund - Regular Plan (G) 7.24%

Bottom 3 Funds Bottom 3 Funds

L&T Hybrid Equity Fund - Regular Plan (G) 10.46% L&T Equity Savings Fund - Regular Plan (G) 6.32%

L&T Equity Fund - Regular Plan (G) 9.49% L&T Conservative Hybrid Fund - Regular Plan (G) 6.18%

L&T Dynamic Equity Fund - Regular Plan (G) 4.89% L&T Arbitrage Opportunities Fund - Regular Plan (G) 6.17%

call 1800 2000 400

www.ltfs.com

Follow us on Riskometer

tely Moderate Mo

d

era Higerate

od Low h

M

ly

This product is suitable for investors who are seeking*

• Long-term capital appreciation and generation of reasonable returns.

High

• Investment predominantly in equity and equity-related securities, including

Low

equity derivatives in Indian markets with key theme focus being emerging

companies (small cap stocks); and foreign securities

LOW HIGH

*Investors should consult their financial advisers if in doubt

about whether the product is suitable for them. Investors understand that their principal will be at moderately high risk

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. CL05733

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Bill Poulos - Quantum Swing TraderDocumento124 pagineBill Poulos - Quantum Swing Traderbruce1976@hotmail.com100% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grifols SA: Scranton and The Undisclosed DebtsDocumento65 pagineGrifols SA: Scranton and The Undisclosed Debtsgothamcityresearch88% (25)

- Investment FundamentalsDocumento16 pagineInvestment FundamentalsJay-Jay N. ImperialNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Cfa Ques AnswerDocumento542 pagineCfa Ques AnswerAbid Waheed100% (4)

- CK Ee Ebook (Trend Trading Made Easy)Documento58 pagineCK Ee Ebook (Trend Trading Made Easy)SBNessuna valutazione finora

- Ass 9Documento7 pagineAss 9Vũ Hoàng DiệuNessuna valutazione finora

- CH 14Documento42 pagineCH 14Mohamed AdelNessuna valutazione finora

- Who Are India's Best Equity Investors Who Invest For Themselves - QuoraDocumento3 pagineWho Are India's Best Equity Investors Who Invest For Themselves - QuoraHemjeet BhatiaNessuna valutazione finora

- VCMethod PDFDocumento10 pagineVCMethod PDFMichel KropfNessuna valutazione finora

- FCB Records Summarized 20-22Documento8 pagineFCB Records Summarized 20-22Eric HopkinsNessuna valutazione finora

- Flatbush Shipyards English Week 5Documento6 pagineFlatbush Shipyards English Week 5Rennya Lily KharismaNessuna valutazione finora

- Volume CyclicalityDocumento15 pagineVolume CyclicalityRajeshNessuna valutazione finora

- PR Academy Financial Ratio Analysis GuideDocumento22 paginePR Academy Financial Ratio Analysis GuideMadesh KuppuswamyNessuna valutazione finora

- Financial Accounting-I Sem-1 (GU-DEC-2014)Documento12 pagineFinancial Accounting-I Sem-1 (GU-DEC-2014)Ekta RanaNessuna valutazione finora

- Economic Analysis Chapter 5Documento32 pagineEconomic Analysis Chapter 5School BackupNessuna valutazione finora

- New Generation Biofuels: NGBF: Financially Strapped But Still Moving ForwardDocumento7 pagineNew Generation Biofuels: NGBF: Financially Strapped But Still Moving ForwardMarkpactNessuna valutazione finora

- Prancer Construction AnswerDocumento3 paginePrancer Construction AnswerAayush ThapaNessuna valutazione finora

- Title IX Merger and ConsolidationDocumento3 pagineTitle IX Merger and ConsolidationJave MagsaNessuna valutazione finora

- Conceptual Framework and Accounting StandardsDocumento4 pagineConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNessuna valutazione finora

- Direct Tax Summary For Ay 2023-24Documento39 pagineDirect Tax Summary For Ay 2023-24CA PASSNessuna valutazione finora

- Icfai File Merge1Documento108 pagineIcfai File Merge1satyavaniNessuna valutazione finora

- FASB 144 Impairment of AssetsDocumento9 pagineFASB 144 Impairment of AssetsPriyadarshi BhaskarNessuna valutazione finora

- S&P500 Handbook SheetDocumento2 pagineS&P500 Handbook SheetRavi Swaminathan0% (1)

- XA Risk Reward RatioDocumento4 pagineXA Risk Reward Ratiocarlos.ernesto.aa2023Nessuna valutazione finora

- Case 06 Financial Detective 2016 F1763XDocumento6 pagineCase 06 Financial Detective 2016 F1763XJosie KomiNessuna valutazione finora

- Split 162013 190909 - 20220331Documento5 pagineSplit 162013 190909 - 20220331NUR FASIHAH BINTINessuna valutazione finora

- First Magnus: Too Big To FailDocumento3 pagineFirst Magnus: Too Big To FailRoy WardenNessuna valutazione finora

- Value InvestingDocumento10 pagineValue InvestingAtul Divya SodhiNessuna valutazione finora

- Final ExamDocumento6 pagineFinal ExamOnat PNessuna valutazione finora

- RiskDocumento10 pagineRiskSanath FernandoNessuna valutazione finora