Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

) PV (Fvif I) PV (1 FV N I I I IP: Inv. Turnover Sales/Inventories DSO Receivables/Avg. Sales Per Day

Caricato da

Ricky ImandaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

) PV (Fvif I) PV (1 FV N I I I IP: Inv. Turnover Sales/Inventories DSO Receivables/Avg. Sales Per Day

Caricato da

Ricky ImandaCopyright:

Formati disponibili

RANGKUMAN INTRODUCTION FINANCIAL MANAGEMENT

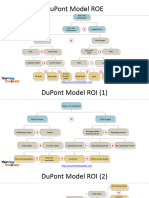

Nama : Ricky Imanda Nim : 42E17022 Profit Total assets

ROE margin turnover

Equity

multiplier

ROE (NI/Sales) (Sales/TA) (TA/Equity )

Depr. and Capital Operating

margin = EBIT/Sales (Current assets Inventories )

FCF EBIT(1 T) NOWC Quick ratio

AT operating income = EBIT(1 – Tax rate) amortizati on expenditur es EVA = = $492.6/$7,036 = 7.0%

Current liabilities

Profit margin = Net income/Sales Operating margin = EBIT/Sales

Current Current Notes Inv. turnover = Sales/Inventories DSO= Receivables/Avg.

= $253.6/$7,036 =sales

3.6% per day = $492.6/$7,036 = 7.0%

NOWC Current assets

assets liabilitie s payable Current ratio Profit margin = Net income/Sales

Current liabilities Basic earning power = EBIT/Total assets

Operating margin= = EBIT/Sales= 14.1%

$492.6/$3,497 = $253.6/$7,036 = 3.6%

> FA turnover =debt/Total

= Sales/Net fixed assets > TA turnover= Sales/Total assets >Debt ratio= Total $492.6/$7,036 = 7.0% = EBIT/Interest charges

assets >TIE

Basic earning power = EBIT/Total assets

> ROA = Net income/Total assets > ROE= Net income/Total common equity >P/E = Price/Earnings per share > M/B = Market price/Book value per= share

= $492.6/$3,497 14.1%

Profit margin = Net income/Sales

Value =

FCF1

FCF2

...

FCF r r *=3.6%

= $253.6/$7,036 IP DRP LP MRP

bill r RF r * IP

( 1 WACC ) ( 1 WACC )2

( 1 WACC )Basic earning power rTassets

= EBIT/Total

FVn PV(1 i) n PV(FVIFi,n ) = $492.6/$3,497 = 14.1%

I I ... I n

IPn 1 2

1 n

PV0 FVn FV(1 i) -n FV(PVIFi,n )

(1 i) n i

m

EAR 1 nom 1

(1 i) n 1 m

FVA n PMT PMT (FVIFA i,n ) mn

i i PV

PMT

FVn PV1 nom

FVAD n FVA n (1 i) PMT (FVIFA i,n ) (1 i) m i

1 (1 i) -n ROIC

NOPAT

PVA 0 PMT PMT (PVIFA i,n )

i Operatingcapital

PVAD 0 PVA 0 PMT (PVIFA i,n ) (1 i) n

r̂ Pi ri

n

i 1

( r ˆr ) P

i 1

i

2

i

t

1

CFt PVIFi ,t

n n

PV CFt n

t 1 1 i t 1 ( r t r Avg )2

t 1 CV

ˆr

FV CFt 1 i CFt FVIFi ,t

n 1

n n

t

n

t 1 t 1

ˆrP w iˆri = w AˆrA ( 1 w A )ˆrB

NOWC = OCA – OCL NOWC = C + AR + IN – AP – ACRU i 1

n

NOPAT = EBIT (1-T)

Cov( AB ) ( rAi ˆrA )( rBi ˆrB )Pi

FCF = NOPAT + Depreciation – Gross investment in operating capital t 1

MVA = Market stock + market value of debt – total capita = S Price x S shares – Tot Capt Cov AB n

EVA = EBIT(1-T) – NOWC*WACC = (Operating capital)(ROIC – WACC)= AB P w ii

AB i 1

r ˆrp Pi = w ( 1 w A ) 2w A ( 1 w A ) AB A B

n

2 2 2 2

p

2

A A B Cov( ri , rM ) i

iM

pi

i1 bi

N

INT M 1 ( 1 rd ) N M

2M M

VB INT

t 1 ( 1 r ) t

( 1 r ) N

r ( 1 rd )N ˆr r D

d d d

ˆrp rRF M RF p rps ps

M

2N

INT 2 M

VB

N

VB

INT

Call price Vps

t 1 ( 1 rd 2 ) ( 1 rd 2 ) t 1 (1 rd ) (1 rd ) N

t 2N t

ri rRF (rM rRF )i rRF RPM i

ˆ D1 D 0 (1 g)

Dt

P̂0 P D

Vps ps D

rs rRF (RPM )Firm ˆrS 1 g

t 0

t 1 (1 rs ) rs g rs g rps

P0

D N1

ˆ D1

ˆ D1 D2 DN r g re g

P ... s N P0 (1 F )

0

1 rs 1 rs

1 2

1 rs N 1 rs WACC = wdrd(1-T) + wpsrps + wce*rs

n

CFt

Paybacks Yearbeforefullrecov ery

Unrecov ered costatstartofyear NPV CF0

t 1 (1 r )t

Cashflowduringyear

EBIT NI

BEP ROA

TA TA

Potrebbero piacerti anche

- FA Assignment 6Documento2 pagineFA Assignment 6Sidhant ThakurNessuna valutazione finora

- Cheating Sheet IFMDocumento2 pagineCheating Sheet IFManggittutpinilihNessuna valutazione finora

- Attock Cement Ratio Analysis 2019 by RizwanDocumento8 pagineAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNessuna valutazione finora

- Ringkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Documento14 pagineRingkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Anna KholibbiyahNessuna valutazione finora

- Formula Sheet-FinalDocumento3 pagineFormula Sheet-FinalSales ExecutiveNessuna valutazione finora

- Assignment 1 - Financial Statement Analysis: Assets 2012Documento4 pagineAssignment 1 - Financial Statement Analysis: Assets 2012kartika tamara maharaniNessuna valutazione finora

- Formula SheetDocumento1 paginaFormula SheetNikhil TodiNessuna valutazione finora

- Financial AnalysisDocumento2 pagineFinancial AnalysisdavewagNessuna valutazione finora

- Du Pont Chart: Multiplied byDocumento9 pagineDu Pont Chart: Multiplied bymedhaNessuna valutazione finora

- FSA Part2Documento19 pagineFSA Part2trangNessuna valutazione finora

- Ratio Formulae Sheet - Feb 2022 Ver 5.0Documento1 paginaRatio Formulae Sheet - Feb 2022 Ver 5.0Needhi NagwekarNessuna valutazione finora

- Formula Sheet-FinalDocumento3 pagineFormula Sheet-FinalMuhammad MussayabNessuna valutazione finora

- Ratio Analysis TemplateDocumento5 pagineRatio Analysis TemplateAdil AliNessuna valutazione finora

- Financial Ratios For Topp TilesDocumento30 pagineFinancial Ratios For Topp TilesAyaz AhmadNessuna valutazione finora

- Financial Analysis Cheat Sheet: by ViaDocumento2 pagineFinancial Analysis Cheat Sheet: by Viaheehan6Nessuna valutazione finora

- Comm 203 Final SheetDocumento3 pagineComm 203 Final SheetReagan MartinNessuna valutazione finora

- Book 1Documento4 pagineBook 1pjdevicenteNessuna valutazione finora

- BUSFIN FinancialRatios PDFDocumento6 pagineBUSFIN FinancialRatios PDFTermin CheeseNessuna valutazione finora

- Profitability Liquidity RatiosDocumento10 pagineProfitability Liquidity RatiosPaola EsguerraNessuna valutazione finora

- This Study Resource Was: Assignment #2 Problem # 4-1Documento6 pagineThis Study Resource Was: Assignment #2 Problem # 4-1Viren DeshpandeNessuna valutazione finora

- FM 211 Big Picture B UlobDocumento11 pagineFM 211 Big Picture B UlobTricia Nicole BahintingNessuna valutazione finora

- ACCT503 Sample Project TemplateDocumento6 pagineACCT503 Sample Project TemplateAriunaaBoldNessuna valutazione finora

- Formula SheetDocumento2 pagineFormula SheetChad OngNessuna valutazione finora

- CHAP - 5 - Measuring and Evaluating The Performance of BanksDocumento73 pagineCHAP - 5 - Measuring and Evaluating The Performance of BanksNgọc Minh VũNessuna valutazione finora

- CHAP 5 Measuring and Evaluating The Performance of BanksDocumento60 pagineCHAP 5 Measuring and Evaluating The Performance of BanksDương Thuỳ TrangNessuna valutazione finora

- Kel 10 AF-Tugas Kelompok1Documento6 pagineKel 10 AF-Tugas Kelompok1sinuraya12Nessuna valutazione finora

- Fa Cheat Sheet MM MLDocumento8 pagineFa Cheat Sheet MM MLIrina StrizhkovaNessuna valutazione finora

- Finance Formula BankDocumento2 pagineFinance Formula BankMELISSA ANN COLOMANessuna valutazione finora

- Bholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Documento9 pagineBholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Chirag MalhotraNessuna valutazione finora

- Arendain Tp4 FinanceDocumento4 pagineArendain Tp4 FinanceMgrace arendaknNessuna valutazione finora

- Citsit MankeuDocumento14 pagineCitsit MankeuAgna AegeanNessuna valutazione finora

- Chap 2 Market Value RatiosDocumento22 pagineChap 2 Market Value Ratiosyemsrachhailu8Nessuna valutazione finora

- TIFA CheatSheet MM X MLDocumento10 pagineTIFA CheatSheet MM X MLCorina Ioana BurceaNessuna valutazione finora

- ACC501 MID Term IMP FormulasDocumento4 pagineACC501 MID Term IMP FormulasFatma beygNessuna valutazione finora

- Chapters 2 and 3 HandoutsDocumento8 pagineChapters 2 and 3 HandoutsCarter LeeNessuna valutazione finora

- Financial Analysis Cheat Sheet 1709070577Documento2 pagineFinancial Analysis Cheat Sheet 1709070577herrerofrutosNessuna valutazione finora

- Edited Formula SheetDocumento2 pagineEdited Formula Sheetlinhngo.31221020350Nessuna valutazione finora

- Thomson Reuters corporation-excel-SHEETDocumento31 pagineThomson Reuters corporation-excel-SHEETshantoNessuna valutazione finora

- Fadm ExamDocumento2 pagineFadm ExamAnyone SomeoneNessuna valutazione finora

- Unit 2Documento17 pagineUnit 2hassan19951996hNessuna valutazione finora

- Dokumen 2Documento2 pagineDokumen 2Dian HaniifahNessuna valutazione finora

- Vertical Analysis Exercise: Strictly ConfidentialDocumento2 pagineVertical Analysis Exercise: Strictly ConfidentialPRANAV BHARARANessuna valutazione finora

- Stracos Notes 1Documento1 paginaStracos Notes 1bangtan sonyeondanNessuna valutazione finora

- Financial Ratios: Tata Steel Standalone Tata Steel Group 2017-18 2017-18Documento1 paginaFinancial Ratios: Tata Steel Standalone Tata Steel Group 2017-18 2017-18varun rajNessuna valutazione finora

- RatioDocumento2 pagineRatioAtikah AzimNessuna valutazione finora

- RatioDocumento2 pagineRatioAtikah AzimNessuna valutazione finora

- Profitability RatiosDocumento2 pagineProfitability Ratiosmuhammad AhmadNessuna valutazione finora

- Current RatioDocumento2 pagineCurrent RatioRujean Salar AltejarNessuna valutazione finora

- Formula SheetDocumento2 pagineFormula SheetAnarghyaNessuna valutazione finora

- Traditional Models of Financial Statements AnalysisDocumento4 pagineTraditional Models of Financial Statements AnalysisMary LeeNessuna valutazione finora

- DuPont Model 16 9Documento4 pagineDuPont Model 16 9Hilman RiskiNessuna valutazione finora

- Exam 1 Formula Sheet (1) - 2Documento2 pagineExam 1 Formula Sheet (1) - 2haleeNessuna valutazione finora

- 000 REC Working Formula Compiled by GMRCDocumento12 pagine000 REC Working Formula Compiled by GMRCbhobot riveraNessuna valutazione finora

- Steinberg Alexandra 4536 A3Documento136 pagineSteinberg Alexandra 4536 A3Yong RenNessuna valutazione finora

- Ratio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosDocumento9 pagineRatio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosArsl331Nessuna valutazione finora

- Ratio & Financial Analysis: by Danial RezaDocumento11 pagineRatio & Financial Analysis: by Danial Rezaansary75Nessuna valutazione finora

- Calculation of The Financial Ratios of GPH Ispat - 2019-2020Documento10 pagineCalculation of The Financial Ratios of GPH Ispat - 2019-2020Yasir ArafatNessuna valutazione finora

- DupontDocumento20 pagineDupontMaha IndraNessuna valutazione finora

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Da EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Valutazione: 3.5 su 5 stelle3.5/5 (17)

- Accelerating Innovation in The EPC Industry - BechtelDocumento5 pagineAccelerating Innovation in The EPC Industry - BechtelRicky ImandaNessuna valutazione finora

- Case Analysis Report (INDIVIDUAL)Documento8 pagineCase Analysis Report (INDIVIDUAL)Ricky ImandaNessuna valutazione finora

- Tugas SM Case 25 Southwest Airlines Kelompok 10Documento17 pagineTugas SM Case 25 Southwest Airlines Kelompok 10Ricky Imanda100% (2)

- Case Analysis Report (INDIVIDUAL)Documento8 pagineCase Analysis Report (INDIVIDUAL)Ricky ImandaNessuna valutazione finora

- Pil 1Documento58 paginePil 1Ricky ImandaNessuna valutazione finora

- A Report On Ford Motor Company: Birla Institute of Technology & Science, Pilani Second Semester (2012-2013)Documento12 pagineA Report On Ford Motor Company: Birla Institute of Technology & Science, Pilani Second Semester (2012-2013)Ricky Imanda100% (1)

- Case26 Assignment QuestionsDocumento1 paginaCase26 Assignment QuestionsRicky ImandaNessuna valutazione finora

- Managing Ethics Risks & OpportunitiesDocumento38 pagineManaging Ethics Risks & OpportunitiesRicky ImandaNessuna valutazione finora

- Marketing Plan Restoran: October 2015Documento29 pagineMarketing Plan Restoran: October 2015Ricky ImandaNessuna valutazione finora

- Theon DemandgenerationDocumento57 pagineTheon DemandgenerationRicky ImandaNessuna valutazione finora

- Foundations and Deep BasementsDocumento76 pagineFoundations and Deep BasementsRicky Imanda100% (1)

- Law of DemandDocumento16 pagineLaw of DemandDivya GuptaNessuna valutazione finora

- Dee50s PostsDocumento814 pagineDee50s PostsPhillip White100% (2)

- Contract To Sell - PAG-IBIGDocumento2 pagineContract To Sell - PAG-IBIGJet Mitchelle Ferrolino86% (7)

- Costing Run ProcessesDocumento41 pagineCosting Run ProcessesjuanachangeNessuna valutazione finora

- Advantages and Disadvantages of TaxationDocumento20 pagineAdvantages and Disadvantages of TaxationNimraa NoorNessuna valutazione finora

- Proj FinanceDocumento104 pagineProj FinanceBiswajeet PattnaikNessuna valutazione finora

- Maggi Soups - Marketing PPT - Division C - Group 2Documento22 pagineMaggi Soups - Marketing PPT - Division C - Group 2venkat1105Nessuna valutazione finora

- Transworld Xls460 Xls EngDocumento6 pagineTransworld Xls460 Xls EngAman Pawar0% (1)

- Stock ValuationDocumento3 pagineStock ValuationnishankNessuna valutazione finora

- Chapter 3 (Unit 1)Documento21 pagineChapter 3 (Unit 1)GiriNessuna valutazione finora

- Marginal Thinking, Economic GrowthDocumento44 pagineMarginal Thinking, Economic GrowthVanessa HaliliNessuna valutazione finora

- Brand Manager Job DescriptionDocumento3 pagineBrand Manager Job DescriptionAkanksha DurgvanshiNessuna valutazione finora

- Merger Exercises1Documento2 pagineMerger Exercises1Kate Crystel reyesNessuna valutazione finora

- 2.1 Site Selection Criteria and FactorsDocumento4 pagine2.1 Site Selection Criteria and Factorseric swaNessuna valutazione finora

- Wheel of Retailing and Accordian TheoryDocumento11 pagineWheel of Retailing and Accordian TheoryKarthick PNessuna valutazione finora

- Business Plan FormatDocumento15 pagineBusiness Plan FormatWavingOceansNessuna valutazione finora

- AP Macro 2008 Audit VersionDocumento24 pagineAP Macro 2008 Audit Versionvi ViNessuna valutazione finora

- MAT112 - Past Year Instalment PurchaseDocumento4 pagineMAT112 - Past Year Instalment PurchaseatiqahcantikNessuna valutazione finora

- Online Paper PDFDocumento17 pagineOnline Paper PDFManisha TiwariNessuna valutazione finora

- TNT 147Documento481 pagineTNT 147kalli2rfdfNessuna valutazione finora

- Antimonopoly RulesDocumento6 pagineAntimonopoly RulescacatuareaNessuna valutazione finora

- Battery CostDocumento21 pagineBattery CostChenna VijayNessuna valutazione finora

- Specifications 132Kv LineDocumento204 pagineSpecifications 132Kv LineDhirendra Singh50% (2)

- Chapter 3Documento21 pagineChapter 3nitinNessuna valutazione finora

- Branch Less BankingDocumento20 pagineBranch Less BankingBinay KumarNessuna valutazione finora

- FM11 GuideDocumento15 pagineFM11 GuideRoss CarpenterNessuna valutazione finora

- FTR RTMDocumento8 pagineFTR RTMSagar BhandariNessuna valutazione finora

- List of Legend ReportsDocumento100 pagineList of Legend Reportsapi-137303031Nessuna valutazione finora

- Boon or Bane For FarmersDocumento9 pagineBoon or Bane For FarmersTarikdeep50% (44)

- Foundations of Business 6th Edition Pride Test BankDocumento35 pagineFoundations of Business 6th Edition Pride Test Bankdanielwilkinsonkzemqgtxda100% (29)