Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Unit 1 Strategic Management: Meaning

Caricato da

rajendrakumarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Unit 1 Strategic Management: Meaning

Caricato da

rajendrakumarCopyright:

Formati disponibili

Strategic Management

Unit 1

STRATEGIC MANAGEMENT

Meaning

Strategic Management is the set of managerial decisions and actions that determines the long-run performance of a

corporation. It includes environmental scanning, strategy formulation, strategy implementation, and evaluation & control.

It emphasizes the monitoring and evaluating of external opportunities and threats in light of a corporation’s strengths and

weaknesses. The major focus of Strategic Management is getting Competitive Advantage by pursuing the best strategy in

dynamic environment. It involves attention to following critical areas:

Determining the mission of the company

Developing a company profile that reflects internal conditions and capabilities

Assessment of the company’s external environment, in terms of both competitive and general contextual factors

Analysis of possible options uncovered in the matching of the company profile with the external environment

Identifying the desired options uncovered when possibilities are considered in light of the company mission

Strategic choice of a particular set of long-term objectives and grand strategies needed to achieve the desired

options

Development of annual objectives and short-term strategies compatible with long-term objectives and grand

strategies

Implementing strategic choice decisions based on budgeted resource allocations and emphasizing the matching

of tasks, people, structures, technologies, and reward systems

Review and evaluation of the success of the strategic process to serve as a basis for control and as an input for

future decision-making.

Dimensions of Strategic Decisions

Strategic issues have six identifiable dimensions. They are:

a. Strategic Issues Require Top-management Decisions: Top management involvement in decision-making is

imperative. Top-management has the power to authorize the resource allocations necessary for implementation.

b. Strategic Issues Involve the Allocation of Large Amounts of Company Resources: Strategic decisions naturally

involve substantial resource deployment. The people, physical assets, or moneys needed must be either

redirected from internal sources or secured from outside the firm.

c. Strategic Issues Are Likely to Have a Significant Impact in the Long-term Prosperity of the Firm: Strategic

decisions commit the firm for a long period of time, typically for the five years or more. Once a firm has

committed itself to a particular strategic option in a major way, its competitive image are usually tied to that

strategy. Firms become known in certain markets, for certain products, with certain characteristics. Strategic

decisions have enduring effects on the firm for better or worse.

d. Strategic Issues Are Future-oriented: Strategic decisions are based on what managers anticipate or forecast

rather than on what they know. In the turbulent and competitive free enterprise environment, a successful firm

must take a proactive stance toward change.

e. Strategic Issues Usually Have Major Multifunctional or Multi-business Consequences: A strategic decision is

coordinative. Decisions about such factors as customer mix, competitive emphasis, or organizational structure

necessarily involve a number of a firm’s strategic business units (SBUs), functions, divisions, or program units.

Compiled By: Lal B. Pun Page 1 of 4

Strategic Management

Each of these areas will be affected by the allocation or reallocation of responsibilities and resources related to

the decisions.

f. Strategic Issues Necessitate Considering Factors in the Firm’s External Environment: All business firms exist in

an open system. They impact and are impacted by external conditions largely beyond their control. Therefore, if

a firm is to succeed in positioning itself in future competitive situations, its strategic managers must look beyond

the limits of the firm’s own operations. They must consider the footstep of and changes in competitors,

customers, suppliers, creditors, government, labor etc. that are relevant to the firm.

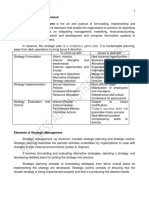

Characteristics of Strategic Management Decisions

The characteristics of strategic management decisions vary with the level of strategic activity considered. Corporate level

decisions tend to be value oriented, conceptual, and less concrete than those at the business or functional level of strategy

formulation and implementation. They are relatively costly and take longer time to make. Examples of corporate level

decisions include the choice of business, dividend policies, sources of long-term financing, and priorities for growth.

Functional level decisions are relatively short range and involve low risk and modest costs because they are

dependent on available resources. These decisions are relatively concrete and quantifiable. They receive critical attention

and analysis even though their comparative profit potential is low. Examples of functional level decisions include generic

versus brand-name labeling, basic versus applied R&D, high versus low inventory level, general versus specific-purpose

production equipment.

Business-level decisions fall between corporate-level and functional-level decisions. These decisions are less

costly, risky, and potentially profitable than corporate-level decisions, but they are more costly, risky, and potentially

profitable than functional-level decisions. Examples of business-level decisions include plant location, market

segmentation and geographic coverage, and distribution channels.

Characteristics of Strategic Management Decisions at Different Levels:

Characteristics Corporate Level Business Level Functional Level

Type Conceptual Mixed Operational

Measurability Value judgment dominant Semi-quantifiable Usually quantifiable

Frequency Periodic or sporadic Periodic or sporadic Periodic

Adaptability Low Medium High

Relation to present activities Innovative Mixed Supplementary

Risk Wide range Moderate Low

Profit potential Large Medium Small

Cost Major Medium Modest

Time horizon Long-term Medium-range Short-range

Flexibility High Medium Low

Cooperation required Considerable Moderate Little

Formality in Strategic Management

Formality refers to the degree to which membership, responsibility, authority, and discretion in decision making are

specified. The degree of formality is usually positively correlated with the cost, comprehensiveness, accuracy, and success

of planning. Formality is often associated with two factors: size and stage of development of the company. Smaller firms

Compiled By: Lal B. Pun Page 2 of 4

Strategic Management

are basically under the control of a single individual and produce a limited number of products or services. With this mode,

performance evaluation is very informal, intuitive, and limited in scope. On the other hand, large companies have more

formalities to be completed. Similarly, in stable environment, the companies have more formalities than in the turbulent

(fast changing) environment.

The Strategy Makers:

The ideal strategic management process is developed and governed by a strategic management team. The team consists

principally of decision makers at all three levels (corporate, business and functional) in the corporation. The team also

relies on input from two types of support personnel: company planning staffs and lower-level managers. The latter provide

data for strate4gic decision making and are responsible for implementing strategies.

Top management shoulders responsibility for broadly approving plans and strategies. They are assisted in the

execution of these responsibilities by the corporate planning department, staff, or personnel, who actually prepare major

components of the corporate plan. Top management also reviews, evaluates, and counsels on most major phases of the

plan’s preparation.

General Managers at the business level have principal responsibilities for approving environmental analysis and

forecasting, establishing business objectives, and developing business plans prepared by staff groups. One final point must

be made about strategic decision makers: a company’s president or CEO characteristically plays a dominant role in the

process. The principal duty of a CEO is often defined as giving long-term direction to the firm. He is ultimately

responsible for the success of the business and therefore of its strategy. However, his personality often prevents him from

delegating substantive authority to others in formulation or approval of strategic decisions.

Hierarchy of Objectives and Strategies:

Ends Means BOD Corporate Business Functional

(What is to be achieved) (How it is to be achieved) Managers Managers Managers

Mission and goals √√ √√ √

Long-term objectives Grand strategy √ √√ √√

Annual objectives Short-term strategy √ √√ √√

Functional Objectives Tactics √ √√

Note: √√ indicates a principal responsibility

√ indicates a secondary responsibility

Value of Strategic Management

Financial Benefits:

The principal appeal of any managerial approach is the expectation that it will lead to increased profit for the firm.

Financial goals of a firm are increase in sales, assets, sales price, earnings per share, and earnings growth. The

improvement in a firm’s profitability is achieved through changes in the company’s strategic direction. Organizations that

adopt a strategic management approach do so with the strong and reasonable expectation that the new system will lead to

improves financial performance.

Benefits of Strategic Management:

The strategic management approach emphasizes on participative decision-making that has certain behavioral consequence.

Therefore, an accurate assessment of the impact of strategy formulation on organizational performance also requires a set

of non-financial evaluation criteria – measures of behavioral based effects. However, regardless of the eventual

profitability of particular strategic plans, several behavioral effects can be expected to improve the welfare of the firm.

Compiled By: Lal B. Pun Page 3 of 4

Strategic Management

a. Strategy formulation activities should enhance the problem prevention capabilities of the firm.

b. Group-based strategic decisions are most likely to reflect the best available alternatives.

c. Employee motivation should improve as employees better appreciate the productivity-reward relationships

inherent in every strategic plan.

d. Gaps and overlaps in activities among diverse individuals and groups should be reduced as participation in

strategy formulation leads to a clarification of role differentiation.

e. Resistance to change should be reduced. The participative decision-making helps eliminate the uncertainty

associated with change.

Risks of Strategic Management:

While involvement in strategy formulation generates financial and behavioral based benefits for participants and for the

firm, managers must regard three types of unintended negative consequences. First, strategic management process is costly

in terms of hours invested by participants. Second, if the formulators of strategy are not intimately involved in

implementation, individual responsibility for input to the decision process and subsequent conclusions can be shirked.

Third, strategic managers must be trained to anticipate, minimize, or constructively respond when participating

subordinates become disappointed or frustrated over unattained expectations. In the collective view, strategic management

clearly is critical to managers and organizational success.

Role of Chief Executives in Strategic Management

Chief executive is a person whose responsibility is to make major decisions for the organization and implementation of

those decisions to secure the ends. In most Nepalese companies, the chief executive is referred as Chief Executive Officer,

Managing Director, Chairman, President, and General Manager etc. The CEO of the firm has to perform the roles of

strategists, organizational builder, and a leader.

CEO is basically responsible for setting major organizational objectives including corporate mission, long-term

goals, and major policies. He scans the external environment, analyzes opportunities and threats of the corporation as well

as business units it has. Furthermore, a CEO is also responsible for implementing projects, committing new projects,

measurement of performance against plans, monitoring deviations, and measuring organizational effectiveness. In this

way, a CEO is an architect of strategy and a leader to lead organizational resources.

In sum, a CEO plays every role that a manager has to play. But his major focus is on the long-run issues of the

corporate that has implication for each and every division. However, the role of CEO includes the following more specific

roles in the organization –

a. Interpersonal Roles (Figurehead, Leader, Liaison)

b. Informational Roles (Monitor, Disseminator, Spokesperson)

c. Decisional Roles (Entrepreneur, Disturbance handler, Resource Allocation, Negotiator)

Strategic Management is top management and all other managements are operational managements. There are

vast differences in the thought processes, attitudes, the perspective, the frame of reference, the method of analysis, and the

skills between these two types of management. The operating managers – the specialists in the particular areas say

marketing, finance, production devote their entire lifetime to specialize in the particular area that suits them, where as the

CEO or General Manager considers all the relevant functional areas and makes decisions which are in the best interest of

the organization.

The End

Compiled By: Lal B. Pun Page 4 of 4

Potrebbero piacerti anche

- Making Strategy Work (Review and Analysis of Hrebiniak's Book)Da EverandMaking Strategy Work (Review and Analysis of Hrebiniak's Book)Nessuna valutazione finora

- Chapter 01Documento35 pagineChapter 01silkykak63% (8)

- Strategic Management New - 2Documento47 pagineStrategic Management New - 2aebryeaNessuna valutazione finora

- A.Strategic ManagementDocumento219 pagineA.Strategic ManagementSweety JoyNessuna valutazione finora

- Strategic CH1Documento30 pagineStrategic CH1one loveNessuna valutazione finora

- Strategic Management: Key ConceptsDocumento30 pagineStrategic Management: Key ConceptsShelly SinghalNessuna valutazione finora

- I Strategic Management EssentialsDocumento48 pagineI Strategic Management Essentialslorenz joy bertoNessuna valutazione finora

- Strategic Management GuideDocumento7 pagineStrategic Management GuideAnooja SajeevNessuna valutazione finora

- Afzal - 1511 - 3780 - 1 - Lecture 1Documento27 pagineAfzal - 1511 - 3780 - 1 - Lecture 1rabab balochNessuna valutazione finora

- Strategic Management: A Guide to Formulating, Implementing and Evaluating Business StrategyDocumento27 pagineStrategic Management: A Guide to Formulating, Implementing and Evaluating Business StrategyAnas khanNessuna valutazione finora

- "Corporate Strategy": by H I AnsoffDocumento14 pagine"Corporate Strategy": by H I AnsoffjashanNessuna valutazione finora

- Strategic Management Notes Strategy andDocumento48 pagineStrategic Management Notes Strategy and'Chaaru' Anannt sharmaNessuna valutazione finora

- Strategic Management SWOT AnalysisDocumento39 pagineStrategic Management SWOT AnalysisPramod DhakalNessuna valutazione finora

- Chapter-1Documento52 pagineChapter-1Hana100% (1)

- Strategic Management-Module-1Documento44 pagineStrategic Management-Module-1Mahesh RangaswamyNessuna valutazione finora

- Chapter 1 - Strat ManDocumento6 pagineChapter 1 - Strat ManHannah LegaspiNessuna valutazione finora

- Strategy Evaluations: Unit 7Documento16 pagineStrategy Evaluations: Unit 7Duffin AngganaNessuna valutazione finora

- Chapter 1 PDFDocumento4 pagineChapter 1 PDFAmrNessuna valutazione finora

- Module 2 Unit 8Documento10 pagineModule 2 Unit 8sejal AgarwalNessuna valutazione finora

- Nature of Strategic Management Strategic Management Is The Art and Science of Formulating, Implementing andDocumento15 pagineNature of Strategic Management Strategic Management Is The Art and Science of Formulating, Implementing andArya ManaloNessuna valutazione finora

- The Concept of Strategy ExplainedDocumento31 pagineThe Concept of Strategy ExplainedIndu Shekhar PoddarNessuna valutazione finora

- New WordDocumento6 pagineNew WordAdetunji TaiwoNessuna valutazione finora

- Strategic Management FundamentalsDocumento42 pagineStrategic Management FundamentalsPalash SahaNessuna valutazione finora

- Strategic Management I All ChapterDocumento101 pagineStrategic Management I All Chapterbutwalservice75% (4)

- Strategic Decisions, Levels of StrategyDocumento13 pagineStrategic Decisions, Levels of Strategykafi70156Nessuna valutazione finora

- 2232.presentation On Strategic ManagemntDocumento16 pagine2232.presentation On Strategic ManagemntRahul BansalNessuna valutazione finora

- Chap 1 SummaryDocumento6 pagineChap 1 SummaryaminajavedNessuna valutazione finora

- Strategic Management: Aatm Prakash RaiDocumento180 pagineStrategic Management: Aatm Prakash RaiRiya SinghNessuna valutazione finora

- Strategic Management Chapter 1 OverviewDocumento5 pagineStrategic Management Chapter 1 OverviewRiri CanezoNessuna valutazione finora

- To 5 (Strategi)Documento95 pagineTo 5 (Strategi)Effria Wijayanti WahyuningsihNessuna valutazione finora

- Nature, Scope, Importance, ProcessDocumento10 pagineNature, Scope, Importance, ProcessAshlesha VermaNessuna valutazione finora

- SM Mod1Documento26 pagineSM Mod1HemanthNessuna valutazione finora

- Strategic Management: Types of StrategiesDocumento28 pagineStrategic Management: Types of StrategiesAgit_MuhammadNessuna valutazione finora

- Strategic Management Process & ImportanceDocumento2 pagineStrategic Management Process & ImportanceTitus ClementNessuna valutazione finora

- What Is Strategic Decision?Documento3 pagineWhat Is Strategic Decision?Let's learn the basicsNessuna valutazione finora

- Process of Strategic ChoiceDocumento44 pagineProcess of Strategic Choicemangal gupta100% (1)

- Normann: Strategy Is The Art of Creating ValueDocumento13 pagineNormann: Strategy Is The Art of Creating ValueSharath NairNessuna valutazione finora

- Stretegic Management StrategiesDocumento99 pagineStretegic Management Strategies✬ SHANZA MALIK ✬Nessuna valutazione finora

- 02 Review 2 Group 6Documento1 pagina02 Review 2 Group 6boifvck21Nessuna valutazione finora

- Ch1 SMDocumento24 pagineCh1 SMAbdiaziz Mohamed OmarNessuna valutazione finora

- Excerpt From Sun Tzu's "The Art of War Writings"Documento2 pagineExcerpt From Sun Tzu's "The Art of War Writings"XNessuna valutazione finora

- Introducing Strategy and Strategic Management: Prepared by Rohan WickremasingheDocumento4 pagineIntroducing Strategy and Strategic Management: Prepared by Rohan WickremasinghedikpalakNessuna valutazione finora

- BBA Semester-I Decision Making GuideDocumento6 pagineBBA Semester-I Decision Making GuideSiddharthJainNessuna valutazione finora

- MS 91Documento6 pagineMS 91rabindarbhuiyaNessuna valutazione finora

- Strategic Management PresentationDocumento123 pagineStrategic Management PresentationJones JebarajNessuna valutazione finora

- BBA Strategic Management - IDocumento135 pagineBBA Strategic Management - IbijayNessuna valutazione finora

- Nature of Strategic ManagementDocumento41 pagineNature of Strategic ManagementNaveed AkhterNessuna valutazione finora

- Nature, Scope and Importance of Strategic ManagementDocumento14 pagineNature, Scope and Importance of Strategic ManagementvishakhaNessuna valutazione finora

- Strategic ManagementDocumento102 pagineStrategic ManagementSagar ShresthaNessuna valutazione finora

- Corp Strat Mgmt-Mission,Levels,EvolutionDocumento60 pagineCorp Strat Mgmt-Mission,Levels,EvolutionAbesheik HalduraiNessuna valutazione finora

- A Management ProjectDocumento97 pagineA Management Projectnave736100% (5)

- A Strategic View: Them With Uncompensated Risks - Often, Strategic Risks Are "Compensated"Documento4 pagineA Strategic View: Them With Uncompensated Risks - Often, Strategic Risks Are "Compensated"Hassan KhawajaNessuna valutazione finora

- 01 IntroductionDocumento31 pagine01 IntroductionRahat Rahman RadiNessuna valutazione finora

- Chapter - I The Nature of Strategic ManagementDocumento62 pagineChapter - I The Nature of Strategic ManagementSuleimaan Mohamed OmarNessuna valutazione finora

- Value of Strategic Management Source: Ybanez JR., Antonio Errol. Applied Strategic Management and Business Policy: A Case StudyDocumento6 pagineValue of Strategic Management Source: Ybanez JR., Antonio Errol. Applied Strategic Management and Business Policy: A Case StudyAiko YoonNessuna valutazione finora

- Strategic HRMDocumento62 pagineStrategic HRMGourav PatidarNessuna valutazione finora

- Chapter 7Documento5 pagineChapter 7Fisseha KebedeNessuna valutazione finora

- Production Management: Lecture No 4 Resource Person: Engr Muhammad Raheel ButtDocumento17 pagineProduction Management: Lecture No 4 Resource Person: Engr Muhammad Raheel ButtZeeshan QaraNessuna valutazione finora

- Meaning of EdDocumento1 paginaMeaning of EdrajendrakumarNessuna valutazione finora

- MSC 516: Production Operations ManagementDocumento1 paginaMSC 516: Production Operations ManagementrajendrakumarNessuna valutazione finora

- The Key Elements of EntrepreneurshipDocumento7 pagineThe Key Elements of EntrepreneurshiprajendrakumarNessuna valutazione finora

- The Key Elements of EntrepreneurshipDocumento1 paginaThe Key Elements of EntrepreneurshiprajendrakumarNessuna valutazione finora

- Tbibliography Used It For TarajiDocumento16 pagineTbibliography Used It For TarajirajendrakumarNessuna valutazione finora

- Course DescriptionDocumento2 pagineCourse DescriptionrajendrakumarNessuna valutazione finora

- External Environmental Analysis & ForecastingDocumento4 pagineExternal Environmental Analysis & ForecastingrajendrakumarNessuna valutazione finora

- Leadership Style and Organizational ImpactDocumento5 pagineLeadership Style and Organizational ImpactAlee HulioNessuna valutazione finora

- Strategic Management IDocumento1 paginaStrategic Management IrajendrakumarNessuna valutazione finora

- What Is Strategy?: Foresight VisionDocumento1 paginaWhat Is Strategy?: Foresight VisionrajendrakumarNessuna valutazione finora

- BBA 8 Sem Business Strategy Tribhuvan UniversityDocumento1 paginaBBA 8 Sem Business Strategy Tribhuvan Universityrajendrakumar100% (2)

- Organizational Behavior: Course ObjectivesDocumento1 paginaOrganizational Behavior: Course ObjectivesrajendrakumarNessuna valutazione finora

- Defining and Articulating Your VisionDocumento23 pagineDefining and Articulating Your VisionrajendrakumarNessuna valutazione finora

- Nepal submits TFA ratification documents to WTODocumento1 paginaNepal submits TFA ratification documents to WTOrajendrakumarNessuna valutazione finora

- Using The Systematic - Constructive ApproachDocumento1 paginaUsing The Systematic - Constructive ApproachrajendrakumarNessuna valutazione finora

- Strategic Thinking: T 8 Hours. If V Is 50 MPH in Clear Conditions and 30 MPH When It Rains, Then TheDocumento1 paginaStrategic Thinking: T 8 Hours. If V Is 50 MPH in Clear Conditions and 30 MPH When It Rains, Then TherajendrakumarNessuna valutazione finora

- Subprocesses of PerceptionDocumento1 paginaSubprocesses of Perceptionrajendrakumar100% (1)

- Marketing Information System in NepalDocumento1 paginaMarketing Information System in NepalrajendrakumarNessuna valutazione finora

- New Features of Organisational BehaviourDocumento2 pagineNew Features of Organisational Behaviourrajendrakumar100% (3)

- Personality, Attitudes, and Positive Organizational BehaviorDocumento1 paginaPersonality, Attitudes, and Positive Organizational BehaviorrajendrakumarNessuna valutazione finora

- 2018the Effect of Labor UnionsDocumento1 pagina2018the Effect of Labor UnionsrajendrakumarNessuna valutazione finora

- Designing Your Marketing Program: ProductDocumento5 pagineDesigning Your Marketing Program: ProductrajendrakumarNessuna valutazione finora

- All These Characteristics Are Explained in Detail As FollowsDocumento4 pagineAll These Characteristics Are Explained in Detail As FollowsrajendrakumarNessuna valutazione finora

- New Features of Organisational BehaviourDocumento2 pagineNew Features of Organisational Behaviourrajendrakumar100% (3)

- A New Proposed Course of Organizational Behavior 1st SemDocumento2 pagineA New Proposed Course of Organizational Behavior 1st SemrajendrakumarNessuna valutazione finora

- Times WorkDocumento2 pagineTimes WorkrajendrakumarNessuna valutazione finora

- AssetDocumento7 pagineAssetrajendrakumarNessuna valutazione finora

- 1.1 Background of The Study: VolatilityDocumento10 pagine1.1 Background of The Study: VolatilityrajendrakumarNessuna valutazione finora

- Relation Between Occupational Stress and Organizational Commitment: Evidences From Nurses of NepalDocumento1 paginaRelation Between Occupational Stress and Organizational Commitment: Evidences From Nurses of NepalrajendrakumarNessuna valutazione finora

- Packing, Transportation and Marketing of Ornamental FishesDocumento16 paginePacking, Transportation and Marketing of Ornamental Fishesraj kiranNessuna valutazione finora

- Final System DocumentationDocumento31 pagineFinal System DocumentationEunice AquinoNessuna valutazione finora

- Sci9 Q4 Mod8.2Documento24 pagineSci9 Q4 Mod8.2John Christian RamosNessuna valutazione finora

- CTM Catalogue 2015-2016Documento100 pagineCTM Catalogue 2015-2016Anonymous dXcoknUNessuna valutazione finora

- Feasibility of Traditional Milk DeliveryDocumento21 pagineFeasibility of Traditional Milk DeliverySumit TomarNessuna valutazione finora

- Airframe Exam Review QuestionsDocumento23 pagineAirframe Exam Review QuestionsbirukNessuna valutazione finora

- Main Sulci & Fissures: Cerebral FissureDocumento17 pagineMain Sulci & Fissures: Cerebral FissureNagbhushan BmNessuna valutazione finora

- Th255, Th255c Axle Cat ServiceDocumento280 pagineTh255, Th255c Axle Cat ServiceKevine KhaledNessuna valutazione finora

- Use DCP to Predict Soil Bearing CapacityDocumento11 pagineUse DCP to Predict Soil Bearing CapacitysarvaiyahimmatNessuna valutazione finora

- Seminar - Review 2 FinalDocumento12 pagineSeminar - Review 2 FinalBhaskaruni Sai TarunNessuna valutazione finora

- Catalogue: Product Offering 51Documento56 pagineCatalogue: Product Offering 51Bruno MartinsNessuna valutazione finora

- Chemical Engineering Assignment SubmissionDocumento10 pagineChemical Engineering Assignment SubmissionFahad KamranNessuna valutazione finora

- CD1 ISO/IEC 17000 Conformity Assessment - Vocabulary and General PrinciplesDocumento26 pagineCD1 ISO/IEC 17000 Conformity Assessment - Vocabulary and General PrinciplesMAC CONSULTORESNessuna valutazione finora

- MAPEH 6- WEEK 1 ActivitiesDocumento4 pagineMAPEH 6- WEEK 1 ActivitiesCatherine Renante100% (2)

- Face To Face Pre-Intermediate B1Documento162 pagineFace To Face Pre-Intermediate B1Andra OlariNessuna valutazione finora

- Vega Plus 69Documento3 pagineVega Plus 69yashNessuna valutazione finora

- Stylistic and DiscourseDocumento4 pagineStylistic and Discourseeunhye carisNessuna valutazione finora

- ISO 17000 2004 Terms & DefintionsDocumento6 pagineISO 17000 2004 Terms & DefintionsSelvaraj SimiyonNessuna valutazione finora

- Comparison of Waste-Water Treatment Using Activated Carbon and Fullers Earth - A Case StudyDocumento6 pagineComparison of Waste-Water Treatment Using Activated Carbon and Fullers Earth - A Case StudyDEVESH SINGH100% (1)

- Astm A105, A105mDocumento5 pagineAstm A105, A105mMike Dukas0% (1)

- Silicon ManufacturingDocumento132 pagineSilicon ManufacturingAndrea SottocornolaNessuna valutazione finora

- Events of National Importance 2016Documento345 pagineEvents of National Importance 2016TapasKumarDashNessuna valutazione finora

- E Requisition SystemDocumento8 pagineE Requisition SystemWaNi AbidNessuna valutazione finora

- G String v5 User ManualDocumento53 pagineG String v5 User ManualFarid MawardiNessuna valutazione finora

- NACE CIP Part II - (6) Coatings For Industry - (Qs - As)Documento23 pagineNACE CIP Part II - (6) Coatings For Industry - (Qs - As)Almagesto QuenayaNessuna valutazione finora

- Brake System PDFDocumento9 pagineBrake System PDFdiego diaz100% (1)

- Reflecting on UPHSD's Mission, Vision, and Core ValuesDocumento3 pagineReflecting on UPHSD's Mission, Vision, and Core ValuesBia N Cz100% (1)

- TM500 Design Overview (Complete ArchitectureDocumento3 pagineTM500 Design Overview (Complete ArchitectureppghoshinNessuna valutazione finora

- SO CF, Internal Fault Map Class 1A SO CF, Internal Fault Map Class 2A SO CF, External Condition Map Class 1BDocumento15 pagineSO CF, Internal Fault Map Class 1A SO CF, Internal Fault Map Class 2A SO CF, External Condition Map Class 1BATMMOBILISNessuna valutazione finora

- Design of Hydraulic Structures Seepage TheoryDocumento13 pagineDesign of Hydraulic Structures Seepage TheorySuleman FaisalNessuna valutazione finora

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDa EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsValutazione: 5 su 5 stelle5/5 (48)

- HBR Guide to Setting Your StrategyDa EverandHBR Guide to Setting Your StrategyValutazione: 4.5 su 5 stelle4.5/5 (18)

- Generative AI: The Insights You Need from Harvard Business ReviewDa EverandGenerative AI: The Insights You Need from Harvard Business ReviewValutazione: 4.5 su 5 stelle4.5/5 (2)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Da EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Nessuna valutazione finora

- Amp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityDa EverandAmp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityValutazione: 5 su 5 stelle5/5 (50)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerDa EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerValutazione: 4 su 5 stelle4/5 (121)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewDa EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewValutazione: 4.5 su 5 stelle4.5/5 (104)

- Impact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeDa EverandImpact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeValutazione: 5 su 5 stelle5/5 (8)

- Sales Pitch: How to Craft a Story to Stand Out and WinDa EverandSales Pitch: How to Craft a Story to Stand Out and WinValutazione: 5 su 5 stelle5/5 (1)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdDa EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdValutazione: 4.5 su 5 stelle4.5/5 (17)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantDa EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantValutazione: 4 su 5 stelle4/5 (387)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessDa EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessValutazione: 4.5 su 5 stelle4.5/5 (80)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Da EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Da EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Valutazione: 4.5 su 5 stelle4.5/5 (11)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceDa EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceValutazione: 4.5 su 5 stelle4.5/5 (38)

- HBR's 10 Must Reads on Business Model InnovationDa EverandHBR's 10 Must Reads on Business Model InnovationValutazione: 4.5 su 5 stelle4.5/5 (12)

- HBR's 10 Must Reads 2023: The Definitive Management Ideas of the Year from Harvard Business Review (with bonus article "Persuading the Unpersuadable" By Adam Grant)Da EverandHBR's 10 Must Reads 2023: The Definitive Management Ideas of the Year from Harvard Business Review (with bonus article "Persuading the Unpersuadable" By Adam Grant)Valutazione: 3.5 su 5 stelle3.5/5 (3)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffDa EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffValutazione: 5 su 5 stelle5/5 (60)

- Create the Future: Tactics for Disruptive ThinkingDa EverandCreate the Future: Tactics for Disruptive ThinkingNessuna valutazione finora

- Small Business For Dummies: 5th EditionDa EverandSmall Business For Dummies: 5th EditionValutazione: 4.5 su 5 stelle4.5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Learn and Understand Business AnalysisDa EverandLearn and Understand Business AnalysisValutazione: 4.5 su 5 stelle4.5/5 (31)

- The Digital Transformation Playbook: Rethink Your Business for the Digital AgeDa EverandThe Digital Transformation Playbook: Rethink Your Business for the Digital AgeValutazione: 4.5 su 5 stelle4.5/5 (48)

- HBR's 10 Must Reads on Managing Yourself, Vol. 2Da EverandHBR's 10 Must Reads on Managing Yourself, Vol. 2Valutazione: 4.5 su 5 stelle4.5/5 (11)

- The Strategy Legacy: How to Future-Proof a Business and Leave Your MarkDa EverandThe Strategy Legacy: How to Future-Proof a Business and Leave Your MarkNessuna valutazione finora

- Strategic Risk Management: New Tools for Competitive Advantage in an Uncertain AgeDa EverandStrategic Risk Management: New Tools for Competitive Advantage in an Uncertain AgeValutazione: 5 su 5 stelle5/5 (1)

- Strategic Roadmap: An Intentional, Memorable Approach to Achieving SuccessDa EverandStrategic Roadmap: An Intentional, Memorable Approach to Achieving SuccessNessuna valutazione finora

- Your Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesDa EverandYour Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesValutazione: 4 su 5 stelle4/5 (10)