Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Social Security Cola Facts 2019

Caricato da

Jim KinneyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Social Security Cola Facts 2019

Caricato da

Jim KinneyCopyright:

Formati disponibili

Fact Sheet

SOCIAL SECURITY

2019 SOCIAL SECURITY CHANGES

Cost-of-Living Adjustment (COLA):

Based on the increase in the Consumer Price Index (CPI-W) from the third

quarter of 2017 through the third quarter of 2018, Social Security and

Supplemental Security Income (SSI) beneficiaries will receive a 2.8 percent

COLA for 2019. Other important 2019 Social Security information is as follows:

Tax Rate 2018 2019

Employee 7.65% 7.65%

Self-Employed 15.30% 15.30%

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare.

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable

taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all

earnings. Also, as of January 2013, individuals with earned income of more than

$200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent

in Medicare taxes. The tax rates shown above do not include the 0.9 percent.

2018 2019

Maximum Taxable Earnings

Social Security (OASDI only) $128,400 $132,900

Medicare (HI only) No Limit

Quarter of Coverage

$1,320 $1,360

Retirement Earnings Test Exempt Amounts

$17,040/yr. $17,640/yr.

Under full retirement age

($1,420/mo.) ($1,470/mo.)

NOTE: One dollar in benefits will be withheld for every $2 in earnings above

the limit.

The year an individual reaches full $45,360/yr. $46,920/yr.

retirement age ($3,780/mo.) ($3,910/mo.)

NOTE: Applies only to earnings for months prior to attaining full retirement

Social Security National Press Office Baltimore, MD

age. One dollar in benefits will be withheld for every $3 in earnings above the

limit.

Beginning the month an individual attains

None

full retirement age.

2018 2019

Social Security Disability Thresholds

Substantial Gainful Activity (SGA)

Non-Blind $1,180/mo. $1,220/mo.

Blind $1,970/mo. $2,040/mo.

Trial Work Period (TWP) $ 850/mo. $ 880/mo.

Maximum Social Security Benefit: Worker Retiring at Full Retirement Age

$2,788/mo. $2,861/mo.

SSI Federal Payment Standard

Individual $ 750/mo. $ 771/mo.

Couple $1,125/mo. $1,157/mo.

SSI Resource Limits

Individual $2,000 $2,000

Couple $3,000 $3,000

SSI Student Exclusion

Monthly limit $1,820 $1,870

Annual limit $7,350 $7,550

Estimated Average Monthly Social Security Benefits Payable in January

2019

Before After

2.8% COLA 2.8% COLA

All Retired Workers $1,422 $1,461

Aged Couple, Both Receiving Benefits $2,381 $2,448

Widowed Mother and Two Children $2,797 $2,876

Aged Widow(er) Alone $1,348 $1,386

Disabled Worker, Spouse and One or

$2,072 $2,130

More Children

All Disabled Workers $1,200 $1,234

Potrebbero piacerti anche

- Where's My Money?: Secrets to Getting the Most out of Your Social SecurityDa EverandWhere's My Money?: Secrets to Getting the Most out of Your Social SecurityNessuna valutazione finora

- Answers to 100 Frequently Asked Questions about Social Security Retirement BenefitsDa EverandAnswers to 100 Frequently Asked Questions about Social Security Retirement BenefitsNessuna valutazione finora

- CISA 2018 Farm Products GuideDocumento92 pagineCISA 2018 Farm Products GuideJim KinneyNessuna valutazione finora

- Authorization Letter - SSS BurialDocumento1 paginaAuthorization Letter - SSS BurialAnonymous FrKBId100% (11)

- Work History Report SSA-3369-BKDocumento10 pagineWork History Report SSA-3369-BKLevine BenjaminNessuna valutazione finora

- Payroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingDocumento11 paginePayroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingheenimNessuna valutazione finora

- Company Weekly Excel Timesheet Template Multiple EmployeesDocumento11 pagineCompany Weekly Excel Timesheet Template Multiple EmployeesngomaNessuna valutazione finora

- Cash and Cary Payslip Jan-2016 PDFDocumento24 pagineCash and Cary Payslip Jan-2016 PDFSubramanian KalyanaramanNessuna valutazione finora

- Obama SSN Fraud ProofDocumento10 pagineObama SSN Fraud ProofPamela Barnett0% (1)

- USDA Responses To Senator Richard Blumenthal Re Beulah and KarenDocumento3 pagineUSDA Responses To Senator Richard Blumenthal Re Beulah and KarenJim KinneyNessuna valutazione finora

- Applied Golf Solar Project at Hickory Ridge in AmherstDocumento118 pagineApplied Golf Solar Project at Hickory Ridge in AmherstJim KinneyNessuna valutazione finora

- IRS Rates Limits 2019Documento1 paginaIRS Rates Limits 2019claokerNessuna valutazione finora

- Age Pension Age Set To Change 2023Documento11 pagineAge Pension Age Set To Change 2023FrankNessuna valutazione finora

- Rate+Sheet+and+Examples 2Documento3 pagineRate+Sheet+and+Examples 2mayordrillNessuna valutazione finora

- 5 Big Social Security Changes Took Effect in January 2024Documento4 pagine5 Big Social Security Changes Took Effect in January 2024617249399Nessuna valutazione finora

- How Work Affects Your Benefits: SSA - GovDocumento10 pagineHow Work Affects Your Benefits: SSA - GovalexNessuna valutazione finora

- Federal Budget 2021Documento4 pagineFederal Budget 2021api-227304535Nessuna valutazione finora

- 5 Big Social Security Changes Took Effect in January 2024Documento4 pagine5 Big Social Security Changes Took Effect in January 2024617249399Nessuna valutazione finora

- Read This First:: Loan & General InfoDocumento14 pagineRead This First:: Loan & General InfoJoannaNessuna valutazione finora

- Math SignDocumento5 pagineMath SignaliyaNessuna valutazione finora

- En 05 10069Documento10 pagineEn 05 10069Ioan CercetasulNessuna valutazione finora

- Payroll and Contribution Rates Employers PDFDocumento2 paginePayroll and Contribution Rates Employers PDFNicquainCTNessuna valutazione finora

- Statement Redesign Noncovered EarningsDocumento2 pagineStatement Redesign Noncovered EarningsAntonio RodriguezNessuna valutazione finora

- Canada Pension Plan: Annual ReportDocumento69 pagineCanada Pension Plan: Annual ReportDorothy LamNessuna valutazione finora

- Formula Sheet: Income Tax Rates 2012/13Documento6 pagineFormula Sheet: Income Tax Rates 2012/13scribbyscribNessuna valutazione finora

- Pajor, Camille: SubscriberDocumento3 paginePajor, Camille: SubscriberRose LoBue FoleyNessuna valutazione finora

- RG146 Pocket GuideDocumento30 pagineRG146 Pocket GuideMentor RG146Nessuna valutazione finora

- 2015 Brackets & Planning Limits (Janney)Documento5 pagine2015 Brackets & Planning Limits (Janney)John CortapassoNessuna valutazione finora

- Retirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Documento17 pagineRetirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Harshi SoniNessuna valutazione finora

- Assignment 3 MathDocumento7 pagineAssignment 3 MathEugen OdojeNessuna valutazione finora

- 1 Financial Plan Cover PageDocumento5 pagine1 Financial Plan Cover Pageapi-404263747Nessuna valutazione finora

- En 05 11015Documento36 pagineEn 05 11015Kenneth GarrisonNessuna valutazione finora

- Statement Redesign OnlineDocumento2 pagineStatement Redesign OnlineJoshua LaporteNessuna valutazione finora

- Nys Paid Family LeaveDocumento3 pagineNys Paid Family Leaveapi-220141813Nessuna valutazione finora

- Lesson 1 DebtDocumento21 pagineLesson 1 DebtAlf ChingNessuna valutazione finora

- Ac00unting 2Documento45 pagineAc00unting 2Hazem El SayedNessuna valutazione finora

- Roth Vs - Traditional InvestmentDocumento1 paginaRoth Vs - Traditional InvestmentShivam MishraNessuna valutazione finora

- SlidesDocumento67 pagineSlidesluxuriousclassic100Nessuna valutazione finora

- 250 WDP MveDocumento28 pagine250 WDP MveMichael Van EssenNessuna valutazione finora

- 1.09 - Jackson Combass 09.22.2023Documento5 pagine1.09 - Jackson Combass 09.22.2023jackson combassNessuna valutazione finora

- D 485 A 21 Eff 73 e 155Documento8 pagineD 485 A 21 Eff 73 e 155Rica PulongbaritNessuna valutazione finora

- Tax Foundation FF6241Documento5 pagineTax Foundation FF6241muhammad mudassarNessuna valutazione finora

- Press Release Statement From The BoardDocumento2 paginePress Release Statement From The Boardkristin frechetteNessuna valutazione finora

- Statement From The SBSD School Board 092817Documento2 pagineStatement From The SBSD School Board 092817NicoleNessuna valutazione finora

- Enhanced Healthcare SchemesDocumento2 pagineEnhanced Healthcare SchemesSyed ZaheedNessuna valutazione finora

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Documento3 pagineTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangNessuna valutazione finora

- Job CenterfuelfundFLYER MAY26June1Documento1 paginaJob CenterfuelfundFLYER MAY26June1Frances LaddNessuna valutazione finora

- Fiscal Year 2031 Budget DocumentDocumento73 pagineFiscal Year 2031 Budget DocumentEddie O'BrienNessuna valutazione finora

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingDocumento4 pagineSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553Nessuna valutazione finora

- HA ZONE-Ben Cov Details PlanComp-EnglishApril12019DDocumento4 pagineHA ZONE-Ben Cov Details PlanComp-EnglishApril12019DGilad RozenbergNessuna valutazione finora

- Important Information About Your Insurance: GPO Box 1901 Melbourne VIC 3001 Australia T 1300 300 273 F 1300 366 273Documento8 pagineImportant Information About Your Insurance: GPO Box 1901 Melbourne VIC 3001 Australia T 1300 300 273 F 1300 366 273Antoine Nabil ZakiNessuna valutazione finora

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Documento9 pagineThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNessuna valutazione finora

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocumento3 pagineTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNessuna valutazione finora

- Will Get Free Meals.: Written DuringDocumento6 pagineWill Get Free Meals.: Written Duringanon-579447Nessuna valutazione finora

- Budget WsDocumento2 pagineBudget Wsapi-376482253Nessuna valutazione finora

- FIN 5003 Midterm Review Winter 2024 - TaggedDocumento21 pagineFIN 5003 Midterm Review Winter 2024 - TaggedYash PatelNessuna valutazione finora

- FinanceDocumento9 pagineFinancecrystalNessuna valutazione finora

- Kaitlin Loughran - The Power of Compound Interest AssignmentDocumento3 pagineKaitlin Loughran - The Power of Compound Interest Assignmentapi-524390398Nessuna valutazione finora

- Housekeeping Matters: Please Silence Your Cell PhonesDocumento61 pagineHousekeeping Matters: Please Silence Your Cell PhonesSaurabh RajNessuna valutazione finora

- Workfare Factsheet (English)Documento2 pagineWorkfare Factsheet (English)pinkstars247Nessuna valutazione finora

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocumento44 pagineSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manualvernier.decyliclnn4100% (22)

- Greater Financial Security For Women With Personal Retirement Accounts, Cato Briefing PaperDocumento10 pagineGreater Financial Security For Women With Personal Retirement Accounts, Cato Briefing PaperCato InstituteNessuna valutazione finora

- Average Social Security Benefits For Retirees in 2020Documento7 pagineAverage Social Security Benefits For Retirees in 2020MikeNessuna valutazione finora

- Retirement Plan InputsDocumento3 pagineRetirement Plan Inputsapi-645059243Nessuna valutazione finora

- 529credit SS1Documento1 pagina529credit SS1loristurdevantNessuna valutazione finora

- The Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsDa EverandThe Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsNessuna valutazione finora

- Fire Your Over-Priced Financial Advisor and Retire SoonerDa EverandFire Your Over-Priced Financial Advisor and Retire SoonerValutazione: 5 su 5 stelle5/5 (1)

- 2020 MassTrails Grant AwardsDocumento9 pagine2020 MassTrails Grant AwardsJim KinneyNessuna valutazione finora

- Massachusetts To Help Homeowners With Crumbling FoundationsDocumento8 pagineMassachusetts To Help Homeowners With Crumbling FoundationsJim KinneyNessuna valutazione finora

- Hotel JessDocumento2 pagineHotel JessJim KinneyNessuna valutazione finora

- Acute Hospital Health System Financial Performance Report - 2019Documento32 pagineAcute Hospital Health System Financial Performance Report - 2019Jim KinneyNessuna valutazione finora

- Amtrak Valley Flyer ScheduleDocumento1 paginaAmtrak Valley Flyer ScheduleJim Kinney100% (1)

- JD Byrider JudgmentDocumento8 pagineJD Byrider JudgmentJim KinneyNessuna valutazione finora

- Enfield Square Mall Deed DocumentDocumento14 pagineEnfield Square Mall Deed DocumentJim KinneyNessuna valutazione finora

- MBTA Procurement For 80 Bi-Level Commuter Rial CarsDocumento16 pagineMBTA Procurement For 80 Bi-Level Commuter Rial CarsJim KinneyNessuna valutazione finora

- American Outdoor Brands Report To Shareholders On Gun SafetyDocumento26 pagineAmerican Outdoor Brands Report To Shareholders On Gun SafetyJim KinneyNessuna valutazione finora

- MassMutual Puts Enfield Campus On The MarketDocumento14 pagineMassMutual Puts Enfield Campus On The MarketJim KinneyNessuna valutazione finora

- March 19 Presentation Final 3 19 19 PDFDocumento72 pagineMarch 19 Presentation Final 3 19 19 PDFJim KinneyNessuna valutazione finora

- Victims' Suit Against Bill Cosby Stays Alive As Comedian Serves Prison Sentence in PennsylvaniaDocumento2 pagineVictims' Suit Against Bill Cosby Stays Alive As Comedian Serves Prison Sentence in PennsylvaniaJim KinneyNessuna valutazione finora

- CTRAIL ScheduleDocumento2 pagineCTRAIL ScheduleJim Kinney100% (1)

- Springfield Default Letter To SilverBrickDocumento3 pagineSpringfield Default Letter To SilverBrickJim KinneyNessuna valutazione finora

- Public Response To Interstate 91 PlansDocumento26 paginePublic Response To Interstate 91 PlansJim KinneyNessuna valutazione finora

- New Valley Bank & Trust Public Co. FileDocumento91 pagineNew Valley Bank & Trust Public Co. FileJim KinneyNessuna valutazione finora

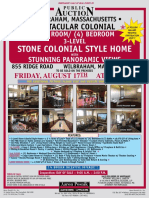

- Auction at 274-276 High StreetDocumento2 pagineAuction at 274-276 High StreetJim KinneyNessuna valutazione finora

- Saratoga Race Course MapDocumento1 paginaSaratoga Race Course MapJim KinneyNessuna valutazione finora

- Interstate 91 Meeting PresentationDocumento35 pagineInterstate 91 Meeting PresentationJim KinneyNessuna valutazione finora

- Hartford Springfield Line ScheduleDocumento2 pagineHartford Springfield Line ScheduleJim KinneyNessuna valutazione finora

- Wilbraham AuctionDocumento2 pagineWilbraham AuctionJim KinneyNessuna valutazione finora

- Monthly Timesheet Template ExcelDocumento28 pagineMonthly Timesheet Template ExceltajudinNessuna valutazione finora

- Form B - Attendance Record of Full Time Security Officers 2020Documento2 pagineForm B - Attendance Record of Full Time Security Officers 2020Clement ChanNessuna valutazione finora

- Schedule of Social Security Benefit Payments 2019: Socialsecurity - GovDocumento1 paginaSchedule of Social Security Benefit Payments 2019: Socialsecurity - GovBejan OvidiuNessuna valutazione finora

- Social Security & Supplemental Security Income (SSI) : WWW - Ssa.govDocumento5 pagineSocial Security & Supplemental Security Income (SSI) : WWW - Ssa.govanon_26882226Nessuna valutazione finora

- Randell James D. Manjarres: UPS - Under Preventive Suspension (Counted Incl. of Saturdays, Sundays & Holidays)Documento21 pagineRandell James D. Manjarres: UPS - Under Preventive Suspension (Counted Incl. of Saturdays, Sundays & Holidays)Randell ManjarresNessuna valutazione finora

- Castle CheatSheetDocumento1 paginaCastle CheatSheetATC CastleNessuna valutazione finora

- TeleDirctory2004 (Big) 16 19Documento47 pagineTeleDirctory2004 (Big) 16 19Sneha Roy NandiNessuna valutazione finora

- Esi Sample Filled Esic Form 10Documento2 pagineEsi Sample Filled Esic Form 10mangala0% (1)

- PMAPY ChartDocumento1 paginaPMAPY ChartRamsharan KumarNessuna valutazione finora

- Dsmun '15Documento25 pagineDsmun '15farjiNessuna valutazione finora

- Leave Policy-4Documento7 pagineLeave Policy-4Saimoon ChowdhuryNessuna valutazione finora

- SSS TableDocumento1 paginaSSS Tablegmangalo95% (22)

- Monthly Time Sheet: Date Hours Time Type Comments Date Hours Comments Time TypeDocumento1 paginaMonthly Time Sheet: Date Hours Time Type Comments Date Hours Comments Time TypeHemendra KalalNessuna valutazione finora

- Winter Fuel PaymentDocumento2 pagineWinter Fuel PaymentForth Valley Sensory CentreNessuna valutazione finora

- Sc2 Self Certification FormDocumento2 pagineSc2 Self Certification FormdiannehoosonNessuna valutazione finora

- Swarna Jayanti Gram Swarozgar Yojana FinancialsDocumento4 pagineSwarna Jayanti Gram Swarozgar Yojana FinancialsNisarg ShahNessuna valutazione finora

- EdasdafsafDocumento73 pagineEdasdafsafadi0077Nessuna valutazione finora

- Leave FormDocumento1 paginaLeave FormRey Caminos MorenoNessuna valutazione finora

- New DTR - JoDocumento7 pagineNew DTR - JoDarwin HiterozaNessuna valutazione finora

- Background Guide On Cyber TerrorismDocumento8 pagineBackground Guide On Cyber TerrorismRamakrishnan LokanathanNessuna valutazione finora

- En 05 10031 2017 PDFDocumento1 paginaEn 05 10031 2017 PDFmichael caseyNessuna valutazione finora

- Weekly Timesheet Template ExcelDocumento10 pagineWeekly Timesheet Template ExceltajudinNessuna valutazione finora

- UH Findings by The Centers For Medicare and MedicaidDocumento11 pagineUH Findings by The Centers For Medicare and MedicaidWKYC.comNessuna valutazione finora

- CPA4 Seetec Annex 1 FinalDocumento1 paginaCPA4 Seetec Annex 1 FinalMWA_Mandatory_WorkNessuna valutazione finora

- Attendance Allowance - : Why Are You Completing or Signing This Claim For Someone ElseDocumento13 pagineAttendance Allowance - : Why Are You Completing or Signing This Claim For Someone ElseTony CustardNessuna valutazione finora