Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Overview of Regular Savings Key Policies and Fees: Bank of America Clarity Statement

Caricato da

Jacob DaleTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Overview of Regular Savings Key Policies and Fees: Bank of America Clarity Statement

Caricato da

Jacob DaleCopyright:

Formati disponibili

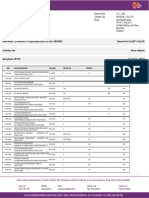

Sort_Audit: CC:00-14-9323NSB

Bank of America® Clarity Statement®

Overview of Regular Savings key policies and fees

Your Regular Savings Account

Monthly $5.00 The Monthly Maintenance Fee provides you with access to online and mobile banking, ATMs and

Maintenance each financial centers and security protection on your accounts, such as fraud monitoring.

Fee month You can avoid the Monthly Maintenance Fee when you meet ONE of the following requirements during

each statement period:

• Maintain a minimum daily balance of $300 or more, OR

• Link your account to your Bank of America Interest Checking® or Bank of America Advantage® account

(waiver applies to first 4 savings accounts), OR

• Are enrolled in the Preferred Rewards1 program (waiver applies to first 4 savings accounts)

You can also avoid the Monthly Maintenance Fee if you make combined monthly automatic

transfers of $25 or more from your Bank of America checking account to your savings account

during the immediately preceding statement cycle. (Effective with statement cycles that start on or

after September 7, 2017, you will no longer be able to make automatic transfers to avoid the $5

Monthly Maintenance Fee for the subsequent statement cycle.)

Withdrawal Limit Fee and Transaction Limitations

It Applies To How It Works

Withdrawal All types of withdrawals and transfers Each monthly statement cycle:

Limit Fee from a savings account, including: • You can make a total of 6 withdrawals and transfers with no

• ATM withdrawals and transfers Withdrawal Limit Fee

• Financial center teller withdrawals • After your first 6, the Withdrawal Limit Fee is $10.00 for each

• Online and Mobile Banking transfers additional withdrawal and transfer

or payments • No more than 6 Withdrawal Limit Fees will be charged

• Automatic or pre-authorized transfers • You can avoid the Withdrawal Limit Fee by maintaining a

(includes an automatic payment to a minimum daily balance of $20,000 or more in your savings

merchant or bank) account or if you are enrolled in the Preferred Rewards1 program.

• Telephone transfers If you receive a quarterly statement, please note that we

• Checks, drafts or debit card transactions calculate and apply these fees to each monthly period in the

quarter. This means that the first 6 transactions in each month

of the quarter can be made with no Withdrawal Limit Fee.

Transaction Certain types of withdrawals and Certain types of withdrawals and transfers from savings accounts

Limitations transfers from a savings account, are limited to a total of 6 per monthly cycle. This limit is governed

including: by federal Regulation D and our Deposit Agreement and

• Online and Mobile Banking transfers Disclosures.

or payments However, this limit doesn’t apply to transactions made at financial

• Automatic or pre-authorized transfers centers, by mail or at an ATM. (Please note that Withdrawal Limit

(includes an automatic payment to a Fees still apply to these types of transactions.)

merchant or bank) If you exceed the transaction limitations on more than

• Telephone transfers an occasional basis, we’ll convert your account to a checking

account that will no longer earn interest.

• Checks, drafts or debit card transactions

Interest rate policy

Interest rate and Your account has a variable interest rate, which means the interest rate may change. Interest

interest calculation rates for your account are set at our discretion and may change at any time without notice.

To calculate interest, we apply a daily periodic rate to the collected balance in your account

each day. We compound and pay any interest earned monthly. Interest is only paid in whole

cents and we use standard rounding rules to calculate the amount. This means that an amount

less than half of one cent is rounded down to zero, and an amount of half of one cent or more

is rounded up to the next whole cent.

Where can I find the You can find the current interest rate by checking bankofamerica.com, calling the number on

current interest rate? your account statement or visiting a financial center.

Information is current as of 07/2017 and is subject to change.

See reverse

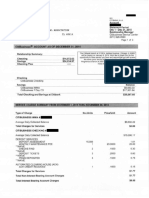

When your deposits are available

Cash, direct deposits, wire transfers: On the day we receive them.

Checks: Usually the next business day if deposited before the financial center or ATM cutoff time.

Mobile Check Deposit: Usually the next business day if deposited by applicable cutoff times (please refer to “Help”, "Browse

More Topics”, then “Mobile Check Deposit” in the Mobile Banking app for additional details and terms and conditions).

If we place a hold on your deposit, we’ll let you know the hold reason and when funds will be available for you to use. This

is typically provided at the time of deposit but may also be mailed later. Deposits greater than $5,000 and checks deposited

within the first 30 days of your account opening may be held longer.

Overdraft fees

To help you avoid fees, we won’t authorize ATM withdrawals or everyday debit card purchases if you don’t have enough money

in your account.

Overdraft Item Fee $35.00 You pay a $35 Overdraft Item Fee for each item that we

per overdraft authorize and pay. An Overdraft Item fee can apply to a

recurring debit card payment. No more than

4 Overdraft or

Returned Item

NSF: Returned $35.00 You pay a $35 NSF: Returned Item Fee for each item that we

fees are charged

Item Fee per declined/ decline or return unpaid. However, there’s no NSF: Returned Item

per day.

returned Fee for one-time or recurring declined debit card payments.

transaction

Overdraft Protection $12.00 You can use your Regular Savings account for our optional Overdraft Protection

Transfer Fee2 per transfer service to help you avoid overdrafts. Just link this account to your eligible checking

(charged to or money market savings account. If you’re about to overdraw your eligible checking

your linked or money market savings account, we automatically transfer available funds from

account) your Regular Savings account. The Overdraft Protection Transfer Fee is charged to

the eligible linked checking or money market savings account for each transfer.

When you use this service, we make one transfer per day.

The Overdraft Protection Transfer Fee is waived for transfers to a

Bank of America Interest Checking or Advantage checking account.

Additional Services

Bank of America ATMs No ATM fee For deposits, withdrawals, transfers or balance inquiries

Non-Bank of America ATMs $2.50 In the U.S., plus any fee charged by the ATM’s operator

$5.00 Outside the U.S., plus any fee charged by the ATM’s operator

Statement copies $5.00 You can avoid this fee by viewing and printing your available statements in the

(each) Statements & Documents tab in Online Banking instead of ordering a copy from us

Deposited item returned $12.00 Domestic item

(each)

$15.00 Foreign item

Keep the Change® savings program

Build your savings automatically when you enroll in our Keep the Change savings program. Simply make everyday purchases

with your Bank of America debit card, and we’ll round up your purchases to the nearest dollar amount and transfer the

difference from your checking account to your savings account.

This Clarity Statement summarizes key policies and fees for this account. For more information about the terms

that govern your account, please review your Personal Schedule of Fees and Deposit Agreement.

1

Learn how to qualify for Preferred Rewards at bankofamerica.com/preferredrewards, or visit your local financial center.

2

Overdraft Protection is also available from your Bank of America credit card. Overdraft Protection transfers from your credit card are Bank Cash Advances.

They are subject to Overdraft Protection cash advance fees and will accrue interest at the Bank Cash Advance APR. Please refer to your Credit Card Agreement

for additional details.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

© 2017 Bank of America Corporation. ARD6LBGW | ALL STATES 00-14-9323NSB

Potrebbero piacerti anche

- Supermarket CodeDocumento22 pagineSupermarket CodehassenNessuna valutazione finora

- AZ Argan Ventures LTDDocumento20 pagineAZ Argan Ventures LTDBarangaySanLuisNessuna valutazione finora

- Ach FormDocumento1 paginaAch FormHimanshu Motiyani100% (1)

- F 941Documento4 pagineF 941gopaljiiNessuna valutazione finora

- Carlile Da 4187 Transfer Request TemplateDocumento1 paginaCarlile Da 4187 Transfer Request Templateapi-242596953Nessuna valutazione finora

- CreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Documento3 pagineCreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Rabbul RahmanNessuna valutazione finora

- CitiBank ApplicationDocumento15 pagineCitiBank ApplicationJordan P HunterNessuna valutazione finora

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocumento1 paginaMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNessuna valutazione finora

- Jessica LaplaceDocumento2 pagineJessica Laplacejtm3323Nessuna valutazione finora

- L. Schneider Experian Credit ReportDocumento1 paginaL. Schneider Experian Credit Reportlarry-612445Nessuna valutazione finora

- Verizon Software Requirement SpecificationDocumento253 pagineVerizon Software Requirement SpecificationcopslockNessuna valutazione finora

- WalmartDocumento11 pagineWalmartJootoo NitishNessuna valutazione finora

- Revenue Report March 2023Documento8 pagineRevenue Report March 2023Russ LatinoNessuna valutazione finora

- Statement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)Documento2 pagineStatement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)OPERATIONAL WINSTARNessuna valutazione finora

- Verizon Employee Personal Discount Form WWUDocumento1 paginaVerizon Employee Personal Discount Form WWUmuggsyNessuna valutazione finora

- Revised BBIL Outgoing Wire Transfer FormDocumento1 paginaRevised BBIL Outgoing Wire Transfer FormRODOLFONessuna valutazione finora

- Account Statement: Shashwat MishraDocumento11 pagineAccount Statement: Shashwat MishraShashwat MishraNessuna valutazione finora

- Including The Long Form Fee Disclosure ("List of All Fees.")Documento9 pagineIncluding The Long Form Fee Disclosure ("List of All Fees.")Shamara LoganNessuna valutazione finora

- Edward Burns - 5444Documento5 pagineEdward Burns - 5444Mark WilliamsNessuna valutazione finora

- Bank SynopsisDocumento2 pagineBank SynopsisShreya AgrawalNessuna valutazione finora

- Debt Limit AnalysisDocumento68 pagineDebt Limit AnalysisWashington ExaminerNessuna valutazione finora

- Direct DepositDocumento1 paginaDirect DepositMike BelmoreNessuna valutazione finora

- AsdfghjklDocumento2 pagineAsdfghjklAdventurous FreakNessuna valutazione finora

- Sme BookDocumento397 pagineSme BookVivek Godgift J0% (1)

- Electronic Cash1Documento4 pagineElectronic Cash1AtharvaNessuna valutazione finora

- Roadrunner Password RecoveryDocumento7 pagineRoadrunner Password RecoverySteve SmithNessuna valutazione finora

- TNC 280Documento20 pagineTNC 280naveen.bitsgoa8303Nessuna valutazione finora

- IT Word Document - Fraudulent Bank TransactionsDocumento14 pagineIT Word Document - Fraudulent Bank Transactionsjhanak guptaNessuna valutazione finora

- Document 2Documento5 pagineDocument 2rosaNessuna valutazione finora

- Free Credit Score and Report - Free Monthly Credit CheckDocumento3 pagineFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaNessuna valutazione finora

- Ez Payment 2 UDocumento12 pagineEz Payment 2 USophy Sufian SulaimanNessuna valutazione finora

- Lembar JawabanDocumento26 pagineLembar JawabanFajar SepdiantoNessuna valutazione finora

- AccountsDocumento6 pagineAccountsMunira PithawalaNessuna valutazione finora

- DocumentDocumento4 pagineDocumentMichele PadillaNessuna valutazione finora

- Https Online2.penfedDocumento2 pagineHttps Online2.penfedyes_kaushik100% (1)

- 10-02-26 BANK OF AMERICA CORP - DE - (Form - 10-K, Received - 02 - 26 - 2010 07 - 51 - 53 SDocumento765 pagine10-02-26 BANK OF AMERICA CORP - DE - (Form - 10-K, Received - 02 - 26 - 2010 07 - 51 - 53 SHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- Canara Bank Debit CardDocumento8 pagineCanara Bank Debit Cardmir musaweer aliNessuna valutazione finora

- Axis Bank: Corporate Salary Offering To InfosysDocumento13 pagineAxis Bank: Corporate Salary Offering To InfosyssanjayNessuna valutazione finora

- Bank Statement Template 1 - TemplateLabDocumento3 pagineBank Statement Template 1 - TemplateLabHasanNessuna valutazione finora

- Wire Transfer Payment OptionDocumento1 paginaWire Transfer Payment OptionWilliamsNessuna valutazione finora

- MC An5543 PinDocumento9 pagineMC An5543 PinMilagros Barrenechea AldereteNessuna valutazione finora

- Delinquent Listing Immovable 3122018Documento66 pagineDelinquent Listing Immovable 3122018gnarly tiredNessuna valutazione finora

- Astrid C Arboleda: Personal InfoDocumento19 pagineAstrid C Arboleda: Personal InfoSergio LitumaNessuna valutazione finora

- 360 Rewards Catalog PDFDocumento50 pagine360 Rewards Catalog PDFSyed Zain0% (1)

- AirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enDocumento8 pagineAirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enCHOON ONN LIMNessuna valutazione finora

- Gmail - Welcome To Chase! PDFDocumento4 pagineGmail - Welcome To Chase! PDFAnonymous 4R2auQblZ7Nessuna valutazione finora

- SCC-ApCo ApprovalDocumento8 pagineSCC-ApCo ApprovalPat ThomasNessuna valutazione finora

- CIBIL Score & ReportDocumento20 pagineCIBIL Score & ReportKumar GowdaNessuna valutazione finora

- C and B Cheat Sheet To ShareDocumento47 pagineC and B Cheat Sheet To ShareTash KentNessuna valutazione finora

- 04 Social Security Get Your Payments Electronically En-05-10073Documento8 pagine04 Social Security Get Your Payments Electronically En-05-10073api-309082881Nessuna valutazione finora

- Adobe Scan 16-Dec-2022Documento8 pagineAdobe Scan 16-Dec-2022PRADEEP PHOTOGRAPHY AND JOB NOTIFICATIONNessuna valutazione finora

- Incoming Wire Instructions: Questions?Documento2 pagineIncoming Wire Instructions: Questions?Niknjim PoseyNessuna valutazione finora

- Payroll Direct Deposit PAD Form en PDFDocumento1 paginaPayroll Direct Deposit PAD Form en PDFcham kongNessuna valutazione finora

- Credit FormDocumento2 pagineCredit Formyoeyar@gmail.comNessuna valutazione finora

- Business Plan For:: Name of Your BusinessDocumento10 pagineBusiness Plan For:: Name of Your Businesshuzure alaNessuna valutazione finora

- Direct Deposit FormDocumento1 paginaDirect Deposit Formmichaelmonique010Nessuna valutazione finora

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocumento3 pagineStatement of Account: Credit Limit Rs Available Credit Limit RsAbhishek goyalNessuna valutazione finora

- Lori Hutchison May 30 2020 EXP PDFDocumento15 pagineLori Hutchison May 30 2020 EXP PDFLarryNessuna valutazione finora

- Gt1businesse A - A 1 1 1 1 1 1 1 1 1 1 1 S E R 311 2 0 1 1 1 M 1 1 1 1 1 1 1 1 1 1 1 1 1Documento3 pagineGt1businesse A - A 1 1 1 1 1 1 1 1 1 1 1 S E R 311 2 0 1 1 1 M 1 1 1 1 1 1 1 1 1 1 1 1 1Ngoc Hanh Bui ThiNessuna valutazione finora

- Closed School SearchDocumento3.492 pagineClosed School SearchJacob DaleNessuna valutazione finora

- Breakfast Muffins: This Recipe Is A !Documento1 paginaBreakfast Muffins: This Recipe Is A !Jacob DaleNessuna valutazione finora

- Appendix B From The Book DNA of RelationshipsDocumento4 pagineAppendix B From The Book DNA of RelationshipsJacob DaleNessuna valutazione finora

- BB Coloring JesuswithChildrenDocumento1 paginaBB Coloring JesuswithChildrenJacob DaleNessuna valutazione finora

- Broad City 1x01 - What A Wonderful WorldDocumento30 pagineBroad City 1x01 - What A Wonderful WorldJacob DaleNessuna valutazione finora

- Hall, The Power of Hidden DifferencesDocumento8 pagineHall, The Power of Hidden DifferencesJacob DaleNessuna valutazione finora

- 30 Rock 3x08 - Flu ShotDocumento37 pagine30 Rock 3x08 - Flu ShotJacob DaleNessuna valutazione finora

- Housing FinanceDocumento33 pagineHousing FinanceShubhendu Mallick88% (8)

- Chapter 8 In-Class Problems SOLUTIONSDocumento4 pagineChapter 8 In-Class Problems SOLUTIONSAbdullah alhamaadNessuna valutazione finora

- MPBF - Tandon CommitteeDocumento1 paginaMPBF - Tandon Committeeneeteesh_nautiyal100% (5)

- AT.2900b - Auditing (AUD) SyllabusDocumento2 pagineAT.2900b - Auditing (AUD) SyllabusBryan Christian MaragragNessuna valutazione finora

- Key Information Memorandum Cum Application FormDocumento44 pagineKey Information Memorandum Cum Application FormChromoNessuna valutazione finora

- Types of Audit AssignmentDocumento21 pagineTypes of Audit AssignmentKanika GoelNessuna valutazione finora

- List Bibliography PDFDocumento5 pagineList Bibliography PDFInes SantosNessuna valutazione finora

- 2 Discount Rate BSLDocumento44 pagine2 Discount Rate BSLfarNessuna valutazione finora

- Advacc 3 Question Set A 150 CopiesDocumento6 pagineAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNessuna valutazione finora

- Brochure PGDM Exe PDFDocumento39 pagineBrochure PGDM Exe PDFtrishajainmanyajainNessuna valutazione finora

- Theory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™ PDFDocumento401 pagineTheory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™ PDFjez100% (1)

- Derivative Pricing BITS PilaniDocumento35 pagineDerivative Pricing BITS PilaniAmbuj GargNessuna valutazione finora

- 5Documento2 pagine5ABDUL WAHABNessuna valutazione finora

- Cash Problem 1Documento3 pagineCash Problem 1Dawson Dela CruzNessuna valutazione finora

- 04.09.2022 - 14.06.1401Documento14 pagine04.09.2022 - 14.06.1401Sarajuddin IbrahimzadaNessuna valutazione finora

- Chapter 14Documento54 pagineChapter 14ManalFayezNessuna valutazione finora

- NG Cho Cio V NG Diong-Case DigestDocumento2 pagineNG Cho Cio V NG Diong-Case DigestAngelette BulacanNessuna valutazione finora

- MFRS123Documento23 pagineMFRS123Kelvin Leong100% (1)

- Economy India EnglishDocumento76 pagineEconomy India EnglishSudama Kumar BarailyNessuna valutazione finora

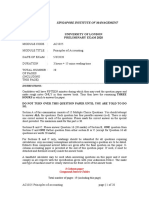

- Singapore Institute of Management: University of London Preliminary Exam 2020Documento20 pagineSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNessuna valutazione finora

- التأمين ٢٠٢٢-٢٠٢٣Documento2 pagineالتأمين ٢٠٢٢-٢٠٢٣lafamfatamNessuna valutazione finora

- Chapter 2 Plant Asset PDFDocumento20 pagineChapter 2 Plant Asset PDFWonde Biru100% (1)

- Free Cash Flow To Equity Discount ModelsDocumento2 pagineFree Cash Flow To Equity Discount ModelsDavid Ignacio Berastain HurtadoNessuna valutazione finora

- Advanced Camarilla Pivot Based TradingDocumento1 paginaAdvanced Camarilla Pivot Based TradingrajaNessuna valutazione finora

- Double Entry Worksheets PDSTDocumento2 pagineDouble Entry Worksheets PDSTChit Manzon CruzNessuna valutazione finora

- AppendicesDocumento8 pagineAppendicescrackheads philippinesNessuna valutazione finora

- Internal Control Internal Audit Internal Checks by Good PDFDocumento8 pagineInternal Control Internal Audit Internal Checks by Good PDFpnditdeepak786Nessuna valutazione finora

- Personal Tax Checklist-Turbo TaxDocumento3 paginePersonal Tax Checklist-Turbo TaxMortgage MississaugaNessuna valutazione finora

- All I KnowDocumento305 pagineAll I Knowhitesh_21Nessuna valutazione finora

- Olamic Healthcare GST Invoice: Sri Krishna PharmaDocumento2 pagineOlamic Healthcare GST Invoice: Sri Krishna PharmaYours PharmacyNessuna valutazione finora