Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

COSTING

Caricato da

rajes wari0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni4 pagineTitolo originale

COSTING.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni4 pagineCOSTING

Caricato da

rajes wariCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

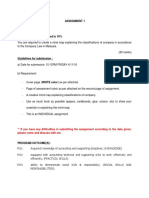

No Item Details

1. Course Title Costing

2. Course Code DBCA2033

3. Course Core

Classification

4. Lecturer Dr. Tee

5. Rationale Accountants must learn the principles and practice of

Costing so that they can do their job and function as

accountants affectively..

6. Semester & Year Year 2, Semester 5

7. Total Student

Learning hours Face to Face Self Learning

(SLH)

L = Lectures L T P O

T = Tutorial 28 14 84

P = Practical/Lab Total Student Learning hours (SLH): 126

O= Others

8. Credit Hours 3

9. Prerequisite DBCA1013 and DBCA1023

10. Objectives To learn basic concepts, principles and practices of

Costing relevant to managing business organizations.

11. Learning At the end of the course, students should be able to;

Outcomes 1. Understand the environment, basic concepts,

principles and practices of Costing in managing

modern businesses.

2. Identify Costing issues and select the best methods to

solve them.

3. Apply lessons learned in managing organizational

activities.

12. Synopsis This module provides a general introduction to accounting

and in particular to key elements of management

accounting - costing. Its aim is to provide students with an

understanding of the theory and practice of costing and

cost accounting principles and their relevance to the

business environment. Topics covered will include

purpose of accounting, elements of cost, cost behaviour,

costing for long and short-term decision making. Profit

and not-for profit, service and (to a lesser extent)

manufacturing sector cases will be used.

13. Learning Methods Lectures, Tutorials and self learning assignments

14. Assessment Mid-Semester Exam 20%

Methods Final Exam 50%

Continuous Assessments 30%

15. Relationships between Course Learning Outcomes (CLO) and Programme

Learning Outcomes (PLO) :-

PLO 1 2 3 4 5 Learning Methods Assessments

CLO

1 3 2 2 2 3 Lectures, Tutorials, Exams, Assg.

Assignments

2 3 3 Lectures, Tutorials, Exams, Assg.

Assignments

3 3 2 2 2 3 Lectures, Tutorials, Exams, Assg.

Assignments

1= CLO fulfills PLO without official assessment

2= CLO fulfills PLO through partial assessment

3= CLO fulfills PLO through official assessment

16a. Relationship between Course Content, CLO & Bloom Taxonomy

Levels (BTL)

Bloom

Topic Title SLO Taxonomy

*

1 Introduction 1-3 1-3

Reporting to meet internal management needs

Features and sources of accounting and cost

data

Responsibility centres (cost, profit and

investment) and impacts on the demand for

accounting information

Information gathering, decision making and the

impact of IT on cost accounting systems

Recording techniques, processing and record

keeping of relevant information for decision

making

2 Costs Classifications and Behaviour 1-3 1-3

Cost concepts, classifications and

categorizations

Cost behavior and its applications – FC, VC and

Semi VC

Cost estimates / estimating the cost function –

High Low, graphical, expert classifications and

scatter diagram methods

Relationships between unit costs and activity

levels

3 Cost Elements 1-3 1-3

Costing for materials, labour and overheads

Cost allocations – Joint vs byproducts

absorptions of overheads

Treatment of over and under absorption

4 Activity Based Costing 1-3 1-3

Concepts of ABC and differences with traditional

methods (product vs activity costing)

Cost hierarchies, cost drivers and cost pools

Implementing an ABC in service and

merchandising

Comparing alternative costing methods

5 Costing Approaches - Marginal vs Absorption 1-3 1-3

Concepts and basics of absorptions

Over and under absorption

Calculative techniques and impacts of reporting

Impacts on income

6 Costing Techniques 1-3 1-3

Job Order costing

Batch costing

Contract costing

Process Costing

Service and output costing

BTL: 1= Knowledge; 2= Understanding; 3=Application; 4= Analysis; 5= Synthesis; 6=

Evaluation

16b. Detailed Contact Hours According to Learning Methods

Self

Topi Lec Tut

Tittle P/L Stud SLH

c . .

y

1 Information for Management 2 1 0 6 9

2 Cost Classifications and Behaviour 2 1 0 6 9

3 Cost Elements 4 2 0 12 18

4 Activity Based Costing 4 2 0 12 18

5 Approaches to Costing - Marginal vs 4 2 0 12 18

Absorption

6 Costing Techniques 12 6 0 36 54

Total Learning Hours per Semester 28 14 0 84 126

Notional Learning Hours Required 120

Notional Credit Hours 3

17. Main Reference 1. Raiborn C.A. and Kinney M.R.; (2009). Cost

Accounting, 7th Edition, South- Western.

2. Drury, C., Costs and Management Accounting,

(2006). 6th Edition, Thomson Learning.

Additional 1. Hilton R.W. (2005). Management Accounting, 6th

Edition, McGraw-Hill.

References 2. Horngren, C.T., Foster, G. & Datar, S.M. (2006).

Cost Accounting, 12th Edition, Pearson Education.

3. Garrison, R. H, Noreen, E. W. & Brewer, P.C. (2005)

Managerial Accounting, 11th Ed. Irwin

18. Other None

Information

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Lesson Plan For Young LearnersDocumento5 pagineLesson Plan For Young LearnersLia TouskaNessuna valutazione finora

- LP 3rd QUARTER EIM XDocumento3 pagineLP 3rd QUARTER EIM XLuis John VillamagnoNessuna valutazione finora

- WEEK 5 CU-5.-Designing Health Education For Age SpecificDocumento8 pagineWEEK 5 CU-5.-Designing Health Education For Age Specificchanise casem100% (1)

- 1) Code of Ethics For AuditorsDocumento29 pagine1) Code of Ethics For Auditorsrajes wari50% (2)

- Assessment in Learning 1Documento14 pagineAssessment in Learning 1Jona MatiasNessuna valutazione finora

- Objective of The Job ScorecardDocumento2 pagineObjective of The Job ScorecardKesho RizkNessuna valutazione finora

- Case of Bank Islam Malaysia BHD V Adnan Bin OmarDocumento10 pagineCase of Bank Islam Malaysia BHD V Adnan Bin Omarrajes wariNessuna valutazione finora

- ManipulativeDocumento3 pagineManipulativeMaria ada ignacioNessuna valutazione finora

- Telephone Business Conversation Role-PlayDocumento3 pagineTelephone Business Conversation Role-Playrajes wariNessuna valutazione finora

- Ensure Their Company Receives Payments For Goods and Services, and Records These Transactions AccordinglyDocumento3 pagineEnsure Their Company Receives Payments For Goods and Services, and Records These Transactions Accordinglyrajes wariNessuna valutazione finora

- Foods.: A Short Phrase Used in Advertising To Identify Our ProductDocumento2 pagineFoods.: A Short Phrase Used in Advertising To Identify Our Productrajes wariNessuna valutazione finora

- EditingDocumento5 pagineEditingrajes wariNessuna valutazione finora

- Date Work Summary/Daily Activities Duration RemarksDocumento38 pagineDate Work Summary/Daily Activities Duration Remarksrajes wariNessuna valutazione finora

- Log Book May Final WorkDocumento41 pagineLog Book May Final Workrajes wariNessuna valutazione finora

- LI ReportDocumento28 pagineLI Reportrajes wariNessuna valutazione finora

- Corporate Reporting 2Documento6 pagineCorporate Reporting 2rajes wariNessuna valutazione finora

- Accounting Information System 1 - Ais20103Documento35 pagineAccounting Information System 1 - Ais20103rajes wariNessuna valutazione finora

- Bar Graph and ConclusionDocumento4 pagineBar Graph and Conclusionrajes wari0% (1)

- Review of GST Vs SST Implementation in MalaysiaDocumento10 pagineReview of GST Vs SST Implementation in Malaysiarajes wariNessuna valutazione finora

- Moa PDFDocumento12 pagineMoa PDFrajes wariNessuna valutazione finora

- Business StatisticsDocumento4 pagineBusiness Statisticsrajes wariNessuna valutazione finora

- Accounting Information SystemDocumento4 pagineAccounting Information Systemrajes wariNessuna valutazione finora

- Assignment 1Documento4 pagineAssignment 1rajes wariNessuna valutazione finora

- Assignment 2 - TopicsDocumento5 pagineAssignment 2 - Topicsrajes wariNessuna valutazione finora

- Formative Assessment BingoDocumento2 pagineFormative Assessment Bingoroziem88Nessuna valutazione finora

- Naomi Muennich Resume August 2019Documento1 paginaNaomi Muennich Resume August 2019api-455068071Nessuna valutazione finora

- Generic - Specific Task RubricDocumento3 pagineGeneric - Specific Task RubricRUTHY ANN BALBIN BEEd 2-1Nessuna valutazione finora

- Psyche Panacea: Let Us Grow TogetherDocumento2 paginePsyche Panacea: Let Us Grow TogetherVikas VatsNessuna valutazione finora

- G4 Math TeachersManualDocumento356 pagineG4 Math TeachersManualrachel.tigenNessuna valutazione finora

- Correction and Evaluation Penny UrDocumento4 pagineCorrection and Evaluation Penny UrMiss AbrilNessuna valutazione finora

- BSBCMM511 - Session Plan - Week 1SAMPLEONLYDocumento9 pagineBSBCMM511 - Session Plan - Week 1SAMPLEONLYwayne tonerNessuna valutazione finora

- Shubham Front PageDocumento7 pagineShubham Front PageSHOAIB MEMONNessuna valutazione finora

- Nursery Planner Lesson Plan 27 Feb 2023 - 5 March 2023 Week 9 Ongoing ObjectivesDocumento8 pagineNursery Planner Lesson Plan 27 Feb 2023 - 5 March 2023 Week 9 Ongoing Objectivessyeda mariamNessuna valutazione finora

- M - 1.6 - Training EvaluationDocumento15 pagineM - 1.6 - Training EvaluationLGED ManikganjNessuna valutazione finora

- CMucat Application Form PDFDocumento1 paginaCMucat Application Form PDFMD OntonganNessuna valutazione finora

- Pedagogy of The OppressedDocumento2 paginePedagogy of The Oppressedandres diazNessuna valutazione finora

- 4 Writing Behavioral ObjectivesDocumento45 pagine4 Writing Behavioral ObjectivesRoselyn DawongNessuna valutazione finora

- PP Sample AssignmentDocumento110 paginePP Sample AssignmentIshani PuvimannasingheNessuna valutazione finora

- Plac908 Dap Record 2023 Individual 3Documento3 paginePlac908 Dap Record 2023 Individual 3api-707012797Nessuna valutazione finora

- Work Immersion Rubric & Assessment ReportDocumento2 pagineWork Immersion Rubric & Assessment ReportJEE AR CANTERENessuna valutazione finora

- PRE-SCHOOL FOREIGN LANGUAGE TEACHING (1st Part)Documento16 paginePRE-SCHOOL FOREIGN LANGUAGE TEACHING (1st Part)Madalina madaNessuna valutazione finora

- Study Guide Finally 123Documento36 pagineStudy Guide Finally 123Krizza Aubrey Orias AmparadoNessuna valutazione finora

- Las 5 eDocumento8 pagineLas 5 eAna Lily OrozcoNessuna valutazione finora

- GRADES 11/ 12 11/12 Practical Research I: School: Grade Level: Teacher: Learning AreaDocumento6 pagineGRADES 11/ 12 11/12 Practical Research I: School: Grade Level: Teacher: Learning AreaRomelSorianoLadislaoNessuna valutazione finora

- Teacher Collaboration in Secondary SchoolsDocumento8 pagineTeacher Collaboration in Secondary SchoolsEFL Classroom 2.0Nessuna valutazione finora

- Evaluation Form For TeachersDocumento2 pagineEvaluation Form For TeachersROCHELL DELA TORRENessuna valutazione finora

- Chapte 14 Choosing A Career - Preparing For The FutureDocumento12 pagineChapte 14 Choosing A Career - Preparing For The FuturePrincess May Castillo RamosNessuna valutazione finora

- GRammar - Lesson Plan PDFDocumento1 paginaGRammar - Lesson Plan PDFolivethiagoNessuna valutazione finora