Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Comm of Internal Revenue vs. American Express International, Inc.

Caricato da

Kat CastilloTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Comm of Internal Revenue vs. American Express International, Inc.

Caricato da

Kat CastilloCopyright:

Formati disponibili

8. Comm of Internal Revenue vs. American Express International, Inc.

(Philippine Branch) business outside the Philippines), when paid in acceptable foreign currency and

Zero Rated Sale of Service | June 29, 2005 | Panganiban, J. accounted for in accordance with the R&R of BSP, are zero-rated. Respondent renders

service falling under the category of zero rating.

Keywords: VAT, Destination Principle c. As a general rule, the VAT system uses the destination principle as a basis for the

Digest maker: LEUCH jurisdictional reach of the tax. Goods and services are taxed only in the country where

SUMMARY: they are consumed. Thus, exports are zero-rated, while imports are taxed.

DOCTRINE: As a general rule, the value-added tax (VAT) system uses the destination d. In the present case, the facilitation of the collection of receivables is different from the

principle. However, our VAT law itself provides for a clear exception, under which the utilization of consumption of the outcome of such service. While the facilitation is done in

supply of service shall be zero-rated when the following requirements are met: (1) the the Philippines, the consumption is not. The services rendered by respondent are

service is performed in the Philippines; (2) the service falls under any of the categories performed upon its sending to its foreign client the drafts and bulls it has gathered from

provided in Section 102(b) of the Tax Code; and (3) it is paid for in acceptable foreign service establishments here, and are therefore, services also consumed in the Philippines.

currency that is accounted for in accordance with the regulations of the Bangko Sentral ng Under the destination principle, such service is subject to 10% VAT.

Pilipinas. e. However, the law clearly provides for an exception to the destination principle; that is 0%

VAT rate for services that are performed in the Philippines, “paid for in acceptable foreign

FACTS: currency and accounted for in accordance with the R&R of BSP.” The respondent meets

Respondent, a VAT taxpayer, is the Philippine Branch of AMEX USA and was tasked with the following requirements for exemption, and thus should be zero-rated:

servicing a unit of AMEX-Hongkong Branch and facilitating the collections of AMEX-HK (1) Service be performed in the Philippines

receivables from card members situated in the Philippines and payment to service (2) The service fall under any of the categories in Section 102B of the Tax Code

establishments in the Philippines. (3) It be paid in acceptable foreign currency accounted for in accordance with BSP R&R.

It filed with BIR a letter-request for the refund of its 1997 excess input taxes, citing as basis

Section 110B of the 1997 Tax Code, which held that “xxx Any input tax attributable to the RULING: Since respondent’s services meet the requirements to be exempt from the destination

purchase of capital goods or to zero-rated sales by a VAT-registered person may at his principle, they are zero-rated. Petitioner’s Revenue Regulations that alter or revoke the above

option be refunded or credited against other internal revenue taxes, subject to the requirements are ultra vires and invalid.

provisions of Section 112.”

In addition, respondent relied on VAT Ruling No. 080-89, which read, “In Reply, please be

informed that, as a VAT registered entity whose service is paid for in acceptable foreign

currency which is remitted inwardly to the Philippine and accounted for in accordance

with the rules and regulations of the Central Bank of the Philippines, your service income

is automatically zero rated xxx”

Petitioner claimed, among others, that the claim for refund should be construed strictly

against the claimant as they partake of the nature of tax exemption.

CTA rendered a decision in favor of respondent, holding that its services are subject to

zero-rate. CA affirmed this decision and further held that respondent’s services were

“services other than the processing, manufacturing or repackaging of goods for persons

doing business outside the Philippines” and paid for in acceptable foreign currency and

accounted for in accordance with the rules and regulations of BSP.

ISSUE/S & RATIO:

1. WON AmEx is entitled to a refund – YES

a. Section 102 of the Tax Code provides for the VAT on sale of services and use or lease of

properties. Section 102B particularly provides for the services or transactions subject to 0%

rate:

(1) Processing, manufacturing or repacking goods for other persons doing business

outside the Philippines which goods are subsequently exported, where the services are

paid for in acceptable foreign currency and accounted for in accordance with the rules and

regulations of the BSP;

(2) Services other than those mentioned in the preceding subparagraph, e.g. those

rendered by hotels and other service establishments, the consideration for which is paid

for in acceptable foreign currency and accounted for in accordance with the rules and

regulations of the BSP

b. Under subparagraph 2, services performed by VAT-registered persons in the Philippines

(other than the processing, manufacturing or repackaging of goods for persons doing

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

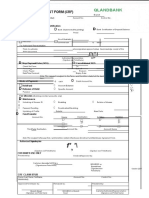

- Gar 29Documento2 pagineGar 29smvpdy0% (1)

- 2020 Tax Return: Prepared ByDocumento5 pagine2020 Tax Return: Prepared ByAdam MasonNessuna valutazione finora

- Konnect DebitCard-Terms and Conditions PDFDocumento10 pagineKonnect DebitCard-Terms and Conditions PDFHassan FarooqiNessuna valutazione finora

- UMS Tariff Pakistan PostDocumento2 pagineUMS Tariff Pakistan PostMir SohailNessuna valutazione finora

- Contoh Laporan LazadaDocumento30 pagineContoh Laporan LazadaHermizal YansyahNessuna valutazione finora

- Customer Request Form (Front)Documento2 pagineCustomer Request Form (Front)noel bandaNessuna valutazione finora

- What Is The Difference Between Lapping and KitingDocumento2 pagineWhat Is The Difference Between Lapping and KitingBenjie Silva33% (3)

- PaytmDocumento10 paginePaytmKunal randhirNessuna valutazione finora

- RK MANDIRI Timindo-DikonversiDocumento18 pagineRK MANDIRI Timindo-DikonversiJake Santoso100% (3)

- Admiral Markets UK LTD Payments Terms and ConditionsDocumento2 pagineAdmiral Markets UK LTD Payments Terms and ConditionsTensonNessuna valutazione finora

- Final Complete CIDocumento32 pagineFinal Complete CIBhaskar ReddyNessuna valutazione finora

- Challan PaymentDocumento1 paginaChallan Paymentjyoti meenaNessuna valutazione finora

- Disputes Assessment TestDocumento21 pagineDisputes Assessment Testshakg0% (1)

- IFIC Schedulebof ChargesDocumento16 pagineIFIC Schedulebof ChargesSohel RanaNessuna valutazione finora

- Wells Fargo Everyday CheckingDocumento4 pagineWells Fargo Everyday Checkingpeter.pucciNessuna valutazione finora

- Packing and Packaging in LogisticsDocumento26 paginePacking and Packaging in Logisticsali3800100% (1)

- StatementDocumento1 paginaStatementNozipho Zipho DlaminiNessuna valutazione finora

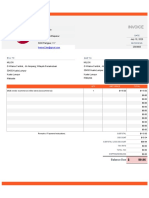

- Total 1.372,48: Almar Speed SRL STR Sondei NR 4 Peris, 077150Documento2 pagineTotal 1.372,48: Almar Speed SRL STR Sondei NR 4 Peris, 077150Alin NitaNessuna valutazione finora

- Annex F-ICQ DraftDocumento5 pagineAnnex F-ICQ Draftrussel1435Nessuna valutazione finora

- Spaghetti Chs LTD: Date: 10-May-2020Documento3 pagineSpaghetti Chs LTD: Date: 10-May-2020Pavlov Kumar HandiqueNessuna valutazione finora

- T3TSL - Syndicated Loans - R11.1Documento238 pagineT3TSL - Syndicated Loans - R11.1sivanandini100% (1)

- RTGSDocumento1 paginaRTGSsales Celsol57% (21)

- Confirmation - Your Booking Confirmation and Reference - FlydubaiDocumento2 pagineConfirmation - Your Booking Confirmation and Reference - FlydubaiMurugan Raja67% (9)

- Picop VS CaDocumento17 paginePicop VS CaQuennie Jane SaplagioNessuna valutazione finora

- Pharma Erp BrochureDocumento8 paginePharma Erp BrochuresanthoshinouNessuna valutazione finora

- Invoice 03Documento1 paginaInvoice 03Frank WalterNessuna valutazione finora

- P 2Documento12 pagineP 2Uday kumarNessuna valutazione finora

- SRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionDocumento93 pagineSRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionmnasirmehmoodNessuna valutazione finora

- List of Doc Types and Posting Keys CombinationDocumento10 pagineList of Doc Types and Posting Keys CombinationPavan UlkNessuna valutazione finora

- Other Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateDocumento18 pagineOther Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateZaaavnn VannnnnNessuna valutazione finora