Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2015 Golden Notes Mercantile Law PDF

Caricato da

Zyki Zamora LacdaoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2015 Golden Notes Mercantile Law PDF

Caricato da

Zyki Zamora LacdaoCopyright:

Formati disponibili

LETTERS OF CREDIT

LETTERS OF CREDIT Duration of Letters of Credit

DEFINITION AND NATURE OF LETTER OF CREDIT 1. Upon the period fixed by the parties; or

2. If none is fixed, one year from the date of issuance.

Letter of Credit (L/C) Incidents in the life of a Letter of Credit (SAIS-ERR)

It is any arrangement, however named or described, 1. Contract of Sale between the buyer and seller

whereby the issuing bank acting at the request and on the 2. Application for L/C by the buyer with the bank

instructions of a customer (applicant) or on its own 3. Issuance of L/C by the bank

behalf, binds itself to: (PAN) 4. Shipping of goods by the seller

5. Execution of draft and tender of documents by the

1. Pay to the order of, or accept and pay drafts drawn by a seller

third party (Beneficiary), or 6. Redemption of draft (payment) and obtaining of

2. Authorize another bank to pay or to accept and pay documents by the issuing bank

such drafts, or 7. Reimbursement to the bank and obtaining of

3. Authorizes another bank to Negotiate, against documents by the buyer

stipulated documents

Essential conditions of a Letter of Credit

Provided, the terms and conditions of the credit are

complied with (Uniform Customs & Practice for 1. Issued in favor of a definite person.

Documentary Credits, Art. 2). 2. Limited to a fixed or specified amount, or to one or more

amounts, but with a maximum stated limit (Code of

Nature of Letters of Credit as a Financial Device Commerce, Art. 568).

A letter of credit is a financial device developed by NOTE: If any of these essential conditions is not present,

merchants as a convenient a relatively safe mode of the instrument is merely considered as a letter of

dealing with sales of goods to satisy the seemingly recommendation.

irreconcilable interests of a seller, who refuses to part

with his goods before he is paid, and a buyer, who wants Q: Letters of Credit are financial devices in

to have in control of the goods before paying. The use of commercial transactions which will ensure that the

credits in commercial transactions serves to reduce the seller of the goods is sure to be paid when he parts

risk of nonpayment of the purchase price under the with the goods and the buyer of the goods gets control

contract of sale of the goods and to reduce the risk of non- of the goods upon payment. Which statement is most

performance of an obligation in a non-sale setting accurate? (2012 Bar)

(Transfield Philippines, Inc. vs. Luzon Hydro Corp., GR. No.

146717, November 22,2004). A: A.The use of the Letter of Credit serves to reduce the

risk of nonpayment of the purchase price in a sale

Purpose of Letter of Credit transaction

The purpose of a letter of credit is to ensure certainty of Kinds of Letter of Credit

payment. The bank makes the commitment to pay. This

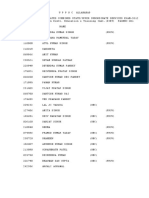

addresses problems arising from seller’s refusal to part COMMERCIAL L/C STANDBY L/C

with his goods before being paid and the buyer’s refusal Involves the payment of

Involves non-sale

to part with his money before acquiring the goods, thus, money under a contract of

transactions.

facilitating commercial transactions. sale.

Payable upon certification

Laws governing Letters of Credit by the beneficiary of the

applicant’s non-

Payable upon the

Letter of credit is governed by theUniform Customs and performance of the

presentation by the seller-

Practice for documentary Credits issued by the agreement. The

beneficiary of documents

International Chamber of Commerce (Metropolitan documents that

that show he has taken

Waterworks vs. Daway, G.R. No. 160723, July 21, 2004). accompany the

affirmative steps to comply

beneficiary's draft must

with the sales agreement

NOTE: The law on contracts and damages shall also apply show that the applicant

to provide remedies to the party aggrieved by the breach has not performed the

of the main contract although such breach will not affect undertaking

the obligation of the bank to pay the beneficiary or its (Transfield Philippines, Inc. v. Luzon Hydro Corp., supra).

right to obtain reimbursement from the applicant of the

letter of credit if the terms of the letters of credithave been

complied with.

1 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

Irrevocable Letter of Credit v. Confirmed Letter of 2. Issuing Bank – one which, whether a paying bank or

Credit not, Issues the L/C and undertakes to pay the seller upon

receipt of the draft and proper documents of title from the

BASIS IRREVOCABLE seller and to surrender them to the buyer upon

CONFIRMED L/C

L/C reimbursement. After due payment, issuing bank is

What it Kind of obligation entitled to reimbursement as a matter of right.

pertains Duration of the L/C assumed by the Reimbursement includes debiting the bank account of the

to correspondent bank. applicant, if any. The failure of the beneficiary to present

The correspondent the draft to the applicant does not affect the right of the

bank gives an issuing bank to reimbursement.

The issuing bank

absolute assurance to

may not, without 3. Beneficiary/Seller/Exporter – in whose favor the

the beneficiary that it

the consent of the instrument is executed. One who delivers the documents

What it will undertake the

beneficiary and the of title and draft to the issuing bank to recover payment.

means issuing bank’s

applicant, revoke He has a prestation to do under the main contract but his

obligation as its own

its undertaking failure to fulfill his obligation under the main contract

according to the

under the letter. does not negate his right to payment from the issuing

terms and condition

of the credit. bank as long as he is able to submit the required

(FEATI Bank and Trust Company v. CA, G.R. No. 94209, April documents and comply with the terms of the credit,

30, 1991). without prejudice to his liability against the account party

under the law on contracts and damages.

Courts cannot order the release to the applicant of the

proceeds of an Irrevocable Letter of Credit without NOTE: The number of parties may be increased. The

the consent of the Beneficiary following additional parties may be:

Such order violates the irrevocable nature of the L/C. The a) Advising/notifying bank – the correspondent bank

terms of an irrevocable letter of credit cannot be changed (agent) of the issuing bank and determines the

without the consent of the parties, particularly the apparent authenticity of the L/C. it assumes no liability

beneficiary thereof (Phil. Virginia Tobacco Administration except to notify and/or transmit to the beneficiary the

v. De Los Angeles, G.R. No. L-27829, August 19, 1988). existence of the L/C.

Non-payment of the buyer of its obligation under the b) Confirming bank –lends credence to the L/C issued by a

Letter of Credit does not give the bank the right to lesser known bank as if it were the one that issued the

take possession of the goods covered by the Letter of letter of credit. Its obligation is similar to the issuing

Credit bank. Thus, beneficiary may tender documents to the

confirming bank and collect payment. It collects fees for

The opening of a L/C does not vest ownership of the goods such engagement and obtains reimbursement from the

in the bank in the absence of a trust receipt agreement. A issuing bank (Divina, 2013).

letter of credit is a mere financial device developed by

merchants as a convenient and relatively safe mode of c) Paying bank – bank on which the drafts are to be drawn,

dealing with the sales of goods to satisfy the seemingly which may be the issuing bank, the advising bank or

irreconcilable interests of a seller, who refuses to part another bank not in the city of the beneficiary.

with his goods before he is paid, and a buyer, who wants

to have control of the goods before paying (Transfield d) Negotiating bank – buys or discounts a draft under the

Philippines, Inc. v. Luzon Hydro Corporation, G.R. No. letter of credit. Its liability is dependent upon the stage

146717, November 22, 2004). of the negotiation. If before negotiation, it has no

liability with respect to the seller but after negotiation,

PARTIES TO A LETTER OF CREDIT a contractual relationship will then prevail between the

negotiating bank and the beneficiary.

Parties to a Letter of Credit transaction

RIGHTS AND OBLIGATIONS OF PARTIES

1. Applicant/Buyer/Importer/Account Party – procures

the letter of credit, purchases the goods and obliges Three (3) distinct but intertwined contracts in a

himself to reimburse the issuing bank upon receipt of the Letter of Credit transaction (2002, 2008 Bar)

documents of title. The aplicant has no obligation to

reimburse the issuing bank if the latter pays without the 1. Between the applicant/buyer/importer/account party

and the beneficiary/seller/exporter - The applicant is the

stipulated documents or in case of discrepant documents,

unless the applicant waives the discrepancy. He has the one who procures the letter of credit and obliges himself

right to have the marginal deposit deducted from the to reimburse the issuing bank upon receipt of the

principal obligation under the L/C and to have the interest documents of title while the beneficiary is the one who in

computed only on the balance and not on the face value compliance with the contract of sale ships the goods to the

thereof. buyer and delivers the documents of title and draft to the

issuing bank to recover payment for the goods. The

relationship between them is governed by the law on

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 2

LETTERS OF CREDIT

sales if it is a commercial L/C but if it is a stand-by letter the L/C (Bank of authority. (Bank

of credit it is governed by the law on obligations and America NT & SA of America NT &

contract. v. CA, G.R. No. SA v. CA, G.R. No.

105395, 105395, December

2. Between the issuing bank and the beneficiary/ December 10, 10, 1993)

seller/exporter - The issuing bank is the one that issues the 1993).

letter of credit and undertakes to pay the beneficiary upon It does not

strict compliance of the latter to the requirements set guarantee the

forth in the letter of credit. On the other hand, the genuineness or

beneficiary surrenders document of title to the bank in due execution of

compliance with the terms of the L/C. Their relationship the L/C. It is not

is governed by the terms of the L/C. liable for

damages even if

3. Between the issuing bank and the applicant/ the L/C turns out

buyer/importer - The applicant obliges himself to to be spurious

reimburse the issuing bank upon receipt of the provided the

documents of title. Their relationship is governed by the spurious

terms of the application and agreement for the issuance character is not

of the L/C by the bank. apparent on the

face of the

An Issuing Bank is not a guarantor instrument.

The concept of guarantee vis-a-vis the concept of Confirming Lends credence Direct obligation,

irrevocable L/C is inconsistent with each other. L/Cs are Bank to the L/C issued as if it is the one

primary obligations and not security contracts and while by a lesser- which issued the

they are security arrangements, they are not converted known bank. L/C.

thereby into contracts of guaranty (MWSS v. Hon. Daway,

G.R. No.160732, June 21, 2004). The confirming Its obligation is

bank collects similar to the

NOTE: The liability of issuing bank is primary and fees for such issuing banks.

solidary. Neither is the issuing bank entitled to the benefit engagement and Thus, beneficiary

of excussion. obtains may tender

reimbursement documents to the

Entitlement of a bank to reimbursement from the issuing confirming bank

bank. and collect

Once the issuing bank shall have paid the beneficiary after payment.

the latter’s compliance with the terms of the L/C. Negotiating Buys the seller’s Depends on the

Presentment for acceptance to the customer/applicant is Bank draft and later stage of

not a condition sine qua non for reimbursement on sells the draft negotiation, thus:

(Prudential Bank v. IAC, G.R. No. 74886, December 8, 1992). to the issuing

bank. 1. Before

Consequence of payment upon an expired Letter of negotiation – No

Credit liability with

respect to the

An issuing bank which paid the beneficiary upon an seller. Merely

expired L/C can recover the payment from the applicant suggests its

which obtained the goods from the beneficiary to prevent willingness to

unjust enrichment (Rodzssen Supply Co. v. Far East Bank negotiate.

and Trust Co, G.R. No. 109087, May 9, 2001).

2. After

Different roles and liabilities of the banks involved in negotiation – A

Letter of Credit transactions contractual

relationship will

KIND OF ROLE LIABILITY then arise,

BANK making the bank

Notifying/ Serves as an Does not incur liable. As holder,

Advising agent of the any obligation it has the right to

Bank issuing bank; more than just payment from the

notifying the bank primarily

Warrants the seller/beneficiary liable on the draft

apparent of the opening of (either the issuing

(Appearance to the L/C after it or confirming

unaided senses) has determined bank). If the party

authenticity of its apparent

3 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

primarily liable with documents and not goods (BPI v. De Reny Fabric

on the L/C Industries, Inc., L-2481, October 16, 1970). In effect, the

refuses to honor buyer has no course of action against the issuing bank.

the draft, the

negotiating bank

has the right to

proceed against

the drawer Two-Fold nature of the Independence Principle

thereof.

Paying May either be Direct obligation. 1. Independence in toto where the credit is independent

Bank the issuing bank from the justification aspect and is a separate obligation

or any other from the underlying agreement. This principle is

bank in the place illustrated by standby L/C; or

of the issuing

bank to facilitate 2. Independence only as to the justification aspect which

payment to the is identical with the same obligations under the

beneficiary. underlying agreement. This principle is illustrated by a

commercial L/C or repayment standby (Transfield v.

Luzon Hydro Corp., supra).

BASIC PRINCIPLES OF LETTER OF CREDIT

Effect of the buyer’s failure to procure a Letter of

Letters of Credit are not considered as Negotiable

Credit to the main contract

Instruments

The L/C is independent from the contract of sale. The

A L/C is not considered a negotiable instrument.

failure of Reliance to open, the appropriate L/C did not

However, drafts issued in connection with L/C’s can be

prevent the birth of that contract, and neither did such

considered negotiable instruments. The presumption that

failure extinguish that contract. The opening of the L/C in

the drafts drawn in connection with the L/C’s have

favor of Daewoo was an obligation of the buyer and the

sufficient consideration applies (Lee v. CA, G.R. No. 117913,

performance of that obligation by buyer was a condition

February 1, 2002).

of enforcement of the reciprocal obligation of seller to

ship the subject matter of the contract to buyer. But the

Q: ABC Company filed a Petition for Rehabilitation

contract itself between the buyer and the sellerhad

with the Court. An order was issued by the Court, (1)

already sprung into legal existence and was enforceable.

staying enforcement of all claims, whether money or

otherwise against ABC Company, its guarantors and

The failure of a buyer seasonably to furnish an agreed L/C

sureties not solidarily liable with the company; and

is a breach of the contract between buyer and seller.

(2) prohibiting ABC Company from making payments

Where the buyer fails to open a letter of credit as

of the liabilities, outstanding as of the date of the filing

stipulated, the seller or exporter is entitled to claim

of the Petition. XYC Company is a holder of an

damages for such breach. Damages for failure to open a

irrevocable Standby Letter of Credit which was

commercial credit may, in appropriate cases, include the

previously procured by ABC Company in favor of XYC

loss of profit which the seller would reasonably have

Company to secure performance of certain

made had the transaction been carried out (Reliance

obligations. In the light of the Order issued by the

Commodities, Inc. v. Daewoo Industrial Co. Ltd., G.R. No.

Court, can XYC Company still be able to draw on their

100831, December 17, 1993).

Irrevovable Standby Letter of Credit when due?

Explain your answer. (2012 Bar)

Partial payments on the loan cannot be added in

computing the issuing bank’s liability under its own

A: XYC Company, the beneficiary of the standby letter of

Standby Letter of Credit

credit, can draw on the letter of credit despite filing of

petition for corporate rehabilitation. The liability of the

Although these payments could result in the reduction of

bank that issued the letter of credit is primary and

the actual amount, which could ultimately be collected

solidary. Being solidary, the claims against them can be

from the issuing bank, the latter’s separate undertaking

pursued separately from and independently of the

under its letters of credit remain. The letter of credit is an

rehabilitation case (MWSS v. Daway, supra).

absolute and primary undertaking which is separate and

distinct from the contract underlying it (Insular Bank of

DOCTRINE OF INDEPENDENCE

Asia & America v. IAC, G.R. No. 74834, November 17, 1988).

Doctrine of Independence/ Independence Principle

In a standby letter of credit securing a loan obligation, any

payment of the debtor to the creditor should not be

The relationship of the buyer and the bank is separate and

deducted from the total obligation of the issuing bank to

distinct from the relationship of the buyer and seller in the

the beneficiary. The issuing bank, after payment of the full

main contract; the bank is not required to investigate if

amount, is entitled to full reimbursement from the debtor.

the contract underlying the L/C has been fulfilled or not

But the debtor may recover excess payment from the

because in transactions involving L/C, banks deal only

creditor to prevent unjust enrichment.

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 4

LETTERS OF CREDIT

In other words, PNB cannot evade responsibility on the

Q: SMC entered into an Exclusive Dealership sole ground that the RTC judgment found Goroza liable

Agreement with Goroza wherein the latter was given and ordered him to pay the amount sought to be

by SMC the right to trade, deal and market or recovered by SMC. PNB's liability, if any, under the letter

otherwise sell its various beer products. of credit is yet to be determined (Philippine National Bank

vs San Miguel Corporation, GR No. 186063, January 15,

Goroza applied for a credit line with SMC, but one of 2014).

the requirements for the credit line was a letter of

credit. Thus, Goroza applied for and was granted a Q: AAA Carmakers opened an Irrevocable Letter of

letter of credit by the PNB in the amount of Credit with BBB Banking Corporation with CCC Cars

P2,000,000.00 and subsequently an additional credit Corporation as beneficiary. The irrevocable Letter of

line of P2,400,000.00 which the latter approved. Credit was opened to pay for the importation of ten

Under the credit agreement, the PNB has the (10) units of Mercedes Benz S class. Upon arrival of

obligation to release the proceeds of Goroza's credit the cars, AAA Carmakers found out that the cars were

line to SMC upon presentation of the invoices and all not in running condition and some parts were

official receipts of Goroza's purchases of SMC beer missing. As a consequence, AAA Carmakers instructed

products to PNB. Initially, Goroza was able to pay his BBB Banking Corporation not to allow drawdown on

credit purchases with SMC. However, Goroza started the Letter of Credit. Is this legally possible? (2012

to become delinquent with his accounts. Demands Bar)

were made by the SMC against Goroza and PNB but

neither of them paid. SMC filed a Complaint for A: a. No, because under the "Independence Principle",

collection of sum of money against PNB and Goroza. conditions for the drawdown on the Letters of Credit are

RTC rendered a decision in favor of the plaintiff based only on documents, like shipping documents, and

ordering Goroza to pay. In the meantime, trial not with the condition of the goods subject of the

continued with respect to PNB. importation.

PNB moved to terminate the proceedings on the Q: X Corporation entered into a contract with PT

ground that a decision was already rendered finding Construction Corporation for the latter to construct

Goroza solely liable. The RTC denied the PNB's motion and build a sugar mill within six (6) months. They

and issued a Supplemental Judgment which stated agreed that in case of delay, PT Construction

that the RTC omitted by inadvertence to insert in its Corporation will pay X Corporation P100,000.00 for

decision the phrase "without prejudice to the decision everyday of the delay. To ensure payment of the

that will be made against the other co-defendant, agreed amount of damages, PT Construction

PNB, which was not declared in default." The CA Corporation secured from Atlantic Bank a confirmed

affirmed the Resolution of RTC. and irrevocable letter of credit which was accepted by

X Corporation in due time. One week before the

Was the CA incorrect in affirming the RTC despite expiration of the six (6) month period, PT

complete adjudication of relief to SMC and the Construction Corp. requested for an extension of time

perfection of appeal by Goroza? to deliver claiming that the delay was due to the fault

of X Corporation. A controversy as to the cause of

A: No. It is clear from the proceedings held before and the delay which involved the worksmanship of the

orders issued by the RTC that the intention of the trial building ensued. The controversy remained

court is to conduct separate proceedings to determine the unsolved. Despite the controversy, X corporation

respective liabilities of Goroza and PNB, and thereafter, to presented a claim against Atlantic Bank by executing

render several and separate judgments for or against a draft against the letter of credit.

them.

a. Can Atlantic Bank refuse payment due to the

The propriety of a several judgment is borne by the fact unresolved controversy? Explain.

that SMC's cause of action against PNB stems from the b. Can X Corporation claim directly from PT

latter's alleged liability under the letters of credit which it Construction Corp.? Explain. (2008 Bar)

issued. On the other hand, SMC's cause of action against

Goroza is the latter's failure to pay his obligation to the A:

former. As to the separate judgment, PNB has a a. No. Atlantic Bank cannot refuse to pay X Corporation.

counterclaim against SMC which is yet to be resolved by This is because of the Doctrine of Independence which

the RTC. The so-called "independence principle" assures provides that the obligation of the issuing bank to pay

the seller or the beneficiary of prompt payment the beneficiary does not depend on the fulfillment or

independent of any breach of the main contract and non-fulfillment of the contract supporting the letter of

precludes the issuing bank from determining whether the credit. The only instance where Atlantic Bank can

main contract is actually accomplished or not.As the refuse payment is when X Corporation was not able to

principle's nomenclature clearly suggests, the obligation strictly comply with the letter of credit.

under the letter of credit is independent of the related and

originating contract. In brief, the letter of credit is b. Yes. X Corporation may directly claim from PT

separate and distinct from the underlying transaction. Construction Corporation. A letter of credit by itself

does not come into operation without a contract

5 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

supporting it. It is no a contract that can stand on its Q: BV agreed to sell to AC, a Ship and Merchandise

own, it needs a supporting contract. It is merely an Broker, 2500 cubic meters of logs at $27 per cubic

alternative course and does not in any way prevent the meter FOB. After inspecting the logs, CD issued a

beneficiary from directly claiming from the applicant purchase order.

(Transfield Philippines, Inc. v. Luzon Hydro Corporation,

supra). On the arrangement made upon instruction of the

consignee, H&T Corporation of LA, California, the SP

FRAUD EXCEPTION PRINCIPLE Bank of LA issued an irrevocable letter of credit

available at sight in favor for the total purchase price

The Exception to the Independence Principle (2010 of the logs. The letter of credit was mailed to FE Bank

Bar) with the instruction "to forward it to the beneficiary".

The letter of credit provided that the draft to be

The “Fraud Exception Principle”is the exception to the drawn is on SP Bank and that it be accompanied by,

Independence Principle. It provides that the among other things, a certification from AC, stating

untruthfulness of a certificate accompanying a demand that the logs have been approved prior shipment in

for payment under a standby letter of credit may qualify accordance with the terms and conditions of the

as fraud sufficient to support an injunction against purchase order.

payment.

Before loading of the vessel chartered by AC, the logs

Under the fraud exception principle, the beneficiary may were inspected by custom inspectors and

be enjoined from collecting on the letter of credit if the representatives of the Bureau of Forestry, who

beneficiary committed fraud by substituting fraudulent certified to the good condition and exportability of

documents even if on their face the documents complied the logs. After loading was completed, the Chief Mate

with the requirements. of the vessel issued a mate receipt of the cargo which

stated that the logs are in good condition. However,

This principle refers to fraud in relation with the AC refused to issue required certification in the letter

independent purpose or character of the L/C and not only of credit. Because of the absence of certification, FE

fraud in the performance of the obligation or contract Bank refused to advance payment on the letter of

supporting the letter of credit (Transfield vs. Luzon Hydro credit.

Corp., supra).

a. May FE Bank be held liable under the Letter of

Remedy for fraudulent abuse Credit? Explain.

b. Under the facts above, the seller, BV, argued

Injunction against payment is the remedy; provided the that FE Bank, by accepting the obligation to

requisites enumerated immediately below this item are notify him that the irrevocable letter of credit

present. has been transmitted to it on his behalf, has

confirmed the letter of credit. Consequently, FE

Requisites in order to enjoin the Beneficiary from Bank is liable under the letter of credit. Is the

drawing or collecting under the Letter of Credit on the argument tenable? Explain. (1993 Bar)

basis of fraud (PAI)

A.

1. Clear Proof of fraud; a. FE Bank cannot be held liable under the letter of

2. Fraud constitutes fraudulent Abuse of the independent credit since the certificate is not issued by BV. It is a

purpose of the letter of credit and not only fraud under settled rule in commercial transactions involving letters

the main agreement; and of credit that the documents tendered must strictly

3. Irreparable Injury might follow if injunction is not conform to the terms of the letter of credit. The tender of

granted or the recovery of damages would be seriously documents by the beneficiary (seller) must include all

damaged (Ibid.) documents required by the letter. A correspondent bank

which departs from what has been stipulated under the

DOCTRINE OF STRICT COMPLIANCE letter of credit, as when it accepts a faulty tender, acts on

(1993, 2008 Bar) its own risks and it may not thereafter be able to recover

from the buyer or the issuing bank, as the case may be, the

The documents tendered by the seller/beneficiary must money thus paid to the beneficiary. Thus the rule of strict

strictly conform to the terms of the L/C. The tender of compliance. (Feati Bank and Trust Company v. CA, supra).

documents must include all documents required by the

letter. It is not a question of whether or not it is fair or The argument made by BV is untenable. The FE Bank in

equitable to require submission of documents but this case is only a notifying bank and not a confirming

whether or not the documents were agreed upon. Thus, a bank. It is tasked only to notify and/or transmit the

correspondent bank which departs from what has been required documents and its obligation ends there. It is not

stipulated under the L/C acts on its own risk and may not privy to the contract between the parties, its relationship

thereafter be able to recover from the buyer or the issuing is only with that of the issuing bank and not with the

bank, as the case may be, the money thus paid to the beneficiary to whom he assumes no liability.

beneficiary (Feati Bank and Trust Company v. CA, supra).

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 6

TRUST RECEIPTS LAW

Doctrine of Strict Compliance v. Independence

Principle TRUST RECEIPTS LAW

Basis Doctrine of Doctrine of DEFINITION/CONCEPT OF A TRUST RECEIPT

Strict Independence TRANSACTION

Compliance

Principle Documents Relationship of Trust Receipt (TR) transaction

tendered by the the buyer and

seller or the bank is It is any transaction between the entruster and entrustee:

beneficiary must separate and

strictly conform distinct from the 1) Whereby the entruster who owns or holds title or

to the terms of relationship of security interests over certain specified goods,

the letter of the buyer and documents or instrument (GDI), releases the same to

credit. seller in the main the possession of entrustee upon the latter’s execution

contract. of a TR agreement.

Consequence of A correspondent The bank is not

the Doctrine bank which required to 2) Wherein the entrustee binds himself to hold the GDI in

departs from investigate trust for the entruster and, in case of default,

what has been whether the a) to sell or otherwise dispose such GDI with the

stipulated and contract obligation to turn over to the entruster the

acts on its own underlying the proceeds to the extent of the amount owing to it or

risk may not L/C has been b) to turn over the GDI itself if not sold or otherwise

thereafter be fulfilled or not. disposed of in accordance with the terms and

able to recover. conditions specified in the TR.

Payment of the Beneficiary Fraud Exception

Beneficiary cannot draw on Principle can A TR is considered a security transaction intended to aid

the letter of enjoin in financing importers and retail dealers who do not have

credit if he did beneficiary from sufficient funds or resources to finance the importation or

not comply with drawing or purchase of merchandise, and who may not be able to

its terms and collecting under acquire credit except through utilization, as collateral, of

conditions. the L/C if there is the merchandise imported or purchased. Similarly,

fraud in relation American Jurisprudence demonstrates that TR

with the transactions always refer to a method of “financing

independent importations or financing sales.” The principle is of

purpose of the course not limited in its application to financing

L/C. importations, since the principle is equally applicable to

domestic transactions. Regardless of whether the

transaction is foreign or domestic, it is important to note

Q: At the instance of CCC Corporation, AAA Bank

that the transactions discussed in relation to trust

issued an irrevocable Letter of Credit in favor of BBB

receipts mainly involved sales (Anthony Ng vs. People, G.R.

Corporation. The terms of the irrevocable Letter of

no. 173095, April 23, 2010; 1992, 2007 Bar).

Credit state that the beneficiary must present certain

documents including a copy of the Bill of Lading of the

Subjects of a Trust Receipt transaction (GDI)

importation for the bank to release the funds. BBB

Corporation could not find the original copy of the Bill

1. Goods – shall include chattels and personal property

of Lading so it instead presented to the bank a xerox

other than: money, things in action, or things so affixed to

copy of the Bill of Lading. Would you advise the bank

land as to become a part thereof (P.D. 115, Sec. 3 [d]).

to allow the drawdown on the Letter of Credit? (2012

Goods must be object of lawful commerce.

Bar)

2. Documents – written or printed evidence of title to

A: a. No, because the rule of strict compliance in

goods (P.D. 115, Sec. 3 [a]). E.g. L/C.

commercial transactions involving letters of credit,

requiring documents set as conditions for the release of

3. Instruments – negotiable instruments; certificates of

the fund, has to be strictly complied with or else funds will

stock, or bond or debenture for the payment of money

not be released.

issued by a corporation, or certificates of deposit,

participation certificates or receipts, credit or investment

instruments of a sort marketed in the ordinary course of

business or finance (P.D. 115, Sec. 3 [e]). E.g. checks, drafts,

promissory notes, bills of exchange.

Parties to a Trust Receipt transaction

1. Entruster - A lender, financer or creditor. Person

holding title over the GDI subject of a TR transaction;

7 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

releases possession of the goods upon execution of TR A Trust Receipt is not a negotiable instrument

(P.D. 115, Sec. 3[c]).

Like L/C’s, TR’s are not negotiable instruments. The

2. Entrustee - A borrower, buyer, importer or debtor. He is presumption of consideration under the negotiable

the person to whom the goods are delivered for sale or instrument law may not necessarily be applicable to trust

processing in trust, with the obligation to return the receipts (Lee v. CA, supra).

proceeds of sale of the goods or the goods to the entruster

(P.D. 115, Sec. 3[b]). Q: C contracted D to renovate his commercial

building. D ordered construction materials from E

Transactions not considered as a Trust Receipt and received delivery thereof. The following day, C

went to F Bank to apply for a loan to pay the

1. A sale by a person in the business of selling for profit construction materials. As security for the loan, C was

who retains general property rights in the GDI. made to execute a trust receipt. One year later, after C

failed to pay the balance on the loan, F Bank was

2. Where the seller retains title or other interest as charged with violation of the Trust Receipts Law.

security for the payment of the purchase price (P.D. 115,

Sec. 4). a. What is a Trust Receipt?

b. Will the case against C prosper? Reason

NOTE: The sale of goods by a person in the business of briefly. (2007 Bar)

selling goods, for profit, who at the outset of the

transaction, has as against the buyer, general property A:

rights in such goods, or who sells goods to the buyer on a. A TR is a written or printed document signed by the

credit, retaining title or other interest as security for the entrustee in favor of the entruster containing terms and

payment of the purchase price, does not constitute as conditions substantially complying with the provision of

trust receipt transaction. There is no trust receipt, PD 115 whereby the bank as entruster releases the goods

notwithstanding the label, if goods offered as security for to the possession of the entrustee but retain ownership

a loan accommodation are goods sold to the debtor unde thereof while the entrustee may sell the goods and apply

a supposed trust receipt transaction (Sps. Dela Cruz vs. the proceeds for the full payment of his liability to the

Planters Products, Inc., G.R. No. 158649, February 18, 2013, bank (P.D. 115, Sec. 3(j)).

in Divina, 2014).

It is also defined as a document in which is expressed a

3. If the entrustee is already the owner or in security transaction, whereunder the lender, having no

possession of the goods before delivery of the loan and prior title in the goods on which the lien is to be given, and

execution of the trust receipt transaction, the transaction not having possession which remains in the borrower,

shall be considered a simple loan even though the parties lends his money to the borrower on security of the goods,

may have denominated the agreement as one of TR. To be which the borrower is privileged to sell clear of lien on

in the nature of TR, the entruster should have financed the agreement to pay all or part of the proceeds of sale to the

acquisition or importation of the goods. The funds should lender. The term is specifically applied to a written

have been delivered before or simultaneously with instrument whereby a banker having advanced money for

delivery of the goods. purchase of imported merchandise and having taken title

in his own name, delivers possession to an imported on

4. Where the entruster bank knew even before the agreement in writing to hold the merchandise in trust fir

execution of the trust receipt agreements that the the banker till he is paid.

construction materials covered were never intended by

the entrustee for resale or for the manufacture of items to Finally, a document executed between an entruster and

be sold (Hur Tin Yang v. People, supra). entrustee, under which the goods are released to the

latter who binds himself to hold the goods in trust, or to

Two views regarding Trust Receipts sell or dispose of the goods with the obligation to turn

over the proceeds to the entrustor to the extent of the

1. As a commercial document - the entrustee binds entrustee's obligation to him, or if unsold, to return the

himself to hold the designated GDI in trust for the same.

entruster and to sell or otherwise dispose of GDI with the

obligation to turn over to the entruster the proceeds if b. The case of estafa against C will not prosper. PD 115

they are unsold or not otherwise disposed of, in does not apply in this case because the proceeds of the

accordance with the terms and conditions specified in the loan are used to renovate C's commercial building. TR

TR (P.D. 115, Sec. 4). transactions are intended to aid in financial importers and

retail dealers who do not have sufficient funds or

2. As a commercial transaction – It is a separate and resources to finance the importation or purchase of

independent security transaction intended to aid in merchandise and who may not be able to acquire credit

financing importers and retail dealers who do not have except through utilization, as collateral, of the

sufficient funds (Nacu v. CA, G.R. No. 108638, March 11, merchandise imported or purchased. The transactions

1994). contemplated under the Trust Receipts Law mainly

involved acquisition of goods for the sale thereof. The

transaction is properly called a simple loan with the trust

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 8

TRUST RECEIPTS LAW

receipt as merely a collateral or security for the loan (Ng LOAN/SECURITY FEATURE

vs. People, supra).

Two features of a Trust Receipt transaction

Q: Supermax is a domestic corporation engaged in the

construction business. On various occasions, 1. Loan feature - is brought about by the fact that the

Metrobank extended several commercial letters of entruster financed the importation or purchase of the

credit to Supermax. These commercial credits were goods under TR (Sps. Vintola vs. Insular Bank of Asia and

used by Supermax to pay for delivery of several America, G.R. No. 73271, May 29, 1987).

construction materials to be used in their

construction business. Thereafter, Metrobank 2. Security feature - property interest in the GDI to secure

required Hur Tin Yang, as representative and Vice- performance of some obligation of the entrustee or of

President for Internal Affairs of Supermax, to sign 24 some third persons to the entruster (Rosario Textile

trust receipts as security for the construction Mills Corp. v. Home Bankers Savings and Trust Company,

materials. When 24 TRs fell due and despite the G.R. No. 137232, June 29, 2005).

receipt of demand letter, Supermax failed to pay or

deliver the goods or proceeds to Metrobank. As the Effects of the dual features of a Trust Receipt

demands fell on deaf ears, Metrobank filed a

complaint for estafa against Hur Tin Yang. 1. The entrustee cannot absolutely be relieved of the

obligation to pay his loan just because he surrendered

Hur Tin Yang, while admitting signing the trust the goods to the entruster if the entruster refuses to

receipts, argued that said trust receipts were accept and subsequently deposited them in the custody

demanded by Metrobank as additional security for of the court (Sps. Vintola vs. Insular Bank of Asia and

the loans extended to Supermax for the purchase of America, supra).

construction equipments and materials, and that

Metrobank knew all along that the construction 2. The entrustee cannot be relieved of his obligation to

materials subject of the TRs were not intended for pay the loan in favor of the entruster bank in case of loss

resale but for personal use of Supermax relating to its or destruction of the GDI (Rosario Textile Mills Corp. vs.

construction business. Home Bankers Savings and Trust Company, supra).

Is Hur Tin Yang not guilty of estafa? 3. Where the proceeds of the sale are insufficient to satisfy

the loan executed by the entrustee, the entruster bank

A: Yes. In the instant case, the factual findings of the trial can institute an action to collect the deficiency (Landl

and appellate courts reveal that the dealing between Hur Co. vs. Metropolitan Bank and Trust Co. G.R. No. 159622,

Tin Yang and Metrobank was not a TR transaction but one July 30, 2004).

of simple loan. His admission – that he signed the TRs on

behalf on Supermax, which failed to pay the loan or turn 4. Repossession by the entruster of the GDI does not

over the proceeds of the sale or the goods to Metrobank amount to dacion en pago. The repossession of the

upon demand – does not conclusively prove that the goods by the entrustee was merely to secure the

transaction was, indeed, a trust receipts transaction. In payment of its obligation to the entrustor and not for

contract to the nomenclature of the transaction, the the purpose of transferring ownership in satisfaction of

parties really intended a contract of loan. The Court, in Ng the obligation (PNB vs. Pineda, G.R. No. L-46658 May 13,

vs. People, and Land Bank of the Philippines v. Perez ,cases 1991).

which are in all four corners the same as the instant case,

ruled that the fact that the entruster bank knew even OWNERSHIP OF THE GOODS, DOCUMENTS, AND

before the execution of the trust receipt agreements that INSTRUMENTS UNDER A TRUST RECEIPT

the construction materials covered were never intended

by the entrustee for resale or for the manufacture of items Real owner of the articles subject of the Trust Receipt

to be sold is sufficient to prove that the transaction was a transaction

simple loan and not a trust receipts transaction.

The real owner of the articles subject of the TR is the

When both parties enter into an agreement knowing fully entrustee who binds himself to hold the designated GDI.

well that the return of the goods subject of the trust The entruster merely holds a security interest. If under

receipt is not possible even without any fault on the part the trust receipt, the bank is made to appear as the owner,

of the trustee, it is not a trust receipt transaction it was but an artificial expedient, more of legal fiction than

penalized under Sec. 13 of PD 115 in relation to Art. 315, fact, for if it were really so, it could dispose of the goods in

par. 1(b) of the RPC, as the only obligation actually agreed any manner it wants, which it cannot do, just to give

upon by the parties would be the return of the proceeds consistency with purpose of the trust receipt of giving a

of the sale transaction. This transaction becomes a stronger security for the loan obtained by the

mere loan, where the borrower is obligated to pay the importer. To consider the bank as the true owner from the

bank the amount spent for the purchase of the goods inception of the transaction would be to disregard the

(Hur Tin Yang vs. People, supra). loan feature thereof (Rosario Textile Mills Corp. vs. Home

Bankers Savings and Trust Company, supra).

9 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

The entrustee, however, cannot mortgage the goods or whatever form, separate and capable of

because one of the requisites of a valid mortgage is that identification as property of the entruster;

the mortgagor must be the absolute owner of the property

mortgaged or must have free disposal thereof. Entrustee 5. To Return GDI to the entruster in case they could not be

is not the absolute owner of the goods under trust receipt sold or upon demand of the entruster; and

nor has free disposal thereof.

6. To Observe all other conditions of the TR (P.D. 115, Sec.

The entrustee is not responsible as principal or vendor 9).

under any sale or contract to sell made by the entrustee.

NOTE: Not all obligations of the entrustee are criminal in

RIGHTS OF THE ENTRUSTER nature. The gravamen of the criminal offense under the

trust receipts law is the failure of the entrustee to deliver

(PRCS) the proceeds of the sale to the entruster up to the extent

1. To be entitled to the Proceeds from the sale of the GDI of the entrutee's obligations or the return of the same in

to the extent of the amount owing to him. case of non-sale.

2. To the Return of the GDI in case of non-sale and

enforcement of all other rights conferred to him in the PAYMENT/DELIVERY OF PROCEEDS OF SALE OR

TR. DISPOSITION OF GOODS, DOCUMENTS OR

3. May Cancel the trust and take possession of the goods, INSTRUMENTS

upon default or failure of the entrustee to comply with

any of the terms and conditions of the TR (P.D. 115, Sec. Disposition of the proceeds of the sale of the goods,

7). documents or instruments

4. To Sell the goods with at least five day notice to the

entrustee and apply the proceeds in payment of the The proceeds of the sale of GDI shall be applied in the

obligation. Entrustee liable to pay deficiency, if any. following (SDP):

VALIDITY OF THE SECURITY INTEREST AS AGAINST 1. Expenses of the Sale;

THE CREDITORS OF THE ENTRUSTEE/ INNOCENT 2. Expenses Derived from re-taking, keeping and storing

PURCHASERS FOR VALUE the GDI; and

3. Principal obligation (P.D. 115, Sec. 7).

Entruster has a better right over the goods than that

of the creditors of the entrustee NOTE: Full payment of the loan or delivery of the sale

proceeds equivalent to the full amount of the obligation

The entruster’s security interest in goods, documents, or extinguishes both criminal and civil liabilities of the

instruments pursuant to the written terms of a TR shall be entrustee. In case of deficiency, the entrustee shall be

valid as against all creditors of the entrustee for the liable thereon. However, any excess shall belong to him.

duration of the TR agreement (P.D. 115, Sec. 12).

Q: The President of Novachem, Crisologo, applied for

The security interest of the entruster over the goods commercial letters of credits from private

under the trust receipt is superior to the monetary claims respondent Chinabank to finance the purchase of

of the laborers of the entrustee. 1,600 kgs. of amoxicillin trihydrite micronized from

Hyundai Chemical Company in South Korea and glass

Purchaser in good faith can defeat the rights of the containers from San Miguel Corporation.

entruster over the goods Subsequently, Chinabank issued Letters of Credit.

After petitioner received the goods, he executed for

A purchaser in good faith acquires the goods, documents and in behalf of Novachem the corresponding trust

or instruments free from the entruster's security interest receipt agreements in favour of Chinabank.

(P.D. 115, Sec. 11).

On January 2004, Chinabank, through its staff

OBLIGATION AND LIABILITY OF THE ENTRUSTEE assistant, filed before the City Prosecutor’s Office a

Complaint-Affidavit charging Crisologo for violation

Obligations and liabilitites of the Entrustee (HR-IKRO) of P.D. No. 115 in relation to Article 315 of RPC for his

purported failure to turn-over the goods or the

1. To Hold GDI in trust for the entruster and to dispose of proceeds from the sale thereof. RTC rendered a

them strictly in accordance with the terms of TR; Decision acquitting Crisologo of criminal charges. It

however adjudged him civilly liable to Chinabank. On

2. To Receive the proceeds of the sale for the entruster appeal of the civil aspect, the CA affirmed the RTC

and to turn over the same to the entruster to the extent Decision. It noted that the Crisologo signed the

of amount owing to the latter; “Guarantee Clause” of the trust receipt agreements in

his personal capacity and even waived the benefit of

3. To Insure GDI against loss from fire, theft, pilferage or excussion against Novachem. As such, he is personally

other casualties; and solidarily liable with Novachem. Is the decision of

CA correct?

4. To Keep GDI or the proceeds thereof, whether in money

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 10

TRUST RECEIPTS LAW

A: Yes. Section 13 of the Trust Receipts Law explicitly proceeds of the sales, CCC Car Inc. used the proceeds

provides that if the violation or offense is committed by a to buy another ten (10) units of BMW 3 series.

corporation, as in this case, the penalty provided for

under the law shall be imposed upon the directors, a. Is the action of CCC Car, Inc. legally justified?

officers, employees or other officials or person Explain your answer.

responsible for the offense, without prejudice to the civil b. Will the corporate officers of CCC Car, Inc. be

liabilities arising from the criminal offense. held liable under the circumstances? Explain

your answer. (2012 Bar)

In this case, Crisologo was acquitted of the charge for A:

violation of the Trust Receipts Law in relation to Article a. No. It is the obligation of the entrustee, CCC Car,Inc.

315 of the RPC. As such, he is relieved of the corporate to receive the proceeds of the sale of the goods covered by

criminal liability as well as the corresponding civil the trust receipts in trust for the entruster and to turn

liability arising therefrom. However, as correctly found by over the same to him th extent of the obligation (P.D. 115,

the RTC and CA, he may still be held liable for the trust Sec. 4)

receipts and L/C transactions he had entered into in

behalf of Novachem. b. Yes. Failure of the entrustee to turn over the

proceeds of the sale of the goods shall constitute the crime

Settled is the rule that debts incurred by directors, of estafa. If the violation is committed by a juridical entity,

officers, and employees acting as corporate agents are not the penalty shall be imposed upon the directors, officers,

the direct liability but of the corporation they represent, employees or other officials or persons therein

EXCEPT if they contractually agree/stipulate or assume to responsible for the offense, without prejudice to the civil

be personally liable for the corporate’s debts, as in this liabilities arising from the criminal offense. Hence, the

case. The RTC and CA correctly adjudged petitioner corporate officers are criminally liable for the violation of

personally and solidarily liable with Novachem for the the law being he human agent responsible for the same

obligations secured by the subject trust receipts based on (P.D. 115, Sec. 13).

the finding that he signed the guarantee clauses therein in

his personal capacity an even waived the benefit of LIABILITY FOR LOSS OF GOODS, DOCUMENTS OR

excussion (Crisologo vs. People of the Philippines, G.R. No. INSTRUMENTS

199481, December 3, 2012).

Entrustee shall bear the loss of the goods, documents,

RETURN OF GOODS, DOCUMENTS OR INSTRUMENTS or instruments which are the subject of a Trust

IN CASE OF NON-SALE Receipt

Obligation of the Entrustee in case the goods, Loss of the GDI which is the subject of a TR, pending their

documents or instruments were not sold disposition, irrespective of whether or not it was due to

the fault or negligence of the entrustee, shall not

The entrustee should return the GDI to the entruster (P.D. extinguish his obligation to the entruster for the value

115, Sec. 4). thereof (P.D. 115, Sec. 10).

The return of the GDI in case of non-sale extinguishes only Principle of Res Perit Domino is not a valid defense

the criminal liability of the entrustee unless he pays in full against an Entrustee in cases of loss or destruction of

his loan obligation. The consequent acquittal of the the goods, documents, or instrumentssecured by a

entrustee in the criminal case does not bar the filing of a Trust Receipt

separate civil action to enforce the civil liability of the

entrustee. For the principle of res perit domino to apply the entrustee

must be the owner of the goods at the time of the loss. A

The failure to turn over goods or proceeds realized from TR is a security agreement, pursuant to which a bank

the sale thereof is a criminal offense under Art. 315(l) (b) acquires a ‘security interest’ in the goods. It secures an

of RPC (estafa) except if he disposed of the goods in indebtedness and there can be no such thing as security

accordance with the terms. interest that secures no obligation.If under a trust receipt

transaction, the entruster is made to appear as the owner,

Q: CCC Car, Inc. obtained a loan from BBB Bank, which it was but an artificial expedient, more of legal fiction than

fund was used to import ten (10) units of Mercedes fact, for if it were really so, it could dispose of the goods in

Benz S class vehicles. Upon arrival of the vehicles and any manner it wants. Thus, the ownership of the goods

before release of said vehicles to CCC Car, Inc. X and Y, remaining with the entrustee, he cannot be relieved of the

the President and Treasurer, respectively, of CCC Car, obligation to pay his/her loan in case of loss or

Inc. signed the Trust Receipt to cover tha value of the destruction (Rosario Textile Mills vs. Home Bankers

ten (10) units of Mercedes Benx S class vehicles after Association, supra).

which, the vehicles were all delivered to the Car

display room of CCC Car, Inc. Sale of the vehicles were

slow, and it took a month to dispose of the ten (10)

units. CCC Car, Inc. wanted to be in business and to

save on various documentations required by the

bank, decided that instead of turning over the

11 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

PENAL SANCTION IF OFFENDER IS A CORPORATION To be a TR transaction, the goods must be intended for

sale or resale. The Supreme Court, in one case, held that

Elements to be established in order to validly the trial court erred in ruling that the agreement in the

prosecute the Entrustee for Estafa case was a TR transaction because the goods involved

were intended to be used in the fabrication of steel

In order that the entrustee may be validly prosecuted for communication towers.

estafa under Art. 315, paragraph 1(b) of the RPC, in

relation with Sec. 13 of PD 115, the following elements The Court further ruled that, “the true nature of a trust

must be established (R-MAD): receipt transaction can be found in the ‘whereas’ clause of

PD 115 which states that a trust receipt is to be utilized

1. The entrustee Received the subject goods in trust or ‘as a convenient business device to assist importers and

under the obligation to sell the same and to remit the merchants solve their financing problems.’ Obviously,

proceeds thereof to the entruster, or to return the the State, in enacting the law, sought to find a way to assist

goods if not sold; importers and merchants in their financing in order to

encourage commerce in the Philippines.”

2. The entrustee Misappropriated or converted the The principle is of course not limited in its application to

goods and/or the proceeds of the sale; financing importations, since the principle is equally

applicable to domestic transactions. Regardless of

3. The entrustee performed such acts with Abuse of whether the transaction is foreign or domestic, it is

confidence to the damage and prejudice of entruster; important to note that the transactions discussed in

and relation to trust receipts mainly involved sales (Ng vs.

People, G.R. No. 173905, April 23, 2010).

4. A Demand was made on the entrustee by entruster

for the remittance of the proceeds or the return of the In another case it was held that when both parties enter

unsold goods (Land Bank of the Philippines vs. Perez, into an agreement knowing that the return of the goods

GR No. 166884, June 13, 2012). subject of the trust receipt is not possible even without

any fault on the part of the entrustee, it is not a trust

NOTE: If proof as regards the delivery of GDI to the receipt transaction penalized under Section 13 of P.D.

accused (entrustee) is insufficient, estafa cannot lie 115; the only obligation actually agreed upon by the

(Ramos vs. CA, G.R. No. L-3992-25, August 21, 1987). parties would be the return of the proceeds of the sale

transaction. The transaction becomes a mere loan, where

Compliance with the obligation under the Trust the borrower is obligated to pay the bank the amount

Receipt agreement vis-a-vis criminal liability spent for the purchase of the goods (LBP vs. Perez, supra).

1. If compliance occurred before the criminal charge- Penal sanction when the offender is a corporation

there is no criminal liability.

2. If compliance occurred after the charge even before Though the entrustee is a corporation, nevertheless, the

conviction- the criminal action will not be law specifically makes the officers, employees or other

extinguished. officers or persons responsible for the offense, without

prejudice to the civil liabilities of such corporation and/or

P.D. 115 does not violate the prohibition in the board of directors, officers, or other officials or employees

Constitution against imprisonment for non-payment responsible for the offense.

of a debt

If the crime is committed by a corporation or other

What is being punished is the dishonesty and abuse of juridical entity, the directors, officers, employees or other

confidence in the handling of money or goods to the officers thereof responsible for the offense rshall be

prejudice of another regardless of whether the latter is charged and penalized for the crime, precisely because of

the owner or not. It does not seek to enforce payment of the nature of the crime and the penalty therefor. A

the loan. Thus, there can be no violation of a right against corporation cannot be arrested and imprisoned; hence,

imprisonment for non-payment of a debt (People vs. cannot be penalized for a crime punishable by

Nitafan, G.R. No. 81559, April 6, 1992). imprisonment (Ching vs. Secretary of Justice, supra).

Q: Is lack of intent to defraud a bar to the prosecution Rationale behind the accountability of the officers of

of these acts or omissions? (2006 Bar) the corporation

A: No. The mere failure to account or return gives rise to The rationale is that such officers or employees are vested

the crime which is malum prohibitum. There is no with the authority and responsibility to devise means

requirement to prove intent to defraud (Ching vs. necessary to ensure compliance with the law and, if they

Secretary of Justice, G.R. No. 164317, February 6, 2006). fail to do so, are held criminally accountable; thus, they

have a responsible share in the violations of the law (ibid).

Penal sanction is not available if the goods are not

intended for sale or resale NOTE: An officer of a corporation who signed a TR cannot

hide behind the cloak of the separate corporate

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 12

TRUST RECEIPTS LAW

personality of the corporation, where “he is the actual, The civil action may be instituted in the criminal action or

present and efficient actor.” Corporate officers or separately filed independently of the criminal action. The

employees, through whose act, default or omission the criminal action is based on ex-delictu for violation of the

corporation commits a crime, are individually guilty of the law while the civil action is based on ex-contractu for

crime. The principle applies whether or not the crime violation of the trust receipt arrangement.

requires the consciousness of wrongdoing (Ching vs.

Secretary of Justice, supra). Repossession of the goods by the Entruster cannot be

considered as payment

REMEDIES AVAILABLE

Payment would legally result only after the entruster has

Defenses available to negate CRIMINAL liability of the foreclosed on the securities, sold the same and applied the

Entrustee (CoCo CaCo No LP) proceeds thereof to the entrustee’s obligation. Since the

TR is a mere security arrangement, the repossession by

1. Compliance with the terms of the TR either by the entruster cannot be considered payment of the

payment, return of the proceeds or return of the loan/advances given to the entrustee under the letter of

goods (P.D. 115, Sec. 13). credit/trust receipt (PNB v. Pineda, supra).

2. Consignment. In the event of default by the Entrustee on his

obligation under the Trust Receipt agreement, it is

3. Cancellation of the TR agreement and taking into NOT absolutely necessary for the Entruster to cancel

possession of the goods by the entruster. the trust and take possession of the goods to be able

to enforce his right thereunder.

NOTE: Repossession of the goods will extinguish

only the criminal liability. The law uses the word "may" in granting to the entruster

the right to cancel the trust and take possession of the

4. Compromise by parties before filing of information in goods. Consequently, the entrustee has the discretion to

court. Compromise of estafa case arising from TR avail of such right or seek any alternative action, such as a

transaction, after the case has been filed in court does third party claim or a separate civil action which it deems

not amount to novation and does not erase the best to protect its right, at any time upon default or failure

criminal liability of the accused (Ong vs. CA, G.R. No. of the entrustee to comply with any of the terms and

L-58476, September 2, 1983). conditions of the trust agreement (South City Homes, Inc.

vs. BA Finance Corporation, G.R. No. 135462, December 7,

5. Non-receipt of the goods by the entrustee or where 2001).

proof of delivery of goods to the accused is

insufficient. (Ramos vs. CA, supra). Q: BBB Banking Corporation issued a Letter of Credit

in the amount of P5Million, for the purchase of five (5)

6. Loss of goods without fault of the entrustee. tons of corn by X. Upon arrival of the goods, the goods

were delivered to the warehouse of X. Thereafter he

7. The transaction does not fall under PD 115 (Colinares was asked to sign a Trust Receipt covering the goods.

vs. CA, G.R. No. 90828, September 5, 2000, Consolidated When the goods were sold, X did not deliver the

Bank and Trust Corporation vs. CA, G.R. No. 114286, proceeds to BBB Banking Corporation, arguing that

April 19, 2001). he will need the fund for the subsequent importation.

Is there sufficient basis to sue for criminal action?

NOTE: In these cases, the execution of a TR was made (2012 Bar)

after the goods covered by it had been purchased, making

the buyer the owner thereof. The transaction does not A: B. When the trust receipt was signed, the ownership of

involve a TR but a simple loan even though the parties the goods was already with X.

denominate the transaction as one of a TR.

Q. Dennis failed to comply with his undertaking under

Failure of the entrustee to deliver the proceeds of sale the TR he issued in favor of ABC bank. The bank filed

will give the entruster the right to file a civil action both criminal and civil cases against Dennis. The

and a criminal action for estafa (1991, 1997, 2006 court proceeded with the civil case independently

Bar) from the criminal case. Is the court correct in

proceeding independently although a criminal case is

Sec. 13 of P.D. 115, Trust Receipts Law, provides that the also instituted?

failure of an entrustee to turn over the proceeds of the

sale of the goods, documents or instruments covered by a A: Yes, the complaint against Dennis is based on the

trust receipt to the extent of the amount owing to the failure of the latter to comply with his obligation as

entruster or as appears in the trust receipt or to return spelled out in the TR. This breach of obligation is separate

said goods, documents or instruments if they were not and distinct from any criminal liability for "misuse and/or

sold or disposed of in accordance with the terms of the misappropriation of goods or proceeds realized from the

trust receipt shall constitute the crime of estafa. sale of goods, documents or instruments released under

trust receipts", punishable under Sec. 13 of the PD 115.

Being based on an obligation ex contractu and not ex

13 UN IVERSITY OF SAN TO TOM AS

FACULTY OF C IVIL LA W

MERCANTILE LAW

delicto, the civil action may proceed independently of the whether public or bailment contracts other

criminal proceedings instituted against petitioners private, bonded or not. than warehouse receipts

regardless of the result of the latter (Sarmiento vs. CA, G.R. (NCC, Art.1507-1520)

No. 122502, December 27, 2002).

Warehouseman (WHM)

Effect of novation of a Trust Agreement

A person, natural or juridical, lawfully engaged in the

Where the entruster and entrustee entered into an business of storing of goods for profit (WHR Law, Sec. 58).

agreement which provides for conditions incompatible

with the TR agreement, the obligation under the trust Warehouse (WH)

receipt is extinguished. Hence, the breach in the

subsequent agreement does not give rise to a criminal The building or place where goods are deposited and

liability under P.D. 115 but only civil liability (Philippine stored for profit.

Bank vs. Ong, G.R. No. 133176, August 8, 2002).

Persons who may issue a Warehouse Receipt

Deposits in a savings account opened by the buyer

subsequent to the Trust Receipttransaction cannot be 1. WHM, whether public or private, bonded or not

automatically applied to outstanding obligations (WHR Law, Sec. 1).

under the Trust Receipt account 2. A person authorized by a WHM.

The receipt of the bank of a sum of money without Form and essential terms of a Warehouse Receipt

reference to the TR obligation does not obligate the bank

to apply the money received against the trust receipt It need not be in particular form but must embody within

obligation. Neither does compensation arise because its written or printed terms (LCD-DSWD-LF):

compensation is not proper when one of the debts

consists in civil liability arising from criminal 1. Location of the WH

(Metropolitan Bank and Trust Co. v. Tonda, G.R. No. 2. Consecutive number of the receipt

134436, Aug. 16, 2000). 3. Date of the issue

4. A statement whether the goods received will be

Q: E received goods from T for display and sale in E's Delivered to bearer, to a specified person or to a

store. E was to turn over to T the proceeds of any sale specified person or his order

and return the ones unsold. To document their 5. Signature of the WHM

agreement, E executed a trust receipt in T’s favor 6. If the receipt is issued for goods of which the

covering the goods. When E failed to turn over the Warehouseman is the owner, either solely or jointly

proceeds from his sale of the goods or return the ones or in common with others, the fact of such

unsold despite demand, he was charged in court for ownership; and

estafa. E moved to dismiss on the ground that his 7. Description of the goods

liability is only civil. Is he correct? (2011 Bar) 8. A statement of the amount of advances made and of

liabilities incurred for which the warehouseman

A: No, since his breach of the trust receipt agreement claims a Lien.

subjects him to both civil and criminal liability for estafa. 9. Fees (WHR Law, Sec. 2)

Effects of omission of any of the essential terms (CIV-

WAREHOUSE RECEIPTS LAW

N)

(ACT 2137, AS AMENDED)

1. Conversion of the contract to ordinary deposit.

Warehouse Receipt (WHR) 2. Injured person can hold WHM liable for all damages

caused by the omission

It is a written acknowledgment by the warehouseman 3. Validity of receipt not affected

that he has received and holds certain goods therein 4. Negotiability of receipts not affected (Gonzales vs. Go

described in his warehouse for the person to whom the Fiong & Luzon Surety Co., G.R. No. 91776, August 30,

document is issued.The warehouse receipt has two-fold 1958).

functions, that is, it is a contract and a receipt (Telengtan

Bros. & Sons vs. CA, G.R. No. L-110581, September 21, 1994). Prohibited terms in a Warehouse Receipt

Warehouse receipt law v. Documents of title under A warehouseman may insert in a receipt issued by him,

the Civil Code any other terms and conditions provided that such terms

and conditions shall not be (C2-RMN):

WAREHOUSE DOCUMENTS OF TITLE

RECEIPTS LAW UNDER CIVIL CODE 1. Contrary to the Warehouse Receipts Law (Sec. 3).

Warehouse receipts Other receipts of 2. Contrary to law, morals, good customs, public order

issued by warehouses, documents issued in or public policy.

3. Terms Reducing the required diligence of the

warehouseman (Ibid)

UN IVERSITY OF SAN TO TOM AS

2015GOLDE N N OTES 14

WAREHOUSE RECEIPTS LAW

4. Those exempting the warehouseman from liability 2. There is no Direct obligation of the WHM; and

for Misdelivery or for not giving statutory notice in

case of sale of goods. 3. The transferee can Compel the transferor to complete

5. Those exempting the warehouseman from liability the negotiation by indorsing the instrument. Negotiation

for Negligence. takes effect as of the time when the indorsement is

actually made.

Effect when the goods deposited are incorrectly

described Rights of the owner of the Negotiable Warehouse

Receipt in case the signature of an owner was forged

GR: Warehouseman shall be liable for damages for non- and the forger was able to withdraw the goods from

existence or misdescription of goods at the time of its the Warehouseman

issue.

1. If under WHR, the goods are deliverable to the

XPN: When the goods are described based on: depositor or to his order, the owner of the said negotiable

1. Series or labels upon them receipt may proceed against the WHM and/or the holder.

2. Statement that the goods are of certain kind.

2. Without the valid indorsement of the owner to the

Person to whom the goods should be delivered (PDO) holder or in blank, the WHM is liable to the owner for

conversion in the misdelivery.

1. To the person lawfully entitled to the Possession of the

goods, or his agent; 3. If the goods are deliverable to bearer, the owner may

only proceed against the holder. The WHM is not liable for

2. To the person entitled to Delivery under a non- conversion where the goods are delivered to a person in

negotiable instrument or with written authority; or possession of a bearer negotiable instrument.

3. To the lawful Order of a negotiable receipt (person in Duplicate receipts must be so marked in case one

possession of a negotiable receipt) (WHR Law, Sec. 9). negotiable receipt is issued for the same goods

KINDS A WHM shall be liable for all damages caused by his failure

to do so to anyone who purchased the subsequent receipt

Kinds of Warehouse Receipt for value supposing it to be an original, even though the

purchase be after the delivery of the goods by the WHM to

1. Negotiable warehouse receipt the holder of the original receipt (WHR Law, Sec. 6).

2. Non-negotiable warehouse receipt

NOTE: The word “duplicate” shall be plainly placed upon

Negotiable WHR the face of every such receipt, except the first one issued

(ibid.).

It is a receipt in which it states that the goods received will

be delivered to the bearer or to the order of any person Non-Negotiable Warehouse Receipt

named in such receipt (WHR Law, Sec. 5). It is negotiated

by delivery or indorsement plus delivery. It is a receipt in which it is stated that the goods received

will be delivered to the depositor or to any other specified

NOTE: No provision shall be inserted in a negotiable person (WHR Law, Sec. 4).

receipt that it is non-negotiable. Such provision, if

inserted, shall be void, and the receipt shall remain NOTE: To make it non-negotiable, it is needed to be

negotiable. A negotiable warehouse receipt cannot be indicated in the face of the WHR by the warehouseman

converted into non-negotiable (WHR Law, Sec. 5). issuing it that the same is “non-negotiable,” or “not

negotiable” (WHR Law, Sec.7).

Person who may negotiate a Negotiable WHR

Effect of failure to place an indication of non-

1. The owner; negotiability in the WHR

2. Any person to whom the possession or custody of the

receipt has been entrusted by the owner, if, by the terms Failure to mark the WR as “non-negotiable” shall entitle

of the receipt, the goods are deliverable to the order of the the holder, who purchased it for value supposing it to be

person to whom the possession or custody of receipt has negotiable, to treat such receipt negotiable (ibid).

been entrusted or in such form that it may be negotiated

by delivery (WHR Law, Sec. 40). Transfer of a Non-Negotiable Warehouse Receipt