Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Consolidation Wholly Owned With Differential

Caricato da

ashibhallauCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Consolidation Wholly Owned With Differential

Caricato da

ashibhallauCopyright:

Formati disponibili

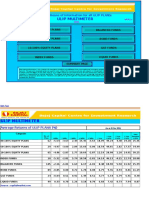

Consolidation of wholly-owned with differential

Big Co. bought 100% of Little's voting stock on 1/1/20 for $645

Little had a book value of $338

Little had the following misvalued or unreported assets and/or liabilities:

Little's inventory (FIFO basis) was undervalued by $6

Little's PPE (7 year remaining life) was undervalued by $24

Little had in-process R&D (4year remaining life) valued at $8

Little had bonds payable (3 year remaining life) undervalued by $11

Any remaining differential was attributed to goodwill

At the end of 2020 and 2021 impairment tests were prepared. It was determined that at the end of 2020 the correct goodwill

At the end of 2021 the correct goodwill value was determined to be $244

Trial balances for 1/1/20, 12/31/20, and 12/31/21 are given below.

Required:

Prepare a "differential analysis" to determine the correct amount of goodwill at purchase

Prepare elimination entries and complete the "consolidation at date of acquisition"

Prepare equty method and elimination entries and complete the consolidation worksheet for both 2020 and 2021.

Note that "interest expense" and R&D amortization are included within "other expenses" in the in

Cost of investment 645.00

Book value of Little at acquisition 338.00

Undervalued inventory (FIFO basis) 6.00

Undervalued PPE 24.00

Remaining life of PPE 7.00

In process R&D 8.00

Useful life of R&D 4.00

Bonds payable undervalued by 11.00

Remaining life of bonds 3.00

gw 280.00

12/31/20 correct goodwill 261.00

12/31/21 correct goodwill 244.00

1/1/20 Trial balances Big Little debit credit Consolidated

Cash & receivables 24.00 21.00

Inventory 49.00 47.00

Investment in Little 645.00

PPE, net 290.00 237.00

Intangible assets 64.00 62.00

Goodwill

In-process R&D

Other assets 37.00 161.00

Current liabilities 28.00 22.00

Bonds payable 221.00 168.00

Premium on bonds payable 0.00

Common Stock 30.00 53.00

Retained earnings 830.00 285.00

12/31/20 Trial balance Big Little debit credit Consolidated

Sales 484.00 522.00

Cost of goods sold 226.00 238.00

Depreciation expense 95.00

Amortizaton expense 11.00 14.00

Other expenses 162.24 215.00

Impairment loss

Investment income 28.24

Net Income 18.00 55.00

Beginning R/E 830.00 285.00

Add: Income 18.00 55.00

Less: Dividends declared 30.00 31.00

Ending R/E 818.00 309.00

Cash & Receivables 28.00 28.00

Inventory 49.00 41.00

Investment in Little 642.24

PPE, net 195.00 237.00

Intangible assets 53.00 48.00

Goodwill

In-process R&D

Other assets 125.76 200.00

Current liabilities 24.00 24.00

Bonds payable 221.00 168.00

Premium on bonds payable

Common Stock 30.00 53.00

Retained earnings 818.00 309.00

12/31/21 Trial balance Big Little debit credit Consolidated

Sales 442.00 467.00

Cost of goods sold 239.00 286.00

Depreciation expense 55.00 77.00

Amortizaton expense 10.00 10.00

Other expenses 135.24 63.00

Impairment loss

Investment income 12.24

Net Income 15.00 31.00

Beginning R/E 818.00 309.00

Add: Income 15.00 31.00

Less: Dividends declared 36.00 27.00

Ending R/E 797.00 313.00

Cash & Receivables 20.00 22.00

Inventory 49.00 49.00

Investment in Little 627.48

PPE, net 140.00 160.00

Intangible assets 43.00 38.00

Goodwill

In-process R&D

Other assets 198.52 286.00

Current liabilities 30.00 21.00

Bonds payable 221.00 168.00

Premium on bonds payable

Common Stock 30.00 53.00

Retained earnings 797.00 313.00

end of 2020 the correct goodwill should have been $261

cost

or both 2020 and 2021.

"other expenses" in the income statements

Potrebbero piacerti anche

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Practice Questions - SOLUTIONSDocumento7 paginePractice Questions - SOLUTIONSShuting QinNessuna valutazione finora

- Bab 11 Prospective AnalysisDocumento57 pagineBab 11 Prospective AnalysisNovilia FriskaNessuna valutazione finora

- The Valuation of Digital Intangibles: Technology, Marketing and InternetDa EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNessuna valutazione finora

- AppleDocumento15 pagineApplevaleriamontejocNessuna valutazione finora

- Titan Balance-SheetDocumento2 pagineTitan Balance-SheetDt.vijaya ShethNessuna valutazione finora

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Documento6 pagineCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasNessuna valutazione finora

- Mayes 8e CH02 SolutionsDocumento36 pagineMayes 8e CH02 SolutionsRamez AhmedNessuna valutazione finora

- Balance SheetDocumento2 pagineBalance SheetSachin SinghNessuna valutazione finora

- HCL BalancesheetDocumento2 pagineHCL BalancesheetTharunyaNessuna valutazione finora

- Ayigya Central Hospital-July 2023Documento7 pagineAyigya Central Hospital-July 2023Abubakari Abdul MananNessuna valutazione finora

- Coca-Cola Residual Income Valuation TemplateDocumento8 pagineCoca-Cola Residual Income Valuation TemplateAman TaterNessuna valutazione finora

- Excel File For Financial Ratio Activities UpdatedDocumento4 pagineExcel File For Financial Ratio Activities Updated0a0lvbht4Nessuna valutazione finora

- Icrrs 2Documento3 pagineIcrrs 2Sadia HossainNessuna valutazione finora

- Inditex - Ratio AnalysisDocumento7 pagineInditex - Ratio AnalysisAshmita LamsalNessuna valutazione finora

- Brewer Chapter 13Documento7 pagineBrewer Chapter 13Atif RehmanNessuna valutazione finora

- Update Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021Documento9 pagineUpdate Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021The Meme ReaperNessuna valutazione finora

- HZL Balance SheetDocumento6 pagineHZL Balance SheetPratyush Kumar JhaNessuna valutazione finora

- Financial Statements FinalssssssDocumento5 pagineFinancial Statements FinalssssssHelping Five (H5)Nessuna valutazione finora

- FS Preparation 1Documento4 pagineFS Preparation 1Bae Tashnimah Farina BaltNessuna valutazione finora

- Consolidated Income Statements For Urban Outfitters IncDocumento4 pagineConsolidated Income Statements For Urban Outfitters IncAshutosh AgarwalNessuna valutazione finora

- 1Documento20 pagine1Denver AcenasNessuna valutazione finora

- Coca-Cola Working-From Sagar - PGPFIN StudentDocumento23 pagineCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNessuna valutazione finora

- Update Date: 15/03/2023 Unit: Million Dong: Balance Sheet - GTA 2018 2019 2020 2021Documento9 pagineUpdate Date: 15/03/2023 Unit: Million Dong: Balance Sheet - GTA 2018 2019 2020 2021The Meme ReaperNessuna valutazione finora

- EBC Company For Ratio AnalysisDocumento2 pagineEBC Company For Ratio AnalysisChristine Frias CobarrubiasNessuna valutazione finora

- Balance Sheet SimpleDocumento3 pagineBalance Sheet Simplegeovanny ordonezNessuna valutazione finora

- Income: Profit & Loss Account of Infosys - in Rs. Cr.Documento6 pagineIncome: Profit & Loss Account of Infosys - in Rs. Cr.Radhika RocksNessuna valutazione finora

- Income Statement of Apple IncDocumento6 pagineIncome Statement of Apple IncBharat PanthiNessuna valutazione finora

- Bal Sheet BreakupDocumento23 pagineBal Sheet BreakupSiddharthNessuna valutazione finora

- Financial Analysis For PepsicoDocumento5 pagineFinancial Analysis For PepsicoZaina Alkendi100% (1)

- Previous YearsDocumento6 paginePrevious YearsAnonymous 6JMZk9mNNessuna valutazione finora

- AK2 13 Kheisya Buku BesarDocumento2 pagineAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2Nessuna valutazione finora

- Balance Sheet of Hindustan UnileverDocumento7 pagineBalance Sheet of Hindustan UnileverPranjal JoshiNessuna valutazione finora

- Solved - Trinity Electro Case - Class WorkDocumento5 pagineSolved - Trinity Electro Case - Class WorkPrarthuTandon0% (1)

- FM AssignmentDocumento4 pagineFM AssignmentAnonymous s9cw5oy3100% (1)

- Jalib Industruies QDocumento2 pagineJalib Industruies Qmichealcorleone1923Nessuna valutazione finora

- FS Group 2Documento5 pagineFS Group 2Ge-Ann BonuanNessuna valutazione finora

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsPreethaNessuna valutazione finora

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsSpuran RamtejaNessuna valutazione finora

- Turbo X Motors CaseDocumento3 pagineTurbo X Motors CasedeoverNessuna valutazione finora

- FRA Endterm QP-Term 1 - PGDM 2023-25Documento4 pagineFRA Endterm QP-Term 1 - PGDM 2023-25elitesquad9432Nessuna valutazione finora

- Caso Coca-Cola Plantilla CursantesDocumento11 pagineCaso Coca-Cola Plantilla CursantesJuan PabloNessuna valutazione finora

- Excel Case Lady MDocumento10 pagineExcel Case Lady MSayan BiswasNessuna valutazione finora

- VietstockFinance BBC Bao Cao Tai Chinh LCTT 20220626 222838Documento9 pagineVietstockFinance BBC Bao Cao Tai Chinh LCTT 20220626 222838hlm84359Nessuna valutazione finora

- This Spreadsheet Supports The Analysis of The Case "Flinder Valves and Controls Inc." (Case 43)Documento17 pagineThis Spreadsheet Supports The Analysis of The Case "Flinder Valves and Controls Inc." (Case 43)Lalang PalambangNessuna valutazione finora

- Hindustan Unilever: PrintDocumento2 pagineHindustan Unilever: PrintSamil MusthafaNessuna valutazione finora

- Ice NineDocumento4 pagineIce NinePolene GomezNessuna valutazione finora

- Delos Santos - John Marquin - Prefinal-Ia3Documento18 pagineDelos Santos - John Marquin - Prefinal-Ia3Delos Santos, John Marquin S.Nessuna valutazione finora

- ANNUAL REPORT ITC COMPANY Ltd.Documento13 pagineANNUAL REPORT ITC COMPANY Ltd.KUNAL ANANDNessuna valutazione finora

- Asahimas Flat Glass, TBK: Statement of Financial PositionDocumento3 pagineAsahimas Flat Glass, TBK: Statement of Financial PositionRatu ShaviraNessuna valutazione finora

- Chapter 8 - Financial AnalysisDocumento4 pagineChapter 8 - Financial AnalysisLưu Ngọc Tường ViNessuna valutazione finora

- Fundamentals of Corporate Finance by Ross 12ed 2019 Ch2.mini CaseDocumento2 pagineFundamentals of Corporate Finance by Ross 12ed 2019 Ch2.mini CaseIrakli AmbroladzeNessuna valutazione finora

- Microsoft Corporation: Financial Analyis and ForecastDocumento40 pagineMicrosoft Corporation: Financial Analyis and ForecastPrabhdeep DadyalNessuna valutazione finora

- Illustrative Full Set of IFRS For SME Financial StatementsDocumento16 pagineIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento12 pagineBalance Sheet of Reliance IndustriesMohit Kumar SinghNessuna valutazione finora

- Browning Mfmg. CompanyDocumento4 pagineBrowning Mfmg. CompanyDV VillanNessuna valutazione finora

- Company Info - Print Financials VIDocumento2 pagineCompany Info - Print Financials VIMayank BhardwajNessuna valutazione finora

- Module 2 Ae4 Fs Analysis 2 1Documento37 pagineModule 2 Ae4 Fs Analysis 2 1Kate Cyrene PerezNessuna valutazione finora

- 99 A Benzeer Tanha Funfin FinalsDocumento7 pagine99 A Benzeer Tanha Funfin FinalsBenzeer TanhaNessuna valutazione finora

- Chapter 22 HomeworkDocumento19 pagineChapter 22 HomeworkashibhallauNessuna valutazione finora

- Book 1Documento4 pagineBook 1ashibhallauNessuna valutazione finora

- 2020 S2 Assessment 3 - ACC00724Documento2 pagine2020 S2 Assessment 3 - ACC00724ashibhallauNessuna valutazione finora

- 2020 S2 Assessment 3 - ACC00724Documento2 pagine2020 S2 Assessment 3 - ACC00724ashibhallauNessuna valutazione finora

- 2020 S2 Assessment 3 - ACC00724Documento2 pagine2020 S2 Assessment 3 - ACC00724ashibhallauNessuna valutazione finora

- Chapter 19. CH 19-06 Build A ModelDocumento2 pagineChapter 19. CH 19-06 Build A ModelashibhallauNessuna valutazione finora

- XLSXDocumento20 pagineXLSXashibhallau100% (3)

- "Archive - View - Restricted","page":"read","action": "Download","logged - In":true,"platform":"web")Documento1 pagina"Archive - View - Restricted","page":"read","action": "Download","logged - In":true,"platform":"web")ashibhallauNessuna valutazione finora

- ScribdDocumento1 paginaScribdashibhallauNessuna valutazione finora

- Chapter 22 HomeworkDocumento19 pagineChapter 22 HomeworkashibhallauNessuna valutazione finora

- LLLLDocumento1 paginaLLLLashibhallauNessuna valutazione finora

- SBIRT ModelDocumento1 paginaSBIRT ModelashibhallauNessuna valutazione finora

- SssDocumento1 paginaSssashibhallauNessuna valutazione finora

- URL Fixed (Y/N)Documento6 pagineURL Fixed (Y/N)ashibhallauNessuna valutazione finora

- Concepts in Federal Taxation Hiring Incentives To Restore Employment ActDocumento9 pagineConcepts in Federal Taxation Hiring Incentives To Restore Employment ActashibhallauNessuna valutazione finora

- "Context":"archive - View - Restricted","page":"read","action ":"download","logged - In":true,"platform":"web")Documento1 pagina"Context":"archive - View - Restricted","page":"read","action ":"download","logged - In":true,"platform":"web")ashibhallauNessuna valutazione finora

- Evaluation of Capital ProjectsDocumento3 pagineEvaluation of Capital ProjectsashibhallauNessuna valutazione finora

- CPP ADocumento8 pagineCPP ATuan NguyenNessuna valutazione finora

- Manufacturing Manager Identified The Costs Already Incurred in The ProductionDocumento1 paginaManufacturing Manager Identified The Costs Already Incurred in The ProductionashibhallauNessuna valutazione finora

- The Following Cumulative Frequency Histogram and Polygon Shows The Examination Scores For A Class of Management Studies StudentsDocumento1 paginaThe Following Cumulative Frequency Histogram and Polygon Shows The Examination Scores For A Class of Management Studies StudentsashibhallauNessuna valutazione finora

- Chapter 19. CH 19-06 Build A ModelDocumento2 pagineChapter 19. CH 19-06 Build A ModelashibhallauNessuna valutazione finora

- Acc 620 Milestone Three Guidelines and Rubric U40pr3j1Documento2 pagineAcc 620 Milestone Three Guidelines and Rubric U40pr3j1ashibhallauNessuna valutazione finora

- CompanyDocumento1 paginaCompanyashibhallauNessuna valutazione finora

- No. of Repairs Mid-Point FrequencyDocumento1 paginaNo. of Repairs Mid-Point FrequencyashibhallauNessuna valutazione finora

- 12 3BDocumento4 pagine12 3BashibhallauNessuna valutazione finora

- Risk Anaylis of Londonkingsxlsx 61549xlsx 61753Documento1 paginaRisk Anaylis of Londonkingsxlsx 61549xlsx 61753ashibhallauNessuna valutazione finora

- SECTION #1 Financial StatementDocumento3 pagineSECTION #1 Financial StatementashibhallauNessuna valutazione finora

- Home NetDocumento2 pagineHome NetashibhallauNessuna valutazione finora

- Present Value TablesDocumento2 paginePresent Value TablesFreelansir100% (1)

- APC308 Assignment Question - June 17 SubmissionDocumento6 pagineAPC308 Assignment Question - June 17 Submissionashibhallau0% (2)

- Chapter 7 Caselette Audit of Ppe PDFDocumento35 pagineChapter 7 Caselette Audit of Ppe PDFErica PortesNessuna valutazione finora

- Part1 Topic 5 Accounting For Partnership Firms Admission of A PartnerDocumento54 paginePart1 Topic 5 Accounting For Partnership Firms Admission of A PartnerShivani ChoudhariNessuna valutazione finora

- Chapter 6 Review in ClassDocumento32 pagineChapter 6 Review in Classjimmy_chou1314Nessuna valutazione finora

- Module - Financial Statement AnalysisDocumento3 pagineModule - Financial Statement AnalysisCATHERINE FRANCE LALUCISNessuna valutazione finora

- QuizDocumento3 pagineQuizSam VNessuna valutazione finora

- Callenmaycongdasan: Page1of3 Blk10Lot9Brgysilingbatapandi 3 1 8 9 - 3 7 3 5 - 3 7 Villagei Pandibulacanprovince 3 0 1 4Documento4 pagineCallenmaycongdasan: Page1of3 Blk10Lot9Brgysilingbatapandi 3 1 8 9 - 3 7 3 5 - 3 7 Villagei Pandibulacanprovince 3 0 1 4Callen DasanNessuna valutazione finora

- Students Slides - Hanoi PDFDocumento168 pagineStudents Slides - Hanoi PDFLong Quân LạcNessuna valutazione finora

- Session 2 - NSVDocumento29 pagineSession 2 - NSVGiuseppeNessuna valutazione finora

- Indian Oil 17Documento2 pagineIndian Oil 17Ramesh AnkithaNessuna valutazione finora

- Chapter 1 - TutorialDocumento13 pagineChapter 1 - TutorialPro TenNessuna valutazione finora

- Viva PPT SipDocumento15 pagineViva PPT SipRudresh TrivediNessuna valutazione finora

- StatementDocumento3 pagineStatementeliaNessuna valutazione finora

- Question 3 Cash Flow StatementDocumento2 pagineQuestion 3 Cash Flow StatementjbmggknbrxNessuna valutazione finora

- Questions CF STMTDocumento6 pagineQuestions CF STMTNaresh BajracharyaNessuna valutazione finora

- Ratio Analysis MockDocumento10 pagineRatio Analysis Mockomirza_3Nessuna valutazione finora

- WSO Private Equity Guide NotesDocumento2 pagineWSO Private Equity Guide NotesP Win100% (1)

- Cost FM Sample PaperDocumento6 pagineCost FM Sample PapercacmacsNessuna valutazione finora

- BONDSDocumento3 pagineBONDSjdjdbNessuna valutazione finora

- Ulip MultimeterDocumento17 pagineUlip MultimeterRaghu RaoNessuna valutazione finora

- Relative ValuationDocumento2 pagineRelative ValuationKhushboo MehtaNessuna valutazione finora

- Far1 Accounts ReceivableDocumento8 pagineFar1 Accounts ReceivableRico Jay EmejasNessuna valutazione finora

- Mock Exam M9a 2Documento16 pagineMock Exam M9a 2Malvin TanNessuna valutazione finora

- COMMODITY EXCHANGE ChecklistDocumento3 pagineCOMMODITY EXCHANGE ChecklistMuslih AbdikerNessuna valutazione finora

- Introduction To Finance: Finance Is A Field That Deals With The Study of Investments. It Includes The DynamicsDocumento2 pagineIntroduction To Finance: Finance Is A Field That Deals With The Study of Investments. It Includes The DynamicsSuba SelvarajNessuna valutazione finora

- ACC 401 Homework CH 4Documento4 pagineACC 401 Homework CH 4leelee03020% (1)

- AA MJ23 Examiner's Report - FinalDocumento25 pagineAA MJ23 Examiner's Report - FinalSoykat HossainNessuna valutazione finora

- Chapter 1: Introduction To Accounting Learning Outcome at The End of The Learning, Student Should Be Able ToDocumento8 pagineChapter 1: Introduction To Accounting Learning Outcome at The End of The Learning, Student Should Be Able ToNur Syazmira HarunNessuna valutazione finora

- Question A A IreDocumento4 pagineQuestion A A Irenanmun_17Nessuna valutazione finora

- Duracell'S Acquisition by Berkshire Hathaway: A Case StudyDocumento19 pagineDuracell'S Acquisition by Berkshire Hathaway: A Case Studytanya batraNessuna valutazione finora

- Problem 1 4Documento1 paginaProblem 1 4Olaysa BacusNessuna valutazione finora