Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Format. Engg - "Cryptocurrency - Could It Be A Menace To The Society"

Caricato da

Impact JournalsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Format. Engg - "Cryptocurrency - Could It Be A Menace To The Society"

Caricato da

Impact JournalsCopyright:

Formati disponibili

IMPACT: International Journal of Research in

Engineering & Technology

ISSN(P): 2347-4599; ISSN(E): 2321-8843

Vol. 6, Issue 8, Aug 2018, 57-66

© Impact Journals

“CRYPTOCURRENCY – COULD IT BE A MENACE TO THE SOCIETY”

Anita Venaik1 & Nikhil Budhiraja2

1

Professor, Amity Business School, Amity University, Noida, India

2

Business Analysis, Smart Cube, Noida, India

Received: 06 Aug 2018 Accepted: 10 Aug 2018 Published: 27 Aug 2018

ABSTRACT

In 2008, there was a financial crisis throughout the world and economy was severely affected by it, it was also

known as the great the depression. This incident led to the emergence of peer to peer form of virtual currency backed by

block-chain technology. Satoshi Nakamoto published a white paper about how blockchain could be use to initiate virtual

currency and eradicate the problem of double spending, Thereafter the very first bitcoin was introduced which was peer to

peer, anonymous, and encrypted form of virtual currency, which is backed by the blockchain technology – This technology

act as a ledger which records every single transaction happening via bitcoin, Blockchain inherently challenges to replace all

forms central authority with a decentralized, peer-to-peer, and open source trust protocol.

KEYWORDS: Longer Run, Bitcoin Currency Exchanges

INTRODUCTION

Cryptocurrency – crypto means encrypted or hidden which means it cannot be read by the normal human without

any using decryption tools, and currency is the legal tender used by the people for the buying of goods and services.

Cryptocurrency is a digital and encrypted form of soft currency, which can only be used at online stores and e-commerce

for the purchase and selling of goods and services.

Cryptocurrency is the decentralized, volatile form of currency, which means that it can neither regulated nor

controlled by the government of any country. This currency USP is that it’s anonymous in nature, i.e. the when the

transaction happens the sender and receiver don’t know who the receiver is and who is the sender due to its strong

cryptographic methods.

LITERATURE REVIEW

Benedikt Eikmanns (2015) - This research paper talks about the volatility of a cryptocurrency thus affecting the

trust of the users, due to the high volatility of currency people don’t trust on currency, thus volatility has a major impact and

defers the users from adopting this currency.

William J. Luther (2015) – This paper talks about the future of this currency, the author concludes that future of the

cryptocurrency could not be predicted due to switching cost, network cost, excessive regulation of the currency. Although

the author believes that it could only be helpful if blockchain technology is adopted in a longer run, thus it will reduce the

cost of the transaction.

Impact Factor(JCC): 3.9074- This article can be downloaded from www.impactjournals.us

58 Anita Venaik & Nikhil Budhiraja

Campbell R. Harvey (2014) – Author focusses on the problems which would hinder the growth of cryptocurrency,

one those are the issue of volatility due to the small size of digital currency market size. Also, due to the anonymity, it

promotes illegal activities on the dark web.

Reuben Grinberg (2011) – Author raises the issue of government regulation, that if it’s centralized it would create

a monopoly. Thus, the government would have an upper hand on controlling the money, thus it also reduces the anonymity.

Which is one of the USP of it another issue like tax evasion and banking without charter are various other issues link with

it.

Danton Bryans (2013) – Author talks about the legal issues of money laundering where it makes little since to

regulate entities other than Bitcoin currency exchanges. Increased pressure on users will only serve to increase the cost of

enforcement in the long run. It says that enforcement of the law could prevent money laundering. Due to the high nature of

anonymity, it’s close to impossible to track the sender due to encryption techniques.

Rainer Böhme, Nicolas Christin, Benjamin Edelman, and Tyler Moore (2015) – Authors says that cryptocurrency

could be used to replace credit and debit card industry because transactions could be processed directly without any

intermediator, also due to its disruptive nature, it would hold the growth of banks. Also, in a technically advanced era, due

to the availability of various other types of coins competition would soar.

Michal Polasik (2017) – Author claims through his study that price fluctuation is still a problem, although it

doesn’t yield dividends, cash flows, or earnings. It talks about the supply and demand of the currency. Also, the technology

has not reached masses or it has not been adopted by a majority of the people, thus making it a small market. Also, the legal

issues related to it and many countries banning the currency due to anonymity nature.

Ferdinando M. Ametrano (2016) - Bitcoin is changing the global economic and political environment of the world,

people have used the barter system and moved to money from past many years. Now it’s the time to move onto a good

money aka cryptocurrency. As people would move to cryptocurrency, the demand for fiat currency would reduce thereby

lead to depreciation, thus slowly and gradually cryptocurrency would replace it and thus generating more demand and

stability in the market.

Garrick Hileman (2016) – Cryptocurrency is evolving slowly and eventually grow over the period of time, bitcoin

mining has increased to a greater extent in the countries like India, China despite giving several warnings to people by the

government of India and China respectively. Although bitcoin does not have immediate potential it is likely to increase in

the future in the international market.

RESEARCH METHODOLOGY

The aim of this research is to provide the insight and impart knowledge to the readers about the cryptocurrency it’s

implication on society and speculating whether it would be a menace to the society or not, how benefits of this technology

could be utilized in more effective and efficient manner. And what changes have already occurred due to the emergence of

cryptocurrency, problems people are facing during its adoptability. This study will help in analyzing the scope of the

crypto-currency going forward.

NAAS Rating: 2.73- Articles can be sent to editor@impactjournals.us

“Cryptocurrency – Could it Be a Menace to the Society” 59

Research Objectives

• Status of cryptocurrency and how it is blending with the current scenario.

• How it is being adopted by the consumers.

• Changes occurring due to its adoption and adaption.

The research objectives heavily depend on the users and their adoptability towards the cryptocurrency, thus it is

very important to have the right amount of education, so that consumers are equipped with the knowledge so that to avoid

the consequences due to the virtual form of currency and ultimately help in providing better decision making, because being

ignorant could lead to miss opportunity or also avert the dangers associated with it.

CORRELATION

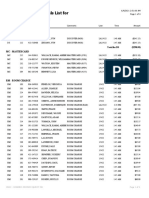

Correlations

Table 1

purchase

cryptocurrency if

How old are volatility

you? reduced?

Pearson Correlation 1 .139

Sig. (2-tailed) .034

N 117 117

Pearson Correlation .139 1

Sig. (2-tailed) .034

N 117 117

The correlation has been done between age vs the purchase of cryptocurrency (if volatility is reduced), there is a

positive correlation between the two factors, and thus, if age is increased the probability of buying

cryptocurrency will increase as the volatility is reduced. At the young age, people have a tendency to experiment

more and more, so they tend to invest more (irrespective of fluctuation), thus doesn’t care about the money as they

experiment to get better ROI. But as the age progresses, people start their family thus saves more for their family, whereas

if the price or fluctuation is reduced people tend to purchase when the price of such commodity is stable.

Impact Factor(JCC): 3.9074- This article can be downloaded from www.impactjournals.us

60 Anita Venaik & Nikhil Budhiraja

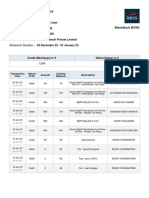

Correlations

Table 2

could_crypto_be crypto_govt_inte

_a_menace rvention

Pearson Correlation 1 .398**

Sig. (2-tailed) .000

N 117 117

Pearson Correlation .398** 1

Sig. (2-tailed) .000

N 117 117

**. Correlation is significant at the 0.01 level (2-tailed).

Government intervention would create ruckus in the cryptocurrency world, as it would kill the privacy of the

people, if cryptocurrency is regulated by the government, there will be no difference between normal fiat currency as price

will be regulated by the govt., the main feature of cryptocurrency is peer to peer anonymous transaction would be in danger,

thus if government intervention increases, it will eventually lead to the menace. Recently, the Government of India has

announced that banks will not allow any transactions based on cryptocurrency. There is a positive correlation between the

two variables. The value is ~ 0.400, which tells that there is a significant correlation between the variables.

REGRESSION

Security

Ho: There is no relation between cryptocurrency a menace to the society and security.

H1: There is a relation between cryptocurrency a menace to the society and security.

Low-Cost Transaction

Ho: There is no relation between cryptocurrency a menace to the society and low-cost transaction. H1: There is a

relation between cryptocurrency a menace to the society and low-cost transaction. Government Intervention

H0: There is no relation between cryptocurrency a menace to the society and government intervention.

H1: There is a relation between cryptocurrency a menace to the society and government intervention.

Volatility

H0: There is no relation between cryptocurrency a menace to the society and Volatility

H1: There is a relation between cryptocurrency a menace to the society and Volatility

Now hypothesis for different variables have been decided, now by comparing a significant value with that of alpha,

we would decide that whether to accept the null hypothesis or reject that.

Confidence Interval = 95% i.e. Alpha = 0.05.

NAAS Rating: 2.73- Articles can be sent to editor@impactjournals.us

“Cryptocurrency – Could it Be a Menace to the Society” 61

Table 3

Coefficientsa

Unstandardized Standardized

Coefficients Coefficients

B Std. Error Beta

(Constant) 1.261 .290 4.348 .000

crypto_security -.088 .087 -.121 -1.010 .314

crypto_lowcost .193 .115 .205 1.678 .096

crypto_govt_interventio

.256 .083 .331 3.080 .003

N

crypto_volatile .072 .085 .091 .850 .397

Dependent Variable: Could_Crypto_Be_A_Menace

Now comparing the significant value of every variable with that of alpha value i.e. 0.05 in order to check that

whether to reject the hypothesis or whether to accept that in order to find the find the relation between various factors and

the consumer purchasing behavior.

If the significant value is less than that of alpha value, we would be rejecting the null hypothesis.

Government Intervention

The significant value is less than that of alpha so we would be rejecting the null hypothesis. (0.03<0.05)

This is being interpreted that there is a relationship between government intervention and cryptocurrency a menace

to society i.e. government influence into cryptocurrency does lead to menace to society.

Talking about security, low-cost transaction, and volatility, the significant value is greater than 0.05 i.e. alpha

values so we would be accepting the null hypothesis. As per the analysis security, low-cost transaction and volatility

would not be a menace to society.

REGRESSION MODEL

Dependent variable = [Standardized coefficient Beta (independent variable)]

could_crypto_be_a_menace = (Minus) -.121* crypto_security +.205* crypto_lowcost +.331*

crypto_govt_intervention +.091* crypto_volatile

Interpretation

The regression model has provided with the information that how dependent variable i.e. consumer purchase

behavior changes with change in different independent variables.

With the regression model equation, while comparing the influence of different independent variables over the

consumer purchase behavior, all the independent variables have a positive impact over dependent variable except for the

security of cryptocurrency.

Impact Factor(JCC): 3.9074- This article can be downloaded from www.impactjournals.us

62 Anita Venaik & Nikhil Budhiraja

Security: If there is more security towards the cryptocurrency, there are chances that people would actually buy

the cryptocurrency, thus people have a frame of mind that their currency is secured and it cannot be stolen or lost.

Higher the security, lesser problematic for the people. Also, cryptocurrency works on the block-chain principle, which is

highly secured and practically impossible to hack.

Low Cost Transaction: The cryptocurrency transactions are cheaper than normal online bank transaction,

websites like IRCTC, Book My Show, Swiggy and other national and international websites incur high transaction fee,

which is an unnecessary spend done by the user, thus, if transactions are made using cryptocurrency, the fee is relatively

lower than the usual. Thus reduce the mental pressure and reduce the problem for an individual.

Government Intervention: Government intervention would create ruckus in the cryptocurrency world, as it would

kill the privacy of the people, if cryptocurrency is regulated by the government, there will be no difference between normal

fiat currency as price will be regulated by the govt., the main feature of cryptocurrency is peer to peer anonymous

transaction would be in danger, thus if government intervention increases, it will eventually lead to the menace.

Recently, the government of India has announced that banks will not allow any transactions based on cryptocurrency.

FINDINGS

Objectives

• Status of cryptocurrency and how it is blending with the current scenario.

• How it is being adopted by the consumers.

• Changes occurring due to its adoption and adaption.

People definitely have basic knowledge about the crypto-currency, yet they still have to understand that it’s not just

any other type of investment opportunity but it has to offer more and more to its users. Many users know the basic

fundamental criteria of the cryptocurrency – they do and know the how online transactions are performed, which clearly

tells that they have basic knowledge of computers or the mobile banking.

Our first objective which talks about the status of cryptocurrency and how it is merging and blending with the

society and the current scenario tells that yes, people are willing to perform online transaction, the data shows that 93.16%

people do online transaction which is the basic essential requirement for cryptocurrency, also 52.99% people have started

keeping online wallet or some kind of online banking, which shows that people really know how to handle and run an

online bank and handle the e-banking solutions. People are also eager to invest in cryptocurrency as 47.01% people said yes

that it is a new investment opportunity for them to increase their wealth. People earlier used to depend a lot on the hard

cash, which used to create a problem during travelling and also had security issues associated with it. But due to the

emergence of plastic money, the scenario has changed, the issue of carrying money has reduced drastically and a problem of

money theft has reduced drastically, but there is still a chance of card cloning and theft. But these kinds of problem are

taken care by the cryptocurrency, as it’s a most secured form of currency available right now, with maximum encryption

security. Thus 33.08 % People also think that e-commerce websites like Amazon.com and Flipkart should start adopting

cryptocurrency in India also. Which not only replace the credit and debit cards system but it will also have lower transaction

fees during the whole transaction.

NAAS Rating: 2.73- Articles can be sent to editor@impactjournals.us

“Cryptocurrency – Could it Be a Menace to the Society” 63

Also, People use various international banks to send and receive money across the world, which generally takes

time and leads to higher transaction fees, thus ending paying huge amount of their hard-earned money, but with the

cryptocurrency there is no issue of transacting the huge amount of money, because it’s a peer to peer form of transaction,

thus there is no middle-men required and there are no conversion charges dealt with it.

Secondly, our another objective was to know how people are seeing and speculating the cryptocurrency, most of

the responses that are received are generally neutral or below neutral for example people fear about the cryptocurrency

being an illegal asset, thus most of the people might like to invest in it but due to security, political and economic issues,

they would opt out by not investing, results shows that out of 117 people, only 19 people think that they don’t have fear of

illegality, other issues like government regulations- what if it ends up-regulated by the government, thus, our each every

transaction will be traced by the government, all our personal information will be taken up the by the government, which

would kill the essence of it and kill the purpose of the currency, also, prices will be under the control of the government.

People who have not yet purchased the currency are only seeing it as a bogus/ cheat scheme to loot people’s

money, out of 117 people, 20 people think that it’s not a scam, rest have given neutral or negative responses to it. People

also say that they would only purchase the cryptocurrency if and only if, there is a less volatility/ and less price fluctuations,

people don’t want to suffer losses from their hard earned money, thus they want to play it safe, it has been seen that there is

a positive correlation between age vs the purchase of cryptocurrency (if volatility is reduced), there is a positive correlation

between the two factors, Thus, if age is increased the probability of buying cryptocurrency will increase as the volatility is

reduced. At the young age, people have the tendency to experiment more and more, so they tend to invest more (irrespective

of fluctuation), thus doesn’t care about the money as they experiment to get better ROI. But as the age progresses, people

start their family thus saves more for their family, whereas if the price or fluctuation is reduced people tend to purchase

when the price of the commodity is stable.

Thirdly, changes which are occurring due to its adaptation most of the people also think that it’s the new

investment opportunity, but it’s only restricted to for the investment purpose right now. In foreign countries the

cryptocurrency is used while traveling abroad, the people pay heavy taxes at the money exchange due to which they

generally have to cut out on their expense, but crypto-currency on contrary, have a universal price all over the world. Thus,

cryptocurrency could be used to exchange fiat money internationally relatives at lower fees, which not only saves the

money but also allows you to pay lower taxes. Also, recently many start-ups have emerged with their various goals and

motive, to drive ahead, the investors could invest and fund these start-ups with cryptocurrency, because network fee and

transaction fee are relatively higher in some countries, to avoid that investors could fund cryptocurrencies to avoid higher

transaction fees.

In some countries, both large and small retailers accept cryptocurrencies as a form of currency, especially in

Germany where it is legal to perform a transaction, although this number is relatively low, the trend has been started.

People could also purchase these currencies to increase their worth of wealth, where the government cannot block the

access or take a margin out of it. Also, people look at it as an investment option, many financial institutes and traders have

seen it as a potential source of income due to volatile nature. Big companies like Amazon, Microsoft etc. have started

accepting payments in the form of bitcoins, where countries like USA, Japan, have installed bitcoin ATMs to people could

trade bitcoins from their as cryptocurrencies are legal in such countries.

Impact Factor(JCC): 3.9074- This article can be downloaded from www.impactjournals.us

64 Anita Venaik & Nikhil Budhiraja

Government intervention would create ruckus in the cryptocurrency world, as it would kill the privacy of the

people, if cryptocurrency is regulated by the government, there will be no difference between normal fiat currency as price

will be regulated by the govt., the main feature of cryptocurrency is peer to peer anonymous transaction would be in danger,

thus if government intervention increases, it will eventually lead to the menace. Recently, the Government of India has

announced that banks will not allow any transactions based on cryptocurrency.

Being backed by Block-chain technology, tend to eradicate the problem of double spending of money, uses the

online 256-bit encrypted secured ledger to store transaction, every single transaction is being recorded in online ledger,

which cannot be decrypted easily, thus it is highly secure, any kind of theft from block-chain could not take place

theoretically.

RECOMMENDATION

While traveling abroad, the people pay heavy taxes at the money exchange due to which they generally have to cut

out on their expense, but cryptocurrencies on contrary, have a universal price all over the world. Thus, cryptocurrency could

be used to exchange fiat money internationally relatives at lower fees, which not only saves the money but also allows you

to pay lower taxes.

Also, recently many start-ups have emerged with their various goals and motive, to drive ahead, the investors could

invest and fund these start-ups with cryptocurrency, because network fee and transaction fee are relatively higher in some

countries, to avoid that investors could fund cryptocurrencies to avoid higher transaction fees.

In some countries, both large and small retailers accept cryptocurrencies as a form of currency, especially in

Germany where it is legal to perform a transaction, although this number is relatively low, the trend has been started. But in

India,

People could also purchase these currencies to increase their worth of wealth, where the government cannot block

the access or take a margin out of it. Also, people look at it as an investment option, many financial institutes and traders

have seen it as a potential source of income due to volatile nature.

Big companies like Amazon, Microsoft etc. have started accepting payments in the form of bitcoins, where

countries like USA, Japan, have installed bitcoin ATMs to people could trade bitcoins from their as cryptocurrencies are

legal in such countries.

Being backed by Block-chain technology, tend to eradicate the problem of double spending of money, uses the

online 256 bit encrypted secured ledger to store transaction, every single transaction is being recorded in online ledger,

which cannot be decrypted easily, thus it is highly secure, any kind of theft from block-chain could not take place

theoretically.

NAAS Rating: 2.73- Articles can be sent to editor@impactjournals.us

“Cryptocurrency – Could it Be a Menace to the Society” 65

REFERENCES

1. Catalini, Christian (2016, November, 16), some simple economics of the blockchain,

https://ssrn.com/abstract=2874598

2. Usman, Chohan (2017, august, 2017), cryptocurrencies, a brief thematic review,

https://ssrn.com/abstract=3024330

3. Kenji, Saito (2014, october, 25), Can We Stabilize the Price of a Cryptocurrency?: Understanding the Design of

Bitcoin and Its Potential to Compete with Central Bank Money,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2519367

4. Sean, Foley (2017, janauary, 27), Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed Through

Cryptocurrencies? https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3102645

5. Catalini, Christian (2017, March, 13), Initial Coin Offerings and the Value of Crypto Token,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3137213

6. William J. Luther (2015, July, 16), Bitcoin and the future of digital payments, https://ssrn.com/abstract=2631314

7. Linus Föhr ( 2017, November, 17), The ICO Gold Rush: It's a Scam, It's a Bubble, It's a Super Challenge for

Regulators, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3072298

8. Larissa Lee (2015, September, 07), New Kids on the Blockchain: How Bitcoin's Technology Could Reinvent the

Stock Market, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2656501

9. Usman Chohan (2017, December, 05), initial coins offerings: risks, regulations and analysis,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3080098

10. Vavrinec Cermak (2017, May, 02), can bitcoin become a viable alternative for fiat currency?,

https://ssrn.com/abstract=2961405

11. William J. Luther (2013, july, 13), cryptocurrencies, network effects and switching cost,

https://ssrn.com/abstract=2295134

12. Geoff Lightfoot (2014, November, 01), price fluctuation and use of bitcoins: an empirical analysis,

https://ssrn.com/abstract=2516754

13. Michael Meredith (2014,August, 24), rethinking virtual currency regulation in bitcoin age,

https://ssrn.com/abstract=2485550

14. Danton Bryans, (2013, August,23), Bitcoin and money laundering, https://ssrn.com/abstract=2317990

15. Ciamac C. Moallemi (2013, August, 28), An economic analysis of bitcoin payment system,

https://ssrn.com/abstract=3025604

16. Usman Chohan (2017, October, 06), A history of bitcoin, https://ssrn.com/abstract=3047875 William J. Luther

(2014, November, 24), A political economy of Bitcoins,

17. https://ssrn.com/abstract=2531518

Impact Factor(JCC): 3.9074- This article can be downloaded from www.impactjournals.us

66 Anita Venaik & Nikhil Budhiraja

18. Neil Gandal (2014, October, 24), competition in cryptocurrency market, https://ssrn.com/abstract=2506463

19. Christopher Marsden (2015, December, 25), regulatory response of cryptocurrency,

https://ssrn.com/abstract=2704852

20. Cameron Harwick(2014, November, 14), cryptocurrency and the problem of intermediate,

https://ssrn.com/abstract=2523771 Usman Chohan(2017, September, 27),

21. Assessing the Differences in Bitcoin & Other Cryptocurrency Legality Across National Jurisdictions,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3042248

22. Lawrence H. White (2014, December, 15), the market of cryptocurrencies, https://ssrn.com/abstract=2538290,

Misha Tsukerman (2015, april, 03), The Block Is Hot: A Survey of the State of Bitcoin Regulation and Suggestions

for the Future, https://ssrn.com/abstract=2587421

23. Houman B. Shadab (2014, October, 24),

24. Regulating Bitcoin and Block Chain Derivatives, https://ssrn.com/abstract=2508707

NAAS Rating: 2.73- Articles can be sent to editor@impactjournals.us

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Chase Sep V 2.9Documento11 pagineChase Sep V 2.9faxev8373350% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Account Statement: 4445935743 Bhayander (W)Documento17 pagineAccount Statement: 4445935743 Bhayander (W)Nitin kumar SinghNessuna valutazione finora

- Export FinancingDocumento27 pagineExport FinancingPresha ShethNessuna valutazione finora

- The Digital Fifth Fintech Annual Report 2022Documento88 pagineThe Digital Fifth Fintech Annual Report 2022Shantanu YadavNessuna valutazione finora

- Revolut EUR Statement Juni 2021Documento2 pagineRevolut EUR Statement Juni 2021Анастасия Рязанова100% (1)

- SDM LMH 1 HW OUYONtvDocumento5 pagineSDM LMH 1 HW OUYONtvHEES GPT NZB 005Nessuna valutazione finora

- 09-12-2022-1670567289-6-Impact - Ijrhal-06Documento17 pagine09-12-2022-1670567289-6-Impact - Ijrhal-06Impact JournalsNessuna valutazione finora

- 12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsDocumento7 pagine12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsImpact JournalsNessuna valutazione finora

- 14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalDocumento13 pagine14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalImpact JournalsNessuna valutazione finora

- 19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsDocumento4 pagine19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsImpact JournalsNessuna valutazione finora

- 09-12-2022-1670567569-6-Impact - Ijrhal-05Documento16 pagine09-12-2022-1670567569-6-Impact - Ijrhal-05Impact JournalsNessuna valutazione finora

- 19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsDocumento6 pagine19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsImpact JournalsNessuna valutazione finora

- Influence of Erotic Nollywood Films Among Undergraduates of Lead City University, Ibadan, NigeriaDocumento12 pagineInfluence of Erotic Nollywood Films Among Undergraduates of Lead City University, Ibadan, NigeriaImpact JournalsNessuna valutazione finora

- 12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateDocumento10 pagine12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateImpact JournalsNessuna valutazione finora

- 28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Documento10 pagine28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Impact JournalsNessuna valutazione finora

- 25-10-2022-1666681548-6-IMPACT - IJRHAL-4. IJRHAL-Challenges of Teaching Moral and Ethical Values in An Age of Instant GratificationDocumento4 pagine25-10-2022-1666681548-6-IMPACT - IJRHAL-4. IJRHAL-Challenges of Teaching Moral and Ethical Values in An Age of Instant GratificationImpact JournalsNessuna valutazione finora

- Effect of Sahaja Yoga Meditation in Reducing Anxiety Level of Class Vi Students Towards English As A Second LanguageDocumento8 pagineEffect of Sahaja Yoga Meditation in Reducing Anxiety Level of Class Vi Students Towards English As A Second LanguageImpact JournalsNessuna valutazione finora

- Effect of Organizational Commitment On Research and Development Performance of Academics: An Empirical Analysis in Higher Educational InstitutionsDocumento12 pagineEffect of Organizational Commitment On Research and Development Performance of Academics: An Empirical Analysis in Higher Educational InstitutionsImpact JournalsNessuna valutazione finora

- 15-10-2022-1665806338-6-IMPACT - IJRBM-1. IJRBM Theoretical and Methodological Problems of Extra-Budgetary Accounting in Educational InstitutionsDocumento10 pagine15-10-2022-1665806338-6-IMPACT - IJRBM-1. IJRBM Theoretical and Methodological Problems of Extra-Budgetary Accounting in Educational InstitutionsImpact JournalsNessuna valutazione finora

- 11-10-2022-1665489521-6-IMPACT - IJRHAL-Analysing The Matrix in Social Fiction and Its Relevance in Literature.Documento6 pagine11-10-2022-1665489521-6-IMPACT - IJRHAL-Analysing The Matrix in Social Fiction and Its Relevance in Literature.Impact JournalsNessuna valutazione finora

- 02-09-2022-1662112193-6-Impact - Ijrhal-1. Ijrhal - Shifting Gender Roles A Comparative Study of The Victorian Versus The Contemporary TimesDocumento12 pagine02-09-2022-1662112193-6-Impact - Ijrhal-1. Ijrhal - Shifting Gender Roles A Comparative Study of The Victorian Versus The Contemporary TimesImpact JournalsNessuna valutazione finora

- 21-09-2022-1663757720-6-Impact - Ijranss-3. Ijranss - The Role and Objectives of Criminal LawDocumento8 pagine21-09-2022-1663757720-6-Impact - Ijranss-3. Ijranss - The Role and Objectives of Criminal LawImpact JournalsNessuna valutazione finora

- 27-10-2022-1666851544-6-IMPACT - IJRANSS-2. IJRANSS - A Review On Role of Ethics in Modern-Day Research Assignment - 1Documento6 pagine27-10-2022-1666851544-6-IMPACT - IJRANSS-2. IJRANSS - A Review On Role of Ethics in Modern-Day Research Assignment - 1Impact JournalsNessuna valutazione finora

- 05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaDocumento12 pagine05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaImpact JournalsNessuna valutazione finora

- 07-09-2022-1662545503-6-Impact - Ijranss-2. Ijranss - Role of Bio-Fertilizers in Vegetable Crop Production A ReviewDocumento6 pagine07-09-2022-1662545503-6-Impact - Ijranss-2. Ijranss - Role of Bio-Fertilizers in Vegetable Crop Production A ReviewImpact JournalsNessuna valutazione finora

- 22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesDocumento10 pagine22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesImpact JournalsNessuna valutazione finora

- 19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldDocumento12 pagine19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldImpact JournalsNessuna valutazione finora

- 20-09-2022-1663649149-6-Impact - Ijrhal-2. Ijrhal - A Review of Storytelling's Role and Effect On Language Acquisition in English Language ClassroomsDocumento10 pagine20-09-2022-1663649149-6-Impact - Ijrhal-2. Ijrhal - A Review of Storytelling's Role and Effect On Language Acquisition in English Language ClassroomsImpact JournalsNessuna valutazione finora

- 28-09-2022-1664362344-6-Impact - Ijrhal-4. Ijrhal - Understanding The Concept of Smart City and Its Socio-Economic BarriersDocumento8 pagine28-09-2022-1664362344-6-Impact - Ijrhal-4. Ijrhal - Understanding The Concept of Smart City and Its Socio-Economic BarriersImpact JournalsNessuna valutazione finora

- 21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesDocumento10 pagine21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesImpact JournalsNessuna valutazione finora

- 24-09-2022-1664015374-6-Impact - Ijranss-6. Ijranss - Patterns of Change Among The Jatsas Gleaned From Arabic and Persian SourcesDocumento6 pagine24-09-2022-1664015374-6-Impact - Ijranss-6. Ijranss - Patterns of Change Among The Jatsas Gleaned From Arabic and Persian SourcesImpact JournalsNessuna valutazione finora

- Comparison of Soil Properties Collected From Nalgonda, Ranga Reddy, Hyderabad and Checking Its Suitability For ConstructionDocumento8 pagineComparison of Soil Properties Collected From Nalgonda, Ranga Reddy, Hyderabad and Checking Its Suitability For ConstructionImpact JournalsNessuna valutazione finora

- 01-10-2022-1664607817-6-Impact - Ijrbm-2. Ijrbm - Innovative Technology in Indian Banking Sector-A Prospective AnalysisDocumento4 pagine01-10-2022-1664607817-6-Impact - Ijrbm-2. Ijrbm - Innovative Technology in Indian Banking Sector-A Prospective AnalysisImpact JournalsNessuna valutazione finora

- Study and Investigation On The Red and Intangible Cultural Sites in Guangdong - Chasing The Red Mark and Looking For The Intangible Cultural HeritageDocumento14 pagineStudy and Investigation On The Red and Intangible Cultural Sites in Guangdong - Chasing The Red Mark and Looking For The Intangible Cultural HeritageImpact JournalsNessuna valutazione finora

- 29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasDocumento8 pagine29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasImpact JournalsNessuna valutazione finora

- 25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaDocumento6 pagine25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaImpact JournalsNessuna valutazione finora

- YES Prosperity Savings Account W.E.F. 1st March 2018 PDFDocumento2 pagineYES Prosperity Savings Account W.E.F. 1st March 2018 PDFJeyakumara Vel CNessuna valutazione finora

- A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTDDocumento1 paginaA Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTDTalha AwanNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento7 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVinod KumarNessuna valutazione finora

- PNB Request FormDocumento1 paginaPNB Request FormNagamuthu.SNessuna valutazione finora

- Credit Card & MAB - Escalation MatrixDocumento2 pagineCredit Card & MAB - Escalation MatrixRomanshu PorwalNessuna valutazione finora

- Transaction Banking Slides-FinalDocumento25 pagineTransaction Banking Slides-FinalManjil ShresthaNessuna valutazione finora

- KU Question Bank E-Commerce - 2018Documento3 pagineKU Question Bank E-Commerce - 2018Ehhan SinghaniagoldNessuna valutazione finora

- KAPIDocumento14 pagineKAPIKapil SharmaNessuna valutazione finora

- Anil Uzun Will Share His Advice For Fintech EntrepreneursDocumento3 pagineAnil Uzun Will Share His Advice For Fintech EntrepreneursPR.comNessuna valutazione finora

- CC Sem VBV BRDocumento3 pagineCC Sem VBV BRjocianemarcelino1Nessuna valutazione finora

- Chase Ink Business Premier Offer DetailsDocumento5 pagineChase Ink Business Premier Offer DetailsDiem TranNessuna valutazione finora

- Attitude of Customers Towards Plastic MoneyDocumento84 pagineAttitude of Customers Towards Plastic MoneyLove Aute50% (2)

- Itr PaymentDocumento1 paginaItr PaymentAjit GuptaNessuna valutazione finora

- Detail Transaction Totals List For 6/3/2021 To 6/4/2021: Ds - DiscoverDocumento4 pagineDetail Transaction Totals List For 6/3/2021 To 6/4/2021: Ds - DiscoverJuhi ShahNessuna valutazione finora

- Fastag Account Summary:: Blackbuck User: 8954736002: UP32NN4603Documento1 paginaFastag Account Summary:: Blackbuck User: 8954736002: UP32NN4603rpNessuna valutazione finora

- NBPDebit Card FormDocumento11 pagineNBPDebit Card Formƒム乄คneeร GamingNessuna valutazione finora

- Indian Institute of Technology: Bank Copy Session:2010-2011 (SPRING)Documento2 pagineIndian Institute of Technology: Bank Copy Session:2010-2011 (SPRING)Maheshchandra PatilNessuna valutazione finora

- CorvusPay IntegrationManual 5.1.0Documento69 pagineCorvusPay IntegrationManual 5.1.0kiyNessuna valutazione finora

- Bank Quest April-June 2020Documento48 pagineBank Quest April-June 2020Poonam PremNessuna valutazione finora

- Statement 234302000000228Documento2 pagineStatement 234302000000228Dada sonawaneNessuna valutazione finora

- Customer Inquiry ReportDocumento3 pagineCustomer Inquiry ReportJenan HananNessuna valutazione finora

- Payment Step-By-Step: ZilingoDocumento1 paginaPayment Step-By-Step: ZilingoEKNessuna valutazione finora

- Vaathilil Aa VaathililDocumento2 pagineVaathilil Aa VaathililVarghese RyanNessuna valutazione finora

- CTF StrukturaDocumento13 pagineCTF StrukturaDamir KajtezovićNessuna valutazione finora