Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Stocks and Bonds

Caricato da

Jeffrey Del MundoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Stocks and Bonds

Caricato da

Jeffrey Del MundoCopyright:

Formati disponibili

STOCKS AND BONDS Term (or Tenor) of a Bond – fixed period of time (in

Stocks – share in the ownership of a company years) at which the bond is redeemable as stated in the

Dividend – share in the company’s profit bond certificate; the number of years from time of

Dividend Per Share – ratio of the dividends to the purchase to maturity date

number of shares Fair Price of a Bond – present value of all cash inflows

Stock Market – a place where stocks can be bought or to the bondholder

sold. The stock market in the Philippines is governed by Example

the Philippines Stock Exchange (PSE) 1. Determine the amount of the semi-annual coupon

Market Value – the current price of a stock at which it for a bond with a face value of P300,000 that pays

can be sold 10% payable semi-annually for its coupons

Stock Yield Ratio – ratio of the annual dividend per Activity

share and the market value per share. Also called Tell whether the following is a characteristic of stocks

current stock yield. or bonds.

Par Value – the per share amount as stated on the 1. A form of equity financing or raising money by

company certificate. Unlike market value, it is allowing investors to be part owners of the

determined by the company and remains stable over company.

time 2. A form of debt financing, or raising money by

Example borrowing from investors.

1. A certain financial institution declared a 3. Investors are guaranteed interest payments and a

P30,000,000 dividend for the common stocks. If return of their money at the maturity date.

there are a total of 700,000 shares of common 4. Investors can earn if the security prices increase,

stock, how much is the dividend per share? but they can lose money if the security prices

2. A certain corporation declared a 3% dividend on a decrease or worse, if the company goes bankrupt.

stock with a par value of P500. Mrs. Lingan owns 5. It can be appropriate for retirees (because of the

200 shares of stock with a par value of P500. How guaranteed fixed income) or for those who need

much is the dividend she received? the money soon.

3. Corporation A, with a current market value of P52, Answer the following problems completely.

gave a dividend of P8 per share for its common 6. The table below shows the data on 5 stockholders

stock. Corporation B, with a current market value of given the par value and the dividend percentage

P95, gave a dividend of P12 per share. Use the stock and the number of shares of stock they have with a

yield ratio to measure how much dividends certain corporation. Find the dividend of the 5

shareholders are getting in relation to the amount stockholders.

invested. Stockholder Par Value Dividend % # of Shares

Bond – interest-bearing security which promises to pay A 50 3% 100

(1) A stated amount of money on the maturity B 48 2.75% 150

date, and C 35 2.5% 300

(2) Regular interest payments called coupons D 42 3.12% 400

Coupon – periodic interest payment that the E 58 3.5% 500

bondholder receives during the time between purchase

date and maturity date; usually received semi-annually 7. A land developer declared a dividend of

Coupon Rate – the rate per coupon payment period; P10,000,000 for its common stock. Suppose there

denoted by r are 600,000 shares of common stock, how much is

Price of a Bond – the price of the bond at purchase the dividend per share?

time; denoted by P 8. A certain company gave out P25 dividend per share

Par value or Face Value – the amount payable on the for its common stock. The market value of the stock

maturity date; denoted by F is P92. Determine the stock yield ratio.

If P = F, the bond is purchased at par. 9. A property holdings declared a dividend of P9 per

share for the common stock. If the common stock

If P < F, the bond is purchases at a discount. closes at P76, how large is the stock yield ratio on

the investments?

If P > F, the bond is purchased at premium. 10. Find the amount of the semi-annual coupon for a

P250,000 bond which pays 7% convertible semi-

annually for its coupons.

Potrebbero piacerti anche

- Business Mathematics AnnuitiesDocumento9 pagineBusiness Mathematics AnnuitiesJuliet RoseNessuna valutazione finora

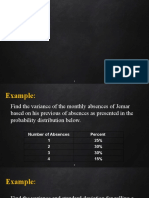

- Finding the mean and variance of probability distributionsDocumento13 pagineFinding the mean and variance of probability distributionsAna Marie ValenzuelaNessuna valutazione finora

- Grade 11 - General Mathematics (Learning Activity Sheets # 4)Documento4 pagineGrade 11 - General Mathematics (Learning Activity Sheets # 4)SerjohnRapsingNessuna valutazione finora

- Stat ReviewerDocumento2 pagineStat ReviewerDanilo CumpioNessuna valutazione finora

- General Mathematics - Stocks and BondsDocumento32 pagineGeneral Mathematics - Stocks and BondsLourence Clark ElumbaNessuna valutazione finora

- Mathematics in The Modern WorldDocumento20 pagineMathematics in The Modern WorldPulido Michaela B.Nessuna valutazione finora

- 13 Statistics and ProbabilityDocumento18 pagine13 Statistics and ProbabilityJennifer Ledesma-PidoNessuna valutazione finora

- Math of Investment: Name: Joana Lhyn A. Rudas Gr/Sec: 11 HE (D)Documento12 pagineMath of Investment: Name: Joana Lhyn A. Rudas Gr/Sec: 11 HE (D)eunha allaybanNessuna valutazione finora

- Practical Research 2 ReviewerDocumento4 paginePractical Research 2 ReviewerMaria Christine OgenaNessuna valutazione finora

- Gen Math Handout For LogicDocumento9 pagineGen Math Handout For LogicJeffreynald Arante FranciscoNessuna valutazione finora

- Mathematics OF Investment: Cavite State UniversityDocumento14 pagineMathematics OF Investment: Cavite State UniversityAlyssa Bianca AguilarNessuna valutazione finora

- Microeconomics IntroductionDocumento24 pagineMicroeconomics IntroductionjavedNessuna valutazione finora

- Genmath q2 Module WK 1 2 Final MSVDocumento24 pagineGenmath q2 Module WK 1 2 Final MSVLiecky Jan BallesterosNessuna valutazione finora

- Gen Math PrelimDocumento15 pagineGen Math PrelimKristina PabloNessuna valutazione finora

- MODULE-9 Freedom of The Human PersonDocumento19 pagineMODULE-9 Freedom of The Human PersonmalditoNessuna valutazione finora

- Stats and ProbDocumento195 pagineStats and Probtiyoya7462100% (1)

- 4 StocksDocumento21 pagine4 Stockssass sofNessuna valutazione finora

- MMW Oralexamination ReviewerDocumento5 pagineMMW Oralexamination ReviewerZenetib YdujNessuna valutazione finora

- Business Math w1 DLLDocumento4 pagineBusiness Math w1 DLLAnn Cruse100% (1)

- AnnuityDocumento10 pagineAnnuityiamamayNessuna valutazione finora

- Statistics and Probability RANDOM SAMPLINGDocumento8 pagineStatistics and Probability RANDOM SAMPLINGfaith marceloNessuna valutazione finora

- Notes 1-Professional SalesmanshipDocumento18 pagineNotes 1-Professional SalesmanshipJessica CerezaNessuna valutazione finora

- HOPE Reviewer 1st-QuarterDocumento4 pagineHOPE Reviewer 1st-QuarterJohn Marithe PutunganNessuna valutazione finora

- LABOR AND EMPLOYMENT TOPICS UNDER 40 CHARACTERSDocumento3 pagineLABOR AND EMPLOYMENT TOPICS UNDER 40 CHARACTERSRIZZA MAE OLANONessuna valutazione finora

- Borrow ₱1000 from the Bank - How Much Interest Must Be PaidDocumento16 pagineBorrow ₱1000 from the Bank - How Much Interest Must Be Paidmary joy v, chiquillo100% (1)

- 1-2 Mathematical Language - EditedDocumento12 pagine1-2 Mathematical Language - EditedAngelica Rey TulodNessuna valutazione finora

- ENTREPRENEURSHIP - FinalsDocumento8 pagineENTREPRENEURSHIP - FinalsPolNessuna valutazione finora

- Applied Statistics SyllabusDocumento7 pagineApplied Statistics SyllabusPaul Dela RosaNessuna valutazione finora

- Business MathematicsDocumento2 pagineBusiness MathematicsLuz Gracia OyaoNessuna valutazione finora

- LOGIC OF ARGUMENTSDocumento55 pagineLOGIC OF ARGUMENTSSufi KhanNessuna valutazione finora

- Module 7. Annuities: 1. Simple AnnuityDocumento19 pagineModule 7. Annuities: 1. Simple AnnuityMori OugaiNessuna valutazione finora

- Chapter 1 - MMWDocumento34 pagineChapter 1 - MMWMina SaflorNessuna valutazione finora

- Management Theories EvolutionDocumento13 pagineManagement Theories EvolutionJowjie TV100% (1)

- Mutual Fund: Course Learning OutcomesDocumento19 pagineMutual Fund: Course Learning OutcomesJohnVerjoGeronimoNessuna valutazione finora

- Reflections on God's Blessings and SalvationDocumento3 pagineReflections on God's Blessings and SalvationMariecris Batas100% (1)

- Edited - 10 23 2019Documento40 pagineEdited - 10 23 2019Karyl Sepulveda De VeraNessuna valutazione finora

- General Math Functions WorksheetDocumento9 pagineGeneral Math Functions WorksheetChristina Mae SalvanNessuna valutazione finora

- A. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyDocumento12 pagineA. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyArcon Solite BarbanidaNessuna valutazione finora

- Genmath q2 Mod19 Validityofcategoricalsyllogisms v2Documento35 pagineGenmath q2 Mod19 Validityofcategoricalsyllogisms v2Khriselle Mae BetingNessuna valutazione finora

- Calculate Gross Pay for Hourly and Salaried EmployeesDocumento36 pagineCalculate Gross Pay for Hourly and Salaried EmployeesquincyNessuna valutazione finora

- A Uscp DocumentDocumento5 pagineA Uscp DocumentRinoa Keisha CortezNessuna valutazione finora

- Tend To Spend: A Comparative Study On The Academic Expenses of Grade 11 STEM and ABM StudentsDocumento12 pagineTend To Spend: A Comparative Study On The Academic Expenses of Grade 11 STEM and ABM StudentsayaNessuna valutazione finora

- Parental Consent Form for Vaccinated Students' Limited Campus AttendanceDocumento2 pagineParental Consent Form for Vaccinated Students' Limited Campus AttendanceMarilyn QuimodNessuna valutazione finora

- G11 General-Mathematics Q2 LAS-3Documento7 pagineG11 General-Mathematics Q2 LAS-3Maxine ReyesNessuna valutazione finora

- Quantitative Research Benefits Across FieldsDocumento8 pagineQuantitative Research Benefits Across FieldsJaiseo FunumichiNessuna valutazione finora

- MathDocumento6 pagineMathLyndMargaretteVicencioNessuna valutazione finora

- SIMPLEtestofhypothesisDocumento35 pagineSIMPLEtestofhypothesisJulius EstrelladoNessuna valutazione finora

- 2Q - STEM - GenMath - LEC 07 - Simple Annuities PDFDocumento12 pagine2Q - STEM - GenMath - LEC 07 - Simple Annuities PDFKim Cinderell PestijoNessuna valutazione finora

- AbM Chap2Documento38 pagineAbM Chap2Lawrence Fabregas DelimaNessuna valutazione finora

- Earth and Life Science: PhilosophyDocumento11 pagineEarth and Life Science: PhilosophyLady FloresNessuna valutazione finora

- Module 2 in College and Advance AlgebraDocumento9 pagineModule 2 in College and Advance AlgebraJaycel NepalNessuna valutazione finora

- General MathematicsDocumento2 pagineGeneral MathematicsJoshua AndayaNessuna valutazione finora

- Notes - Mathematics of FinanceDocumento11 pagineNotes - Mathematics of FinanceShadweyn PerseusNessuna valutazione finora

- General Mathematics 2Documento11 pagineGeneral Mathematics 2Ryzel Vonne DantesNessuna valutazione finora

- Concept Paper Animal CrueltyDocumento2 pagineConcept Paper Animal CrueltyMark Anthony CabangonNessuna valutazione finora

- Linear Programming - MINIMIZATIONDocumento3 pagineLinear Programming - MINIMIZATIONCarlo B CagampangNessuna valutazione finora

- Grade 12: Physical Education and HealthDocumento35 pagineGrade 12: Physical Education and HealthAyn RealosaNessuna valutazione finora

- Business Finance 2.2: Financial Ratios: Lecture NotesDocumento16 pagineBusiness Finance 2.2: Financial Ratios: Lecture NotesElisabeth HenangerNessuna valutazione finora

- Lesson 31 - Stocks and BondsDocumento19 pagineLesson 31 - Stocks and BondsApril Joy LascuñaNessuna valutazione finora

- Presentation of MATHEMATICSDocumento18 paginePresentation of MATHEMATICSJenemarNessuna valutazione finora

- University of Perpetual Help System Laguna Graduate SchoolDocumento3 pagineUniversity of Perpetual Help System Laguna Graduate SchoolJeffrey Del MundoNessuna valutazione finora

- Measures of Central Tendency and Dispersion in Data SetsDocumento1 paginaMeasures of Central Tendency and Dispersion in Data SetsJeffrey Del MundoNessuna valutazione finora

- S1 Introduction To StatisticsDocumento2 pagineS1 Introduction To StatisticsJeffrey Del MundoNessuna valutazione finora

- Solving Rational EquationsDocumento1 paginaSolving Rational EquationsJeffrey Del MundoNessuna valutazione finora

- INVERSE OF ONE-TO-ONE FUNCTIONSDocumento1 paginaINVERSE OF ONE-TO-ONE FUNCTIONSJeffrey Del Mundo100% (1)

- Solving Rational InequalityDocumento1 paginaSolving Rational InequalityJeffrey Del MundoNessuna valutazione finora

- Simple and Compound InterestDocumento2 pagineSimple and Compound InterestJeffrey Del MundoNessuna valutazione finora

- S1 Introduction To StatisticsDocumento2 pagineS1 Introduction To StatisticsJeffrey Del MundoNessuna valutazione finora

- Calculate Annuity Present ValuesDocumento3 pagineCalculate Annuity Present ValuesJeffrey Del Mundo50% (2)

- LETTER HeadingDocumento3 pagineLETTER HeadingJeffrey Del MundoNessuna valutazione finora

- MA101 College Algebra (Course Outline)Documento2 pagineMA101 College Algebra (Course Outline)Jeffrey Del MundoNessuna valutazione finora

- Omnibus Certification of Authenticity and Veracity of DocumentsDocumento1 paginaOmnibus Certification of Authenticity and Veracity of DocumentsMildewvilDewVillquilloNessuna valutazione finora

- Bloom AffectDocumento1 paginaBloom AffectjosephismNessuna valutazione finora

- Training Application Forms For The Faculty Training For Teaching GE Core Courses 2nd Generation TrainingDocumento6 pagineTraining Application Forms For The Faculty Training For Teaching GE Core Courses 2nd Generation TrainingJeffrey Del MundoNessuna valutazione finora

- Contemporary WorldDocumento39 pagineContemporary WorldEmmanuel Bo100% (9)

- L'OREAL Social Audit ProgramDocumento24 pagineL'OREAL Social Audit ProgramHanan Ahmed0% (1)

- Emaan Bil Laah (Final Version)Documento52 pagineEmaan Bil Laah (Final Version)Farheen KhanumNessuna valutazione finora

- Supreme Court of the Philippines upholds refusal to register corporation for unlawful purposeDocumento3 pagineSupreme Court of the Philippines upholds refusal to register corporation for unlawful purposeRhoddickMagrataNessuna valutazione finora

- Apostolic Fathers & Spiritual BastardsDocumento78 pagineApostolic Fathers & Spiritual Bastardsanon_472617452100% (2)

- MMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadDocumento1 paginaMMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadRajesh pvkNessuna valutazione finora

- Recurring Inspection Process in SAP QM - SAP BlogsDocumento16 pagineRecurring Inspection Process in SAP QM - SAP BlogsManish GuptaNessuna valutazione finora

- Making Friends (Excerpt)Documento21 pagineMaking Friends (Excerpt)Graphix61% (72)

- Tripura Public Service CommissionDocumento4 pagineTripura Public Service CommissionMintu DebbarmaNessuna valutazione finora

- Audition Guide for "Legally BlondeDocumento6 pagineAudition Guide for "Legally BlondeSean Britton-MilliganNessuna valutazione finora

- 400 Flexible Cords-NEC 2008-MHDocumento5 pagine400 Flexible Cords-NEC 2008-MHJOSE LUIS FALCON CHAVEZNessuna valutazione finora

- Main Ethical Concerns of The Philippine Society in Relation To Business PDFDocumento10 pagineMain Ethical Concerns of The Philippine Society in Relation To Business PDFGwyneth MalagaNessuna valutazione finora

- Dispute A TicketDocumento3 pagineDispute A TicketKaty WeatherlyNessuna valutazione finora

- CopyofbillcreatorDocumento2 pagineCopyofbillcreatorapi-336685023Nessuna valutazione finora

- Email Ids and Private Video Link UpdatedDocumento4 pagineEmail Ids and Private Video Link UpdatedPriyanshu BalaniNessuna valutazione finora

- Bank Victoria International Tbk2019-03-11 - Annual-Report-2012Documento537 pagineBank Victoria International Tbk2019-03-11 - Annual-Report-2012sofyanNessuna valutazione finora

- Patterns of AllophonyDocumento6 paginePatterns of AllophonyPeter ClarkNessuna valutazione finora

- 47 Iii 2Documento2 pagine47 Iii 2Vaalu MuthuNessuna valutazione finora

- (30.html) : Read and Listen To Sentences Using The WordDocumento3 pagine(30.html) : Read and Listen To Sentences Using The Wordshah_aditNessuna valutazione finora

- Ravine and Natural Feature Permit ApplicationDocumento1 paginaRavine and Natural Feature Permit ApplicationMichael TilbrookNessuna valutazione finora

- QuitclaimDocumento2 pagineQuitclaimManny B. Victor VIIINessuna valutazione finora

- 323-1851-221 (6500 R13.0 SLAT) Issue3Documento804 pagine323-1851-221 (6500 R13.0 SLAT) Issue3Raimundo Moura100% (1)

- REMEDIAL LAW BAR EXAMINATION QUESTIONSDocumento11 pagineREMEDIAL LAW BAR EXAMINATION QUESTIONSAubrey Caballero100% (1)

- Career Development Work Values q3m1.Documento4 pagineCareer Development Work Values q3m1.almafebe caselNessuna valutazione finora

- ACE AMERICAN INSURANCE COMPANY Et Al v. MOHAWK NORTHEAST INC ComplaintDocumento3 pagineACE AMERICAN INSURANCE COMPANY Et Al v. MOHAWK NORTHEAST INC ComplaintACELitigationWatchNessuna valutazione finora

- Spamming Tutorial: What What What What Is IS IS Is Spamming Spamming Spamming SpammingDocumento20 pagineSpamming Tutorial: What What What What Is IS IS Is Spamming Spamming Spamming Spammingfaithscott100% (3)

- Cuong Vi Ngo, A057 771 073 (BIA June 8, 2017)Documento8 pagineCuong Vi Ngo, A057 771 073 (BIA June 8, 2017)Immigrant & Refugee Appellate Center, LLCNessuna valutazione finora

- Intro To ISO 13485 Presentation MaterialsDocumento10 pagineIntro To ISO 13485 Presentation Materialsrodcam1Nessuna valutazione finora

- Angeles v. Gutierrez - OmbudsmanDocumento2 pagineAngeles v. Gutierrez - OmbudsmanLeslie OctavianoNessuna valutazione finora

- ELS - Q1 - Week 4aDocumento3 pagineELS - Q1 - Week 4apeterjo raveloNessuna valutazione finora