Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lim Tanhu vs. Ramolete

Caricato da

smtm06Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lim Tanhu vs. Ramolete

Caricato da

smtm06Copyright:

Formati disponibili

Topic: Obligations of Partners; Loyalty/Fiduciary Duty; Art 1807

Lim Tanhu vs. Ramolete

No. L-40098. August 29, 1975

Barredo J.

Petitioners: ANTONIO LIM TANHU, DY OCHAY, ALFONSO LEONARDO

NG SUA and CO OYO,

Respondents: HON. JOSE R. RAMOLETE, as Presiding Judge, CFI-Cebu and

TAN PUT

Facts:

Defendants and Po Chuan were partners in the commercial partnership,

Glory Commercial Company, which was dissolved upon Po Chuan’s death.

Respondent Tan alleged that she was the widow of Tee Hoon Lim Po Chuan

(Po Chuan) and that during the lifetime of Po Chuan, defendants Lim Tanhu

and Ng Sua managed to use huge amounts of the funds and assets of the

partnership for personal purposes. (Where problem started)

Also, Tan claimed that after Po Chuan’s death, defendants, without

liquidation continued the partnership by purportedly organizing a

corporation, Glory Commercial Company, Incorporated, and acquired lands

using the money and assets of the partnership.

Tan sued the defendants and prayed for judgment ordering defendants to

render an accounting of the properties of Glory Commercial Company and

to deliver to Tan 1/3 of the total value of the partnership.

Defendants answered that they acquired the lands using their personal fund

and it would be impossible to use such huge amount from the partnership’s

funds without other partners knowing. Also, that if such amount would be

withdrawn, the partnership would have become insolvent.

It appeared that Po Chuan, Lim Tanhu and Ng Sua were brothers, and

partners in the business but it was Po Chuan who had the controlling interest

as he was the one who actively managed the business of the partnership.

Issue: Whether Tan was entitled to an accounting of the partnership?

Ruling:

No.

Article 1807 of the NCC refers to a mandatory accounting of the partnership

where profits of the partnership were used by some partners without the consent of

the other partners.

In the present case, Article 1807 is not applicable since it was impossible for

the defendants to take partnership funds when Po Chuan was in control of the

affairs of the company. It is hard to believe that defendants could have defrauded

Po Chuan of the amounts Tan was claiming. The more logical inference is that if

defendants had obtained the funds, Po Chuan would have known and consented.

Thus, there was no violation of trust in the part of the defendants that would have

demanded them for the accounting that Tan prayed.

Accordingly, defendants have no obligation to account to anyone for such

acquisitions that were transferred in their names long after the dissolution of the

partnership, in the absence of clear proof that they had violated the trust of Po

Chuan during the existence of the partnership.

Doctrine:

A partner has no obligation to account to anyone for properties acquired

after dissolution of partnership in absence of proof he violated trust of

deceased partner during existence of partnership.

Potrebbero piacerti anche

- Human Resource Manual IIIDocumento182 pagineHuman Resource Manual IIIDewald Murray100% (5)

- Abbain V ChuaDocumento2 pagineAbbain V ChuaJillian AsdalaNessuna valutazione finora

- CIR V Fitness by DesignDocumento3 pagineCIR V Fitness by Designsmtm06100% (4)

- Vector Shipping Cor V Adelfo MacasaDocumento2 pagineVector Shipping Cor V Adelfo Macasasmtm06100% (2)

- 95 Phil Charter Insurance V Chemoil Lighterage CorpDocumento2 pagine95 Phil Charter Insurance V Chemoil Lighterage Corpsmtm06100% (1)

- Chavez v. RomuloDocumento5 pagineChavez v. RomuloMargo Wan RemolloNessuna valutazione finora

- Meralco Workers Union V MeralcoDocumento2 pagineMeralco Workers Union V MeralcoKatrinaNessuna valutazione finora

- PAL Vs BalanguitDocumento2 paginePAL Vs BalanguitRen ConchaNessuna valutazione finora

- Chua Jan Vs BernasDocumento2 pagineChua Jan Vs BernasNJ GeertsNessuna valutazione finora

- Silverio v. RepublicDocumento7 pagineSilverio v. RepublicShiela Al-agNessuna valutazione finora

- Panama House Rules PDFDocumento5 paginePanama House Rules PDFGerdNessuna valutazione finora

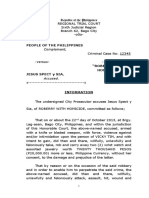

- Information - Robbery With HomicideDocumento3 pagineInformation - Robbery With HomicideRey Victor Garin100% (2)

- Rivera vs. Unilab, 586 SCRA 269Documento1 paginaRivera vs. Unilab, 586 SCRA 269Martin PagtanacNessuna valutazione finora

- 8 Vasquez V CADocumento2 pagine8 Vasquez V CAsmtm060% (1)

- Refunds: What Type of Refund Are You Applying For?Documento2 pagineRefunds: What Type of Refund Are You Applying For?Leigh OlssonNessuna valutazione finora

- RR No. 7-2018Documento2 pagineRR No. 7-2018Rheneir MoraNessuna valutazione finora

- Phil Journalists Inc V CIRDocumento2 paginePhil Journalists Inc V CIRsmtm06Nessuna valutazione finora

- Durban Apartments V Pioneer - ToraynoDocumento1 paginaDurban Apartments V Pioneer - ToraynoKC ToraynoNessuna valutazione finora

- No. 86 Republic vs. Posadas Estate IIIDocumento2 pagineNo. 86 Republic vs. Posadas Estate IIIBella CrosatNessuna valutazione finora

- G.R. No. 167684 July 31, 2006 JAIME O. SEVILLA, Petitioner, Vs CARMELITA N. CARDENAS, Respondent. Facts of The CaseDocumento1 paginaG.R. No. 167684 July 31, 2006 JAIME O. SEVILLA, Petitioner, Vs CARMELITA N. CARDENAS, Respondent. Facts of The CaseEric RecomendableNessuna valutazione finora

- 16 Abueg V San DiegoDocumento2 pagine16 Abueg V San Diegosmtm06Nessuna valutazione finora

- Commissioner of Internal Revenue v. Suter, 27 SCRA 152 (1969) .Documento3 pagineCommissioner of Internal Revenue v. Suter, 27 SCRA 152 (1969) .nazhNessuna valutazione finora

- 17 20 MANAOG GONO - PhilAm MatalinDocumento6 pagine17 20 MANAOG GONO - PhilAm MatalinMariel CabubunganNessuna valutazione finora

- Osmena v. Orbos (1993)Documento2 pagineOsmena v. Orbos (1993)Arnel ManalastasNessuna valutazione finora

- Prats Vs CA DigestDocumento1 paginaPrats Vs CA DigestJogie AradaNessuna valutazione finora

- Physical Security Management GuidelinesDocumento8 paginePhysical Security Management GuidelinesRakesh Ricki Radharaman100% (2)

- 153 - Pardo V Hercules LumberDocumento1 pagina153 - Pardo V Hercules Lumbermimiyuki_Nessuna valutazione finora

- Worcester v. OcampoDocumento27 pagineWorcester v. OcampoJerickson A. ReyesNessuna valutazione finora

- 04 - Valeroso v. PeopleDocumento2 pagine04 - Valeroso v. PeopleMelcris CastroNessuna valutazione finora

- 9 Cayetano V LeonidasDocumento2 pagine9 Cayetano V Leonidassmtm06Nessuna valutazione finora

- Guevarra - Et - Al. v. BanachDocumento8 pagineGuevarra - Et - Al. v. BanachEun ChoiNessuna valutazione finora

- SEC Memorandum Circular No. 19 Series of 2016 Code of Corporate Governance For Publicly-Listed CompaniesDocumento2 pagineSEC Memorandum Circular No. 19 Series of 2016 Code of Corporate Governance For Publicly-Listed CompaniesAaron Josua AboyNessuna valutazione finora

- Kilusang Mayo Uno V GarciaDocumento2 pagineKilusang Mayo Uno V Garciasmtm06Nessuna valutazione finora

- Indophil Vs Calica DigestDocumento1 paginaIndophil Vs Calica DigestCAJNessuna valutazione finora

- Rural Bank of Milaor V Ocfemia, G.R. No. 137686, February 8, 2000.Documento3 pagineRural Bank of Milaor V Ocfemia, G.R. No. 137686, February 8, 2000.mae ann rodolfoNessuna valutazione finora

- Stolt Nielsen Marine Services Inc. vs. National Labor Relations CommissionDocumento15 pagineStolt Nielsen Marine Services Inc. vs. National Labor Relations CommissionIsobel RookNessuna valutazione finora

- Sec Opinion - Sept 3 1984 PDFDocumento2 pagineSec Opinion - Sept 3 1984 PDFRobin ScherbatskyNessuna valutazione finora

- Intestate Estate of Jose Uy v. Atty Pacifico - A.C. No.10525 - 11pagesDocumento11 pagineIntestate Estate of Jose Uy v. Atty Pacifico - A.C. No.10525 - 11pagesJessica AbadillaNessuna valutazione finora

- GRMM vs. ParsonsDocumento1 paginaGRMM vs. ParsonsAyzel PalmeroNessuna valutazione finora

- Pacific Commercial CoDocumento2 paginePacific Commercial CoelizNessuna valutazione finora

- People Vs ArchillaDocumento5 paginePeople Vs ArchillaDah Rin CavanNessuna valutazione finora

- 2 in The Matter of The Petition For Authority To Continue Use of The Firm Name "Ozaeta, Romulo, Etc.Documento2 pagine2 in The Matter of The Petition For Authority To Continue Use of The Firm Name "Ozaeta, Romulo, Etc.JemNessuna valutazione finora

- Lim Tanhu V RamoleteDocumento2 pagineLim Tanhu V RamoleteNikkiAndrade100% (1)

- Agency Case DigestDocumento17 pagineAgency Case DigestMarlon SevillaNessuna valutazione finora

- Danon Vs BrimoDocumento1 paginaDanon Vs BrimoPatricia Anne SorianoNessuna valutazione finora

- Si Boco V YapDocumento1 paginaSi Boco V YapNic NalpenNessuna valutazione finora

- 030 People Vs AnchetaDocumento4 pagine030 People Vs AnchetaDonaldDeLeonNessuna valutazione finora

- CONSTI Magalona vs. ErmitaDocumento2 pagineCONSTI Magalona vs. ErmitaPafra BariuanNessuna valutazione finora

- Case Digests in Constitutional Law 1Documento1 paginaCase Digests in Constitutional Law 1Feeyell UyNessuna valutazione finora

- Dela Paz V Senate DigestDocumento2 pagineDela Paz V Senate DigestDonn LinNessuna valutazione finora

- Mejorada DoctrineDocumento1 paginaMejorada DoctrineWresen AnnNessuna valutazione finora

- 227 - Luna vs. IACDocumento3 pagine227 - Luna vs. IACNec Salise ZabatNessuna valutazione finora

- People's Aircargo & Warehousing Co Inc Vs CA - 117847 - October 7, 1998 - J. Panganiban - First DivisionDocumento11 paginePeople's Aircargo & Warehousing Co Inc Vs CA - 117847 - October 7, 1998 - J. Panganiban - First DivisionJennyNessuna valutazione finora

- APOLINARIO G. DE LOS SANTOS and ISABELO ASTRAQUILLO, Plaintiffs-Appellees, vs. J. HOWARD MCGRATH ATTORNEY GENERAL OF THE UNITED STATESDocumento2 pagineAPOLINARIO G. DE LOS SANTOS and ISABELO ASTRAQUILLO, Plaintiffs-Appellees, vs. J. HOWARD MCGRATH ATTORNEY GENERAL OF THE UNITED STATESJaylordPataotaoNessuna valutazione finora

- Ramon Ruffy v. The Chief of StaffDocumento2 pagineRamon Ruffy v. The Chief of StaffDGDelfinNessuna valutazione finora

- Case Digest of People Vs Carino 7 SCRA 900Documento2 pagineCase Digest of People Vs Carino 7 SCRA 900Lord Jester AguirreNessuna valutazione finora

- Labor - Social Legislation Cagatin V MagsaysayDocumento2 pagineLabor - Social Legislation Cagatin V MagsaysayLouie SalazarNessuna valutazione finora

- De Leon Vs Esguerra Case DigestDocumento1 paginaDe Leon Vs Esguerra Case Digestemmaniago08Nessuna valutazione finora

- Pangilinan Vs AlvendiaDocumento1 paginaPangilinan Vs AlvendiaRolan Klyde Kho YapNessuna valutazione finora

- People vs. Mingoa (Case)Documento2 paginePeople vs. Mingoa (Case)jomar ico0% (1)

- Trail Smelter ArbitrationDocumento3 pagineTrail Smelter ArbitrationJessamine OrioqueNessuna valutazione finora

- Lim Tong Lim v. Phil. Fishing Gear (GR 136448, 3 November 1999)Documento8 pagineLim Tong Lim v. Phil. Fishing Gear (GR 136448, 3 November 1999)Cari Mangalindan MacaalayNessuna valutazione finora

- Ferrazzini v. Gsell, (45 Phil. 697) FACTS: On A Friday Evening at Supper, Plaintiff TogetherDocumento26 pagineFerrazzini v. Gsell, (45 Phil. 697) FACTS: On A Friday Evening at Supper, Plaintiff TogetherTed CastelloNessuna valutazione finora

- Saguid Vs Court of Appeals GR 150611 FACTS: Seventeen-Year Old Gina S. Rey Was MarriedDocumento2 pagineSaguid Vs Court of Appeals GR 150611 FACTS: Seventeen-Year Old Gina S. Rey Was MarriedShimi FortunaNessuna valutazione finora

- Microsoft v. Farajallah PDFDocumento2 pagineMicrosoft v. Farajallah PDFRostum AgapitoNessuna valutazione finora

- Spouses Miniano Vs ConcepcionDocumento1 paginaSpouses Miniano Vs ConcepcionCelinka ChunNessuna valutazione finora

- Silva Vs CabreraDocumento11 pagineSilva Vs CabreraRihan NuraNessuna valutazione finora

- Situs of Construction and InterpretationDocumento3 pagineSitus of Construction and InterpretationShierly Ba-adNessuna valutazione finora

- 4 C C - Daging-v-DavisDocumento2 pagine4 C C - Daging-v-DavisesfsfsNessuna valutazione finora

- Conde vs. Ca FactsDocumento8 pagineConde vs. Ca FactsasdfghjkattNessuna valutazione finora

- Liguez Vs CADocumento3 pagineLiguez Vs CALynn MartinezNessuna valutazione finora

- Garcia vs. Court of Appeals 312 SCRA 180Documento11 pagineGarcia vs. Court of Appeals 312 SCRA 180CyrusNessuna valutazione finora

- Case DigestDocumento39 pagineCase DigestrmelizagaNessuna valutazione finora

- Andamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Documento1 paginaAndamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Rizchelle Sampang-ManaogNessuna valutazione finora

- HanlonDocumento3 pagineHanlonNic NalpenNessuna valutazione finora

- Albano v. Reyes, 175 SCRA 264 PDFDocumento15 pagineAlbano v. Reyes, 175 SCRA 264 PDFJey RhyNessuna valutazione finora

- 7TH Day ProvisionsDocumento2 pagine7TH Day Provisionssmtm06Nessuna valutazione finora

- Rmo 20 90Documento2 pagineRmo 20 90smtm06Nessuna valutazione finora

- Philippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.Documento12 paginePhilippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.AlvinClaridadesDeObandoNessuna valutazione finora

- Philippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.Documento12 paginePhilippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.AlvinClaridadesDeObandoNessuna valutazione finora

- RR No 17-18 Estate and Donor's TaxDocumento1 paginaRR No 17-18 Estate and Donor's TaxGil PinoNessuna valutazione finora

- Gelisan V AldayDocumento9 pagineGelisan V Aldaysmtm06Nessuna valutazione finora

- 1701rmo 04 - 08Documento2 pagine1701rmo 04 - 08smtm06Nessuna valutazione finora

- CIR vs. Procter Gamble Pilippine Manufacturing CorpDocumento45 pagineCIR vs. Procter Gamble Pilippine Manufacturing CorpLRBNessuna valutazione finora

- RMONo14 2016Documento3 pagineRMONo14 2016Yan Rodriguez DasalNessuna valutazione finora

- RR No. 30-2002Documento1 paginaRR No. 30-2002smtm06Nessuna valutazione finora

- RR No 21-2018 PDFDocumento3 pagineRR No 21-2018 PDFJames Salviejo PinedaNessuna valutazione finora

- 413rr04 08Documento2 pagine413rr04 08Sy HimNessuna valutazione finora

- Phil Journ V CirDocumento7 paginePhil Journ V Cirsmtm06Nessuna valutazione finora

- Phil Journ V CirDocumento7 paginePhil Journ V Cirsmtm06Nessuna valutazione finora

- CIR V Fortune Tobacco EscraDocumento69 pagineCIR V Fortune Tobacco Escrasmtm06Nessuna valutazione finora

- RR 9-2013 PDFDocumento1 paginaRR 9-2013 PDFnaldsdomingoNessuna valutazione finora

- CIR V Fitness by DesignDocumento14 pagineCIR V Fitness by Designsmtm06Nessuna valutazione finora

- CIR V Fortune Tobacco EscraDocumento69 pagineCIR V Fortune Tobacco Escrasmtm06Nessuna valutazione finora

- San Miguel V MAERC Integrated ServicesDocumento3 pagineSan Miguel V MAERC Integrated Servicessmtm06Nessuna valutazione finora

- Abesco Construction and Development Corporation vs. RamirezDocumento9 pagineAbesco Construction and Development Corporation vs. RamirezT Cel MrmgNessuna valutazione finora

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocumento10 pagineHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280Nessuna valutazione finora

- Presentation On Appeals Rule 47 by Prof. Manuel RigueraDocumento219 paginePresentation On Appeals Rule 47 by Prof. Manuel RigueraErwin April MidsapakNessuna valutazione finora

- KP FORM #2 AppointmentDocumento10 pagineKP FORM #2 Appointmentahimuro23Nessuna valutazione finora

- OBH G FormDocumento52 pagineOBH G FormRMNessuna valutazione finora

- Notify Council of Change of Name FormDocumento2 pagineNotify Council of Change of Name FormLaura ParkaNessuna valutazione finora

- Rules 10-14Documento73 pagineRules 10-14JCapskyNessuna valutazione finora

- Motion For Postponement MRC ALLIED vs. City of Naga, Et. ALDocumento3 pagineMotion For Postponement MRC ALLIED vs. City of Naga, Et. ALgiovanniNessuna valutazione finora

- RA 9165 CasesDocumento177 pagineRA 9165 CasesEstela Benegildo100% (1)

- United States v. Katay Joseph, 11th Cir. (2015)Documento6 pagineUnited States v. Katay Joseph, 11th Cir. (2015)Scribd Government DocsNessuna valutazione finora

- Defendant's Motion For Summary Judgment 08-30-16Documento55 pagineDefendant's Motion For Summary Judgment 08-30-16ThinkProgressNessuna valutazione finora

- Japan TaxesDocumento72 pagineJapan Taxesmagasara123Nessuna valutazione finora

- Judicial AffidavitDocumento5 pagineJudicial Affidavitsunsetsailor85Nessuna valutazione finora

- Second Half Part OneDocumento196 pagineSecond Half Part OneDatu TahilNessuna valutazione finora

- Passport Application Form: Department of Foreign AffairsDocumento1 paginaPassport Application Form: Department of Foreign AffairsCarlo ELad MontanoNessuna valutazione finora

- PT - T Vs LaplanaDocumento7 paginePT - T Vs LaplanaMonica FerilNessuna valutazione finora

- Joaquin v. BarrettoDocumento2 pagineJoaquin v. BarrettoZoe RodriguezNessuna valutazione finora

- 2021.04.21 - Hearing TranscriptDocumento73 pagine2021.04.21 - Hearing TranscriptScott McClallenNessuna valutazione finora

- Legal CounselingDocumento106 pagineLegal CounselingCarloErica Austria TambioAdapNessuna valutazione finora

- Mukesh v. NCT of DelhiDocumento33 pagineMukesh v. NCT of DelhiFaisal AhmadNessuna valutazione finora

- Reading The Internal Fraud SignsDocumento5 pagineReading The Internal Fraud SignsMuhammad Farhan Ahmad AllybocusNessuna valutazione finora

- Attachments Amaia Land Corp.Documento4 pagineAttachments Amaia Land Corp.AbbaNessuna valutazione finora

- Pensioner Life Certificate 2016 A4 FormatDocumento1 paginaPensioner Life Certificate 2016 A4 FormatNihar KNessuna valutazione finora

- Magendran Mohan V PPDocumento23 pagineMagendran Mohan V PPSyaheera RosliNessuna valutazione finora

- City Government of Baguio V Atty Masweng - FulltextDocumento8 pagineCity Government of Baguio V Atty Masweng - FulltextRio AborkaNessuna valutazione finora